Long-short funds generally position themselves as “the new 60/40,” that is, as funds appropriate as a core holding for a reasonably conservative investor. Their argument is that 60/40 funds work only when both the stock and bond markets are in a relatively good mood. A fund that simultaneously bets against wobbly companies with overvalued stocks and bets in favor of high-quality companies with undervalued ones has the prospect of earning money, or at least minimizing pain, even when markets are behaving poorly.

There are two problems with such funds. First, they tend to be egregiously expensive. That’s not necessarily a reflection of a manager’s avarice; instead, it reflects the fact that a shorting strategy can be quite expensive to execute. Second, the category can cover funds with dramatically different strategies. Some, as in our opening examine, target stocks one-by-one. Some make bets against entire market sectors. Some use complex derivatives. That means that long-term investors need to do rather more due-diligence here than in many “vanilla” investment sectors. The key is that you’re got to have a clear understanding of what your manager is doing and when it’s likely to make you feel like an idiot for owning it; in 2019, for example, the average long-short fund made 12% while the Vanguard 500 Index Fund (VFINX) made 32% and the stodgy Vanguard Balanced Index (VBINX) made 22%.

The category looked a lot better in the first quarter of 2020, where the average long-short fund dropped 12.5%, close to the 11.6% loss for VBINX far better than the 19.6% decline in VFINX. Eight long-short funds finished Q1 in the black, and most of the funds with top 25% YTD returns also best the Balanced Index over the past three years.

Top 25% of long-short equity funds, based on Q1 2020 performance

| ytd | rk | 3 yr | rk | 5 yr | e.r. | |

| Benchmark: Vanguard Balanced Index | -11.63 | 18 | 4.57 | 11 | 4.93 | 0.18 |

| ABR Dynamic Blend Equity & Volatility ABRTX | 33.33 | 1 | 13.94 | 1 | — | 2.25 |

| RiverPark Long/Short Opportunities RLSFX | 9.48 | 3 | 13.19 | 2 | 8.97 | 2.18 |

| Nuance Concentrated Value Long-Short NCLIX | 6.12 | 4 | 4.64 | 13 | — | 3.61 |

| Absolute Capital Opportunities | 1.71 | 7 | 5.07 | 10 | — | 3.02 |

| JPMorgan Opportunistic Equity | 1.64 | 7 | 4.96 | 11 | 4.61 | 1.75 |

| MFS Managed Wealth | 1.52 | 7 | 5.50 | 8 | 3.53 | 0.65 |

| Toews Tactical Monument | 1.45 | 9 | 9.17 | 5 | 3.34 | 1.25 |

| Alger Dynamic Opportunities | 1.02 | 11 | 7.56 | 6 | 5.11 | 2.17 |

| Salient Tactical Growth | -0.41 | 11 | 4.25 | 15 | 3.70 | 1.43 |

| Longboard Alternative Growth | -1.35 | 15 | 6.24 | 7 | 5.21 | 1.99 |

| Anchor Risk Managed Equity Strategy | -2.35 | 16 | 10.34 | 4 | — | 2.19 |

| Salient Tactical Plus | -3.32 | 18 | 5.60 | 8 | 4.77 | 1.09 |

| Neuberger Berman Long Short | -5.64 | 21 | 3.99 | 17 | 2.70 | 1.78 |

| 361 Domestic Long/Short Equity | -7.06 | 23 | 2.74 | 25 | — | 2.43 |

The story of the top three

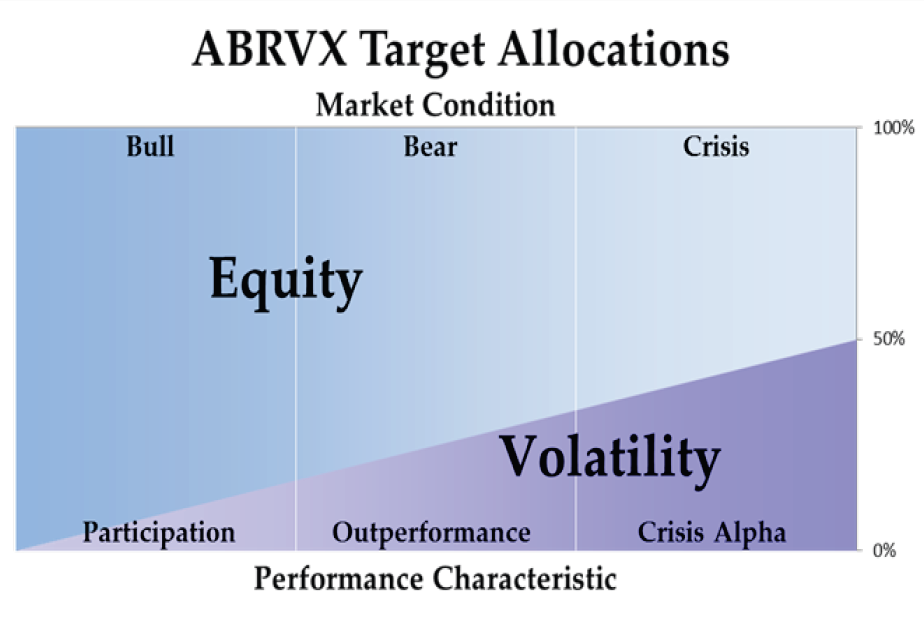

ABR Dynamic Blend Equity & Volatility (ABRTX) rebalances daily between S&P500 index futures, S&P VIX Short-term volatility futures and cash. If their models show rising volatility, they buy the VIX. The goal is to thrive in high-volatility markets and to at least make some money in the others.

This is been a near-perfect market for the strategy. Over the longer-term, it’s been a middle-of-the-road long-short fund, trailing its peers in three of the past four years. The minimum initial investment is $2,500.

RiverPark Long-Short Opportunity (RLSFX) starts by identifying important secular themes (for example, the switch to online retail), then dividing the financial world into thriving sectors and dying sectors (big box retail). They invest long in the best companies in thriving sectors and short the worst companies in dying sectors. The strategy has worked pretty consistently: Mr. Rubin has outperformed his long-short peers in four of the past five years and now has top 1-3% returns for every trailing time period.

Our profile of RLSFX, written shortly after the fund’s launch, concluded, “Both of [Mitch Rubin’s] long-short hedge funds offered annual returns within a few tenths of a percent of the stock market’s but did so with barely half of the volatility. Even with the drag of substantial expenses, RLSFX has earned a place on any short-list of managed volatility equity funds.”

The minimum initial investment is $1,000.

Nuanced Concentrated Value Long-Short (NCLIX) invests long in the stocks of 15-35 “leading businesses with stable competitive positions when they are underearning their long-term potential” and shorts 0-50 “large businesses with average competitive positions when they are over-earning their long-term potential.” The fund has tended to seesaw back and forth between top-tier relative performance (2016, 2018, Q1/2020) and the bottom tier (2017, 2019).

The minimum initial investment is $2,500.