Dear friends,

Welcome to summer.

Had I mentioned that I have the coolest job in the world? I love a challenge. Augustana offers them to me at the rate of sixty a week, approximately the number of students I work with. They often leave me stunned.

(See how important punctuation is? “They often leave me stunned” and “they often leave me, stunned” are two very different observations. Hmmm … both might be accurate, now that I think of it.)

My college started in 1860 with a very humble mission: it wanted to help the children of immigrants build a good life in a new land without ever forsaking the beauty and culture of their ancestral home. In 1860, that meant Sweden … though there was a short-lived experiment in peaceful coexistence with Norwegian Lutherans. (Predictably, that came to naught.)

In 2023, it means Vietnam and Ethiopia, Nepal and Ghana, more than it means Sweden or France, China or Japan. Over 2500 kids from other lands applied to join us; nearly a third of our incoming class of 840 – the largest in our history – will be international students. But another 20% will be the first in their families to attend college, a quarter will come from low-income households, and a quarter will be US students of color. On the whole, they rock.

And we just launched 550 of them back in your direction.

In the June issue of Mutual Fund Observer

Summer is a time when young people head home on break from school or university while their slightly older siblings in the workforce often get a bit of vacation time. For their benefit, we offer three articles designed to help young investors who are trying to make sense of things and get started: Mark shares the story of the young investor’s secret weapon: the health savings account, which can do three great things at once. Lower medical insurance costs. Lower taxes. Build wealth. Lynn Bolin walks through the process of setting up a financial plan; he’s working with an older friend, but the process is identical. And I cap things off with the answer to the question we’ve all been asking: how does Taylor Swift invest her millions? The answer is surprising: prudently, in real estate … and in closed-end funds? We’ll explain.

Devesh shared an evening with David Sherman, president of Cohanzick Management and a really sharp investor. In a singularly brisk article, Devesh shares 15 investing insights worth pursuing. In a second essay, Devesh channels a second great investor – Warren Buffett, in this case – to consider stocks, inflation, and your portfolio.

Counterbalancing Devesh’s reflections on inflation, Lynn takes up the recession watch. His recommendation comes down to two words: Buckle. Up.

I profile Leuthold Core Investment, one of the OG quant tactical funds. While Morningstar recently ridiculed the tactical allocation group, Leuthold has stood apart over decades for offering a balanced portfolio that makes smart, disciplined adjustments to evolving market conditions. So you don’t have to.

Finally, Shadow gets us up to speed on the industry’s developments, including the lamentable and slightly ludicrous infatuation with single-stock ETFs, in “Briefly Noted.”

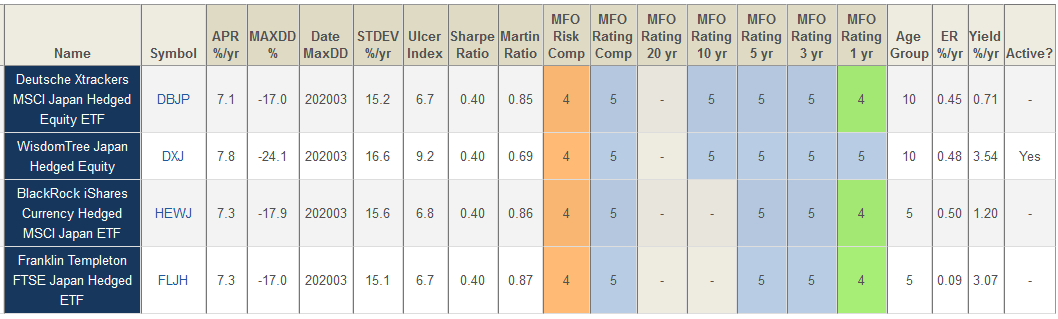

Devesh and David S. (the other David S.): consider Japan

In their long dinner conversation, Devesh and David Sherman explored the prospects of advising in the Japan stock market. A quick survey helps answer the question of how to invest there.

The MFO Premium screener offers up two insights: all of the best-performing funds are ETFs, and they all hedge against currency fluctuations. Here are the Great Owl funds, with their five-year returns and volatility metrics.

Morningstar’s recommended funds tend toward “large and well-established.” There are no publicly available Gold rated funds, but they do offer up two Silver medalists: T. Rowe Price Japan and Hennessey Japan.

Horizon Kinetics: Eight months later, Morningstar discovers the risk Devesh highlighted

In November 2022, Devesh Shah warned investors about the enormous risk that the Horizon Kinetics funds were subjecting their investors to by stashing nearly 50% of all of its firm’s assets into a single stock: Texas Pacific Land Corp.

Horizon Kinetics has placed a spectacular bet – firm wide – on a single stock. My argument is not that their bet is imprudent or that it will harm their investors. Instead, my argument is that the managers’ decisions carry the potential for spectacularly atypical performance.

If they manage to pull a rabbit, Kinetics is on its way to the Hall of Fame of investment returns in an otherwise awful market year. If Lady Luck decides not to cooperate, the risk for investors in Kinetics funds could be substantial. At the minimum, the large position concentration size of TPL in Kinetics portfolio seems diametrically opposite to their belief that investors are better served not by taking more risk…

Kinetics Fund investors: be hyperalert. (“Kinetics Mutual Funds: Five Star funds with a Lone Star Risk,” MFO, 11/2022)

Eight months later, almost to the day, a crack Morningstar team reported their discovery: Horizon Kinetics has a huge stack in Texas Pacific Land (“A Fund Shop Bets the Ranch on One Stock,” Morningstar, 6/1/2023).

Thoughts on the confluence of the two articles:

- We warned you of the risk before the funds crashed. Their flagship is down 22% YTD.

- Morningstar’s piece doesn’t hint at the existence of Devesh’s prescient warning. That might be because Morningstar doesn’t like sharing credit, or we’re too small for them to notice, or they’re too self-absorbed to care about other sources. None of the possibilities is terribly affirming.

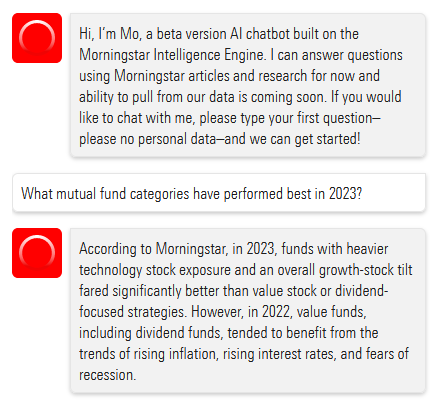

Bigger is not necessarily, or even usually, better. If you’ve had the opportunity to use Morningstar’s newly crippled fund screener (the “premium” screener of old is gone) and compare it to the MFO Premium screener, you might reach the same conclusion. I spent a very long hour online trying to answer a very simple question: what has worked so far in 2023? The answer completely escaped me, but it also completely escaped “Mo,” their version of Microsoft’s Clippy office assistant.

Bigger is not necessarily, or even usually, better. If you’ve had the opportunity to use Morningstar’s newly crippled fund screener (the “premium” screener of old is gone) and compare it to the MFO Premium screener, you might reach the same conclusion. I spent a very long hour online trying to answer a very simple question: what has worked so far in 2023? The answer completely escaped me, but it also completely escaped “Mo,” their version of Microsoft’s Clippy office assistant.

Here’s our exchange:

One would think that “mutual fund categories” is a term that might have been available, somewhere or somewhen, in the “Morningstar articles and research.”

Neither the “basic screener” nor the Investor allows you to compare funds with ETFs and CEFs (a function I’d asked about two years ago and to which I’d gotten a “future iterations” response). Investor doesn’t allow a search by returns (“Japan funds with YTD returns over 10%”). I can’t even get either to stop reporting every share class of every fund in the results. The Basic Screener announces there are 200 funds with YTD returns over zero. (There aren’t, that’s just the screener’s unannounced limit.) The first 25 “funds” listed were actually just seven funds with repeated share classes.

It’s hard to come up with a good answer to the simple question, why bother?

CrossingBridge Strategic Income vs. Osterweis Strategic Income: Month Two

In response to my April profiles of his RiverPark Strategic Income (soon to be CrossingBridge Strategic Income) Fund and Carl Kaufman’s Osterweis Strategic Income Fund, David took to the MFO discussion board to toss down the gauntlet:

Mr. Snowball and my fellow named firms:

I would like to have a gentleman’s wager of a dinner between all parties for the fund is considered the best based on the next 12 months in which David Snowball judges as well as determines criteria. Winner pays. Losers show up with winner at Mr. Snowball’s restaurant selection in Davenport environs, New York City, San Francisco, or Santa Fe. We can make it an annual event.

Not “winner takes all” quite so much as “winner takes dinner!” Our tally-to-date:

| CrossingBridge (bps) | Osterweis (bps) | |

| April 2023 | 115 | 85 |

| May 2023 | 54 | 0 |

| Overall | 170 | 85 |

We will say now what we said then: these are two exceptional funds run by skilled and canny managers who share an independent streak and a loathing of unnecessary risk.

Thanks, as ever …

To our faithful monthly contributors, Greg, William, and the other William, Brian, David, Wilson, Doug, and the good folks at S&F Investments.

And too to Sharon from Illinois (with a matching gift!), Marty (Hi, Marty! My frustration with Morningstar’s screener was triggered by work on your request about funds that recovered dramatically from the 2022 debacle; my current plan is to share a “worst to first” story in our July issue using MFO Premium data through 5/30/23), and Marc from Maryland.

Speaking of July, we’ll share two redemption stories (Goodhaven, which looked hard in the mirror, and First Foundation Total Return, an old failure adopted by a new team, are rolling right along) and updates on our two favorite really passive strategies (Voya Corporate Leaders is approaching its 90th year without a manager or without evidence need for a manager and OneFund’s S&P 500 Equal Weight Index strategy has received endorsements from the Bank of America analyst team and John Rekenthaler who grumbles, “I cannot explain why the equally weighted portfolio has been superior to the sum of its parts … I am merely reporting the findings, which have been impressive.”).

As ever,