Objective and strategy

The Standpoint Multi-Asset Fund seeks positive absolute returns through an “All-Weather strategy.” The fund holds a global equity portfolio built from regional equity ETFs. The strategy also invests, both long and short, in exchange traded futures contracts from seven sectors: equity indexes, currencies, interest rates, metals, grains, soft commodities, and energy. The managers attempt to participate in medium- to long-term trends in global futures markets and to produce a reasonable return premium in exchange for assuming risk.

Adviser

Standpoint Asset Management, LLC. Standpoint, with about six employees, is headquartered in Scottsdale. Tom Basso is the chairman of the board for Standpoint Asset Management. He’s been a mentor to Eric Crittenden since the late 1990s. Mr. Basso, a veteran hedge fund manager, is featured alongside other legendary money managers such as Stanley Druckenmiller and Paul Tudor Jones in the classic “Market Wizards” series written by Jack Schwager. He is invested in the fund but does not participate in its day-to-day operations. The firm manages this one strategy, has $700 million in AUM (as of December 2023), and has seen strong inflows in 2023.

Because the strategy is managed according to “a comprehensive set of systematic rules” and has little room for human intervention, the firm can effectively manage large amounts of money with few staff.

Manager

Eric Crittenden and Shawn Serikov.

Eric Crittenden became Chief Investment Officer and Portfolio Manager in August 2019. He designed the firm’s rules-based investment strategies, oversees the daily investment operation, and conducts research. Before Standpoint, he was Co-CIO and Co-Portfolio Manager for Longboard Asset Management (2011-2018) and Director of Research for Blackstar Funds (2003-2011). He graduated summa cum laude from Wichita State University in 1999 with a BBA in Finance.

Shawn Serikov is the primary software developer and second portfolio manager for the fund. Before becoming Chief Technology Officer and Portfolio Manager (August 2019), he was a Computer Systems Analyst at Longboard Asset Management (2015-2019) and Senior Software Developer and Product Manager at INTL FC Stone LLC (2011-2015). He graduated summa cum laude from Wichita State University in 1999 and holds a Master of Finance degree from the University of Toronto.

They are supported by Mike Striano who’s responsible for risk management, cash management, and compliance, and five other folks in areas such as compliance, software development, client relations, and business operations. He is a 25+ year veteran of the industry, having worked for several high-profile macro-oriented hedge funds including Crabel Capital, Chesapeake Capital, and Fall River Capital.

Strategy capacity and closure

Standpoint reports that “We designed the strategy to handle approximately $10+ billion with no meaningful changes. We designed the fund to have high capacity and have operated it as such since inception. If we are fortunate enough to grow significantly we will likely implement a soft close well short of peak capacity, and eventually a hard close as we further approach peak capacity.”

Management’s stake in the fund

Eric Crittenden has between $500,000 and $1,000,000 invested in the fund, and Shawn Serikov has between $100,000 and 500,000 in the fund.

Opening date

December 30, 2019.

Minimum investment

Investor shares minimum purchase is $2,500. The Institutional minimum is $25,000.

Expense ratio

The fund charges 1.55% (after waivers) on assets of for Investor shares and 1.30% for Institutional shares.

Comments

It’s easy to write about a fund that does normal things but tries to do it just a bit better.

It’s hard to write about a fund that tries to do worthwhile things with a strategy that no one else is pursuing: A sui generis strategy, one that’s in a category of its own.

It appears that Standpoint Multi-Asset Fund is and does.

Standpoint positions itself as an “absolute return” strategy; that is, it wants to make reasonable positive returns in all markets. Period. The fund has returned 11.0% annually since inception (through December 2023) and posted gains in 2020, 2021, 2022, and 2023.

The strategy seems sensible and straightforward. The fund provides exposure to equities (which help in times of economic growth or inflation), fixed income (which buffers deflationary periods and stock market declines), and commodities (which are uncorrelated with the first two, making it possible to minimize the effects both sustained price changes and of an equity market decline). Half of the portfolio is invested in low-cost ETFs to give exposure to the global equity market. The argument is simple: over time, equities make serious money, especially if you don’t overpay for them. The fund holds eight equity ETFs charging between 3 and 7 basis points.

The other half of the portfolio is managed futures positions. Because of the financial requirements of futures investing, about 30% of the portfolio is in T-bills. The futures positions can be in stocks and fixed income, as well as currencies and commodities. “Once a year we pull down the information on all the future contracts in the world, arrayed from most liquid to least liquid. We exclude the untradeable, then select the 75 most liquid in six sectors.” Using a market-following strategy, the futures contracts allow the portfolio’s exposure to equity markets to be increased beyond its 50% base (it peaked at 101%) or decreased to near zero.

The distinction is that the strategy is momentum-based:

the risk-management process in our macro program cuts risk in losing positions. Unlike some other alternative strategies, ours does not “double down” or increase risk in positions because they are moving against us. The philosophy of trend-oriented macro investing is to rotate out of what is not working, and rotate into what is working, in a disciplined manner, with a risk budget enforced each step of the way.

“Decent returns without ever losing investors’ money” seems like an unbearably attractive proposition, so why don’t other funds attempt it?

The short answer is, that some do. We found about 18 funds with “absolute return” in their names and, via a full-text search of the SEC’s Edgar database, a few more with the term in their objective. On the whole, there are a couple dozen contenders out of a field of 12,200 funds and ETFs.

On the whole, they have not performed brilliantly. We used the MFO Premium screener to identify funds with “Absolute Return” in their name. From there, we asked the simple question: did they produce positive absolute returns over reasonable time periods?

In general, they have not. We looked for the funds’ minimum three- and five-year rolling averages; that is, what’s the worst experience that an investor might have had when holding the fund over any three-year (for example, March 2020 – February 2022) or five-year period? Of the 19 funds we identified, 17 have posted at least one negative three-year average. Of the 15 with a record longer than five years, eight have a negative five-year roll on their record.

53% of absolute return funds have at least one five-year (60-month stretch) underwater! 89% have at least one three-year (36-month stretch) underwater.

These comparisons are complicated by the fact that “absolute return” is not recognized as a peer group by firms such as Morningstar and Lipper. Morningstar categorizes Standpoint Multi-Asset Fund as a “macro trading” fund. Lipper calls it a “flexible portfolio,” in the company of such dissimilar funds as RiverPark Strategic Income and FPA Crescent. Morningstar ridicules “flexible portfolios” and recommends that you consider the simple, inflexible option of a 60/40 hybrid fund.

[T]actical allocation funds [are] the quintessential “managed” multi-asset strategy, as the managers frequently adjust the funds’ asset-allocation exposures depending on their market forecasts or other factors. [We calculated their 10-year returns.] One thing that’s quickly evident about these tactical funds is that they were stinkers: The average fund gained a measly 2.3% per year over the decade ended April 30, 2023, roughly a third that of the U.S. 60% stocks/40% bonds mix. (Jeff Ptak, “They Came, They Saw. They Incinerated Half 0f Their Fund’s Potential Returns,” Morningstar.com, 5/30/2023).

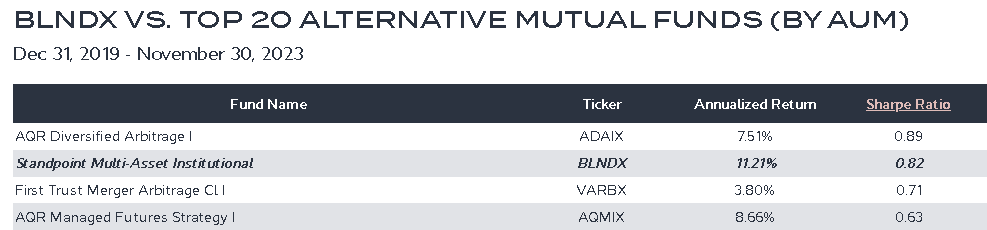

Standpoint itself tracks its performance against the 20 largest “alternatives” funds in the industry.

That wealth of possible benchmarks – flexible funds, managed futures funds, 60/40 funds, alternatives – underscores a powerful point: to date, Standpoint has outperformed all of them in both returns and risk-adjusted returns.

Lipper, hence MFO, categorizes Standpoint as a “flexible portfolio” fund. Some flexible portfolios are looking for steady returns akin to short-term bonds, some for more nearly equity-like returns. In the group below we compare Standpoint to all flexible funds (column 3) and then only to the subset of flexible funds that have equity-like total returns (column 4, “high return funds”).

The group ranged from 16% APR to -6.5%. The median fund returned 2.6%, with 37 of 160 having lost money over the past three years (12/2020-11/2023)

Three-year comparison, Standpoint versus Lipper peers and peer subset

| Standpoint | Flexible portfolio peer ranking | Peer ranking among high-return funds | |

| Annualized returns | 10.9% | #3 out of 160 funds | #3 of 12 funds |

| Standard deviation | 6.3% | #21 | #1 |

| Downside deviation | 4.5% | 14 | 1 |

| Down market deviation | 3.1% | 15 | 1 |

| Bear market deviation | 2.7% | 14 | 2 |

| Maximum drawdown | 5.3% | 6 | 1 |

| Sharpe ratio | 1.04 | 2 | 1 |

| Sortino ratio | 1.94 | 1 | 1 |

| Martin ratio | 4.13 | 1 | 1 |

| Ulcer Index | 2,1 | 5 | 1 |

Source: MFO Premium data calculations and Lipper global data feed

Here’s how to read that table: the first raw measures total return (10.9% annualize) against its Lipper group (#3 of 160 flexible funds) and the high-return subset (#3 of 12 funds). The next five rows are different measures of volatility, which most investors treat as “risk.” Standpoint is in the top 10% of all flexible funds, including very conservative ones, by that measure and is ranked #1 or #2 in the high-return subset. Finally, the last four rows are measures of risk-adjusted returns; that is, how much volatility you had to absorb relative to the returns you received. Against the full group, Standpoint ranks between #1 (the best) and #5; against the higher-returning funds, it’s #1 across the board.

We can broaden the review by comparing Standpoint with the average flexible fund, and with Morningstar’s preferred completely inflexible fund, the Vanguard Balanced Index. And finally, we can look at it in comparison to other managers using managed futures.

Three-year comparison, Standpoint, Lipper peers, pure 60/40, and managed futures group

| Standpoint | Flexible portfolio peers | Vanguard Balanced Index | Managed futures near-peers | |

| Annualized returns | 10.9% | 2.4 | 3.0 | 8.6 |

| Standard deviation | 6.3 | 11.8 | 12.6 | 15.2 |

| Downside deviation | 4.5 | 8.4 | 9.1 | 9.4 |

| Down market deviation | 3.1 | 7.8 | 8.7 | 5.8 |

| Bear market deviation | 2.7 | 7.4 | 8.6 | 3.5 |

| Maximum drawdown | -5.3 | -18.9 | -20.9 | -15.9 |

| Sharpe ratio | 1.04 | 0.0 | 0.6 | 0.54 |

| Sortino ratio | 1.94 | 0.3 | 0.6 | 0.93 |

| Martin ratio | 4.13 | 0.16 | 0.8 | 1.41 |

| Ulcer Index | 2.1 | 9.5 | 10.0 | 8.1 |

Source: MFO Premium data calculations and Lipper global data feed

Standpoint has outperformed every plausible peer group in total returns, risk management, and risk-adjusted returns.

Finally, Standpoint itself publishes two comparisons which are updated monthly. The first is a comparison of the 20 largest alternatives funds by asset. Since inception (through 11/30/2023), Standpoint beat all of them in total return and all but one in risk-adjusted returns, as measured by the Sharpe ratio.

Source: Standpoint Asset Management

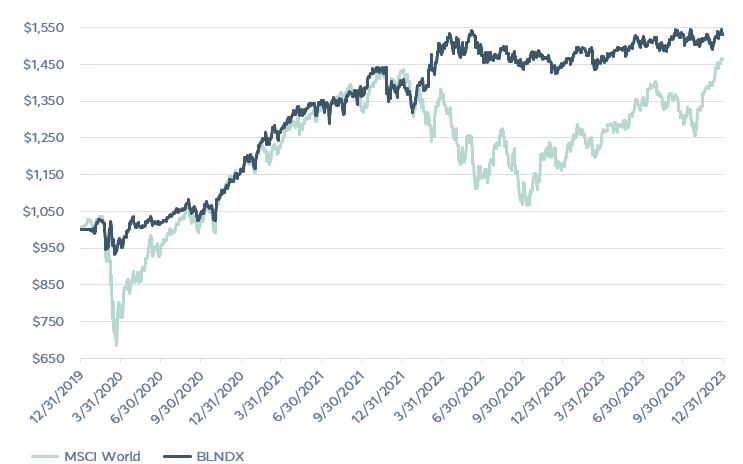

The second is a comparison with a pure global equity portfolio.

Source: Standpoint Asset Management, “performance” tab

So far, the fund has matched or outperformed a pure equity portfolio with a fraction of the volatility. The fund did have a 5% down day in November 2021. They explain it this way:

November of 2021, the fund did have a down -5% day. After a nice run in both equities and macro oriented markets like energy and currencies, on the day after Thanksgiving, there were scares about the Omnicron virus which led to our largest positions moving strongly against us on holiday-shortened low-volume day. (The guys note, separately, that oil dropped 13% in a day, grains and currencies got crushed; macro people call it their “Black Friday”.)

From what we could tell, most of our investors were not overly concerned after our -5% day. I believe it’s because they understand that the risk-management process in our macro program cuts risk in losing positions. Unlike some other alternative strategies, ours does not “double down” or increase risk in positions because they are moving against us. The philosophy of trend-oriented macro investing is to rotate out of what is not working, and rotate into what is working, in a disciplined manner, with a risk budget enforced each step of the way.

They conclude with an interesting reflection on having reasonable downside expectations. To date their maximum drawdown has been 9% or so. Their internal models allow that the strategy is susceptible to a worst-case drawdown in the 15-20% range.

Bottom Line

Ultimately, the fund should provide three sources of gain. The equity risk premium, the risk-free gains from T-bills and TIPS, and a risk-transfer premium that comes from providing liquidity to hedgers in the futures markets. That’s allowed them to generate a negative beta in bear markets.

The argument for Standpoint is much like the old argument for managed futures: it can provide absolute positive returns with muted volatility even when the equity markets correct or the fixed-income markets are priced to return less than zero in the immediate future.

“Our edge,” Mr. Crittenden says, “is that we know how to build a good macro program without the traditional 2 & 20 fee structure.” It is designed to be a permanent piece of your portfolio: simple, durable, and resilient.

Life is uncertain, and investing even more so. Standpoint is trying to offer an island of predictability that investors might use to complement and strengthen their core portfolios. With positive absolute returns each year, they have earned a place on any sensible investor’s due diligence list.

Fund website

It’s worth investigating. The fund’s website is pretty low flash but has a fair amount of information and several video interviews.