All the developments that are worth knowing but aren’t worth separate stories, including the liquidation of Marsico Flexible Capital and worthy alternatives to it, notes on the other 19 funds slated for termination and the surprising roster of “A” tier firms with “A” tier outflows.

Updates

The Morningstar funds have gone live!

Less us at Moerus. Amit Wadhwaney reached out this month to let us know that Ian Lapey had chosen to move on. Ian, a former colleague of Amit’s at Third Avenue and a former manager of Third Avenue Value, joined Moerus in November, 2016, and has worked as an analyst for them. Amit tells us that Ian has recently become intrigued by the prospects of a financial services portfolio, and left, with Amit’s blessing, to pursue his dream.

Morningstar’s assessment was sanguine. “It’s worth noting that Ian Lapey, an analyst on the team since May 2016, will soon leave the firm to pursue another opportunity. While Lapey’s departure is disappointing–and his expertise will certainly be missed–the founding team remains in place and focused on the firm’s single strategy.”

Not so fine. Third Avenue Value continues to struggle. Under the team of Fine and Fineman, installed in September 2017, the fund has trailed 97% of its peers. Investor withdrawals have become much smaller but Morningstar gives the fund a negative rating on all five of the “pillars” through which its analysts assess funds. Third Avenue Real Estate Value remains a bright spot for the firm, but the departure of Michael Winer, the guy who led the fund for 20 years, suggests that cautious watching is in order.

If you look good in a fedora, GQG Partners might have a spot for you. GQG Partners is now advertising for an investigative journalist. While I did not receive a callback from the firm about the advertised position, founder Rajiv Jain had an investigative journalist on staff before. His argument was fascinating: he needs the best understanding he can possible get about a firm in which he might invest (or is invested). Financial analysts are all trained to look at firms through the same lens and he wanted people who could look using a different lens and different approaches. A journalist certainly can’t supplant financial analysts, but can provide critical insights that might otherwise be missed until it was too late. On whole, a cool firm and an intriguing opportunity.

Briefly Noted . . .

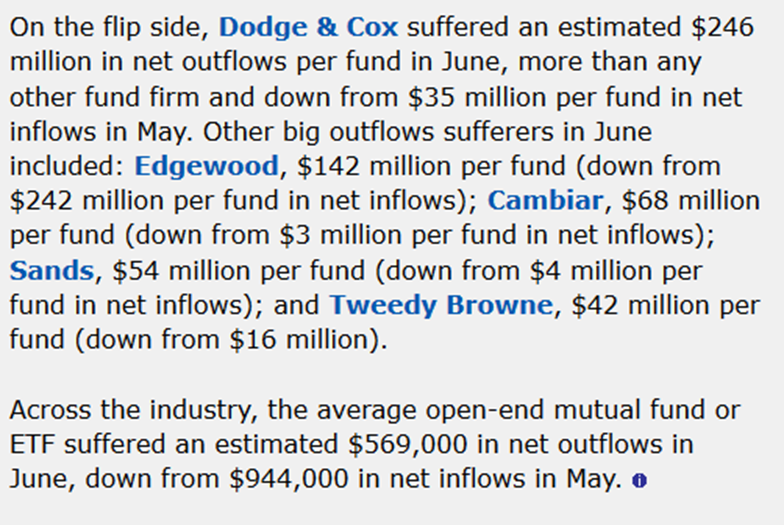

Dodge and Cox deflates a bit. In general, active funds have been seeing a bit of a turnaround in fund flows, which good active funds pulling assets from their passive competitors. A July 20 2018 article by MFWire’s Neil Anderson found some interesting exceptions to that pattern, with Dodge & Cox being the biggest loser:

Neil reports that, on the flip side, that Edward Jones’s proprietary Bridge Builder funds gained nearly $400 million each in June.

Do I take this opportunity to point out the essential silliness of MFWire’s “Reporters covering mutual funds” list, which highlights “which reporters matter most”? Well, sure. The list includes Bloomberg folks with one story and zero views, but no one at MFO. It also includes loveable curmudgeons like John Rekenthaler and the sui generis Chuck Jaffe, neither of whom is a reporter … but no one at MFO. It almost seems a bit disrespectful to the 25,000-35,000 folks who read the Observer each month.

SMALL WINS FOR INVESTORS

Every month, fund advisers and ETF sponsors cut fees in a silly and unproductive race to the bottom. Why silly and unproductive? Active funds will never be able to compete on price with passive ones, their expenses are simply too different. It’s a delusion for advisers to slice three or four basis points from the expense ratios, thinking that they’re somehow reversing the tide. Active managers need to demonstrate the value they’ve created through intelligent risk-management and enduring relationships with their investors. They need to help investors understand it’s not about “market beating returns,” it’s about meeting meaningful goals. And they need to make that argument now, before a break in the market leads to an outbreak of mass stupidity.

Many “active” managers, of course, provide neither intelligent risk management nor meaningful relationships. Like the dodo, they’re mostly praying that no one notices and, unlike the dodo, they mostly deserve the extinction they face.

Many “active” managers, of course, provide neither intelligent risk management nor meaningful relationships. Like the dodo, they’re mostly praying that no one notices and, unlike the dodo, they mostly deserve the extinction they face.

Fidelity has taken price competition to an unsustainable extreme, by introducing two loss leaders: funds which charge nothing and have no minimum investment. As with grocery store loss leaders, the hope is that the $.99 blueberries will lure you in and you’ll end up buying some King Crab legs at $36/pound to go with them.

At the other end of the spectrum, some advisers are playing around the edges with the fees on the high cost funds, which is better than not playing with them but which is not a game-changer.

“Effective August 1, 2018, Vivaldi Asset Management, LLC has agreed to lower its management fee from 1.60% to 1.20% of the Vivaldi Multi-Strategy Fund’s (OMOAX) average daily net assets.” Morningstar currently reports net expenses of 4.18% for the fund’s “A” shares, so that should drop by 40 bps. OMOAX is a four-star fund. Your fee supports 13 managers at three different sub-advisers. The new fee structure will move the retail shares from the most expensive fund in Lipper’s peer group to the second most expensive, but the institutional share class will remain the costliest option for institutional investors.

CLOSINGS (and related inconveniences)

Effective at the close of market on August 29, 2018, Franklin Convertible Securities Fund (FISCX) will be closed to new investors.

Effective September 4, 2018, the T. Rowe Price Emerging Markets Stock Fund (PRSMX) and T. Rowe Price Institutional Emerging Markets Equity Fund(IEMFX) will close to new investors.

OLD WINE, NEW BOTTLES

Hennessey gets energized! BP Capital TwinLine Energy Fund (BPEAX) and BP Capital TwinLine MLP Fund (BPMAX) are in the process of becoming Hennessey funds. The process requires shareholder approval, but that’s generally pro forma.

Shortly after announcing the reorganization, BP Capital shared very sad news with its shareholders, that portfolio manager “Anthony Riley, CFA, unexpectedly and tragically passed away on Saturday, July 21, 2018. The BP Capital TwinLine team is extremely saddened by the news, but is grateful for Anthony’s hard work and contributions, and he will be greatly missed.” We extend our sympathies to Mr. Riley’s family and the folks at BPC, and wish them great peace.

Shortly after announcing the reorganization, BP Capital shared very sad news with its shareholders, that portfolio manager “Anthony Riley, CFA, unexpectedly and tragically passed away on Saturday, July 21, 2018. The BP Capital TwinLine team is extremely saddened by the news, but is grateful for Anthony’s hard work and contributions, and he will be greatly missed.” We extend our sympathies to Mr. Riley’s family and the folks at BPC, and wish them great peace.

On August 7, 2018, Goldman Sachs TreasuryAccess 0-1 Year ETF (GBIL) will be rechristened Goldman Sachs Access Treasury 0-1 Year ETF. Subtle change: TreasuryAccess (one word) to Access Treasury (two).

On July 16, 2018, Innovator S&P High Quality Preferred ETF (EPRF) became Innovator S&P Investment Grade Preferred ETF.

Manning & Napier Strategic Income Moderate Series (MSMSX) is getting a new name and new portfolio profile. As of August 20, 2018, the fund is rechristened as Manning & Napier Income Series (MSMSX) and its stock exposure drops by 10%. Currently it holds 35-65% equity, going forward that will be 25-55% with the remainder in bonds.

The always-amazing Shadow notes that PhaseCapital Dynamic Multi-Asset Growth Fund (PHDZX) has been rechristened Astoria Multi-Asset Risk Strategy Fund (MARZX).

Vanguard Precious Metals and Mining Fund (VGPMX) is undergoing a complete transformation, which is pretty rare for Vanguard but having a specialty sector fund was pretty unusual, too. As of late September 2018, it’s being renamed Vanguard Global Capital Cycles Fund. What, you might reasonably ask, is a global capital cycles fund? Good question! Here’s the official non-explanation: “The Fund will invest globally across a range of sectors and market capitalizations and will continue to maintain meaningful exposure to the precious metals and mining industry.” So, Metals and Mining Lite? The expense ratio is set to soar by one basis point and Wellington Management will replace M&G Investment Management Limited as the fund’s advisor.

OFF TO THE DUSTBIN OF HISTORY

Really, it doesn’t get much more ironic than this. Brown Advisory – Macquarie Asia New Stars Fund (BIANX) will be liquidated on August 30, 2018. We’re taking nominations for best “new stars” lines. Over the past three years, the fund earned only one star and achieved the signal distinction of trailing (per Morningstar) 100% of its peers.

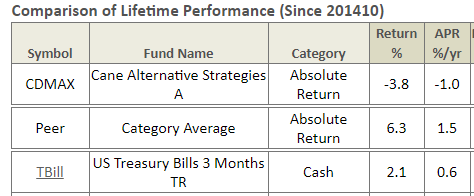

The $18 million Cane Alternative Strategies Fund (CDMAX) is slated to liquidate on August 15, 2018. It’s ironic, given the fund’s ticker, that it substantially underperformed CDs during the lifetime of its “A” class retail shares.

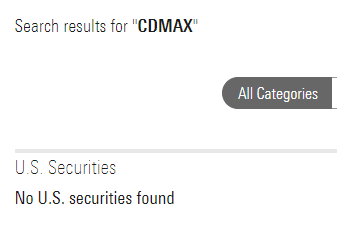

Morningstar’s increasingly moody website wouldn’t recognize the fund’s ticker:

While it did recognize the fund’s name, clicking on the result link looped you around to a “no such creature” page.

DGHM All-Cap Value Fund (DGHMX) will liquidate on August 30, 2018, following the advisor’s morose assessment of “factors such as the current level of assets under management, limited growth opportunities, and the Adviser’s indication that it does not desire to continue supporting the Fund.”

Direxion Indexed CVT Strategy Fund (DXCBX) will be liquidated on September 28, 2018. Continuous variable transmission is on its way out? Odd.

GMO International Large/Mid Cap Equity Fund Class III (GMIEX) will liquidate on Halloween. $10 million minimum, $40 million in assets, mediocre record.

Heartland International Value Fund (HINVX/HNNVX) has closed to all investments. The Board of Trustees is asking shareholders to approve liquidation of the fund. Not that the Board thinks of such approval as pro forma, but they’ve directed the managers to cease pursuing the fund’s investment objective and move the portfolio to cash.

A series of Ivy funds are slated to merge away in mid-autumn. Shareholders have recently received a proxy asking them to support the mergers and Ivy has announced plans to close each “target fund” on October 24 in anticipation of their disappearance. The dramatis personae (uhhh, dramatis fundae?) are

| Target Fund | Acquiring Fund |

| Ivy Global Income Allocation Fund | Ivy Asset Strategy Fund |

| Ivy Tax-Managed Equity Fund | Ivy Large Cap Growth Fund |

| Ivy LaSalle Global Risk-Managed Real Estate Fund | Ivy LaSalle Global Real Estate Fund |

| Ivy Micro Cap Growth Fund | Ivy Small Cap Growth Fund |

| Ivy European Opportunities Fund | Ivy International Core Equity Fund |

As a reminder, as of the close of business on July 27, 2018, the Keeley All Cap Value Fund (KACVX) was reorganized into the Keeley Small-Mid Cap Value Fund (KSMVX) and the Keeley All Cap Value Fund subsequently liquidated and dissolved.

Lazard US Realty Income Portfolio (LRIOX) is going to disappear into Lazard US Realty Equity Portfolio (LREOX) on or about August 17, 2018. LRIOX surrender a substantial advantage in yield (about 200 bps) for a substantial gain (about 500 bps) in total returns.

LoCorr Multi-Strategy Fund (LMUAX), run by eight guys including four named “Billings,” has closed and will liquidate on August 24, 2018. Several of the non-Billings managers participate in running the four-star LoCorr Macro Strategies Fund (LFMAX) which continues as a relatively excellent performer in a relatively rotten category.

Manning & Napier Strategic Income Conservative Series (MSCBX) is liquidating on or about September 27, 2018. Its sibling fund, Strategic Income Moderate Series, is simultaneously being renamed just “Income Series,” so it appears that the strategic income experiment has been terminated.

Manning & Napier World Opportunities Series (EXWAX) will be absorbed by Manning & Napier Overseas Series (EXOSX) on or about September 24, 2018. “The EXWAX advantage” sounds like a line from a bad 1950s TV commercial for, well, waxative. In any case, Morningstar rated EXWAX as a Bronze medalist and it was not, in terms of performance, markedly worse than the surviving fund. This might be a good time for former EXWAX shareholders to perk up and ask, “if I didn’t own shares on EXOSX, is there anything that would want to make me buy shares of it?”

Marsico Flexible Capital Fund (MFCFX) will be absorbed by Marsico Global Fund (MGLBX) on or about August 3, 2018. It’s a sad and odd tale, since Flexible Capital has over $200 million in assets and a four star rating but … the 10-year rating is five stars, the five year rating is three stars and the three year rating is just two stars. After a strong run under Corydon Gilchrist and Doug Rao (roughly 2006-2012), the fund’s record softened but did not crash. It’s been a middling performer since Mr. Rao’s departure and has seen slow, steady outflows monthly since early 2014. Mr. Marsico stepped in to manage the fund in March 2018 and it has performed well since then. We don’t know whether the fund’s fate was sealed even back then.

Global is barely one-quarter the size of Flexible Capital, though Global has seen some inflows while Flexible posted $43 million in outflows over the past twelve months. Over the past five years, Global has posted far high returns (14% versus 10%) though it has understandably also had higher volatility. The correlation between the funds over the past five- and ten-year periods is in the low- to mid-90s.

Bottom line: investors are being moved into a fine fund, but its higher risk profile might not be what they signed up for. If that’s the case, you might consider an alternative.

We searched the MFO Premium fund screener for comparable funds, looking particularly at the past five years. The funds below all have higher returns and lower volatility over the past five years than does MFCFX and far lower volatility than Marsico Global. They all fall in Lipper’s “flexible portfolio” peer group, all have substantial insider ownership and are open to new retail accounts. With the exception of RPGAX, they all have track records of 10+ years. With the exception of Provident Trust (PROVX), we’ve written about all of them.

| Name | Returns | Returns vs Peer | Max Drawdown | Std Dev | Ulcer Index | Sharpe Ratio | Martin Ratio | ER | Correlation to MFCFX |

| Provident Trust Strategy PROVX | 14.4 | 8.9 | -5.8 | 9.8 | 1.9 | 1.42 | 7.35 | 1.01 | 80 |

| AMG Chicago Equity Partners Balanced MBEAX | 8.9 | 3.4 | -5.5 | 6.3 | 1.6 | 1.35 | 5.15 | 1.09 | 94 |

| Leuthold Core Investment LCORX | 7.7 | 2.2 | -5.7 | 6.4 | 2 | 1.12 | 3.63 | 1.27 | 75 |

| T Rowe Price Global Allocation RPGAX | 7.5 | 2.0 | -9.1 | 6.6 | 2.7 | 1.06 | 2.63 | 0.98 | 86 |

| FPA Crescent FPACX | 6.8 | 1.4 | -8.7 | 6.8 | 2.4 | 0.94 | 2.61 | 1.1 | 77 |

| Marsico Flexible Capital MFCFX | 9.7 | 4.2 | -10.3 | 9.9 | 3.4 | 0.93 | 2.72 | 1.45 | 100 |

| Northern Trust Global Tactical Asset Allocation BBALX | 6 | 0.6 | -7.7 | 6.3 | 2.5 | 0.88 | 2.21 | 0.64 | 81 |

| Marsico Global MGLBX | 14.0 | -12.9 | 12.7 | 4.4 | 1.07 | 3.09 | 1.05 | 87 |

We’ve highlighted the best five-year performance in each column.

If you’ve enjoyed your last five years with MFCFX, you might want to look at MBEAX particularly since it’s a fine fund with a high correlation to MFCFX with just slightly lower returns but substantially lower risk. If you’re looking for an upgrade, consider especially Provident Trust with substantially higher returns and modestly lower volatility. Or, if you simply like Mr. Marsico’s way of thinking about the world and investing, stay with Marsico Global but prep yourself for higher volatility.

And if you’re suddenly wondering why we haven’t profiled Provident Trust yet, join the club. I’m wondering the same thing.

Rex VolMAXX Long VIX Futures Strategy ETF (VMAX) is expected to cease operations and liquidate on or about July 27, 2018.

What on earth? “The Board of Trustees has determined to liquidate the Six Thirteen Core Equity Fund (TZDKX) and to cease operations of the Fund due to the adviser’s business decision that it no longer is economically feasible to continue managing the Fund because of the Fund’s small size and the difficulty encountered in attracting and maintaining assets.” The fund launched on April 27, 2018. It will close on July 27, 2018. The announcement “I will fight no more forever” came after a total 10 grueling weeks in the marketplace.

Transamerica Bond (IDITX, formerly Transamerica Flexible Income) has closed and will liquidate on August 31, 2018.