Updates

Eric Heufner, president of Grandeur Peak Global, shares the sad news of the death on January 21, 2021, of one of his colleagues.

Eric Heufner, president of Grandeur Peak Global, shares the sad news of the death on January 21, 2021, of one of his colleagues.

It is with great sadness that we announce the death of our dear friend and colleague, Keefer Babbitt. Keefer was not only a great partner and friend, he also set the bar extremely high as it relates to his work. His character, work ethic, depth of thought and the quality of his output were greatly admired by all of us at Grandeur Peak. Keefer joined Grandeur Peak in 2012 as one of our first interns, and over the past 8+ years he has been a true builder of our firm. He made an enormous difference here and he will be greatly missed.

Keefer’s current roles included co-managing the Global Contrarian Fund alongside Mark Madsen and Robert Gardiner, co-managing the Global Reach Fund with six other portfolio managers, contributing on our Industrials team, and of course first and foremost serving as a global research analyst. Given our unique team-based approach, we do not anticipate making any immediate changes to the portfolio management of either fund.

Mr. Babbitt is survived by his wife Riley and their young daughter Ivy Lou. With the Grandeur Peak folks, we mourn his passing and wish peace and the comfort of friends for his family.

Briefly Noted . . .

Here’s the filing: “Effective at the close of business on December 31, 2020, Jill T. McGruder resigns as President of the [Touchstone Funds] Trusts and Steven M. Graziano resigns as a Vice President of the Trusts. Their resignations are not motivated by any disagreement with the Board or management.” It’s always nice when two leaders of an organization leave without any disagreement with those running the shop, though it would be nice to know what other than disagreement motivated the move.

The active ETF revolution is beginning to gnaw at the passive ETF business. Effective March 23, 2021, the passively managed ERShares 30 Entrepreneurs ETF (ENTR) becomes the actively managed ERShares Entrepreneur ETF and the passive ERShares Non-US Small Cap ETF becomes the active ERShares NextGen Entrepreneurs ETF. In each case, the fund’s policy concerning industry concentration was revised to make them more diversified.

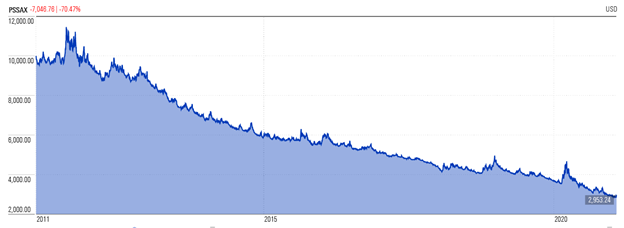

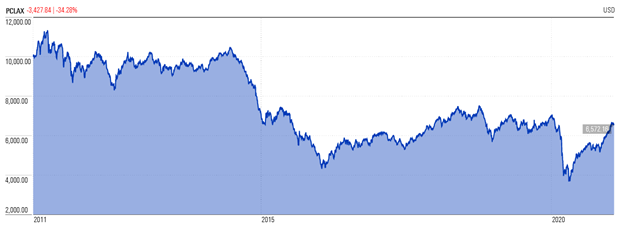

Effective March 26, 2021, PIMCO StocksPLUS Short Fund and PIMCO CommoditiesPLUS shareholders will receive one share in exchange for every two shares of a Fund they currently own, which is called either “a reverse-split” or “evidence that our strategy is cratering.” Let’s see how things have gone in the past 10 years …

Oh.

Well, that’s better, at least. Folks investing $10,000 in the commodity fund 10 years ago would still have $6572 left.

CLOSINGS (and related inconveniences)

Effective as of the close of business on February 5, 2021, the JPMorgan Small Cap Growth Fund will be closed to new investors. By MFO’s measures, over the past decade it’s been a little more volatile and a lot more profitable than its small-growth peers. Four-star, $6.8 billion small growth fund with booked a 59% gain in 2020. All of the managers have invested in the fund, with the lead manager having over a million in it.

Effective as of the close of business on March 31, 2021, Kopernik Global All-Cap Fund will be closed to new investors. $1.5 billion international small- to mid-cap value fund. David Iben, the manager, has been running the fund since 2013 but has yet to invest in it or in its International sibling. Mr. Iben previously ran Nuveen Tradewinds Global All-Cap and Value Opportunities, both of which beat their peers by a 3:1 margin over time. In the year after Mr. Iben’s departure, Tradewinds lost 75% of its AUM and both were eventually liquidated.

OLD WINE, NEW BOTTLES

The Horizon Defensive Multi-Factor Fund will be changed to Horizon U.S. Defensive Equity Fund on or about March 29, 2021.

On March 1, 2021, iShares MSCI Frontier 100 ETF becomes their Frontier and Select EM ETF, which will add stocks from Pakistan, Philippines, Peru, Colombia, Argentina and Egypt to the portfolio.

On March 30, 2021 North Country Equity Growth Fund will change to North Country Large Cap Equity Fund. Only 5% of the current portfolio is invested in anything other than large cap equities, so the new name won’t force any change in the portfolio.

Effective March 31, 2021, the sustainability profiles of three of the Pax World Funds will be enhanced and the Funds’ names will be changed to better reflect their core focus of investing in the transition to a more sustainable economy. The new Fund names will be the Pax U.S. Sustainable Economy Fund (currently, Pax ESG Beta Quality Fund), the Pax International Sustainable Economy Fund (currently, Pax MSCI EAFE ESG Leaders Index Fund) and Pax Global Sustainable Infrastructure Fund (currently, Pax ESG Beta Dividend Fund).

As of January 14, 2021, The Gabelli Focus Five Fund has changed its name to The Gabelli Focused Growth and Income Fund. You’ll notice the “The” as an official part of the fund’s name, akin to Miami’s college football players (last seen losing in the Cheez-It Bowl on December 20 2020) announcing their identification for “THE U” or that institution in Columbus declaring itself “THE Ohio State University” as a defense against all of those other Ohio state universities.

On May 1, 2021, T. Rowe Price New America Growth will change its name to T. Rowe Price All-Cap Opportunities Fund and broaden its benchmark index from the Russell 1000 Growth to the Russell 3000.

Effective on March 22, 2021, Virtus Newfleet Dynamic Credit ETF will be renamed Virtus Newfleet High Yield Bond ETF.

OFF TO THE DUSTBIN OF HISTORY

Effective on March 15, 2020, Cambria Sovereign Bond ETF will convert from an actively managed, non-diversified ETF that invests primarily in the sovereign and quasi-sovereign bonds of developed and emerging market countries into Cambria Global Tail Risk ETF (FAIL), an actively managed, diversified ETF that “invests in a mix of developed and emerging market sovereign bonds and U.S. government bonds, while utilizing a put option strategy to manage the risk of a significant negative movement in the value of global ex-U.S. equities (i.e., global tail risk) over rolling one-month periods.” Technically the existing ETF isn’t being liquidated but the change is so substantial that the original will have been obliterated.

There’s a new liquidation date for Columbia Pacific/Asia Fund; it’s been changed from February 5, 2021 to March 19, 2021.

Counterpoint Long-Short Equity Fund will cease operations on or about February 10, 2021.

Dupont Capital Emerging Markets Debt Fund faces “final liquidation” (as opposed, presumably, to all of those preliminary and intermediate liquidations) on or about February 26, 2021.

First Trust RiverFront Dynamic Asia Pacific ETF is set to merge into First Trust RiverFront Dynamic Developed International ETF. The Board assures us both funds are active and looking for capital appreciation, and surely “Asia PC” and “Developed” are practically synonyms. No date set.

The F/m Investments European L/S Small Cap Fund (BESRX) has terminated the public offering of its shares and will discontinue its operations effective February 12, 2021. Ummm … $800k in assets, 3.65% expense ratio after five years of operation.

Effective April 23, 2021, four Invesco funds will be absorbed by their siblings.

| Disappearing Funds | Acquiring Funds |

| Invesco Endeavor Fund | Invesco Main Street Mid Cap Fund |

| Invesco Pacific Growth Fund | Invesco Greater China Fund |

| Invesco Select Companies Fund | Invesco Main Street Small Cap Fund |

| Invesco Senior Floating Rate Plus Fund | Invesco Senior Floating Rate Fund |

Jaguar Global Property Fund (JAGGX) will be liquidated on February 26, 2021.

JPMorgan International Advantage Fund (JFTAX), trailing 93-95% of its peers and having offered no real advantage (none of the fund’s current managers chose to invest in it), will be liquidated on February 26, 2021. It’s striking because this is the largest fund liquidation – the portfolio holds $1.2 billion – in memory.

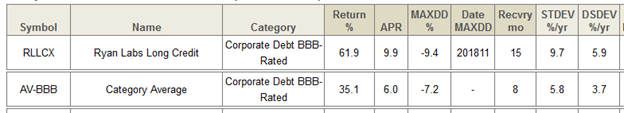

Ryan Labs Long Credit Fund (RLLCX) has terminated the public offering of its shares and will discontinue its operations effective February 25, 2021. It’s a high-risk / high-return high-yield fund. The performance-since-inception profile is pretty telling:

No reason for the liquidation is explicitly stated but the note “the adviser will continue to waive fees” pretty much signals that it’s been a money-losing proposition.

SPDR EURO STOXX Small Cap ETF, SPDR Solactive Canada ETF, SPDR Solactive Germany ETF, SPDR Solactive Hong Kong ETF, SPDR Solactive Japan ETF, SPDR Solactive United Kingdom ETF, SPDR MFS Systematic Core Equity ETF, SPDR MFS Systematic Growth Equity ETF, SPDR Dorsey Wright Fixed Income Allocation ETF and SPDR MFS Systematic Value Equity ETF will all be liquidated between March 18 and March 23, 2021.

The three-star Schroder North American Equity Fund is expected to cease operations and liquidate on or about February 22, 2021.

Stone Ridge All Asset Variance Risk Premium Fund (AVRPX) will be reorganized into the tiny, year-old Stone Ridge Diversified Alternatives Fund on February 5, 2021

Theta Income Fund (LQTIX) will be liquidated on or about March 22, 2021.

Virtus Aviva Multi-Strategy Target Return Fund will be liquidated on or about February 26, 2021.