2020 seems to have restored our belief in wizards, wands, fairy dust, and the powers of the Great Wizard Jerome (Powell). It is a year in which more funds and ETFs posted 100%-plus returns than any I know of. Setting aside leveraged, double-leveraged, triple-leveraged, and inverse-leveraged funds (please set them aside!), 36 funds posted triple-digit returns in 2020.

| Invesco Solar ETF | 234% |

| Invesco WilderHill Clean Energy ETF | 205 |

| GMO Special Opportunities VI | 194 |

| First Trust NASDAQ Clean Edge Green Energy Index Fund | 184 |

| ARK Genomic Revolution ETF | 181 |

| ARK Next Generation Internet | 157 |

| ARK Innovation ETF | 153 |

| Morgan Stanley Inst Inception | 151 |

| Baron Partners | 149 |

| American Beacon ARK Transformative Innovation | 148 |

| Invesco Global Clean Energy ETF | 145 |

| Zevenbergen Genea | 145 |

| Morgan Stanley Inst Discovery | 143 |

| iShares Global Clean Energy ETF | 142 |

| ALPS Clean Energy ETF | 140 |

| KraneShares MSCI China Environment ETF | 138 |

| SPDR Kensho Clean Power ETF | 138 |

| Global X Lithium & Battery Tech ETF | 128 |

| Baillie Gifford US Equity Growth | 125 |

| Zevenbergen Growth | 125 |

| Amplify Online Retail ETF | 124 |

| Jacob Internet | 123 |

| Baron Focused Growth | 122 |

| Virtus Zevenbergen Innovative | 119 |

| Morgan Stanley Insight | 117 |

| Morgan Stanley Inst Growth | 116 |

| Shelton Green Alpha | 114 |

| ProShares Online Retail ETF | 112 |

| Transamerica Capital Growth | 112 |

| WisdomTree Cloud Computing ETF | 110 |

| Morgan Stanley Global Endurance | 110 |

| Upright Growth | 109 |

| O’Shares Global Internet Giants ETF | 108 |

| ARK Fintech Innovation ETF | 108 |

| Renaissance IPO ETF | 108 |

| Baillie Gifford Long Term Global | 102 |

This list is long, but not terribly diverse. Read the prospectuses and you’ll come across the same words over and over: focused, concentrated, disruptive, innovative, disruptive innovation, next-gen, thematic, pure-play, sustainable.

I’m passionate about the “sustainable” part; really, our children’s and grandchildren’s world hangs in the balance. If we’d acted when we first discovered the role of human activity on disrupting the global climate – nearly 50 years ago – modest and unremarkable changes (from stepping up the replacement of Depression-era power grids to avoiding our embrace of 74oo pound urban assault vehicles) would have led us to a far less threatening future. But if the best time to act was 50 years ago, the second-best is surely “now.”

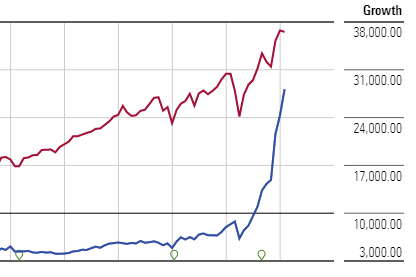

That said, many of the Titans of ’20 show the same performance chart, here illustrated by the Invesco WilderHill Clean Energy ETF.

This is a fund that had lost money in six of the preceding nine years. An investment made in the fund in February of 2011 was still underwater almost 10 years later. And then, without noticeably economic and government tailwinds, the returns exploded. An investment made on March 31, 2020, quadrupled in value by year’s end.

For many funds, 2020 will have been the high point of their existence. By way of illustration, the table below identifies the mutual funds which returned 30% or more last year after having trailed 66-100% of their peers in 2019, 2018 and 2017.

| Morningstar Category |

2020 Return | 2020 Rank | 2019 Rank | 2018 Rank | 2017 Rank | 2016 Rank | Morningstar Risk |

|

| Upright Growth | Technology | 108.7 | 3 | 99 | 100 | 100 | 83 | High |

| US Global Investors World Precious Minerals | Equity Precious Metals | 70.6 | 1 | 93 | 94 | 97 | 7 | Above Average |

| Tanaka Growth | Mid-Cap Growth | 50.9 | 21 | 99 | 100 | 100 | 95 | High |

| Royce Smaller-Companies Growth | Small Growth | 49.3 | 27 | 75 | 78 | 68 | 56 | Above Average |

| Matthews Asia Small Companies | Pacific/Asia ex-Japan Stk | 43.7 | 17 | 73 | 79 | 75 | 80 | Average |

| Ashmore Emerging Markets Small Cap | Diversified Emerging Mkts | 43.4 | 4 | 75 | 93 | 74 | 44 | High |

| Permanent Portfolio Aggressive | Large Growth | 38.0 | 36 | 84 | 99 | 88 | 1 | High |

| Quantified Market Leaders | Mid-Cap Growth | 37.9 | 38 | 90 | 89 | 91 | 2 | Average |

| WesMark Small Company Growth | Small Growth | 36.6 | 49 | 87 | 92 | 90 | 43 | Below Average |

| Timothy Plan Aggressive Growth | Mid-Cap Growth | 36.1 | 40 | 85 | 85 | 84 | 93 | Average |

| Sit Small Cap Growth | Mid-Cap Growth | 35.9 | 40 | 76 | 81 | 94 | 66 | Above Average |

| Fidelity Capital Appreciation | Large Growth | 33.8 | 49 | 70 | 77 | 74 | 50 | Average |

| SEI Extended Market Index | Mid-Cap Growth | 32.9 | 53 | 83 | 74 | 88 | 3 | Above Average |

| Rydex S&P MidCap 400 Pure Grow | Mid-Cap Growth | 30.7 | 61 | 99 | 91 | 86 | 71 | Above Average |

| BNY Mellon Small/Mid Cap Multi-Strategy | Mid-Cap Growth | 30.0 | 64 | 81 | 82 | 76 | 78 | Above Average |

The members of the Centennial Club – the funds that posted triple-digit gains in 2020 – show the same pattern of inconsistent excellence and high volatility, if to a lesser degree than the funds above.

| Morningstar Category |

2020 Return | 2020 Rank | 2019 Rank | 2018 Rank | 2017 Rank | 2016 Rank | M-star Risk | |

| GMO Special Opportunities VI | 70% to 85% Equity | 194% | 1 | 92 | 90 | 1 | 21 | High |

| Morgan Stanley Inst Inception | Small Growth | 151 | 1 | 11 | 17 | 46 | 96 | High |

| Baron Partners | Mid Growth | 149 | 1 | 1 | 18 | 9 | 63 | High |

| American Beacon ARK Transfmt I | Mid Growth | 148 | 1 | 74 | 56 | — | — | High |

| Zevenbergen Genea | Large Growth | 145 | 1 | 79 | 1 | 1 | 81 | High |

| Morgan Stanley Inst Discovery | Mid Growth | 143 | 2 | 8 | 1 | 1 | 99 | High |

| Baillie Gifford US Equity Growth | Large Growth | 125 | 1 | 73 | 2 | — | — | High |

| Zevenbergen Growth | Large Growth | 125 | 1 | 9 | 4 | 14 | 91 | High |

| Jacob Internet | Technology | 123 | 1 | 93 | 26 | 86 | 41 | High |

| Baron Focused Growth | Mid Growth | 122 | 3 | 71 | 5 | 31 | 87 | High |

| Virtus Zevenbergen Innovative | Large Growth | 119 | 1 | 15 | 2 | 14 | 89 | High |

| Morgan Stanley Insight | Large Growth | 117 | 1 | 38 | 1 | 1 | 94 | High |

| Morgan Stanley Inst Growth | Large Growth | 116 | 2 | 97 | 3 | 2 | 87 | High |

| Shelton Green Alpha | Mid-Cap Growth | 114 | 3 | 3 | 96 | 14 | 95 | High |

| Transamerica Capital Growth | Large Growth | 112 | 2 | 98 | 3 | 2 | 92 | High |

| Morgan Stanley Global Endurance | World Large Stock | 110 | 1 | 19 | — | — | — | — |

| Upright Growth | Technology | 109 | 3 | 99 | 100 | 100 | 83 | High |

| Baillie Gifford Long Term Global | World Large Stock | 102 | 1 | 7 | 3 | 1 | 96 | High |

Bottom line

Without any question, some of these are very fine funds. Likewise ETFs. But you cannot now buy the fund’s 2020 returns, so you should not use them to justify 2021’s purchases.