*This fund has been liquidated.*

Objective and strategy

Continuous Capital pursues long-term capital appreciation through investing in a diversified portfolio of EM equities. The managers view their core competence as security selection. They try to keep the portfolio roughly sector- and country-neutral relative to their benchmark so that the portfolio’s performance will be driven primarily by their security selection. Security selection, in turn, is driven by the interplay of three factors: value, quality, and dividends. In consequence, the fund’s “style” might appear more growth-oriented in some markets and more value-oriented in others.

The portfolio is broadly diversified, with a commitment to including both mid- and small-cap stocks. The managers anticipate holding 50% large caps and 50% small- and mid-caps on average, over time. They anticipate holding 100-140 stocks. In addition, individual positions are “loosely” equally weighted so each of the current 130 positions occupies roughly 0.75% of the portfolio.

Adviser

Resolute Investment Managers of Irving, Texas, is the parent company. Resolute oversees $102 billion in assets and has nine affiliated managers including American Beacon, ARK Invest, and Continuous Capital.

Continuous Capital, the sub-adviser responsible for the fund’s day-to-day operations launched in April 2018 as a dedicated EM manager. It is jointly owned by former Allianz Global Investors portfolio manager Morley Campbell and Resolute.

Campbell worked at Allianz for 10 years, rising to run $4.2 billion across six funds before his departure,

Managers

Morley Campbell and Luis Lemus. Mr. Campbell is the founder of Continuous Capital, its chief investment officer, and the named manager on the fund. Prior to that he worked for Allianz NFJ as an investment analyst (2007-08), portfolio manager (2008-18), and Managing Director (2013-2018). While there he was the lead portfolio manager from the inception of the AllianzNFJ Emerging Markets Value Fund (AZMIX), a four- to five-star fund across his tenure. Overall, he managed or co-managed approximately $4.2 billion prior to his departure. Mr. Lemus joined Continuous Capital in April 2020 after stints at Goldman Sachs, Lord Abbett, Chiron Investment Management, and Highland Capital Management. They are supported by nine professionals who assist with operations, legal, compliance, and other investment management functions.

Strategy capacity and closure

The adviser estimates the strategy’s current capacity is around $5 billion. That’s driven by their assessment of trading liquidity within their universe. At base, they need to remain small enough that they can get out of any particular position within five days without disrupting the market with their sales. That means that the capacity is necessarily a moving target. If it becomes necessary to close this fund, they have plans to launch a second fund that doesn’t compete for the same liquidity.

Management’s stake in the fund

Morley Campbell currently holds between $100,000 – $500,000 and Luis Lemus currently holds between $50,000 – $100,000.

Opening date

December 18, 2018.

Minimum investment

Investor Shares carry a $2,500 minimum. The minimums for various Institutional share classes run from $100,000 – $1,000,000. As a practical matter, online brokers can choose to reduce or eliminate the minimums.

The fund is available through the major national brokerages, Fidelity, Schwab, TD Ameritrade, BNY/Pershing as well as some of the regional platforms like Waddell & Reed.

Expense ratio

1.54% for the Investor shares (CCEPX) and 1.16-1.27% for Institutional shares on assets of $30 million.

Comments

Investing in emerging markets is a tricky business. On the other hand, there’s a near-universal consensus that they offer the most attractive potential returns of any public asset class over the remainder of the decade. On the other hand, most EM funds – both active and passive, OEF and ETF – tend to embed a series of biases. They tend to build portfolios that are large-cap, growth, and export-oriented. One signal of that herding behavior is the long-term correlation between the ten largest EM funds, around .98. The EM world is, they note, “crowded into about five names.” In 2020, almost all of the index returns were attributed to just 10 names. The largest fund managers in the category aspire to offer more of an echo than a choice.

The folks at Continuous Capital share the enthusiasm for the prospects of the emerging markets and set out to offer investors a choice rather than an echo. Drawing on a substantial body of academic research and Mr. Campbell’s decades of experience at Allianz NFJ, they built a portfolio driven by four core tenets.

- Value + Quality Outperforms: Academic research indicates that high-quality companies have historically outperformed if purchased at the right price.

- Dividends Dampen Volatility: Dividends and share repurchases help dampen volatility and provide downside protection.

- Security Analysis Adds Alpha: Data-driven security analysis helps identify companies in which desirable characteristics and factors are likely to persist.

- Diversification Reduces Risk: Diversification across multiple dimensions – countries, sectors, industries, and companies – helps minimize uncompensated risks to achieve more consistent results for investors.

They start with an investable universe of about 4000 stocks, many inaccessible to large institutional investors, and use quantitative screens to reduce that to a watch list of 300-500 stocks which have relatively attractive value, quality, and dividend characteristics. They then subject those companies to an intensive analysis of their financial statements to determine the answers to questions such as

- Is the company overvalued relative to its history or the market?

- Has the company grown or changed so much that a historical valuation comparison is not relevant?

- How stable are returns on invested capital?

- Does management deploy capital wisely?

- Is the balance sheet strong enough to maintain the dividend and/or buyback growth?

That analysis leads them to a portfolio of 100-140 attractive stocks.

How’s that working out?

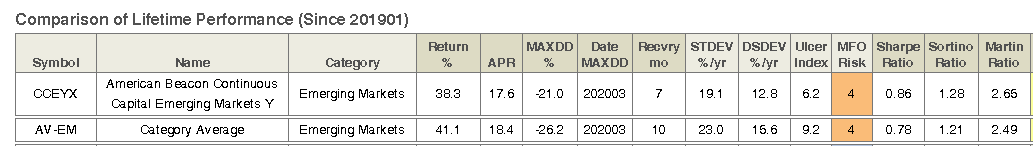

Since its inception, the fund has offered slightly lower returns with substantially lower volatility than its peers.

In consequence, it posted above-average performance on all four measures of risk-adjusted returns: the Ulcer Index (which tracks the depth and duration of a fund’s drawdown) as well as the Sharpe, Sortino, and Martin ratios. They were on-track to outperform their peers in 2020 until an explosive late-year rally left them behind.

The bigger question is, is the cause for long-term investors to pursue the fund? If Mr. Campbell’s long-term record is any indication, yes. His previous charge:

- Achieved a 4-or 5-star Morningstar Rating throughout his tenure

- Posted a downside market capture ratio of 89% (December 2012-April 2018)

- Outperformed its benchmark in four of his five full years at the helm: 2013, 2015, 2016, and 2017. CCEYX did the same in 2019.

His current portfolio has more of a growth tilt than would traditionally be the case. The managers attribute that, primarily, to the effects of Covid which led them to a greater focus on quality, which is more expensive than value. With the arrival of Covid vaccines (the Chinese version of which is cheap and available, though not as effective as the Western vaccines), the reopening of businesses and immense monetary stimulus – BOE Fed ECB BOJ have all seen unprecedented growth in their balance sheets – things could rotate the other way pretty quickly.

Bottom Line

In general, Mr. Campbell’s track record is very sound and reflects exceptional risk-consciousness. CCEYX offers a distinctive option with substantially more exposure to smaller capitalization stocks, substantially less portfolio concentration, broad diversification and a sensible balance of forces. Like many sensible choices, it’s least likely to shine in irrationally frothy markets but might well serve investors well over time. It’s warranted a place on of due diligence list for risk-sensitive EM investors.

Fund website

Adviser website: American Beacon Continuous Capital Emerging Markets

Sub-adviser website: Continuous Capital