“Things as certain as death and taxes can be more firmly believed” was written by Daniel Defoe in “The Political History of the Devil” in 1726. Benjamin Franklin wrote, “In this world, nothing can be said to be certain, except death and taxes” in 1789. Few subjects I have written about elicit such a passionate response as “Roth Conversion” and “Deferring Social Security Benefits.” This article is the first of a three-part series describing my experiences as I retire on June 29th within a few days of age 67.

- Part 1: “Certainty of Death and Taxes” describes how death, taxes, social security, and Medicare may impact financial retirement plans.

- Part 2: “Planning the Next 365 Days” is my personal journey in preparing for my new life in retirement.

- Part 3: “Financial Adjustments in Retirement” is how I am adapting portfolios shifting from earning a paycheck to living on pensions and savings.

According to the IRS, nearly 900 thousand taxpayers converted about $17B from Traditional IRAs to ROTH IRAs in 2019. It is a popular decision. Deferring a Social Security Pension until age 70 increases the monthly benefit by about 8 percent for each year of delay. A U.S. News article by Emily Brandon, “The Most Popular Ages to Collect Social Security,” describes that the number of people waiting to draw social security until full retirement age is increasing. Currently, 36% of men and 31% of women sign up at their full retirement age. Only 6% of women and 4% of men wait until age 70 to begin drawing Social Security.

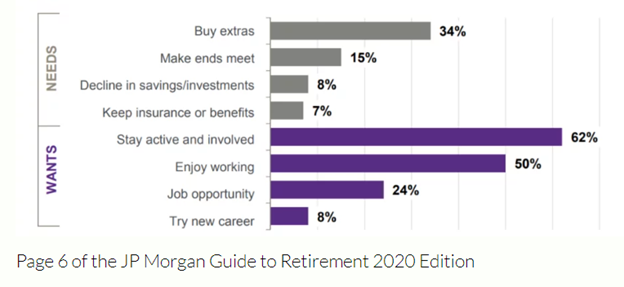

Abraham Maslow introduced the “Hierarchy of Needs” in 1943 in “A Theory of Human Motivation,” consisting of 1) Physiological (food, water, shelter, etc.), 2) Security and Safety, 3) Social (family, friends, community), 4) Esteem (appreciation, respect, value), and 5) Self-Actualization (personal growth, potential). Figure #1 from Ashy Daniels for the Retirement Field Guide, in “10 Charts About Retirement Every Retiree Should See (2020),” explains why Americans are working longer by dividing the reasons into the “Needs” and “Wants.”

Figure #1: Reasons People Work Beyond Age 65

Please feel free to share suggestions and ideas about retiring on the Mutual Fund Observer Discussion Board. Keep in mind that this is research for my own retirement, and I am still learning the ins and outs.

Aha! Moments in Retirement Planning

I began my career after the military, graduating as a non-traditional student in 1985, and managed to catch nearly every cyclical industry downturn for the next twenty years. I have been through at least two dozen workforce reductions (in which I was mostly fortunate), mergers, acquisitions, shutdowns, and joint ventures. I married Anna more than thirty years ago when we had a combined net worth of close to zero. With a dual-income family, we have built up several pensions, social security, and retirement benefits, and maximizing contributions to savings plans has put us on track for a secure retirement.

In 2008, I used my company’s pension planning service to get estimates of pension benefits at different ages. It was an eye-opener to learn that if I retired at the full age of 62 instead of 57 that my pension would be more than two and a half times larger. Aha! In 2010, I read Retire Secure!: Pay Taxes Later – The Key to Making Your Money Last by James Lange, who is a CPA, Attorney, and Financial Advisor. I followed the advice by creating a lifetime budget. I realized that if everything went according to plan, pensions and deferring social security would put us in a high tax bracket when I started drawing required minimum distributions from traditional IRAs. I immediately switched to a Roth IRA. Aha! Less risk should be taken in traditional IRAs where taxes have yet to be paid, and higher risk should be taken in Roth IRAs where taxes have already been paid. Aha!

The Certainty of Death

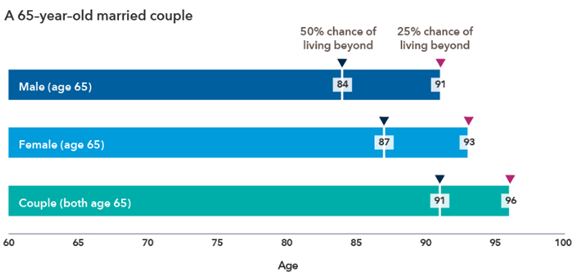

Kate Beattie, Senior Retirement Income Strategist at Capital Group, makes the point in “Longevity: Don’t Plan For An Average Retirement” that people planning on retirement should use more than life expectancy when planning on retirement. As the chart below shows, there is a 25% probability that at least one member of a couple will live to age 96, well above the median life expectancy of 84 to 87 years of age.

Figure #2: Life Expectancy Of A 65-Year-Old Married Couple

Source: Capital Group and Society of Actuaries and American Academy of Actuaries, Actuaries, Actuaries Longevity Illustrator, as of May 10th, 2021

CNBC Personal Finance Reporter, Greg Iacurci, describes in this article, new U.S. Department of Labor requirements that 401k administrators provide “lifetime income illustrations” to participants starting in July of this year. These are estimates of the approximate income people will get in retirement if they were to buy an annuity with 401(k) savings at age 67. This is intended to change how people think about retirement savings. Having $500,000 in a 401(k) savings plan is a lot of money, but this NewRetirement Lifetime Annuity Calculator puts it in perspective that it would buy an annuity that pays about $2,000 per month if you elect 75% Survivor Benefits for your spouse and 3% inflation protection.

Survivor Benefits

Women tend to live longer than men, and I want to make sure that Anna is well cared for in case I pass away before her. To this objective, I set up a meeting with our Fidelity Financial Advisor and enrolled in Fidelity Wealth Management Services for a portion of our savings. Our advisor provided us with a list of Certified Public Accountants/Financial Planners to assist with analyzing the tax consequences of various strategies. We interviewed two CPAs and selected one that we are comfortable with.

Anna and I have planned on guaranteed income to meet our living expenses by electing the pension option with 100% Joint and Survivor Annuity for one pension. It lowers my monthly benefit by about 6% but gives me peace of mind knowing that Anna will have both her and my pension for life. The Widow’s Tax refers to women moving into a single tax category instead of a joint after the husband passes away. I took another pension as a lump sum.

Social Security plays a secondary role in providing survivor benefits to spouses and dependents. Someone who is collecting a pension not covered under social security, such as many public service pensions, may have spousal benefits reduced by the Government Pension Offset (GPO). Anna was a school teacher and administrator and is impacted by this program. This is where delaying one’s social security benefits until age 70 increases survivor benefits. In the case of Anna, my delaying social security benefits has a considerable impact on the survivor benefits that she may get.

A widow or widower whose spouse waited until 70 to file for Social Security is entitled to the full amount the deceased was getting — including the delayed retirement credits — so long as the surviving spouse has reached full retirement age.

(“If I Wait Until 70 To Claim Social Security, Will My Spouse Get A Bigger Benefit As Well?”, AARP)

Beware, The Tax Man Cometh

While retirees may be fortunate to have worked and saved throughout their careers so that they can enjoy a secure retirement, retirees will still pay taxes on income from earnings, pensions, social security, and income levels may also impact Medicare premiums.

Stealth Taxes in Retirement

Robert Klein, founder and president of the Retirement Income Center, describes in “Six Stealth Taxes That Can Derail Your Retirement” the taxes that people nearing retirement should be aware of. I describe many of these taxes in this section.

The goal of retirement income planning is to optimize the longevity of your after-tax retirement income to pay for your projected inflation-adjusted expenses. In addition to having adequate retirement assets, there are two ways to achieve this goal: (a) maximize income and (b) minimize income tax liability.

- Stealth Tax #1: 10-Year Payout Rule

- Stealth Tax #2: Social Security

- Stealth Tax #3: Increased Medicare Part B and D Premiums

- Stealth Tax #4: Net Investment Income Tax

- Stealth Tax #5: Widow(er)’s Income Tax Penalty

- Stealth Tax #6: $10,000 Limitation on Personal Income Tax Deductions

Secure Act – 10-Year Payout Rule

The Secure Act changed the inheritance rules for children and grandchildren after reaching the age of majority so that now they have to empty out both traditional and Roth IRAs over ten years after the death. This may cause them to draw out money faster than the required minimum distributions would have been, which potentially increases taxes.

Tax Cuts and Jobs Act – Limitation on Tax Deductions

The Tax Cuts and Jobs Act of 2017 nearly doubled the standard deduction and reduced mortgage interest deductions. The deductions for state and local taxes (SALT) for state and local real estate, personal property, and either income or sales taxes are now capped at $10,000.

Tax Rates and the 2026 Sunset Law

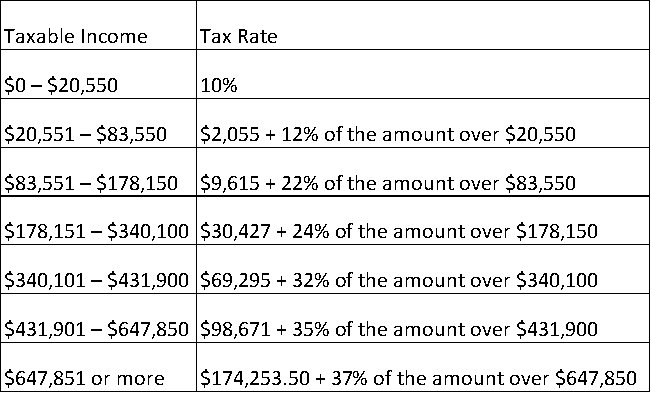

The tax table from the Internal Revenue Service for a couple filing jointly is shown below. The large jumps in tax rate occur at $83,551, where the marginal tax rate jumps from 12% to 22%, and at $340,101, where the rate jumps from 24% to 32%. Managing one’s taxable income around these levels may reduce overall taxes.

Table #1: 2022 Federal Tax Rates

The Tax Cuts and Jobs Act was passed in 2017 and is set to expire in 2025, known as the “2026 Sunset Laws” described by the Federal Employees Tax Planners. If not extended, tax rates will rise in 2026 as follows:

- 12% tax rate goes back up to 15%

- 22% tax rate goes back up to 25%

- 24% tax rate goes back up to 28%

Required Minimum Distributions

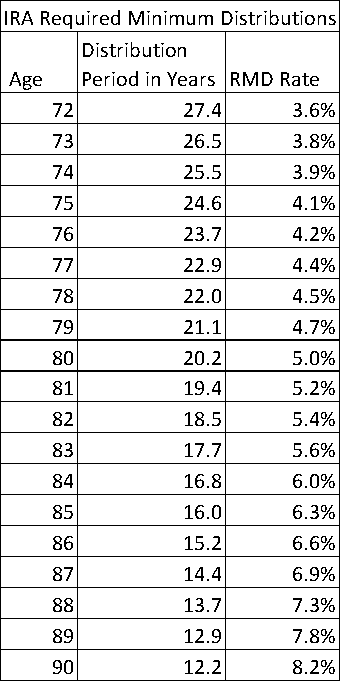

Traditional IRAs require that minimum distributions are taken, as shown in Table #2. For every million dollars that a retiree has in Traditional IRAs, they must take $36,496 out at age 72 and pay taxes on it. This is in addition to pensions, social security, and other taxable income.

Table #2: Required Minimum Distribution Rates

(Ben Geier, “IRA Required Minimum Distribution (RMD) Table for 2022”, Smartasset)

Taxes on Social Security

The American Association of Retired Persons (AARP) explains taxes on social security in “How is Social Security taxed?”:

- up to 50 percent of your benefits if your income is $25,000 to $34,000 for an individual or $32,000 to $44,000 for a married couple filing jointly.

- up to 85 percent of your benefits if your income is more than $34,000 (individual) or $44,000 (couple).

Net Investment Income Tax (Medicare) 3.8% Surtax

The Net Investment Income Tax (NIIT) came into effect in 2013. It adds an extra 3.8% tax when net income is $250,000 or higher if married. In “Roth IRA Conversion: 7 Things to Know”, Fidelity describes that a conversion to a Roth may trigger the Medicare surtax:

Married couples (filing jointly) with a modified adjusted gross income (MAGI) of more than $250,000 may be subject to a 3.8% Medicare surtax. (The MAGI thresholds are $125,000 for married taxpayers filing separately and $200,000 for single filers.) The surtax applies to net investment income (which includes income from interest, dividends, capital gains, annuities, rents, and royalties, among other things); or MAGI in excess of the income thresholds, whichever is less.

The amount you convert from a traditional IRA to a Roth IRA is treated as income—just like all taxable distributions from qualified pre-tax accounts. Therefore the conversion amount is part of your MAGI, and it may move you above the surtax thresholds. This may cause you to incur the additional Medicare surtax on your investment income.

Roth 401k vs. Roth IRA

Roth 401k’s are subject to required minimum distributions by age 72, but you do not have to pay taxes on the qualified distributions. Roth 401k’s may be rolled over into a Roth IRA to avoid these RMDs. For more information on Roth 401k’s, please read “What Are the Roth 401(k) Withdrawal Rules?” at Investopedia.

When It Might Be Right To Do A Roth Conversion

Mr. Klein further lists the “7 Reasons To Start A Staged Roth Ira Conversion Plan Today” in the Retirement Income Center, as shown below.

- Eliminate taxation on the future growth of converted assets.

- Take advantage of low federal tax rates scheduled to expire after 2025.

- Reduce required minimum distributions beginning at age 70-1/2.

- Potentially reduce Medicare Part B premiums.

- Reduce widow or widower’s income tax liability.

- Reduce dependency on taxable assets in retirement.

- Stay focused on retirement income planning.

In “Roth IRA Conversions and Taxes,” Fidelity describes when a Roth conversion might be right for a retiree and offers seven considerations to think about. Whether a Roth conversion is right for you may depend on your outlook for taxes and future returns, and Fidelity has a nifty Roth Conversion Calculator. Fidelity offers situations when a Roth Conversion may be advantageous:

- You expect to be in a higher tax bracket in retirement than you are now.

- You think the value of your IRA investments is hitting a low point.

- You have other losses or deductions to offset the tax due on the conversion.

- You don’t need to take distributions by age 72.1

- You are moving to a state with higher income taxes.

Allan Roth, founder of Wealth Logic, LLC, a Colorado-based fee-only registered investment advisor, provides a comprehensive description of Roth Conversions in “The Seven Cases to do a Roth Conversion.” He leans toward a Roth conversion if clients answer in the affirmative to the following questions:

- Is the Roth pot of money small compared to the taxable and tax-deferred pots?

- Is the current marginal tax-bracket low? This could be the case if the client retired before taking Social Security or RMDs, or if they are starting a pass-through business (LLC or Sub-S) with very little income or even losses.

- Will the client have a high income in retirement, such as pension income?

- Will the RMDs be burdensome if the client doesn’t convert some money to the Roth?

- Does the client have any after-tax money in their tax-deferred accounts and if all IRAs are converted, will that allow for future backdoor Roth contributions?

- Will the client benefit from a possible state income tax exemption for amounts converted?

- Are there some estate planning benefits from conversions?

Roth Conversion Sweet Spot

Matt Bacon from Carmichael Hill describes “The Roth Conversion Sweet Spot,” which is the time between retirement and when a deferred social security pension and RMDs begin.

Income is generally lower than it was during your working years, withdrawals from pre-tax retirement accounts aren’t mandatory, and living expenses can be pulled from taxable accounts with favorable capital gains rates (potentially 0%)!

More Ways to Reduce Taxes

Gifting and charitable donations are more ways of reducing income.

- Gifting/Early Inheritance: You and your spouse can collectively give your child $32,000/year as a tax-free gift and the same amount for their spouse. Instead of having excess RMDs accumulate value in your account, it can be in theirs at lower tax rates and with no Medicare concerns.

- Donor-Advised Charities: If you are financially secure and expect to make donations to charities yearly over the next ten years, you might consider bundling the next ten years of donations (for the example, $10,000 x 2 x 10yr= $200,000) and making a donation from an IRA in a single year. The withdrawal would be totally deductible from MAGI, lower the value of the IRA and RMDs going forward, and allow a one-year itemization to get the tax deduction. After that, you have the option of disbursing the money where and when you choose, although it is committed to qualified charities.

- Direct donation of IRA withdrawal to a charity allows a direct decrease in MAGI for that year.

Understanding Medicare and the Impact of Income

For those of us that are new to Medicare, Fidelity summarizes options concisely in 6 Key Medicare Questions. There are plenty of rules and deadlines associated with Medicare and penalties for being late.

Higher Medicare Premiums for High-Income Retirees

Medicare Premiums are based on your modified adjusted gross income (MAGI). Shane Ostrom, former Director of the Military Officers Association of America, describes what is included in MAGI in These Actions Will Increase Your Medicare Part B Premiums. MAGI is your Adjusted Gross Income from two years ago before deductions plus your tax-exempt interest income. The following items may increase your MAGI:

- IRA and retirement account withdrawals

- Roth IRA conversions

- Withdrawals from insurance annuity policies

- Withdrawals (but not loans) from the cash value of life insurance

- The gain from the sale of a home or securities

- Interest, dividends, and capital gains from held savings and investments

- Business income

- Alimony

- Rental real estate

- Farm income

The cost of Medicare Premiums goes up for high-income earners, as shown in Table #3. Crossing over an income bracket by even $1 raises your monthly premium to the next level for both you and your spouse if both are on Medicare. The table shows that annual Medicare Premiums for a couple can increase by $2,448 if their income crosses $1 into the next income bracket. High-income earners may pay two to three times the base cost. Another important point is that the income is based on your modified adjusted income from two years ago when a retiree may still have been working and not based on your current lower retirement income.

Table #3: Medicare Part B Premiums

(Based on “Part B costs,” Medicare.gov)

Popular Medicare Options

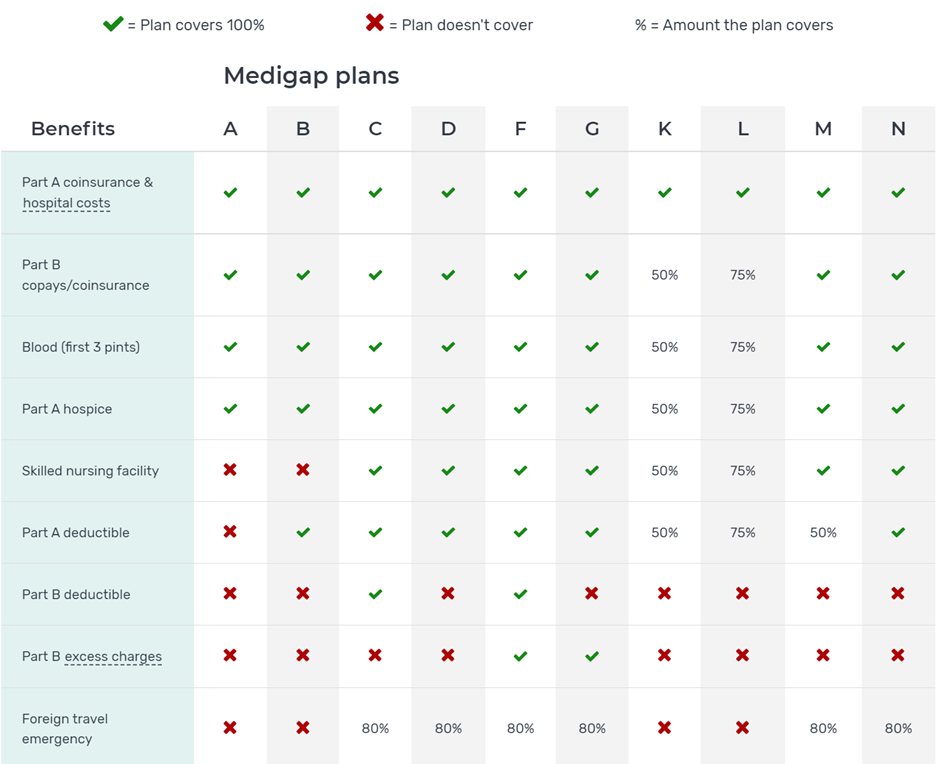

I searched on the internet to find the most popular plans for those that want full coverage. Medicare.gov provides a good summary of the plans available, as shown in Table #4. The most popular options are to have Parts A and B of Medicare and Supplemental Coverage, known as Medigap, or to select a Medicare Advantage. The most popular options are Medigap Plan G and Medicare Advantage. The Medicare site provides Star Ratings for the Medicare Advantage Plans along with the details.

Table #4: Medigap Plans

One of the benefits from my company is to have Alight help us select a plan and get enrolled. Another benefit is assistance with coverage for health care costs, and Alight was helpful in this regard. Based on my own research, I decided on the Medigap Plan G and pre-selected five providers in my area based on Star Ratings before talking to Alight. Linda Wnek (1-884-779-9561, ext 10095) was the representative from Alight, and she was helpful in going through the remaining questions that I had and with the details. To sign up for Medigap, you have to also have Medicare Part B. I applied for this online.

Closing Thoughts

I have been researching the financial aspects of retiring for well over a decade. There have been both pleasant and unpleasant surprises, as described in this article. “Part 2: Planning the Next 365 Days” addresses the realization that I have put too little thought into what I will do when I am retired.