At the recent Chicago conference, Morningstar’s Gregg Warren stated that asset management remains an attractive business because of steady fees, high operating margins, low start-up costs, and because “investment inertia is its best friend.”

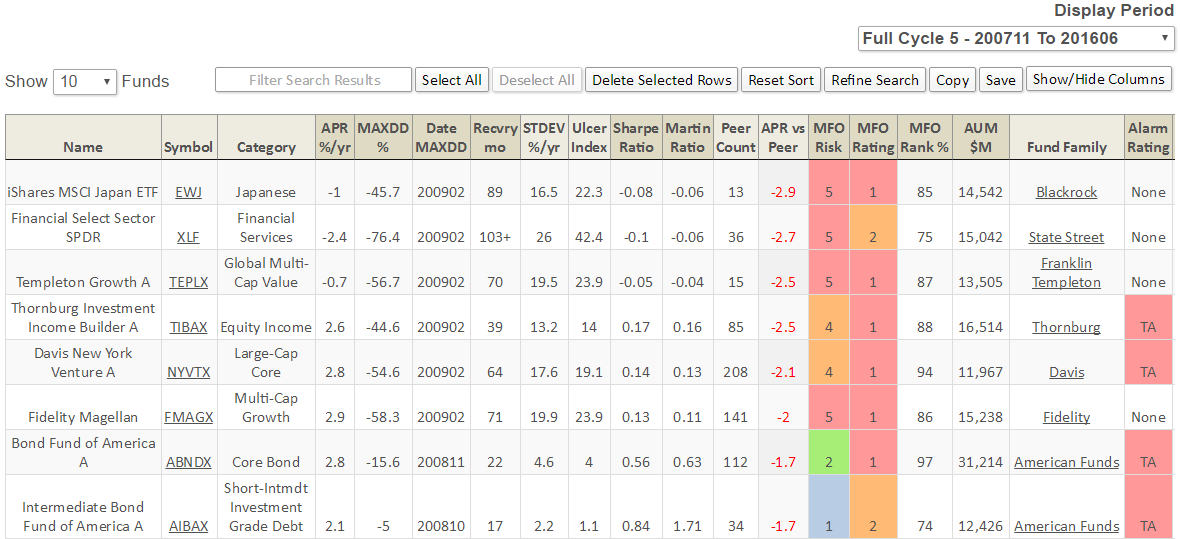

Through June there were 281 funds with assets over $10B, including 8 that have trailed their peers in absolute return by at least 1.7% per year during the current market cycle since November 2007, or about 14% or more in underperformance. (See table below, click on image to enlarge.) Most are bottom quintile performers, trail nearly 90% of their peers, and four are Three Alarm funds. They include Templeton Growth (TEPLX), Thornburg Investment Income Builder (TIBAX), Davis New York Venture (NYVTX), Fidelity Magellan (FMAGX), and American Funds’ Bond Fund of America (ABNDX) and Intermediate Bond Fund of America (AIBAX). The folks invested in these funds certainly can’t be accused of chasing returns.

Speaking of inertia, for the June commentary I wrote of a “Certified Financial Planner” who placed a family friend in 34 American Funds across five tax deferred accounts. My friend has since decided to transfer his accounts to Vanguard. The actual transfer remains excruciatingly long, say to say. Although Vanguard makes it easy enough to start the process on-line, actual transfers between fund houses can take weeks and involve printed forms, snail mail, and even paper checks. (Much longer than my experience when transferring from say Schwab to Fidelity, which was just a day or two.)

In my friend’s case, the transfers can only be done “in-kind,” so unless the 34 funds are liquidated at American Funds (transferred actually to an AF money market fund), Vanguard will charge $35 per fund or $1,200 to sell the 34 funds prior to reinvesting in Vanguard funds. Good grief! On the other hand, liquidating before transfer means being out of the market for some uncertain period of time, which comes with its own attendant risk. In any case, the word “entrenched” comes to mind.

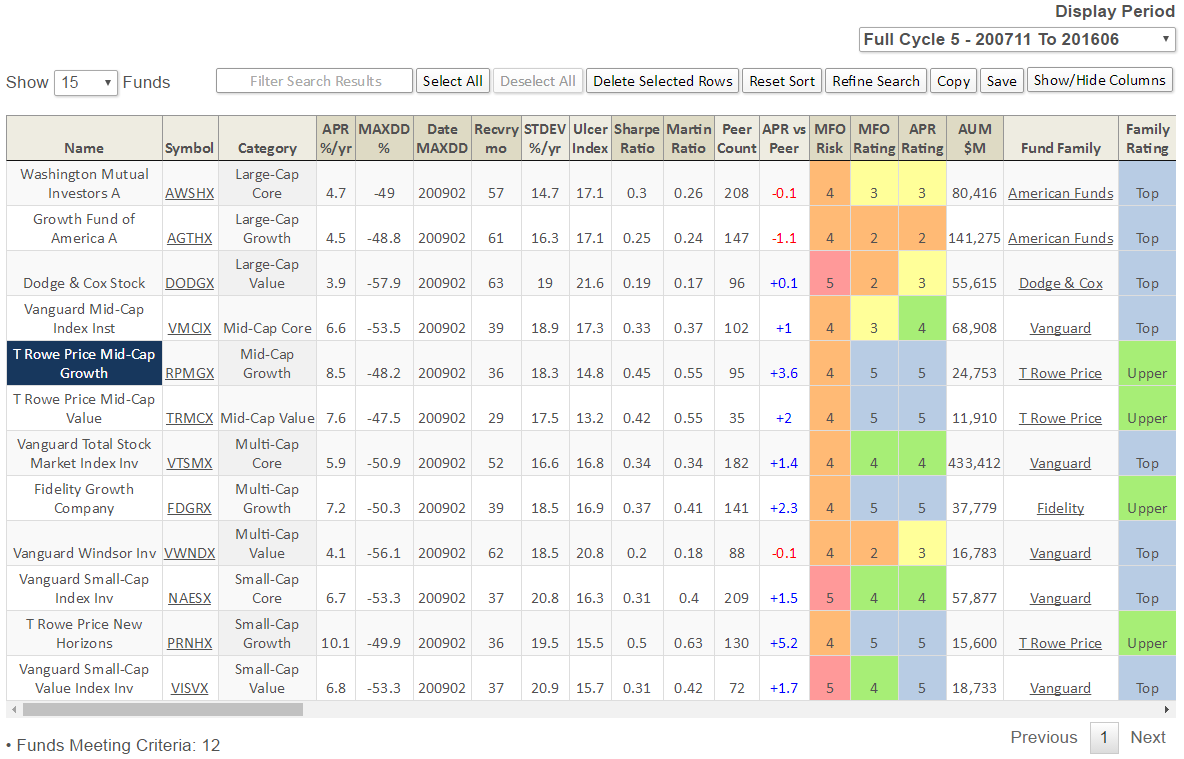

Speaking of AUM, what is the top fund by AUM in each category? We’ve recently added this screen and others to the MultiSearch tool on the Premium site. Below are results month ending June, for large-, mid-, multi-, and small-cap US equity funds (click image to enlarge). Performance metrics are for current market cycle.

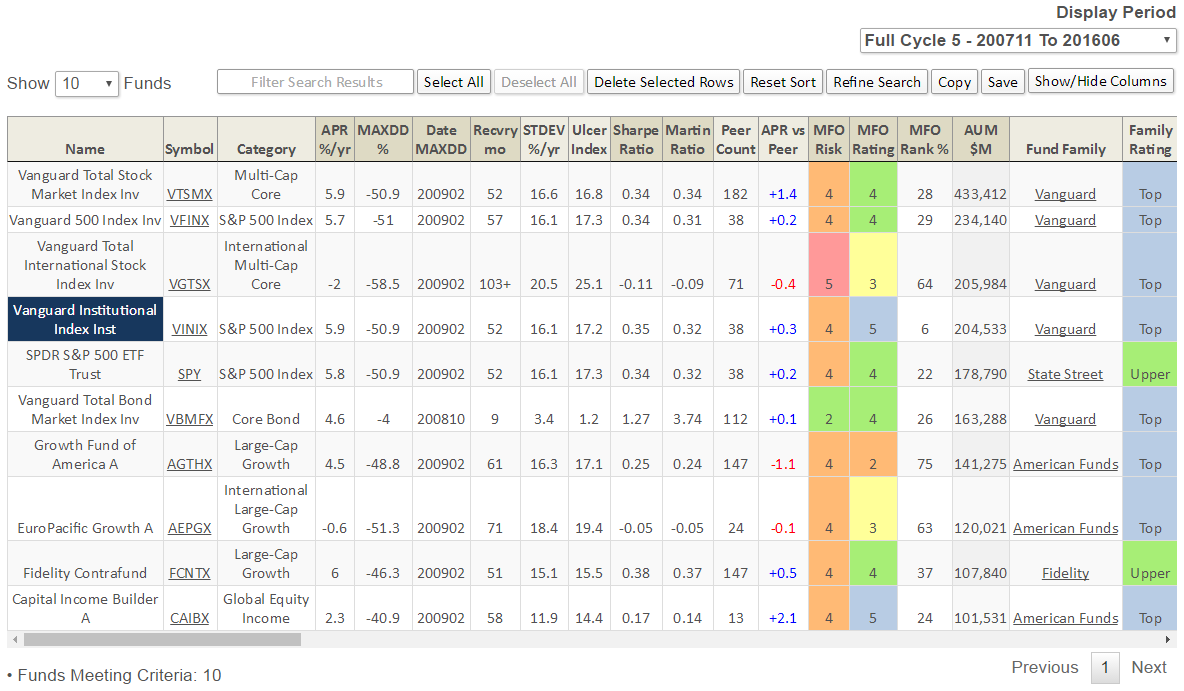

Below are top 10 funds by AUM of all 9,371 rated funds through June (click image to enlarge). Vanguard holds 5 stops, American Funds holds 3.

Meb Faber has now posted 9 podcasts. I’ve enjoyed the first three so far, especially the one with Patrick O’Shaughnessy. Wes Gray is next up. One can learn a lot in short period listening in on these conversations.

In one episode, Meb speaks of the 521 Rule. He explains, “Stocks around the world average 5% a year, bonds around 2% a year. I’m averaging up and T-Bills about 1%.” He’s talking real returns after inflation and notes US equities have done a little better.

The numbers remind me of excess returns, which is the difference between total return and risk-free rate (90-day TBill). In the piece Timing Method Performance Over Ten Decades, we find US equities, US bonds, and US TBill dating back to 1926 have returned 10, 6, and 4% annually, round numbers, respectively. So, annualized percent excess return (APER) equates to 6% for stocks and 2% for bonds.

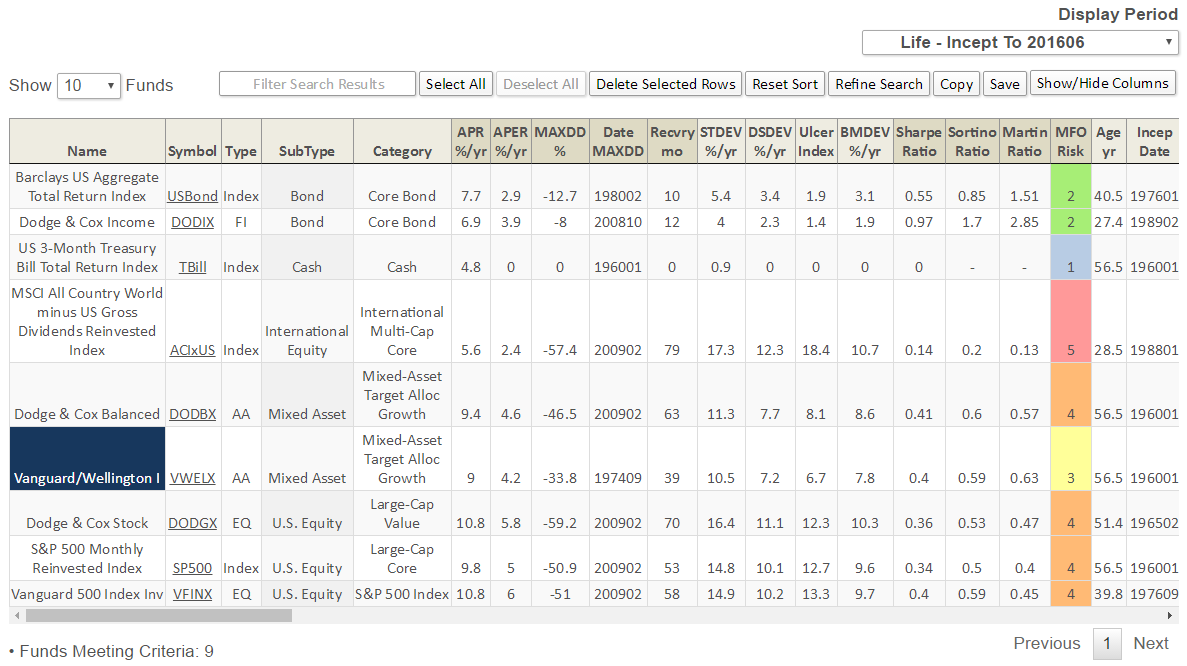

Zero interest rate monetary policy has resulted in APER and annualized percent return (APR) being nearly identical the past several years. Nonetheless, we’ve added APER to the MultiSearch screening metrics … rates have to start going up, right? (Eric Cinnamond suggests not. In his new blog Absolute Return Investing, he wonders if nomalization is impossible given current level of global debt.)

Below please find a sample output (click image to enlarge) showing several reference indices and stalwart funds, each since inception, which varies from about 30 years to almost 60 years (the extent of our Lipper database). For the past 30-40 years, bonds have delivered excess returns better than the much longer-term norms, while international stocks have remained an enduring disappointment.

Finally, to help address Where In The World Is Your Fund Adviser?, we’ve added screens for fund company Management Location (city and state). It turns out there are fund companies in more than 300 cities across 46 states … who would have guessed? They include:

- First Security Fund Advisers Inc of Little Rock, Arkansas,

- Viking Fund Management LLC of Minot, North Dakota,

- Thornburg Investment Management Inc of Santa Fe, New Mexico,

- Reynolds Capital Management of Las Vegas, Neveda, and

- WesBanco Bank Inc of Wheeling, West Virgina.

States not represented? Alaska, Idaho, Mississippi, and Wyoming.