| Ticker |

Fund |

Out with the old |

In with the new |

Dt |

| APGAX |

AB Large Cap Growth Fund |

Karen Sesin is no longer listed as a portfolio manager for the fund. |

Vinay Thapar joins Frank Caruso and John Fogarty in managing the fund. |

5/18 |

| CABDX |

AB Relative Value Fund |

No one, but . . . |

Vinay Thapar and John Fogarty join Fran Caruso on the management team. |

5/18 |

| CHUSX |

Alger Global Growth Fund |

Pedro Marcal and Deborah Velez Medencia are no longer listed as portfolio managers for the fund. |

Gregory Jones and Pragna Shere will now manage the fund. |

5/18 |

| AFGPX |

Alger International Growth Fund Class B |

Pedro Marcal is no longer listed as a portfolio manager for the fund. |

Gregory Jones and Pragna Shere will now manage the fund. |

5/18 |

| ALMMX |

AllianzGI Emerging Markets Small-Cap Fund |

Jie Wei will no longer serve as a portfolio manager for the fund. |

Kunal Ghosh and Lu Yu will continue to manage the fund. |

5/18 |

| ACTIX |

American Century Capital Value |

Brendan Healy will no longer serve as a portfolio manager for the fund. |

Philip Sundell joins Brian Woglom on the management team. |

5/18 |

| ALVIX |

American Century Large Company Value |

Brendan Healy will no longer serve as a portfolio manager for the fund. |

Phillip Davidson joins Brian Woglom on the management team. |

5/18 |

| MMCFX |

AMG Managers Emerging Opportunities Fund |

Effective immediately, Arthur Weise no longer serves as a portfolio manager for the portion of the fund managed by Lord, Abbett & Co. LLC |

F. Thomas O’Halloran and Matthew DeCicco are designated as portfolio managers for the portion of the fund managed by Lord Abbett. The rest of the management team remains. |

5/18 |

| MGSEX |

AMG Managers Special Equity Fund |

Effective immediately, Arthur Weise no longer serves as a portfolio manager for the portion of the fund managed by Lord, Abbett & Co. LLC |

Matthew DeCicco is designated as a portfolio manager for the portion of the fund managed by Lord Abbett. The rest of the management team remains. |

5/18 |

| ARDEX |

AMG River Road Dividend All Cap Value Fund |

No one, but . . . |

Andrew McIntosh joins Henry Sanders, James Shircliff, and Thomas Forsha on the management team. |

5/18 |

| ADVTX |

AMG River Road Dividend All Cap Value Fund II |

No one, but . . . |

Andrew McIntosh joins Henry Sanders, James Shircliff, and Thomas Forsha on the management team. |

5/18 |

| SYAMX |

AMG Systematic Mid Cap Value Fund |

No one, but . . . |

Aman Patel joins Ronald Mushock and D. Kevin McCreesh on the management team. |

5/18 |

| AZEIX |

AQR Emerging Defensive Style Fund |

Mr. Hoon Kim will no longer serve as a portfolio manager. |

Michele Aghassi, Andrea Frazzini, and Jacques Friedman will continue to manage the fund. |

5/18 |

| QERIX |

AQR Emerging Relaxed Constraint Equity Fund |

Mr. Hoon Kim will no longer serve as a portfolio manager. |

Michele Aghassi, Andrea Frazzini, and Jacques Friedman will continue to manage the fund. |

5/18 |

| ANDNX |

AQR International Defensive Style Fund |

Mr. Hoon Kim will no longer serve as a portfolio manager. |

Michele Aghassi, Andrea Frazzini, and Jacques Friedman will continue to manage the fund. |

5/18 |

| QIRNX |

AQR International Relaxed Constraint Equity Fund |

Mr. Hoon Kim will no longer serve as a portfolio manager. |

Michele Aghassi, Andrea Frazzini, and Jacques Friedman will continue to manage the fund. |

5/18 |

| AUEIX |

AQR Large Cap Defensive Style Fund |

Mr. Hoon Kim will no longer serve as a portfolio manager. |

Michele Aghassi, Andrea Frazzini, and Jacques Friedman will continue to manage the fund. |

5/18 |

| QLRIX |

AQR Large Cap Relaxed Constraint Equity Fund |

Mr. Hoon Kim will no longer serve as a portfolio manager. |

Michele Aghassi, Andrea Frazzini, and Jacques Friedman will continue to manage the fund. |

5/18 |

| QLENX |

AQR Long-Short Equity Fund |

Mr. Hoon Kim will no longer serve as a portfolio manager. |

Michele Aghassi, Andrea Frazzini, and Jacques Friedman will continue to manage the fund. |

5/18 |

| QSRIX |

AQR Small Cap Relaxed Constraint Equity Fund |

Mr. Hoon Kim will no longer serve as a portfolio manager. |

Michele Aghassi, Andrea Frazzini, and Jacques Friedman will continue to manage the fund. |

5/18 |

| BXEAX |

Barings Emerging Markets Debt Blended Total Return Fund |

Novruz Bashirov will no longer serve as a portfolio manager for the fund. |

Ricardo Adrogué, Cem Karacadag, and Brigitte Posch will continue to manage the fund. |

5/18 |

| BICHX |

BlackRock Emerging Markets Dividend Fund |

Alethea Leung is no longer listed as a portfolio manager for the fund. |

Stephen Andrews and Emily Fletcher will continue to manage the fund. |

5/18 |

| MFOMX |

BNY Mellon Focused Equity Opportunities Fund |

Irene O’Neill is no longer listed as a portfolio manager for the fund. |

Thomas Lee and Donald Sauber will now manage the fund. |

5/18 |

| ETDFX |

Carillon Cougar Tactical Allocation Fund |

No one, but . . . |

Abdullah Sheikh joins James Breech in managing the fund. |

5/18 |

| CRCBX |

Carillon Reams Core Bond Fund |

No one, but . . . |

Jason Hoyer joins Clark Holland, Stephen Vincent, Todd Thompson, Thomas Fink, and Mark Egan on the management team. |

5/18 |

| SCPDX |

Carillon Reams Core Plus Bond Fund |

No one, but . . . |

Jason Hoyer joins Clark Holland, Stephen Vincent, Todd Thompson, Thomas Fink, and Mark Egan on the management team. |

5/18 |

| SUBDX |

Carillon Reams Unconstrained Bond Fund |

No one, but . . . |

Jason Hoyer joins Clark Holland, Stephen Vincent, Todd Thompson, Thomas Fink, and Mark Egan on the management team. |

5/18 |

| CADYX |

Cavalier Dynamic Growth Fund |

Justin Lent will no longer serve as a portfolio manager for the fund and StratFi, LLC will no longer sub-advise the fund. |

Scott Wetherington will continue to manage the fund. |

5/18 |

| CAHIX |

Cavalier Hedged High Income Fund |

Gavan Duemke and Sean Wright will no longer serve as portfolio managers for the fund. Carden Capital, LLC will no longer subadvise the fund. |

Sott Wetherinton will continue to manage the fund. |

5/18 |

| CMSYX |

Cavalier Multi Strategy Fund, formerly Cavalier Multi Strategist Fund |

Gavan Duemke, Sean Wright, and Henry Ma will no longer serve as portfolio managers for the fund. Carden Capital, LLC and Julex Capital Management, LLC will no longer subadvise the fund. |

Scott Wetherington, Lee Albert Calfo, and Brian Shevland will continue to manage the fund. |

5/18 |

| RIMOX |

City National Rochdale Fixed Income Opportunities Fund |

No one, but . . . |

Matthew Peron joins the management team. |

5/18 |

| CRMEX |

CRM All Cap Value Fund |

Jeffrey Reich will no longer serve as a portfolio manager for the fund. |

Robert Maina and Jay Abramson will continue to manage the fund. |

5/18 |

| CRMSX |

CRM Small Cap Value Fund |

No one, but . . . |

Bernard Frojmovich joins Brian Harvey in managing the fund. |

5/18 |

| SGSCX |

Deutsche Global Small Cap Fund |

Joseph Axtell will no longer serve as a portfolio manager for the fund. |

Peter Barsa now manages the fund. |

5/18 |

| DNLDX |

Dreyfus Active MidCap Fund |

Ronald Gala will no longer serve as a portfolio manager for the fund. |

C. Wesley Boggs, William Cazalet, Peter Goslin, and Syen Zamil will continue to manage the fund. |

5/18 |

| DBEAX |

Dreyfus Diversified Emerging Markets Fund |

Ronald Gala will no longer serve as a portfolio manager for the fund. |

Michelle Chan, C. Wesley Boggs, William Cazalet, Julianne McHugh, Peter Goslin, Elizabeth Slover, and Syen Zamil will continue to manage the fund. |

5/18 |

| DQIAX |

Dreyfus Equity Income Fund |

Ronald Gala will no longer serve as a portfolio manager for the fund. |

C. Wesley Boggs, William Cazalet, Peter Goslin, and Syen Zamil will continue to manage the fund. |

5/18 |

| DOFAX |

Dreyfus Strategic Beta Emerging Markets Equity Fund |

Ronald Gala will no longer serve as a portfolio manager for the fund. |

C. Wesley Boggs, William Cazalet, Peter Goslin, and Syen Zamil will continue to manage the fund. |

5/18 |

| DPSAX |

Dreyfus Structured Midcap Fund |

Ronald Gala will no longer serve as a portfolio manager for the fund. |

C. Wesley Boggs, William Cazalet, Peter Goslin, and Syen Zamil will continue to manage the fund. |

5/18 |

| Various |

Fidelity Advisor Asset Manager Funds and Fidelity Asset Manager Funds |

No one, but . . . |

Avishek Hazrachoudhury has joined Geoff Stein in managing the funds. |

5/18 |

| FMFIX |

Free Market Fixed Income Fund |

Kenneth Gatliff is no longer listed as a portfolio manager for the fund. |

Sean Babin joins Mark Matson and Steven Miller in managing the funds. |

5/18 |

| FMNEX |

Free Market International Equity Fund |

Kenneth Gatliff is no longer listed as a portfolio manager for the fund. |

Sean Babin joins Mark Matson and Steven Miller in managing the funds. |

5/18 |

| FMUEX |

Free Market U.S. Equity Fund |

Kenneth Gatliff is no longer listed as a portfolio manager for the fund. |

Sean Babin joins Mark Matson and Steven Miller in managing the funds. |

5/18 |

| SFAFX |

Goldman Sachs Strategic Factor Allocation Fund |

Amna Qaiser will no longer serve as a portfolio manager for the fund. |

Christian Morgenstern and Nishank Modi will continue to manage the fund. |

5/18 |

| MXIGX |

Great-West MFS International Growth Fund |

Filipe Benzinho and Daniel Ling are no longer listed as portfolio managers for the fund. |

Shane Duffy, Donald Huber, Thomas Murray, and John Remmert will now manage the fund. |

5/18 |

| SGBVX |

Hartford Schroders Global Strategic Bond Fund |

Thomas Sartain will no longer serve as a portfolio manager for the fund. |

Robert Jolly and Paul Grainger will continue to manage the fund. |

5/18 |

| IQHOX |

IQ Hedge Multi-Strategy Plus Fund |

Effective April 30, 2018, Paul Fusaro will no longer serve as a portfolio manager for the fund. |

James Harrison will join Greg Barrato on the management team. |

5/18 |

| IBNAX |

Ivy Balanced Fund |

Rick Perry is no longer listed as a portfolio manager for the fund. |

Susan Regan and Mark Beischel join Matthew Hekman on the management team. |

5/18 |

| IBJAX |

Ivy Bond Fund |

Rick Perry is no longer listed as a portfolio manager for the fund. |

Susan Regan joins Mark Beischel in managing the fund. |

5/18 |

| ICKAX |

Ivy Crossover Credit Fund |

Rick Perry is no longer listed as a portfolio manager for the fund. |

Susan Regan joins Mark Beischel in managing the fund. |

5/18 |

| IVFGC |

Ivy Focused Growth NextShares |

Daniel Becker is no longer listed as a portfolio manager for the fund. |

Bradely Kapmeyer will continue to manage the fund. |

5/18 |

| IGJAX |

Ivy Government Securities Fund |

Rick Perry is no longer listed as a portfolio manager for the fund. |

Susan Regan is joined by Mark Beischel in managing the fund. |

5/18 |

| WLGAX |

Ivy Large Cap Growth Fund |

Daniel Becker is no longer listed as a portfolio manager for the fund. |

Bradely Kapmeyer will continue to manage the fund. |

5/18 |

| JTCAX |

John Hancock Technical Opportunities Fund |

Effective June 29, 2018, Frank Teixeira will no longer serve as a portfolio manager for the fund. |

David Lundgren will continue to manage the fund. |

5/18 |

| MAWNX |

MainStay Epoch U.S. All Cap Fund |

No one, but . . . |

Justin Howell joins David Pearl, William Priest and Michael Welhoelter on the management team. |

5/18 |

| MAPOX |

Mairs & Power Balanced Fund |

Ronald Kaliebe will retire at the end of June, 2019. |

As part of a succession plan, Kevin Early has been named lead portfolio manager and Robert Thompson has joined the team, in advance of Mssr. Kaliebe’s departure. |

5/18 |

| MGFAX |

MassMutual Premier Global Fund |

Rajeev Bhaman has announced his intention to retire as of March 31, 2019. |

There’s nearly a year to plan. John Delano will continue to manage the fund. |

5/18 |

| MEFAX |

MassMutual Select Mid Cap Growth Fund |

Stephen Knightly is expected to retire as of December 31, 2019. |

Brian Berguis and Christopher Scarpa will continue to manage the fund. |

5/18 |

| OHYDX |

Oaktree High Yield Bond Fund |

James Turner will no longer serve as a portfolio manager for the fund. |

Madelaine Jones joins Sheldon Stone and David Rosenberg in managing the fund. |

5/18 |

| OPPAX |

Oppenheimer Global Fund |

Rajeev Bhaman has announced his intention to retire as of March 31, 2019. |

John Delano will continue to manage the fund. |

5/18 |

| PMDEX |

PMC Diversified Equity Fund |

Effective May 25, 2018, Mark Donovan, David Pyle, Francis Morris, Michael Morris, Christopher Adams, Donald Padilla, David Reidinger, Ronald Gala, William Cazalet, Michael Kaminski, William Booth, Glen Petraglia, Lilian Quah, and William Priest will no longer serve as a portfolio managers for the fund. The fund will eliminate its “manager of managers” investment strategy and terminate agreements with it’s subadvisors. |

Janis Zvingelis and Brandon Thomas will continue to manage the fund. |

5/18 |

| PQCMX |

Prudential Commodity Strategies Fund |

Adam De Chiara is no longer listed as a portfolio manager for the fund. |

Marco Aiolfi and Yesim Tokat-Acikel will now manage the fund. |

5/18 |

| HGSAX |

Rational Risk Managed Emerging Markets Fund |

Edward Baker, Mathias Wikberg and Walid Khalfallah will no longer serve as a portfolio managers for the fund. The Cambridge Strategy Limited will no longer subadvise the fund. |

Barrow, Hanley, Mewhinney & Strauss, LLC will now subadvise the funds, with Rondolph Wrighton, Jr., Josh Ayers and Sherry Zang on the management team. |

5/18 |

| FSIEX |

Touchstone International Value Fund |

David Hodges is no longer listed as a portfolio manager for the fund. |

T.J. Carter and Charles Radtke join Randolph Wrighton in managing the fund. |

5/18 |

| BNAAX |

UBS Dynamic Alpha Fund |

Nathan Shetty will no longer serve as a portfolio manager for the fund. |

Alan Zlater joins José Ignacio Andrés on the management team. |

5/18 |

| UTBAX |

UBS Total Return Bond Fund |

No one, but . . . |

Jeffrey Haleen and Branimir Petranovic will join Scott Dolan and Craig Ellinger on the management team. |

5/18 |

| PWTAX |

UBS U.S. Allocation Fund |

Nathan Shetty will no longer serve as a portfolio manager for the fund. |

Alan Zlater joins Paul Lang on the management team. |

5/18 |

| UNAVX |

USA Mutuals Navigator Fund |

No one, but . . . |

Jordan Waldrep joins Steven Goldman in managing the fund. |

5/18 |

| IEOSX |

Voya Large-Cap Growth Fund |

Christopher Corapi will no longer serve as a portfolio manager for the fund. |

Jeffrey Bianchi and Michael Pytosh will continue to manage the fund. |

5/18 |

| WFAAX |

Wells Fargo Asia Pacific Fund |

Anthony Cragg will retire on September 1, 2018, but will step down from the fund after June 15th. |

Elaine Tse joins Alison Shimada in managing the fund. |

5/18 |

| EMGAX |

Wells Fargo Emerging Markets Equity Income Fund |

Anthony Cragg will retire on September 1, 2018, but will step down from the fund after June 15th. |

Elaine Tse joins Alison Shimada in managing the fund. |

5/18 |

| WFSAX |

Wells Fargo Small Company Growth Fund |

James Ross will take a leave of absence. |

William Grierson, Daniel Hagen, and Paul von Kuster will continue to manage the fund. |

5/18 |

analyst if he is familiar with the high school football team whose coach never let them punt on fourth down. The analyst says yes, the coach figured out that statistically the team had a better chance of winning if they used all four downs for offense. Taylor says yes, but the coach also wanted to win more championships. The analyst then gets it, that it is all about the firm’s “edge.” Taylor then explains that they had their edge when there was “dumb” capital in the marketplace. But, and this is critical, they have lost that edge. Taylor then says that all the dumb capital has been sucked out of the marketplace by the trillions of dollars that have gone into ETF’s (exchange-traded funds). What is left in the marketplace – aggressive firms with killer instincts and research, just like themselves. The reason to hire quants is to regain the edge. And even with lots of quants already out competing against them, Axe Capital has the resources to find better ones to get the edge back.

analyst if he is familiar with the high school football team whose coach never let them punt on fourth down. The analyst says yes, the coach figured out that statistically the team had a better chance of winning if they used all four downs for offense. Taylor says yes, but the coach also wanted to win more championships. The analyst then gets it, that it is all about the firm’s “edge.” Taylor then explains that they had their edge when there was “dumb” capital in the marketplace. But, and this is critical, they have lost that edge. Taylor then says that all the dumb capital has been sucked out of the marketplace by the trillions of dollars that have gone into ETF’s (exchange-traded funds). What is left in the marketplace – aggressive firms with killer instincts and research, just like themselves. The reason to hire quants is to regain the edge. And even with lots of quants already out competing against them, Axe Capital has the resources to find better ones to get the edge back.

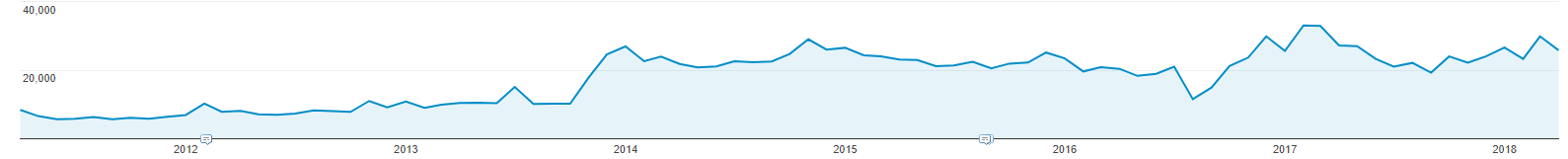

In the succeeding years, the fund has steadily earned 2.0 – 4.0% annually and assets have flowed steadily in. Like RiverPark Short Term High Yield (RPHIX), Zeo’s accomplishments are masked by Morningstar’s classification of it as a high-yield bond fund. In reality, it’s far milder and more reliable than they.

In the succeeding years, the fund has steadily earned 2.0 – 4.0% annually and assets have flowed steadily in. Like RiverPark Short Term High Yield (RPHIX), Zeo’s accomplishments are masked by Morningstar’s classification of it as a high-yield bond fund. In reality, it’s far milder and more reliable than they. PowerShares no more: On April 19, 2018, the Board of Trustees of PowerShares Exchange-Traded Fund Trust approved changing the names of all of their funds to replace “PowerShares” with “Invesco.” Those changes are effective on or about June 4, 2018. A small sample of the name changes will give you the flavor of the thing:

PowerShares no more: On April 19, 2018, the Board of Trustees of PowerShares Exchange-Traded Fund Trust approved changing the names of all of their funds to replace “PowerShares” with “Invesco.” Those changes are effective on or about June 4, 2018. A small sample of the name changes will give you the flavor of the thing: