Objective and strategy

PROVX seeks long-term growth of capital. As a concentrated, non-diversified, bottom-up, multi-cap core growth equity fund, it aims to exceed the S&P 500 Index over full investment cycles, which are typically five to seven calendar years in length and contain both a 30% advance and a 20% decline.

The managers generally prefer to invest in large and medium capitalization stocks (namely, companies with at least $2 billion in market cap) but may also invest a portion in small capitalization companies.

Provident has the flexibility to move much of the portfolio to cash and/or high quality bonds during periods of extreme stock market risk.

Adviser

Provident Trust Company, Waukesha, WI was founded in 1998 by J. Scott Harkness, now a co-manager of the fund. The firm also manages an equity strategy, a balanced strategy, and a fixed income strategy, and provides integrated financial forecasting besides trust services. The firm employs 14 and had about $3.6 billion in assets under management, as of September 30, 2018.

Managers

J. Scott Harkness, CFA, and Michael A. Schelbe, CFA, JD, MS.

Mr. Harkness is Provident Trust’s, CEO and founder. Prior to founding Provident, Mr. Harkness was Chairman and CIO of Firstar Investment Research and Management Company and, earlier still Senior Vice President and CIO for Firstar Bank Madison where he managed the Firstar Special Growth Fund and the Firstar Special Equity Growth Funds. He has 40 years of investment experience.

Mr. Schelble is President, COO, and Director of Provident Trust Company, and has been since its inception in 1998. Like Mr. Harkness, his earlier career was with FIRMCO and Firstar. He has 25 years of investment experience.

Both have managed the fund since 2002.

Strategy capacity and closure

The strategy used in PROVX is also used in a series of separately-managed accounts. Overall, the strategy has a capacity limit of about $10 billion. The fund currently holds under $200 million and the managers are responsible for under $3 billion overall.

Active share

91.5% as of September 30, 2018

Active share measures the degree to which a fund’s portfolio differs from the holdings of its benchmark portfolio, in this case, the S&P 500. The fund’s active share shows a very high level of independence from its benchmark.

Management’s stake in the fund

Mr. Harkness and Mr. Schelbe have each invested more than $1,000,000 in the fund. As of January 31, 2018, three of the four directors also have substantial personal investments: two have over $100,000 invested and the third falls between $50,000-100,000.

Opening date

Technically December 30, 1986 but, as a practical matter, September 9, 2002. The earlier date is the opening, but Provident Trust did not take responsibility for its management and strategy until 2002. That means that the fund’s 15 year record is rather more relevant and any “since inception” data.

Minimum investment

$1,000

Expense ratio

0.93%, on assets of $192 million, as of July 2023.

Comments

The Provident Trust managers exhibit uncommon skill at executing a straightforward discipline. The portfolio is highly concentrated with just 15 names, virtually all in the domestic large- to mega-cap space. Primarily bottom-up investors, the managers look for good quality growth stocks which might be signaled by improving revenue and earnings growth, increasing margins, significant stock ownership by management and improving price-to-earnings ratios.

They make some consideration of macro factors, such as inflation and interest rates, then buy and hold for the long term. Morningstar reports on average turnover rate of 2%, compared to 55% for their peers. The advisers long-term calculation is that turnover averaged 17.0% over the past 10 years.

Provident Trust Company began sub-advising the fund on September 9, 2002 and became the primary advisor role on August 31, 2012. Here’s how the fund has performed since Provident came onboard in 2002:

| Month Ended: 10/31/2018 | PROVX | S&P 500 Index |

| 3 year annualized | 11.94% | 11.52% |

| 5 year annualized | 11.86 | 11.34 |

| 10 year annualized | 11.90 | 13.24 |

| Since managing, 9/9/02 | 9.87 | 9.25 |

Source: Provident Trust, 10/31/18

That’s pretty compelling.

Investors remember that this period includes the 2007-09 financial crisis. What they may not know is that in 2008, the fund lost 21.0% compared to the S&P 500’s 37.0% decline. That ranked the fund in the 1st percentile.

While paralyzed investors and central banks struggled, the fund held between 61% in cash and fixed income instruments at the end of ’08 and 70% at the market bottom in March ’09. That positioning dramatically reduced the fund’s losses compared to the market, while giving it ample “dry powder” for the gains that followed.

What’s the lesson here?

The managers (1) place a premium on keeping shareholders through bad times so that they can participate in good times and (2) provide an example of a flexible strategy that preserves assets during the most difficult market environment during the last 50 years at that time.

But how has it performed to date?

During Provident’s tenure as portfolio manager to September 30, 2018, PROVX gained +389% cumulatively with a 79.8% average month-end allocation to equities vs. +348% for the always fully invested S&P 500.

During Provident’s tenure as portfolio manager and ending September 30, 2018, PROVX’s equity allocation ranged from 29.8% to 97.1%.

During the current full market cycle (11/2007 through 10/2018), it’s exceeded the S&P 500 by 0.9% and its large cap growth peers by 4.3%.

During the current full market cycle, its maximum drawdown was -28.4% with a recovery of 28 months compared to the S&P 500 at -50.9% with a recovery of 52 months.

The managers have explained their historical allocations to hold cash and short-term securities as part of their decision to invest defensively and prudently. Those decisions have affected their shorter-term performance for both better or worse.

It is predictable, and admirable, that the fund outperformed the market during the 2007-09 crash, declining at about half the rate of the S&P 500. It’s more surprising, and more admirable, that the fund managed to outperform the market over the five years beginning in 2003 and ending in March 2008. That is, the fund’s performance in the frothy markets preceding the crash were solid and its performance during the crash was decisive.

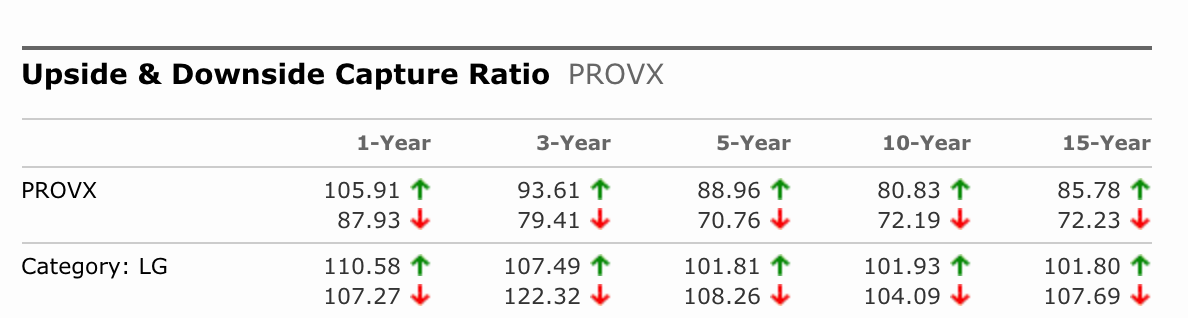

Here’s a look at the Upside & Downside Capture ratios, first from Morningstar.

Bottom Line

Provident wants to be your manager. Singular. As in, “the only guys you need.” Failing that, they’d like to be your core holding. We believe that they have made a strong argument, over 15 years and several market cycles, to be precisely that.

Their aim is to provide risk-conscious management in pursuing of a sustainable investment; that is, one you can live with for the long term. One measure of their success comes from Morningstar’s calculation of the fund’s “investor returns.” Investor returns are a proxy for what the average fund investors has earned in a period, which is often dramatically different from what the fund has produced. The reason is simple: high volatility funds produce poor behavior on the part of investors, who rush for the doors during inevitable swoons and rush toward the entrances after dramatic rises. As a result, investor returns are lower than the fund returns.

For Provident? 15 year fund returns: 9.48%. 15 year investor returns: 9.54%. Far more than with their peers, investors have stuck with the fund and benefited from it.

The managers, likewise. The managers have both committed over a million of their own money to the fund. That represents one-hundred percent of the portfolio managers’ retirement assets.

To their credit, some folks at MFO – for example, our publisher who referenced it positively in his August 2018 “Briefly Noted” — wondered why it hasn’t been profiled. Others at MFO own it, have owned it, contributed discussion, or asked MFO to write about it.

Two factors help explain why so few others have embraced the fund.

- Seventy-five percent of their SA clients are HNW individuals, and the next highest non-HNW individuals. They offer the fund for those who wish to invest in their strategy but who may not meet their minimum investment threshold and who desire a daily valued product.

- Provident engages in very limited marketing efforts, primarily relying upon word of mouth. Because their strategy is unique, they tend to target a specific type of client, and so broad or generalized marketing efforts tend not to be fruitful.

Their investors tend to be sticky, long-term shareholders. But overall other investors have given them time and opportunities but not their attention.

The skill of the current managers shouldn’t be ignored, most especially in these uncertain times. Provident is an excellent option for a long-term core holding when confronted by fears of uncertainty and surprise.

The fund can underperform in rapidly rising markets but historically outperforms in declining markets. In the end, it’s how much investors keep of what they’ve earned, something this team has done for investors consistently.

Allied on their side are managers who have patiently and successfully navigated markets of all types as stewards of shareholders’ capital – and of their own.

Fund website

Investors preferring concise, straightforward, factual reports, no fluff or stylish circumlocutions will appreciate the site. It includes all relevant documents and is distinctive by the firm’s intent to have shareholder letters only one page long.

Disclosure

Dennis Baran: I’ve invested in the fund since August 2018, made additional buys, and will be adding more.