I’ve been pondering things at year’s end, from elections and intransigence to the possibilities of functional government and transcendence. I’m not at all (not even 1%) sure of what 2021 will bring, and yet I need to plan for it anyway.

So, here’s a sort of think-aloud experiment in which I just share what I’ve learned in the past couple of months and where it might (or might not) lead in the year ahead. I’ll divide the essay into two sections: “stakes in the ground” represent the things I’m pretty sure are true, and “things I think I think” are possible implications if I am right.

Here are the stakes in the ground.

-

U.S. stocks are historically expensive.

As of 12/30/2020, the Shiller CAPE P/E ratio (technically, “a price-earnings ratio based on average inflation-adjusted earnings from the previous ten years,” which is an attempt to mitigate short-term earnings volatility) is 34.19. That would represent the second-highest p/e peak since 1860. That’s twice its historic average and 25% higher than its post-Global Financial Crisis average.

As of 12/30/2020, the Shiller CAPE P/E ratio (technically, “a price-earnings ratio based on average inflation-adjusted earnings from the previous ten years,” which is an attempt to mitigate short-term earnings volatility) is 34.19. That would represent the second-highest p/e peak since 1860. That’s twice its historic average and 25% higher than its post-Global Financial Crisis average.Apologists for stock valuations make two arguments. (1) It’s a whole new world where traditional measures of valuation don’t count. And (2) it still beats the heck out of bonds. The former argument is at its loudest shortly before market crashes (remember “the fundamental measures of a stock’s value are clicks and eyeballs” during the late 90s bubble?). The latter is true, though stocks are more volatile, and it takes only a brief rise in interest rates to destabilize the market.

-

Stock valuations were driven by zero interest rates and a sea of borrowed money.

FINRA reports that stock investors drew a record $722 billion against their stock portfolios through November (“Margin debt reaches a record,” Wall Street Journal, 12/28/2020). Margin debt rose 50% in the last eight months. The translation: stock investors have borrowed three-quarters of a trillion dollars this year in order to buy more stocks, using their portfolios as collateral for the loan. If the value of your portfolio falls, you can be forced to sell portions off at the worst possible time in order to repay the borrower; that’s “a margin call.” And selling into a falling market triggers more selling, more marginal calls, and so on. The last two times margin debt spiked by 50% were, by the way, at the market peaks in 2000 and 2007 (per a tweet by investor Troy Bombardia, 12/28/2020).

Unbeknownst to the borrowers, that’s a tricky business. Several guys much savvier than me (think: John Rekenthaler, “Robinhood was indeed too good to be true,” 12/21/2020, and Jason Zweig, “When the stock market is too much fun,” 12/11/2020) have made fairly convincing arguments that the Robinhood trading platform encourages rampant risk-taking by inexperienced (Covid-dimmed) investors. Regulators in Massachusetts are pursuing action against the company on the same grounds.

-

The U.S. dollar has grown weaker, a move that will likely continue.

The value of the U.S. dollar against a basket of other currencies has declined by 12% since March, and most analysts believe that the decline will continue as the global economy starts to snap back from the Covid-induced slump (“King dollars abdicates and that is OK,” Wall Street Journal, 12/31/2020). At base, non-US entities need U.S. dollars only to buy U.S. stuff, primarily financial assets such as stocks and bonds. And if their interest in U.S. financial assets wanes (remember those zero interest rates and ridiculous stock valuations we mentioned above?), so does the demand for – and price of – U.S. dollars.

-

Investors are feeling cocky.

In a research note, the Leuthold Group reported that “Lately, investor-sentiment measures have become an increasing concern. Several metrics, including the AAII Bulls less Bears, the put/call ratio, CNN’s Fear & Greed Index, the smart-money/dumb-money indicator, and the investment newsletter writers’ sentiment index all suggest optimism has become excessive” (“Sentiment Skepticism,” 12/14/2020). In commenting on the excess of margin debt, Georgetown finance professor James Angel was a bit blunter, “The stock market is euphoric right now. A lot of people are extrapolating from the recent past and going, ‘Wow, the market’s gone up a lot, and I think it’ll go up more.’ We’ve seen this play out before, and it doesn’t end well” (WSJ, 12/28/2020).

-

“Markets can remain irrational a lot longer than you and I can remain solvent.”

Generally attributed to John Maynard Keynes, the likeliest (though not certain) source of the aphorism is Wall Street economist A. Gary Shilling. Sensible people know that we’re ripe for a wipeout. The problem is that “the market” doesn’t know that and might well refuse to cooperate for years.

Remember, Fed chair Alan Greenspan warned that “irrational exuberance has unduly escalated asset values” in December 1996 … three years and three months before the market peak.

Things I think

- There’s a chance that the federal government might act to pass a vast infrastructure bill, likely targeting “green” investments, early in the Biden administration.

- There’s a likelihood that the economy will begin to rebound by mid-2021 as more of us get vaccinated, and the Covid threat recedes.

- The companies most likely to prosper if that occurs are the firms left behind in the work-from-home / find the next Tesla (Blink Charging Co., up 2100%) / find a vaccine (vaccine maker Novamax, up 2700%) / love me my Zoom (Z.M., stock up 425% last year) meetings frenzy of 2020. Vacation destinations, airlines, hotel chains, construction firms, financials all might benefit from a rebound in the real economy.

-

The passion for ESG / green / sustainable / impact investing will rise as all-Covid-all-the-time fades and knowledge of the climate crisis reasserts itself. That’s in-line with the Biden administration’s emphasis on the climate crisis, with a rising impulse among conservatives to find market-based green solutions rather than continuing to deny the obvious, and with the prospect that a new Secretary of Labor will suspend attacks on using ESG-screened investments in retirement plans.

Brown Advisory Sustainable Growth is a five-star, Great Owl that we’ve profiled and that I’ve included in my own portfolio. By our reckoning, there are 42 funds that are socially-responsible and have excellent records over more than five years but “socially-responsible” covers (for the pun) a multitude of sins. Some are funds with conservative social agendas. Others pursue alternate energy or women’s global empowerment. In this area, more than most, quant screens barely scratch the surface of what you need to know.

-

If the market doesn’t “pop,” it might well rotate. That’s what happened in 2000 when TMT (tech-media-telecom) stocks crashed, but “real economy” value stocks sailed on.

Investors interested in small + value might want to know about Palm Valley Capital Fund (which we’ve profiled) and North Star Micro Cap (which we will). Large + value are, indisputably, the two Yacktman funds. Folks looking beyond the U.S. might be intrigued by Johnson International, one of the very few international value funds to earn the Great Owl designation, or T. Rowe Price Global Value Equity, a tiny fund with a “Gold” rating at Morningstar.

-

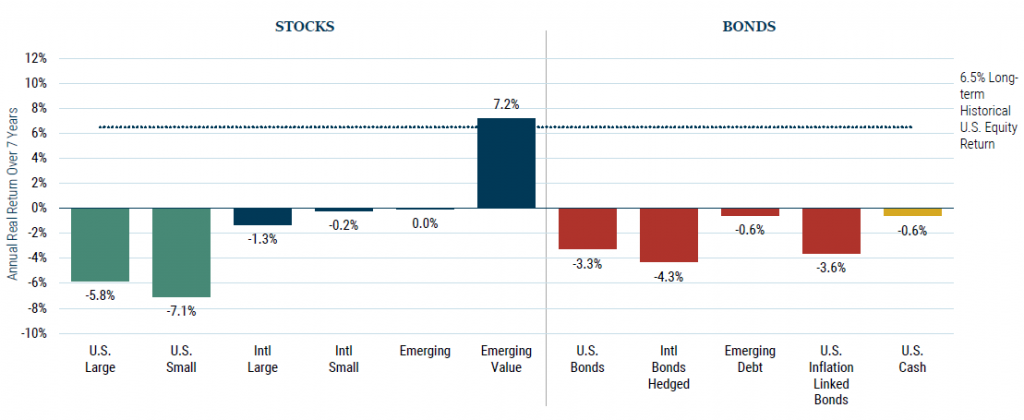

Almost all asset class projections have emerging markets, and often E.M. value, outperforming all other asset classes over the next 5-10 years. The starkest is GMO’s 7-year asset class projection, below, but the same point is made by major investors from Research Affiliates to BlackRock.

A falling dollar (see above) drives dramatic gains in E.M. stocks. The Leuthold Group notes, “there is a close inverse relationship between movement in the U.S. dollar and E.M. stocks’ relative performance. Dollar weakness played a huge role in driving E.M. outperformance in the early 1990s and again during the 2000s … further dollar weakness may also make E.M. stocks the big winners of 2021” (James Paulsen, “A Dollar Bust Is An EM Boom!” 12/18/2020).

If that’s the case, investors ought to consider adding EM / EM value exposure while it’s still relatively cheap. A number of fine new E.M. value funds have begun to appear, but we wanted to look at funds that have survived some of the market’s vicissitudes. We started by screening all E.M. funds by five-year performance, then identified the ones that ended up in Morningstar’s “value” style box. The top five, ranked by five-year returns:

1-year 3-year 5-year Schwab Fundamental Large Company Index Fund (SFENX) -1.68 1.85 11.42 Pzena Emerging Markets Value (PZVEX) 7.46 2.35 11.24 PIMCO RAE Emerging Markets (PEAFX) 1.38 0.54 10.86 Seafarer Overseas Growth and Income (SFGIX/SIGIX) 21.49 7.17 10.79 T. Rowe Price Emerging Markets Discovery (PRIJX) 6.92 4.27 10.59 (By way of full disclosure, I own shares of Seafarer in my personal account and T. Rowe Price in my retirement account.)

If we broaden the inquiry to all open, retail E.M. funds, some unexplored possibilities emerge. Those include Artisan Developing World, Virtus KAR Emerging Markets Small Cap, WCM Focused Emerging Markets, and Touchstone Sands Capital Emerging Markets Growth: all five-star, Great Owl funds with retail investor minimums, first-rate managers, and exceptional performance.

-

You need to stop reading manic-depressive financial media. The function of profit-driven media is to attract your attention. Nothing does that like alternating extremes of pessimism and euphoria. Take, for instance, this sampling of December’s insights from Business Insider:

-

Value will outperform growth for the next 4-5 years, December 1

-

The S&P 500 could gain 10% over the next year, December 2

-

The S&P 500 will soar 25% by the end of 2022, December 3

-

The U.S. will see an explosion of growth in 2021, a veritable supersonic boom, December 4

-

The stock market will crash by 70% and suffer 12 lean years, December 7

-

Small cap stocks will climb another 13% in 2021, December 7

-

Investors will enjoy double-digit yearly returns over the next two years, December 7

-

Four indicators are pointing to a roaring stock market, December 8

-

Positive feedback loop set to drive stocks higher in 2021, December 11

-

A Great Depression-like crash could strike at any moment, December 12, the same day Goldman offers 16 stocks, including one with a 159% return potential

-

Morgan Stanley’s found 90 sustainable stocks with upsides of 10-137%, December 17

-

Stocks are primed for sustained gains in a way they haven’t been in years, December 18

-

We’re in for a 61% stock market crash in the next 18-24 months, December 21

-

It could be a Roaring 20s that will end badly, December 22

-

We’re at the extreme end of the fear/greed spectrum, December 23

-

We’re a few months away from a 75% crash, December 26

Business Insider editors would rightly point out that none of those represent the editorial judgment of the publication itself. They’re just the opinions of Wall Street Experts who’ve agreed to speak with Business Insider.

And what makes them Wall Street Experts? Umm … their willingness to speak with Business Insider?

-

-

You should avoid Yahoo

Really, how hard could that be?

Yahoo has a partnership with Zacks to provide a daily stream of robo-articles, presumably for cheap. Each article has the same template:

“If you’re looking to invest in <Area X>, then you should really <consider / avoid> Fund Y because it’s rated <strong buy / strong sell> which is based on nine forecasting factors like size, cost, and past performance, and is expected to outperform its peers in the future.” A fill in the blank fund profile follows.

A recent article on mid-cap growth funds starts with this promise: “For high returns, investors can choose mid-cap funds that bear lesser risk than small-cap funds. Mid-cap funds are unfazed by broader market gyrations” (Top 3 Mid-Cap Growth Funds to Make Your Portfolio Grow, 12/22/2020). They then recommend three funds.

“Unfazed by broader market gyrations”? Really? The average mid-cap growth fund declined 52.5% in the 2009 bear market, and the recommended funds declined 45 – 54% at the same time. Did anyone even read that sentence before publishing it?

-

We all should focus on the things with can control, rather than obsessing over the ones we can’t. There is an indisputable body of psychological and motivational research that all supports the same finding: the prospect of Big Changes terrifies us at an instinctual level, and all attempts at making sweeping changes in our lives fail. (Go on! Try: “I’m going to hit the gym and put in an hour of HIT three times a week, then celebrate with a vegan steak afterward.”)

On the upside, some changes are possible and sustainable: small, concrete, measurable changes don’t scare us, quickly reassure us, and tend to stick. Take a walk to the corner and back before dinner. Have one brightly colored food at each meal. Ask your employer to bump your retirement withholding by 1%. Each change sticks and makes the next change more possible.

- Say thanks. Often. For small things and large. It strengthens the bonds between people, reminding them that they make a difference and that their actions matter to you. It makes a remarkable and growing difference in your psychological and physical health and in the health of the people you say it to. I’ll share the research if you’d like.