Updates

Fido’s conversion

![]() Fidelity converted its “disruptive” funds to ETFs. They are Fidelity Disruptive Automation (FBOT), Fidelity Disruptive Communications (FDCF), Fidelity Disruptive Finance (FDFF), Fidelity Disruptive Medicine (FMED), and Fidelity Disruptive Technology (FDTX). As a group, they are not terribly compelling. They began trading this week.

Fidelity converted its “disruptive” funds to ETFs. They are Fidelity Disruptive Automation (FBOT), Fidelity Disruptive Communications (FDCF), Fidelity Disruptive Finance (FDFF), Fidelity Disruptive Medicine (FMED), and Fidelity Disruptive Technology (FDTX). As a group, they are not terribly compelling. They began trading this week.

Next up: the conversion of its six Enhanced Index funds into ETFs, likely in November 2023.

The Polar Plunge

According to CityWire, FPA, and Polar Capital have agreed to settle their reciprocal lawsuits over the failed transition of two FPA funds, rechristened Phaeacian Partners, to Polar. “Pursuant to the terms of the settlement agreement, Polar and First Pacific are each required to dismiss all claims against the other.” That settlement does not, however, resolve the conflict between Polar and manager Pierre Py – they claim that his decision to live in Switzerland rather than Los Angeles is to blame – nor does it bring Mr. Py and his team closer to returning as professional investors. That’s his stated intent and he is really good. We’ll keep watch.

T. Rowe tweaks

T Rowe Price is updating its target date funds lineup. Price offers three distinct sets of target-date funds:

T Rowe Price is updating its target date funds lineup. Price offers three distinct sets of target-date funds:

Target funds, with names such as Target 2035.

Retirement funds, with names such as Retirement 2035.

Retirement Blend funds, with names such as Retirement Blend 2035.

All are funds-of-funds. Here are the key differences:

Retirement funds: relatively aggressive glide path, highly diversified portfolio, primarily actively managed funds. (Full disclosure: a large chunk of my retirement portfolio is invested in T. Rowe Price Retirement 2025.)

Retirement Blend funds: relatively aggressive glide path (the same as Retirement’s), diversified portfolio, a mix of active and passive funds.

Target funds: relatively less aggressive glide path, highly diversified portfolio, primarily actively managed funds.

We can use a single target date from each series to highlight the differences.

| Rating | Equity | E.R. | |

| Target 2035 | Four stars | 70% | 0.57% |

| Retirement 2035 | Five stars | 80% | 0.59% |

| Blend 2035 | Unrated | 80% | 0.41% |

Two developments were just announced. First, Price is adding two hedge-like funds to the roster of funds that might be included. Those are T Rowe Price Dynamic Credit and T Rowe Price Hedged Equity. That highlights one of the attractions of the Price target date series. They are research-driven and incorporate lots of small slices of assets, including hedging assets, that most of their competitors cannot or will not duplicate. Second, in 2024, the Retirement I fund series is being folded into the Retirement series. The latter change is mostly an administrative matter that reflects changing regulations about fund share pricing. It should have no impact on investors.

Briefly Noted . . .

American Beacon AHL Multi-Alternatives Fund has filed a registration filing. The fund will execute two complementary strategies: a managed futures strategy and a target risk strategy. A target risk strategy asks, “In which assets can we now invest to get the highest return without exceeding our level of targeted risk”? In this case, the managers will try to invest opportunistically across equities, bonds, interest rates, corporate credit, and commodities which the goal of making as great a return as possible without subjecting investors to more than 10% annualized across any 12-month period. Expenses vary contingent upon each investment share class.

The merger of FlexShares International Quality Dividend Defensive Index Fund and FlexShares International Quality Dividend Index Fund has been suspended. The reason for the cancellation of the proposed reorganization is that, following the reconstitution of the underlying indexes of IQDE and IQDF, there was no longer sufficient overlap in the two portfolios to support a tax-free reorganization.

SMALL WINS FOR INVESTORS

Driehaus Micro Cap Growth Fund reopened to existing investors, provided you meet the stated conditions, on July 10. Eligible buyers: current fund shareholders, participants in retirement plans with the fund as an option, and advisers whose clients already have fund accounts. The roster of people eligible to open a new account is limited to Driehaus employees, investors who exchange shares of another Driehaus fund for shares of Micro-cap, and (don’t fully understand this one) advisors “whose clients have Fund accounts.”

The fund is rated five stars and it has pretty much smushed the competition since launch.

Comparison of Lifetime Performance (Since 201312)

| Name | Annual return | Standard deviation | Ulcer Index | Sharpe Ratio | Sortino Ratio | Martin Ratio | MFO Rating |

| Driehaus Micro Cap Growth | 14.7% | 24.8 | 14.8 | 0.55 | 0.86 | 0.92 | 5 |

| Small-Cap Growth Category Average | 7.4 | 19.5 | 12.1 | 0.33 | 0.49 | 0.57 | 1 |

It’s clearly a “returns story” much more than a “risk story,” but the returns have been pretty spectacular.

Columbia Small Cap Growth Fund is reopening to new investors on July 31, Morningstar rates the fund four stars. The fund last closed to new investors on June 1, 2021. It has a rocky three-year record but is rock-solid for all of the other time periods we track. The fund launched in 1996 and its longest-tenured manager has been on board since 2006. The 10-year record seems broadly representative of its performance.

Comparison of 10-Year Performance (Since 201306)

| Annual return | Standard deviation | Ulcer Index | Sharpe Ratio | Sortino Ratio | Martin Ratio | MFO Rating | |

| Columbia Small Cap Growth | 10.8 | 21.7 | 15.9 | 0.45 | 0.69 | 0.62 | 2 |

| Small-Cap Growth Category Average | 8.8 | 19.2 | 11.8 | 0.41 | 0.61 | 0.71 | 1 |

As with Driehaus, whose performance is not directly comparable because it’s a much younger fund, the story here is about the magnitude of excess returns swamping the magnitude of excess risk (both are high), leading to really solid risk-adjusted returns.

CLOSINGS (and related inconveniences)

Nary a one!

OLD WINE, NEW BOTTLES

Abrdn is set to acquire four closed-end health-related funds from Tekla. Lest you think “closed-end funds, aren’t those like Studebakers?” we’ll note that the performance of the Tekla CEFs has been quite solid.

In case you’re thinking, “Wow! How did you get detailed information on closed-end funds so quickly,” you need to check out MFO Premium. It’s the only tool costing less than a car with also allows side-by-side comparisons of mutual funds, ETFs, and closed-end funds.

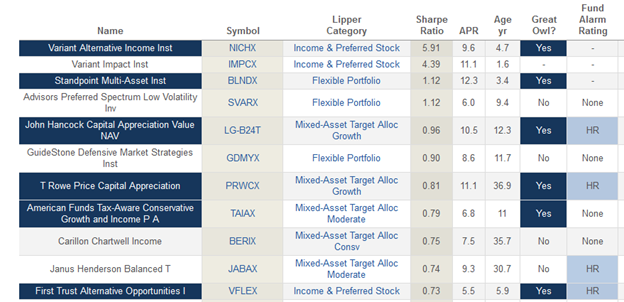

Ask: what multi-asset fund has the best risk-return tradeoff?

Bink:

Here’s a screen of all multi-asset funds, sorted by Sharpe ratio. You’ll notice that the first two are closed-end funds that are vastly outperforming the field, the third is a young fund that we’ve profiled, while #4 and 6 are T Rowe Price Cap App and a clone.

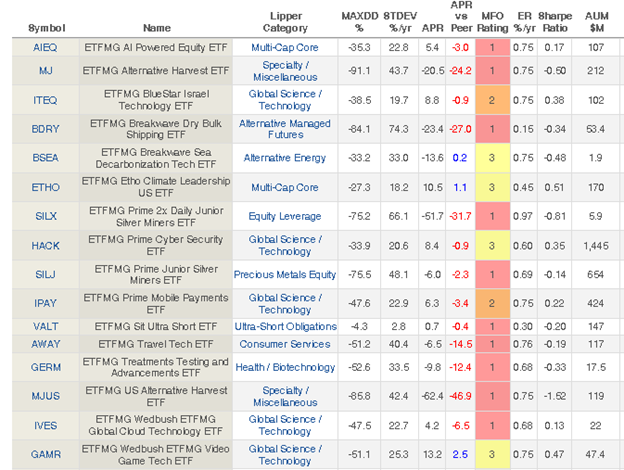

Amplify ETFs is acquiring the assets from ETF Managers Group, a thematic boutique of … idiosyncratic offerings. Here’s the performance of the funds since inception.

Perhaps the columns to focus on might be “APR versus peers” – the amount by which they lead or trail the average fund in their category – and “MFO Rating,” a quick snapshot of risk-adjusted returns where blue/5 cells are the very best (see any?) and red/1 cells are the very worst (ummm … 10?).

Brown Advisory Total Return Fund has been reorganized into the Brown Advisory Sustainable Bond Fund effective as of the close of business on June 23, 2023.

The Board of Trustees of FundX Investment Trust has approved converting FundX Flexible Income Fund and FundX Conservative Upgrader Fund into ETFs. There will be no change to each Fund’s investment objective, investment strategies, or portfolio management as a result of the reorganizations.

OFF TO THE DUSTBIN OF HISTORY

The AlphaMark Fund will be liquidated on or about July 31.

Delaware Ivy Funds is liquidating its Ivy Emerging Markets Local Currency Debt and International Small Cap Funds. The liquidations will occur on or about August 31, 2023.

Frontier MFG Select Infrastructure Fund will be liquidated on August 23.

Lazard Global Fixed Income Portfolio will be liquidated on or about July 31.