Ten new funds are in the queue, ready to launch somewhere between Thanksgiving and New Years. Several high-profile firms are launching new funds, including DoubleLine, Northern, Osterweis and TIAA-CREF. (We also snuck in a small handful of institutional launches from AMG and AQR.)

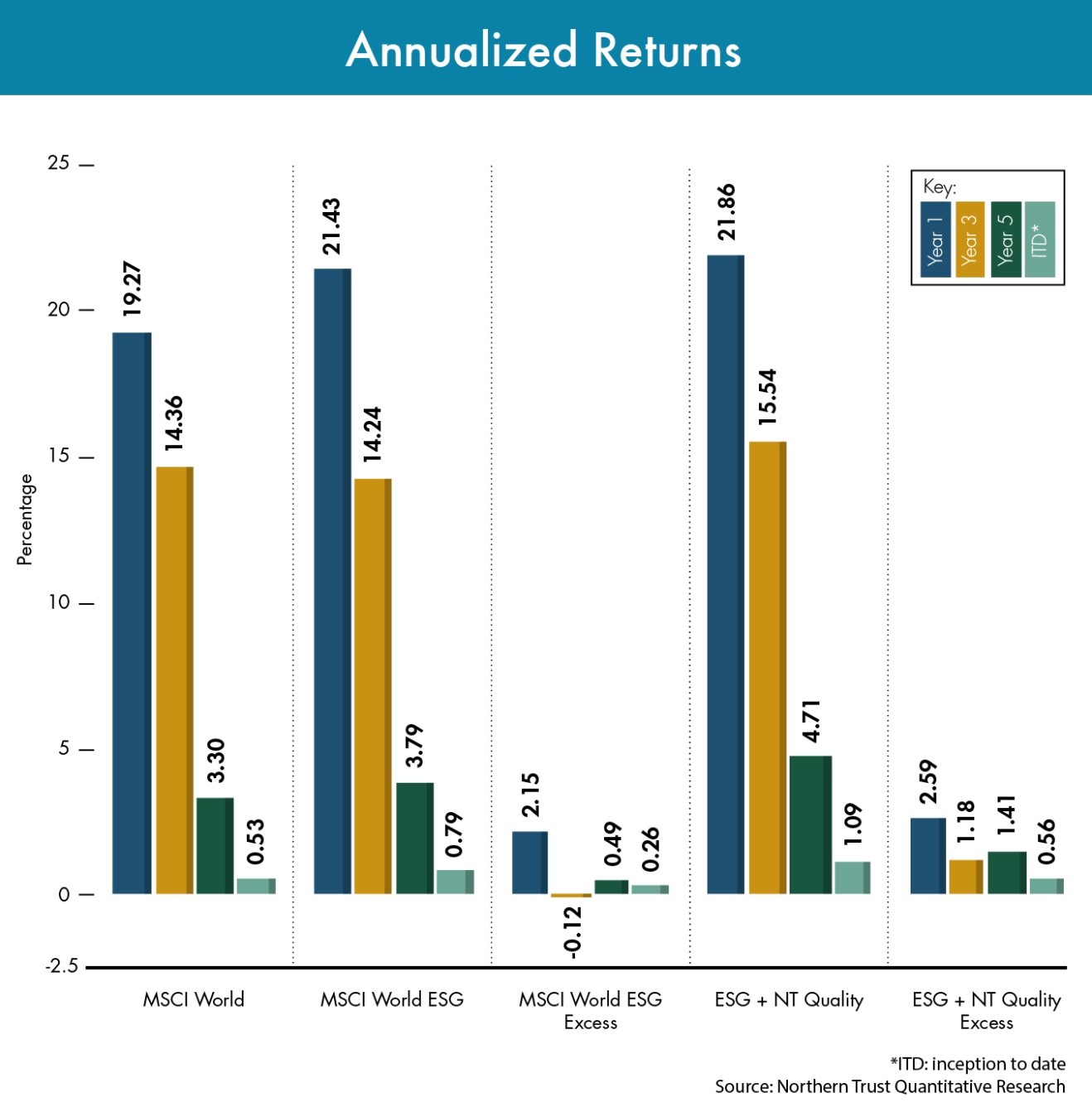

U.S. Quality ESG strikes me as particularly interesting. Northern Trust has made a major commitment to responsible investing. This fund will be the latest in a series of launches by Northern Trust, which has offered a global ESG index fund, Global Sustainability Index Fund (NSRIX) and added FlexShares STOXX US ESG Impact Index Fund (ESG) and FlexShares STOXX Global ESG Impact Index Fund (ESGG) on July 14, 2016. Northern’s passive products are consistently factor-tilted; that is, they tend to follow the research that favors value over growth, smaller over larger, and so on. In a momentum-driven market which rewards larger and pricier, that’s a painful decision. Their argument is that’s why you need quantitative discipline: it’s simply too painful for most humans to do the right thing when the market is rewarding “the wrong thing.” Their research, graphed below, shows that good corporate citizens tend to inch out average citizens most years (that’s shown in the third column, ESG Excess which can be negative some years) and good citizens that are also exceptionally well-managed corporations tends to lead the pack by a bit more (column five).

A low minimum and an e.r. lower than many ESG index funds and ETFs help, too.

In truth, the fate of the world hangs in the balance. Where doubt about the human role in climate change was once the province of thoughtful skeptics (I was, 20 years ago, among them), it’s increasingly the demesne of a coterie of fanatics who have surrendered any passing concern for the truth. Their conscious, reckless distortion of the evidence appalls me.

We can neither precisely predict, nor reverse, over the next century anyway, the damage we are doing to our planet’s life-support system. We can only seek now to minimize, anticipate and mitigate it. MFO’s commitment to using a “green” server won’t save the world nor will your decision to invest in an ESG index. But we each make dozens of decisions each day about what we value and what we will bequeath to our children’s children. This might represent one of them.

AMG TimesSquare Emerging Markets Small Cap Fund

AMG TimesSquare Emerging Markets Small Cap Fund will seek long-term capital appreciation. The plan is to invest in between 40-100 small cap stocks. The fund will be managed by Caglar Somek and Magnus Larsson. The initial expense ratio is 1.50%. The minimum initial investment will be between $1,000,000 and $5,000,000.

AQR Large Cap Relaxed Constraint Equity Fund

AQR Large Cap Relaxed Constraint Equity Fund will seek long-term capital appreciation. The plan is to beat the Russell 1000 by taking both long and short positions in equities; in AQR’s mind, short positions are “relaxed” because it relaxes the (mythical, non-existent) constraint to invest long-only. The fund, and its siblings, will attempt to revive the moribund 130/30 approach which was once at the vogue but is now consigned to a couple ETFs. They anticipate a tracking error relative to the index of 3-4%. The fund will be managed by Michele L. Aghassi, Andrea Frazzini, Jacques A. Friedman, and Hoon Kim, three of whom have PhD’s from major universities. The initial expense ratio has not yet been announced. The minimum initial investment will be somewhat between $100,000 and $5,000,000, depending on which of their eligibility criteria you meet. AQR is simultaneously launching small cap, international and emerging markets versions of the fund with the same team and constraints.

DoubleLine Shiller Enhanced European CAPE

DoubleLine Shiller Enhanced European CAPE will seek total returns in excess of its benchmark, the MSCI Europe Net Return USD Index. The plan is to use derivatives to produce index-like returns then a bond portfolio to add a bit of alpha. The fund will be managed by The Jeffreys, Gundlach and Sherman. The initial expense ratio has not been disclosed. The minimum initial investment will be $2,000, reduced to $500 for IRAs.

Harding Loevner Global Equity Research Portfolio

Harding Loevner Global Equity Research Portfolio will seek long-term capital appreciation. “Research” in a fund’s name often means that it’s being used as a way of rewarding and highlighting the work of its research analysts. In this case, “The investment adviser expects that a majority of the stocks that its analysts have rated for purchase that meet the Portfolio’s investment characteristics and guidelines will be held in the Portfolio.” At base, an all-cap global equity portfolio that will use broad diversification for risk management.The fund will be managed by Andrew West and Moon Surana. The initial expense ratio has not been released. The minimum initial investment is $5,000.

Harding Loevner Emerging Markets Research Portfolio

Harding Loevner Emerging Markets Research Portfolio will seek long-term capital appreciation through investments in equity securities of companies based in emerging (and frontier) markets. “Research” in a fund’s name often means that it’s being used as a way of rewarding and highlighting the work of its research analysts. In this case, “The investment adviser expects that a majority of the stocks that its analysts have rated for purchase that meet the Portfolio’s investment characteristics and guidelines will be held in the Portfolio.” At base, an all-cap global equity portfolio that will use broad diversification for risk management. The fund will be managed by Andrew West and Moon Surana. The initial expense ratio has not been released. The minimum initial investment is $5,000.

Osterweis Emerging Opportunity Fund

Osterweis Emerging Opportunity Fund will seek long-term capital appreciation. The plan is to buy “high quality companies within emerging industries and market niches with significant revenue and earnings growth potential before they are widely discovered.” The managers hope, in particular, to exploit the misplaced skepticism of other investors. The fund is a converted hedge fund and will be managed by James L. Callinan, who has been running the hedge fund since 2012. The record, since inception, has been unremarkable. The initial expense ratio is 1.50%. The minimum initial investment will be $5,000, reduced to $1,500 for various tax-advantaged accounts.

RVX Emerging Market Equities Opportunities Fund

RVX Emerging Market Equities Opportunities Fund will seek long-term capital appreciation. The plan is to buy the stocks of emerging markets companies, which includes preferred shares, REITs, convertibles and various derivatives. Up to 20% might be invested in frontier markets. The fund will be managed by Cindy New and Robin Kollannur. The initial expense ratio has not yet been disclosed. The minimum initial investment will be $2,500 for the no-load shares.

TIAA-CREF International Small-Cap Equity Fund

TIAA-CREF International Small-Cap Equity Fund will seek “favorable long-term total returns.” The plan is to deploy “proprietary quantitative models” in pursuit of just the right balance of risk and reward. The fund will be managed by Antonio Ramos and Steve Rossiello. The initial expense ratio is 1.21% for the retail shares, lower for retirement ones. The minimum initial investment will be $2,500, reduced to $2000 for various tax-advantaged accounts.

U.S. Quality ESG Fund

U.S. Quality ESG Fund will seek provide long-term capital appreciation. The plan is to invest in U.S. based firms which are “highly rated environmental, social and governance (ESG) companies that exhibit strong business fundamentals, solid management and reliable cash flows.” The fund will be managed by Jeff Sampson and Peter Zymali, both of Northern Trust. The initial expense ratio is 0.44%. The minimum initial investment will be $2,500, $500 for an IRA or $250 under the Automatic Investment Plan.