The scariest line of the election season appeared on the front page of The Wall Street Journal:

The U.S. stock boom has its roots in tactics that fund managers, small savers and Robinhood traders alike have applied over the past decade: Don’t hide from markets by hoarding cash.

The Dow Jones Industrial Average closed above 30000 on Tuesday for the first time, extending an eight-month rebound that has taken many analysts by surprise … The run has put the Dow up 62% from its March low, when the U.S. Federal Reserve ended a panic that wiped out trillions of dollars in investments by outlining a plan to counter the pandemic’s economic stress.

The market appears to be in a self-perpetuating upward spiral, defying the pandemic and accompanying economic woes. (“Behind Dow 30000: A Self-Perpetuating Upward Spiral,” Wall Street Journal, 11/25/2020, pg 1).

That sounds only one step removed from the “permanent high plateau” that Yale economist Irving Fischer knew that US stocks have reached … two weeks before the stock market crash of 1929.

The fact that we’ve been driven there by “small savers and Robinhood traders alike” is not a source of comfort for us and shouldn’t be for them. Their enthusiasm for the market is substantial. James Mackintosh reports that since the start of October, there’s been a complete reversal of bullish and bearish sentiment.

At the start of October 43% of those taking part in the self-selecting AAII survey were bearish and 26% bullish. Now, 47% are bullish and 27% bearish. Investor newsletters are reflecting the zeitgeist with Investor Intelligence’s long-running survey finding almost two-thirds are bullish, the most since January 2018 – just before volatility exploded and stocks fell sharply. (“Market expects everything will be super,” 12/1/2020)

Those enthused souls are embracing financial engineering to manage their returns. The folks at Knowledge Leaders Capital note that short interest is at a 15 year low and “Activity in the options market is just downright euphoric in our view and a huge source of potential dislocation. Call volumes are 4x normal, while the put/call ratio is at multi-year lows” (“Extreme Euphoria … What’s an Investor to Do?” 12/2020).

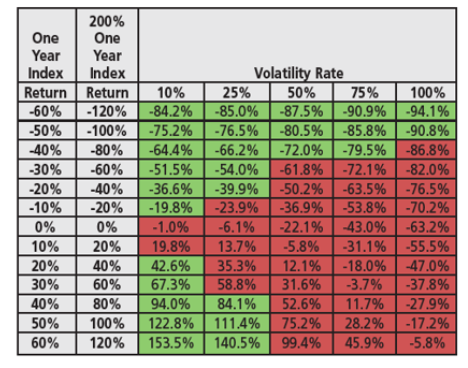

Likewise, Morningstar reports near-record inflows into leveraged ETFs and funds: vehicles that promise 200% to 300% of the market’s daily returns. Such funds have attracted over $16 billion this year. One wonders how many of those investors have actually thought about the “principal risks” enumerated in their prospectuses? Here, for example, is the chart of potential gains and losses one might expect from holding any Direxion 2X Bull Fund for a year under a variety of market conditions.

You might think “hmmm, the market goes up 20% so I go up 40%.” Not so. Depending on the degree of market volatility, you might book anything from a gain of 42.6% to a loss of 47%. Similarly, a 20% market decline could translate into losses ranging from 36.6% to 76.5%.

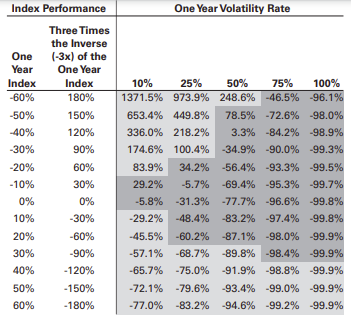

That effect is dramatically compounded with any of the 80 or so ETFs that have 300% leveraged positions. ProShares warns, “The Fund will lose money if the Index’s performance is flat over time, and the Fund can lose money regardless of the performance of the Index, as a result of daily rebalancing, the Index’s volatility, compounding of each day’s return and other factors.” How much money could you possibly lose if your index was flat for the year? With a 3X fund, effectively 100% of your money.

You might note the dismaying frequency with which losses of 90% or more appear regardless of whether the market is going up or down over time. The key is the compounding effects of losses triggered by market volatility.

And that’s where a bunch of the bored young investors seem to have flocked.

And, oh yeah … Biden. China. Covid. Gridlock. Housing bubble. Got it.

What if you not a wildly overconfident, bored young investor?

A modest list of possibilities to guide your year-end portfolio refresh.

-

Allow your equity managers to hold cash

The simplest possible hedge against overvalued markets and high equity volatility isn’t the use of complex hedges or shorts. It’s a simple willingness to wait until reasonable values reappear, which often occurs when markets are crashing and panicked people are willing to sell at any price. (At any price? Really? Yes, in sharp corrections we see closed-end funds selling at 40% discounts to the value of their portfolios.)

Folks who do that well include funds such as AMG Yacktman Focused, AMG Yacktman, FPA Queens Road Small Cap Value, Royce Special Equity, Intrepid Endurance, Pinnacle Value, Frank Value, Marshfield Concentrated Opportunity and Provident Trust, many of which we’ve profiled.

In my own portfolio, Palm Valley Capital Fund, up 18% YTD, fills that niche.

-

If you don’t like cash, insist on quality.

As we note in the month’s profile of Rondure Overseas, high quality stocks participate in but don’t lead the frothiest phases of a bull market. They make their money by steadily compounding year and after, losing less in down markets which more than makes up for modest lags in the late phases of bull markets.

Rondure Overseas, Seven Canyons World Innovators, Harbor Global Leaders, KL Allocation and Osterweis Emerging Opportunities are all profiled funds with a commitment to investing in the world’s top companies.

-

Keep skating to where the puck is going to be, not to where it is.

The market drivers are a handful of large, fast-growing beneficiaries of the Covid-on / work-from-home economy. You should consider not only the astronomic valuations that many of those firms hold and their stranglehold on the performance of passive index funds, but also who’s going to benefit in a world … where people leave their homes, employment picks up, climate stabilization becomes a multi-trillion dollar investment and small countries are no longer crushed by the dual burdens of pandemic and being cut off from the financial flows out of the developed world.

A surprising number of serious investors continue to push for larger international, and particularly emerging markets, allocations. Here are some of their arguments.

T. Rowe Price: “Our Asset Allocation Committee is overweight emerging markets stocks, as risks—such as the coronavirus pandemic and unresolved trade issues — are more than fairly priced-in at the moment. We are entering extreme valuation territory, where emerging markets stocks have become quite attractive, all else being equal, by historical standards. Also, a weaker U.S. dollar should favor emerging markets.” Why Our Asset Allocation Committee Favors Emerging Markets Stocks

Jonathan Wheatley. FT.com, 11/24/2020: “This month’s breakthroughs in the hunt for an effective Covid-19 vaccine have fed optimism over the global economy, rekindling interest in some riskier investments. Emerging market currencies and stocks have been big winners, rallying hard for the past two weeks, while bonds have also made up lost ground. The broad-based rally took MSCI’s benchmark EM stock index into positive territory for the year, up more than 50 per cent since its March low. And as Wall Street sets out its big ideas for 2021, EM is top of the list.” Vaccine hopes set off rush for emerging markets

Steve Johnson, FT.com, 11/1/2020: “Big investors might be reluctant to publicly express their forecasts for Tuesday’s poll, but the prevailing view is that a Joe Biden victory would be good for most developing countries and offer opportunities that have not yet been priced in. “Emerging markets are going to do better out of a Biden presidency,” said Charles Robertson, chief economist at Renaissance Capital, an EM investment bank.

Historically, the valuation of emerging market assets has often been driven by the strength of the US dollar. When the greenback is weak, investors typically pull money out of the US and put it into areas such as EMs, where the returns of local currency-denominated equities and bonds look better in dollar terms. “EM is a proxy for global growth and a Biden win means more global growth and trade,” he added. What the US election could mean for EM investing

Craig Mellow, Barrons, 11/20/2020: “Rotation from growth into value stocks is the talk of the financial world, as light starts to gleam at the end of the Covid-19 tunnel. Emerging markets may be following the trend. The MSCI Emerging Markets Value Index jumped 5% in the week after Nov. 9, when Pfizer unveiled encouraging vaccine results. “That rally can continue for the next several quarters,” says Louis Lau, director of investments at Brandes Investment Partners.

The arithmetic for a value catch-up is compelling enough, after a 2020 rally driven by a handful of Chinese tech champions. The emerging markets value asset class trades at a 60% price/earnings discount to growth, says Alejo Czerwonko, chief investment officer for Americas emerging markets at UBS Global Wealth Management.” It May Be Time to Invest in Emerging Market Value Stocks. Here’s Where to Look.

My own exposure to emerging markets comes from Grandeur Peaks Emerging Markets Opportunities, Seafarer Overseas Growth & Income, and T. Rowe Price Emerging Discovery, which have first-rate managers and reflect the spectrum of styles from small growth to large value. We’ve also profiled Driehaus Emerging Markets Small Cap Growth, Fidelity Total Emerging Markets (a stock/bond hybrid) and Touchstone Sands Capital Emerging Markets Growth. Given our review of Rondure Overseas, Rondure New World would have strong appeal for quality-conscious long-term investors.

-

Do Good while you’re doing well.

Sustainable investing has dropped way down on the to-do list for many Covid-shocked investors, professionals and otherwise. That simple distraction does not change the increasingly powerful case for creating a sustainability tilt in your portfolio. As the number of impact-oriented funds rise and spread across all asset classes, your opportunity set is rich.

I’ve been more than satisfied with my investment in Brown Advisory Sustainable Growth, up 35% YTD, which we profiled last year. In the months ahead, we’ll add to our collection of profiled funds by looking at top tier funds that combine a commitment to sustainability with specialties in quality stocks, emerging markets and income-oriented funds.

Bottom line

The markets might crash sometime in the next three to six months. Don’t know. Alternately, the markets might correct and rotate, with former leaders falling sharply and unloved sectors surging. Don’t know. The key for all of us remains this: take no more risk than you need to and diversify your exposure so that the realization of outsized risks in one area does not do irreparable harm to your entire portfolio.