A close friend, who I will call Carol for this article, wanted to meet to discuss whether she should get a Financial Planner. Here is her situation and what she is interested in learning:

Carol and her husband were good savers and earned pensions and Social Security. He passed away a couple of years ago after a prolonged illness. Their focus had been on healthcare needs and not on financial planning. She also received an inheritance from her parents. Carol explained that she had savings scattered at multiple banks in savings accounts, Inherited IRAs, Traditional IRAs, and Roth IRAs. She had questions about why she should invest when her living expenses were met with pensions and Social Security. We established that her preliminary financial goals were 1) to leave an inheritance to her children, 2) to simplify her finances, and 3) to manage taxes efficiently.

Over the past few months, we went over most of the information in this article. Carol assisted me in writing this article to share her experiences. This article is divided into the following sections:

- Section 1: Financial Literacy

- Section 2: Assessing Needs and Goals

- Section 3: Financial Institutions and Advisors

- Section 4: Fidelity Versus Vanguard

- Section 5: Evaluating Types of Accounts and Funds

- Section 6: Setting up a Tax-Efficient Account at Vanguard

- Section 7: The Next Steps

FINANCIAL LITERACY

Carol has a lot of money in savings accounts and certificate of deposit ladders at different banks. I showed her that her bank was paying 1.5% while a money market at Vanguard was paying over four percent. Carol asked, “What is a money market?” Carol is an intelligent person who wants some assistance in becoming more financially literate. For this reason, I spent some time explaining stocks, bonds, mutual funds, and exchange traded funds.

Anna and I helped set Carol up with a computer and virus protection. I set up a web browser with the following links so that she could research financial information at her leisure.

- Mutual Fund Observer | .. a site in the tradition of Fund Alarm

- Bloomberg Originals

- Morningstar | Empowering Investor Success

- Insider (businessinsider.com)

- Star Ratings | BauerFinancial

- Vanguard: Helping you reach your investing goals | Vanguard

- Fidelity Investments – Retirement Plans, Investing, Brokerage, Wealth Management, Financial Planning and Advice, Online Trading.

ASSESSING NEEDS AND GOALS

Carol’s Spending Needs

Carol and I started by understanding her situation, including her spending needs, as follows:

- Pensions and Social Security cover expenses.

- Has a net worth of several million dollars.

- Would like to relocate closer to her children within a year

- Would like money available to cover emergencies.

- Her money is mostly in low-yielding savings accounts.

- Investments are driving up her taxes.

- Her assets are scattered over many financial companies.

The Bucket Approach

We went over “The Bucket Approach to Retirement Allocation“ by Christine Benz at Morningstar. Ms. Benz describes having enough money in conservative Bucket #1 to meet near-term living expenses for one or more years. Moderate Bucket #2 contains living expenses for the next five or more years. Aggressive Bucket #3 contains investments that won’t be needed for longer periods of time.

Understanding Carol’s Risk Tolerance

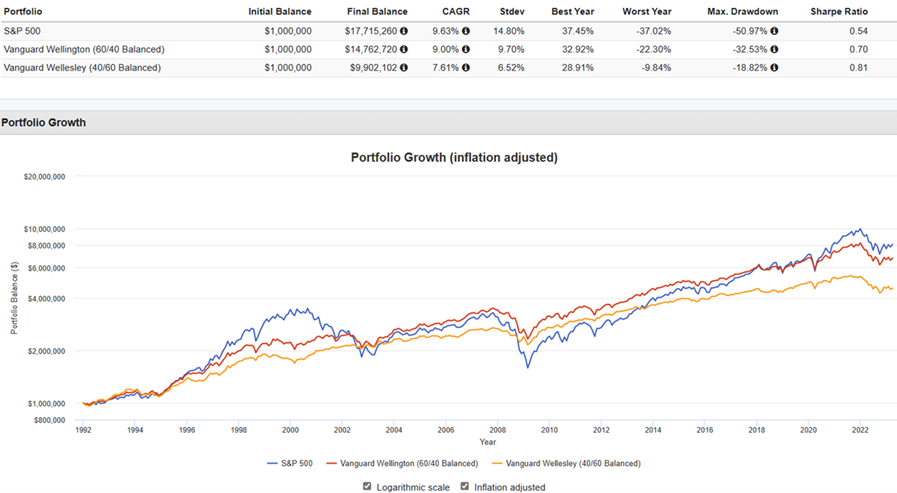

I showed Carol how stocks and bonds can be combined to reduce volatility. I used Portfolio Visualizer to compare how one million dollars invested in the conservative Vanguard Wellesley (VWIAX), moderate Vanguard Wellington (VWELX), and the S&P 500 would have grown over the past thirty years. We looked at the final balance compared to the drawdowns. We discussed that this was a simplified example and, in reality, instead of owning one fund, she should follow the bucket approach to match spending needs.

Figure #1: Growth of One Million Dollars

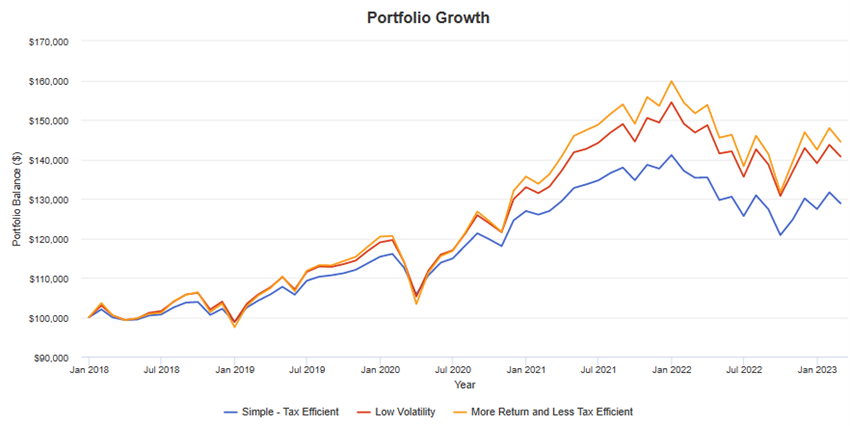

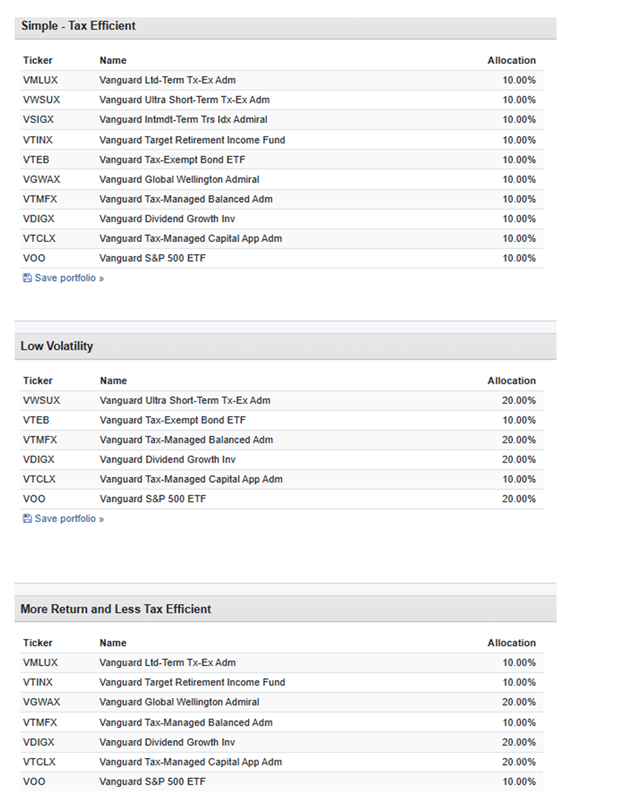

I then built three portfolios using Portfolio Visualizer to represent a Simple Tax Efficient portfolio, a Low Volatility Portfolio, and a Less Tax Efficient Portfolio with higher returns. We discussed that the returns were before taxes, and the one that was best for her might depend on what tax bracket that she is in. We also talked about rebalancing the portfolios to maintain a consistent allocation to the funds.

Figure #2: Growth of Tax Efficient Portfolios

Table #1: Portfolios of Tax Efficient Funds

I asked her how she would feel if she lost 20% to 50% of her financial assets in a recession. Carol said that she would be comfortable with a stock-to-bond ratio between forty and sixty percent.

Developing Goals

Once we had a firm understanding of what is available, we were ready to define some broad financial goals:

- Leave a tax-efficient inheritance for her children.

- Have assistance managing her assets.

- Simplify finances.

- Manage taxes more efficiently.

- Improve her financial literacy.

FINANCIAL INSTITUTIONS AND ADVISORS

Carol asked me how to find a Financial Advisor and how she would know if they were right for her. The most important criteria for me are that the Financial Advisor listens to my concerns, understands my situation, puts my interests first, and is financially knowledgeable. Surprisingly, most potential advisors have not passed this simple test. I told Carol that she should interview potential Advisors, and if she felt that they weren’t listening to her and putting her needs first, then they weren’t right for her.

Does Carol (or Anyone) Need a Financial Advisor?

Dr. James Dahle wrote “The Value of a Financial Advisor” in The White Coat Investor, discussing the pros and cons of using an advisor from the perspective of an investor. For me, it comes down to spending the time to educate yourself on the complexity of investing and the ever-changing environment. The main advantage for me is that it provides my wife with someone to give guidance in case I pass away unexpectedly. The second advantage is to help me stay up-to-date as I age. I like a hybrid approach between using an advisor and Do-It-Yourself.

Fraud

Fraud and incompetence should be major concerns for any investor seeking financial advice. Bernie Madoff comes to mind immediately as someone whose $65 billion Ponzi scheme collapsed during the financial crisis in 2008. Ginger Szala at Think Advisor describes just a sampling of financial fraud in “12 Worst Financial Advisors in America: 2016”. One can minimize the risk of fraud by selecting a good asset manager or financial advisor(s) and keeping it simple.

Largest Asset Managers

We reviewed where Carol’s money was invested, and she expressed a desire to consolidate her money. A good place to start is America’s Top 50 Asset Managers by ADV Ratings. BlackRock, Vanguard, Fidelity, State Street Global Advisors, and Morgan Stanley are the five largest, with at least three trillion dollars in assets under management. We then reviewed the IRA Accounts considered “best” by Forbes Advisor, Nerdwallet, and US News.

Financial Advisors

“Financial Advisors” is often used synonymously with “Asset Managers,” but they can be distinct. Once you have selected an Asset Manager such as Vanguard, you may also select an Independent Financial Planner. For example, John Woerth, Senior Communication Adviser at Vanguard, wrote “How To Select a Financial Advisor,” which is a good summary of how to find an advisor and verify their credentials.

“Best” Financial Advisors is subjectively based on what an investor is most interested in. “Best Financial Advisors” by Ashley Eneriz at Consumer Affairs and “10 Best Financial Advisors of April 2023” by Alana Benson at Nerdwallet provide comparisons. Catherine Brock at Forbes has some good guidelines on how to conduct an interview in “16 Important Questions You Should Be Asking Your Financial Advisor”.

Financial Advisors at Financial Asset Managers

I started using Fidelity Executive Services on a limited basis over five years ago through my employer. Upon retirement last year, I started using Fidelity Wealth Services to manage some accounts. My preference is to use a Financial Advisor from the Asset Manager rather than an Independent Financial Advisor. I like companies that use a team approach or have solid practices in place. I have talked with Vanguard representatives about their advisory services but have not used them.

I like Vanguard for its simplicity, philosophy, low-cost funds, and company structure and policies. In my opinion, its educational and analytical tools were lacking but are improving. I like Fidelity for its financial resources and tools, range of products, business cycle approach, and services. Their fees are below the industry average but higher than Vanguard’s in many respects. Below are the Customer Relationship Summaries for Fidelity and Vanguard describing services and fees.

- Form CRS Conversation Starters by Vanguard

- Customer Relationship Summary by Fidelity

Verifying Your Investment Advisor

Once you have identified a potential Adviser, there are several sources that can assist you to verify their credentials:

- Check Out Your Investment Professional by the U.S. Securities and Exchange Commission

- BrokerCheck by the Financial Industry Regulatory Authority (FINRA)

- Investment Adviser Public Disclosure by The U.S. Securities and Exchange Commission

- How to Check Your Financial Advisor’s Credentials by Dana Anspach at The Balance.

FIDELITY VERSUS VANGUARD

Carol expressed an interest in knowing more about Fidelity and Vanguard. I provided her with the following articles, comparing them. In general, Fidelity is best for frequent traders, for ease of use, research and data, technology, and retirement planning assistance. Vanguard is better for long-term/retirement investors, buy-and-hold investors, and those who prefer low-cost investments, simplicity, and index funds.

- “Vanguard vs. Fidelity: 2023 Comparison” by Arielle O’Shea at Nerdwallet

- “Vanguard vs. Fidelity: Which Is Better for You?” by Kat Tretina at U.S. News

- “Vanguard vs. Fidelity: Which Brokerage Is Best?“ by Ashley Kilroy at SmartAsset

- “Vanguard vs. Fidelity“ by Jean Folger at Investopedia

Companies change, and Advisors change. I like to diversify across financial institutions as well as across asset classes because I can choose the best products and services from each. This is the preliminary conclusion that Carol reached as well.

How Will Fidelity or Vanguard Manage Carol’s Money?

Ultimately an investor needs to talk to the Financial Advisor to determine how they will work together to manage the client’s money because the services are highly customizable. I chose to set up my accounts that are managed in mutual funds and exchange traded funds.

Both Fidelity and Vanguard have a range of Advisory services, from robo-investing to Private Wealth Management, as shown in the links below. To get a full sense of what they offer, I suggested that Carol call both Fidelity and Vanguard and ask them about their advisory services.

What I suggested as a starting point for Carol is considering the Personal Advisor Select at Vanguard, which has a minimum of $500,000 and fees of 0.30%. With this, she gets a dedicated advisor and a host of other services. By comparison, at Fidelity, I suggest Fidelity Wealth Management which has a dedicated advisor and a minimum of $250,000 in assets managed through Fidelity. Fees range from 0.50% to 1.5%, depending upon the amount managed. Another option is Fidelity Wealth Services and Portfolio Advisory Services, which will manage your account.

Investment Approach

Fidelity approach is described in The Business Cycle Approach to Equity Sector Investing by Fidelity Institutional Insights. I find the Insights from Fidelity Wealth Management to be highly informative.

Over the past decade, I talked to Vanguard representatives twice about managing a portion of my financial assets. While I like Vanguard, their advisory services were not a good fit for me. Helping Carol has led me to review what is new at Vanguard. I ran across the recent articles below that describe some of Vanguard’s approaches, and they are on my reading list for June. In particular, I am curious about the Time-Varying Portfolio. Roger Aliaga-Diaz, Global Head of Portfolio Construction, wrote For a Disciplined Investor, Allocations That Fluctuate where he says:

“It’s important to understand two things about our time-varying asset allocation approach. It’s not for everyone; it’s intended for investors willing to accept a level of active risk, specifically the risk that our models may not accurately capture economic and market dynamics. And we recommend that investors make use of professional financial advice in relation to time-varying portfolios.”

- Vanguard’s Principles for Investing Success

- Global Equity and Fixed Income Outlook

- Two Approaches to Asset Allocation (Time Varying vs Tactical Asset Allocation)

- Our Time-Varying Portfolio and a Dynamic Economy

- Vanguard’s Portfolio Construction Framework

- Sophisticated Modeling and Forecasting

- Portfolio Construction: Principles Inform Possibilities

- Time Varying Asset Allocation

EVALUATING TYPES OF ACCOUNTS AND FUNDS

I believe Carol will benefit from a Financial Advisor helping to set up a withdrawal strategy, manage taxes, understand investment products, and rebalance a portfolio. Carol’s situation is complicated because she has about six different types of accounts.

Withdrawal Strategy

Even though Carol has pensions and Social Security to meet spending needs, she is going to have to make withdrawals from inherited IRAs and Traditional IRAs. With her goal of passing along an inheritance to her children, she needs to take into account taxes. “How to Make Your Retirement Account Withdrawals Work Best for You” by T. Rowe Price was particularly insightful for me because it describes taking accelerated withdrawals from a Traditional IRA and putting the money into an after-tax, tax-efficient account.

- “From Assets to Income: A Goals-Based Approach to Retirement Spending” at Vanguard Institutional

Taxes

Dividends and interest are taxed as ordinary income, usually at a higher rate than capital gains. A large portion of Carol’s assets are in savings accounts, and she has to pay taxes on this income. Carol and I looked at municipal bond funds and municipal money markets as a way of reducing taxes. Income levels can also impact Medicare income-adjusted premiums, which need to be considered. Passing along an Inherited Traditional IRA can complicate taxes for heirs because they have to withdraw the money within ten years.

- “Taxation Rules for Bond Investors” by Andre Bloomenthal on Investopedia

- “The Answers You’re Looking for This Tax Season” by Gary Stark at Vanguard

Tax Efficient Accounts

It was timely that Christine Benz at Morningstar wrote “Tax-Efficient Retirement-Bucket Portfolios for Vanguard Investors” while Carol and I were working on financial planning. The article describes Conservative, Moderate, and Aggressive tax-efficient portfolios of Vanguard funds using the Bucket Approach.

- “Vanguard Tax-Managed Capital Appreciation Fund Admiral Shares (VTCLX)”

- “Vanguard Tax-Managed Balanced Adm VTMFX” Morningstar

- “Vanguard Tax-Managed Balanced Fund Admiral Shares VTMFX” Vanguard

Rebalancing a Portfolio

Rebalancing sounds simple but involves knowing when and how often to rebalance and what the tax consequences are.

- “3 Rebalancing Tips to Fine-Tune Your Portfolio” by Vanguard.

- “Monitoring Your Risk Level and Rebalancing” by Vanguard.

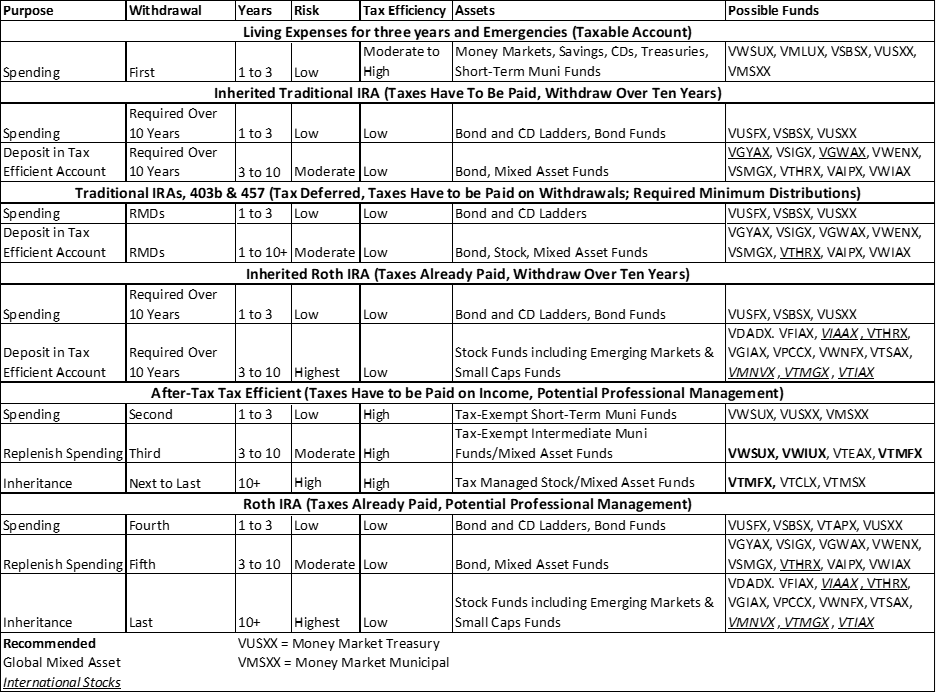

The Bucket Approach with Tax Advantaged Accounts

I put together the table below to explain Carol’s accounts, taxes, and possible withdrawal and investment strategies. “Years” refers to when money will be withdrawn for spending, required minimum distributions, or tax rules. “Risk” refers to whether the Bucket is intended for spending, which should be invested conservatively, or long-term investments. I then listed possible Vanguard funds based on risk and tax efficiency. Carol and I then matched her accounts with the Buckets. Some of the Buckets were eliminated as we defined a withdrawal strategy. Less tax-efficient, higher risk/reward investments should be concentrated in Roth IRAs.

Table #2: Combined Bucket and Accounts by Tax Status

SETTING UP A TAX-EFFICIENT ACCOUNT AT VANGUARD

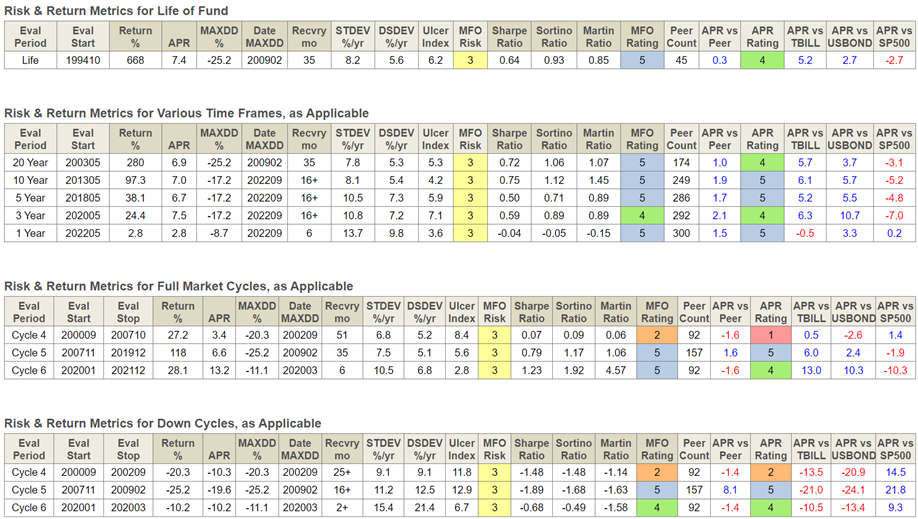

Carol decided that she wanted to open an after-tax account at Vanguard to manage longer-term tax-efficient investments. I helped her set up the account and transfer the funds from a savings account. Carol and I reviewed the portfolios described by Christine Benz, and she decided to invest in “Vanguard Tax-Managed Balanced Admiral (VTMFX),” which maintains roughly a 50% allocation to stocks as a self-directed portion of her portfolios. The benefit of this fund is that it is an all-in-one fund that Vanguard manages for tax efficiency, and Carol doesn’t have to worry about rebalancing. Table #3 contains some risk and reward metrics from Mutual Fund Observer Multi-Search.

Carol raised a concern about the US economy going into a recession this year and the stock market falling. I explained that she wanted the account and fund to be a long-term investment and to work in a tax-efficient manner, so it should be “buy and hold”. I agreed with her that a recession is likely and that short-term interest rates were high. We invested the money in the Vanguard Municipal Money Market Fund (VMSXX), which currently has a seven-day SEC yield of 3.19%, and put a modest amount in Vanguard Tax-Managed Balanced Fund Admiral Shares (VTMFX). Over the course of the year, we will move more money into VTMFX as opportunities arise.

Table 3: Vanguard Tax-Managed Balanced Fund Admiral Shares (VTMFX)

THE NEXT STEPS

Carol has identified a potential advisor at Fidelity and will be calling him to open an account and discuss financial advisory services. She will also be calling Vanguard to discuss advisory services.

CLOSING THOUGHTS

In Carol’s words:

My comfort level has improved dramatically. Before working with Lynn, the only place that I felt comfortable putting my money was in savings accounts at banks even though I knew the yields were low. I have a better understanding of the topics covered in this article. I now have a good set of financial tools to do my own research. We set up a tax efficient account at Vanguard with security authorization. I will be contacting both Fidelity and Vanguard to evaluate whether I want to have them as Financial Advisors or manage a portion of my assets. What I will be looking for when I talk to them is how well they listen to me. I will take a step back and think over my options before reaching a conclusion.

I have enjoyed helping Carol and am happy that she has learned so much. Investing is a passion of mine, but as a cancer-free cancer survivor, I remind myself that if I am not around, am I leaving my wife in a good position to manage money? I will read the articles on the Vanguard Time Varying Asset Allocation Model and set up an appointment to see what Vanguard advisory services, if any, I may be interested in.

Best wishes to Readers on the same journey as Carol. I hope you found some of the information in this article informative.