James Mackintosh, who has always been adamantly skeptical of ESG/SRI/green investing (though less loudly opposed to anti-woke/red investing, perhaps because it’s so marginal), offered a nice analysis (“Green Investors Were Crushed. Now It’s Time to Make Money,” WSJ.com, 12/5/2023) of the declining popularity of ESG investing in 2023 and the challenges facing certain green energy firms.

“Invest according to your political views,” he begins, “and you’re unlikely to make money.”

“[T]he real world is tougher than advocates of ESG—environmental, social and governance—investing claimed,” he huffed.

It’s “The Big Green Misery Machine,” they warn.

(sigh)

One might point out that ESG investing isn’t merely a political gesture. The “G” in ESG, measuring effective corporate governance, especially, is predictive of corporate performance, but he’s never been interested in nuance.

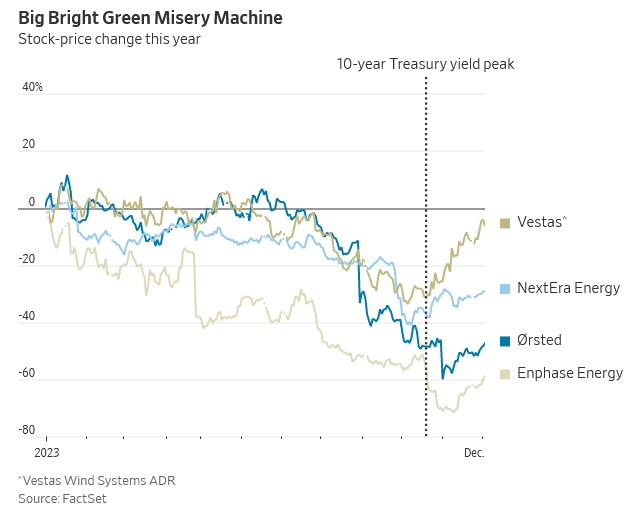

His case highlights the stock price declines of four small “green energy” firms:

One might point out that “green energy firms” are not the core of an ESG-screened portfolio, though they might indeed be included in it. The largest holdings in the ESG-screened version of the S&P 500: Microsoft, Apple, Amazon, Invidia, Alphabet, Tesla, UnitedHealth Group, JPMorgan Chase, and Eli Lily.

Here are two more important things to point out.

2024 will be better for ESG funds than was 2023

The point that makes me less irked with him is “investors who bought green stocks probably didn’t think they were making a leveraged bet on Treasuries, but that is what they ended up with.” He argues that rising interest rates impact renewable energy stocks (for which he uses the synonym “green stocks”) in two ways. First, renewable energy projects are 80% debt-funded, and debt is increasingly expensive and hard to acquire. Second, consumers making personal investments in “green” products – heat pumps, solar, electric cars – also use debt, whether credit cards, HELOCs, or second mortgages, to finance them. Higher borrowing costs led to lower demand for those products.

High costs shift people’s attention from the long-term – the need for renewables and global heating – to the short term – the need to cover the bill.

He also argues that much, though not all, of the “greenium” has been squeezed out of the market. Valuations on renewables are way down if not deeply discounted. That makes them more economically rational purchases now than they were two years ago.

In addition, interest rates are likelier to fall than to rise in 2024. Those skilled at examining the Fed’s entrails anticipate three rate cuts of some magnitude, likely starting around mid-year. That’s complemented by a potentially game-changing Treasury Department ruling: profitable green firms can now sell tax credits that they’ve received to other corporations to raise money. The first such sale was just closed by First Solar:

In what both sides are calling the first significant credit transfer of its kind in the solar manufacturing industry, First Solar announced that it entered into two separate Tax Credit Transfer Agreements (TCTAs) in late December to sell $500 million and up to $200 million, respectively, of 2023 Inflation Reduction Act (IRA) Advanced Manufacturing Production tax credits to Fiserv, a financial services company.

The Treasury proposed regulations intending to incentivize the production of eligible components within the United States. Qualifying materials include solar and wind energy components, inverters, some battery parts, and applicable critical minerals.

“This is the IRA delivering on its intent, which is to incentivize high-value domestic manufacturing by providing manufacturers with the liquidity they need to reinvest in growth and innovation,” said Mark Widmar, CEO of First Solar. “This agreement establishes an important precedent for the solar industry, confirming the marketability and value of Advanced Manufacturing Production tax credits.” (Renewable Energy World, 1/5/2024)

The short version is that these credits give the manufacturers of solar, wind, inverters, batteries, and critical materials access to a new source of capital that is independent of traditional credit markets and not constrained by prevailing interest rates.

ESG-screened funds did better in 2023 than their non-ESG counterparts.

While investors (and several Red state governments) fled, ESG versions of the S&P 500 and the equal-weight S&P 500 continued their dominance over the non-screened siblings.

| 2023 (through 12/26) | Three year | Five year | |

| Xtrackers S&P 500 ESG | 27.39% | 11.84 | n/a |

| S&P 500 | 25.68 | 10.41 | 16.31 |

| ESG S&P 500 Equal Weight | 13.39 | n/a | n/a |

| S&P 500 Equal Weight | 13.13 | 9.39 | 14.80 |

S&P Global themselves published this performance comparison, for the period ending 11/30/2023:

| One year | Three-year | Five-year | 10 years | |

| S&P 500 ESG | 15.56 | 11.26 | 14.15 | 12.56 |

| S&P 500 | 13.84 | 9.76 | 12.51 | 11.82 |

And it’s not just the S&P500. MFO Premium tracks 722 ESG sorts of funds and ETFs. In 2023, 370 of them outperformed their peer groups. More than half of ESG funds outperformed their peers even when conditions turned against them.

Thirty-six ESG funds and ETFs posted returns of 30% or more in 2023, including the two Shariah-screened ETF index funds.

Let’s be clear here: in the worst of times, ESG investing makes investment sense. ESG funds make serious money.

Bottom line

If Mr. Mackintosh is right, the future for ESG investing is far brighter than its recent past. Well-managed ESG funds that use screens intelligently, as a tool for eliminating financial disasters and not just for marketing purposes, are worthwhile additions to any portfolio.

That does not free individual investors from the responsibility of researching their funds carefully. Three years ago every damned marketer in the industry started running around with stickers reading “green” and “responsible” on every failed fund in the company. As it turns out, rotten funds with green stickers remain rotten funds and are dying off. At the same time, there are funds with serious, thoughtful strategies that have a long-term track record of using ESG screens to enhance performance (and, just maybe, doing a tiny bit of good in the process).

My sole green holding, which I’ve discussed in each of my annual portfolio disclosures, is Brown Advisory Sustainable Growth. It gained 38.8% in 2023 and has eked out 16% APR since I first bought it. Really, that does not feel like a “misery machine.” Which is to say, I’m not sure that Mr. Mackintosh’s analysis of ESG investing is quite so clear and profound as might be warranted by inclusion in the world’s premier business paper.