Artisan Partners launched its Artisan Global Unconstrained and Artisan Emerging Markets Debt Opportunities Funds on April 7. Michael Cirami will be the Lead Portfolio Manager while Sarah Orvin will serve as the Portfolio Manager of both funds. Both Mr. Cirami and Ms. Orvin previously worked for Eaton Vance Management.

Artisan Partners launched its Artisan Global Unconstrained and Artisan Emerging Markets Debt Opportunities Funds on April 7. Michael Cirami will be the Lead Portfolio Manager while Sarah Orvin will serve as the Portfolio Manager of both funds. Both Mr. Cirami and Ms. Orvin previously worked for Eaton Vance Management.

Charles Schwab has filed filings to offer Direct indexing, which involves direct ownership of securities and thus can involve a greater level of tax management, sometime in April. Schwab’s direct indexing will have an account minimum of $100,000 and will charge a fee of 40 basis points. Initially, investors will have access to three index-based strategies, but more strategies are planned.

– – – – –

DoubleLine Funds has launched two active ETFs, The DoubleLine Opportunistic Bond ETF and DoubleLine Shiller CAPE U.S. Equities ETF. Messrs. Jeffrey Gundlach and Jeffrey Sherman are portfolio managers of the DoubleLine Opportunistic Bond and of the Shiller CAPE U.S. Equities ETF.

DoubleLine Funds has launched two active ETFs, The DoubleLine Opportunistic Bond ETF and DoubleLine Shiller CAPE U.S. Equities ETF. Messrs. Jeffrey Gundlach and Jeffrey Sherman are portfolio managers of the DoubleLine Opportunistic Bond and of the Shiller CAPE U.S. Equities ETF.

The Shiller CAPE Index calculates the p/e of the market based on quarterly inflation-adjusted earnings for the past 10 years. The intent was to block out the short-term noise and allow investors to concentrate on the bigger picture of the market’s valuation. DoubleLine’s take aims to invest in the five sectors with a combination of low valuations and strong momentum, with the latter factor designed to dodge “value traps.” The DoubleLine Shiller Enhanced CAPE Fund (DSENX), managed by Messrs. Gundlach and Sherman, has attracted $8 billion in assets. The fund has pretty much clubbed its peers since inception (15.0% versus 10.4%) with modestly higher volatility. We designate it as a Great Owl fund for having consistently earned top quintile risk-adjusted returns. Morningstar gives it a two-star rating based on just its last five years of operation when its just slightly above average returns were married with “high” risk in their judgment. The ETF is priced at 0.65%, midway between the mutual fund’s retail and institutional shares.

– – – – –

Matthews Asia has filed a registration for its Emerging Markets Equity Active ETF, Matthews Asia Innovators Active ETF and Matthews China Active ETF. The Total Annual Fund Operating Expenses for each of the three ETFs will be .79%. John Paul Lech and Alex Zarechnak are managing the Emerging Markets Equity Active ETF; Michael Oh and Taizo Ishida will manage the Asia Innovators Active ETF; and Andrew Mattock, Winnie Chwang, and Sherwood Zhang will manage the Matthews China Active ETF. Their mutual fund doppelgangers have Morningstar ratings between five stars / Silver (Innovators), three-star / Gold (China), and not yet rated / Silver (Emerging Markets).

Matthews Asia has filed a registration for its Emerging Markets Equity Active ETF, Matthews Asia Innovators Active ETF and Matthews China Active ETF. The Total Annual Fund Operating Expenses for each of the three ETFs will be .79%. John Paul Lech and Alex Zarechnak are managing the Emerging Markets Equity Active ETF; Michael Oh and Taizo Ishida will manage the Asia Innovators Active ETF; and Andrew Mattock, Winnie Chwang, and Sherwood Zhang will manage the Matthews China Active ETF. Their mutual fund doppelgangers have Morningstar ratings between five stars / Silver (Innovators), three-star / Gold (China), and not yet rated / Silver (Emerging Markets).

For investors with an interest in Asian markets, Matthews Asia has the longest record, deepest bench, and broadest product array of any active firm.

– – – – –

Osterweis Capital Management has announced its intent to acquire Zeo Capital Advisors, which oversees two mutual funds, Short Duration Income and Duration Unconstrained Credit, as well as separate accounts effective May 1. CEO Venk Reddy and Zeo Capital’s employees will join the Osterweis team. We’ve spoken with folks at both firms and they seem legitimately excited by the partnership. Carl Kaufman, the co-president/co-CEO/co-manager at Osterweis, has known Venk for more than a decade and was one of the people who originally urged Venk to offer his strategy as a mutual fund rather than limiting it to the net worth crowd. Both groups stress their shared values. Venk, for example, writes that the decision was “primarily driven by the fact that our firms share the same values in how we run our businesses as well as philosophies on how we approach our portfolios. Put simply, our true north was, in this case, the same as it has always been: what is best for our clients and our team.” (The letter to his shareholders adds a bit of nuance.) From a business perspective, the move will relieve Venk of some of the responsibility for managing an advisory firm and allow him and his team to concentrate on their portfolios. At the same time, it broadens Osterweis’s lineup and might serve to both grow the business and reduce overhead.

Osterweis Capital Management has announced its intent to acquire Zeo Capital Advisors, which oversees two mutual funds, Short Duration Income and Duration Unconstrained Credit, as well as separate accounts effective May 1. CEO Venk Reddy and Zeo Capital’s employees will join the Osterweis team. We’ve spoken with folks at both firms and they seem legitimately excited by the partnership. Carl Kaufman, the co-president/co-CEO/co-manager at Osterweis, has known Venk for more than a decade and was one of the people who originally urged Venk to offer his strategy as a mutual fund rather than limiting it to the net worth crowd. Both groups stress their shared values. Venk, for example, writes that the decision was “primarily driven by the fact that our firms share the same values in how we run our businesses as well as philosophies on how we approach our portfolios. Put simply, our true north was, in this case, the same as it has always been: what is best for our clients and our team.” (The letter to his shareholders adds a bit of nuance.) From a business perspective, the move will relieve Venk of some of the responsibility for managing an advisory firm and allow him and his team to concentrate on their portfolios. At the same time, it broadens Osterweis’s lineup and might serve to both grow the business and reduce overhead.

We concur, by the way, that both advisors are uniformly first-rate in their discipline, their communication, and their commitment to their shareholders.

The flagship Zeo Short Duration fund has just passed its 10th anniversary. Conceptually, it’s an absolute return income strategy: modest returns, low volatility, consistently in the black. Through 2021, the fund has never had a down year. While it is down 3.45% YTD (through 4/29/2022), that places Zeo in its category’s elite. Its long-term annual return of 3% took place in a zero-inflation environment, so it was a positive and attractive real return. As rising interest rates change the opportunity set, it is likely that the fund’s nominal returns will rise though its real return (return after adjusting for inflation) might well remain in the 2-4% per year range.

Our colleague Charles Boccadoro’s 2018 profile of ZEOIX concluded, “They’ve successfully executed their strategy of low volatility with modest return through several potentially destabilizing catalysts. They’ve reduced their er from 1.50% to 1.04%. They’ve increased their personal stake in the fund. They’ve communicated well their message.” Charles has expressed concern since then about the departure of co-manager Brad Cook who had a pretty profound understanding of the portfolio companies. More details, such as changes to the funds’ names or expenses, if any, will be available in October when the deal finalizes.

– – – – –

Lydia So, former Matthews Asia manager, plans to leave Rondure Global Advisors. Ms. So co-manages both Rondure New World and Rondure Overseas. She had previously spent 15 years at Matthews Asia and helped manage Matthews Asia Science & Technology Fund (MATFX; now called Matthews Asia Innovators Fund) and Matthews China Small Companies Fund (MCSMX).

Ms. So is leaving “for personal reasons.”

The Rondure funds qualify as “small but splendid.” Founder Laura Geritz remains on both funds, assisted by Blake Clayton and Jennifer Anne McCulloch-Dunne. Ms. Geritz, who is really impressive, launched Rondure in partnership with Grandeur Peak after a 20-year tenure at Wasatch Advisors.

The Rondure funds qualify as “small but splendid.” Founder Laura Geritz remains on both funds, assisted by Blake Clayton and Jennifer Anne McCulloch-Dunne. Ms. Geritz, who is really impressive, launched Rondure in partnership with Grandeur Peak after a 20-year tenure at Wasatch Advisors.

Their EM flagship Rondure New World Fund has about $200 million in assets and a four-star rating. Rondure Overseas carries just $25 million and a two-star rating. New World has handily outperformed its peers, on both absolute and risk-adjusted terms since inception. Overseas has modestly trailed its peers’ total return but Geritz & co. manage a portfolio with dramatically lower volatility (both standard and downside deviation, for example). As a result, its risk-adjusted returns exceed its peers by a good margin.

Rondure Global is one of the very few certifiably women-owned fund advisors. There’s a fair amount of academic literature that finds that, on whole and over time, the sex of your manager matters: female fund managers tend to exhibit less overconfidence, lower volatility, less portfolio turnover, and less style drift. All of those are, in our minds, good things. (“On average and over time” was intentional: some women, Cathie Woods whose flagship ARKK ETF was up 156% in 2020 and is down by two-thirds since, and Nancy Zevenbergen whose flagship Zevenbergen Growth was up 123% in 2020 and down by 50% since then, reflect high visibility outliers.)

– – – – –

Vanguard and American Express announced a new Vanguard financial advice service to be offered exclusively to eligible American Express U.S. Consumer Card Members. The program, INVEST for Amex, will feature an investment minimum of $10,000 and an annual gross advisory fee of 0.50%, with advisory fees waived for the first 90 days for first-time enrollees. Customers will be financial planning and advice methodology will along with these services:

- Invest at least $100,000 will have unlimited access to Vanguard advisor consultations;

- Vanguard’s service will create a customized investment strategy based on INVEST clients’ unique circumstances and goals, and provides ongoing management of portfolios constructed with low-cost, diversified Vanguard ETFs; and

- Clients with at least $50,000 in taxable assets managed by INVEST will be eligible to earn rewards annually. INVEST clients with an American Express® High Yield Savings Account will also be eligible to receive a cash bonus in their Savings Account.

SMALL WINS FOR INVESTORS

On March 10, 2022, the Channel Short Duration Income Fund (CPSIX) was recognized by the Refinitiv Lipper Fund Awards as the best of the 153 US Short-Intermediate Investment Grade Debt Funds over the past three years. The fund was recognized for delivering consistently strong risk-adjusted performance relative to peers in the category. The manager’s goal is to produce returns comparable to an intermediate-term bond fund with volatility similar to a short-term fund’s. We predicted that it would be a five-star star and it is, although a tiny one. Our 2021 profile of the fund concluded, “On whole, the fund bears watching. It has many of the hallmarks of an intriguing new fund.”

On March 10, 2022, the Channel Short Duration Income Fund (CPSIX) was recognized by the Refinitiv Lipper Fund Awards as the best of the 153 US Short-Intermediate Investment Grade Debt Funds over the past three years. The fund was recognized for delivering consistently strong risk-adjusted performance relative to peers in the category. The manager’s goal is to produce returns comparable to an intermediate-term bond fund with volatility similar to a short-term fund’s. We predicted that it would be a five-star star and it is, although a tiny one. Our 2021 profile of the fund concluded, “On whole, the fund bears watching. It has many of the hallmarks of an intriguing new fund.”

PIMCO California Municipal Opportunistic Value and National Municipal Opportunistic Value Funds are to re-open to new investors on April 18. Both funds have been closed since March 3, 2021.

CLOSINGS (AND RELATED INCONVENIENCES)

Fuller & Thaler Behavioral Small-Cap Equity Fund will close to new investors at the close of business on May 23, 2022. A Morningstar five-star rated small blend fund, it is down over 10% YTD which is about average for its peer group. Our 2017 profile of the fund noted, that behavior investing “is what they do, and they do it very well. They communicate clearly, they manage risk well, they outperform their peers and they outperform the indexes. For investors looking for a distinct take on small cap investing, Fuller & Thaler Behavioral Small-Cap Equity should surely be on the due-diligence shortlist.”

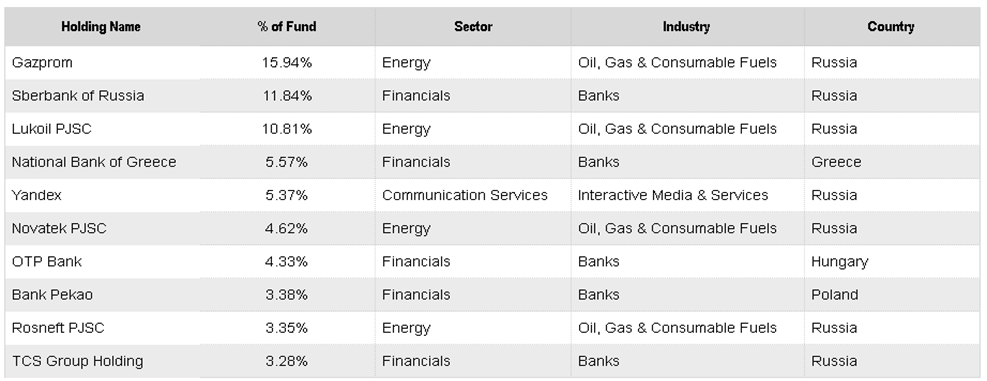

T. Rowe Price Emerging Europe Fund is closing to new investors on the close of business May 9. The fund invests at least 80% of its net assets in the emerging markets of Europe, including Eastern Europe and the former Soviet Union. Existing investors may continue to make optional contributions. The fund is down over 80% YTD. Currently, the fund has only 1.4% of its holdings in Russia but if we roll back to the eve of the invasion, you see a vastly different picture, the seven of the top 10 holdings representing nearly 60% of the portfolio in Russia:

OFF TO THE DUSTBIN OF HISTORY

BBH Partner Fund – Select Short Term Asset was liquidated on March 31.

Conductor International Equity Value Fund will be liquidated on or about May 2, 2022.

Based upon a recommendation by Friess Associates, the Friess Small Cap Growth Fund, Friess Brandywine Fund, and Friess Brandywine Blue will be liquidated on or around May 31, 2022. The adviser has determined that each Fund has limited prospects for meaningful growth. Scott Gates, who participated in a 2021 Elevator Talk, alluded to the challenge that led to the funds’ demise:

We were humbled, though not surprised, when loyal shareholders like you supported us when circumstances prompted us to launch Friess Brandywine Fund and Friess Brandywine Blue Fund in the summer of 2021. Unfortunately, the funds simply did not attract enough assets to make them self-sustaining.

“Circumstances,” in this case, was the decision by AMG to fire all of its sub-advisers, including Friess as advisors to their own flagship Brandywine fund, in 2021. The new suite of funds formerly were separately managed accounts and the hope was that the Friess/Brandywine name, the seed assets and hard work would be good enough to allow the team to recover from the divorce with AMG. Sadly, that was not to be the case.

The Harvest Asian Bond Fund is expected to cease operations on or about May 23, 2022.

Morgan Stanley Emerging Markets Fixed Income Opportunities Portfolio is scheduled to be liquidated on or about May 27, 2022.

– – – – –

Phaeacian Accent International Value (formerly FPA International Value Fund) and Phaeacian Global Value Funds (formerly FPA Global Value Fund) are going to be liquidated on or about May 26, 2022. Both funds were reorganized in October 2020 from the FPA Funds. At the time of the announcement of the liquidation, Accent was five stars and Silver-rated, Global Value four stars, and the aggregated assets were about $600m.

In case you’re asking yourself “Self, do high-performing managers with strong track records and sustainable asset bases often just up and disappear?” the answer would be “no.” “Andrew Daniels, an analyst who covers the firm for Morningstar, told Citywire …he had never seen a liquidation situation quite like this one” (Will Schmitt, “Bizarre and unfortunate,” CityWire, 4/22/2022). The only comparable case that Snowball recalls was Kevin O’Boyle’s decision to liquidate his five-star, $60 million Presidio Fund in 2010.

We reached out to Mr. Py and had a long, wide-ranging conversation on 4/27/2022. Highlights of the conversation might include:

- The business relationship between Phaeacian and Polar had become unsustainable; While Mr. Py and Herr were the General Partners of the business, Polar was responsible for all of the mid- and back-office operations, owned 55% of the business, and raised a series of expectations that could neither be met nor negotiated away. Mr. Py lamented, “This is not something that needed to happen and we’re devastated that it did.”

- This was an incredibly painful decision for the managers. This really was a “we mutually pledge to each other our lives, our fortunes, and our sacred honor” operation. The managers are passionate about their discipline and the honor of serving their shareholders “making a bit of security possible for a lot of hard-working people.” That pain that stepping away from that mission, even if temporarily, engendered is palpable.

- Py is not yet thinking about “next steps” except in very general terms; he’s currently focused on liquidating the portfolio at the best possible price for his investors and helping his team members mourn and adjust. He was the first person to invest in the fund, he has committed all of his investable assets to it and intends to be the last person to withdraw money from it.

- The Phaeacian team was internally coherent and high-functioning; none of them want to break the team up or retire from investing. I got a very clear sense that Pierre himself did not enter this phase of his career as a rich man, at least in the sense that we usually associate with successful portfolio managers, and Phaeacian did not make him rich. In particular, Pierre reflected on his conscious decision to put his skills to the service of ordinary people. “I’m extremely grateful, always amazed, that people are willing to trust others with money that they’ve saved and that their futures depend upon. It matters to me; I chose to devote myself to this because I wanted to make a contribution.”

- They’ll be back, they just don’t have specific plans on how to make that happen. I suggested a couple of options and he seemed to be listening.

As he prepares for this transition from active management, Mr. Py offered a fairly urgent warning to investors: inflation is a much bigger threat than you realize, plan for it.

Investors don’t recognize the threat and how material a change it represents. With inflation, it’s how high it goes – likely high single digits, low double digits – and how long it endures. We haven’t seen the start of the worst effects yet, in part because companies have hedges in place that blunts the short-term effects.

Double-digit compounding works on the way down too; a few years of double-digit inflation will be devastating to many. To survive you must target double-digit returns or you’re going to be ruined. You’re going to need people with the ability to find businesses that can create value, with owner-type managers, who take no financial risk, and take advantage of the madness of crowds to buy them at discounted prices.

Average return on our book is 15% over 10 years.

Investing, he concludes, “is a craft.” Mr. Py has been a remarkable craftsman, skilled and dedicated, for rather a long while. We’ll watch carefully for his return to the field.

There are very few funds to pursue an international value strategy, have a strong long-term record, are open to new investors, and still have the team in place that generated the record. The Phaeacian funds had few peers, at least when we look for statistical markers such as comparable Sharpe ratios and high correlations to the Phaeacian funds themselves. Messrs Py and Herr might, but did not explicitly, encourage you to consider their former colleagues managing Oakmark International or Artisan Global Value (the International Value fund is closed to most new investors). We would commend FMI International and Tweedy Browne International Value for your consideration.

Otherwise, reach out to the Phaeacian team to offer your support and encouragement. It will make a difference.

We’re raising a mug to long-time reader Don Glickstein, who contributed mightily to both the Freiss and Phaeacian stories this month. We’d like to share a lovely and rare MFO coffee mug with Don, as we would with any reader who helps the cause by alerting us to developments that we would all benefit from learning about. Thank you, sir!

– – – – –

PIMCO RAE Global Fund, co-managed by Rob Arnott and Christopher Brightman, is scheduled to be liquidated on or about June 24, 2022.

– – – – –

Vanguard has decided not to launch its Vanguard China Select Stock fund at this time. There was no explanation offered as to why the fund was being discontinued at this time; however, it may be offered again in the future. Given that China’s president has a perspective that is about as insulated, autocratic, and expansionist as Russia’s, the pause is understandable. While it’s not likely that rising accusations of forced labor and internal abuses deterred Vanguard, there are two sets of headlines that might be giving pause.

“. . .some international investors are finding an aggressive allocation to China increasingly unpalatable. Outflows from the country’s stocks, bonds, and mutual funds accelerated after Russia’s invasion of Ukraine…” (Bloomberg, 4/17/2022).

Or …

“After inflation, that (30-year) nominal 1.5% annualized gain disappears entirely. Which means that this column’s headline is overly generous. In real terms, Chinese equities have not taken the road to nowhere: They have headed somewhere distinctly warmer, dropping 1.8 percentage points per year” (John Rekenthaler, 3/21/2022).