By the time this article is published in Mutual Fund Observer, I will have been retired for one day as I near my 67th birthday. I spent 25 hours this past month listening to audiobooks about the psychology of retirement and an equal amount of time searching the internet for ideas generated from these books. I concluded that I should ease into retirement and plan on what to do for the next 365 days, sometimes called the Retirement Honeymoon Phase. This article is the second of a three-part series describing my experiences as I retire.

- Part 1: “Certainty of Death and Taxes” describes how death, taxes, social security, and Medicare may impact financial retirement plans.

- Part 2: “Planning the Next 365 Days” is my personal journey in preparing for my new life in retirement.

- Part 3: “Financial Adjustments in Retirement” is how I am adapting portfolios shifting from earning a paycheck to living on pensions and savings.

I have spent eleven of the past fifteen years living and working in remote and semi-remote mining camps overseas. These assignments are known as expatriate or “ex-pat” for short, on a fly-in-fly-out schedule where we work for six to eight weeks in the country and have two to three weeks on break. My typical day starts at 3:30 am with a cup of coffee before going to the gym. At 5:30 am, I walk 25 minutes to work instead of taking the bus. I have dinner at 5:30 pm and once or twice per week, join friends for a beer before going to bed early. This has been my schedule for six days per week, with the seventh day taken as a personal day.

What I have enjoyed about this lifestyle is the international travel, challenging work, and the lifelong friendships developed. When one of my ex-pat friends, Frank, learned that I am retiring, he said, “It took me two years to get used to not going to work. Now I am too busy to work!” What I want from this retirement planning is to go immediately into having too much to do when I stop working.

Working internationally has allowed plenty of time during travel to read and listen to audiobooks. This article is a result of my personal planning for psychological and social adjustments for retirement. I listened to How to Retire Happy, Wild, and Free: Retirement Wisdom That You Won’t Get from Your Financial Advisor, by Ernie J. Zelinski, Happy Retirement: The Psychology of Reinvention: A Practical Guide to Planning and Enjoying the Retirement You’ve Earned by Dorling Kindersley Limited (DK), and A Couple’s Guide to Happy Retirement: For Better or For Worse…But Not For Lunch by Sara Yogev, Ph.D.

There are many pitfalls in retirement, and mine are going to be related to major changes in my lifestyle as I repatriate to life in a suburb without having to get up so early. We moved to Colorado last year to be closer to family, healthcare facilities, and airports, and I have not spent much time at the new home. It is a shock to go to stores or restaurants and see how much prices have gone up since I have been away. I jump-started retirement by ordering Colorado Bucket List Adventure Guide: Explore 100 Offbeat Destinations You Must Visit! by Don Harris and created a list from the internet of over one hundred places to visit and things to do within a fifty-mile radius of home. As a result of writing this article, I ordered another book to learn from the experience of another retiree, George H. Szlemp, who wrote Retirement: The First 365 Days:: Day-to-Day Advice for Happiness in Retirement. I will read it on my final flight home.

Developing A Shared Vision For Retirement

Abraham Maslow introduced the Hierarchy of Needs in 1943 in “A Theory of Human Motivation,” consisting of Physiological (food, water, shelter, etc.), Security and Safety, Social (family, friends, community), Esteem (appreciation, respect, value), and Self-Actualization (personal growth, potential). Our vision for retirement is that we have enough saved for basic needs for long lives and that we have a margin of safety to cover unexpected events such as inflation and higher healthcare costs with enough to enjoy life’s little pleasures. This vision covers Maslow’s first two needs of Physiological, and Security and Safety. This article focuses on developing a vision for the last three.

The original version of Aesop’s fable, “Ant and the Grasshopper,” believed to be written around the sixth century BCE, is about the cicada (grasshopper) that spent the summer singing and dancing while the ant worked hard storing food for the winter. As winter arrives, the grasshopper asks the ant for food, and the ant tells the grasshopper to dance the winter away. Jean de la Fontaine’s 17th-century retelling of the story is about compassion and charity. My takeaway from the retirement books is to plan for the long term, but remember to stop and smell the roses.

Planning – Self Assessment

Once you have a vision for retirement and have done a realistic self-assessment, you can begin the planning in more detail. Things that should be addressed are lifelong concerns, fears of dependence or abandonment, adopting new passions, skills development, working part-time, and balancing money needs.

My father was a professor, and I had lived in three states by the time I was twelve. I joined the military at age 18 and was stationed in Europe. Anna grew up on a farm and ranch and lived there through high school. Our backgrounds greatly influence what we want in our lifestyles. I like to travel, and Anna doesn’t. Anna loves gardening, and I like spending time in the mountains. Anna and I both have a strong desire for security. We need to take these preferences into account as we plan our retirement.

In general, people nearing retirement have the desire to stay healthy, relax, connect with family, have fun, expand social relationships, continue learning, and give back to society. A good place to look when planning your life in retirement is at what you enjoyed doing during your past, as it is what you are most likely going to have the interest to continue doing in retirement.

I developed a Bucket List of the things that I have enjoyed doing in the past and want to continue or do more with my new freedom. I started with websites about the best attractions and activities within a 50-mile radius of home.

- Diet: Cooking and cooking classes, locally-owned restaurants

- Entertainment: Breweries and wineries,

- Exercise: Gym and nature trails

- Family: Day trips, gardening, grandchildren, lunch, vacations

- Fun: Sports centers and events

- Hobbies: Investing and conferences, writing

- Intellectual Challenge: Continuing education, museums, online learning, reading, podcasts, unbiased news

- Relaxation: Gardens, parks, theater

- Social: Gardening, breakfast, friends, and community

- Volunteering: Environmental, community, society

Beware that there are many pitfalls to retirement, which for some people may be the loss of identity, purpose, and sense of accomplishment that we may get from work. The audiobooks helped me prepare a list of potential pitfalls that I need to work on or avoid:

- Develop a shared vision for retirement

- Assess your individual strengths, weaknesses, and interests

- Be patient

- Don’t procrastinate

- Develop good or better communication

- Involve each other in financial and household planning

- Having the right balance of dependence and independence upon your spouse.

- Plan joint leisure time as well as time separately to pursue personal interests or enjoy friends.

- Share responsibilities, especially housework

- Stay active together

Preparation

Retirement is a process and not an event. The more that you have planned for life after work, the less you will have to adjust in retirement. There are the immediate aspects of preparing for retirement, such as discussions with your employer about benefits, finding a replacement, and applying for pensions and Medicare.

In my early career, I was a workaholic. In 2006, I told Anna, “Life is too short to live like this, and I don’t want to do it anymore.” I decided that a change of environment was necessary and chose to work internationally. A couple of years later, Anna told me that I was right that life was too short to do a job that she was not happy with, and she made a career change. We did not realize it during these times, but these career changes were preparing us for retirement.

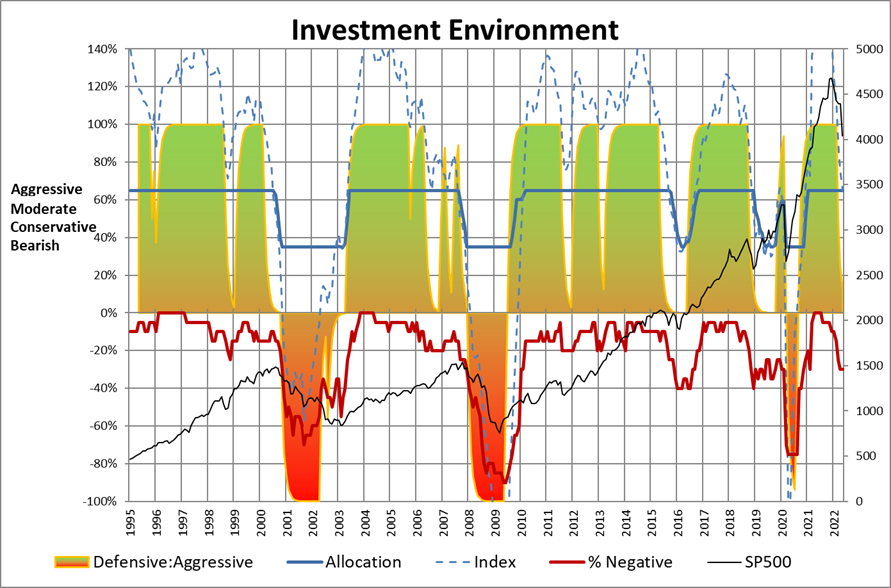

I began reading a lot of history, science, economics, and financial books. One of my interests was to develop the Investment Model, which involved several years of research. I submitted an article to Seeking Alpha to see if anyone was interested in reading about macro-economic models and have been writing financial articles since then. By the way, the Investment Environment (dashed blue line) is falling to a level that warns to reduce allocation to riskier assets (solid blue line). As inflation started rising, I shifted to my neutral stock allocation of 50%. The Percent of Negative Indicators (solid red line) is now about 30% suggesting that a recession is not imminent, but risks are rising.

Honeymoon Phase

My transition to retirement includes a birthday, anniversary, and Fourth of July celebration. I have my list of things to do when I retire already prepared. The suggestions from some authors for transitioning into retirement are to ease into it but not procrastinate. You are likely to have more time than you anticipate, and you should try to make the most of your leisure time. I have begun having discussions with Anna about taking more of the stress of household work when I get home.

When looking at the costs of items on my wish list, I had to take a step back and prioritize. I decided that it was more cost-effective to upgrade. Here is my list of things to do in the first two months after retirement.

- Join a gym through the Silver Sneakers program

- Grill a ribeye steak on our anniversary

- Help Anna with the landscaping

- Call friends

- Make plans to visit family

- Find activities for when our son and grandson come to see us in October.

- Finalize retirement preparations

- Read Colorado Bucket List Adventure Guide: Explore 100 Offbeat Destinations You Must Visit! and Retirement: The First 365 Days:: Day-to-Day Advice for Happiness in Retirement

- Write an article, “Financial Adjustments in Retirement.”

- Develop a plan for the Honeymoon Retirement Period

- Walk in the Benson Park Sculpture Garden and Chapungu Sculpture Park

- Hike Devil’s Backbone Open Space

- Visit the tasting room at Sweet Heart Winery

- Have a beer at the Big Beaver Brewing Company

- Eat at Mo’ Betta Gumbo and Nordy’s Bar-B-Que restaurants

- Have breakfast at the Rise Artisan Bread Bakery

- Ride the Fort Collins Trolley

- Sign up for unbiased news sources

- Attend an online investing class

Those who don’t develop interests and habits through the Honeymoon Phase may find themselves disenchanted with retirement as they struggle with the extra time. They may feel like they lost part of their identity when they left work. They may have grown apart from their friends that they knew at work and not developed new friends.

Future Growth

I have identified a lot of possibilities for helping plan a successful retirement. I want to narrow the list down substantially before deciding on my next steps. AARP has online classes covering many topics. I will be researching Massive Open Online Courses, known as MOOCs, which are free online courses covering a wide variety of topics. “Free Online Classes for the Masses” on the AARP website describes how to get started in MOOCs. Udemy is another possible resource that has 185,000 online video classes for a small fee. For those interested in investing, Morningstar has 170 ten-minute online classes for no charge. The MoneyShow has the MoneyMasters Courses offered by financial experts worth looking into.

Planning the Next 365 Days

I have enjoyed work, the amenities that I have had, the people I have known, and the experiences that I have shared. I have prepared for retirement and look forward to it. I am shifting gears from employment being center stage to preparing for a different life which I am only now taking the time to imagine. I have lived overseas for nearly a quarter of my life and will enjoy spending less time in airports and sleeping on planes. I have not seen many of the great sites in the United States, such as Yellowstone National Park, and I look forward to exploring my new home, like walking through Benson Park Sculpture Garden in Loveland, Colorado.

Yellowstone Falls, Yellowstone National Park

Yellowstone Falls, Yellowstone National Park

Benson Sculpture Park, Loveland, Colorado