Fidelity has disclosed plans to underwrite their money market funds in order to keep their yield from going negative. They have also closed Fidelity Treasury Only Money Market Fund, FIMM Treasury Only Portfolio, and FIMM Treasury Portfolio, which have cumulative $85.5 billion AUM. Fidelity was concerned about the yields on T-bills which, briefly, looked like this:

![]()

If a sense of panic drove more investors into ultra-safe Treasury money markets, Fidelity would be forced to buy a bunch of issues that might have negative rates which would force them either to expand the size of the subsidies that the funds were receiving or allow their funds to go negative. Since the latter was unpalatable and the former was expensive, they chose the third path: closing increasingly popular funds to new investors until conditions allowed them to run the funds in a financially sustainable way.

The Direxion 3X funds just became the Direxion 2X funds, albeit without changing their names. Direxion notes

Effective after market close on March 31, 2020, each Fund’s new investment objective and strategy will be to seek daily leveraged, or daily inverse leveraged, investment results, before fees and expenses, of 200% or -200%, as applicable, of the performance of its underlying index as noted in the table below.

The Philippine Stock Exchange closed on March 17, 2020, which modestly complicates the already-miserable lives of EM managers who are torn between the best valuations in a generation and terrified investors. The Kuwaiti national stock exchange also closed, but for only three days: 12-15 March 2020.

Briefly Noted . . .

About half of all of the substantive 497 filings with the SEC this month report urgent changes to the funds’ “primary investment risks” prospectus text. The risk disclosure du jour is “market disruption risk.” Several fund firms hurried filed “bad s**t can happen” amendments to their “Principal Risks” disclosure. BBH, for example, warns us

Natural disasters, the spread of infectious illness and other public health emergencies, recession, terrorism and other unforeseeable events may lead to increased market volatility and may have adverse effects on world economies and markets generally.

Blackstone classes up their disclosure by designating it as “Force Majeure Risk.”

The Master Fund may be affected by force majeure events (e.g., acts of God, fire, flood, earthquakes, outbreaks of an infectious disease, epidemic/pandemic or any other serious public health concern, war, terrorism, nationalization of industry and labor strikes).

It’s intriguing that God, viruses and labor unions all represent the same sort of risk.

Domini, contrarily, offers the new risk up as “Recent Events.” There’s an echo, there, of “the recent unpleasantness,” a Southern euphemism for the Civil War which can be dated to around 1868. Both rely on a rhetorical figure called “meiosis,” an intentional understatement of the size or significance of a thing (says the guy with the doctorate in rhetoric).

Blackstone Real Estate Income Fund also added a whole series of “hey, remember how we all pretended that illiquid investments were actually things with reliable daily liquidity” disclosures.

The most bewildering, maddening risk disclosure comes from xTrackers who now disclose the thing that mayhap should have been highlighted from Day One for every index investor: “Indexing Risk.”

Because an index fund is designed to maintain a high level of exposure to its Underlying Index at all times, it will not take any steps to invest defensively or otherwise reduce the risk of loss during market downturns.

It’s Splitsville, man!

On March 25, 2020, the Catalyst MLP & Infrastructure Fund (MLXAX) underwent a 5:1 reverse share split. Just guessing here, but the fund’s 20% annualized losses over the past five years probably drove the NAV to embarrassingly low levels ($1.74/share on the day before the reverse split though it had been as low as $1.43), which the 5:1 split was designed to remedy. It doesn’t so much address the 54% YTD decline (through 3/27/2020), which might actually be the more pressing issue.

On March 30, 2020, InfraCap MLP ETF (AMZA) pulled off a 10:1 reverse-split to deal with the fact that their NAV has been as low as $0.72 this month. AMZA is down 76% YTD.

And the Direxion Daily Latin America Bull 3X Shares (LBJ)? 20:1 reverse split, down 90% YTD.

Finally, on March 6, 2020, the Steward Funds had reverse splits ranging from 2:1 to 10:1.

SMALL WINS FOR INVESTORS

Effective 17 March 2020, Artisan International Value Fund and Artisan Small Cap Fund reopened to new investors.

On March 26, Fidelity announced that Fidelity Small Cap Growth (FCPGX) and Fidelity Small Cap Discovery (FSCRX) will reopen on April 1 to new investors.

Forester Discovery Fund (INTLX) reduced its administrative fee from 0.35% of the Fund’s daily average net assets to 0.15%.

All Grandeur Peak Funds have reopened to new investors. Mark Siddoway, their head of client relations, writes:

We continue to be encouraged by the limited redemptions by our shareholders as we experience increasing volatility in the markets, and believe it is in the best interest of both shareholders and portfolio managers to have the funds open at this time. Opening the Funds to new shareholders may provide an opportunity to make investment decisions in today’s depressed markets that we believe will benefit shareholders for the long term.

Grandeur Peak Emerging Markets Opportunities Fund GPEOX/GPEIX Open

Grandeur Peak Global Contrarian Fund GPGCX Open

Grandeur Peak Global Micro Cap GPMCX Open*

Grandeur Peak Global Opportunities Fund GPGOX/GPGIX Open

Grandeur Peak Global Reach Fund GPROX/GPRIX Open

Grandeur Peak Global Stalwarts Fund GGSOX/GGSXY Open

Grandeur Peak International Stalwarts Fund GPIOX/GPIIX Open

Grandeur Peak International Stalwarts Fund GISOX/GISYX Open

Grandeur Peak US Stalwarts Fund GUSYX Open

In the event the market has an unexpected rebound or the flows into the funds exceed our target asset levels, we are prepared to return back to a Soft Closed status to maintain a relatively small asset base and preserve the nimbleness for our research team.

BNY Mellon Municipal Opportunities Fund (MOTIX) reopened to new and existing investors on March 11, 2020. It’s a five-star fund and a 10-year Great Owl.

Effective March 31, 2020, the Vaughan Nelson Small Cap Value Fund (NEFJX) began accepting orders for the purchase of shares from new investors.

All Wasatch funds, except the International Opportunities Fund, are now open to investors. The International Opportunities Fund is sort of “soft open” in the sense that it’s accepting new accounts as long as they’re directly purchased from Wasatch. Existing shareholders can, of course, continue to invest in the fund.

CLOSINGS (and related inconveniences)

Vanguard Managed Payout Fund (VPGDX) has eliminated its monthly payout, effective May 21, 2020. The last scheduled payout is May 15, 2020. Kinda makes you wonder about the significance of the word “Payout” in the fund’s name, doesn’t it? Made Vanguard wonder, too. The fund’s name will soon change to Managed Allocation. In the interim, Dan Wiener reports that “Vanguard stopped charging shareholders the cost of running the fund… Why? No disclosures as far as I can tell, they just did it.”

OLD WINE, NEW BOTTLES

On or about May 1, 2020, Aristotle/Saul Global Opportunities Fund (ARSOX) becomes Aristotle/Saul Global Equity Fund. As far as I can tell, the current version of the fund is equities with the possibility of some fixed income; the new version will be equities.

ASG Dynamic Allocation Fund (DAAFX) became AlphaSimplex Multi-Asset Fund on April 30, 2020.

Centaur no more. I’ve always been uncomfortable about the ability of the new owners of the Centaur Total Return Fund (TILDX) to use the fund’s name and ticker. No disrespect to them, but the “new” Centaur Fund was a complete rebuild of the predecessor: new team, new objective, new (and evolving) strategy. The fund has now changed its name DCM/INNOVA High Dividend Income Innovation Fund (TILDX). While Morningstar still assigns it a star rating and a top 1% 15-year record, the fund is down to $7 million in assets and trails 98% of its Morningstar peers YTD.

In connection with Federated Investors’ corporate name change to Federated Hermes, every Federated Fund will add “Hermes” to their names on June 26, 2020. No other change is attendant to that.

Holmes Macro Trends Fund (MEGAX) will get a new name, strategy, and benchmark. Don’t know when. Don’t know what. The one clue, it will “focus on luxury goods-related investments.” Given the ticker, perhaps mansions and mega-yachts?

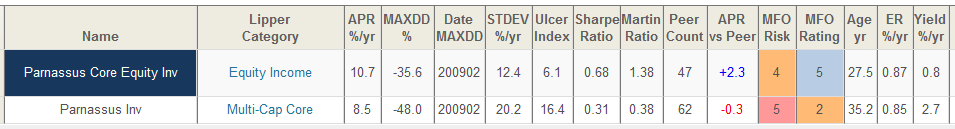

Effective as of May 1, 2020, the name of the Parnassus Fund (PARNX) will change to the Parnassus Mid Cap Growth Fund. Folks on the discussion board speculate that the move is designed to help create clearer distinctions between PARNX and siblings such as Parnassus Core Equity (PRBLX). The correlation between the two funds is 0.91, which Core Equity having a far stronger 25 year (yep, we took the long view) record:

That said, with only 13% of the current portfolio in mid-cap growth stocks, considerable restructuring of the portfolio is likely.

OFF TO THE DUSTBIN OF HISTORY

Acuitas International Small Cap Fund will be liquidated on May 11, 2020.

AdvisorShares Cornerstone Small Cap ETF (SCAP) will be liquidated on April 16, 2020.

On March 3, 2020, the shareholders of the ALPS/WMC Research Value Fund approved merging the fund into the Heartland Mid Cap Value Fund (HRMDX). The Reorganization closed on March 16, 2020.

Two waves of liquidations are coming to American Beacon. A bunch of quant funds, American Beacon Alpha Quant Core Fund, American Beacon Alpha Quant Dividend Fund, American Beacon Alpha Quant Quality Fund, and American Beacon Alpha Quant Value Fund vanish on or about April 30, 2020.

American Beacon Crescent Short Duration High Income Fund and the American Beacon GLG Total Return Fund had been scheduled to disappear on the same date, but the dissolution has now been postponed to June 30, 2020. My guess would be that the managers encountered liquidity challenges and were hopeful of completing the sale of portfolio assets in calmer markets.

The fate of American Beacon Acadian Emerging Markets Managed Volatility Fund is uncertain. It was also scheduled to dissolve on April 30 and might, or might not, be covered by the extension.

AMG River Road Dividend All Cap Value Fund II will merge into AMG River Road Dividend All Cap Value Fund on or about April 27, 2020.

AMG Managers Fairpointe ESG Equity Fund (ARDEX) is expected to disappear on or about April 29, 2020.

Direxion Daily Total Bond Market Bear 1X Shares (SAGG), Direxion Daily MSCI European Financials Bull 2X Shares (EUFL), Direxion Daily MSCI Developed Markets Bear 3X Shares (DPK), Direxion Daily Mid Cap Bear 3X Shares (MIDZ), Direxion Daily Regional Banks Bear 3X Shares (WDRW), Direxion Daily Natural Gas Related Bull 3X Shares (GASL), Direxion Daily Natural Gas Related Bear 3X Shares (GASX), and Direxion Daily Russia Bear 3X Shares (RUSS) no longer trade and will be liquidated on April 6, 2020.

Fiera Capital Equity Allocation Fund (FCEAX) gave its two-week notice (really: 3/12/20) and was liquidated on March 31, 2020. The first was 16 months old and, for whatever reason, neither of its managers had chosen to invest in it.

Harbor Small Cap Growth Opportunities Fund (HISOX) merges into the Harbor Small Cap Growth Fund (the “Acquiring Fund”) on May 15, 2020. The filing assures us that “shareholder interests will not be diluted.”

Highland Opportunistic Credit Fund (HNRAX) will fold its tent on June 16, 2020.

HSBC Frontier Markets Fund will be liquidated on or before April 24, 2020.

Janus Henderson Diversified Alternatives Fund (JDDAX) will be liquidated on June 12, 2020.

Legg Mason Emerging Markets Low Volatility High Dividend ETF (LVHE) will be liquidated about May 22, 2020.

Neuberger Berman Multi-Asset Income Fund (NANAX) hits the scrapheap on April 28, 2020.

RMB Mendon Financial Long/Short Fund (RMBFX) merges into the RMB Mendon Financial Services Fund (RMBKX) on June 12, 2020. It’s rare for an adviser to explain, except in uselessly vague terms, why they’ve chosen to kill a fund. RMBFX is an exception, but the decision to merge it out of existence comes hard on the heels of a change in the fund’s “primary investment risk” language:

As a result of recent market disruptions arising from the rapid and escalating spread of COVID-19, the Fund has experienced significant losses and a decrease in assets. The relatively long positioning of the portfolio coupled with a lack of success in hedging its concentration in smaller cap financials during this severe market drawdown resulted in market losses. As a result, Mendon … has repositioned the portfolio, which includes maintaining a high level of cash and liquidating derivatives and short positions. As a result, the Fund is in a temporary defensive posture as permitted under the Fund’s prospectus. Mendon believes this step will allow the Fund to protect value for shareholders.

“Significant losses” would be 63% YTD (as of 3/27) while its Morningstar long/short peers are down by 13%.

The RMB Dividend Growth Fund (RMBDX) will be liquidated on April 28, 2020.

RVX Emerging Markets Equity Fund (RVEMX), owing to small size and unmanageable economics, was liquidated on March 30, 2020.

Schroder Total Return Fixed Income Fund (SSBIX) will merge into Schroder Core Bond Fund (SCBRX) “during the second quarter of 2020.”

Strategy Shares US Market Rotation Strategy ETF (HUSE) has a date, a date with cessation: April 20, 2020.

T. Rowe Price Institutional Africa & Middle East Fund (TRIAX) has been closed and will be liquidated on May 8, 2020. To be clear: this is not the T. Rowe Price Africa and Middle East Fund (TRAMX), which remains open though tiny.

Vanguard Capital Value Fund (VCVLX) will be reorganized into Vanguard Windsor Fund (VWINX) on July 24, 2020.

Voya Global Equity Dividend Fund is slated to merge into Voya Global High Dividend Low Volatility Fund in mid-September, 2020.

Westwood Flexible Income (WFLEX) will be liquidated on April 27, 2020. It’s a $5M fund led by a very good manager who had one cosmically bad month: YTD through March 26, 2020, the fund lost 38% despite having just 18% in common stock. The majority of the portfolio was in preferred shares, often held through ETFs. The manager notes “our [exposure in] energy, transportation (LNG Shippers) and financials crushed us. It wasn’t just the magnitude of the price correction, but also the swiftness of it. We were taking steps to de-risk and re-position but a lot of things we owned in preferred securities and high yield gapped down.”