I won’t grow up,

I don’t want to wear a tie.

Or a serious expression

In the middle of July.

And if it means I must prepare

To shoulder burdens with a worried air,

I’ll never grow up, never grow up, never grow up

Not me,

Not I,

Not me!

Several readers have asked that I expand on a comment I made about aging a few months ago. This is a hard article for me to write because it means looking at investing from a different perspective. The typical American works 30 to 50 years before retiring and must save enough to last another 20 to 30 years, or more. This means saving diligently and investing wisely while working, and managing expenses and risk during retirement.

This article is set up in the following sections, so readers may skip to sections that interest them. Key points are added at the beginning of each section for those who want to skip ahead.

- Section 1 of this article is an introduction to preparedness for retirement

- Section 2 covers the investment environment to determine allocations

- Section 3 covers the dilemma of investing with high valuations and low-interest rates

- Section 4 looks at simplifying the portfolio as a partial solution to aging.

- Section 5 covers the role of financial advisors and managed accounts

1. Introduction

Key Point: As we age, we will need to prepare for the eventuality that we will need help managing finances. We need to leave our finances in order for our loved ones in case of unplanned circumstances.

I am grateful to the gentleman living in Florida who introduced me to Mutual Fund Observer in 2018. He was retired and about six years older than I. His words of wisdom stuck in my mind, and I pass them along.

“So, just like Bear Markets (you know you will get them) … the same is true for Hurricanes (you know you will get them) … so it’s good to take precautions and have a defensive strategy…

IMHO, any self-managed retirement financial plan should consider normal and above normal cognitive decline/impairment to handle or modify a portfolio at 5-year intervals as the retiree and spouse age. Complex portfolios and systems may be harder for the retiree or their spouse to handle as they age.

In other words, what looks to be working at age 65 may not be working the best at age 75. There are many academic studies in this area as well as articles on sites such as Seeking Alpha:

Defending Your Retirement Financial Plan from Cognitive Decline [by ISTJ Investor]”

I found other articles by ISTJ Investor and began following him on Seeking Alpha. An insightful article on retirement planning, Creating Your Retirement Financial Plan, suggests putting your goals in writing with some well thought out suggestions. I plan on retiring within a couple of years and have printed a copy for when I sit down with my financial advisor. The advice is pertinent to those in their 40’s but becomes more so immediately before retirement. ISTJ Investor addresses one question that I struggle with, “Should you consolidate accounts to simplify and lower fees or maintain accounts at different institutions to diversify?” I choose the latter to protect against potential poor performance or changes at an investment company.

I read an early edition of Retire Secure!: A Guide To Getting The Most Out Of What You’ve Got by James Lange about a decade ago. I was fortunate to implement strategies to be better prepared for retirement, such as preparing lifelong budgets and changing to a Roth 401k instead of a traditional Roth.

When I began working overseas and prepared my finances for long periods away from home, Charles Schwab also had some words of wisdom about family finances that stuck with me for nearly two decades.

“Put bluntly, do all you can to ‘teach your wife to be a widow’-or, if you, as the wife, are in charge of the finances, ‘teach your husband to be a widower’. Take the saying metaphorically: Don’t let yourself, or anyone in your family, be indispensable in terms of understanding family finances.”

There have been several enlightening moments that have impacted my wife’s and my philosophy for savings. Best laid plans are often interrupted through circumstances beyond our control. Retirement strategies should address risk and be simple. Financial advisors should be consulted and managed accounts evaluated.

2. Investing Environment and Strategy

Key Point: High valuations and low-interest rates should be factored into expectations for lower returns over the next decades.

For the 20 year period from 1962 to 1981, large-cap stocks returned 2.8% without dividends or 6.7% with dividends re-invested. (Source: S&P 500 Return Calculator, with Dividend Reinvestment) Dividends averaged 3.9%. Adjusted for inflation, stocks returned 0.8% with dividends re-invested. For the 18 year period from 1982 to 1999, stocks returned 15.0% without dividends and 18.6% with dividends. Dividends averaged 3.1%. For the 13 year period from 2000 to 2012, the stock market returned -0.2% without dividends or 1.8% with dividends or -0.6% when adjusted for inflation with dividends. Dividends averaged 1.9%. There are several key takeaways from these points. First, there are long periods where stocks have low returns. Secondly, dividends have been declining for decades and will play a smaller role in portfolio income and protection. Thirdly, high valuations are a reliable indication of lower returns in the future. These are realities that investors face today.

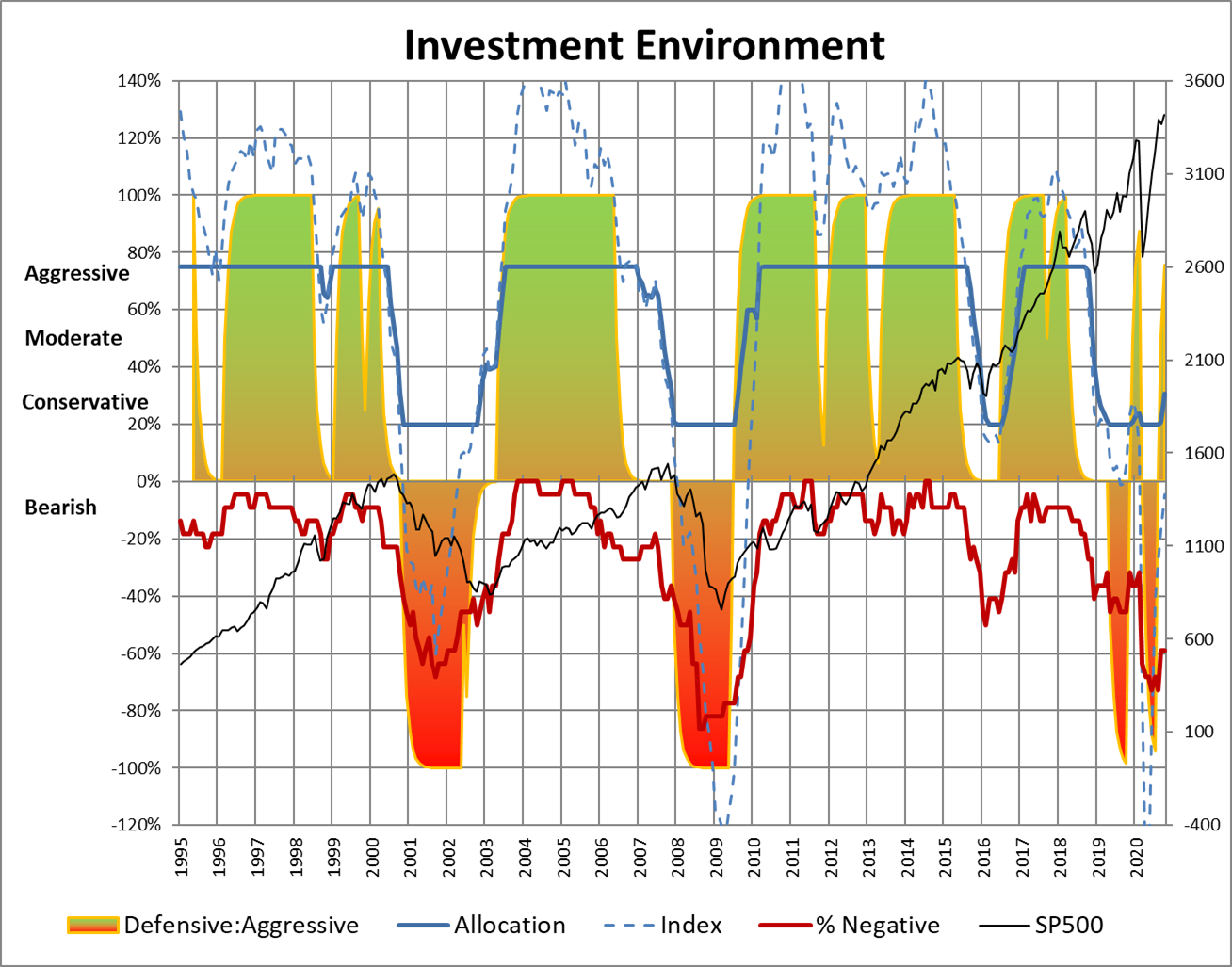

Figure #1 shows the investment model I built based on over 100 economic, financial, monetary policy, and risk data series mostly available at the St. Louis federal Reserve. The model takes into account valuations, dividends, interest rates, and stock technical indicators. These indicators are composited into a single indicator (dashed blue line) that measures the investment environment. The investment environment is poor. The government is injecting massive stimulus for this reason. The dark blue line is my allocation to stocks based on the main indicator and capped using Benjamin Graham’s guidelines of never having more than 75% in stocks nor less than 25%. The model has advocated a low allocation to stocks partly due to falling interest rates and rising bond prices. The dark red line is the percent of indicators that are negative, giving a qualitative feel of the risk in the environment. The shaded area is a rules-based momentum of the main indicator indicating potential time periods where an investor may want to be more or less aggressive. It is not intended as a short term timing tool.

Figure #1: Investment Environment

In my opinion, current high stock prices price in high optimism for economic recovery and benefits from a stimulus. Jeffrey Kleintop at Charles Schwab summarizes my concerns for 2021 in Top Five Global Investment Risks In 2021, which I paraphrase below:

- Slower than anticipated vaccine rollout

- Continued geopolitical and trade tensions

- Negative reaction to stimulus tapering

- Zombie companies with insufficient cash flow to covert debt payments

- Weak dollar with interest rate shock and inflation

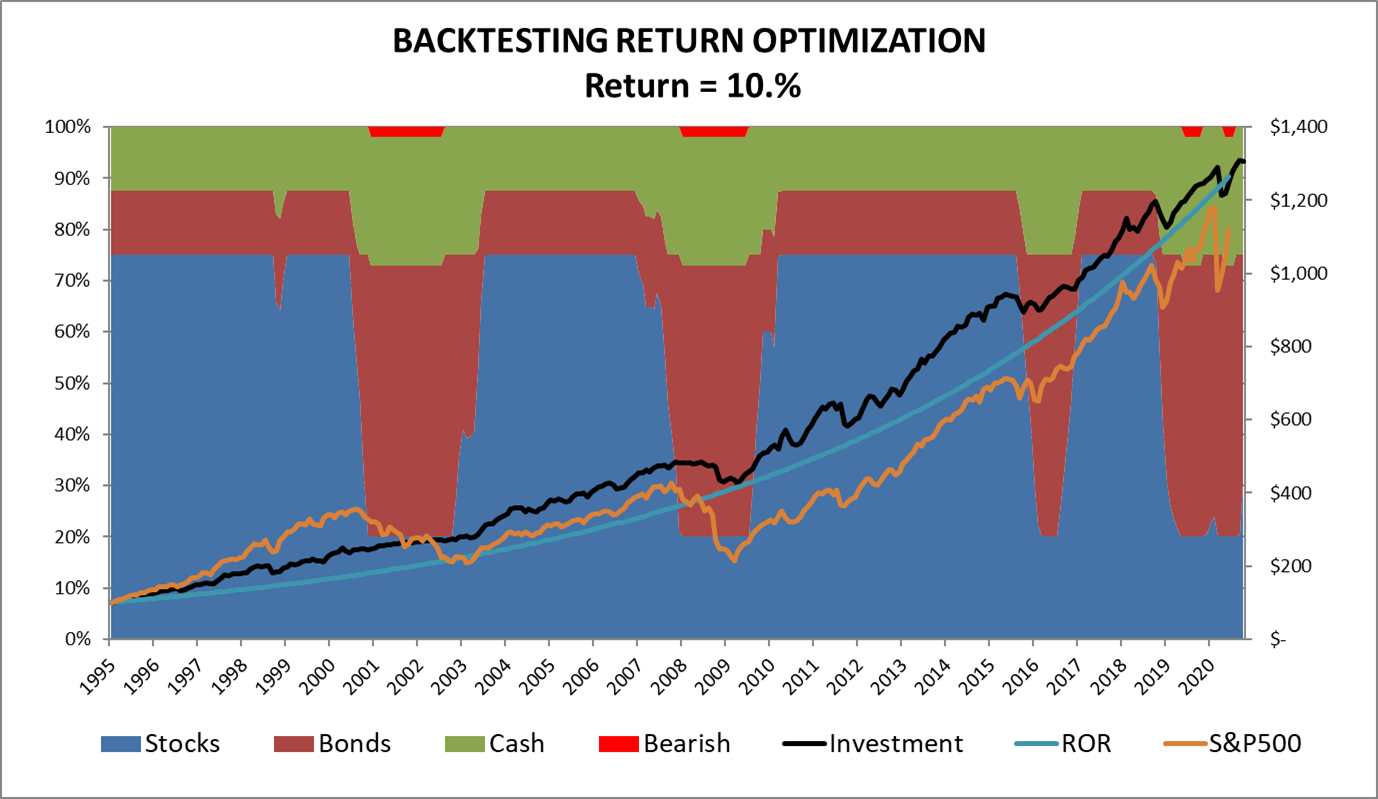

Figure #2 is a simpler view of the same investment model. It shows the value of $1 invested in 1995 following this method (blue line) compared to $1 invested in the S&P 500 with dividends re-invested (orange line). The strategy of the investment philosophy is that lower returns are required when drawdowns are minimized. While this strategy is working now, as I age, I need to simplify and put things on auto-pilot.

Figure #2: Investment Model Allocations

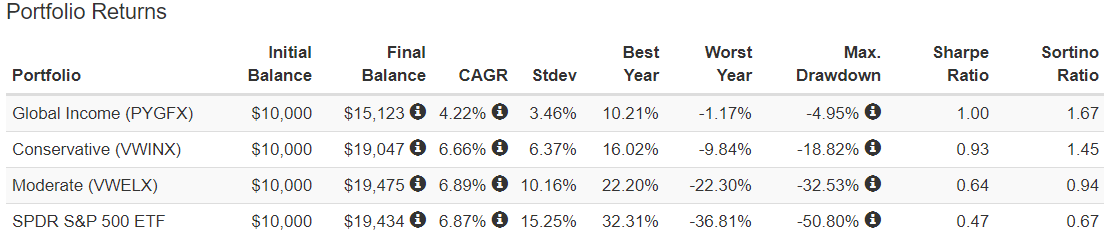

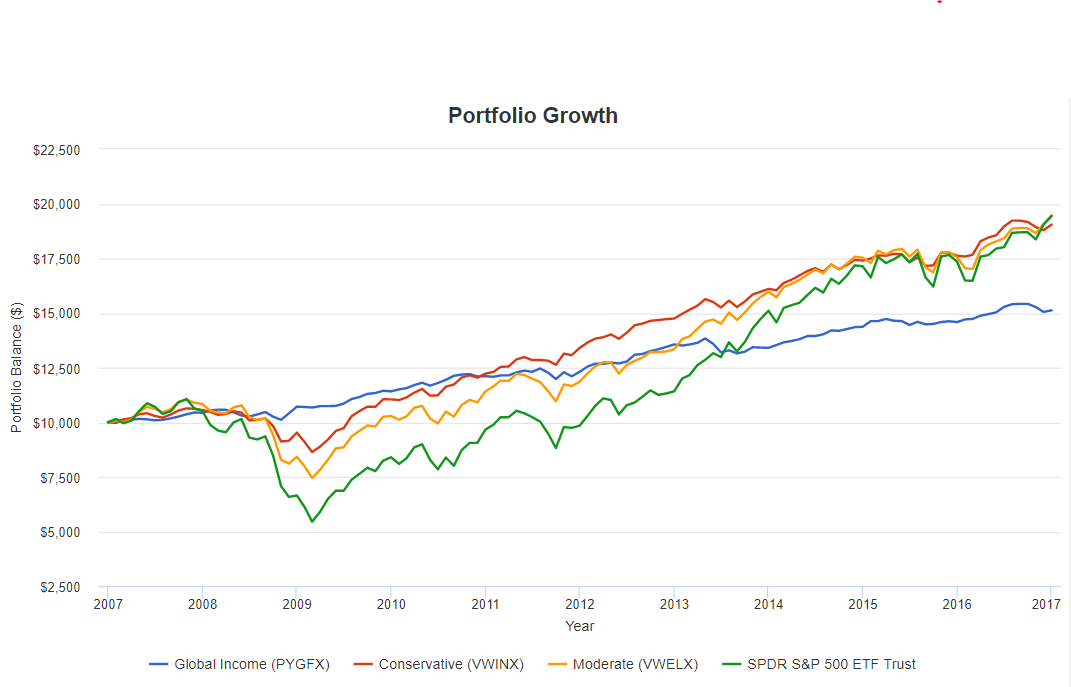

This concept is illustrated using Portfolio Visualizer (link) with Payden Global Fixed Income Fund (PYGFX), the conservative Vanguard Wellesley Income Fund (VWINX), the moderate Vanguard Wellington Fund (VWELX) compared to the S&P 500. It took a decade for the returns of the S&P 500 to catch up to the more conservative funds. This is a critical point for retirees living on investment income.

Table #1: Comparison of Risk Managed Funds Following a Major Bear Market

Figure #3: Performance of Asset Classes Following Major Bear Markets.

3. The Dilemma

Key Point: Diversification and managing risk take on higher importance in the coming decades.

The Investment Model does not know about COVID-19, rising cases and deaths, vaccines, and increasing lockdowns. That is where investors have to use their interpretations of the environment and risks. The current investment environment is high valuations, high deficits and debts, aging demographics, high unemployment, low dividends, and low-interest rates in a pandemic that I expect will gradually get better over the next 12 months. This forms my belief that the next decade or two will likely see higher volatility and lower returns. Uncertainties exist longer-term over inflation and the value of the dollar.

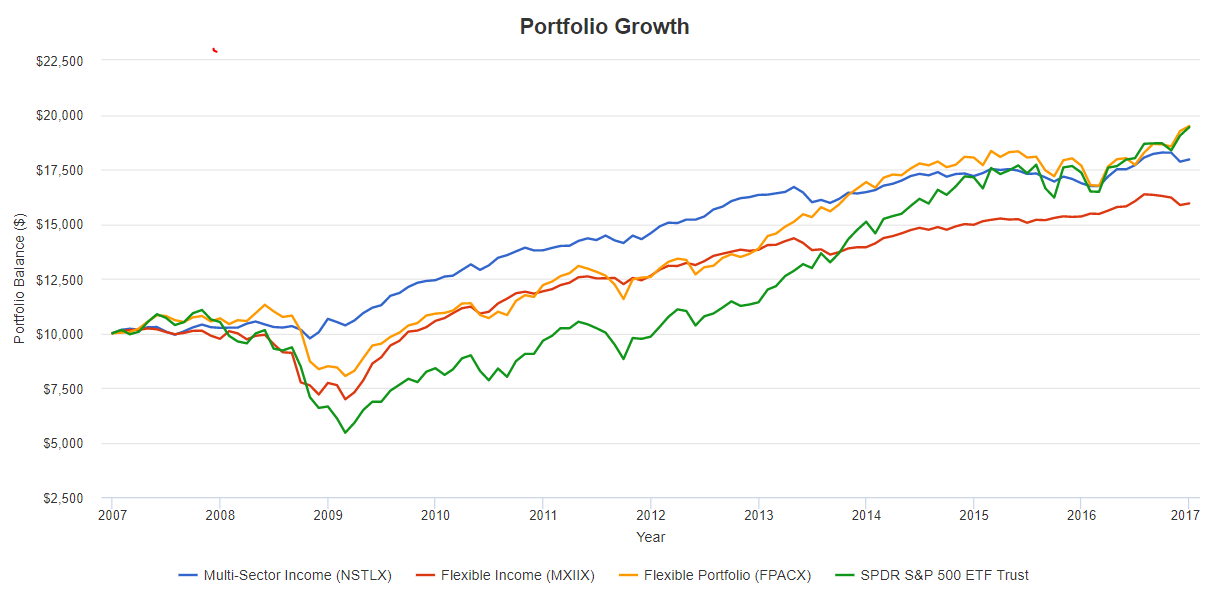

Figure #4 shows the same time period using a multi-sector income fund, flexible income, and portfolio funds as possible supplements to a traditional 60% stock/40% bond portfolio.

Figure #4: Performance of Flexible Asset Classes Following Major Bear Markets

Table #2 shows a summary of all no-load funds by category since 2007. Capital refers to the percent of assets under management. For example, of all funds extracted, only 1% of assets under management are in the Global Income category. Mixed-Asset categories are the most common, with Flexible Income, Flexible Portfolio, and Alternative Global Macro also being popular. Long Term Capital Gains (LTCG) is shown as an approximation of tax efficiency. I have broken the categories into six groups based on risk and risk-adjusted returns. For a retirement portfolio, I favor the first three groups for stability, Group 4 for income, and prefer to minimize assets held in the more aggressive group.

Table #2: Historical Performance of Fund Categories Over the Past 15 Years

| 1) Lower Risk – Higher Risk-Adjusted Returns – Higher Yield – Lower Correlation to Stocks | ||||||||

| Lipper Category | Capital % | LTCG % | APR | Martin Ratio | MAX DD % | Ulcer Index | Yld | R vs SP500 |

| Global Income | 1 | 50 | 6.8 | 3.7 | -6.6 | 1.5 | 2.1 | 0.6 |

| Abs Return Bond | 2 | 37 | 4.9 | 2.6 | -6.7 | 1.6 | 3.3 | 0.6 |

| Mxd-Ast Trgt Today | 5 | 82 | 7.7 | 3.7 | -6.8 | 1.7 | 1.9 | 0.9 |

| Multi-Sector Income | 2 | 62 | 6.9 | 3.5 | -7.6 | 1.8 | 2.9 | 0.7 |

| Alt Multi-Strategy | 1 | 64 | 4.5 | 2.2 | -6.7 | 1.9 | 2.1 | 0.7 |

| 2) Lower Risk – Moderate LTCG – Variable Risk-Adjusted Returns – Lower Yield – High Correlation to Stocks | ||||||||

| Mxd-Ast Trgt Consv | 9 | 79 | 9.0 | 3.8 | -8.6 | 2.0 | 2.7 | 0.9 |

| Absolute Return | 1 | 37 | 5.2 | 1.6 | -8.9 | 2.6 | 1.8 | 0.8 |

| 3) Moderate Risk – Moderate LTCG – Moderate Risk-Adjusted Returns – Lower Yield – High Correlation to Stocks | ||||||||

| Mxd-Ast Trgt Mod | 7 | 60 | 10.1 | 2.7 | -12.4 | 3.3 | 1.7 | 1.0 |

| 4) Moderate Risk – Moderately High LTCG – Lower Risk-Adjusted Returns – Higher Yield | ||||||||

| Alt Global Macro | 4 | 78 | 4.9 | 1.0 | -12.7 | 3.8 | 3.7 | 0.8 |

| Flexible Income | 8 | 76 | 7.0 | 1.5 | -15.2 | 3.8 | 5.0 | 0.8 |

| 5) Diverse Group – Moderate LTCG – Moderate Yields – High Correlation to Stocks | ||||||||

| Flexible Portfolio | 11 | 52 | 7.1 | 1.8 | -13.9 | 4.0 | 2.6 | 0.9 |

| 6) Aggressive – Moderate Risk-Adjusted Returns – High LTCP – Moderate Yield – High Correlation to Stocks | ||||||||

| Mxd-Ast Trgt Growth | 25 | 97 | 10.8 | 2.4 | -14.5 | 4.1 | 1.9 | 1.0 |

| Equity Income | 23 | 87 | 13.8 | 2.3 | -19.0 | 5.5 | 1.9 | 1.0 |

| S&P 500 Index | 14.5 | 2.3 | -19.5 | 5.7 | 1.6 | 1.0 | ||

Source: Created by the Author Using Mutual Fund Observer

4. Simplifying the Portfolio

Key Point: We won’t all be as fortunate as Warren Buffet in health and managing finances and need to prepare for diverse possibilities.

At 65, I prefer to manage my own portfolios but consult with a Financial Advisor once a year. I recognize the need to simplify and set things up in case my wife needs to manage investments. Having a financial advisor can add several thousand dollars of expenses per million dollars of assets. Simplifying portfolios is a step in the direction of more reliance on financial advisors and managed accounts.

Each month, I use Mutual Fund Observer to track the performance of about 500 funds based on Risk, Risk-Adjusted Performance, Momentum, Yield, and Quality. This month, I separated the 100 funds that I will focus on for retirement. These funds are ranked and put into buckets, which are shown below in order of preference. Funds are ranked based on historical performance, but short-term metrics are shown to catch the impact of low-interest rates and trends. Flow refers to money flows into or out of the fund as a percentage of assets. SMA10 is the ten-month moving average, showing whether funds are at the bottom of a trend or toward the top.

Bucket #2 is for funds that should be moderately safe and that investors may need to withdraw in two or more years. As shown previously, the Vanguard Wellesley Income Fund (VWINX, VWIAX) has outperformed the S&P 500 for periods lasting more than a decade, as I expect it to do during the coming decade.

Table #3: Retirement Bucket 2 Funds

| Bucket #2 | Three Month | ||||||

| Symbol | Name | Lynn’s Rank | Rtn | Trend | Flow | Yield | SMA10 |

| BACPX | BlackRock 20/80 Trgt Alloc | 89 | 2.6 | 2.4 | 4.2 | 2.0 | 1.5 |

| AOK | BlackRock Core Cons Alloc | 86 | 2.2 | 2.5 | 2.0 | 2.2 | 0.7 |

| FIKFX | Fidelity Freedom Inc | 83 | 1.6 | 1.7 | 6.7 | 1.4 | 2.2 |

| VWIAX | Vanguard Wellesley Inc | 73 | 3.7 | 3.3 | -6.7 | 2.8 | -0.5 |

| FTANX | Fidelity Asset Manager 30% | 69 | 2.9 | 2.8 | 1.7 | 1.5 | 0.9 |

| Average | 80 | 2.6 | 2.5 | 1.6 | 2.0 | 1.0 | |

Source: Created by the Author Using Mutual Fund Observer

Bucket #3 contains funds that are a little risker than those in Bucket #2. They will have higher drawdowns than those in Bucket #2 but will outperform over longer periods of time.

Table #4: Retirement Bucket 3 Funds

| Bucket #3 | Three Month | ||||||

| Symbol | Name | Lynn’s Rank | Rtn | Trend | Flow | Yield | SMA10 |

| HNDL | Strategy Shares Nasdaq 7HANDL | 100 | 2.0 | 2.9 | 44.3 | 6.6 | 1.5 |

| FMSDX | Fidelity Multi-Asset Inc | 98 | 4.3 | 4.9 | 10.7 | 3.3 | 2.2 |

| COTZX | Columbia Thermostat | 94 | 3.5 | 3.6 | 3.6 | 1.6 | 13.7 |

| ETIMX | Eventide Multi-Asset Inc | 93 | 7.0 | 4.3 | 2.6 | 2.1 | 1.9 |

| SWYDX | Schwab Target 2025 | 85 | 3.8 | 4.1 | 2.6 | 1.7 | -0.1 |

| Average | 94 | 4.1 | 4.0 | 12.8 | 3.1 | 3.8 | |

Source: Created by the Author Using Mutual Fund Observer

The Income Bucket contains safer funds with higher yields. I put High Yield (junk bonds) in Bucket #3.

Table #5: Retirement Income Bucket Funds

| Income | Three Month | ||||||

| Symbol | Name | Lynn’s Rank | Rtn | Trend | Flow | Yield | SMA10 |

| DIAL | Columbia Dvrsfd Fixed Inc Alloc | 96 | 1.6 | 1.6 | 8.3 | 2.7 | 1.7 |

| GIBIX | Guggenheim Total Rtn Bond | 92 | 2.3 | 1.5 | 2.7 | 2.5 | 6.7 |

| SWLRX | Schwab Month Inc-Max Payout | 84 | 1.7 | 1.7 | 1.2 | 2.3 | 1.2 |

| ADVNX | Advisory Research Strat Inc | 79 | 2.1 | 1.8 | 1.3 | 2.2 | 3.5 |

| AIMNX | Horizon Active Income | 75 | 1.2 | 1.4 | 1.0 | 2.2 | 1.8 |

| Average | 85 | 1.8 | 1.6 | 2.9 | 2.4 | 3.0 | |

Source: Created by the Author Using Mutual Fund Observer

For alternatives, I look for funds that manage risk and have good risk-adjusted returns.

Table #6: Retirement Alternative Bucket Funds

| Alternatives | Three Month | ||||||

| Symbol | Name | Lynn’s Rank | Rtn | Trend | Flow | Yield | SMA10 |

| CRAZX | Columbia Adaptive Risk Alloc | 90 | 1.8 | 3.6 | 0.8 | 2.5 | 0.0 |

| TMSRX | T Rowe Price Mlt-Strgy Tot Rtn | 87 | 2.4 | 1.2 | 10.8 | 2.3 | 4.1 |

| BASIX | BlackRock Strat Inc Oppor Portf | 76 | 2.7 | 1.9 | 2.0 | 2.4 | 0.0 |

| ARBIX | Absolute Conv Arbitrage | 71 | 2.0 | 1.1 | 6.2 | 0.4 | 2.5 |

| SUBFX | Carillon Reams Uncons Bond | 64 | 1.9 | 1.5 | 0.2 | 2.3 | 4.5 |

| Average | 77 | 2.2 | 1.9 | 4.0 | 2.0 | 2.2 | |

Source: Created by the Author Using Mutual Fund Observer

Global Bonds may benefit if the dollar continues to weaken.

Table #7: Retirement Global Bond Funds

| Global Bond | Three Month | ||||||

| Symbol | Name | Lynn’s Rank | Rtn | Trend | Flow | Yield | SMA10 |

| VEMBX | Vanguard Emer Markets Bond | 97 | 2.5 | 2.6 | 7.4 | 3.5 | 2.0 |

| FCDSX | Fidelity Intern Credit | 72 | 2.8 | 1.6 | 0.0 | 2.9 | 0.2 |

| PFORX | PIMCO Intern Bond (US$-Hdg) | 67 | 2.1 | 0.6 | 1.1 | 5.8 | 0.7 |

| MDWIX | BlackRock Strategic Global Bond | 65 | 1.5 | 1.3 | 6.4 | 1.4 | 2.2 |

| Average | 75 | 2.2 | 1.5 | 3.7 | 3.4 | 1.3 | |

Source: Created by the Author Using Mutual Fund Observer

Under favorable conditions, I may invest in Bucket #4 funds, which contain S&P 500 funds.

Table #8: Retirement Bucket 4 Funds

| Bucket #4 | Three Month | ||||||

| Symbol | Name | Lynn’s Rank | Rtn | Trend | Flow | Yield | SMA10 |

| DIVO | Amplify CWP Enh Div Income | 99 | 5.3 | 5.1 | 18.6 | 4.6 | -1.7 |

| QUAL | BlackRock USA Qual Fact | 95 | 4.9 | 6.3 | 15.4 | 1.5 | -1.4 |

| SPY | State Street SPDR S&P 500 | 91 | 3.9 | 6.0 | 4.7 | 1.6 | -1.0 |

| FITLX | Fidelity US Sustainability | 88 | 4.1 | 6.0 | 5.4 | 1.1 | -1.1 |

| CDC | VictoryShares US EQ Inc Vol Wtd | 82 | 8.7 | 7.0 | 0.2 | 2.6 | -0.3 |

| Average | 91 | 5.4 | 6.1 | 8.9 | 2.3 | -1.1 | |

Source: Created by the Author Using Mutual Fund Observer

5. Financial Advisors and Managed Accounts

Key Point: We need to rely on experts in investing similarly to how we rely on doctors for health care services.

“Why on Earth should I hire you when I can manage my own money? I have a 401k, and if I want to make other investments, there’s a ton of information and advice available on the internet.”

That question is asked and answered in Is It Worth the Money to Hire a Financial Advisor? by The Balance. When shopping for a vehicle, I go to the internet and look at reviews, prices, and options. Once I narrow my choices, I go to the dealer and take a test drive. It doesn’t work this way with financial advisors. Go to the websites, and there is generic information with an invitation to call for more information. I read plenty of reviews and comparisons about Charles Schwab, Fidelity, and Vanguard, and there is information available about robo-advisors and fees, but not much else.

Let’s begin with changes that face us as we transition from work to retirement. Many of us began saving in Traditional IRAs or 401ks. These funds require minimum distributions (RMDs) when the investor turns 72. These distributions are taxed as ordinary income and may push a retiree into a high tax bracket when combined with other income and social security. There are advantages to contributing to a Roth IRA for many people, such as paying the tax now and letting the investments grow tax-free and no RMDs. For someone retiring before age 72, there may be the opportunity to convert a traditional IRA to a Roth IRA while incomes have dropped and before RMDs begin or starting Social Security Benefits, with the goal of converting while in a lower tax bracket. One should be aware that converting too much may increase Medicare costs. The advantage of money in after-tax accounts is that Long Term Capital Gains taxes will be lower for most people than ordinary income taxes.

Investment companies usually provide education about RMDs such as Charles Schwab, Fidelity, and Vanguard. Fidelity offers Simplicity RMD Funds, which will estimate RMDs for investors. These companies offer services to automatically transfer RMDs for retirees.

There are many reasons to consider using an advisor, but how can you find one you can trust? The following is from Vanguard Advisor’s Alpha, which describes how advisors add value. One thing that I really like about Vanguard is its unique structure in which the company is owned by the funds and thereby the investors. Vanguard Personal Advisor Services is a good starting point for research.

“For many advisors and clients, the answer [to how do advisors add value] would be ‘better than the market,’ but a more pragmatic answer for both parties might be ‘better than investors would most likely achieve if they didn’t work with a professional advisor.’ In this framework, an advisor’s alpha is more aptly demonstrated by relationship-oriented services as just mentioned—providing discipline and reason to clients who are often undisciplined and emotional—than by efforts to beat the market…”

The two largest benefits to having an advisor are for counseling on taxes and helping an investor maintain discipline. I read dozens of articles describing the advisory services available but none as succinct as Schwab vs. Vanguard by Backend Benchmarking.

“Because of its position as one of the largest asset managers in the world, Vanguard can build comprehensive plans via Personal Advisor Services [PAS] with live advice for all of its robo clients for a low fee of 0.30%, a sizable discount compared to similar offerings that offer live advice. At Vanguard, all financial planning centers on the direct client–advisor relationship. Working with a Certified Financial Planner, users can plan for multiple long-term investment goals and receive a complete illustration of their financial life by building a personal financial plan encompassing all of an investor’s various accounts. Though their digital planning tools are not as robust as those offered by some start-ups, their individualized approach available to all PAS clients stands out. Custom financial plans can incorporate complex financial situations, multiple retirement income streams, and the incorporation of accounts held outside of Vanguard. Vanguard is a quality option because of its emphasis on the human experience and low costs.”

“Schwab also provides a range of digital financial and retirement planning tools as well as access to live advisors at their Premium service level. Although it is not guaranteed, users can request to work with the same advisor each time, allowing for a level of personalization. For digital planning, Schwab allows users to create multiple independent goals, as well as prioritize each individual goal by importance into one unified plan. Users can model future account values, create a clear target goal, and see their likelihood of financial success.”

“For those who want a planning approach that is centered on live-advisers, PAS is a good choice. Investors who are looking for a combination of live advice with a robust digital planner should consider Schwab.”

For an independent review of Vanguard in Investopedia, Vanguard Personal Advisor Services Review is a good summary. Accounts up to $500,000 are assigned to a group of advisors, while accounts above that level are assigned a dedicated advisor.

Fidelity Personal and Workplace Advisors is an independent review of Fidelity by Lending Tree. I like the following feature:

“Beyond these offerings, clients willing to invest $200,000 can access a model portfolio provided by BlackRock that aims to find mutual funds and exchange-traded products that will provide risk-adjusted income given the prevailing market conditions.”

For those who want some assistance in selecting investments but are not ready for a financial advisor, an intermediate robo-advisor may be an appropriate option. Descriptions are available at Vanguard Personal Advisor Services Investment, Fidelity Go, and Charles Schwab Intelligent Portfolios.

“Vanguard Personal Advisor Services (PAS) was launched in 2015 to provide algorithmic and human investment advice for client funds placed at wholly-owned broker-dealer Vanguard Marketing Corporation (VMC). When the product was originally launched, the existing retail brokerage customers at Vanguard were the focus as that group got closer to retirement age. As they head into retirement, Vanguard PAS helps them shift from building wealth to drawing it down in a smart way.”

There are comparisons available from independent reviewers:

“But even with all of their retirement planning tools and a decent rate of return, Fidelity offers the ability to plan for retirement and use the latest tools to test your strategies and possibly expand your portfolio.

Vanguard is best for long-term mutual fund investors who really like Vanguard-sponsored trades. However, in-depth research tools, customizable charts, and a great mobile app make Fidelity the ideal online brokerage for most of today’s investors.”

Closing

I have saved diligently since getting stable employment. Income is diversified across funds, pensions, and social security. I paid off my home mortgage last month. The next step for me, as I age, is to meet with financial advisors to fine-tune the transition from work to retirement, particularly for tax planning purposes. I am talking to financial advisors to discuss this and financial advisor services and managed accounts. I favor diversifying across financial companies as well as assets.

I use Charles Schwab, Fidelity, and Vanguard and like each for their strengths. I use the Charles Schwab Intelligent Portfolio as a trial and use Fidelity advisor services with high satisfaction. Over the next five to 10 years, I need to simplify and rely more on financial advisors and possibly managed accounts. Familiarity with the companies and products is a good start, but the only way to know about the retirement services is to set up an appointment.

I won’t grow up,

I don’t want to wear a tie.

Or a serious expression

In the middle of July.

And if it means I must prepare

To shoulder burdens with a worried air,

I’ll never grow up, never grow up, never grow up

Not me,

Not I,

Not me!

I wish everyone a safe and prosperous New Year!