Dear friends,

Welcome to the end of summer. Traditionally, in the markets and on college campuses, it’s a quiet time of year. Trading volumes drop, traders and sensible people alike flock to beaches, and facilities crews at colleges like Augustana work 12-hour days trying to address all the issues that can’t be dealt with in a college jammed with people.

But come this first weekend of September, a new chapter begins … with a new president (Andrea Talentino is the ninth president in our 162-year history, and only the sixth president since 1901), a stunningly generous alumni gift to fund a new scholarship program (Augustana Possible) for high-achieving students from families without a lot of money, and 630 new first-year students. That tally includes something like 120 new students who have traveled 7500 miles from home and who might not see family again until after their sophomore year. At a time when domestic students are hesitant to consider schools more than two hours from mom and dad, that strikes me as an act of faith and bravery that’s profoundly humbling for those of us who are charged with making it all seem possible.

Is the sun rising or setting over Old Main, my academic home? At this moment, with these kids, I know it to be dawn.

The price of keeping your fingers jammed in your ears

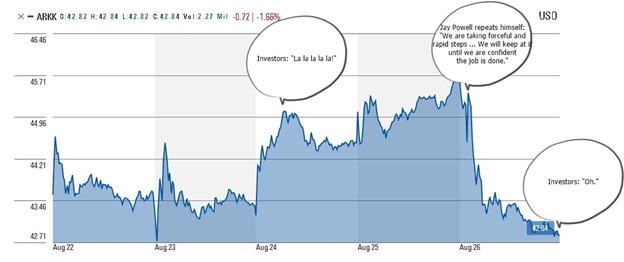

On Friday, August 26 at 10:00 a.m. EDT, Fed chair Jay Powell said exactly (a) what he’d been saying for months and (b) what investors knew he was going to say. One of the mavens at Wells Fargo confidently predicted:

That day’s relief rally looked sort of like this:

If market mavens were capable of blushing …

Historically, September and October have been the year’s two most volatile months. In many ways, this year’s market is likely to be shaped by an unlikely figure: Vladimir Putin. The Federal Reserve is trying to make aggressive but data-driven moves to control inflation. As the head of a major energy exporting nation, should Mr. Putin do something precipitous, a panicky spike in the price of food and energy would follow.

A sensible strategy might be to follow the data rather than follow the talking heads. Mr. Powell has announced his expectation that they will inflict pain on you in order to change your habits; that change in habits will be reflected in data about year-over-year price changes and consumer and industrial activity. If all of those remain elevated, the Fed will crack down harder.

At the moment, investor confidence – reflected in the VIX – remains inexplicably high, and spending is brisk. Professionals are confident that the Fed will bump rates by 75 bps in September and then ease up. Professionals are frequently wrong, though rarely uncertain. If they were wrong in either of these two latest guesses, exceptional unhappiness will ensue.

For me, and most of my colleagues here, our long-term plans were designed with the reality of major drawdowns and grinding markets in mind. Since the market has generously provided both, we’re doing little more than making marginal adjustments. We try to learn from the past, but we can’t outthink the future, and we aren’t trying.

To the extent you can, distance yourself from the noise. Lock your cell phones away in a drawer. Harvest tomatoes. Marvel at the Detroit Lions’ decision to cut all of their backup quarterbacks. And think long-term: is your asset allocation appropriate to your stage in life? Are you comfortable with the funds that enact the plan? Are there ways of adjusting your lifestyle to generate fewer demands and more delights, however quiet?

Painful unwinding of FPA International Value / Phaeacian Accent International Value

Will Schmitt for CityWire (8/25/2022) chronicles the ugly and painful public unwinding of the partnership between FPA and Polar Capital and the liquidation of the two FPA funds adopted by Polar.

We had already shared our conversation with Pierre Py, lead manager for the FPA/Phaeacian funds, about his anguish over the funds’ demise and his determination to one day return to the field (“Off to the Dustbin of History,” May 2022).

Mr. Schmitt’s reporting reveals a series of lawsuits between Polar and Phaeacian and Polar and FPA. He reports,

Polar Capital has accused First Pacific Advisors (FPA) of ‘fraud’ in connection with Polar’s ill-fated acquisition of a team of PMs and their funds from FPA.

Polar made the accusation earlier this month as part of an ongoing legal battle over the future of Phaeacian Partners, a joint venture between Polar and two former FPA portfolio managers, Pierre Py and Greg Herr.

After this article was published, FPA issued a statement ‘categorically’ denying Polar’s allegations which it said are ‘completely unsubstantiated with no factual support.’

It’s sad, not least because it sullies the work of two fine managers and keeps their services from the investors they’d like to serve.

This month in the Observer …

Devesh Shah has been puzzling through the past and future of emerging markets investing. Too often, it feels like the theme song for EM investing has been “Tomorrow” from the musical Annie.

The sun’ll come out tomorrow

So you got to hang on ’til tomorrow

Come what may

Tomorrow, tomorrow, I love ya tomorrow

You’re always a day away

There have been stretches when EM returns have been spectacular and longer stretches when we’ve mostly talked about how they should be spectacular … perhaps tomorrow? Devesh engaged in conversations with six distinguished EM managers about the asset class, its challenges, and its future. He shares his results in “Emerging Markets Investing in the Next Decade: The Game.”

We complement Devesh’s piece with quick bios of the Select Six and their funds in “Emerging Markets Investing in the Next Decade: The Players.”

Lynn Bolin provides more depth to the case for caution in “Here be dragons: Data-driven caution for the market ahead,” then complements that with an in-depth analysis of Fidelity New Millennium ETF (FMIL), the newest addition to his portfolio. And yes, he does talk about why an aggressive fund and a cautious approach can complement one another.

The Shadow brings us up to date on industry news and foolishness in “Briefly Noted.”

Finally, I share profiles of two remarkable funds. We first profiled Harbor International Small Cap Fund (HAISX) in September 2021, around the second anniversary of its new management team, from Cedar Street Asset Management. We told you then that it was going to be good. Turns out it was even better: since Cedar Street joined, HAISX has been the top-performing international small cap fund in existence, sometimes by a mile. Heck, it’s the top performer among both international small value and international small core and is a top five fund even when you add international small growth. Barron’s is on the trail, and you might want to be, too.

Disciplined Growth Investors (DGIFX), headquartered in Minneapolis about a mile from my son’s tiny apartment, is the most distinctive balanced fund in existence and also one of the most successful by a whole string of measures. In a peer group dominated by funds that invest like the S&P 500 Index, DGI pursues a true multi-cap (really, micro-caps in a balanced fund … who’d have imagined?) balanced portfolio whose performance beats even an all-equity benchmark. The team seems talented, focused, and passionate. Learn more.

Thanks, as ever …

To Radley Olson, for his financial support and kind note. There’s a 19th-century adage, “if you want anything done, ask a busy person to do it” (no, not Franklin, not Lucille Ball, or any of the rest … the earliest instance in print is 1856), which seems to rule our lives. As soon as I stepped aside from a quarter century as chair of a large academic department, I was asked to help revive our wobbly Honors program. As soon as Chip moved out of her deanship and into the role of Chief Information Office at her college, her new chancellor poked her head in the door with an innocuous, “do you have just a minute?” (sigh) That said, we’ve planned a couple of weekends away in fall – there’s a fascinating heirloom apple orchard in southeast Wisconsin and lots of reasons to drive up along the Mississippi – and are plotting an escape to the Shetland Islands (her family has roots there) in the year ahead. And so, thanks! We’re good.

Blessings to our indispensable regulars, from the good folks at S&F Investment Advisor in lovely Encino to Wilson, Gregory, William, the other William, Brian, David, and Doug. And to Ira, Andrew, Paul, Sherwin, and James, thank you, thank you, and thank you.

It would be great if you’d join them, either with a tax-deductible contribution to MFO itself or through a $125 membership to MFO Premium. Given the cost and wobble evident in Morningstar’s slimmed-down “Investor” service, serious folks might find it money well invested.

As you’re reading this, I’ll be in Minneapolis helping Will get settled into a tiny apartment near Loring Park and a new life as a graduate student. If you want to get a sense of the passing of the years at MFO (and, I dare say, what “graceful aging” looks like), you might compare this summer’s version of Will and me with the snapshot of us on London’s Millennium Wheel, on the “Support Us” page.

As you’re reading this, I’ll be in Minneapolis helping Will get settled into a tiny apartment near Loring Park and a new life as a graduate student. If you want to get a sense of the passing of the years at MFO (and, I dare say, what “graceful aging” looks like), you might compare this summer’s version of Will and me with the snapshot of us on London’s Millennium Wheel, on the “Support Us” page.

It will be an adventure, as so much of a good life always is.

Take care, and we’ll see you soon,