In the spring of 2019, MFO ran a two-part series on the investment implications of climate change: The Investor’s Guide to the End of the World and The Investors Guide to the End of the World, Part 2: Concrete advice. The former laid out the scientific consensus behind the human role in climate change and explained the four ways in which even the broad perception of climate change would affect your portfolio through a combination of physical, biological, regulatory, and reputational risks. We finished with three investment strategies (divest, invest, innovate) and two fund recommendations: Brown Advisory Sustainable Growth Fund (BIAWX) and Green Century Balanced (GCBLX). Since then, Brown returned 27% (versus 7% for its peers) and Green Century made 8.8% (versus 4% for its peers).

Our second article reviewed the investing recommendations of three major firms: BlackRock, the world’s largest investor, GMO and Morningstar.

This month we wanted to offer a short, research-based update. The first four updates concern the state of our understanding of the science of climate change. The remaining six look at the investment options and implications.

This month we wanted to offer a short, research-based update. The first four updates concern the state of our understanding of the science of climate change. The remaining six look at the investment options and implications.

-

The world may have already passed peak CO2 production.

“Climate researchers increasingly believe 2019 may represent the world’s peak output of carbon dioxide, with a combination of the coronavirus pandemic and a rapid expansion of renewable energy putting a cap on emissions years earlier than expected.

‘The milestone would signal a significant shift for the planet, ending decades of runaway emissions growth and signaling the beginning of a new chapter where CO2 levels start to fall.

‘It really shows us how close we are to turning this corner,’ said Kim Cobb, a professor of earth and atmospheric science at Georgia Tech and the director of the Global Change Program.”

(Benjamin Storrow , “Global CO2 has risen for a century. That appears to be over,” E&E News, 6/1/2020)

-

The current “worst case” projections are less apocalyptic than they once were.

“…the plateauing of carbon emissions is encouraging for several reasons. First, it suggests some dire scenarios by the U.N.’s Intergovernmental Panel on Climate Change—previously seen as inevitable, absent dramatic government action—are actually pretty unlikely. Second, it gives the world more breathing room to figure out how to decarbonize faster.”

(Greg Ip, Coronavirus Is Buying Time on Climate Change. Will We Make Use of It? paywall, Wall Street Journal, 5/28/2020)

Sadly, the same thing is true of the “most hopeful case.”

“A team of 25 scientists from around the world published, July 22 in Reviews of Geophysics, [research that] showed that the planet would most likely warm on average between 4.7 degrees Fahrenheit and 7 degrees Fahrenheit (2.6 degrees Celsius and 3.9 degrees Celsius) if atmospheric carbon dioxide were to double. … that’s much smaller than prior estimated range of 2.7 and 9.1 degrees Fahrenheit (1.5 and 4.5 degrees Celsius) that had been the reigning benchmark for decades.

The new, narrower estimate for climate sensitivity has huge implications, not just for climate science, but for how humanity prepares for a warming world. It shows that the worst-case-scenario is not as dire as previously thought, but also that the best possibilities are still quite grim. In particular, it means that it will be almost impossible to hit the main target of the Paris climate agreement, limiting warming to less than 2 degrees Celsius (3.6 degrees Fahrenheit) this century, by chance; it will require aggressive action to reduce emissions with even less margin for delay.”

(Umair Irfan, “Scientists have ruled out the worst-case climate scenario — and the best one too,” Vox, 7/31/2020)

-

The scientific consensus on the human role has now reached 100%.

“Scholars responded to the controversy by surveying the opinion of scientists. The results of eight such studies conducted between 2009 and 2015 showed a consensus on AGW ranging from 83.5% to 97%. But given the ingrained caution of scientists and their reluctance to affirm findings outside their own field, opinion surveys are likely to underestimate the consensus. The consensus among research scientists on anthropogenic global warming has grown to 100%, based on a review of 11,602 peer-reviewed articles on ‘climate change’ and ‘global warming’ published in the first 7 months of 2019.”

(James Powell, “Scientists Reach 100% Consensus on Anthropogenic Global Warming” Bulletin of Science, Technology & Society, 11/29/2019)

-

The pandemic has had a dozen impacts, good and bad, on the global climate and efforts for climate change management.

“As a result of the lockdowns around the world to control COVID-19, huge decreases in transportation and industrial activity resulted in a drop in daily global carbon emissions of 17 percent in April. Nonetheless, CO2 levels in the atmosphere reached their highest monthly average ever recorded in May — 417.1 parts per million. This is because the carbon dioxide humans have already emitted can remain in the atmosphere for a hundred years; some of it could last tens of thousands of years.

Beyond carbon emissions, however, COVID-19 is resulting in changes in individual behavior and social attitudes, and in responses by governments that will have impacts on the environment and on our ability to combat climate change. Many of these will make matters worse, while others could make them better.”

(Renee Cho, “COVID-19’s Long-Term Effects on Climate Change—For Better or Worse,” Earth Institute / Columbia University, 6/25/2020).

Two points that Ms. Cho makes clear: (1) the substantial reduction in CO2 this year is close to inconsequential and (2) managing the pandemic might restore the citizens’ faith in science and in working today, and raise their caution about grandstanding politicians.

-

There are prospects for widespread financial failures in fossil fuel extraction companies.

“The fossil fuel system is being disrupted by the forces of cheaper renewable technologies and more aggressive government policies. In one sector after another these are driving peak demand, which leads to lower prices, less profit, and stranded assets. The COVID-19 crisis is now accelerating this.

Our analysis finds falling demand, lower prices and rising investment risk is likely to slash the value of oil, gas and coal reserves by nearly two thirds, increasing the risk and likelihood of stranded assets.”

(Decline and Fall: The Size & Vulnerability of the Fossil Fuel System, 6/4/2020)

-

There is a huge amount of money to be made in post-carbon economy investments.

“The low-carbon economy is emerging as a major U.S. employer, though COVID-19 is threatening that progress. In the power sector, zero-emissions generation like solar and wind was responsible for about 544,000 jobs in 2019, more than twice as many as the 214,000 jobs in fossil fuel generation. $1 million spent on clean energy in the United States generates more than twice as many jobs as $1 million spent on fossil fuels in the short- to medium-term.

Emphasis on low-carbon technologies can help the United States to boost its manufacturing sector and secure a share in the booming domestic and global cleantech market. The U.S. advanced energy industry generated $238 billion in revenue in 2018, about 15% of the global total. That’s roughly equal to that of aerospace manufacturing and double that of the biotechnology industry.”

(Devashree Saha and Joel Jaeger, America’s New Climate Economy, July 2020)

Some analysts, by the way, believe that this will be another driver favoring the dominance of growth investing over value, since these advances will likely most benefit fast-growing tech companies.

-

ESG-screened funds, on whole, outperformed during the 2020 turbulence.

“Earlier this year, Morningstar published a wealth of research on the nexus between ESG and risk. One study, “ESG Indexes Protect on the Downside,” concluded that 72% of Morningstar equity indexes that incorporate ESG screens lost less than the market during down periods for the five years through the end of 2019. It also found that the ESG indexes are more likely to select companies that are competitively advantaged and financially healthy, which undoubtedly contributed to their ability to reduce volatility.

Obviously, much has changed in markets since the end of 2019. The rapid, violent sell-off in first-quarter of 2020 offers an excellent follow-up opportunity to look at the performance of our ESG-screened indexes. We found that 51 of Morningstar’s 57 ESG-screened indexes, or 89%, outperformed their broad market equivalents in the first quarter of 2020. This is consistent with the conclusions that Morningstar director of sustainability research Jon Hale outlined in his article, ‘Sustainable Equity Funds Are Outperforming in the Bear Market.’”

(Dan Lefkovitz, “How Did ESG Indexes Fare During the First Quarter Sell-off? Morningstar.com, 4/8/2020).

-

The number of ESG-screened choices is huge and rising.

Investors have a choice of 623 “socially conscious” funds and ETFs. Nearly 10% of those have been launched in the past year. New ESG funds are being registered at the rate of about five a month.

-

ESG funds represent two fundamentally different impulses: doing no harm versus making a difference. The former are generally designated as “ESG-screened” funds, the latter as “impact funds.”

“Impact funds are often focused on specific themes, such as low carbon, gender equity, or green bonds (which fund new and existing projects with environmental benefits).”

Karen Wallace, “Interested in Sustainable Investing? Here’s What You Need to Know About Sustainable Funds,” Morningstar.com, 2/11/2020).

In some cases, “impact funds” are willing to accept somewhat lower short-term returns, especially in the case of bond impact funds, in exchange for fostering social or environmental goals supported by their investors.

-

There are great free tools to allow you to look before you leap.

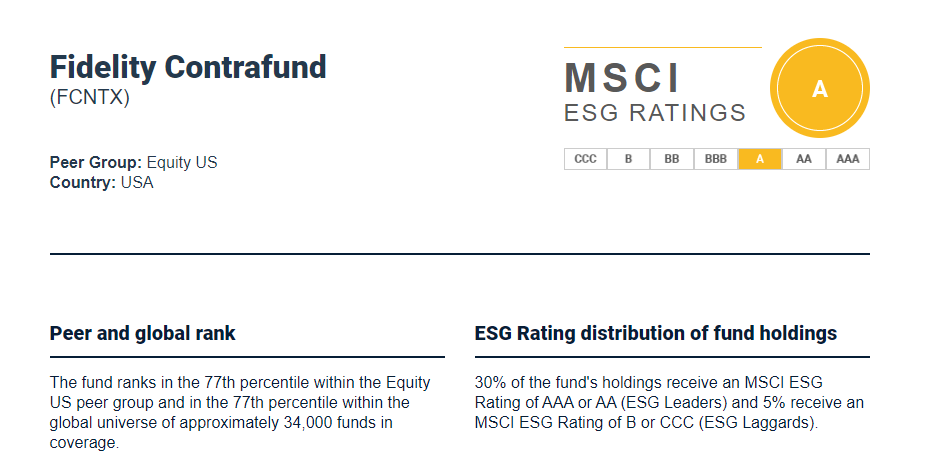

Morningstar’s sustainability assessment of equity funds is available on every fund’s portfolio page. Here, for example, is Fidelity Contrafund (FCNTX).

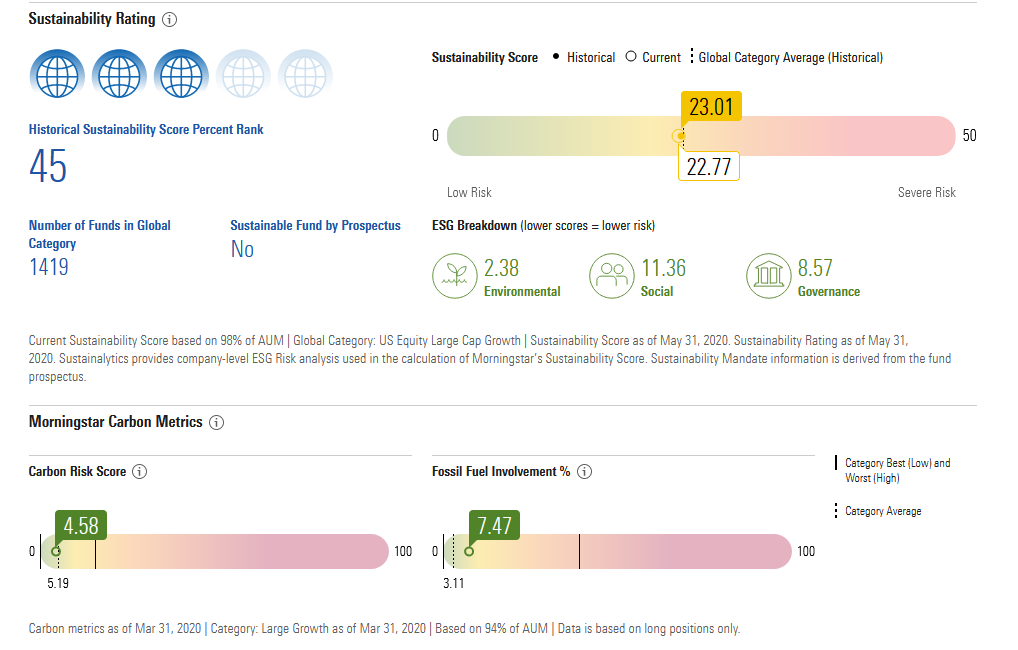

MSCI recently made access to their ESG rating system available for thousands of funds and stocks. Where Morningstar’s ratings are titled toward environmental sustainability, MSCI’s offer a balance of factors. Here’s the top of their Fidelity Contrafund report.

MSCI recently made access to their ESG rating system available for thousands of funds and stocks. Where Morningstar’s ratings are titled toward environmental sustainability, MSCI’s offer a balance of factors. Here’s the top of their Fidelity Contrafund report.