Dear friends,

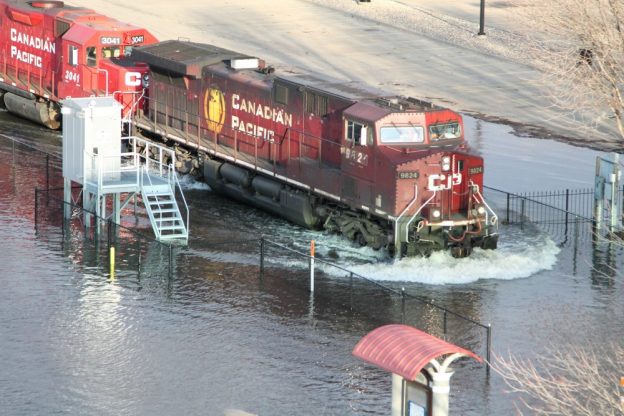

It’s been an especially distressing month. Rapid and widespread flooding following a hard winter destroyed the lives and livelihoods of many thousands of good folks in eastern Nebraska and western Iowa. Levees failed, bridges and roads were swept away, homes and equipment left mangled. Many are in despair at the loss of thousands of newborn calves, with loss to private and public property exceeding a billion dollars. At the same time, Cyclone Idai, the second-worst in the region’s history, swept across eastern Africa, likely killing more than a thousand and leaving hundreds of thousands homeless and hungry. While it is only “weather,” persistent patterns in the weather define our climate and the pattern of the past five years has been increasing numbers of extreme weather events. We really need to work together to figure out how best to manage these challenges.

Speaking of challenges, presidential wannabees are beginning to Continue reading →