Dear friends,

Welcome to the January issue of Mutual Fund Observer.

January was named after Janus, the tutelary deity of the year’s first month. As tutelary, he was guardian, patron, and protector. Absent from the Greek pantheon, Janus was the Roman god of beginnings, transitions, and endings. It was the “transitions” part that led Romans to place the two-faced god near entries and passageways, where he oversaw their comings and goings.

Janus, ca 1225-1230, Museum of Ferrara Cathedral, Ferrara, Italy. (He’s holding a jug of wine, which might be a clue to what he sees.). The French cheerfully promote “the temple of Janus” (the thumbnail on our index page) near Autun in Burgundy, while admitting that it has nothing to do with … well, Janus.

This was a strange, liminal time of year in ancient Rome. Traditionally, the old year ended with a solstice festival, and the new year began around the time of spring planting, in March. When exactly the year began was up to the high priest of Rome’s College of Pontiffs, the pontifex maximus. Since politics is the second-oldest profession (you know the first, and I suspect “brewer” was the third), things promptly got messy. Newly elected governments took power on the first day of the new year, which created an irresistible temptation for the pontifex to accelerate the start of the year when parties they favored were coming to power and to delay the new year when disagreeable parties were incoming.

Julius Caesar eventually put his foot down to end that foolishness and ordered the creation of the two new months out of the void between one year and the next. January was a month for taking stock, looking both upstream and down as we stood in the river of time.

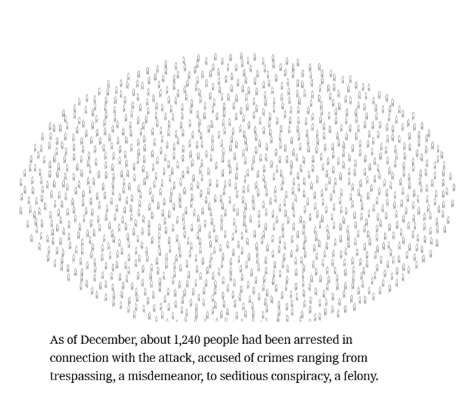

This issue was published on January 6, 2024, the third anniversary of the attack on the US Capitol in which 150 police officers were injured, and five eventually died, in defense of the members of Congress meeting there. In the years since, 1240 people have been arrested with that total still ticking up each week. Of those brought to trial, only two have been acquitted. Of those brought to trial before a jury of their peers, none have been acquitted. The New York Times (1/4/2024) published a fascinating, interactive story on the fate of the rioters.

This issue was published on January 6, 2024, the third anniversary of the attack on the US Capitol in which 150 police officers were injured, and five eventually died, in defense of the members of Congress meeting there. In the years since, 1240 people have been arrested with that total still ticking up each week. Of those brought to trial, only two have been acquitted. Of those brought to trial before a jury of their peers, none have been acquitted. The New York Times (1/4/2024) published a fascinating, interactive story on the fate of the rioters.

The ongoing attempts to whitewash the history of the attack and the public attempts by some to actually celebrate it are a continuing stain. President Biden’s speech from the Capitol on January 5, 2024, is, in equal measure, outraged by the events of the day and by the subsequent attempts to exalt rioters as “martyrs” and “hostages.” And yet, it ends on a hopeful call:

Deep in the heart of America, burns a flame lit almost 250 years ago of liberty, freedom and equality. This is not the land of kings or dictators or autocrats.

We’re a nation of laws of order, not chaos, of peace, not violence. Here in America, the people rule, through the ballot. And their will prevails. So let’s remember together, we’re one nation under God, indivisible, that today, tomorrow and forever, at our best, we are the United States of America.

God bless you all. May God protect our troops. My God bless those who stand watch over our democracy.

The New York Times warns

And yet, progress requires hope. An optimistic mindset is associated with both good health and personal success because optimists are able to see opportunities and seize them; pessimists see threats and recoil from them.

For those seeking a satisfying answer to the question, “What’s there to be optimistic about, Snowball?” here’s a partial list of 2023’s small victories.

- The California drought is over.

- The pandemic officially ended on May 5.

- Egg prices are back to $2 a dozen as inflation abates. Chip and I pay a bit more for jumbo eggs hand-gathered on Amish farms, but that’s a choice rather than a necessity.

- The United States experienced an economic soft landing. It’s only happened once before, I hadn’t anticipated it and it might still unwind but it is profoundly positive for investors. GDP grew 2.6% in 2023, the unemployment rate approaches its pre-pandemic low which was also the lowest in generations. Even better, wage gains have exceeded inflation by about 0.5% this year. And, savers are now actually making money on their savings.

- A banking crisis was avoided. Remember Silicon Valley Bank? If not, hooray for us because it could have become the trigger for a bank collapse spiral that didn’t occur.

- The gender pay gap hit an all-time low, with women earning 84% of what men do, up from 78% 10 years ago.

- The US crime rate is plummeting. (Didn’t see that coming, did you?) The crime rate has been falling (with the exception of the pandemic years 2020-21) throughout this century. By most measures, it was the lowest in 50 years. Murders are down nationally by 12%. Detroit saw a century low in murder. Violent crime in NYC dropped by double digits. Every category of crime, except car theft, is down. And the decrease is accelerating, leading David Graham to describe it as “a peace wave” (The Atlantic, 12/17/2023).

- The US Supreme Court upheld America’s strongest animal welfare law and rejected the wackadoodle “independent state legislature” theory.

- Medical research works. Umm … “science is real”? Gene editing treatments are here, including one that cures deafness for some kids with genetic hearing loss and another that might cure sickle cell anemia. The mRNA technology is generating a surprising array of vaccines against diseases we thought were unavoidable. Cancer treatments are amazing, with new drugs seeing remission rates of 40% in some “incurable” cancers. A spinal implant is allowing a guy with advanced Parkinson’s to walk again.

- Guinea worm disease – don’t Google it, it’s gross beyond description – is almost eradicated, with only 13 human cases last year.

- A cheap and effective vaccine against malaria, the largest killer of children in sub-Saharan Africa, got World Health Organization approval.

- Russia’s power, hard and soft, is waning. Ukraine remains an independent country; Finland joined NATO. Moderates prevailed in elections in Poland and the Czech Republic. And Boris Johnson, whose misrule was breathtaking, is gone.

- President Biden and Xi Jinping met face to face. It’s much better that they talk than not.

- Deforestation in Brazil’s Amazon has dropped by two-thirds in five years. Brazil promises to halt deforestation entirely by 2030, and deforestation in Colombia has fallen apace. Both governments are finding ways for people to make money in forested regions. New EU regulations that ban the import of products linked to deforestation – from lumber to beef, cocoa, and coffee – will likely strengthen such moves.

- The Inflation Reduction Act has spurred $110 billion in corporate investments to reduce greenhouse gas emissions, support clean energy, and encourage electrification. Some analyses suggest that will reduce greenhouse gas emissions by 43-48% in a couple of decades, even without further action. One of the criticisms of the IRA is ironic: it’s costing the government vastly more than initially projected, precisely because it has been vastly more attractive to corporations than anyone could have guessed.

- Montana youth won a landmark climate case in which the state supreme court ruled that the state constitution’s guarantee of a “clean and healthful environment” was actually real, actionable, and enforceable.

- The world may have crossed a solar power tipping point which portends a world in which solar will be the largest source of the world’s energy by 2050. China blew past its solar goals five years early, adding somewhere between 180 and 230 gigawatts last year. Fingers crossed, we might also have reached our peak output of global greenhouse gas emissions, with things beginning to tick down after 2024. US output of such gases has been down substantially since 2007 and continues to fall.

- Americans purchased a million EVs in 2023.

- Climate-vulnerable nations are receiving survival aid. At the COP28 summit this fall, world governments agreed to launch a modest fund – about $100 billion – for loss and damage caused by climate change. The same summit, over the resistance of OPEC states, affirmed for the first time a “transition away from fossil fuels in energy systems.”

- Dam removal and American river restoration are picking up, with the first dam on the Klamath River demolished in November 2023 and two more on tap.

- After decades of negotiations, the High Seas Treaty was ratified as a tool to protect the world’s oceans that lie outside national boundaries.

- The hole in the ozone layer is shrinking, mostly because governments banded together and acted to protect it.

- World Wide Fund for Nature announced that scientists had found 380 new species – including a really cool orchid – in just one small region of the Mekong River valley. Separately, but happily, Africa’s endangered white rhino population ticked up.

- Americans are traveling again, here and abroad, more frequently than we did before the pandemic. Adventure and mischief to follow (at least if Chip and I hit the road again).

And while you might think of it as silly, I’m cheered by the stories of the first person (Kelvin Kiptum) ever to run a marathon in two hours, the return of the stunningly talented Simone Biles to competition, a 104-year-old woman (Dorothy Hoffner) passed away in her sleep a week after fulfilling her dream to go skydiving, and the fact that Lego is making bricks to help teach Braille to visually-impaired kids. Jimmy and Rosalynn got to celebrate their 77th anniversary together, inseparable even as a parting loomed.

And while you might think of it as silly, I’m cheered by the stories of the first person (Kelvin Kiptum) ever to run a marathon in two hours, the return of the stunningly talented Simone Biles to competition, a 104-year-old woman (Dorothy Hoffner) passed away in her sleep a week after fulfilling her dream to go skydiving, and the fact that Lego is making bricks to help teach Braille to visually-impaired kids. Jimmy and Rosalynn got to celebrate their 77th anniversary together, inseparable even as a parting loomed.

Apparently others got excited about something called “Barbenheimer”?

Without any question, we face a multitude of challenges. We need to return to operating with a modicum of trust in one another and of faith in our institutions. We need to accept evidence rather than conspiracy; to rise to the challenge of “reality at stake” in our current political moment. We need to adult up if we want to bequeath a better world to our children and to theirs.

But we can.

And we will.

In the January Mutual Fund Observer …

Much of our success as investors is driven by two factors: a good plan and resilience in executing it. Our colleagues Devesh Shah and Lynn Bolin, approach the art of creating such a plan – technically, of asset allocation – from two very different perspectives. Devesh wanders New York’s Central Park, deep in conversation with trusted friends. Lynn wanders through reams of data, deep in conversation with … well, reams of data. Both offer advice on how to navigate the uncertainties of the year.

I share a profile of Standpoint Multi-Asset Fund, a singularly puzzling success story whose record can’t be denied. The fund married a core global equities portfolio (about 50%), Treasuries (about 30%), and futures contracts to craft an all-weather portfolio. Since its inception four years ago, it has returned 11% annually, been in the black all four years (a nearly impossible feat in 2022), and has crushed pretty much every benchmark and peer group available. It’s worth investigating.

Jeff Wrona, whose career stretches back to the halcyon days of the PBHG funds in the ‘90s (he’s one of the guys to score returns over 200%), engages in an Elevator Talk about his new fund, One Rock (ONERX) which embodies both his personal faith and the lessons of his long career. The fund has returned 32% annually since its birth in March 2020, about twice the returns of its Lipper multi-cap growth peer group.

I look at the triumph of ESG investing! Didn’t see that one coming, didya?

Our colleague Charles Boccadoro updates folks on developments in the market and at the MFO Premium fund screener. Charles now has a YouTube channel!

Let me be clear: with Morningstar’s serial decisions to kill both its Basic and Premium fund screeners, leaving behind only the lame and limited version at Morningstar Investor (the discussion on the MFO discussion board is fairly emphatic) and their nebulous promise that a “revamped basic screener is on the roadmap …but we don’t have a concrete timeline” (leading to the question, why kill two functional screeners if you don’t have a replacement?), the MFO Premium screener is the most affordable, most powerful option available for average investors and smaller advisers.

Looking for a small-cap value fund, with a microcap tilt, with much better than average downside capture metrics, and above average 10-year performance? Got it!

Looking for a core large-cap fund that proved its value by skillfully navigating the madcap stretch from 1995 – 2004, from the dot-com madness through the following crash? No problem. Start with Eaton Vance Tax-Managed Growth, Jensen Quality Growth, and Madison Investors. All posted double-digit returns for the decade with way below-average downside.

It takes a bit of effort to learn how to sort through the treasure trove there, but Charles himself will guide you if only you ask! Drop him a line at [email protected].

And The Shadow reveals the industry’s doings, from green flight and fund conversions to our small victories, including the reopening of Virtus KAR Small-Cap Growth Fund.

Thanks in this New Year to …

New Year’s blessings to our indispensable regulars, from the good folks at S&F Investment Advisor in lovely Encino to Wilson, Gregory, William, William, Stephen, Brian, David, and Doug!

Many thanks to Benjamin of Ann Arbor, Thomas from Virginia, Rae from Ohio, Debbi Debbi Debbi! in honor of Nick who we miss a lot, the Nikolai Family, John from my home state of Pennsylvania, Jeroen of Anchorage, Kevin from California, Eric (the MFO team thanks you!), Kathy from Massachusetts, Donald of Seattle, Steven from Colorado, Charles of Indianapolis, Michael from Virginia, Teresa in honor of Dan (I love hearing about the adventures of our graduates), and David from Oregon.

Thanks, too, to friends in the industry who’ve shared books that might broaden our minds – from Sam Zell’s Am I Being Too Subtle? to Chef Wise and Anderson Cooper’s biography of the Astors, one of the century’s richest and most tragic families – and an awesome coffee cake that might broaden our waists. (We’ll be careful, Dan. We promise!)

If you’re so disposed, please do consider contributing to MFO. Of our 18,000 readers, about 1% chip in. Making it 1% plus 1 would be a gain! It’s tax-deductible, it lets us keep the lights on, and it raises the prospect that we might be able to share a year-end gift with the folks who – without compensation – make this all possible.

As ever,