By Devesh Shah

Is it time to overweight EM stocks now? To answer this and many other questions, the Mutual Fund Observer reached out to six EM Equity Fund Managers. Our plan was to talk with each at length, sharing one manager’s insights with another and seeking their response. Our hope was to help you gain an insight deeper than “boy, EM valuations sure are low! Time to buy, right?”

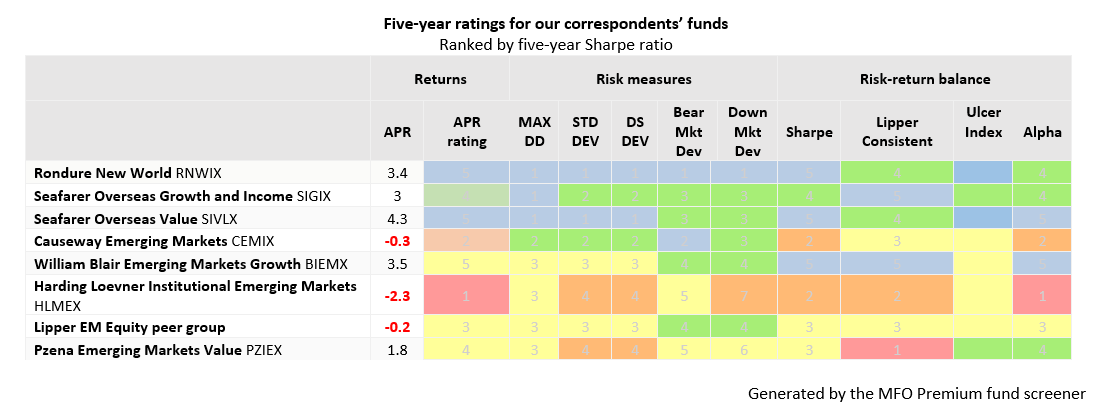

I am deeply grateful to them for helping our readers further their understanding. This essay will walk you through their arguments and our reflections on what EM investors might reasonably expect in the years ahead. Our companion article, EM Investing in the Next Decade: The Players, highlights the biography, strategy, and record of these fund managers.

Investors need to stay engaged and pay attention to underperforming asset classes because returns mean revert. EM equities have been significant laggards in the last decade. To make money, we need to buy good assets cheap. What do these managers, breathing EM stocks in and out every day, have to tell us about this asset class today? We’ll highlight six threads that we’ve drawn from our conversations:

- Wild optimism about the prospects of EM at the dawn of the century.

- Ugly reality interjecting itself by the second decade

- The classic case for EM investing or EM Investing 1.0: They Grow!!

- The revisionist case for EM Investing, or EM Investing 2.0: They’ve Changed

- The most undervalued stocks on the planet

- What could possibly go wrong (i.e., will I soon be writing EM Investing 3.0?)

The 21st century was supposed to be the EM century. It started off that way.

The first decade of the 21st century was an outstanding one for EM stocks. $1 invested in the MSCI Emerging Markets Local Stocks index in Jan 2001 would have turned into $4.04 by Dec 2010, an annualized return of 15 percent. The US dollar was on the down and further juiced EM returns for US investors by an extra 1.2% per year.

| Index (Total Returns) |

MSCI EM Local Index |

MSCI EM US$ Index |

| Jan 2001-Dec 2010 |

15% |

16.2% |

| $1 Invested |

$4.04 |

$4.5 |

In the same time period, from 2001 to 2010, the broad US stock market struggled. The decade was spent digesting the misallocation of capital in two bubbles. $1 invested in the S&P 500 index remained more or less the same, saved by stock Dividends, which helped US stocks return a paltry 1.4% per year.

| Index (Total Returns) |

USA S&P 500 Index |

| Jan 2001-Dec 2010 |

1.4% |

| $1 Invested |

$1.15 |

Laura Geritz of Rondure New World recalls how the book, The Emerging Markets Century by Antoine van Agtmael, was published in 2007 when EM countries and stocks could do no wrong.

Coming out of the 2008-2009 crisis, the geopolitical and market thesis was that US dominance after two 50% stock market crashes in one decade was over. EM countries were supposed to be the future. It got so bad for the US that at one point in the 2009 Copenhagen Climate summit, leaders of Brazil, India, China, and South Africa met secretly to negotiate portions of the climate pact. Unthinkably, they excluded the American President from the meeting. When President Obama found out, he crashed into the meeting uninvited. The US was on its knees.

Coming out of the 2008-2009 crisis, the geopolitical and market thesis was that US dominance after two 50% stock market crashes in one decade was over. EM countries were supposed to be the future. It got so bad for the US that at one point in the 2009 Copenhagen Climate summit, leaders of Brazil, India, China, and South Africa met secretly to negotiate portions of the climate pact. Unthinkably, they excluded the American President from the meeting. When President Obama found out, he crashed into the meeting uninvited. The US was on its knees.

Just when everyone ruled out the US, the second decade had other plans

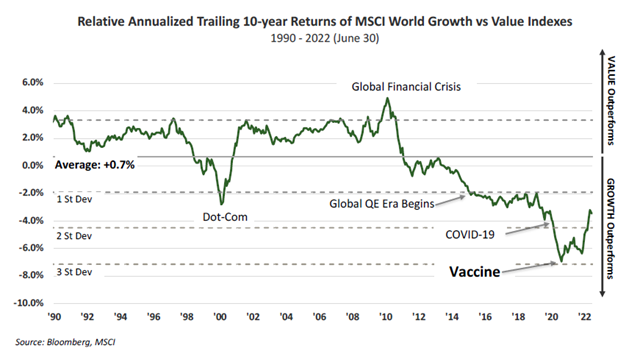

Consensus bullishness for EM in those days couldn’t have been more wrong over the following 12 years. In fact, we all learnt the hard way that the only asset worth being invested in was Mega Cap US Technology Growth Stocks.

In the 12-year period from 2011 to August 2022, $1 in US Stocks became $4.02, a return of 12.7% annualized. The MSCI EM Local index returned 4.9% a year but adjusted for the strengthening US Dollar, returns for American investors clocked in at a low 1.7% a year.

| Index (Total Returns) |

MSCI EM Local Index |

MSCI EM US$ Index |

USA S&P 500 Index |

| Jan 2011-Aug 2022 |

4.9% |

1.7% |

12.7% |

| $1 Invested |

$1.74 |

$1.20 |

$4.02 |

Sequence of Returns Matters

Over the entire 22 years of this century, ironically, both the S&P 500 and the MSCI US$ EM Stocks index, produced similar returns – about 7-8 percent annualized. But, from the perspective of an investor, the sequencing of returns matters.

In hindsight, it would have been better to avoid the consensus EM bullishness coming out of the 08-09 crisis. Why did US stocks do so well, and why couldn’t EM keep up in the second decade?

Todd McClone of William Blair pins the blame on quantitative easing:

Central Banks in the Developed Markets (DM) – Japan, Europe, USA – liberally used Quantitative Easing since the crisis. The lower interest rates in US incentivized corporate borrowing, increased leverage, stock buybacks, leading to PE multiple expansion, and DM stock outperformance. EM Central Banks never had that option. EM countries mostly stuck to orthodox monetary policy.

Various fund managers attributed it to a malign combination of inept policy-making and pure bad luck:

Brazil and South Africa went into a deep political and economic crisis. Turkey is out there running some kind of economic experiment. China went through a mid-decade A-share bubble and burst and then undertook regulatory reform to cut the legs out of her fast-growing technology companies. Covid-19 lockdowns and slow vaccine availability crushed GDP in many countries. The commodity boom, which had helped many EM companies outperform in the previous decade, turned into a bust. The final nail in the coffin was the strengthening US Dollar.

Pradipta Chakrabortty of Harding Loevner sees the Western response to the Russian invasion as inadvertently tripping innocent third-party economies:

The speed at which sanctions were imposed on Russian stocks and the trading ban was unprecedented in the modern era. We are now far more focused on the S (Social) of the ESG now. Not just directly but also 2nd and 3rd tier effects in the supply chain.

Original reason to invest in EM stocks Version 1.0

Starting from the 1990s, there were two intertwined reasons to invest in EM.

First: EM version 1.0 was about faster economic growth in those countries. The prime source of returns was supposed to be the high growth in per capita terms. As countries pursued reforms and productivity, they would increase the living standards and life spans of their citizens. In turn, this would create greater profit opportunities for local companies, propelling higher stock market returns.

Second: Investing in EM economies, which were physically and proverbially different from the US would add an uncorrelated source of returns. investors would benefit from portfolio diversification through EM investing.

Andrew Foster of Seafarer: That version 1.0 is now over. Extinct! The low-hanging fruit has been picked, and whatever productivity growth was possible was met. Many of these countries still have the potential, but they lack the political or social will to undertake additional structural reforms. Many EM countries find themselves in the middle-income trap. As a result, EM countries will struggle to generate Real GDP in excess of 3-4% a year. Individual countries and pro-cyclical policies will take selective growth up from time to time to 5-6%. But the delta of EM Growth outperformance to Developed Market (DM) Growth will decline going forward.

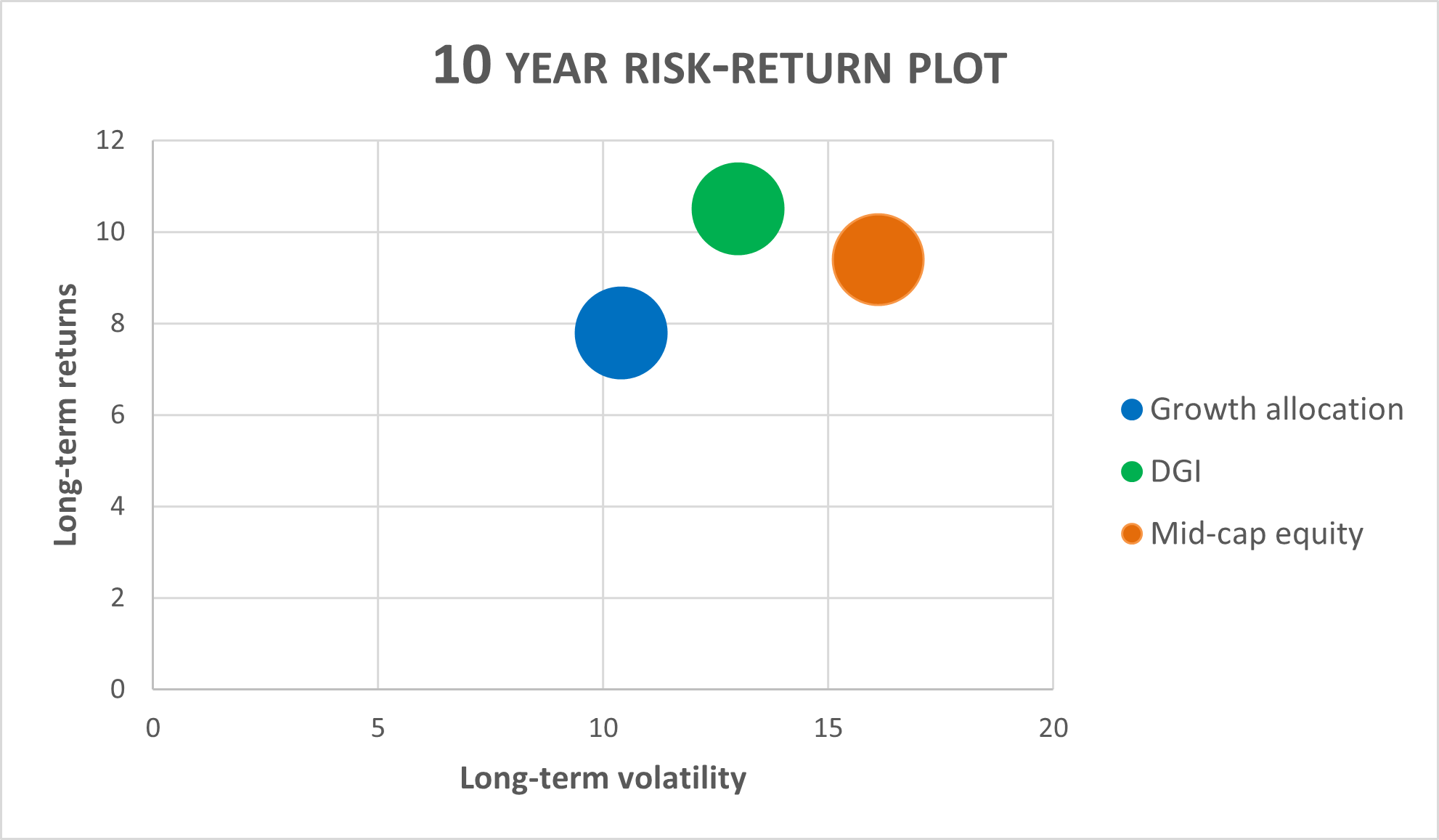

The EM story has now evolved. After twenty-five years of EM investing, we have a more liquid, deeper, and broader investment asset class. This allows for more complicated and nuanced strategies to be implemented. This EM version 2.0 is compelling for investors, provided they have at least a 5-year investment horizon.

Vallabh Bhansali, a hugely successful (and now retired) investment banker in India, in a recent interview with Maggie Lake of Real Vision, said, “I do like to think that if the world had to become rich and prosperous and happy by American standards, it will be a disaster in 20 years.”

I say, why wait for 20 years? Even today, large swaths of Europe have been pushed to the brink by the energy crisis. Shorter hot water showers in Germany, streetlights out in France, state-monitored temperature settings in Spain, and as a UK friend recently mentioned, “the heat wave was so bad, my kids could not sleep. London isn’t built for the summer.” The future of growth in EM and perhaps the world over might require more localized economic models. The companies which succeed will know how to adapt locally in every jurisdiction. Can EM companies cut it? Our fund managers think they are the best suited.

Welcome to the Emerging Markets version 2.0:

What might be some features of this new version, and what factors support the vision? There are two main reasons to be invested in EM today:

- A New kind of company: Confident, regional, and global leaders

In the early days, successful EM investment meant finding local champions. Today, some of these companies have become regional leaders – Mercado Libre, the Amazon of S. America, and Globant, the Infosys of S. America. In a few cases, these EM companies have become global leaders. Samsung and Taiwan Semiconductors in chips, and Tata Consulting in IT.

When a company does well in its own country, it may be because of political patronage or subsidies. But for a company to do well in foreign lands, political favors do not work. The company must have an inbuilt edge: technology, distribution, matured management, and foreign know-how. Such companies have larger revenue streams, bigger market opportunities, and the ability to fire on multiple cylinders. These companies are less prone to cycles in one country. This leads to less earnings volatility and lower cost of capital. It is a small but lucrative subset.

Think about American companies and how they expanded across the globe in the 1980s and 1990s. Globalization brought in a huge profit driver which lasted multiple decades. Many EM companies are today where American companies were 30-40 years ago. They will have to bootstrap their way differently to becoming global companies, but they are knocking on the door, and using every trick in the book.

- Value Investing

Value investing is the concept where investors buy shares of companies in the market lower than the valuation dictated in the Balance Sheet. One can say the value is “hidden,” and through some effort – either by shareholders or management – the value gets unlocked, raising share prices. There are prerequisites to the process which make value investing work. Namely:

-

-

- Accounting standards have to be accurate. The Balance sheet should mean what it says.

- Minority Shareholders should have Governance rights, such as proposals at Annual General Meetings and the ability to vote in and out certain Board Members.

- Litigation should be an option when all else fails to enforce minority shareholder rights.

These options are now available in many (most) Emerging Markets. Even in China, where justice may be heavy-handed and state determined, a fair commercial litigation is now possible.

There were always cheap companies in EM, but previously, there was no way to extract that cheapness because of promoter control. In version 2.0, Value investing is a strategy available to investors. It’s a new and different source of return available in the Emerging Markets.

Factors that are accelerating version 2.0 in EM:

- Many EM companies are family-controlled. Some of them are in their 3rd generation and are often finding that the family is no longer that interested in running the same business as the 1st and 2nd generation.

- Non-family management is being increasingly brought in to run the companies.

- Families are more open to Private Equity investors becoming large shareholders.

- If in the past, owners tried to hide assets from tax authorities, now they are unhiding the asset values to raise selling valuations to institutions.

- Local debt markets are becoming more mature. In the US of the 1980s, KKR was able to buy RJR Nabisco because the Michael Milken crew was willing to lend high-yield money. Bank financing would have never created that buyout. In EM, slowly but surely, debt markets are maturing. Companies are able to borrow for longer maturities. Debt mutual funds are lengthening tenors and increasing credit risk for yield. This makes locally debt-financed M&A in home currencies more likely. An example of this was the shadow banking financed HNA (a Chinese insurance company) trying to buy out Vanda (China’s property developer). China has since clamped that market and HNA got into trouble separately, but the seed of the idea holds. As the local markets mature, debt financing is increasingly an option.

- Local institutions have now become majority investors in their own markets. For example, South Korea’s National Pension Service Investment Management owns 8.5% of Samsung Electronics. The cash sitting on Samsung’s Balance Sheet is valuable to a defined benefits Pension company. NPS might ask Samsung to pay dividends. When local companies can no longer lay the blame at the feet of foreign money, they lose the excuse of hoarding the cash and not rewarding shareholders.

In Version 2.0, growth at a country level helps, but we are no longer just counting on productivity gains. Investors are now searching for companies where management has matured, has become ambitious, has mastered their country or a region, and is setting sights globally to become the best company in that sector in that world. There will be more companies like Taiwan Semi, Samsung, Tata Consulting, and Infosys. Investors are now trying to find and get behind EM companies going global.

Moreover, the massive underperformance of the last 12 years, where EM stocks went nowhere as an asset class, has led to a massive pent-up value sitting on the books of EM companies. Accounting, Governance and Legal conditions now exist to monetize this value.

It’s nice to see a fresh narrative that is no longer chasing growth for growth’s sake, especially when we have realized the hard way that the American version of growth is non-replicable worldwide.

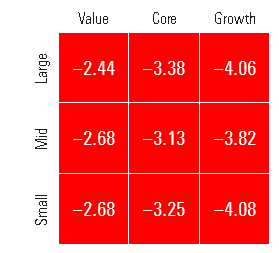

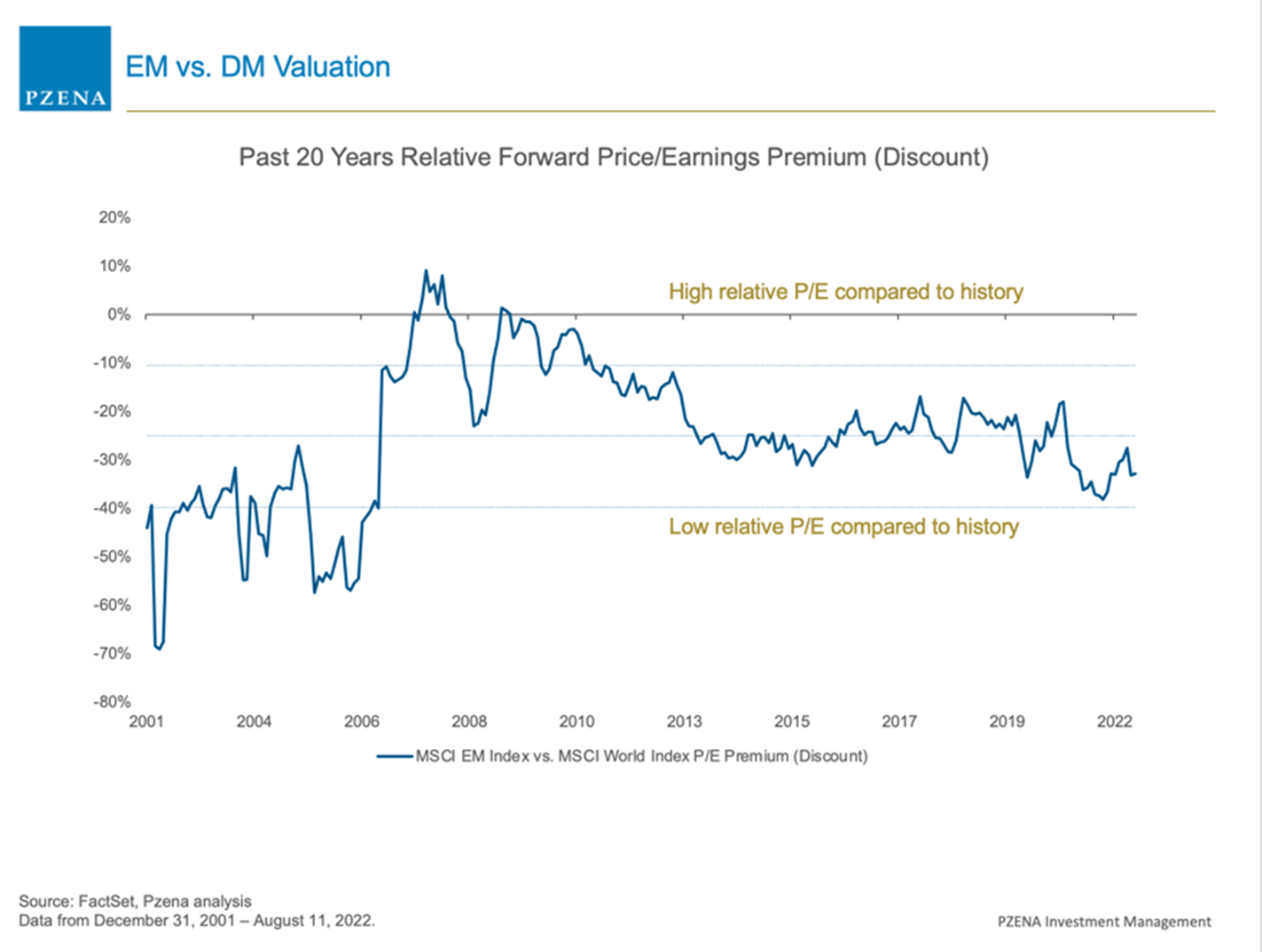

The next step is to look at valuations embedded in Emerging Market stocks, comparing Growth versus Value in EM, and comparing EM valuations to DM/US valuations.

EM Stock Valuation in charts and narratives:

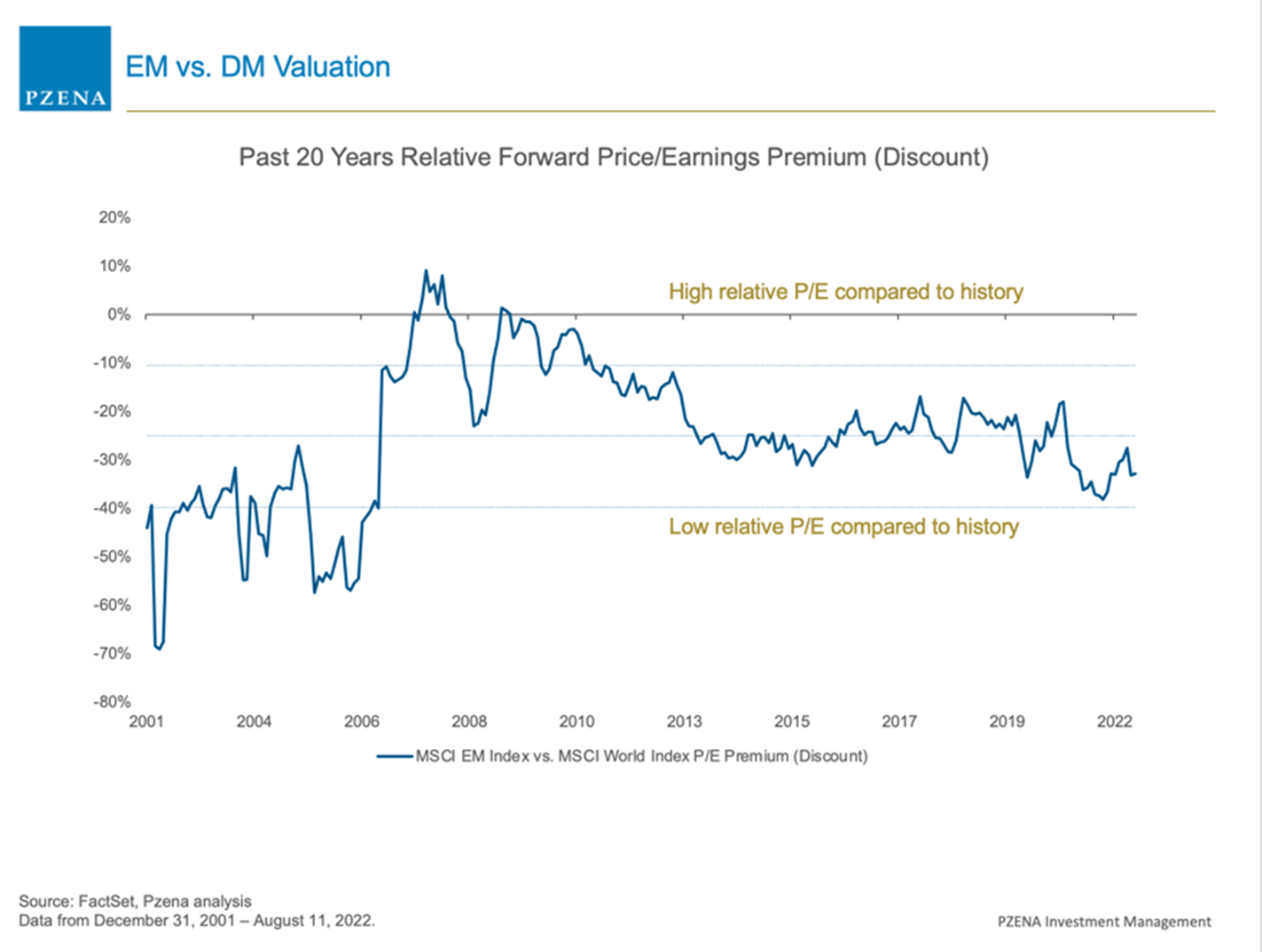

Rakesh Bordia of Pzena: EM stocks today trade at a substantial (35%) discount to DM Valuations.

Investors have practically given up on EM. The Return on Equity (ROE) on EM shares has been about 12.5% since 1992 and is presently even higher, in the 14.5-15% zone.

Many high-quality value businesses are trading at 10-15% FCF yield with good ongoing business models. This compelling valuation starting point means that stock returns are obvious, but the timing is always unclear in our business. EM returns are very lumpy.

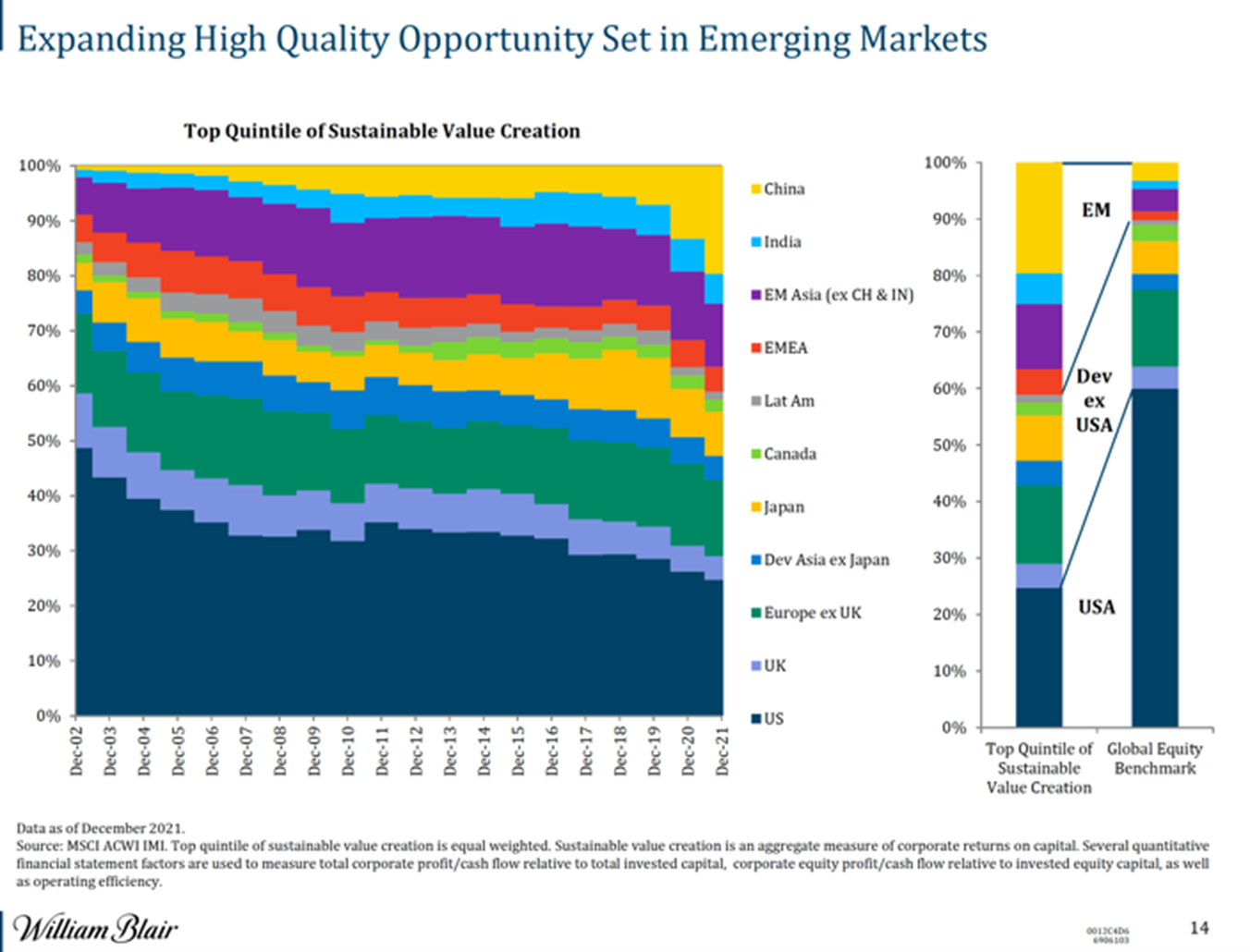

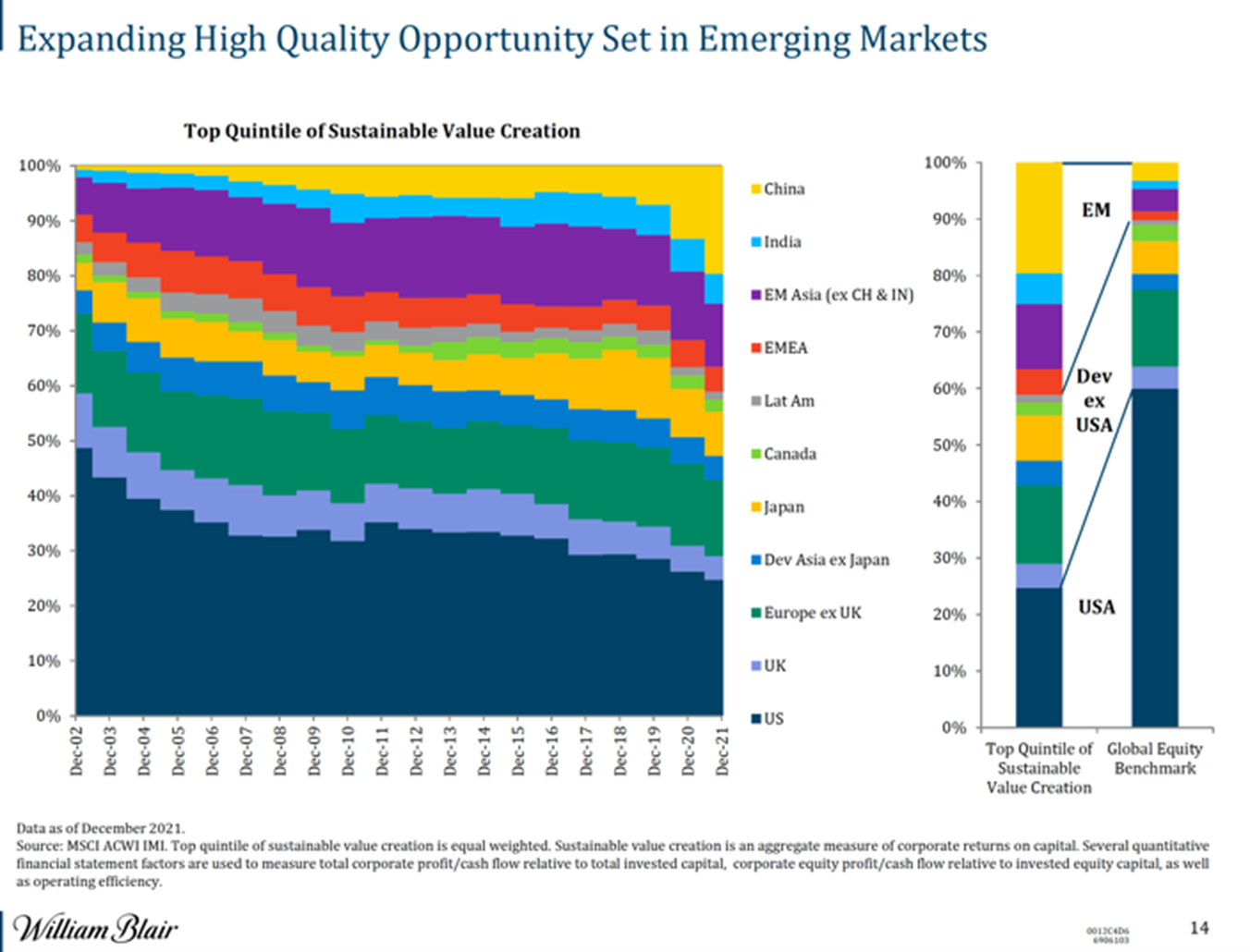

Todd McClone of William Blair: Using Return on Capital (ROC) as a metric and sorting the top 20% of those companies across the world markets – In 2002, only 15% of global companies were based in Emerging Markets. Today, 35% of those companies live in Emerging Markets. Our job is to find the EM leaders and get them on board.

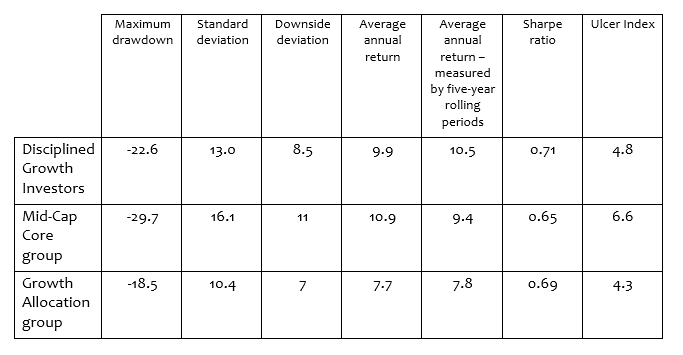

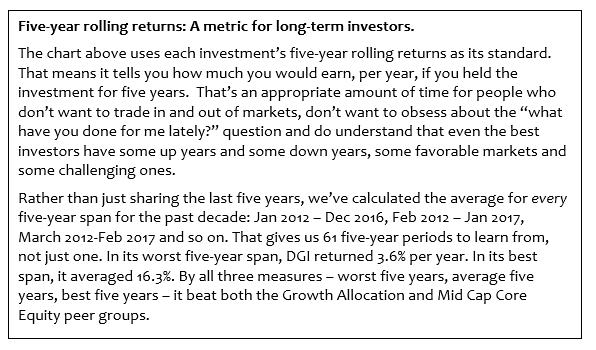

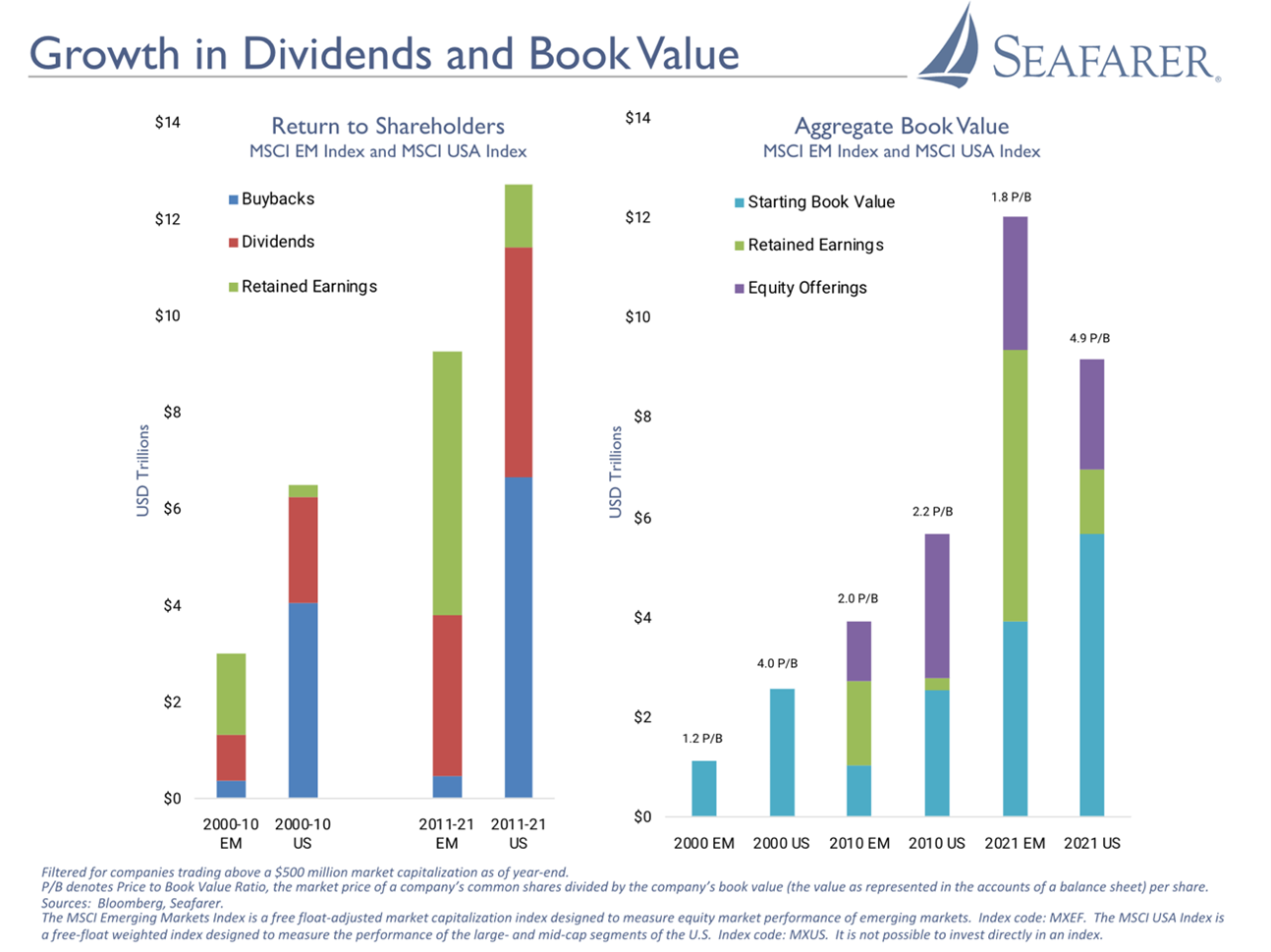

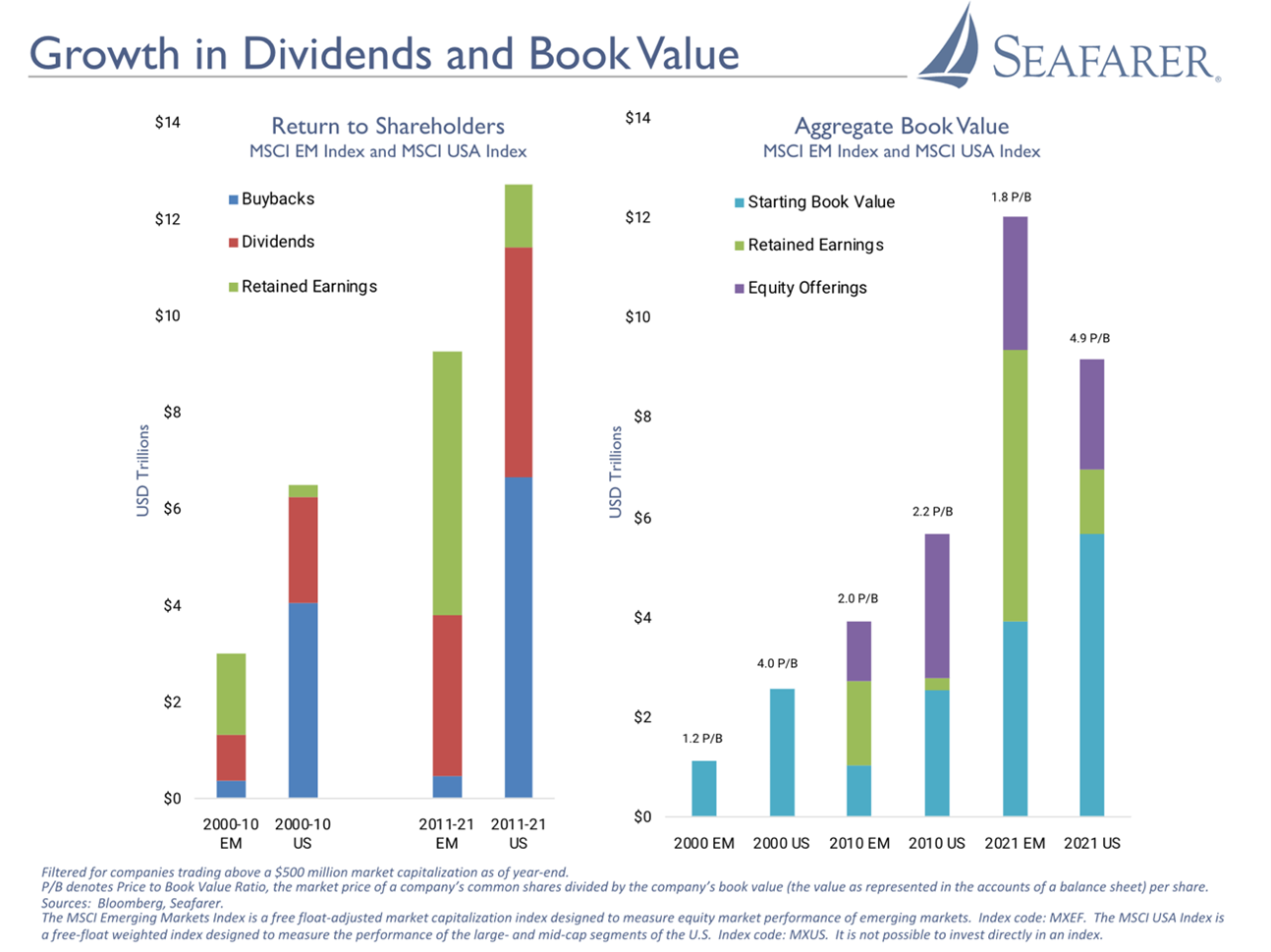

I found the next set of Charts from Seafarer on the growth in Book Value and P/B very insightful. Note that charts use 2021 data. Also, please note Seafarer’s disclosure at the bottom of this article.

* See the note on Seafarer disclosures at the end of this article.

Take time to process all the charts (especially this one above) slowly.

The chart on the left shows the evolutions of how profits were distributed and retained in 2 different decades in EM and in the US.

The first set of bars on the Left shows the progression of Earnings use in the 1st decade. EM stocks produced ~$3 Trillion of Earnings (profits) while US stocks earned ~$6T. Note the Blue bar – which stands for Buybacks, and the Red bar – which stands for Dividends paid.

EM companies’ buybacks and dividends to Shareholders were about 50% of the profits. The other half was saved up in Retained Earnings on the Balance Sheet – the Green bar.

US companies gave away 67% in Buybacks and dividends and retained 33% on their Books.

The next set of bars reflect the 11-year period from 2011 to 2021. EM companies earned ~$9Trillion. EM stocks have almost no increase in Buybacks, but significant Dividends were paid. The total returned to Shareholders was about ~4T out of ~9T, or 44%, a lower number than the previous decade.

US companies meanwhile earned $13T in that period. $11T, or 85%, was returned to shareholders through Dividends and Buybacks.

Lesson: US companies are showering Shareholders with money while EM companies are being stingy with their purses. It’s not that EM doesn’t make money; EM companies don’t like to share profits!

The chart on the right side shows the progression of Price To Book Values for EM and US stocks at 3 distinct points in time: the year 2000, 2010, and 2021.

| Year |

2000 |

2010 |

2021 end |

| ~ MSCI EM Book Value ($Trillions) |

1 |

4 |

12 |

| ~ MSCI US Book Value ($Trillions) |

3 |

6 |

9 |

Did you notice that from 2010 to 2021, EM companies grew book value from $4T to $12T, while US companies went from $6T to $9T?

Because EM companies held on to Retained Earnings, there are now MORE BOOK VALUE EM stocks than in US stocks. This was a big surprise to me. What does Mr. Market think?

Book Value is an accounting concept. The Market Price of companies trades at a premium or discount to Book Value. We call this metric Price to Book or P/B. On top of each of these bars, you will see a number for P/B for each asset in each time window.

| Time Window |

2000 |

2010 |

2021 end |

| MSCI EM P/B |

1.2 |

2.0 |

1.8 |

| MSCI US P/B |

4.0 |

2.2 |

4.9 |

I asked Seafarer for P/B estimates as of today. EM now trades at a P/B of less than 1.5x, and the US now trades at a P/B greater than 4x.

The lesson here is that US companies have rewarded shareholders, and shareholders have rewarded US companies by taking their Prices up.

IF, and it’s a big IF, EM companies started rewarding shareholders, and EM stocks could potentially trade at much higher valuations. Will EM companies pay shareholders?

Andrew Foster of Seafarer: The value is beginning to get realized. Notice how Alibaba and Tencent have initiated share buybacks. Also, keep an eye out on the Korean National Pension fund and if they start asking Samsung to pay more dividends going forward. In either case, I am agnostic about how the value gets monetized. One way or another, the Book Value is there, and the market will find its way to these stocks in EM version 2.0

—

Laura Geritz of Rondure: Today’s EM investor has many choices. If China doesn’t implode, it has one of the best quality and value companies. Opening (post-Covid) will lead to EPS growth, and stocks are cheap. Mexico is very interesting and a beneficiary of reshoring. It was ignored because it was not tech driven. If commodity prices stay balanced (not too low, not too high), that’s the ideal setup for EM stocks.

—

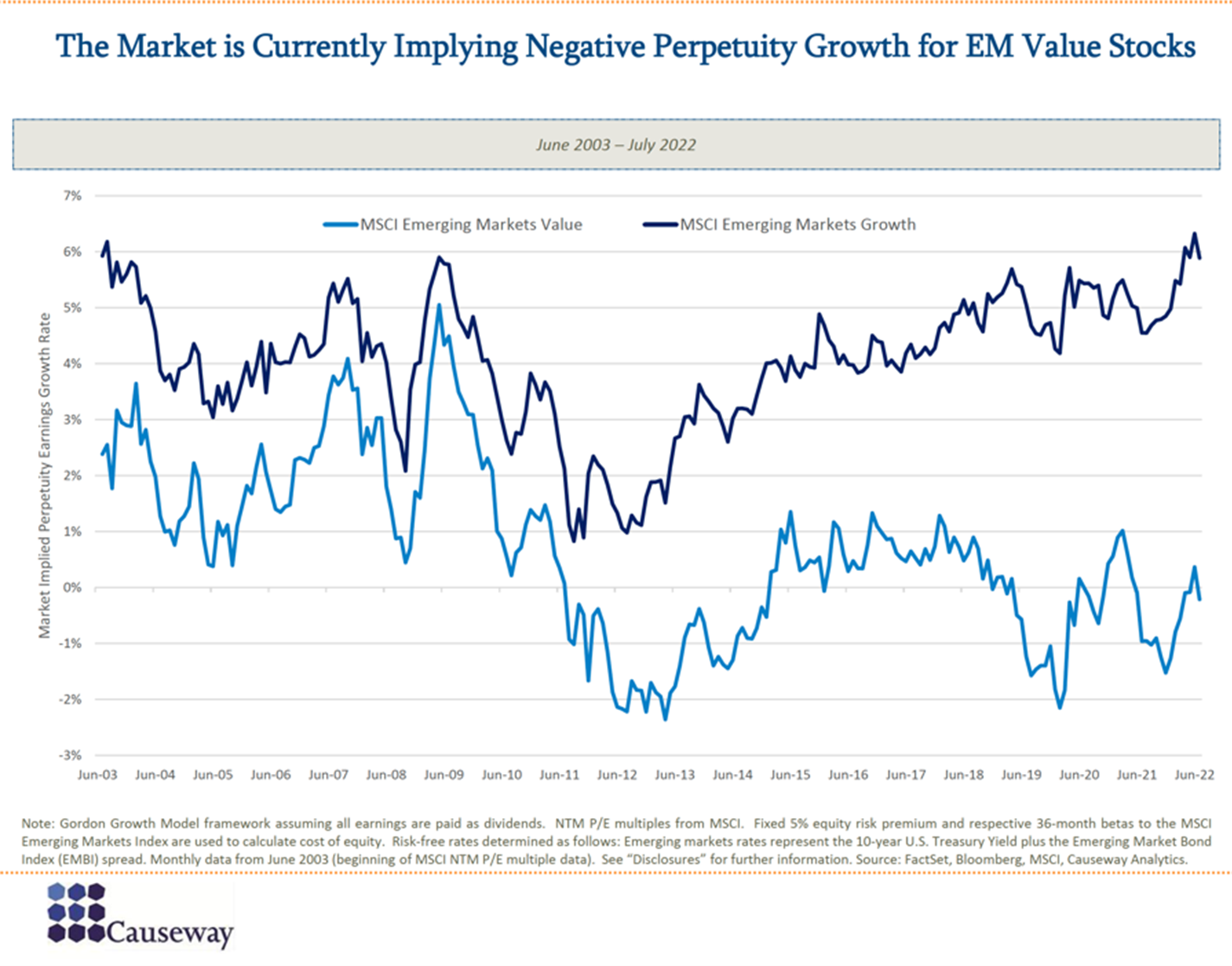

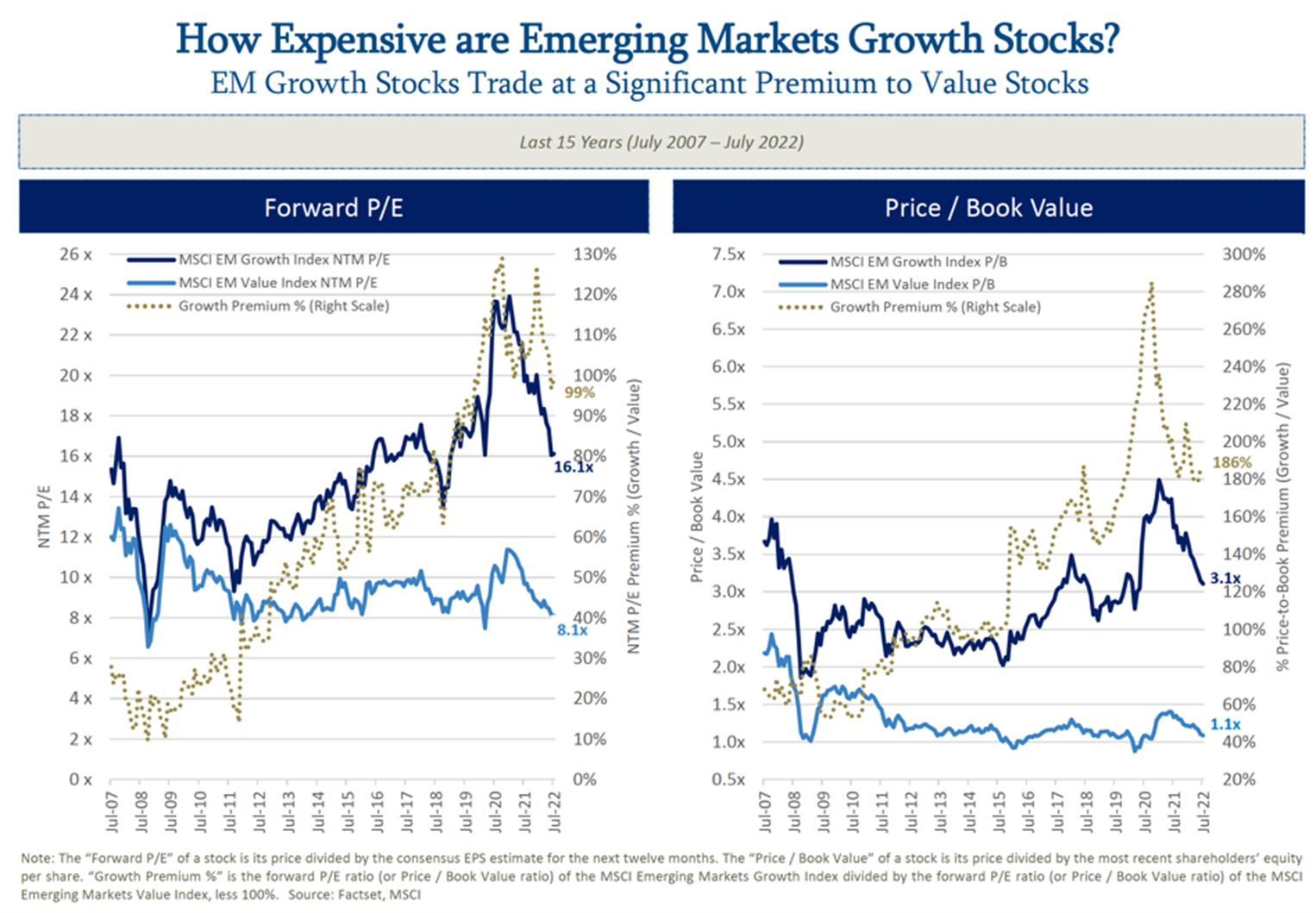

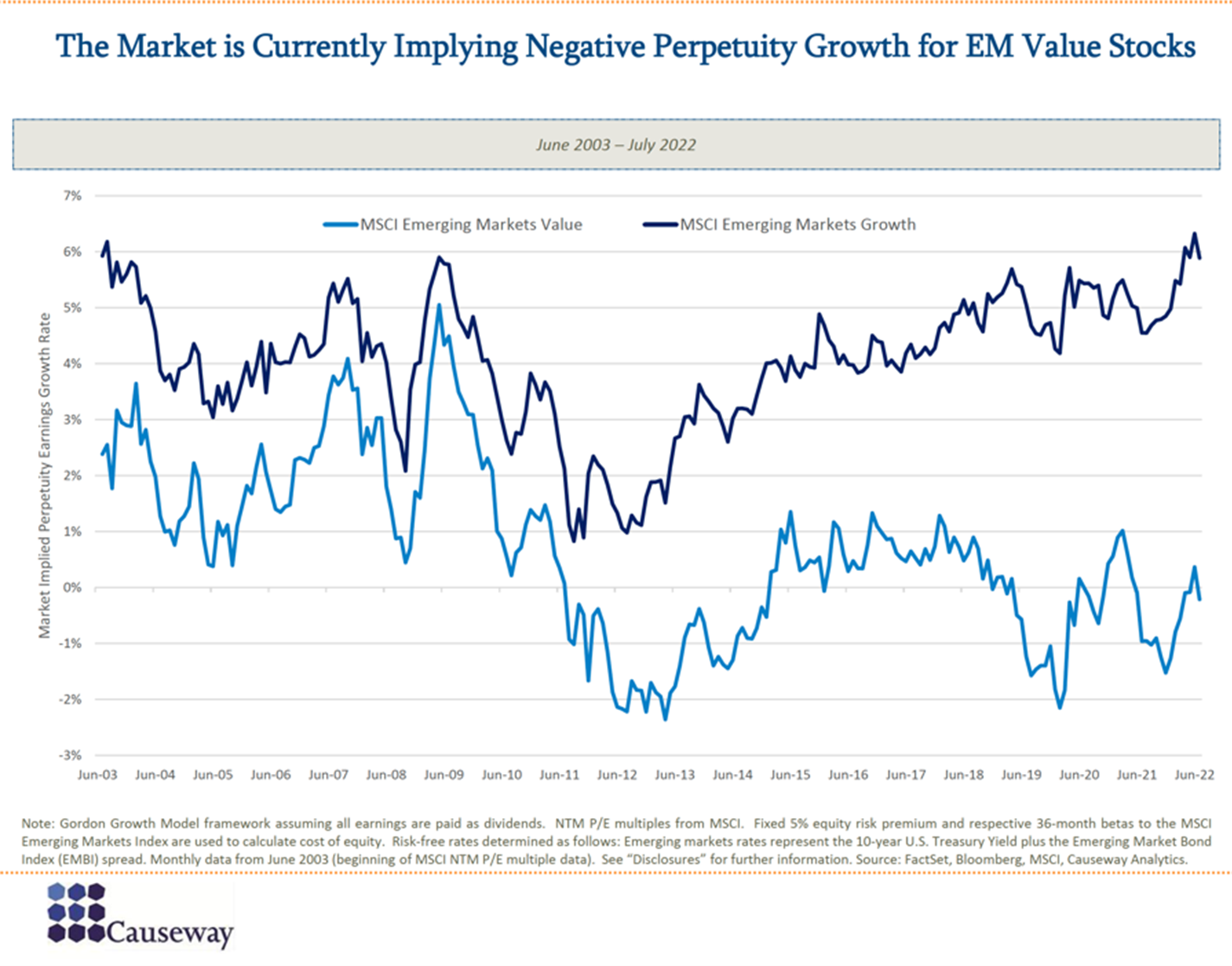

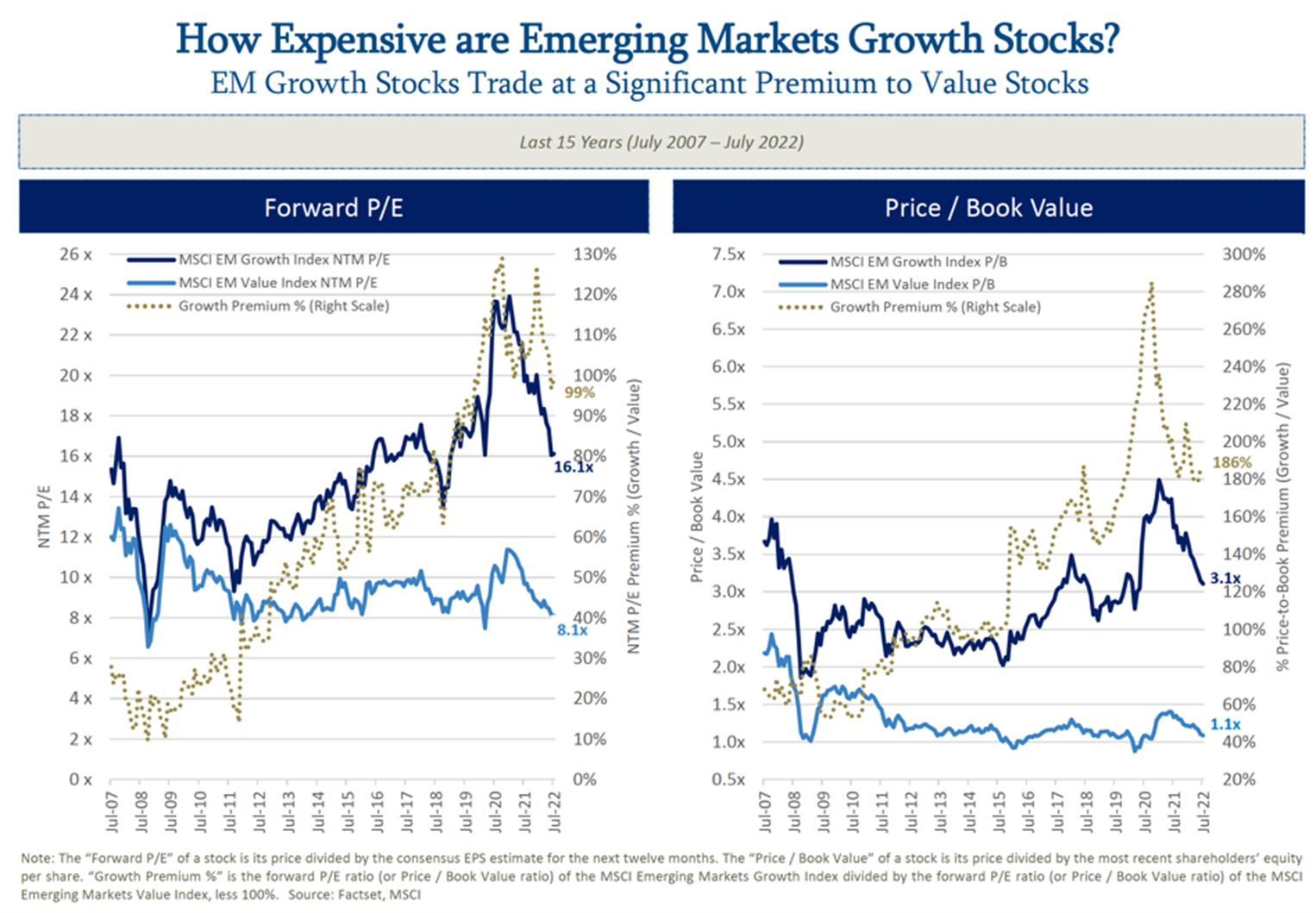

Arjun Jayaraman of Causeway: Now that the US is moving toward QT and rate increases, while a few countries are in the rate easing cycle (notably China and Brazil), the monetary policy equation tide is slowly turning in favor of EM equities. Once the Fed pivot arrives and the US$ peaks, EM has a much greater chance of outperforming. The orthodox monetary and fiscal policies that constrained EM stocks (compared to DM) might be the savior as EM stocks won’t have to deal with an unwinding of QE and negative real rates. Furthermore, we see the greatest opportunity in EM Value Stocks.

From the various charts, here is what stands out:

- EM companies know how to make money.

- But EM companies are not rewarding shareholders.

- The market is not rewarding EM company valuations.

- EM Value Stocks seem probably the cheapest of the stocks among all major asset classes.

- EM Growth stocks exist and are less expensive than in the US but require investment skills to pick carefully.

Rakesh Bordia of Pzena: People panic in EM far more than in DM. These panic moments create value opportunities in those countries where a great asset might be hit along with everything else. We like to swoop in then accompanied with deep research, value analysis, and long-term holding periods.

What could go wrong? What do EM investors need to be able to do?

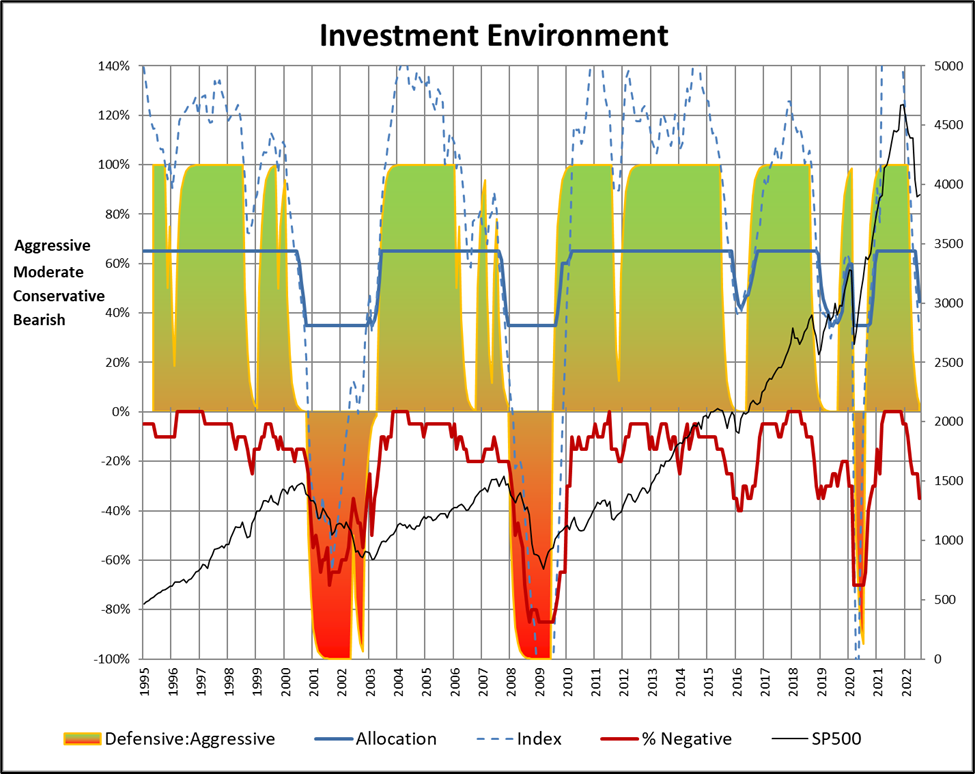

This is no time to be cavalier about taking Risks in the Markets. Even Balanced portfolios are down 16% this year. No one should be throwing caution to the wind.

I asked my wife, Radhika, to read this article, and she said, “Devesh, this is great stuff. But EM is risky for a host of reasons, no?”

Momma, having raised no stupid son, I was quick to tell my wife, “You are right.”

- General Risks

The risks of EM are: Breaking of the dollar hegemony and world monetary order, an invasion of Taiwan, inflation persistency, superpower wars, the end of globalization, weak institutional strength, etc., etc.

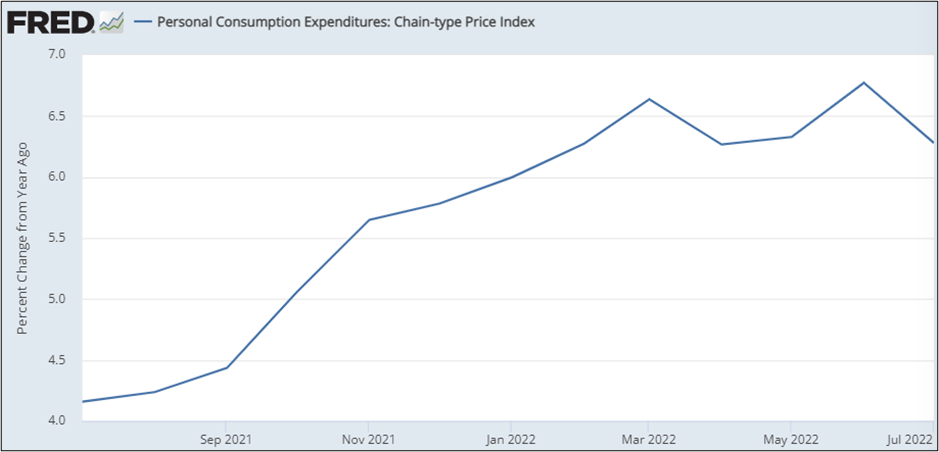

- Inflation and US $ Strength Risk

The biggest source of risk is that inflation is running hot everywhere. If estimates for UK inflation at 20% are true and Europe is running at 8% inflation, the Euro and the British Pound are in for a tough run. In such environments of Dollar strength, Emerging Market Currencies will face an equally tough time.

Emerging Markets depend on Export earnings. They will not allow their currencies to appreciate in times of Dollar strength against major currencies. US investors make money on the stocks, but they will lose money on the FX side.

- Absolute Returns vs Relative Returns

Investors need to eat absolute returns, not just relative returns compared to DM markets. It’s not enough that EM should outperform US stocks. They must deliver positive returns absolutely.

- Preferences vs Constraints

We should all study the geopolitical framework of Marco Papic in Geopolitical Alpha. South and North Korea have been living with each other not because they prefer it, but because neither can afford to blow the other up. China has seen what happened to Russia’s bank accounts and sanctions worldwide. We think we understand geopolitics, but Russia and the sanctions have shown us how little we know.

We should all study the geopolitical framework of Marco Papic in Geopolitical Alpha. South and North Korea have been living with each other not because they prefer it, but because neither can afford to blow the other up. China has seen what happened to Russia’s bank accounts and sanctions worldwide. We think we understand geopolitics, but Russia and the sanctions have shown us how little we know.

- What if the next decade continues like the last one?

Isn’t it possible that EM companies continue to hoard cash and not return money to shareholders? EM version 2.0 requires something to give. Hope is not a strategy. And we investors have to depend on fund managers to argue minority rights on our behalf.

The Bottom Line

EM assets are terribly exciting but complicated beasts. The discussions with EM fund managers, research, and reading have convinced me the opportunity set is truly promising, at least when compared to DM assets, maybe even on an absolute basis. Too many great EM companies are trading at low valuations.

Cheapness in securities is never a reason to go buy an asset. Cheapness does not guarantee returns. But cheap securities with good businesses, high ROE, and high FCF provide a risk floor today and a chance at strong returns tomorrow.

Make a list of EM assets to own. Take a look at your current EM allocations and where you might want them to be. Decide if Passive funds are good enough for you or if you want a manager to execute a nuanced version by actively picking stocks.

Even if it’s not immediate, even if the markets are scary, the opportunity is knocking. Let’s not twiddle thumbs and do nothing.

* Note on Seafarer Disclosures: The views and information discussed in this presentation are as of the date of publication, are subject to change, and may not reflect Seafarer Capital Partners’ current views. The views expressed represent an assessment of market conditions at a specific point in time, are opinions only, and should not be relied upon as investment advice regarding a particular investment or markets in general. Such information does not constitute a recommendation to buy or sell specific securities or investment vehicles. It should not be assumed that any investment will be profitable or will equal the performance of the portfolios or any securities or any sectors mentioned herein. The subject matter contained herein has been derived from several sources believed to be reliable and accurate at the time of compilation. Seafarer does not accept any liability for losses, either direct or consequential, caused by the use of this information.

As you’re reading this, I’ll be in Minneapolis helping Will get settled into a tiny apartment near Loring Park and a new life as a graduate student. If you want to get a sense of the passing of the years at MFO (and, I dare say, what “graceful aging” looks like), you might compare this summer’s version of Will and me with the snapshot of us on London’s Millennium Wheel, on the “Support Us” page.

As you’re reading this, I’ll be in Minneapolis helping Will get settled into a tiny apartment near Loring Park and a new life as a graduate student. If you want to get a sense of the passing of the years at MFO (and, I dare say, what “graceful aging” looks like), you might compare this summer’s version of Will and me with the snapshot of us on London’s Millennium Wheel, on the “Support Us” page.