Roy Weitz, founder of FundAlarm and sort of godfather to MFO, annually shared his portfolio, and his reflections on it, with his readers. He owned up to his mistakes, talked through his logic and revealed his plans. When I began contributing to FundAlarm, he encouraged me to do likewise. This essay, then, is an annual “think aloud” exercise that might help you imagine how to make more informed, satisfying decisions for yourself. In constructing it, I drew on my reading and conversations with managers as well as the tools available at Morningstar and MFO Premium.

I’ve thought long and hard to create a portfolio that allows me to be dumb and lazy. My overarching goal is to have a portfolio that lets me get on with life, not one that consumes my life. I try to make good decisions, then not second-guess myself. The results of those impulses are below. I’ll work through my non-retirement and retirement portfolios, let you know what I’m planning and suggest a few things that you might consider doing in the months ahead.

Non-retirement portfolio

My asset allocation is driven by two insights: (1) I don’t like losing money and (2) the best way to make money in the long term is not losing in the short-term. As a result, I built my portfolio backward from the desire for enough decent returns without attention-grabbing volatility. Mostly, I’ve succeeded. From January 26 – February 8, 2018, the US stock market dropped about 10% and financial journalists dropped a couple extra shots of espresso into their morning coffee before taking up the “the end is nigh” screed. I have no idea of how my portfolio did during those couple weeks and, until I began writing this essay, I didn’t exactly know how it had performed in 2017. Nothing weird was happening with my funds, no one resigned, no one made headlines, no one liquidated … which was all I needed to know.

The process I rely on is simple.

-

Start with an appropriate asset allocation. I’ve written, repeatedly, about the fact that a stock-light portfolio is a far better choice in a non-retirement portfolio (i.e., one where you might reasonably need to make withdrawals this year or sometime in the next three or five years) than a stock-rich portfolio. For the sake of simplicity, I generally target 50% growth and 50% income. Within the growth sleeve, I generally target 50% foreign and 50% domestic. Within the income sleeve, I generally target 50% cash substitutes and 50% other.

Based on a review of 65 years of returns (1949-2013), this allocation would typically return a bit over 8% annually, would lose money about one year in six but its average loss would be in the 4-5% range.

-

Find the funds that best suit my plan and me. In general, the research shows that value works, small works, cheap works, and diversified works. For me, in particular, I’m happiest when I become convinced that my managers are sensible people, with sensible approaches to risk, who are doing sensible things and have been through ugly markets before. That leads me toward value and absolute value managers who write well, have a willingness to close their funds early and have a long record. In general, I prefer funds where the manager is not locked into a single narrow asset class; multi-asset flexibility and a willingness to hold a lot of cash means they can be positioned to cope with the inevitable crash.

-

Automatically invest. I don’t trust myself to write checks to investment companies, there’s always something more tempting to do with the money. So everything I do, I do with a monthly automatic investing plan.

-

Enjoy life, seek challenges, make a difference, ignore my portfolio. The fact that two of my funds returned more than 30% last year is great, but it didn’t make the “top 10 in 2017” list in our Christmas letter: Chip’s decision to move to Iowa (and the moving adventures appertaining thereunto), my sister’s first visit in 20 years, Will’s show choir triumphs, our new rain garden and garden sculptures did. If, in 2018, two of my funds decline by 30%, it’s still not defining my year.

Here’s a quick snapshot of my team, listed from my largest position to my smallest.

| Name | 2017 return | Worst-ever rolling 3-year ave. | Morningstar risk | MFO status | Morningstar’s take | |

| FPA Crescent | Go anywhere, absolute value | 10.39 | -4.1 | Average | Gold 4 star | |

| Seafarer Overseas Growth and Income | Asia-tilted emerging markets | 26.20 | -2.0 | Below average | Silver 4 star | |

| T Rowe Price Spectrum Income | Broadly diversified fund of income funds | 7.02 | -0.5 | Average | Bronze 4 star | |

| Intrepid Endurance | Small cap, absolute value | 2.15 | -0.3 | Low | Q-Neutral 3 star | |

| Artisan International Value | Large cap internat’l | 23.82 | -11.4 | Low | Great Owl | Gold 5 star |

| RiverPark Strategic Income | Sort of like RPHYX, but twitchier | 4.58 | -0.1 | Low | Q-Neutral 2 star | |

| RiverPark Short Term High Yield | Low vol cash alternative | 2.15 | +2.0 | Low | Great Owl | Q-Neutral 1 star |

| Matthews Asian Growth & Income | Dividend stocks & convertibles ex-Japan | 21.85 | -7.2 | Low | Silver 3 star | |

| Matthews Asia Strategic Income | Go anywhere in Asian income markets | 9.40 | -0.1 | Average | Great Owl | Q-Silver 5 star |

| Grandeur Peak Global Micro | $300M ave. market cap | 31.48 | n/a | Not rated | Q-Neutral | |

| Grandeur Peak Global Reach | GP’s master fund | 30.50 | 5.0 | Average | Q-Neutral 4 star | |

| 15.41 |

2017 return is just that.

Worst-ever rolling measures the greatest loss you would have ever suffered if you held a fund for three years. We’re showing the “since inception” record, which means some funds have vastly more datapoints than others. FPACX, MASCX and RPSIX all have over 250 rolling three-year periods, RSIVX and GPROX have under 25.

Morningstar risk is their proprietary, peer-based calculation.

MFO status notes whether a fund qualifies as a Great Owl, the designation reserved for funds in the top 20% of risk-adjusted returns for every trailing period we measure.

Morningstar’s take includes two reports, current as of 3/31/2018. The first is the analyst rating, their forward-looking estimation of a fund’s prospects made either by their analysts (“Silver”) or by their new artificial intelligence engine (“Q-Silver”). The other is their backward-looking (but famous) star rating.

Snapshots of the individual funds

FPA Crescent (FPACX): manager Steve Romick has jokingly described himself as the free-range chicken of the investing world. Romick combines the absolute value discipline that infuses the FPA operation with the willingness to invest in any part of an attractive firm’s capital structure: common or hybrid equity, debt, loans or whatever.

Seafarer Growth & Income (SIGIX, closed): manager Andrew Foster just strikes me as one of the best folks I’ve met. There are lots of smart people I’ve met in the industry, but few truly thoughtful ones. In founding Seafarer, Mr. Foster announced the goal of creating a new kind of fund advisor, one smarter and more shareholder centered. He’s achieved it, through really good writing, steadily falling expenses, and an institutional share class (he’d prefer the term “universal share class”) open to small investors like me. His discipline focuses on avoiding the errors made by index creators and focusing on well-run businesses that don’t have to rely on dysfunctional local capital markets to sustain themselves. For well more than a decade, he’s practiced the art of losing at exactly the right time: his funds tend to have weak relative returns in frothy markets but excellent absolute returns. 2017 is an illustration: he trailed 86% of his peers, but made 26% for his shareholders. In a down year like 2015, he finished in the top 3% of all emerging markets funds. That’s pretty common for him.

T. Rowe Price Spectrum Income (RPSIX): this is a fund of T Rowe Price funds, including one equity fund. It returns about 6-7% annually and its losing years are rare (three in 27 years) and manageable (it dropped 9% during the 2008 meltdown). The fund has been around for 298 rolling three-year periods; its worst ever three year performance was an annualized loss of 0.5% while its average gain is 7%. Income-oriented strategies are, by nature, not tax-efficient. That simply doesn’t bother me here. I’m more than happy to pay my taxes in trade for strong, reliable returns in a portfolio I can easily access.

Intrepid Endurance (ICMAX): this fund pursues the industry’s rarest, hardest discipline. It’s a stock fund that refuses to buy irrationally-priced stocks. When its entire investable universe (small cap value, mostly) becomes irrationally-priced, it simply accumulates cash in anticipation of an eventual fire sale. That makes a world of sense to me: step one, don’t be stupid. Unfortunately, investors become hypnotized by the magic of stock markets that are going to go up forever, this time, and flee from their best hope of profiting from an eventual crash. (Mostly investors fantasize that, as soon as the market begins crashing, they’re going to invest every spare penny in it and make a killing; in reality, they do the opposite.) ICMAX sits at about 60% cash and trails nearly all of its peers over the past five years, with an annual return of 2%. Since I know that markets don’t go up forever and I believe this is one of the most grievously overvalued in history, I’m perfectly comfortable letting an experienced, talented manager hedge my portfolio by holding cash and waiting.

Artisan International Value (ARTKX, closed): I bought this fund as soon as it launched in late 2002. The managers are interested in building a compact, 50 stock portfolio of high quality, undervalued firms, frequently with much lower than average market caps. The fund’s performance has clubbed its peers and pretty much every plausible benchmark over the past 15 years. As undervalued stocks become rare, the managers have moved into larger firms and are holding a lot (15%) of cash. The fund closed to new investors to minimize the risk of bloat and my only concern is that Messrs. Samra and O’Keefe might choose to cash in their chips and retire to a nice chateau, as some other early Artisan managers have already chosen to do. As long as they stay, so do I.

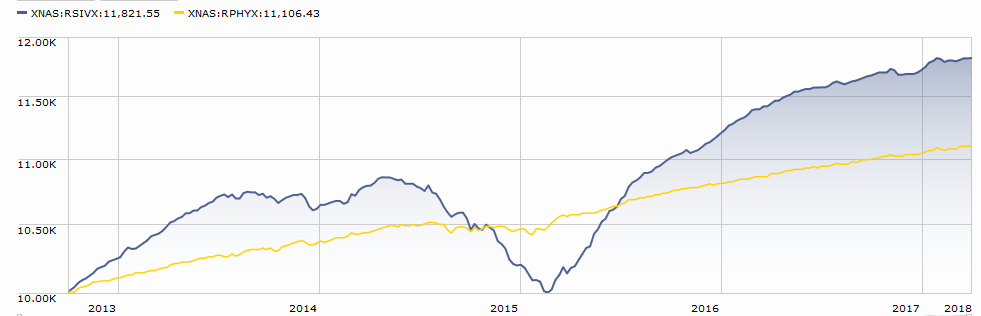

RiverPark Strategic Income (RSIVX) and RiverPark Short Term High Yield (RPHYX): both RiverPark funds are run by David Sherman of Cohanzick Asset Management. The older fund, RPHYX, has been freakishly successful as a cash alternative fund for me: it has averaged 3.2% annually since inception with a negative downside capture rate. Right, markets fall and it makes money. The fund has been around for 78 rolling 12-month periods; so far, its worst-ever loss in a 12 month period was a gain of 0.6%. In consequence, it has the highest five-year Sharpe ratio of any fund in existence. Strategic Income was positioned as one step further out on the risk-return ladder. Over the past three years it has returned about 50% more than its sibling, but with substantially greater volatility. At base, a couple individual issues blew up in 2014; with a concentrated portfolio, that was enough to put a noticeable dent in the fund.

I’m strongly committed to RPHYX, but likely to remain vigilant about Mr. Sherman’s ability to avoid repeating errors of the magnitude we saw in RSIVX’s portfolio in 2014.

Matthews Asian Growth and Income (MACSX): I began investing in this fund, which was for a long time the lowest-risk fund in one of the world’s highest-risk niches, back when Andrew Foster managed it. When he launched Seafarer, I moved half of my stake from MACSX to open my new account. Frankly, I think the fund has gone from “great” to “quite good” and I’m not sure how much longer that will warrant a place in my portfolio. Over the past 10 years, for example, it had the lowest Ulcer Index of any fund that invests in the Pacific. The Ulcer Index combines the size and duration of a fund’s worst drawdowns to estimate how much of an ulcer it will cause. Over the past decade, it’s #1. Over the past five years, it’s dropped to #8. Over the past three years, to #12. That’s still quite good but …

Matthews Asia Strategic Income (MAINX): the argument is that the center of the financial world is ineluctably shifting from places like New York and London to places like Shanghai, and that wise income investors need to accommodate their portfolios to that shift. The fund can go anywhere within the Asian income market, including corporate (currently 50%) and government bonds, convertibles and dividend-paying stocks. The fund, led by Teresa Kong, has been growing slowly and is miscategorized by Morningstar as a “world bond” fund. The decision is entirely understandable, but it also means that star ratings and comparisons to “peer” performance as quite unreliable.

Grandeur Peak Global Reach (GPROX, closed) and Global Micro Cap (GPMCX, closed): the folks at Grandeur Peak are better at small- and micro-cap global investing than anyone else. Full stop. The founders left Wasatch after a strong run there and formed a new firm obsessive about getting investing right. They knew from the outset that they’d eventually launch seven core funds, they knew what their firm-wide capacity was and they resolved to close each fund promptly and tightly. And they have: all seven Grandeur Peak funds are now closed to new investors, including the $42 million micro cap fund that was closed on the day it opened, though their two “alumni” funds, Global Stalwarts and International Stalwarts, were opened to give loyal advisors access to the Grandeur Peak discipline in slightly larger firms. Over the years, there’s need a steady stream of folks looking to align with the firm.

The funds as a team

My final question is whether each of my funds brings something distinct to my portfolio. It wouldn’t make sense to have two funds each trying to do the same thing; I’d want to simply get rid of the weaker of the two and keep the stronger. We assess that by generating a correlation matrix, using the tools at MFO Premium. In general, I’d worry about correlations in the 90s, notice correlations in the 80s and be pleased with correlations in the 70s and below.

| RPHYX | RSIVX | RPSIX | ICMAX | GPROX | FPACX | SIGIX | ARTKX | MAINX | MACSX | ||

| RiverPark Short Term Hi Yld | RPHYX | 1.00 | 0.66 | 0.63 | 0.60 | 0.56 | 0.55 | 0.55 | 0.54 | 0.54 | 0.54 |

| RiverPark Strategic Inc | RSIVX | 1.00 | 0.63 | 0.64 | 0.57 | 0.53 | 0.55 | 0.55 | 0.52 | 0.51 | |

| T R Price Spectrum Inc | RPSIX | 1.00 | 0.72 | 0.73 | 0.61 | 0.83 | 0.72 | 0.88 | 0.81 | ||

| Intrepid Endurance | ICMAX | 1.00 | 0.70 | 0.59 | 0.61 | 0.57 | 0.58 | 0.57 | |||

| Grandeur Peak Global Reach | GPROX | 1.00 | 0.83 | 0.76 | 0.86 | 0.68 | 0.78 | ||||

| FPA Crescent | FPACX | 1.00 | 0.56 | 0.84 | 0.60 | 0.59 | |||||

| Seafarer Overseas Gr & Inc | SIGIX | 1.00 | 0.68 | 0.85 | 0.92 | ||||||

| Artisan Int’l Value | ARTKX | 1.00 | 0.67 | 0.70 | |||||||

| Matthews Asia Strategic Inc | MAINX | 1.00 | 0.83 | ||||||||

| Matthews Asian Gr & Inc | MACSX | 1.00 |

Grandeur Peak Global Micro Cap is too young to appear in any of the following analyses.

So now what do I do?

It’s rare that I hold a fund for less than 7-10 years, mostly because I know that change is rarely warranted if you’ve done the homework and the manager has kept the faith. Three things weigh on my mind as I think about my portfolio following this review.

-

-

-

I’m out of balance. The stock/bond balance is just fine at 51% – 49%. Within stocks, though, the domestic/international balance is badly off-course. It should be 50% domestic, 50% international. It’s closer to 28% domestic, 72% international. That’s the biggest imbalance ever in my portfolio. It reflects two sets of decisions: my decision not to have a “pure” domestic equity fund and my managers’ decision, wherever possible, to underweight domestic equity because valuations are so badly stretched. Two options: let it ride for another year or add a fund with strong exposure to domestic equity.

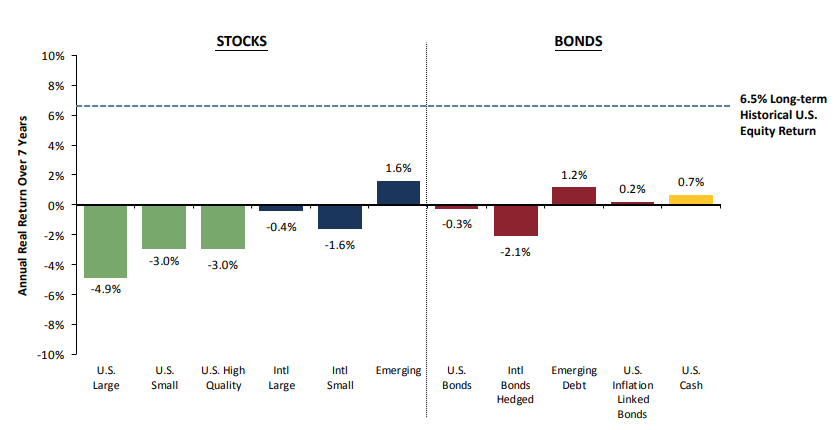

Here is GMO’s February 2018 forecast for equity class returns over the next seven years. It’s created by simply modeling what would happen if valuations and profits regressed to roughly their historic means.

From a valuation perspective, (a) things look bleak but (b) my preference for emerging markets exposure and cash-like investments – a sort of barbell – is looking more justified than forcing exposure to US equities.

- I need to reconsider MACSX. The correlation with Seafarer, which has Mr. Foster and more global flexibility, is high enough to warrant eliminating it. I could add a fund with greater domestic equity, I suppose, or shift the money to Matthews Strategic Income. Ms. Kong’s fund has, since inception, had a fair correlation (low 80s) with MACSX, offered higher returns (4% versus 3% over 5 years) and far lower volatility (5.2% SD versus 10.3%).

- I need to step up my monthly investment. My broker has been Scottrade, recently absorbed by TD Ameritrade. There was an administrative screw-up (uhhh … miscommunication, I’m told) that discontinued my monthly transfer from my bank account a year or so ago. While I’m adding steadily to my non-retirement portfolio through auto-investing in Seafarer, T Rowe Price and Grandeur Peak, the amount should probably rise at least a bit from my current level of several hundred a month.

-

-

My retirement portfolio

My retirement portfolio consists of a 403(b) plan administered by my employer, Augustana College, and a small Roth IRA. The 403(b) part is split between TIAA-CREF (the college’s contribution went there), T. Rowe Price and Fidelity. As part of a retirement plan reform that I helped manage, we’ve effectively shut down my ability to add to the Fidelity or T Rowe portfolios. Our new state-of-the-art system offers fewer choices (CREF funds and accounts, lifecycle funds as a default, and exactly one actively managed outside fund in each asset class) but has vastly higher employee participation. I really wanted to keep my old setup, but knew that it wasn’t in the best interest of the vast majority of college employees.

Each of the three providers has a stand-alone portfolio that’s about 70% equities. The relentless rise of the US stock market and the inconvenience of managing the old accounts through the new system, has allowed my domestic equity exposure to get far too high at about 50% more than international equity.

That said, the returns were just fine last year – 23% or so – driven by all things growth. Expenses across the portfolio come to 0.55%.

So now what do I do?

Three changes are coming in the near future.

-

-

- I am liquidating my Fidelity portfolio and transferring the proceeds to T. Rowe Price. I’m worried that Fidelity is becoming a bit frayed, with reports of sexual harassment, changes in the roles of managers, fund mergers and no clear evidence of a healthy, innovative culture. For the sake of sanity and simplicity, I’d rather one “locked” portfolio than two and I am substantially more confident in Price than in Fido.

- I will simplify things at Price. My plan is to maintain my overweights (small / value / emerging) but I’ll do it with fewer funds. I’m apt to move the bulk of my assets into T Rowe Price Retirement 2025 (TRRHX) then use smaller positions in a few funds to tilt it. Price also has a Target 2025 Fund (TRRVX) with the same manager but a more cautious asset allocation. I’ll ponder it, but lean toward the other.

- I will review my asset allocation. I’m not sure that I want to ratchet back.

-

So what should you do?

As little as possible, but as much as necessary.

-

- Consider contributing, then using the ever-evolving tools at MFO Premium. The contribution part is $100 a year, tax-deductible (mostly). The tools are easy to use and Charles, our colleague and maestro of the Premium site, is an infinitely kind and engaging teacher for those who have questions.

- Consider whether you’re comfortable with the risks you’ve built into your portfolio. You might glance at our 2014 and 2017 articles (here, here, and here) on the implications of asset allocation for risk and return, to see whether you’re aware of the broad risks you face. You might try the lifeboat drill we offered: multiply your funds’ maximum drawdown during the 2007-09 financial crisis by their percentage weight in your portfolio. The result will give you a decent guesstimate of how much your portfolio might fall in a similar meltdown. In my case, the non-retirement loss would likely be in the low 20s. If you look and think, “good gravy, I wouldn’t be able to sleep or eat if I lost that much,” you could act to change your risk profile now by shifting to a lower risk allocation or to more risk-sensitive managers.

- Reduce the clutter, in your life and portfolio both. We don’t have an infinite ability to pay attention to things, much less to enjoy them. If you discover six nearly-identical funds in your portfolio, simplify. If you’re glancing at Facebook and Twitter more than at the faces of your family, simplify. If you’ve structured your day so that you have time neither to learn nor wonder, simplify. (I’m struck by the fact that we’re so sure that even though Gates and Buffett and Musk have lifelong commitments to learning and thinking, such activities don’t warrant our own time.)