By

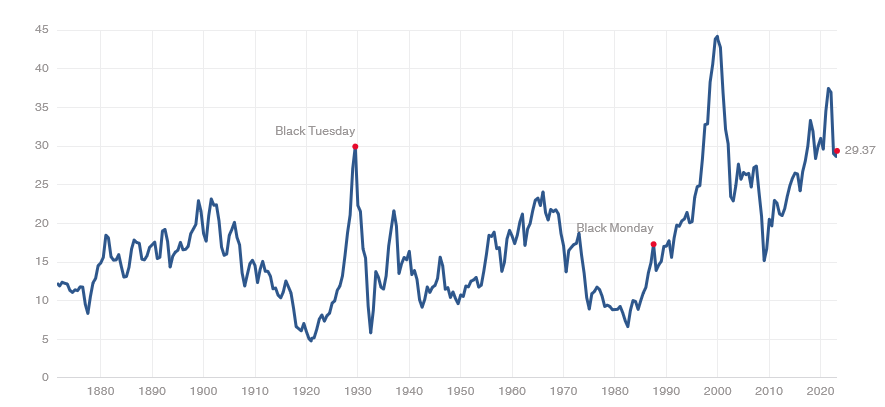

Charles Lynn Bolin This is my annual assessment of the funds that I own and whether it makes sense to hold them with my annual outlook, as described in this month’s companion article. My outlook is “Risk Off” because of economic uncertainty, plus bonds are now paying an attractive yield. The funds assessed in this article exclude bond funds, individual stock, and American Century Advantis All Equity Markets (AVGE). As interest rates rose and stocks and bonds fell, I gradually sold my most volatile funds and bought short-term ladders of certificates of deposit and Treasuries to lock in higher yields. With interest rates higher, I now ask myself, would I rather own my remaining funds in my intermediate buckets or make four or five percent in safer investments? That is the question.

I use the “Bucket Approach” and have Fidelity Wealth Management manage my longer-term portfolios, which collectively resemble Continue reading →