Dear friends,

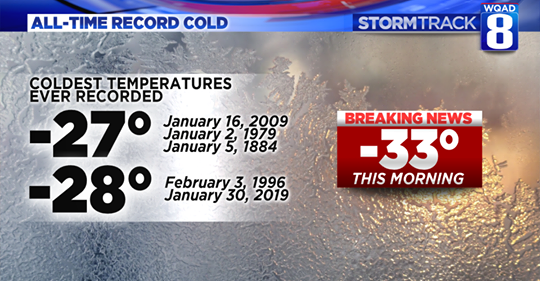

Please join me in bidding a fond adieu to January. It was a month in which our increasingly unstable global climate manifested itself in record-breaking cold and snow. Davenport, Iowa, my adopted hometown, saw the lowest temperature (-33, six degrees colder than the old record) and coldest wind chill readings (-54) in its recorded history. Despite having no precipitation in the first eleven days of January, it still managed 30.2” of snow by month’s end, the most since record-keeping began in 1884. Local drivers responded Continue reading →