Dear friends,

I walked along today, kicking leaves, marveling at the maples, crunching through my last Golden Russet apple and wondering at the tension between local delight and global despair. Things are good in my life. My classes are full and my students are … hmmm, fascinating in a “bright but so very different from what I recall” way. My son just earned his driver’s license and I bought him a respectable used car. I harvested my first-ever potato crop and the last of my carrots and onions, so roasted root veggies are on the menu this week. I’m happy.

The world beyond mine is less happy. Weather forecasters report that Halloween temperatures in much of the country are at mid-summer level, the eastern US – from the Gulf Coast to New England – is trapped in drought, a condition which climatologists think might linger in California for several decades. While we’re distracted by the most dispiriting presidential campaign since, perhaps, the Civil War, several diminutive dictators are exploiting our preoccupation by raising global tensions, unchallenged. And perhaps a third of our brethren are so discouraged about their children’s future that they see a prancing, prattling mountebank as their last, best hope.

And yet, hope endures. More amazing people are putting more thought and energy in the questions of environmental sustainability than ever before. Some of what they’ve found, from sidewalks that convert sunlight to power to the first breakthroughs in carbon capture, is startling. Nations did join together to ban one incredibly powerful greenhouse gas, and to boot Russia out of the U.N. human rights agency. Finding ways to talk with, rather than shout about, those with whom we disagree, is rising on the post-election agenda. It’s certainly on my academic department’s agenda as we imagine the new curriculum we’ll create as Augustana moves to semesters. And I’m hopeful that November 9th feels a lot better than November 7th.

Mea culpa. Mea maxima culpa.

Apologies to the folks at Grandeur Peak and their shareholders for a needlessly worrisome snippet. Last month I reported on a couple changes to the Grandeur Peak prospectuses which seemed to imply a somewhat-tighter close. Wrong! Eric Huefner, GP’s president, explains the reality of the change:

The Global Micro Cap Fund remains hard closed (it was closed the day it opened on 10/20/15, and was officially hard closed as of 12/31/15). Under the hard closure, there has been an exception for just those shareholders who hold the Fund directly through Grandeur Peak Funds to be able to purchase additional shares of up to $6000/year, during each calendar year. As of 9/1/16 we made one very minor change to this, which was to increase the annual limit from $6000/year to now be $6500/year (simply to match the IRA annual Catch-Up limit for those who are investing in this Fund in their IRA).

Thanks to Eric for the clarification. Apologies to all of you for any miscommunication.

Good stuff in the Observer this month!

Leigh Walzer of Trapezoid LLC continues offering sharp, quantitative analyses. This month’s focus is on, well, focus. Our colleague Charles Boccadoro lifts the hood on the Vanguard Quantitative Equity Group. Ed Studzinski surveys the swirling mess around us and recommends caution: avoid conventional wisdom, appreciate cash, ease away from bonds and hold on.

With the return of capital gains season, we’ve also returned to capital gains distribution coverage. Mark Wilson, proprietor of The Cap Gains Valet, offers some preliminary observations on the evolving capital gains season and word on changes at his site. The ever-faithful folks on MFO’s Discussion Board have begun compiling their annual list of announced distributions. Thanks to The Shadow for coordinating it and all of the folks on the board for keeping it current.

There’s more, all of it now easily accessible from our new table of contents page.

In response to several reader requests, Chip and Andrew have added two cool new features for you. First, it’s easier than ever to get back to seeing our traditional layout, which we call “the long scroll.” It turns out that the scroll is helpful to folks who rely on vision augmentation technology and really comfortable to others who’ve become accustomed to it over the past 15 years or so. Second, it’s easier than ever to print and save individual articles. We’ve adapted our stylesheet to accommodate a print layout and added a printer icon to every story. We hope you like the changes.

Thanks for your support of the Observer

MFO Premium launched a year ago as a way of thanking folks for their financial support of the Observer and of providing access to risk and risk-return metrics that are almost impossible to find elsewhere. Readers who choose to make a tax-deductible contribution of $100 or more to the Observer help make the entire enterprise possible; in thanks, we offer a year’s access to MFO Premium. If you were one of the folks in that first wave of subscribers, please do consider contributing again. (We’ll send an email reminder soon.) If you weren’t in the first wave or you’ve been meaning to contribute but haven’t, now’s a great time to do so. It’s simple: Go to mfopremium.com and create an account by clicking on LOGIN tab.

Thanks, in particular, to David from Beaver Dams, NY, Donald from Indiana and to our now three (!) regular subscribers, Greg, Deb and Jonathan. We couldn’t do it without you.

As the holiday shopping season approaches, please do consider using the Observer’s link to Amazon.com when you can. It costs you nothing and earns the Observer 6-7% of the value of your purchases.

As ever,

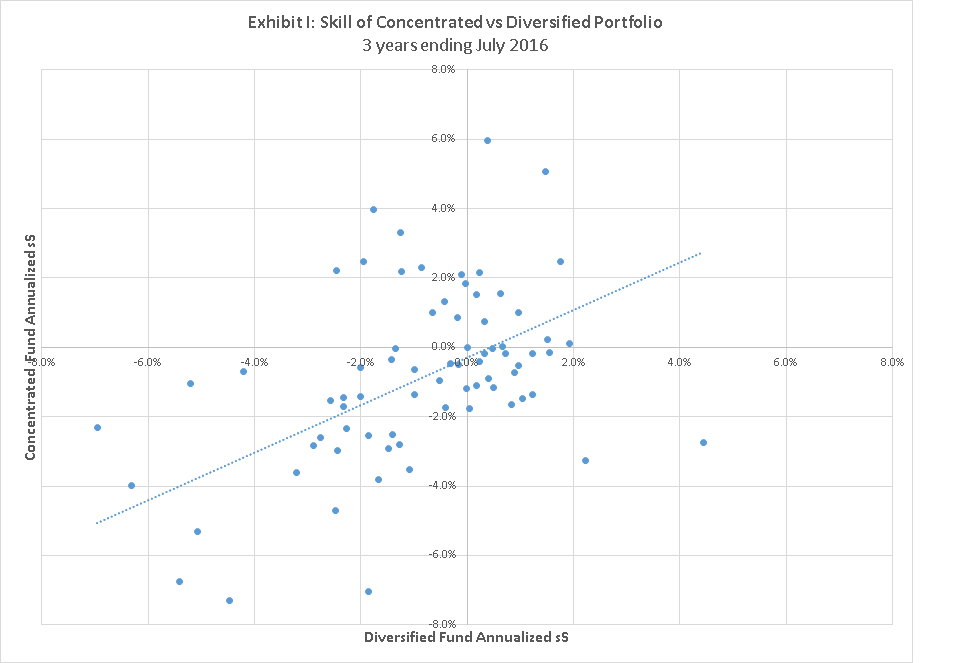

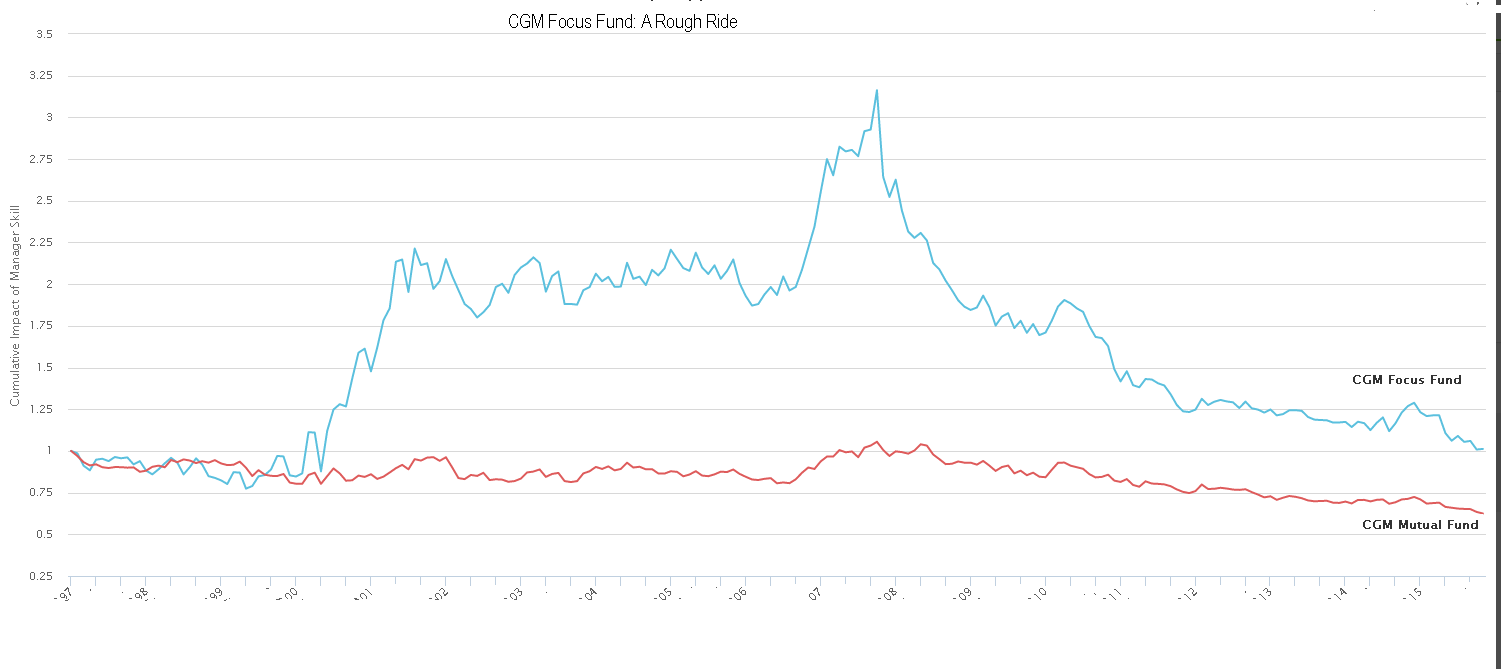

What’s the Trapezoid story? Leigh Walzer has over 25 years of experience in the investment management industry as a portfolio manager and investment analyst. He’s worked with and for some frighteningly good folks. He holds an A.B. in Statistics from Princeton University and an M.B.A. from Harvard University. Leigh is the CEO and founder of Trapezoid, LLC, as well as the creator of the Orthogonal Attribution Engine. The Orthogonal Attribution Engine isolates the skill delivered by fund managers in excess of what is available through investable passive alternatives and other indices. The system aspires to, and already shows encouraging signs of, a fair degree of predictive validity.

What’s the Trapezoid story? Leigh Walzer has over 25 years of experience in the investment management industry as a portfolio manager and investment analyst. He’s worked with and for some frighteningly good folks. He holds an A.B. in Statistics from Princeton University and an M.B.A. from Harvard University. Leigh is the CEO and founder of Trapezoid, LLC, as well as the creator of the Orthogonal Attribution Engine. The Orthogonal Attribution Engine isolates the skill delivered by fund managers in excess of what is available through investable passive alternatives and other indices. The system aspires to, and already shows encouraging signs of, a fair degree of predictive validity. Laid end-of-end, they’d stretch 14.4 billion miles. That is, to Pluto.

Laid end-of-end, they’d stretch 14.4 billion miles. That is, to Pluto.