Or, since I teach at a historically Swedish-Lutheran college, I might use the original Swedish term: I was döstädning my portfolio.

By way of background, my income comes from teaching at the aforementioned Augustana College; it’s exceedingly secure but has not increased much, in real or inflation-adjusted terms, in quite a while. It has “bond-like” qualities. I invest about 13% pretax for retirement, the college has a match that adds about 10% and I squirrel away around 10% of my take-home pay each month. Our home in Davenport is small, snug and affordable. Our cars are used but clean and efficient. Our splurges often enough involve live music and local brews somewhere in town.

Annually I share a bit about how I’ve been thinking about my own portfolios and what I’ve done about them. The short version, most years, is that I think “gosh, markets are weird” and then continue making steady but modest automatic monthly contributions. If that studied calm left me with a portfolio that’s a bit smaller than it might have been, it also left me with the time and energy for a life that’s a bit richer.

Here’s the discipline:

- work out the strategic plan

- work out the tactical plan

- execute the plan

- don’t get all smart and twitchy and screw up the plan (again)

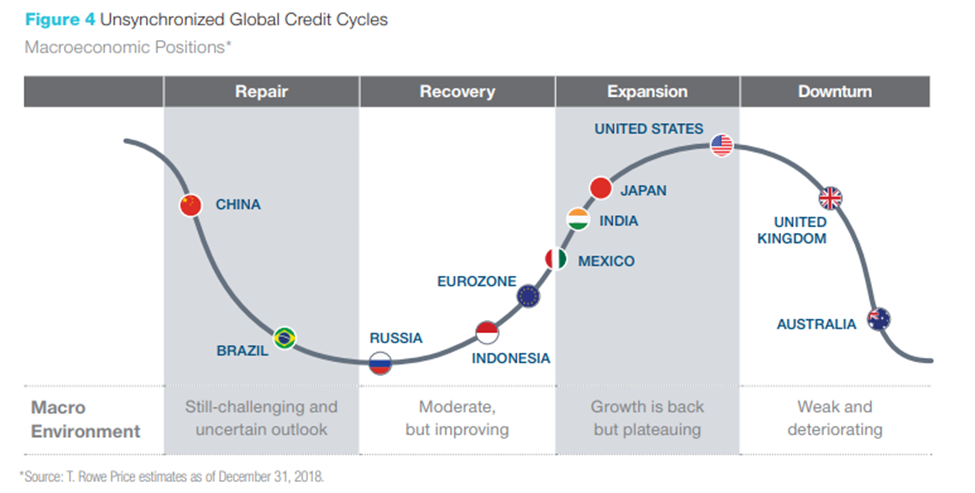

The strategic plan is the big picture and it mostly involves my asset allocation and funding levels. In my retirement portfolio, I invest about two-thirds in equity and one-third in income. My equity exposure tends to have abnormally large commitments to international equity (about half of the total) and emerging markets (nearly half of the international piece). While I prefer to tilt toward the value, size and quality factors, the fact that large, low-quality and growth have been outperforming keeps tilting it back. My income exposure tends, likewise, to have more international and non-investment-grade bond exposure, partly through the TIAA Real Estate portfolio.

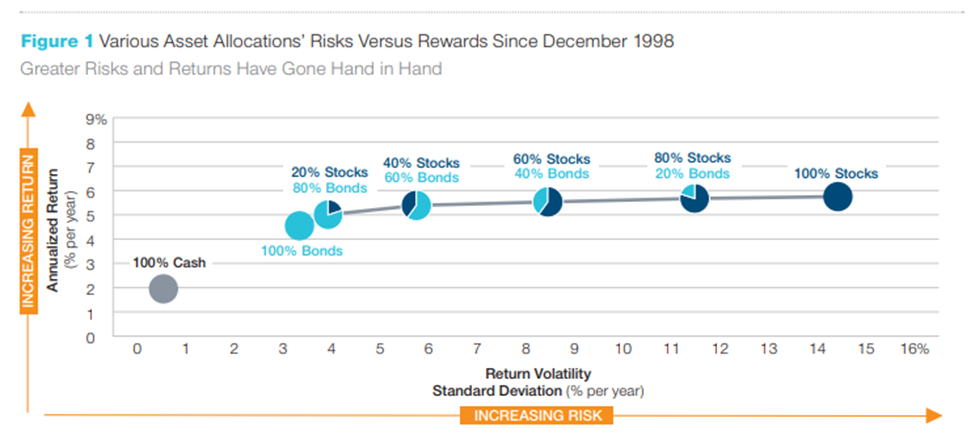

Over the long term, I’ve been able to meet my goal of 5-6% real returns which is what it will take to give me a good chance of managing 25 years in retirement.

In my non-retirement portfolio, I invest about half in equity and half in income. I tend to have a strong tilt toward international, small, value and emerging markets. It is not a tax-efficient allocation. Here’s why: I don’t have a substantial savings account and haven’t for years. I loathe the idea of locking in losses, which is what happens when my credit union’s saving account pays 0.10% APR and my cost-of-living rises at 10-20 times that rate. So instead, I have a substantial commitment to several exceedingly low volatility income funds that return 2-4% annually complemented by a couple slightly riskier income-oriented funds that aren’t hostage to US interest rates.

In general, for non-retirement investors, stocks should be treated like cooks treat habañero peppers: cautiously and with a clear understanding that a little bit is good and a lot is disastrous. Asset allocation research from T. Rowe consistently illustrate the risk: stock-light portfolios make a bit above 5% annually, stock-heavy portfolios make a bit below 6% annually while nearly quadrupling your risk.

The tactical plan is the selection of individual investments needed to carry out the strategic plan. In general, my experience and my reading of the professional and research literature make me comfortable favoring actually active over passive; risk-aware investors over market-beating ones; small, driven firms over large, asset-loving ones; managerial records that are respectable over entire market cycles rather than great during short, arbitrary periods; and advisors whose hearts, souls and family fortunes are invested next to my pittance.

I execute the plan by setting up automatic monthly investments. My personal record of self-discipline is no better than yours; anything that I don’t do automatically, I don’t do.

I avoid getting too smart for my own good by ignoring my portfolio for months on end and refusing to change it for years on end. As long as the manager remains faithful, I do except when there’s a change to my strategic plan.

And that’s where the döstädning kicks in.

Vast changes in my retirement portfolio. For years, Augustana offered a 403(b) retirement plan that provided benefit access to all of TIAA-CREF, Fidelity, T. Rowe Price, American Century and Lutheran Brotherhood. Rather more than 800 funds. That system worked very poorly for most employees of the college and, about five years ago, I participated in a complete redesign of the system to offer just a couple dozen high quality choices, with auto-enrollment and auto-escalation provisions. That worked splendidly for 98% of the college’s employees; I was part of the 2%. The new system shut down access to T. Rowe and Fidelity, leaving me with a tri-part portfolio of TIAA-CREF (funded by the college’s contribution) and Fidelity and Price (funded by my personal withholding). Between the three, I owned just over 30 funds. Given that I can no longer add to either Price or Fidelity it was time to change.

Change #1: I moved all of my Fidelity money over to T. Rowe Price, which reduced the number of funds I was following from 22 to 10.

Change #2: I moved 90% of my Price money into T. Rowe Price Retirement 2025 (TRHHX) then recreated my traditional tilt toward the emerging markets by buying Emerging Markets Discovery (PRIJX) and Emerging Markets Bond (PREMX). All three funds are MFO Great Owl funds, meaning that they’ve landed in the top 20% of their peer groups for risk-adjusted returns in every measurement period longer than one year. Two of the three are also five-star funds under Morningstar’s system and tw0 (2o25 is Silver, EM Bond is Bronze) have received the endorsement of the Morningstar analysts. Morningstar’s machine-learning system projects a Silver assignment for EM Discovery.

Strategic changes in my non-retirement portfolio. I wrote, last month, about the sustained threat posed by climate destabilization. Climate destabilization triggers four different kinds of risks which impact our portfolios as well as our lives. Some of those risks (for example, regulatory and reputational) strike me as pretty immediate, and all seem to be growing in intensity. We made that assessment in our March issue. In our April issue, we’ve worked to identify the sustainable/ESG funds which marry the best long-term performance (measured by MFO and Morningstar ratings) with the most principled portfolios (measured by Morningstar sustainability ratings and Fossil Free Funds).

From that analysis, I concluded that the most compelling ESG equity fund is Brown Advisory Sustainable Growth (BAFWX). In response to that finding, I decided to (a) add BAFWX to my portfolio and (b) provide an updated but condensed version of Dennis Baran’s fine profile of the fund. For folks wanting richer detail, Dennis’s original profile is still the place to turn.

In the months ahead, I’ll look to make a comparable addition to the income-oriented part of the portfolio. No one stands out in the way a couple of the equity ESG funds do, so research is ongoing. Maybe Saturna Sustainable Bond (SEBFX)? Maybe learn a bit more about Zeo Sustainable Credit Fund after its likely launch next month? I really don’t want returns below the rate of inflation (think 2% or more) or to be hostage to the US credit cycle (see above), which means look for “credit” funds or ones with a globally diversified portfolio. I’ll work on it, and share.

– Growth –

Artisan International Value (ARTKX): about the best of the international value funds, the fund got dinged for weak relative performance in 2017 (when it made 24%, for gosh sakes) and 2018 (when it trailed its peers by 1%). No worries there, though the evolution of the management team bears watching: founding managers Samra and O’Keefe have split the responsibilities, with O’Keefe taking custody of Artisan Global Value and Samra taking responsibility here. In each case, they added younger co-managers last year. Planning for change is good, so I cheer them. Now the question is, how will the changes play out? I’ll watch. Closed to new investors.

Brown Advisory Sustainable Growth (BAWFX): new for 2019! Check out the profile.

Grandeur Peak Global Reach (GPROX): the core fund in Grandeur Peak’s global micro- and small-cap lineup. Below average volatility, well above-average returns, four stars at Morningstar and the equivalent of four stars at MFO. Closed to new investors.

Grandeur Peak Global Microcap (GPMCX): Grandeur Peak’s smallest and most venturesome fund, the fund was subject to a prelaunch subscription, a quota on how much you could invest, and a hard closure on the day of launch. I find it fascinating, and it’s returned rather more than 8% a year so far.

Intrepid Endurance (ICMAX): I love the discipline (absolute value, small cap focused) and am increasingly worried about the execution. While ICMAX finished in the top 5% in 2018, its long-time manager Jayme Wiggins left on short notice in September, president Mark Travis filled in for four months, and now three young managers have ascended. The managers haven’t found a use for their 70% cash stake leaving them with a five-year record that trails, oh, my savings account at the credit union. Former managers Eric Cinnamond and Jayme Wiggins have filed to launch a new fund using the Endurance style with slightly lower fees; I’ll keep watch there to see whether I’ll move the money to the original Endurance managers.

– Growth & Income –

Seafarer Overseas Growth & Income (SIGIX): Seafarer is a long-time holding that underwent several evolutionary changes in 2018. Andrew Foster has been the lead manager and pursues a sort of growth-as-a-reasonable price discipline, which led to exceptional returns and muted volatility. With the evolution of the EMs themselves, Andrew instituted two changes at the fund: his two long-time associates are now recognized as co-managers and they are structuring distinctive value and growth components into portfolio. Where, for example, value stocks might have coincidentally been 10% of the total portfolio, now they might consciously be a quarter or more of it.

Matthews Asia Growth & Income (MACSX): one of the most conservative ways to invest in Asian stocks, MACSX tends to have solid absolute returns in rising markets and outstanding relative returns in falling ones. In 2018, its 10% loss bested 80% of its peers.

FPA Crescent (FPACX): managed by Steven Romick, Crescent has long been a “go anywhere we can find exceptional value” fund with a superb record. Mr. Romick, like most of the folks at FPA, pursues an “absolute value” orientation that I find compelling. At base, the absolute value investors say “we’ll only buy if we’re offering an attractive security priced with a compelling margin of safety, absent that, we’re going to wait.” The fund had a rare and substantial stumble in 2018. I’ll wait to hear Mr. Romick’s discussion of it, but I’m not making long-term decisions based on short-term performance.

– Income –

Matthews Asia Strategic Income (MAINX): Teresa Kong strikes me as frighteningly smart, and she’s done a fine job. Morningstar switched their peer group last year from “international” to “emerging,” which makes the relative data weird: Morningstar says they finished at the 50th percentile over the past five years but also that they’ve substantially outperformed their peers in each of those years. Uhhh …

RiverPark Short Term High Yield (RPHYX): my lowest volatility holding, RPHYX typically churns out 2-4% with its maximum-ever drawdown of 0.6%. That constancy has made it an MFO Great Owl. Closed to new investors.

RiverPark Strategic Income (RSIVX): nominally the next-step-out on the risk-return spectrum from the folks who managed RPHYX, which originally aspired to about double its sibling’s return. It hasn’t really managed that over time, though it did trounce RPHYX in two individual years. Much lower Sharpe, much higher maximum drawdown.

T. Rowe Price Strategic Income (RPSIX): a globally diversified T. Rowe Price fund-of-income-funds, with a slice of dividend-paying stocks. It lost 2.6% in 2018 which isn’t surprising given its exposure, however conservative, to stocks and EM bonds.

Bottom line: down about 9% in 2018, with everything touching international equities seeing double-digit declines. It happens. Five goals for 2019:

- sort through the raft of retirement plan changes announced by Augustana (few of which thrilled me) to reassert control over my 403(b);

- rebalance back to my target asset allocation, which means moving some international money into the Brown Advisory fund;

- monitor two funds closely;

- search for a suitable ESG income fund; and

- attend to the new management configurations at Artisan and Seafarer