Dear friends,

They’re gone. Five hundred and twenty-six Augie students who we’ve jollied, prodded, chided, praised, despaired of and delighted in for the past four years have been launched on the rest of you. They’re awfully bright-eyed, occasionally in reflection of the light coming from their cell phone screens. You might suspect that they’re not listening, but if you text them, they’ll perk right up.

This is usually the time for graduation pictures but I’ve never found those engaging since they reflect the dispersion of our small, close-knit community. I celebrate rather more the moments of our cohesion; the times when small and close were incredibly powerful.

Augie’s basketball team finished second in the nation in 2015, doing rather better in our division than the Kentucky Mildcats did in theirs, eh? We did not play in a grand arena but instead in a passionate one: Carver Gymnasium, home of the Carver Crazies. It was a place where the football team (the entire football team) jammed the sidelines of every game, generally shoulder to shoulder with the women’s basketball team and the choir, all shouting … hmmm, deprecations at opposing players.

When the team boarded buses at 5:00 a.m. for the trip east to compete in the Final Four, they were cheered off by hundreds of students and staff who stood in happy gaggles in the dark. A day later, hundreds more boarded buses and jammed in cars to follow them east. And when they came home, one win shy of a championship, they were greeted with the sound of trumpets and cheers.

And while the basketball players won’t go to the NBA, a fair number – over half of our juniors – will go to med school. And so perhaps we’ll yet meet the Kentuckians at an NBA contest as our guys patch together theirs.

I rather like kids, maddened though we make each other.

MFO on FOMO

No, FOMO is not that revolutionary white spray foam that’s guaranteed to remove the toughest pet stains from your carpet; neither is it a campaign rallying cry (“FOMO years! FOMO years!”).

FOMO is “fear of missing out” and it’s one of the more plausible explanations for the market’s persistent rise. There’s an almost-universal agreement that financial assets are, almost without exception, overpriced. Some (bonds) are more badly overpriced than others (small Japanese stocks), but that’s about the best defense that serious investors make of current conditions: they’re finding pockets of relative value rather than much by way of absolute value.

The question is: why are folks hanging around when they know this is going to end badly (again)? The surprising answer is, because everyone else is hanging around. It’s a logic reminiscent of those anxious moments back in our early high school years. We’d get invited to a party (surprise!), it would be great for a while then it would begin to drag. But really, you couldn’t be the first kid to leave. First off, everyone would notice and brand you as a wuss, or worse. Second, while it was late, all the cool kids were still around and that meant, you know, that something cool might happen.

And so you lingered until just after that kid from the football team threw up near the food, one of the girls used “the F word” kinda in your face and someone – no one knows who – knocked over the nice table lamp which really pissed off Emily’s dad. Then everyone was anxious to squeeze as quickly through the door as possible. On whole, the night would have been a lot better if you’d left just a little earlier but still …

It’s like that for professional investors, too. Reuters columnist James Saft points to research that shows professionals falling victim to the same pressures:

Call it status anxiety, call it greed or just call it clever momentum trading, but the fear of missing out is an under-appreciated force in financial markets. No one likes to miss out on a good thing, especially when they see their friends, neighbors and rivals cashing in.

Much of this may be driven by concerns about relative wealth, or how much you have compared to those in your group, a force explored in a 2007 paper by Peter DeMarzo and Ilan Kramer of Stanford University and Ron Kaniel of Duke University. They found that even when traders understand that prices are too high they may stay in the market because they fear losing out as the overvaluation persists and extends.

Investors want to keep pace with their peers, and fear not having as much wealth. That raises, in a certain way, the risk of selling into a bubble. That status and group-motivated anxiety can blind investors towards other, seemingly obvious risks. (“The power of the fear of missing out,” 05/29/2015.)

You might think of it as a financial manifestation of Newton’s first law of motion: “unless acted upon by an outside force, an object in motion tends to stay in motion in the same direction and speed.” It’s sometimes called “the law of inertia.” One technical analyst, looking at the “pattern we have seen for much of 2015, namely choppy with a slight upward bias,” opined that despite “an increasing number of clouds gathering on the horizon … the path of least resistance likely remains to the upside.”

And so the smart money people remain, anxiously, present. Business Insider reporter Linette Lopez, covering the huge SALT Las Vegas hedge fund conference, observes that leading hedge fund strategists:

Across the board … believe asset prices are too high. Mostly bonds, sometimes stocks. Still, everyone is long the market. No one wants to be the first person out of the market as long as they’re making money. This is a huge issue on Wall Street, and everyone at this conference is now looking for a warning signal. (“We’ve already seen the beginning of the quake that could be coming,” 05/06/2015) – didn’t discuss h.f. fees (steadily rising) or h.f. performance (steadily lagging)…

In the same week that the hedgies were meeting in Las Vegas, the Buffett Believers gathered in Omaha. There renowned value investors, such as Jean-Marie Eveillard, now a senior advisor to First Eagle funds, fret that the market was overvalued, kept alive by artificial stimulus that’s coming to an end. Eveillard says investors don’t seem to be factoring that in. “Either everyone is thinking I will just keep dancing until the music stops, or they don’t see the risks that I do.” (“At Berkshire annual meeting, Warren Buffett hosts cautious investors,” 05/02/2015.)

In an interview with Reuters, Joel Tillinghast – one of Fidelity’s two best managers – captured the yin and yang of it:

“I think [the level of the financial markets are] colossally artificial, but I don’t see it ending. How long can we party with our bad selves?” Mr. Tillinghast asked. “You want to know so you can party on until five minutes before it ends.” (“Top Fidelity stockpicker: Financial markets are ‘colossally artificial,’” 05/26/2015)

We raised last month the notion of a “roach motel,” where getting in is easy and getting out is impossible. In the case of bugs, the problem is stickum. In the case of investors, it’s liquidity. At base, you may find that there’s no one willing to pay anything even vaguely like what you think your holdings are worth. Kevin Kinsella, president of a venture capital firm, notes that investors have been making 30% per quarter on privately traded shares, like Uber.

Given the various stratospheric private valuations some of these unicorn companies are reaching, there will be no trade buyers, and it is doubtful whether a sane investment bank would take such companies public at these market caps.

Investors historically delude themselves by concocting rationales as to why the insanity will continue, why it is completely reasonable and why an implosion won’t happen to them. They are always wrong.

How will it end? When interest rates ultimately start to tick up and vast pools of capital begin to shift toward fixed income away from equities. It’s a historic cyclical shift. When the music stops and everyone needs to scramble for their chair, there will be a lot of fannies left hanging out there.

Predicting that this will happen is easy; predicting exactly when, not so easy. But my prediction is that it is not far off. (“Tech Boom 2015: What’s Driving Investor Insanity?” Forbes, 05/21/2015)

Michael Novogratz, head of the $67 billion Fortress hedge fund operation, shared that concern at the SALT gathering:

“I’m going to argue that I think something has fundamentally changed.” He is worried because even though managers know assets are expensive, they are still long. This is a recipe for a difficult exit once all they want to close their positions. The liquidity will disappear and assets will reprice. As legendary trader Stanley Druckenmiller said, assets need a lot of volume and money to go up and much less to crash. (Michael Novogratz CEO of Fortress Investments Is Worried About The Markets)

The question is, what’s a fund investor to do? Five things come to mind:

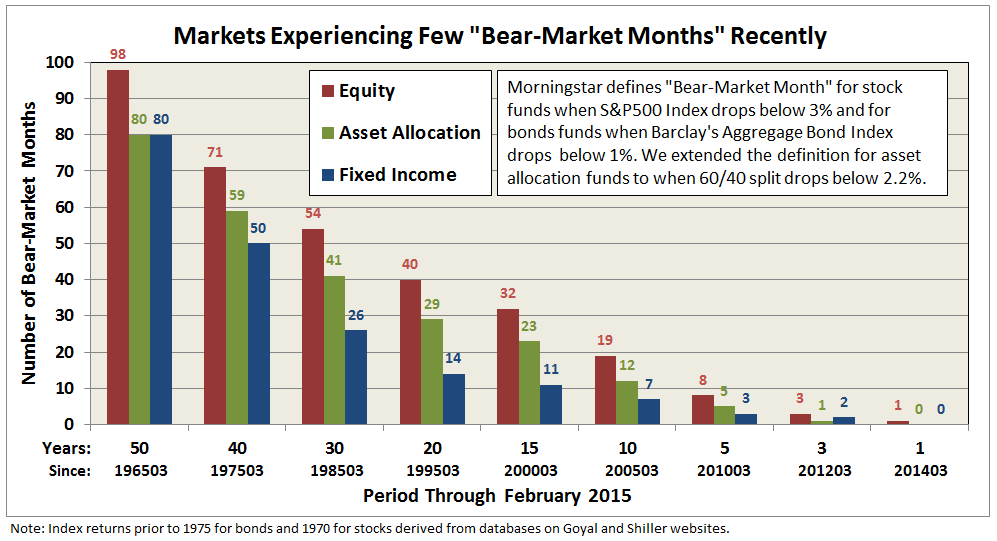

- Do a quick check on your asset allocation and risk exposure. Any idea of how long a core equity fund might remain underwater; that is, how many months it takes for a fund to rebound from a bad decline? I scanned MFO’s premium fund screener for large-cap core funds that had been around 10 years or more. The five best funds took, on average, over two years to rebound. The average large cap fund took 58 months, on average, to recover from their maximum drawdown. Here’s the test: look at your portfolio value today and ask whether you’re capable of waiting until April, 2020 to ever see a number that high again. That’s the worst case for a large cap stock portfolio. For a conservative asset allocation, the recovery time is a year or two. For a moderate portfolio, three or so years. At base, decide now how long you can wait and adjust accordingly.

- Join the Dry Powder Gang. We profiled, last month, a couple dozen entirely admirable funds that are holding substantial cash stakes. Some have been badly punished for their caution, both by investors and raters, but all have strong, stable management teams, coherent strategies and a record of deploying cash when prices get juicy.

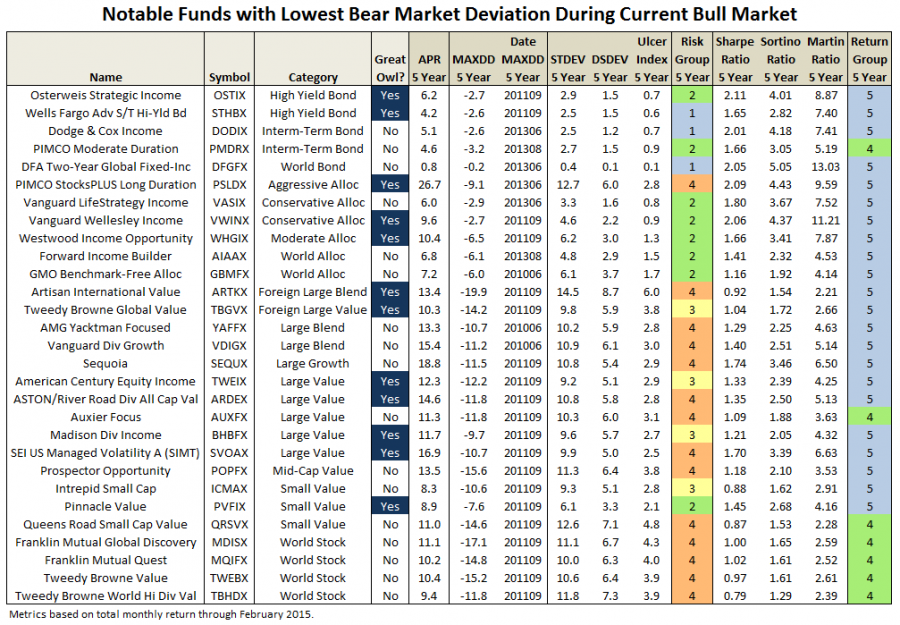

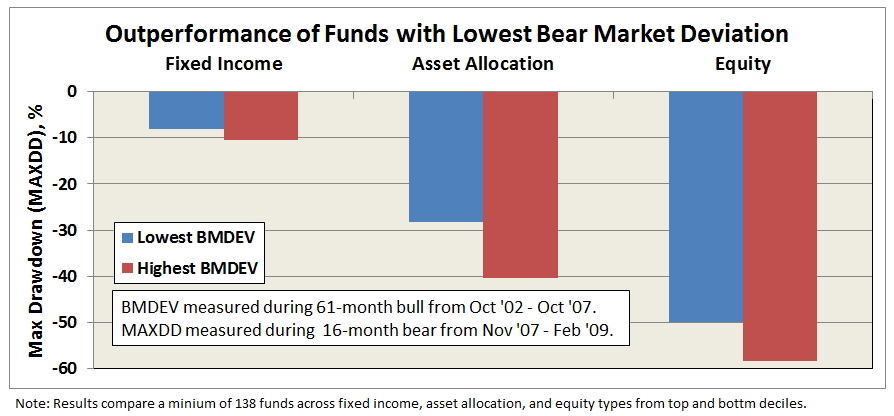

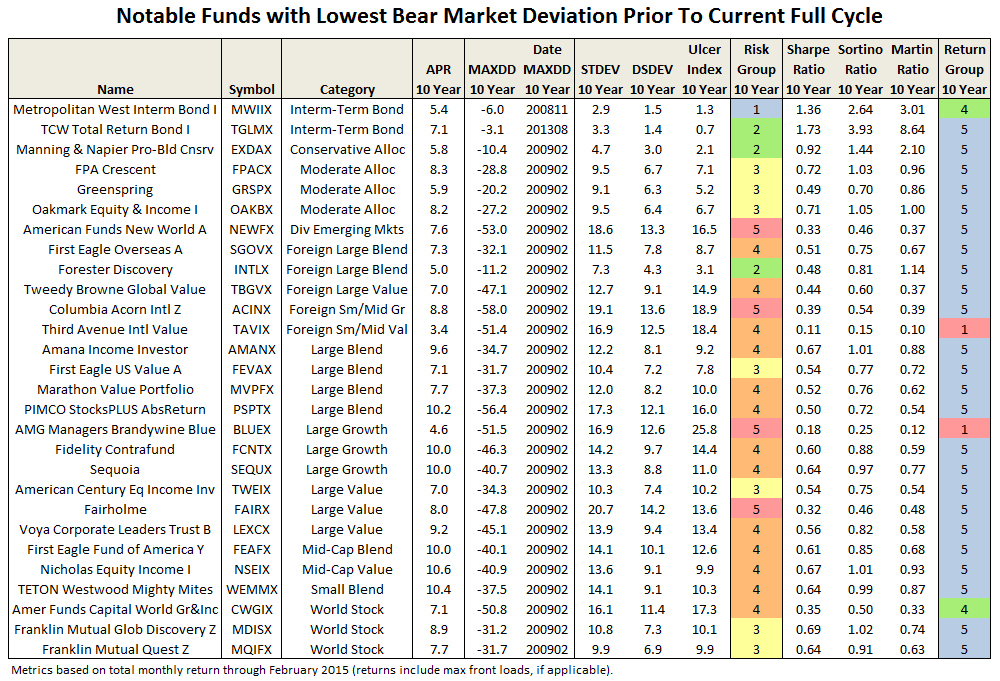

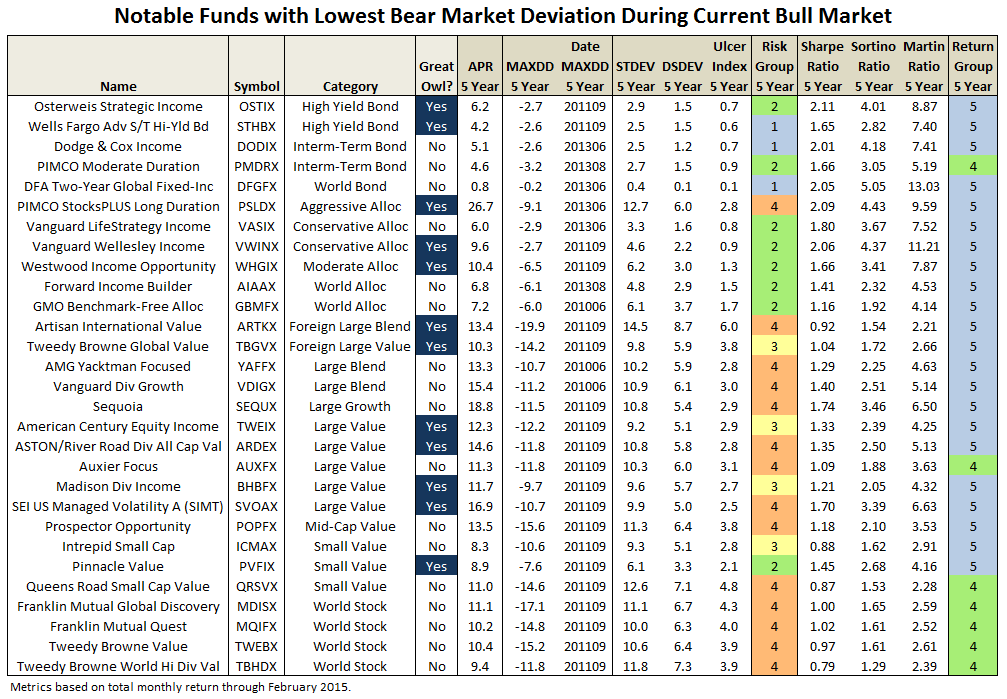

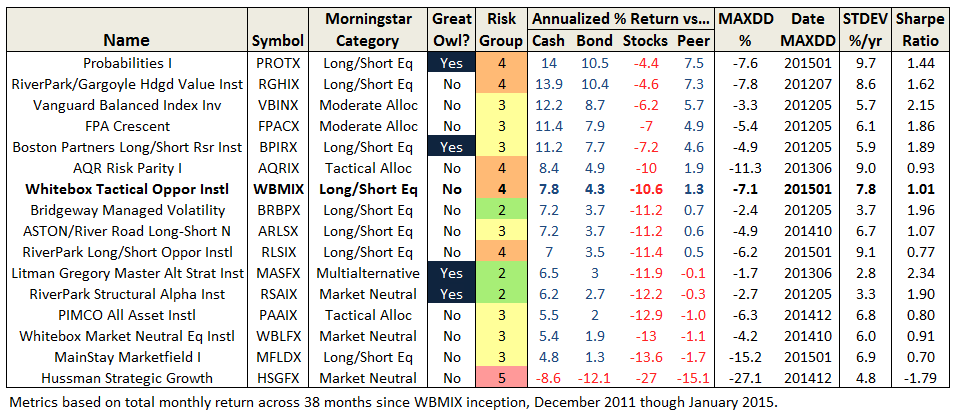

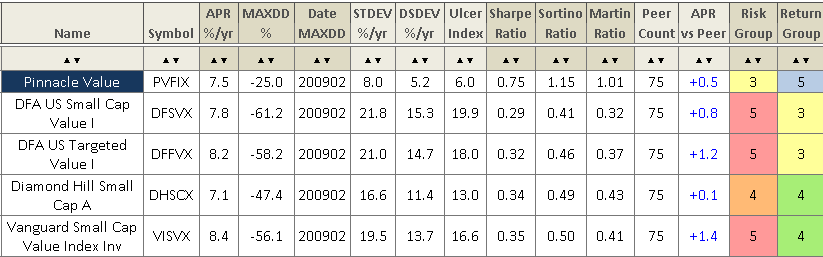

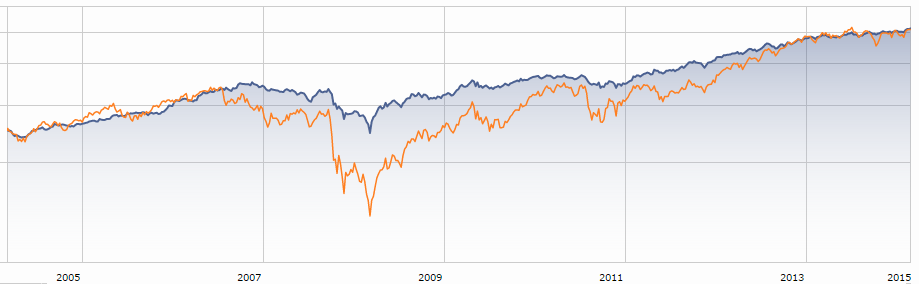

- Allocate some to funds that have won in up and down markets. They’re rare. Daren Fonda at Barron’s recommends “[f]unds such as FPA Crescent (FPACX) and First Eagle Global (SGENX) have flexible strategies and defensive-minded managers.” Charles identified a handful of long-term stalwarts in his April 2015 essay “Identifying Bear-Market Resistant Funds During Good Times.” Among the notable funds (not all open to new investors) he highlighted:

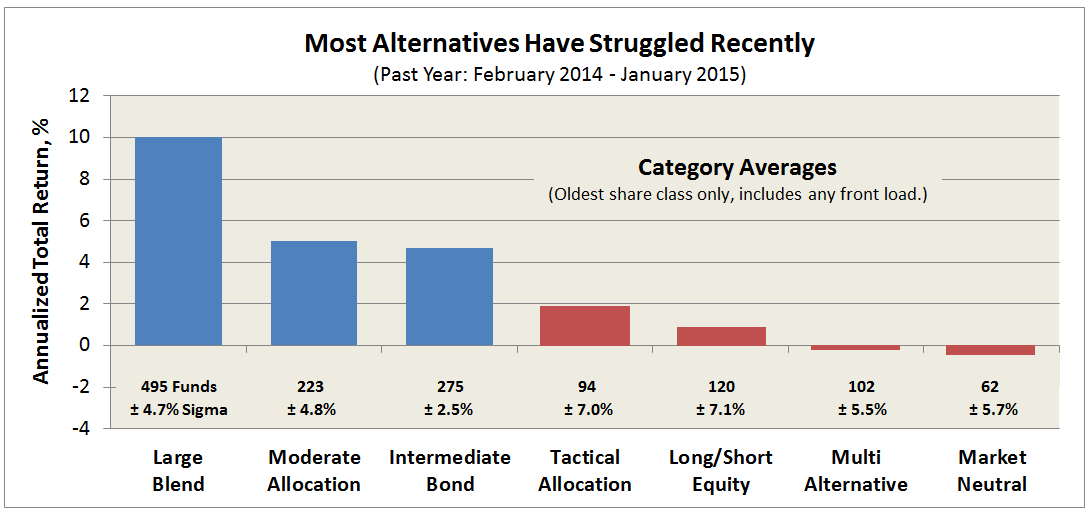

- Cautiously approach the alt-fund space. There are some alt funds which have a plausible claim to thrive on volatility. We’ve profiled RiverPark Structural Alpha (RSAFX), for instance, and our colleagues at DailyAlts.com regularly highlight intriguing options.

- Try to leave when everyone else heads out, too. The Latin word for those massive exits was “vomitaria” which would make you …

Liquidity Problem – What Liquidity Problem?

By Edward A. Studzinski

“Moon in a barrel: you never know just when the bottom will fall out.”

Mabutsu

So as David Snowball mentioned in his May commentary, I have been thinking about the potential consequences of illiquidity in the fixed income market. Obviously, if you have a portfolio in U.S. Treasury issues, you assume you can turn it into cash overnight. If you can’t, that’s a potential problem. That appears to be a problem now – selling $10 or $20 million in Treasuries without moving the market is difficult. Part of the problem is there are not a lot of natural buyers, especially at these rates and prices. QE has given the Federal Reserve their fill of them. Banks have to hold them as part of the Dodd-Frank capital requirements, but are adding to their holdings only when growing their assets. And those people who always act in the best interests of the United States, namely the Chinese, have been liquidating their U.S. Treasury portfolio. Why? As they cut rates to stimulate their economy, they are trying to sterilize their currency from the effects of those rate cuts by selling our bonds, part of their foreign reserve holdings. Remember, the goal of China is to supplant, with their own currency, the dollar as a reserve currency, especially in Asia and the developing world. And our Russian friends have similarly been selling their Treasury holdings, but in that instance using the proceeds to purchase gold bullion to add to their reserves.

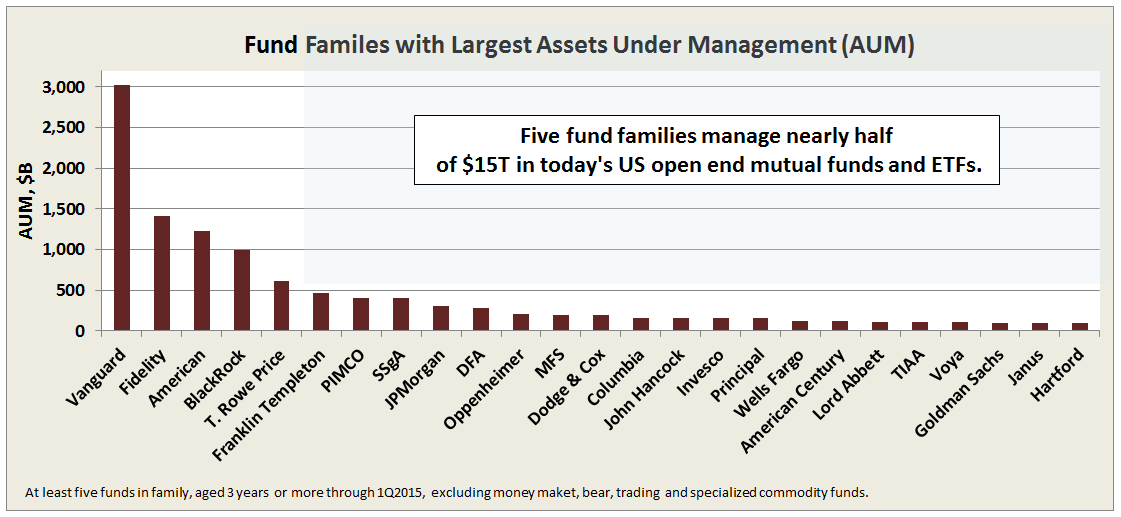

Who is there to buy bonds today? Bond funds? Not likely. If you are a fund manager and thought a Treasury bond was a cash equivalent, it is not. But if there are redemptions from your fund, there is a line of credit to use until you can sell securities to cover the redemptions, right? And it is a committed line of credit, so the bank has to lend on it, no worries! In the face of a full blown market panic, with the same half dozen banks in the business of providing lines of credit to the fund industry, where will your fund firm fall in the pecking order of mutual fund holding companies, all of whom have committed lines of credit? It now becomes more understandable why the mutual fund firms with a number of grey hairs still around, have been raising cash in their funds, not just because they are running out of things to invest in that meet their parameters. It also gives you a sense as to who understands their obligations to their shareholder investors.

We also saw this week, through an article in The Wall Street Journal, that there is a liquidity problem in the equity markets as well. There are trading volumes at the open. There are trading volumes, usually quite heavy, at the end of the day. The rest of the time – there is no volume and no liquidity. So if you thought you had protected yourself from another tsunami by having no position in your fund composed of more than three days average volume of a large or mega cap stock, surprise – you have again fought the last war. And heaven help you if you decide to still sell a position when the liquidity is limited and you trigger one or more parameters for the program and quant traders.

As Lenin asked, “What is to be done?” Jason Zweig, whom I regard as the Zen Philosopher King of financial columnists, wrote a piece in the WSJ on May 23, 2015 entitled “Lessons From A Buffett Believer.” It is a discussion about the annual meeting of Markel Corporation and the presentation given by its Chief Investment Officer, Tom Gayner. Gayner, an active manager, has compiled a wonderful long-term investment record. However, he also has a huge competitive advantage. Markel is a property and casualty company that consistently underwrites at a profitable combined ratio. Gayner is always (monthly) receiving additional capital to invest. He does not appear to trade his portfolio. So the investors in Markel have gotten a double compounding effect both at the level of the investment portfolio and at the corporation (book value growth). And it has happened in a tax-efficient manner and with an expense ratio in investing that Vanguard would be proud of in its index funds.

As Lenin asked, “What is to be done?” Jason Zweig, whom I regard as the Zen Philosopher King of financial columnists, wrote a piece in the WSJ on May 23, 2015 entitled “Lessons From A Buffett Believer.” It is a discussion about the annual meeting of Markel Corporation and the presentation given by its Chief Investment Officer, Tom Gayner. Gayner, an active manager, has compiled a wonderful long-term investment record. However, he also has a huge competitive advantage. Markel is a property and casualty company that consistently underwrites at a profitable combined ratio. Gayner is always (monthly) receiving additional capital to invest. He does not appear to trade his portfolio. So the investors in Markel have gotten a double compounding effect both at the level of the investment portfolio and at the corporation (book value growth). And it has happened in a tax-efficient manner and with an expense ratio in investing that Vanguard would be proud of in its index funds.

I recently was speaking with a friend in Japan, Alex Kinmont, who has compiled a very strong record as a deep value investor in the Japanese market, in particular the small cap end of the market. We were discussing the viability of a global value fund and whether it could successfully exist with an open-ended mutual fund as its vehicle. Alex reminded me of something that I know but have on occasion forgotten in semi-retirement, which is that our style of value can be out of favor for years. Given the increased fickleness today of mutual fund investors, the style may not fit the vehicle. Robert Sanborn used to say the same thing about those occasions when value was out of favor (think dot.com insanity). But Robert was an investment manager who was always willing to put the interests of his investors above the interests of the business.

Alex made another point which is more telling, which is that Warren Buffett has been able to do what is sensible in investing successfully because he has permanent capital. Not for him the fear of redemptions. Not for him the need to appear at noon on the Gong Show on cable to flog his investment in Bank America as a stroke of genius. Not for him the need to pander to colleagues or holding company managers more worried about their bonuses than their fiduciary obligations. Gayner at Markel has the same huge competitive advantage. Both of them can focus on the underlying business value of their investments over the long term without having to worry about short-term market pricing volatility.

What does this mean for the average fund investor? You have to be very careful, because what you think you are investing in is not always what you are getting. You can see the whole transformation of a fund organization if you look carefully at what Third Avenue was and how it invested ten years ago. And now look at what its portfolios are invested in with the departure of most of the old hands.

The annual Morningstar Conference happens in a few weeks here in Chicago. Steve Romick of FPA Advisors and the manager of FPA Crescent will be a speaker, both at Morningstar and at an Investment Analysts Society of Chicago event. Steve now has more than $20B in assets in Crescent. If I were in a position to ask questions, one of them would be to inquire about the consequences of style drift given the size of the fund. Another would be about fees, where the fee breakpoints are, and will they be adjusted as assets continue to be sought after.

I believe in 2010, Steve’s colleague Bob Rodriguez did a well-deserved victory lap as a keynote speaker at Morningstar and also as well at another Investment Analysts Society of Chicago meeting. And what I heard then, both in the presentation and in the q&a by myself and others then has made me wonder, “What’s changed?” Of course, this was just before Bob was going on a year’s sabbatical, leaving the business in the hands of others. But, he said we should not expect to see FPA doing conference calls, or having a large marketing effort. And since all of their funds at that time, with the exception of Crescent, were load funds I asked him why they kept them as load funds? Bob said that that distribution channel had been loyal to them and they needed to be loyal to it, especially since it encouraged the investors to be long term. Now all the FPA Funds are no load, and they have marketing events and conference calls up the wazoo. What I suspect you are seeing is the kind of generational shift that occurs at organizations when the founders die or leave, and the children or adopted children want to make it seem like the success of the organization and the investment brilliance is solely due to them. For those of us familiar with the history of Source Capital and FPA, and the involvement of Charlie Munger, Jim Gipson, and George Michaelis, this is to say the least, disappointing.

Does Your Fund Manager Consistently Beat the Stock Market?

I saw the headline at Morningstar and had two immediate thoughts: (1) uhh, no, and (2) why on earth would I care since “beating the stock market” is not one of my portfolio objectives?

Then I read the sub-title: “Probably not–but you shouldn’t much care.”

“Ah! Rekenthaler!” I thought. And I was right.

John recounts a column by Chuck Jaffe, lamenting the demise of the star fund manager. Rekenthaler’s questions are (1) are they actually gone? And (2) should you care? The answers are “yes” and “no, not much,” respectively.

Morningstar researchers looked to determine how long “winning streaks” last; that is, for how many consecutive years might a fund manager beat his or her benchmark. Over the past 10 years, none of the 1000 U.S. stock funds have beaten the S&P500 for more than six years. Ten funds managed six year streaks, but four of those were NASDAQ 100 index funds. Worse yet, active managers performed worse than simple luck would dictate.

Outliers

Outliers

“At the extreme outer edge of what is statistically plausible” is how Malcom Gladwell defines an outlier in his amazing book, Outliers: The Story of Success (2008).

“At the extreme outer edge of what is statistically plausible” is how Malcom Gladwell defines an outlier in his amazing book, Outliers: The Story of Success (2008).

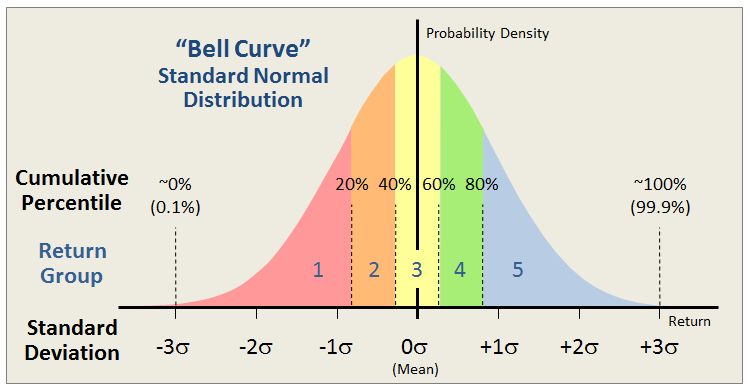

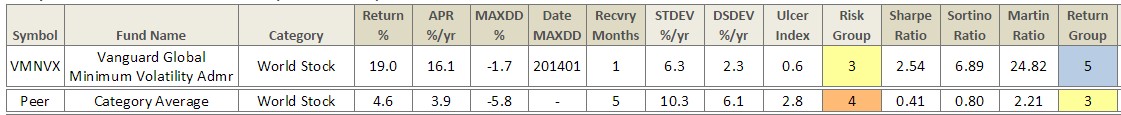

The MFO Rating System ranks funds based on risk adjusted return within their respective categories across various evaluation periods. The rankings are by quintile. Those in the top 20 percentile are assigned a 5, while those in the bottom 20 percentile are assigned a 1.

The percentile is not determined from simple rank ordering. For example, say there are 100 funds in the Large Growth category. The 20 funds with the highest risk adjusted return may not necessarily all be given a 5. That’s because our methodology assumes fund performance will be normally distributed across the category, which means terms like category mean and standard deviation are taken into account.

It’s similar to grading tests in school using a bell curve and, rightly or wrongly, is in deference to the random nature of returns. While not perfect, this method produces more satisfactory ranking results than the simple rank order method because it ensures, for example, that the bottom quintile funds (Return Group 1) have returns that are so many standard deviations below the mean or average returning funds (Return Group 3). Similarly, top quintile funds (Return Group 5) will have returns that are so many standard deviations above the mean.

All said, there remain drawbacks. At times, returns can be anything but random or “normally” distributed, which was painfully observed when the hedge fund Long-Term Capital Management (LTCM) collapsed in 1998. LTCM used quant models with normal distributions that underestimated the potential for extreme under performance. Such distributions can be skewed negatively, creating a so-called “left tail” perhaps driven by a market liquidity crunch, which means that the probability of extreme under-performance is higher than depicted on the left edge of the bell curve above.

Then there are outliers. Funds that over- or under-perform several standard deviations away from the mean. Depending on the number of funds in the category being ranked, these outliers can meaningfully alter the mean and standard deviation values themselves. For example, if a category has only 10 funds and one is an outlier, the resulting rankings could have the outlier assigned Return Group 5 and all others relegated to Return Group 1.

The MFO methodology removes outliers, anointing them if you will to bottom or top quintile, then recalculates rankings of remaining funds. It keeps track of the outliers across the evaluation periods ranked. Below please find a list of positive outliers, or extreme over-performers, based on the latest MFO Ratings of some 8700 funds, month ending April 2015.

The list contains some amazing funds and warrants a couple observations:

- Time mitigates outliers, which seems to be a manifestation of reversion to the mean, so no outliers are observed presently for periods beyond 205 or so months, or about 17 years.

- Outliers rarely repeat across different time frames, sad to say but certainly not unexpected as observed in In Search of Persistence.

- Outliers typically protect against drawdown, as evidenced by low Bear Decile score and Great Owl designations (highlighted in dark blue – Great Owls are assigned to funds that have earned top performance rank based on Martin for all evaluation periods 3 years or longer).

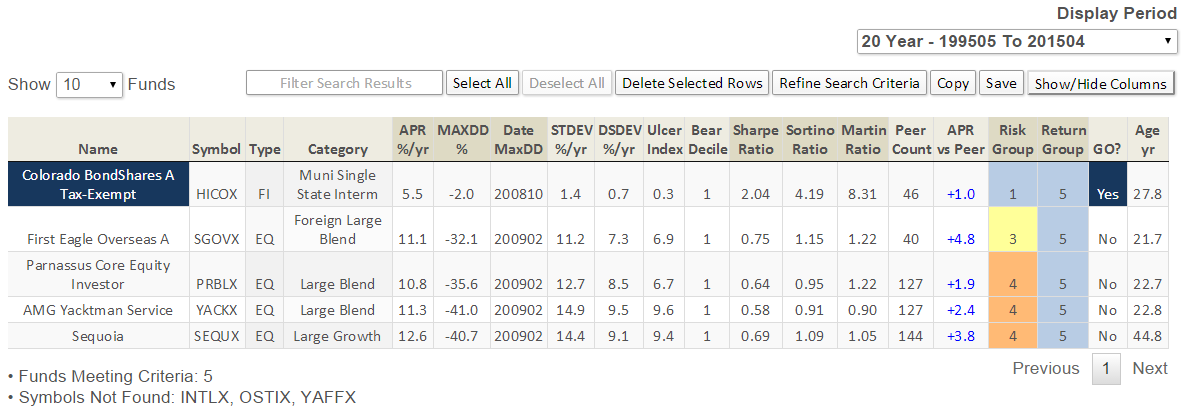

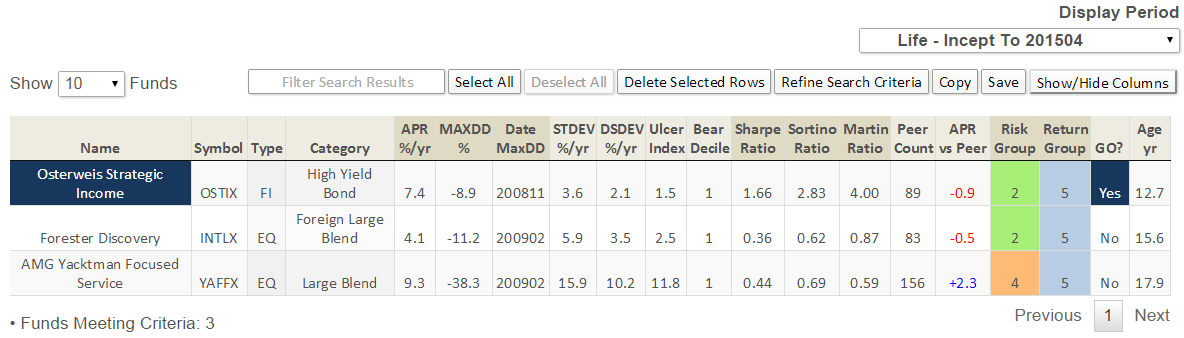

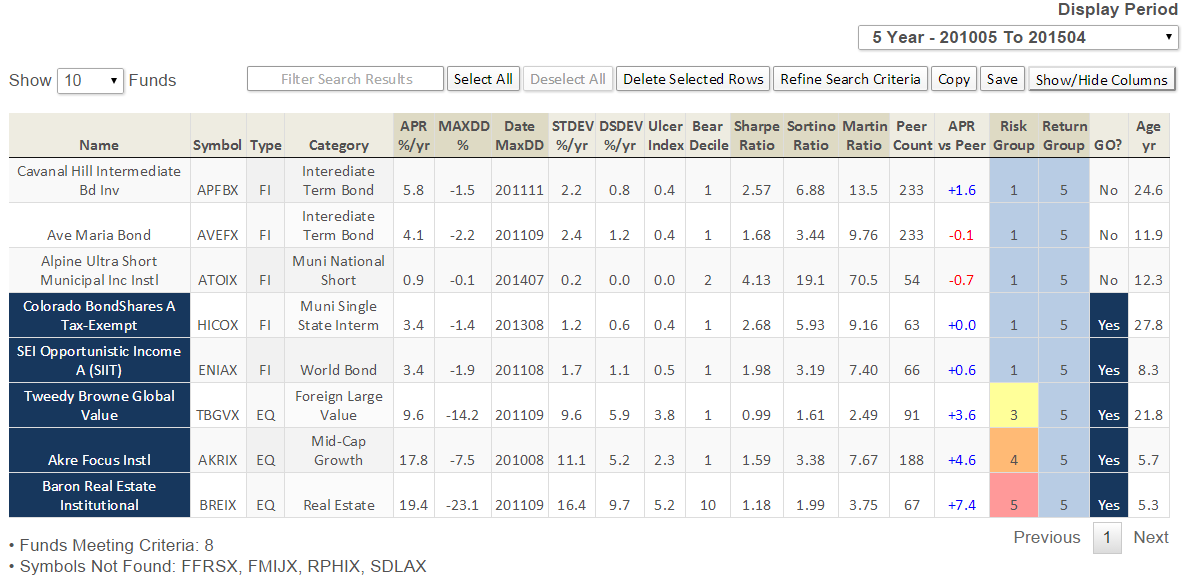

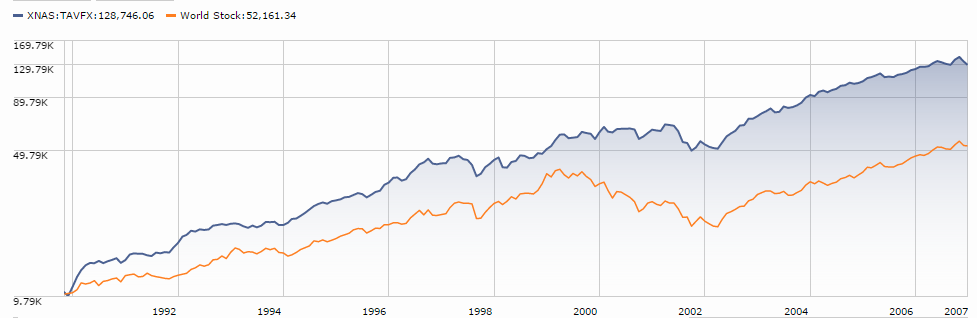

The following outliers have delivered extreme over-performance for periods 10 years and more (the tables depict 20 year or life metrics, as applicable):

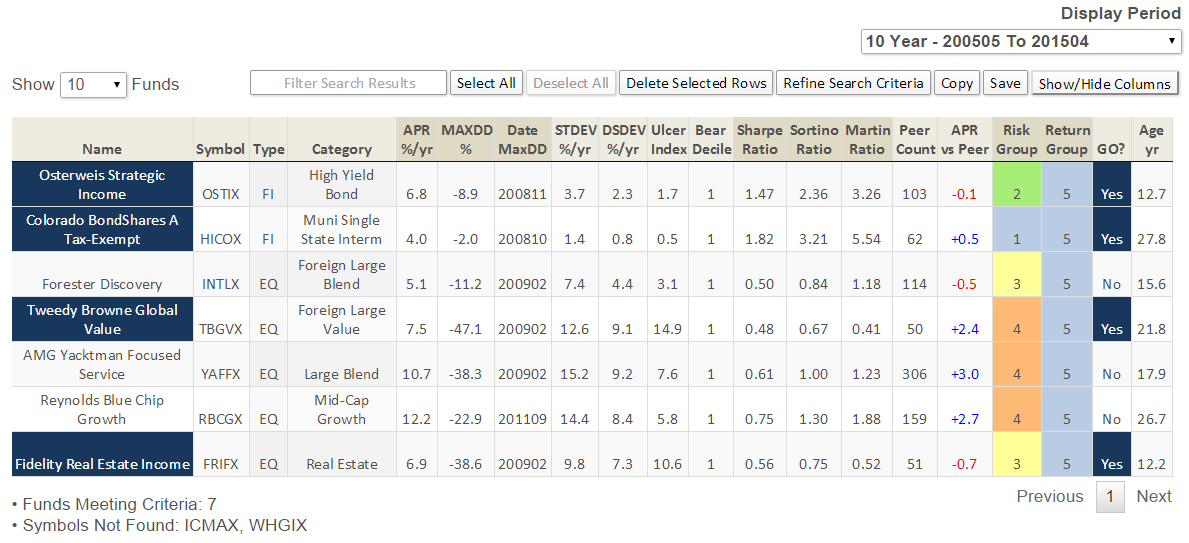

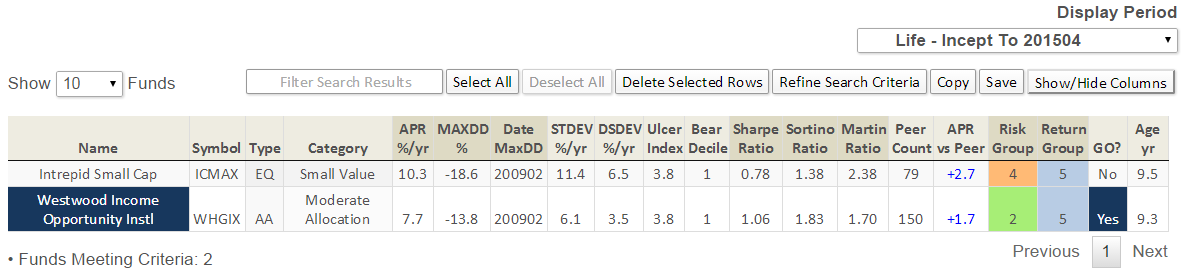

Here are the outliers for periods 5 years and more (the tables depict 10 year or life metrics, as applicable):

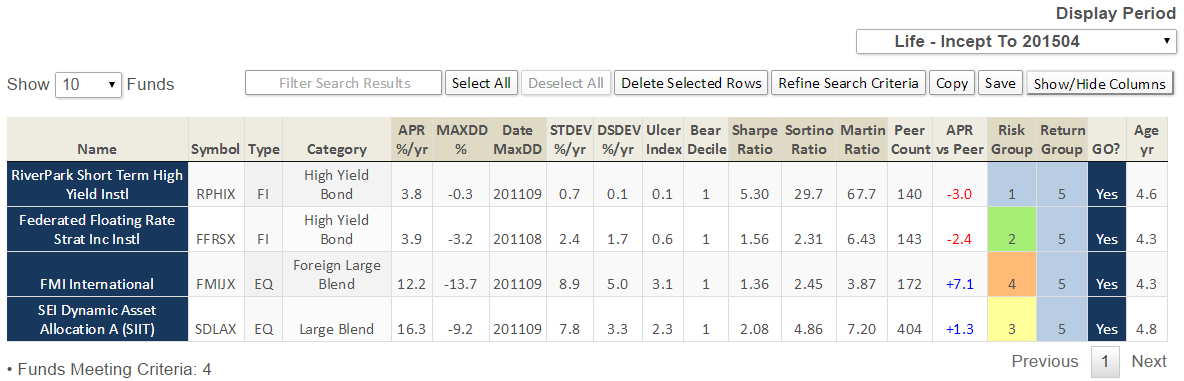

Finally, the outliers for periods 3 years and more (the tables depict 5 year or life metrics, as applicable):

Top developments in fund industry litigation

![]() Fundfox, launched in 2012, is the mutual fund industry’s only litigation intelligence service, delivering exclusive litigation information and real-time case documents neatly organized, searchable, and filtered as never before. For the complete list of developments last month, and for information and court documents in any case, log in at www.fundfox.com and navigate to Fundfox Insider.

Fundfox, launched in 2012, is the mutual fund industry’s only litigation intelligence service, delivering exclusive litigation information and real-time case documents neatly organized, searchable, and filtered as never before. For the complete list of developments last month, and for information and court documents in any case, log in at www.fundfox.com and navigate to Fundfox Insider.

Order

The Tenth Circuit vacated a district court’s order that had granted class certification in the prospectus disclosure lawsuit regarding the Oppenheimer California Municipal Bond Fund, finding that “[t]he district court’s class certification order at issue here did not analyze either the Rule 23(a) or 23(b) factors.” Defendants include independent directors. (In re Cal. Mun. Fund.)

New Lawsuits

A new securities fraud class action targets four Virtus funds, alleging that defendants misrepresented the performance track record of the funds’ “AlphaSector” strategy (created by an unaffiliated sub-adviser). Defendants include independent directors. (Youngers v. Virtus Inv. Partners, Inc.)

A new antitrust lawsuit alleges that Waddell & Reed and Ivy Funds “financed and aided” Al Haymon’s illegal efforts to monopolize professional boxing. (Golden Boy Promotions LLC v. Haymon.)

Briefs

Davis filed a reply brief in support of its motion to dismiss fee litigation regarding its New York Venture Fund. (In re Davis N.Y. Venture Fund Fee Litig.)

PIMCO filed a reply brief in support of its motion to dismiss fee litigation regarding its Total Return Fund (Kenny v. Pac. Inv. Mgmt. Co.)

Having lost in district court, plaintiffs filed their opening appellate brief defending their state-law claims regarding investments of Vanguard mutual fund assets in foreign gambling businesses. Defendants include independent directors. (Hartsel v. Vanguard Group, Inc.)

Amended Complaint

Plaintiffs filed a second amended complaint in fee litigation regarding four MainStay funds issued by New York Life. (Redus-Tarchis v. N.Y. Life Inv. Mgmt., LLC.)

Answer

Having lost on appeal, Putnam filed an answer to fraud and negligence claims, filed by the insurer of a swap transaction, regarding Putnam’s collateral management services to a CDO. (Fin. Guar. Ins. Co. v. Putnam Advisory Co.)

The Alt Perspective: Commentary and news from DailyAlts

Every month Brian J. Haskin, founder, publisher and editor of DailyAlts shares news, perspective and commentary on the alt-space with the Observer’s readers. DailyAlts is the only website with a sole focus on liquid alternative investments. They seek to provide a centralized source for high quality news, research and other information on one of the most dynamic and fastest growing segments of the investment industry. We’re always grateful for Brian’s commentary and he welcomes folks to drop by DailyAlts for more news in great depth. For now, the highlights:

Every month Brian J. Haskin, founder, publisher and editor of DailyAlts shares news, perspective and commentary on the alt-space with the Observer’s readers. DailyAlts is the only website with a sole focus on liquid alternative investments. They seek to provide a centralized source for high quality news, research and other information on one of the most dynamic and fastest growing segments of the investment industry. We’re always grateful for Brian’s commentary and he welcomes folks to drop by DailyAlts for more news in great depth. For now, the highlights:

The Access Revolution

There is an access revolution taking place in today’s investment world, especially with alternative investments. It started a number of years ago with platforms such as Kickstarter and Kiva, where everyday citizens could help others get their new idea off the ground. Today, individual investors can access a broad array of investments with just a few clicks of the mouse:

- Private equity via closed-end mutual funds

- Real estate lending and investing through crowdsourcing platforms

- Angel investing via online venture capital portals

- Private lending via online lending platforms

The list goes on, but the good news is that individual investors have far greater choice today than they did just a few years ago.

Much of the change taking place is due to changes in securities regulations that permit advertising and public promotion of private investment offerings. Other changes are driven by capital flowing to new technology-driven platforms and the broader use of existing investment vehicles.

Just this past month we had two new private equity offerings come to market in closed-end interval funds, one from Altegris / StepStone / KKR and the other from Pomona Capital / Voya:

- New Altegris Fund Gives Accredited Investors Exposure to Private Equity

- Pomona Capital and Voya Team Up on New Private Equity Fund

While these are not pure liquid alternatives (they don’t have daily liquidity, thankfully), they fall into the “near” liquid grouping. And furthermore, they give the mass-affluent access to investments that have never been available for as little as $25,000.

Expect to see more products such as these from the big name financial firms, as well as more access to alternatives through online investment portals. There is a revolution taking place.

Now, onto the liquid part of the alternatives market.

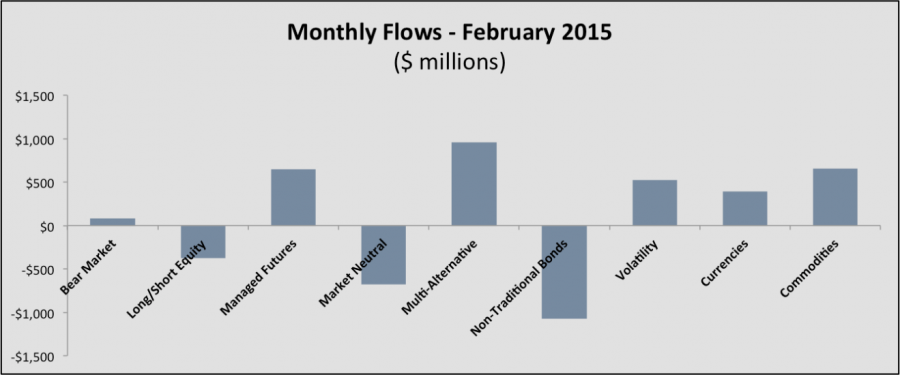

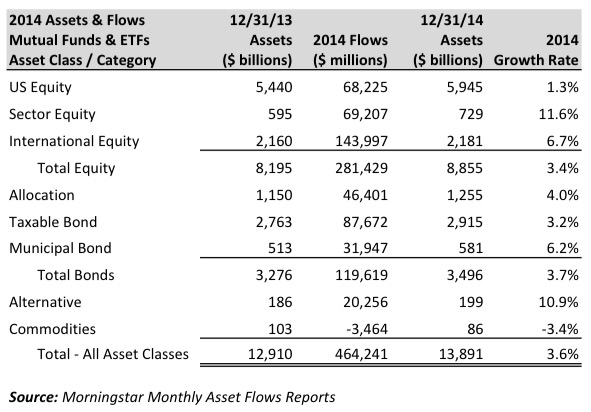

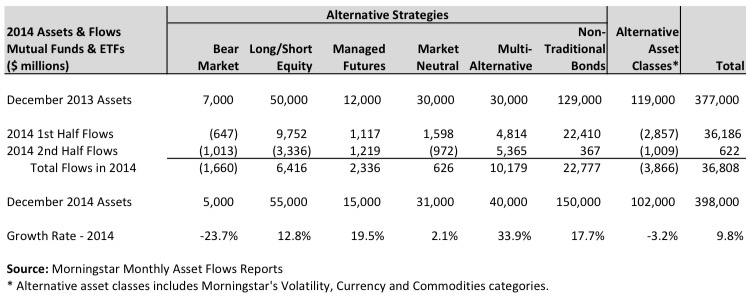

Monthly Liquid Alternative Flows

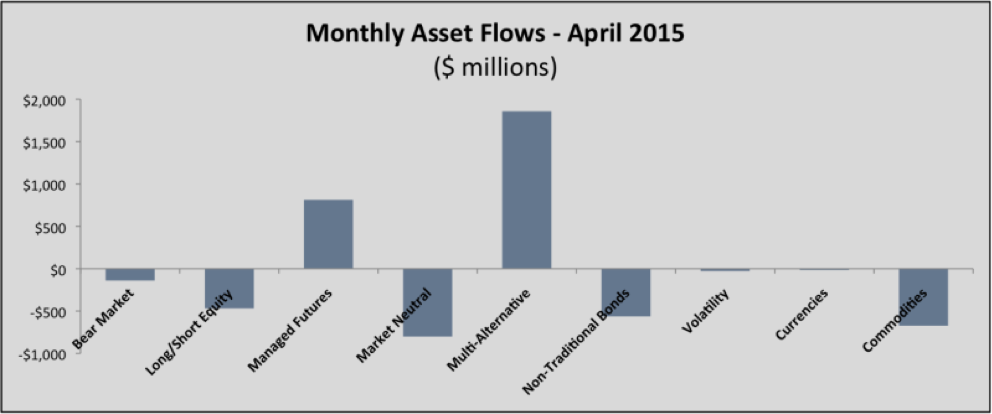

Investors allocated a total of $982 million to actively managed alternative mutual funds and ETFs in April, according to Morningstar’s most recent asset flows report, but pulled $259 million from passively managed alternative funds. Net flows totaled $723 million for the month, down from the healthy $2.8 billion of net new asset flows seen in March.

Interestingly, only two categories had positive flows in April: Multi-alternative funds and managed futures. Clearly a sign that advisors and investors are looking for either a one-stop shop for an alternatives allocation, or are looking to allocate to wholly uncorrelated strategies alongside equity and fixed income allocations. Managed futures strategies are generally expected to perform well during times of crisis, such as during the 2008 credit crisis, and when there are strong directional trends in markets, such as those we have seen in the past year with oil prices and the US dollar.

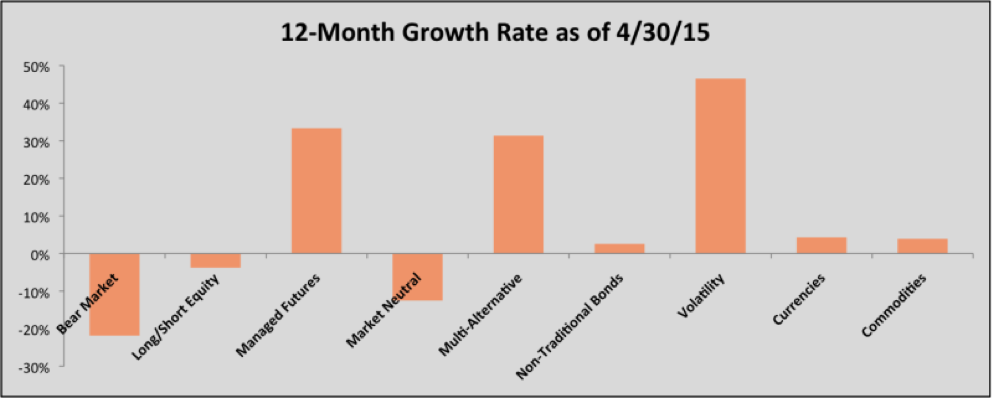

Last year was the year of non-traditional bonds, while 2015 is looking much stronger for several other strategies. Volatility based funds topped the charts for 12-month growth rates, with managed futures and multi-alternative funds not too far behind. And despite strong growth in 2014, non-traditional bond funds are only modestly keeping their head above water with a 12-month growth rate of 2.6%.

Based on growth rates and asset flows, diversification appears to be the primary focus of investors and allocators. In 2014, long/short equity fought against the $7.8 billion of outflows from the MainStay Marketfield Fund and still posted $6.4 billion of net inflows for the year. 2015 is looking quite different. Year-to-date, the long/short equity category is down $1.5 billion. While market neutral strategies can provide low levels of correlation with the equity markets, investors appear to be moving away from these strategies in favor of managed futures, volatility and multi-alternative funds.

Expect asset flows to liquid alternatives to continue on their current course of strong single-digit to low double-digit growth. Should markets falter, investors will look to allocate more to liquid alternatives.

New Fund Launches

We have seen 53 new funds launched this year, including alternative beta funds. In May, we logged 12 new funds, with nearly half being alternative beta funds. The remaining funds cut across multi-alternative, market neutral, non-traditional bonds, volatility and commodities.

Two intriguing funds in the volatility space came to market in May:

These two funds are different because they provide direct exposure to the VIX Index, whereas other VIX related products are indexed to futures contracts on the VIX, and thus can have very high holding costs over the course of a month. Some time is needed on the new AccuShares ETFs, but if VIX is your game, these are worth keeping an eye on.

For more details, you can visit our New Funds 2015 page to see a full listing.

Observer Fund Profiles:

Each month the Observer provides in-depth profiles of between two and four funds. Our “Most Intriguing New Funds” are funds launched within the past couple years that most frequently feature experienced managers leading innovative newer funds. “Stars in the Shadows” are older funds that have attracted far less attention than they deserve.

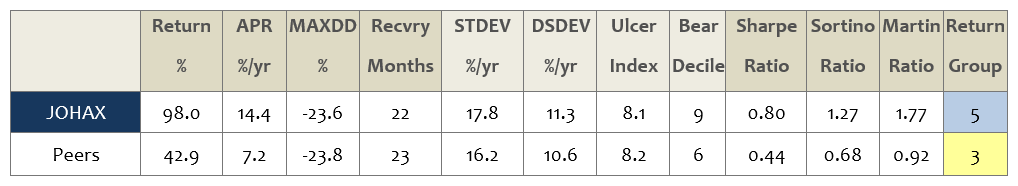

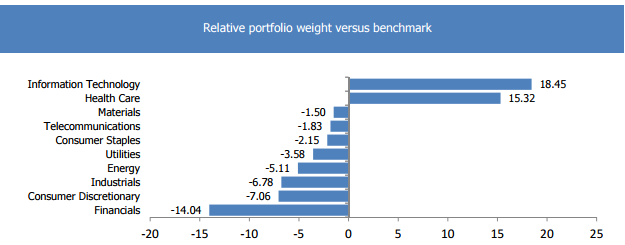

JOHCM International Select II (JOHAX): it’s the single best performing international large growth fund in existence over the past 1, 3 and 5 years. It’s got five stars. It’s a Great Owl. You’ve probably never heard of it and it’s closing in mid-July. Now does any of that offer a compelling reason to add it to your portfolio?

Elevator Talk: Jon Angrist, Cognios Market Neutral Large Cap

Since the number of funds we can cover in-depth is smaller than the number of funds worthy of in-depth coverage, we’ve decided to offer one or two managers each month the opportunity to make a 200 word pitch to you. That’s about the number of words a slightly-manic elevator companion could share in a minute and a half. In each case, I’ve promised to offer a quick capsule of the fund and a link back to the fund’s site. Other than that, they’ve got 200 words and precisely as much of your time and attention as you’re willing to share. These aren’t endorsements; they’re opportunities to learn more.

Since the number of funds we can cover in-depth is smaller than the number of funds worthy of in-depth coverage, we’ve decided to offer one or two managers each month the opportunity to make a 200 word pitch to you. That’s about the number of words a slightly-manic elevator companion could share in a minute and a half. In each case, I’ve promised to offer a quick capsule of the fund and a link back to the fund’s site. Other than that, they’ve got 200 words and precisely as much of your time and attention as you’re willing to share. These aren’t endorsements; they’re opportunities to learn more.

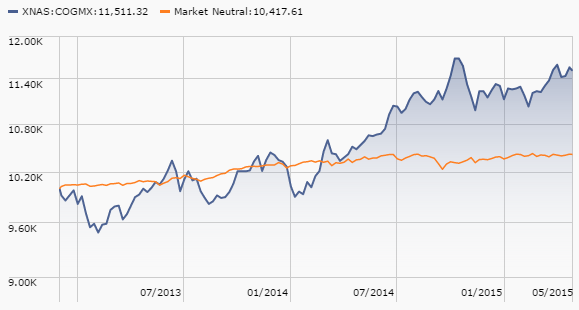

Market-neutral funds are, on whole, dumb investments. They’re funds with complex strategies, high expenses and low returns which provide questionable protection for their investors. By way of simple illustration, the average market-neutral fund charges 1.70% while returning 1.25% annually over the past five years. Right: 60% of the portfolio’s (modest) returns go to the adviser in the form of fees, 40% go to you.

About the best you can say for them is that, as a group, they lost only a little money in 2008: about 0.3%. The worst you can say is that they also lost a little money in 2009. And then a little more in 2010. And yet again in 2011 before their … uh, ferocious rebound led to a 0.18% gain in 2012.

Into the mess steps Jon Angrist, Brian J. Machtley and the folks at Cognios Capital. In 2008, Messrs. Angrist and Machtley co-founded Cognios (from the Latin for “to learn” or “to inquire”) which manages about $325 million, mostly for high net worth individuals. Mr. Angrist, the lead manager, has experience managing investments through limited partnerships (Helzberg Angrist Capital), private equity firms (Harvest Partners) and mutual funds (Buffalo Microcap Fund, now called Buffalo Emerging Opportunities BUFOX).

Cognios argues that most market-neutral managers misconstruct their portfolios. Most managers simply balance their short and long books: if 5% gets invested in an attractively valued car company then another 5% is devoted to shorting an unattractively valued car company. The problem is that an over-priced company might well be more volatile than an underpriced one, which means that the portfolio ceases to be market-neutral. The twist at Cognios, then, is to use quant tools to construct an attractive large cap portfolio while changing the relative sizes of the long and short books to neutralize beta. Cognios Market Neutral Large Cap describes itself as providing a “beta-adjusted market neutral” portfolio.

In a Beta-adjusted market neutral portfolio the size of the short book can be larger or smaller than the size of the long book. If the Beta of the long book is higher than the Beta of the short book, the short book needs to be larger than the size of the long book in order to remove all of the market’s broad movements (i.e., to remove the market’s Beta) … Even though the portfolio will be net short on an absolute dollar basis in [this] example (i.e., more shorts than longs) … [it] both would be market neutral on a Beta-adjusted basis.

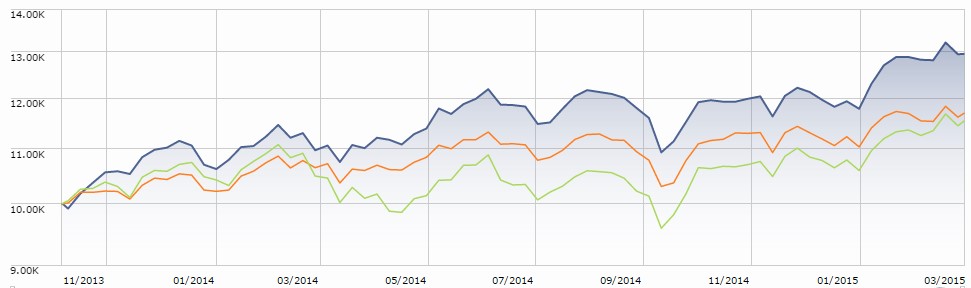

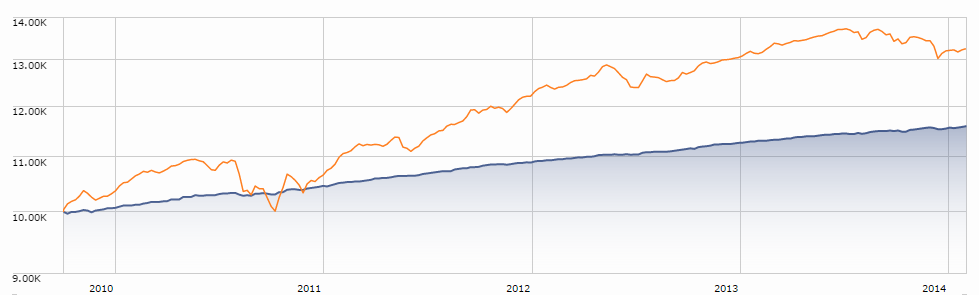

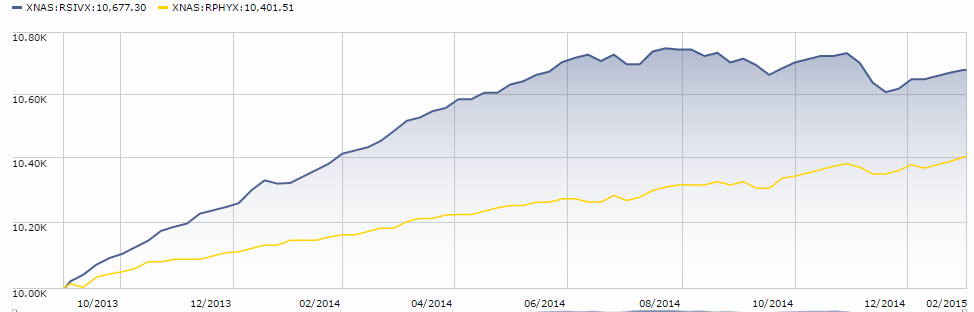

So far, this seems to be a profitable strategy. Below is the comparative performance of Cognios (blue line) since inception, against its market neutral peer group.

Here are Jon’s 264 words on why this might become a standout strategy:

Brian and I have been working in value investing for most of our careers and about three years ago, as we looked at the mutual fund universe, we saw a huge gap in market neutral offerings for individual investors. Even today, there are less than 40 market neutral mutual funds (not share classes). In today’s market environment, I believe a market neutral allocation, beta market neutral in particular, is a critical diversification tool in an investor’s overall asset allocation as it is the only strategy that strives to remove the impact of the market and macro events from the return of the strategy. Unlike most market neutral strategies that target risk-free rates of return, our fund targets equity-like returns over full market cycles because, in my opinion, if an investor wants Treasury-like returns why wouldn’t he/she just buy Treasuries?

There was a real need in the market for which our strategy could provide a solution if packaged in a mutual fund wrapper and because we only invest in large, liquid companies in the S&P 500, we didn’t have to change our strategy in order to deploy it in a mutual fund. Investors and their advisors are looking for strategies that seek to reduce volatility, standard deviation and downside risk in a portfolio, which is the primary objective of our fund. This fund has made it possible for a wide range of investors to access the same strategy that we provide to our institutional clients in other structures. As investors in our own fund, we have a very strong conviction about what we are doing.

Cognios Market Neutral Large Cap (COGMX/COGIX) has a $1000 minimum initial investment for its retail class and $100,000 for the institutional class. Both are modest in comparison to the $25 million minimum for a separately managed account. Expenses are capped at 1.95% on the investor shares, at least through early 2016. The fund has about gathered about $16 million in assets since its December 2012 launch. More information can be found at the fund’s homepage. There’s also a quick slideshow on a third-party website that walks through the basics of the fund’s strategy.

Funds in Registration

New mutual funds must be registered with the Securities and Exchange Commission before they can be offered for sale to the public. The SEC has a 75-day window during which to call for revisions of a prospectus; fund companies sometimes use that same time to tweak a fund’s fee structure or operating details.

Funds in registration this month are eligible to launch in July or August and some of the prospectuses do highlight that date.

This month our research associate David Welsch tracked down eight no-load retail funds in registration, which represents our core interest. Of those, four carry ESG screens (two from TIAA-CREF and two from Trillium) and three represent absolute value or absolute return strategies, while one is a short-term bond index. Interesting cluster of interests.

Manager Changes

This month 66 funds reported partial or complete changes in their management teams, a number slightly inflated by a dozen partial team changes in the AB (formerly AllianceBernstein) retirement date funds. The most striking were the imminent departures of PIMCO’s global equities CIO Virginie Maisonneuve plus several equity managers and analysts as PIMCO pulls back on their attempt to make a mark in pure equity investing. There was, in addition, announcement of the planned departure of Robert Mohn, Domestic Chief Investment Officer of Columbia Wanger Asset Management and Vice President of Wanger Advisors Trust who will step down in the fourth quarter of 2015. The change was announced for Wanger USA (WUSAX) but will presumably ripple through a series of Columbia Acorn funds eventually. In addition, Matt Paschke of the Leuthold Funds is taking a leave of absence to pursue personal interests for a bit. He’s a good and level-headed guy and we wish him well.

Updates

Andrew Foster, manager of Seafarer Overseas Growth & Income (SFGIX), was the guest on a sort-of video interview with Morningstar’s Jason Stipp in mid-May. The interview, entitled “Seeking Sustainable Growth in Emerging Markets,” covers much of the same ground as our recent conference call with Mr. Foster. One difference is that he spoke at greater length about China in his conversation with Mr. Stipp. I’ve designed it as a “sort of” video call because Jason was on-camera while Andrew was on a phone, with his picture superimposed on the screen.

Seafarer, with a three year record and five star rating, seems to have found its footing in the marketplace. The fund now boasts over a quarter billion in well-deserved assets.

Briefly Noted . . .

Ted, The Linkster and long-time stalwart of our discussion board, cheers for Dodge & Cox shareholders. He shared a USA Today story “3 AOL Investors Bag a Quick $200M” that calculates the gain to D&C shareholders from Verizon’s bid to acquire AOL. The Dodge & Cox funds own 15% of the outstanding shares of AOL, which netted them $95,000,000 in a single day. Sadly, the D&C funds are so big that AOL contributed just a fraction of a percent to returns that day. Iridian Asset Management and BlackRock finished second and third in total gains.

Ted also reports that the famously frugal Vanguard Group decided to chuck $200,000 at Bill Clinton in exchange for a 2012 speech for Vanguard’s institutional clients. That’s not an exceptional amount to hear from the former First Saxophonist; The Washington Post shows Bill pocketing $105 million for 542 speeches from the time he left the White House until the time Hilary Rodham-Clinton left the State Department. That comes to an average of $194,000 which suggests that Vanguard might have gotten just a bit flabby on their cost containment with this talk. The record might have been $300,000 paid by Dell that same year.

Ted also reports that the famously frugal Vanguard Group decided to chuck $200,000 at Bill Clinton in exchange for a 2012 speech for Vanguard’s institutional clients. That’s not an exceptional amount to hear from the former First Saxophonist; The Washington Post shows Bill pocketing $105 million for 542 speeches from the time he left the White House until the time Hilary Rodham-Clinton left the State Department. That comes to an average of $194,000 which suggests that Vanguard might have gotten just a bit flabby on their cost containment with this talk. The record might have been $300,000 paid by Dell that same year.

SMALL WINS FOR INVESTORS

Hmmm … does “nothing really bad has happened yet” qualify as a win? Other than that, we’ve got the reopening of BlackRock Event Driven Equity Fund (BALPX) on or about July 27, 2015. Bad news: BALPX is tiny, expensive and sucks. Good news: they brought in a new manager in early May, 2015. Mark McKenna left Harvard’s endowment team and joined BlackRock last year to run an event-driven hedge fund. He’s now been moved here. The other bad news: Harvard’s performance was surprisingly poor during McKenna’s tenure, which doesn’t say McKenna was responsible for the poor performance, just that he didn’t live up to the vaunted Harvard standard. As a result, this is a small win.

CLOSINGS (and related inconveniences)

American Century Small Cap Value Fund sort of closed on May 1. In an increasingly common move, the adviser left the door open for those who invest directly with the fund and for “certain financial intermediaries selected by American Century.”

ASTON/River Road Dividend All Cap Value Fund (ARDEX) and ASTON/Fairpointe Mid Cap Fund (CHTTX) have each been soft-closed. Each management team has a second fund still open.

Effective June 12, 2015, $4.2 billion Diamond Hill Long-Short Fund (DIAMX) will close to most new investors. The fund has exceptional returns for an exceptional period. Its 3-, 5- and 10-year records cluster around the 25th percentile of all long-short funds. Potential investors need to take two factors into consideration when deciding whether to jump in: (1) performance is driven primarily by the strength of its long portfolio and (2) the lead manager for the long portfolio, Chuck Bath, is stepping aside. He’ll remain as a sort of backup manager but wants to focus his attention on Diamond Hill Large Cap. There’s no easy way of guessing how much his reorientation will cost the fund, so proceed thoughtfully if at all.

Effective as of the close of business on July 15, 2015, the $2.8 billion, five-star JOHCM International Select Fund (JOHIX) will be soft-closed. As friend Marjorie Pannell points out, the fund is an MFO Great Owl with eye-popping performance:

1 year – top 1% – (1 out of 339 funds)

3 year – top 1% – (1 out of 293 funds)

5 year – top 1% – (1 out of 277 funds)

Vulcan Value Partners (VVLPX) closed on June 1, rather later than originally planned. Out of respect for manager C.T. Fitzpatrick’s excellent long-term record here and at the Longleaf Funds, we sent out a notice of the extended window of opportunity to the 6000 or so folks on our email list.The $14 billion T. Rowe Price Health Sciences Fund (PRHSX) closed to new investors on June 1, 2015. Morningstar covered the fund avidly until the departure of star manager Kris Jenner. Over 13 years, Jenner nearly doubled the annualized returns of his benchmark. He left with two analysts, leaving the remaining analyst to take the reins. There was about $6 billion in the fund when Jenner (and Morningstar) left. Since then the fund has been much more T. Rowe Price-like: it has converted consistent, modest outperformance and risk consciousness into a fine record under manager Taymour Tamaddon.

OLD WINE, NEW BOTTLES

Barrow All-Cap Core Fund (BALAX) is now Barrow Value Opportunity Fund and Barrow All-Cap Long/Short Fund (BFLSX) has been renamed Barrow Long/Short Opportunity Fund. Morningstar hasn’t caught up with the change yet.

Brown Capital Management Mid-Cap Fund is now Brown Capital Management Mid Company Fund (BCSMX). Rather than investing in mid-cap stocks, the fund will target mid-sized companies: those with total operating revenues of $500 million to $10 billion.

Catalyst Absolute Total Return Fund, will undergo a name and objective change to Catalyst Intelligent Alternative Fund in July.

Over the course of the past month, The Hartford Emerging Markets Research Fund (HERAX) was … uhh, tweaked a bit so that it has a new investment mandate, lower management fee (though no break on the bottom line expense ratio), new manager (Cheryl Duckworth is out, David Elliott of Wellington is in) and new name, Hartford Emerging Markets Equity Fund. One striking element of the change was the introduction of a new “related accounts performance” table, which shows how Mr. Elliott’s other EM porfolios perform before and after deductions for Hartford’s sales charges and expenses. Since inception, Elliott’s portfolio has returned 6.9% which crushes his benchmark’s 3.6%. Deduct sales charges and expenses and investors would pocket only 3.9%. That is, 56% of the manager’s raw performance gets routed to The Hartford and 44% goes to his investors. Other than for that, it was pretty much status quo in Hartford.

Roxbury/Mar Vista Strategic Growth Fund was recently rechristened as the Mar Vista Strategic Growth Fund (MVSGX) while Roxbury/Hood River Small-Cap Growth Fund became Hood River Small-Cap Growth Fund (HRSMX). Both are tiny but have really solid records. Heck, in Hood River’s case, it has a top tier 3-, 5- and 10 year record

On July 1, 2015, the T. Rowe Price Strategic Income Fund (PRSNX) will change its name to the T. Rowe Price Global Multi-Sector Bond Fund.

Effective May 30, 2015, the name of Turner Spectrum Fund was changed to Turner Titan II Fund. . Under its new dispensation, the fund “invests primarily in equity securities of companies with large capitalization ranges across major industry sectors using a long/short strategy in seeking to capture alpha, reduce volatility, and preserve capital in declining markets.”

On May 1, 2015, the European Equity Fund (VEEEX) became the Global Strategic Income Fund. Morningstar continues its membership in the European equity peer group despite the fact that, well, it ain’t.

OFF TO THE DUSTBIN OF HISTORY

It was a bad month for both alternative strategy and bond funds. Of the 23 funds that went extinct this month, five pursued alternative strategies, four were fixed-income funds – mostly international – and two were stock/bond hybrids.

361 Market Neutral Fund (ALSQX) underwent “termination, liquidation and dissolution” on May 29, 2015. The fund had an all-star management team, spotty record and trivial asset base.

As of March 9, 2015, AllianzGI Opportunity Fund merged into AllianzGI Small-Cap Blend Fund (AZBAX). The topic came up in a mid-May SEC filing, so I thought I’d mention.

Ancora Equity Fund (ANQIX) will be liquidated and dissolved on or about June 26, 2015.

Ave Maria Opportunity Fund (AVESX), a tiny small-value fund with a lot of faith in energy stocks, will merge into Ave Maria Catholic Values Fund (AVEMX) at the end of July.

Catalyst Event Arbitrage Fund (CEAAX), which was a good hedge fund and a bad mutual fund, will be liquidated on June 15, 2015.

Clear River Fund (CLRVX) will liquidate on June 30, 2015. No, I’ve never heard of it, either. The closest to a fun fact about the fund is that it never managed to finish any calendar year with above-average returns relative to its Morningstar peer group.

A new speed record: The Trustees of Context Capital Funds launched the Context Alternative Strategies Fund (CALTX) with two managers and seven sub-advisers in March, 2014. Performance started out as mediocre but by December turned ugly. Having been patient for more than a year(!), the Trustees dismissed their two managers on May 18, then filed a prospectus supplement on Friday, May 29, 2015 that announced the liquidation of the fund on the next business day, Monday, June 1, 2015. That liquidation leaves Context with one fund, Context Macro Opportunities (CMOTX), which nominally launched in December, hasn’t traded yet, has $100,000 in assets and a $1,000,000 minimum.

Encompass Fund (ENCPX) liquidated on May 27, 2015. They launched about seven years ago, convinced that it was time to focus on materials stocks. They were right, then they were very wrong; the fund tended to finish in the top 1% or the bottom 1% of its noticeably volatile natural resources peer group. At the end, they had $2 million in AUM and were dead last in their peer group. The managers and trustees, to their great credit if not to their personal gain, held about half of the fund’s total assets.

That said, the managers wrote a thoughtful and appropriate eulogy for the fund in their last letter to shareholders.

We want the shareholders to know that we resigned with a keen sense of disappointment. After posting exceptional returns in 2009 and 2010, we were optimistic that the Fund’s overweight in precious and industrial metals would continue to enable Encompass to excel. However, the last 4 years were difficult ones for resource companies and the Fund has underperformed. We did increase exposure to the energy sector in late 2013 and early 2014. Those stocks performed very well until oil prices shocked investors by declining more than 50% in the second half of 2014.

More recently we increased the Fund’s exposure to the health care, cybersecurity and airline industries with good results. However, the resource companies have continued to weigh on overall portfolio performance even though exposure to metals has been significantly reduced.

When we launched Encompass in mid-2006, we believed the time was right for a diversified mutual fund that emphasized resource companies. For several years we were proven right, but despite fundamentals that historically have been good for metals companies, the last few years have been very challenging. The Fund has not been able to grow and thus we came to the very difficult decision that we should resign as Manager. The Fund’s independent Trustees considered various alternatives and concluded that the Fund should be liquidated.

We have begun liquidating the Fund’s holdings, and intend to complete the process in the next couple of weeks. Of course, we are attempting to maximize the proceeds for the benefit of shareholders.

Guggenheim Enhanced World Equity Fund (GEEWX) will liquidate on June 26, 2015. $6 million in assets with a 600% annual turnover which, I presume, is the “enhancement” implied by the name.

Innealta Capital Global All Asset Opportunity Fund (ROMAX) will discontinue operations on June 19th. The fund managed to rake in just about $3 million in its two years of high expense/high turnover/low returns operations.

In mid-July, Jamestown Balanced Fund (JAMBX) will ask its shareholders for permission to merge into Jamestown Equity Fund (JAMEX). The rationale is that the funds have “similar investment objectives, investment strategies and risk factors,” which is true give or take the nearly 50% higher volatility that investors in the equity fund experience over investors in the balanced one.

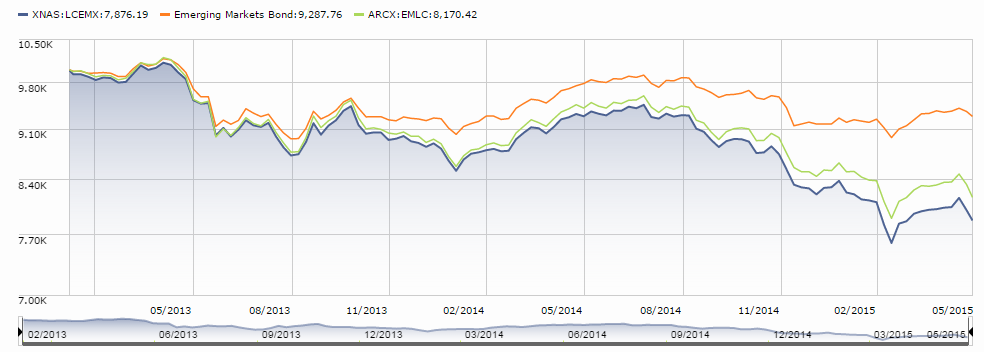

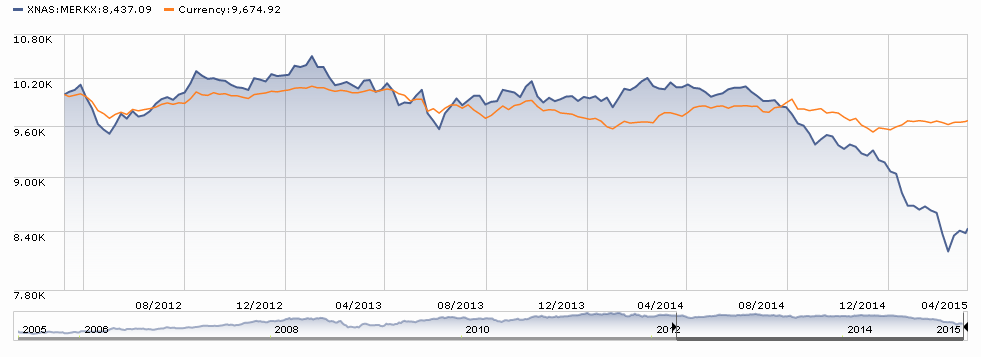

The trustees of the fund have authorized the liquidation of the Pioneer Emerging Markets Local Currency Debt Fund (LCEMX) which will occur on August 7, 2015. To put the decision in context: over the past couple years, investing in emerging markets bonds (the orange line) has been a bad idea, investing in EM bonds denominated in local currencies (green) has been a worse idea and investing in the Pioneer fund (blue) has been a thorough disaster.

On the upside, with only $10 million in assets, no one much was hurt. As of the last SAI, the manager hadn’t invested a single dinar, rupee or pataca in the fund so his portfolio was pretty much unscathed.

The Listed Private Equity Plus Fund become unlisted on May 18, 2015.

On May 15, 2015, the Loomis Sayles International Bond Fund was liquidated. A subsequent SEC filing helpfully notes: “The Fund no longer exists, and as a result, shares of the Fund are no longer available for purchase or exchange.”

PIMCO is retreating from the equity business with the liquidation of PIMCO Emerging Multi-Asset (PEAAX), PIMCO EqS® Emerging Markets (PEQAX) and PIMCO EqS Pathfinder (PATHX) funds, all on July 14, 2015. Pathfinder, with nearly $900 million in assets, was supposed to be a vehicle to showcase the talents of two Franklin Mutual Series managers who defected to PIMCO. That didn’t play out during the fund’s five year history, arguably because it was better positioned for down markets than for rising ones. PEAAX was a small, sucky fund of PIMCO funds. PEQAX was a slightly less small, slightly less sucky fund that was supposed to be the star vehicle for an imported GSAM team. Oops.

Rx Tax Advantaged Fund (FMERX) will liquidate soon. It managed to parlay high expenses and a low-return asset class (muni bonds) into a tiny, money-losing proposition.

Templeton Constrained Bond Fund (FTCAX) goes the way of the dodo bird on August 27, 2015 which “may be delayed if unforeseen circumstances arise.” I can’t for the life of me figure out what the “constraint” in the fund name referred to. The prospectus announces:

Under normal market conditions, the Fund invests at least 80% of its net assets in “bonds.” Bonds include debt obligations of any maturity, such as bonds, notes, bills and debentures.

The constraint is that the bond fund must buy “bonds”? The last portfolio report shows them at 90% cash in a $10 million portfolio.

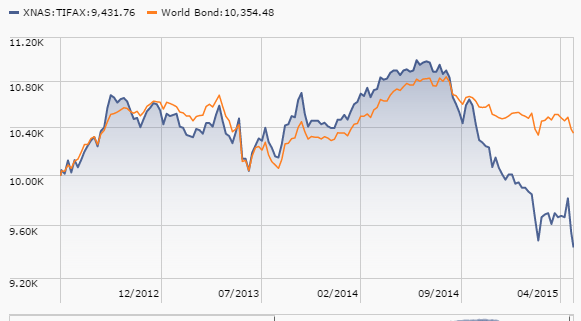

Touchstone International Fixed Income Fund (TIFAX), in recognition of “its small size and limited growth potential,” will liquidate on July 21, 2015. “An overweight to peripheral and speculative issuers” helped performance, right up to the moment when it didn’t:

Okay, they really, really mean it this time: The Turner Funds determined to close and liquidate the Turner Titan Fund (TTLFX), effective on or about June 19, 2015. The Fund had previously been scheduled to close and liquidate on or about June 1, 2015. That’s followed its closure at the end of 2014 and previously announced plans to liquidate in mid-March and late April.

V2 Hedged Equity Fund (VVHEX/VVHIX), responding to “an anticipated decline in Fund assets,” liquidated in early May.

I appreciate thoroughness: “Effective April 30, 2015, the Virtus Global Commodities Stock Fund … was liquidated. The Fund has ceased to exist and is no longer available for sale. Accordingly, the prospectus and SAI are no longer valid.” Any questions?

In Closing . . .

Thanks, as always, to the folks who support the Observer. To Binod, greetings and good luck with the rising waters in Houston. We feel for you! Thanks to Joe for the thumbs-up on our continuing redesign of the Observer’s site; it’s always good to get an endorsement from a pro! Tom, thank you, we’re so glad that you find our site useful. Thanks, finally, to the folks who’ve bookmarked the Observer’s link to Amazon. Normally our Amazon revenue tails off dramatically at mid-year. So far this season, it’s held up reasonably well and we’re grateful.

We’ll look for you at Morningstar. I’ll be the one dressed like a small oak. It’s a ploy! John Rekenthaler (Bavarian for “thunder talker,” I think) recently mused “I don’t actually get invited to parties, but if I did, I’d be chatting with the potted plants.” I figure that with proper foliage I might lure the Great Man into amiable conversation.

We’ll look for you at Morningstar. I’ll be the one dressed like a small oak. It’s a ploy! John Rekenthaler (Bavarian for “thunder talker,” I think) recently mused “I don’t actually get invited to parties, but if I did, I’d be chatting with the potted plants.” I figure that with proper foliage I might lure the Great Man into amiable conversation.

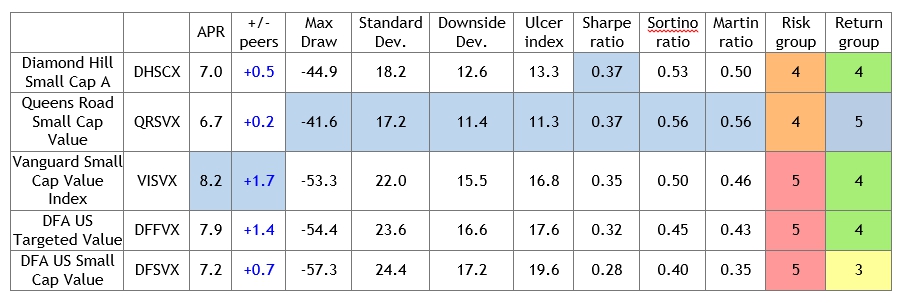

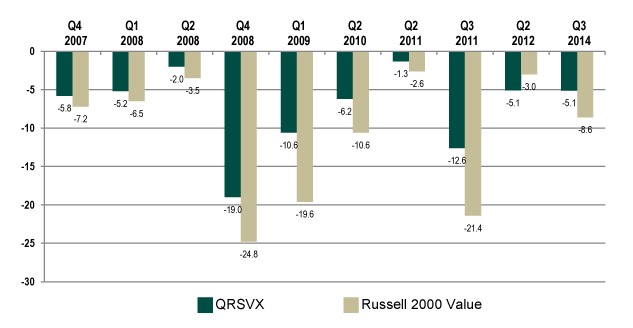

If any of you would like to join Hedda, Jake, (maybe) Tadas and the good folks from the Queens Road funds (they’ve promised me fresh peanuts) in diverting my attention and saving John from my interminable prattle, please do drop us a note and we’ll set up a time to meet. The Observer folks should be around the conference from early Wednesday until well past its Friday close.

As always, we’ll post daily conference highlights on MFO’s discussion board. (No, I don’t tweet and you can’t make me.) If you miss them there, we’ll share them in our July issue. In addition, we have profiles of some new ESG/green funds – equity, income and hybrid – on tap. We’ll explain why in July!

As ever,

Ed is one of a growing number of investors who are fearful that we might be approaching a roach motel; that is, a situation where it’s easy to get into a particular security but where it might be impossible to get back out of it when you urgently want to.

Ed is one of a growing number of investors who are fearful that we might be approaching a roach motel; that is, a situation where it’s easy to get into a particular security but where it might be impossible to get back out of it when you urgently want to.

The spring has brought new life into the liquid alternatives market with both March and April seeing robust activity in terms of new fund launches and registrations, as well as fund flows. Touching on new fund flows first, March saw more than $2 billion of new asset flow into alternative mutual funds and ETFs, while US equity mutual funds and ETFs had combined outflows of nearly $6 billion.

The spring has brought new life into the liquid alternatives market with both March and April seeing robust activity in terms of new fund launches and registrations, as well as fund flows. Touching on new fund flows first, March saw more than $2 billion of new asset flow into alternative mutual funds and ETFs, while US equity mutual funds and ETFs had combined outflows of nearly $6 billion. Here are some quick highlights from our April 16th conversation with Andrew Foster of Seafarer.

Here are some quick highlights from our April 16th conversation with Andrew Foster of Seafarer.

What a difference a month makes. When I wrote to you last month, it was 18 degrees below zero. Right now it’s

What a difference a month makes. When I wrote to you last month, it was 18 degrees below zero. Right now it’s

Identifying Bear-Market Resistant Funds During Good Times

Identifying Bear-Market Resistant Funds During Good Times

There’s Got to be a Pony In This Room …….

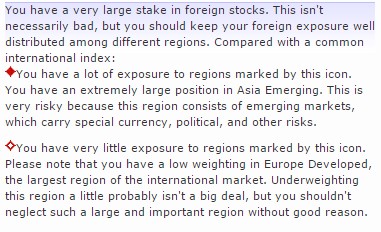

There’s Got to be a Pony In This Room ……. Now if only I could understand the logic of Morningstar’s grumbling about my portfolio. U.S. equities accounted for 36% of the total market capitalization of all equities markets worldwide on 10/21/14. In my portfolio, US equities account for 40% of all equity exposure. On face, that’s a slight underweight. Morningstar’s x-ray interpreter, however, insists on fretting that I have “a very large stake in foreign stocks” (no, I’m underweight), with special notes of my “extremely large” stake in Asia (“this is very risky”) and extremely small stake in Western Europe (which “probably isn’t a big deal”). I understand that most American investors have a substantial “home bias,” but I’m not sure that the bias should be reinforced in Morningstar’s portfolio analyzer.

Now if only I could understand the logic of Morningstar’s grumbling about my portfolio. U.S. equities accounted for 36% of the total market capitalization of all equities markets worldwide on 10/21/14. In my portfolio, US equities account for 40% of all equity exposure. On face, that’s a slight underweight. Morningstar’s x-ray interpreter, however, insists on fretting that I have “a very large stake in foreign stocks” (no, I’m underweight), with special notes of my “extremely large” stake in Asia (“this is very risky”) and extremely small stake in Western Europe (which “probably isn’t a big deal”). I understand that most American investors have a substantial “home bias,” but I’m not sure that the bias should be reinforced in Morningstar’s portfolio analyzer.

Lee Kronzon manages the Gator Opportunities Fund (GTOAX/GTOIX), which launched in early November 2013. While this is his first stint managing a mutual fund, he’s had a interesting and varied career, and it appears that lots of serious people have reason to respect him. He came to Gator after more than a decade as an equity analyst and strategist with the Fundamental Equities Group at Goldman Sachs Asset Management (GSAM). Earlier he cofounded Tower Hill Securities, a merchant bank that funded global emerging growth companies. Earlier still he taught at Princeton as a Faculty Lecturer at the Woodrow Wilson School. In that role he co-taught several courses in applied quantitative and economic analysis with Professors Ben Bernanke (subsequently chairman of the Federal Reserve) and Alan Krueger (chair of Obama’s Council of Economic Advisors). Fortunately, he predated a rating at RateMyProfessors.com where Princeton professor and talking head Paul Krugman gets

Lee Kronzon manages the Gator Opportunities Fund (GTOAX/GTOIX), which launched in early November 2013. While this is his first stint managing a mutual fund, he’s had a interesting and varied career, and it appears that lots of serious people have reason to respect him. He came to Gator after more than a decade as an equity analyst and strategist with the Fundamental Equities Group at Goldman Sachs Asset Management (GSAM). Earlier he cofounded Tower Hill Securities, a merchant bank that funded global emerging growth companies. Earlier still he taught at Princeton as a Faculty Lecturer at the Woodrow Wilson School. In that role he co-taught several courses in applied quantitative and economic analysis with Professors Ben Bernanke (subsequently chairman of the Federal Reserve) and Alan Krueger (chair of Obama’s Council of Economic Advisors). Fortunately, he predated a rating at RateMyProfessors.com where Princeton professor and talking head Paul Krugman gets  His celebration of the alligator gives you a sense of how he’s thinking: “The gator is a survivor, one of the planet’s oldest species and a remnant of the dinosaur era. He’s made it through all sorts of different climates and challenges. And his strategy just works: be still, wait patiently for an opportunity to present itself and then strike. Really, it’s a creature with no weaknesses!”

His celebration of the alligator gives you a sense of how he’s thinking: “The gator is a survivor, one of the planet’s oldest species and a remnant of the dinosaur era. He’s made it through all sorts of different climates and challenges. And his strategy just works: be still, wait patiently for an opportunity to present itself and then strike. Really, it’s a creature with no weaknesses!” David Berkowitz, manager of the newly-launched RiverPark Focused Value Fund, and Morty Schaja, RiverPark’s cofounder and CEO, chatted with me (and about 30 of you) for an hour in mid-March. It struck me as a pretty remarkable call, largely because of the clarity of Mr. Berkowitz’s answers. Here are what I take to be the highlights.

David Berkowitz, manager of the newly-launched RiverPark Focused Value Fund, and Morty Schaja, RiverPark’s cofounder and CEO, chatted with me (and about 30 of you) for an hour in mid-March. It struck me as a pretty remarkable call, largely because of the clarity of Mr. Berkowitz’s answers. Here are what I take to be the highlights.

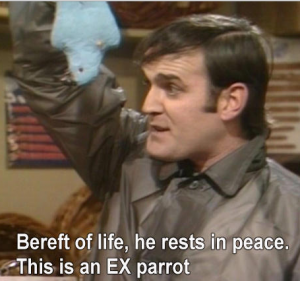

‘E’s not pinin’! ‘E’s passed on! This parrot is no more! He has ceased to be! ‘E’s expired and gone to meet ‘is maker!

‘E’s not pinin’! ‘E’s passed on! This parrot is no more! He has ceased to be! ‘E’s expired and gone to meet ‘is maker! The Royce Fund’s Board of Trustees recently approved a plan of liquidation for Royce Select Fund II (RSFDX), Royce Enterprise Select Fund (RMISX), Royce SMid-Cap Value Fund (RMVSX), Royce Partners Fund (RPTRX) and Royce Global Dividend Value Fund (RGVDX). In their delicately worded phrase, “the plan will be effective on April 23, 2015.” That puts the plan in contrast to the funds themselves, which were part of the seemingly mindless expansion of the Royce lineup. Between 1962 and 2001, Royce launched nine funds – all domestic small caps. They were acquired by Legg Mason in 2001. Between 2001 and the present, they launched 21 mutual funds and three closed-end funds in a striking array of flavors. Almost none of the newer funds found traction, with 10 of the 21 sitting under $10 million in assets. Shostakovich, one of our discussion board’s most experienced correspondents, pretty much cut to the chase: “Chuck sold his soul. He kept his cashmere sweaters and his bow ties, but he sold his soul. And the devil’s name is Legg Mason.”

The Royce Fund’s Board of Trustees recently approved a plan of liquidation for Royce Select Fund II (RSFDX), Royce Enterprise Select Fund (RMISX), Royce SMid-Cap Value Fund (RMVSX), Royce Partners Fund (RPTRX) and Royce Global Dividend Value Fund (RGVDX). In their delicately worded phrase, “the plan will be effective on April 23, 2015.” That puts the plan in contrast to the funds themselves, which were part of the seemingly mindless expansion of the Royce lineup. Between 1962 and 2001, Royce launched nine funds – all domestic small caps. They were acquired by Legg Mason in 2001. Between 2001 and the present, they launched 21 mutual funds and three closed-end funds in a striking array of flavors. Almost none of the newer funds found traction, with 10 of the 21 sitting under $10 million in assets. Shostakovich, one of our discussion board’s most experienced correspondents, pretty much cut to the chase: “Chuck sold his soul. He kept his cashmere sweaters and his bow ties, but he sold his soul. And the devil’s name is Legg Mason.”

Welcome to the world of the

Welcome to the world of the

Prolific MFO board contributor Scott first made us aware of the fund in August 2012 with the post “

Prolific MFO board contributor Scott first made us aware of the fund in August 2012 with the post “

Since the number of funds we can cover in-depth is smaller than the number of funds worthy of in-depth coverage, we’ve decided to offer one or two managers each month the opportunity to make a 200 word pitch to you. That’s about the number of words a slightly-manic elevator companion could share in a minute and a half. In each case, I’ve promised to offer a quick capsule of the fund and a link back to the fund’s site. Other than that, they’ve got 200 words and precisely as much of your time and attention as you’re willing to share. These aren’t endorsements; they’re opportunities to learn more.

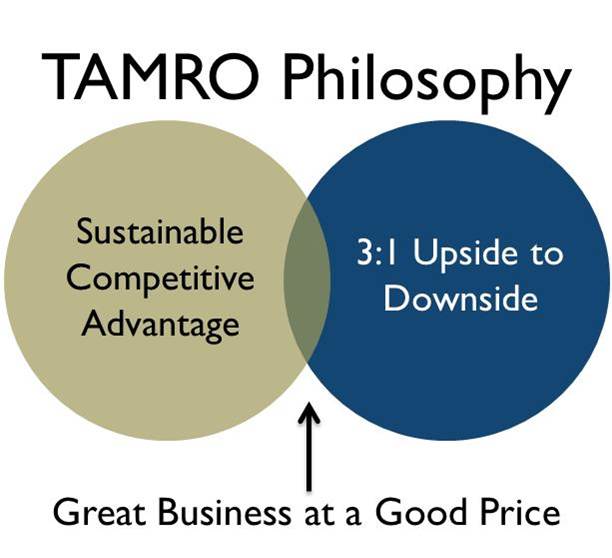

Since the number of funds we can cover in-depth is smaller than the number of funds worthy of in-depth coverage, we’ve decided to offer one or two managers each month the opportunity to make a 200 word pitch to you. That’s about the number of words a slightly-manic elevator companion could share in a minute and a half. In each case, I’ve promised to offer a quick capsule of the fund and a link back to the fund’s site. Other than that, they’ve got 200 words and precisely as much of your time and attention as you’re willing to share. These aren’t endorsements; they’re opportunities to learn more. … we identify undervalued companies with a competitive advantage. We attempt to mitigate our investment risk by purchasing stocks where, by our calculation, the potential gain is at least three times the potential loss (an Upside reward-to-Downside risk ratio of 3:1 or greater). While our investments fall into three different categories – Leaders, Laggards and Innovators – all share the key characteristics of success:

… we identify undervalued companies with a competitive advantage. We attempt to mitigate our investment risk by purchasing stocks where, by our calculation, the potential gain is at least three times the potential loss (an Upside reward-to-Downside risk ratio of 3:1 or greater). While our investments fall into three different categories – Leaders, Laggards and Innovators – all share the key characteristics of success: Every month through the winter, the Observer conspires to give folks the opportunity to do something rare and valuable: to hear directly from managers, to put questions to them in-person and to listen to the quality of the unfiltered answers. A lot of funds sponsor quarterly conference calls, generally web-based. Of necessity, those are cautious affairs, with carefully screened questions and an acute awareness that the compliance folks are sitting there. Most of the ones I’ve attended are also plagued by something called a “slide deck,” which generally turns out to be a numbing array of superfluous PowerPoint slides. We try to do something simpler and more useful: find really interesting folks, let them talk for just a little while and then ask them intelligent questions – yours and mine – that they don’t get to rehearse the answers to. Why? Because the better you understand how a manager thinks and acts, the more likely you are to make a good decision about one.

Every month through the winter, the Observer conspires to give folks the opportunity to do something rare and valuable: to hear directly from managers, to put questions to them in-person and to listen to the quality of the unfiltered answers. A lot of funds sponsor quarterly conference calls, generally web-based. Of necessity, those are cautious affairs, with carefully screened questions and an acute awareness that the compliance folks are sitting there. Most of the ones I’ve attended are also plagued by something called a “slide deck,” which generally turns out to be a numbing array of superfluous PowerPoint slides. We try to do something simpler and more useful: find really interesting folks, let them talk for just a little while and then ask them intelligent questions – yours and mine – that they don’t get to rehearse the answers to. Why? Because the better you understand how a manager thinks and acts, the more likely you are to make a good decision about one.

Vanguard, probably to

Vanguard, probably to

John Kennedy, Richard Nixon, business school deans, the authors of The Encyclopedia of Public Relations, Flood Planning: The Politics of Water Security, On Philosophy: Notes on A Crisis, Foundations of Interpersonal Practice in Social Work, Strategy: A Step by Step Approach to the Development and Presentation of World Class Business Strategy (apparently one unencumbered by careful fact-checking), Leading at the Edge (the author even asked “a Chinese student” about it, the student smiled and nodded so he knows it’s true). One sage went so far as to opine “the danger in crisis situations is that we’ll lose the opportunity in it.”

John Kennedy, Richard Nixon, business school deans, the authors of The Encyclopedia of Public Relations, Flood Planning: The Politics of Water Security, On Philosophy: Notes on A Crisis, Foundations of Interpersonal Practice in Social Work, Strategy: A Step by Step Approach to the Development and Presentation of World Class Business Strategy (apparently one unencumbered by careful fact-checking), Leading at the Edge (the author even asked “a Chinese student” about it, the student smiled and nodded so he knows it’s true). One sage went so far as to opine “the danger in crisis situations is that we’ll lose the opportunity in it.”

P.S. please don’t tell the chairman of Janus. He’s

P.S. please don’t tell the chairman of Janus. He’s

About 40 of us gathered in mid-January to talk with Bernie Horn. It was an interesting talk, one which covered some of the same ground that he went over in private with Mr. Studzinski and me but one which also highlighted a couple new points.

About 40 of us gathered in mid-January to talk with Bernie Horn. It was an interesting talk, one which covered some of the same ground that he went over in private with Mr. Studzinski and me but one which also highlighted a couple new points.