The second decade of the 21st century has just closed. The third decade promises turbulence in the near-term and disappointment in the longer term. A host of factors drives that pessimism. Interest rates are near-zero and likely to remain there, according to the chairman of the Fed, for years. That means that money market funds will return zero only if their sponsors waive all of their operating expenses. It also means that the long-term returns on US bonds may fall below zero because their advisers are not predisposed to offer their services for free. Investors, in response, are poured into equities and have done so using record amounts of borrowed money.

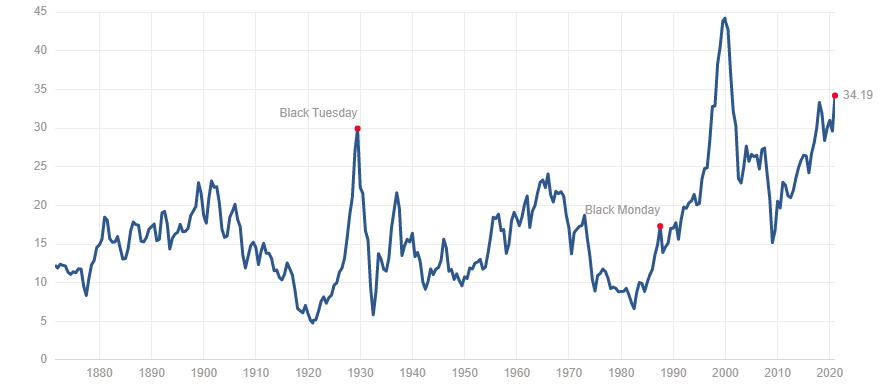

That’s driven the price of US stocks to their second-highest level in 150 years, as measured by the Shiller PE Ratio. At 34.1 (as of 12/30/2020), it is more than double its historic average (16.8).

Over the long term, the returns you earn are conditioned by the price you pay: if you pay too much for your stocks, your long-term returns are going to be disappointing. State Street Global Advisors projects 6% long-term (10+ year) returns on equities, while BlackRock puts it at 5% and JPMorgan at 4%. And those are the professional optimists! We needn’t even talk about the projections from GMO and those horrified by the consequences of more than a decade of financial manipulation by the Fed and others.

So, grownups say 4-6% for US equities over the next decade with high volatility and some risk of a severe price reset. Over the past decade, US growth investors have grown accustomed to 15-16% annual returns, while even much put-upon value investors have made double-digit gains. Translation: you might get slammed in the short-term and see your gains reduced by 50-75% in the long-term.

What to do?

Our recommendation: look for managers who have gotten it right, time after time.

To help identify such managers, we started with a list of 20-year, equity-oriented Great Owl funds. The Great Owl designation is earned by funds that have earned risk-adjusted returns in the top 20% of their peer groups for the past 3-, 5-, 10- and 20-year periods.

That’s really hard. There are 2076 equity-oriented mutual funds with a record of 20 years or more. Only 52 of them – 2.5% – are Great Owls. We refined the list by including only actively managed funds (42 of them, with most of the remainder being S&P 500 index funds) that are open to new investment (35 funds).

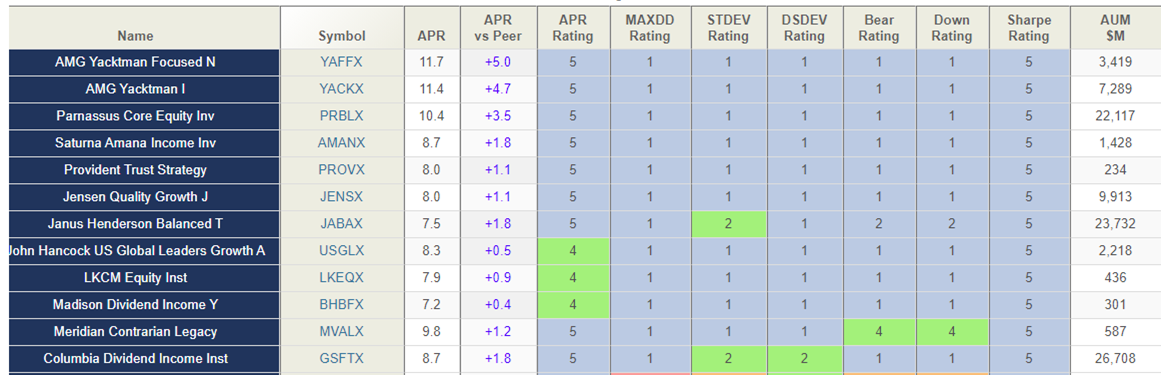

Using the screener at MFO Premium, we looked for ways to make the most relevant information comprehensible at a glance. We did that by identifying ratings that focus on returns (APR rating), risks (maximum drawdown, standard deviation, downside deviation, bear market performance, down market performance), and the risk-return balance (Sharpe rating). In our system, a blue box always represents a value in the top 20%, a green box is a value in the next 20%, yellow is the third tier, and so on.

The following table highlights the 12 best funds of the 21st century. The first six funds received perfect scores (7-for-7 top tier ratings), then four near-perfect funds (6-for-7), and two pretty durn perfect ones (5-for-7), with none receiving a score lower than green.

What does this mean?

Let’s be clear: this is not a list of the funds with the highest 20-year raw returns. That list would be topped by Lord Abbett Micro Cap Growth (LMIYX, 14.4% APR), which is not a Great Owl, and Wasatch Micro Cap (WMICX, 14.3% APR), which is. The difference is driven by our concern for what risks investors were subjected to on the road to the fund’s returns. Why? Two risks: (1) risks are sticky, and returns are not. High volatility strategies tend to remain high volatility across time, which can lead to ugly performance stretches. And (2) investors don’t stick with high volatility strategies for long.

The Great Owl funds are ones whose returns outstrip their risks, not just once in a while but in every measurement period: three years and five years and ten years and 20 years.

What’s up with these funds?

Yacktman and Yacktman Focused are almost freakishly successful, year and year, by almost every measure. They’re sort of the (pre-2020) New England Patriots of investing. Adam Sabban at Morningstar characterizes them as “half equity fund, half absolute-return hedge fund,” which favors great core businesses but is willing to hold cash, buy during panics and shop overseas. They’ve appeared in virtually every MFO essay on great risk-adjusted funds.

Parnassus Core (originally Parnassus Equity Income) is one of the oldest socially-responsible funds around. It has appeared in nearly a dozen MFO essays (Overachieving Defenders, 20 Equity Funds with the best capture ratios, Investors Guide to the End of the World, Best of the Best …) where we were screening for consistent, risk-conscious excellence.

Amana Income is an equity income fund designed to meet the needs of Muslim investors. The translation is that it holds no debt instruments, focuses on socially responsible firms with rock-solid balance sheets, then holds them forever. (Really. Reported portfolio turnover is 0%.) The only caveat is that long-time lead manager Nick Kaiser stepped down in May 2020 as part of a long-planned management transition.

Provident Trust, profiled by our colleague Dennis Baran in 2018, is a multi-cap equity fund that happily turns to bonds and cash to moderate volatility. The plan is to win over the span of entire market cycles, even at the price of lagging during some phases of the market. Dennis concluded, “Provident wants to be your manager. Singular. As in, ‘the only guys you need.’ Failing that, they’d like to be your core holding. We believe that they have made a strong argument, over 15 years and several market cycles, to be precisely that.” The fund is part of the Provident Trust Company of Waukesha, Wisconsin (site of the first legal forward pass in football history).

Jensen Quality Growth is a domestic large-cap fund that holds 20-25 “attractively priced stocks from a well-vetted universe of consistently profitable companies” (Dan Culloton of Morningstar’s phrase). At the launch of Jensen Global Quality Growth, we noted, “Across all those metrics, Jensen sits in the top tier which should be very reassuring to investors contemplating seriously unsettled markets.”

Janus Henderson Balanced has two sleeves: a large-cap US growth equity sleeve and an unconstrained fixed-income sleeve. The fixed income and equity managers decide together how much equity exposure (from 35-65%) is warranted by market conditions. A five-star fund with two flags: it’s huge ($24 billion), and the lead managers have either recently (fixed income) or imminently (equity) retired.

JHancock US Global Leaders Growth is a concentrated domestic equity fund that targets 25-30 high-quality companies with the prospect of sustainable earning growth. The focus is more on the sustainability of a firm’s growth than its raw, short-term growth metrics. From what we can tell, the internal culture encourages healthy disagreement and debate, which seems to lead to fewer investing mistakes.

LKCM Equity invests in mid- to large-cap US stocks. The targets are 60 companies with strong histories of capital allocation and stable balance sheets. Morningstar views it as a slightly underperforming large growth fund, while Lipper (and the firm) view it as an outstanding multi-cap core fund. The key concern here is that the lead manager, Luther King, is 80, and the firm is famously tight-lipped about their plans and perspectives. Mr. King added two co-managers in 2010, including his son.

Madison Dividend Income is a (mostly) domestic, (mostly) large-cap equity fund that holds about 40 names. They first target stocks with yields exceeding the S&P 500’s but have a special attraction to companies with a “history of increasing dividend payments in the past, and a business model which supports the possibility of continuing these increases in the future.” Although they stay fully exposed to the stock market, they stress a “participate (in bull markets) and protect (in bears)” philosophy. Historically, it has captured three-quarters of the market’s upside and less than two-thirds of its downside, which illustrates the principle at work. Before 2012, this was the Madison Mosaic Balanced Fund.

Meridian Contrarian is the only small (or small-to-barely-mid) cap fund on the list. The managers target “fallen angels,” high-quality businesses that are faced “real business challenges” but whose managers have and can execute a turnaround plan. They buy the firms when they’ve stumbled (and hence are historically cheap) and hold on while monitoring the turnaround. As sketchy as that might seem, the fund has a top-five capture ratio and exceptional risk scores.

Columbia Dividend Income is a large-cap, domestic equity fund that targets firms with steady-to-increasing dividend payouts. The managers prefer “sustainable growth” to “fast growth” and seem pretty skeptical of the tendency of management to cook the books in order to generate attractive financial metrics. They’ve got a “to have and to hold” mindset: they have about 80 stocks and hold them about four-times longer than their peers do. The flags here might be the fund’s size, $28 billion, and the persistently modest level of insider investment.

To learn more, use the Search function at MFO, which will lead you to the articles that mention them. Morningstar has analyst coverage of several and ratings on all. Remember, though, that our ratings tend to be more risk-sensitive than Morningstar’s and our assessment periods are different (we’re looking at 20 years here), so the funds highlighted here can range from three- to five-star offerings by Morningstar’s measure.

The complete list of 35 open, 20-year Great Owl funds is available here. (Chip’s warning: the file is printable, but is formatted for legal-sized paper. Otherwise, screen reading will work best.)