Every month we track changes to the management teams of equity, alternative and balanced funds, along with a handful of fixed-income ones. Why “a handful”? Because most fixed-income funds are such sedate creatures, with little performance difference between the top quartile funds and the bottom quartile, that the changes are not consequential. Even in the realms we normally cover, the rise of management committees dilutes the significance of any individual’s departure or arrival.

We tracked down 40 funds with manager changes this month. Special thanks to the folks at Morningstar for sharing their monthly spreadsheet of all major changes in the fund industry with it; it’s an invaluable double-check on the work that Chip, The Shadow and others do in tracking movements in the industry.

Most of the changes are low-key, though it is interesting that Akre Focus(AKREX) has added another co-mananger.

Akre Focus Fund (AKREX / AKRIX) was launched on August 31, 2009, and currently has net assets of approximately $12.8 billion (January 31, 2020). It was launched by Chuck Akre. In 1997, Mr. Akre became of founding manager of FBR Small Cap Growth – Value fund, which became FBR Small Cap Value, then FBR Small Cap, and finally FBR Focus (FBRVX) which is now Hennessy Focus (HFCSX). FBR, imprudently, I believe, put a financial squeeze on Mr. Akre and his firm, which decamped to launch their own fund employing Mr. Akre’s strategy. After originally agreeing to join him on the new fund, several of Mr. Akre’s former analysts were … uhh, incented to return to FBR and manage the fund in his stead.

Akre Focus Fund (AKREX / AKRIX) was launched on August 31, 2009, and currently has net assets of approximately $12.8 billion (January 31, 2020). It was launched by Chuck Akre. In 1997, Mr. Akre became of founding manager of FBR Small Cap Growth – Value fund, which became FBR Small Cap Value, then FBR Small Cap, and finally FBR Focus (FBRVX) which is now Hennessy Focus (HFCSX). FBR, imprudently, I believe, put a financial squeeze on Mr. Akre and his firm, which decamped to launch their own fund employing Mr. Akre’s strategy. After originally agreeing to join him on the new fund, several of Mr. Akre’s former analysts were … uhh, incented to return to FBR and manage the fund in his stead.

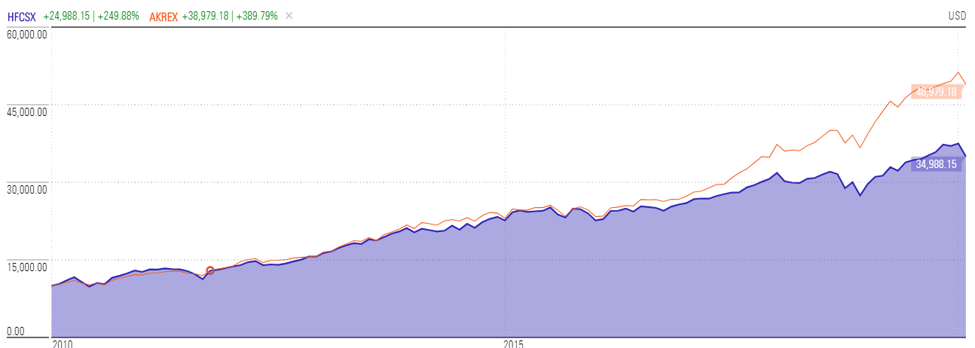

To give you a sense of how that played, here’s the 10-year record for FBR/Hennessy Focus (blue) and Akre Focus (orange).

To be clear, both funds have been far above average performers.The fact that Akre Focus gained 390% to FBR/Hennessy’s 250% might explain why Hennessy has a respectable $1.5 billion in assets while Akre has accumulated a more than respectable $12 billion.

We can understand why one MFO reader was a bit concerned when he saw a new co-manager for the portfolio, and asked us to check into it. We did.

Chris Cerrone quietly joined the management team on January 1, 2020. He joined the firm in 2012, was made a partner in the firm in 2013 and has been an active member of the management team for years. He’s been responsible for something like a third of the names already in the portfolio; his elevation to “manager” simply allows him to legally execute trades on the firm’s behalf rather than channeling them through Mr. Akre or Mr. Neff, the other co-manager.

His promotion is the culmination of a long process of training and acculturation. Mr. Akre, now 77, continues to work 50 hour weeks. Our contract at Akre shared the revealing tidbit that when the firm reorganized their office space three years ago, part of the new plan was creating a bedroom suite for Mr. Akre on the floor above the office space. That accommodates his tendency to become immersed in his work and lose track of time.

The Akre team is 12 people, six of whom “work on ideas.” They have grown together and seem internally cohesive. John Neff’s observation was that he’s never been in a business with a better intelligence-to-ego ratio. That’s allowed a fairly smooth evolution of roles, with Mr. Akre increasingly looking at big picture issues, with Messrs. Neff and Cerrone doing a lot of the firm-by-firm analyses and briefing. By the firm’s count, they’re probably responsible for 90% of the names in the current portfolio.

It’s singularly reassuring that this evolution has largely slipped under the radar. The fund has posted nine consecutive years of above-average returns, even excelling in the chaos of early 2020. That implies that Mr. Akre has succeeded in training the next generation of stock-pickers and portfolio managers, and that the investors in Akre Focus should be reassured.

And now, the rest of the manager changes …

AC Alternatives Market Neutral Value (ACVVX) added David Bryns to the team.

AEW Global Focused Real Estate Fund (NRFAX) lost J Hall Jones, Jr., but the rest of the team remains.

AllianzGI Multi Asset Income Fund (AGRAX) designated Paul Pietranico as lead portfolio following the departure of Ryan Chin.

AlphaClone Alternative Alpha ETF (ALFA) dropped Denise Krisko and Austin Wen, who were succeeded by Travis E. Trampe and Andrew Serowik.

Boston Trust Midcap Fund (BTMFX) and Walden Midcap Fund (WAMFX) removed Belinda Cavazos from the team and added Mark Zagata. The lead manager of both funds, Stephen Amyouny, remains in charge.

Walden SMID Cap Fund (WASMX), Walden Small Cap Fund (WASOX), Boston Trust SMID Cap Fund (BTSMX) and Boston Trust Walden Small Cap Fund (BOSOX) all removed Belinda Cavazos and added Leanne Moore, with the assurance that the rest of the team remains intact.

Catalyst Hedged Futures Strategy Fund (HFXAX) changed management teams, from Ed Walczak of Catalyst Capital to Warrington Asset Management. The fund has been rechristened Catalyst/Warrington Strategic Program (CWXAX).

Cavalier Tactical Rotation Fund (CAVTX) replaced Henry Ma and Julex Capital with Scott Wetherington of Cavalier Investments.

Cognios Large Cap Growth Fund (COGGX), Cognios Large Cap Value Fund (COGLX), and Cognios Market Neutral Large Cap (COGMX) seems in the midst of some administrative turmoil. It looks like the management team stays intact (except for Francisco Bido) but will now be employed by a different company than Cognios. Given that the management team includes the firm’s founder, it’s an odd development. We have inquiries out.

Columbia Emerging Markets Fund (UMUEX) added Derek Lin to the team.

Fidelity Balanced Fund (FBALX) had Jody Simes replace Richard Malnight, which must make the Material Portfolio management feel odd.

Fidelity Select Consumer Staples (FDFAX) loses James McElligott but gains Nicola Stafford.

Fidelity Select Materials Portfolio (FSDPX) added Richard Malnight as co-manager with Jody Simes.

Fidelity Series Emerging Markets Fund (FHKFX) has switched John Chow in for Rahul Desai.

Goldman Sachs Multi-Manager Global Equity Fund (GSEQX) fully embraces the “multi” in “Multi-Manager.” Axiom International Investors becomes the 14th firm helping to co-manage the fund. It’s an odd development, since the fund does not appear to be operating yet.

Harbor Emerging Markets Equity Fund (HIEEX) is losing Timothy Jensen of Oaktree Capital to retirement. Janet Wang will be added in his stead and will serve with Frank Carroll.

JPMorgan Small Cap Value Fund (PSOAX) saw Dennis Ruhl retire at the end of 2019, with four new members joining the team to succeed him.

Litman Gregory Masters International (MNILX) removed Thornburg Investment Management as a sub-advisor.

Miles Capital Alternatives Advantage Fund (MILIX) asks us to “disregard any references to” Steve Stotts and focus instead on Michael Westphal, CFA.

Sprott Gold Equity (SGDLX) has lost Ryan McIntyre but still has Douglas Groh and John Hathaway.

- Rowe Price Global Allocation, T. Rowe Price Balanced, T. Rowe Price Spectrum Growth, T. Rowe Price Spectrum Income, T. Rowe Price Spectrum International, T. Rowe Price Spectrum Moderate Growth Allocation, T. Rowe Price Spectrum Conservative Allocation and T. Rowe Price Spectrum Moderate Allocation Funds all gain the services of Toby Thompson, serving as co-manager with Charles Shriver.

- Rowe Price Global Industrials Fund (RPGIX) is undergoing a management transition. On March 1, 2020, Jason R. Adams will join Peter J. Bates. On June 1, 2020, Mr. Bates will step down and Mr. Adams will become the fund’s sole portfolio manager.

Voya Floating Rate Fund (IFRAX) added Charles LeMieux to the team of Jeffrey Bakalar and Daniel Norman. In French, “le mieux” is “the best.” We’re hopeful.