Dear friends,

Winter is coming.

I’m so thankful.

Traditionally, year’s end has been a slower time. The growing season has ended, and both the farm fields and the sports fields lie mostly empty in this part of the country. Going out at night is just a touch less attractive when “night” settled in at about 4:30. New projects and wild ambitions are set aside for the new year. Traditionally, it’s a season for festivals and celebrations, only occasionally draped in religious garb. In the northern hemisphere, every religion and every culture seems to have reached the same conclusion: it’s cold, it’s dark, it’s time to get together!

Too, it’s time to reflect on the year just past and all the things we have to be thankful for. (Yes, I was awake pretty much all year in 2018, but that doesn’t change my sense of gratitude for all the good the year bequeathed.)

What do I have to be grateful for?

-

The elections are over. You know, we could pretty much stop right there.

I’m grateful for the tens of millions of American voters who spoke their minds, and for the millions who changed their minds.

We have recently become convinced that America is divided between The Forces of Light (that would be “you”) and The Forces of Darkness (that would be “them”). We characterize The Forces of Darkness as self-blinded, uncaring ideologues desperate to retreat into some fantasy past.

And then, oops. They screwed up the easy, apocalyptic story by changing their votes. Some millions of our fellow citizens who voted for one sort of change in 2016 appear to have reflected on how the changes were playing out, and voted for a correction. That’s reflected in the fact that Democrat candidates outpolled their Republican counterparts by 9,000,000 votes in November, in part driven by the votes of folks derided as RINOs. In short, they acted reasonably. They might act differently again in two years. The reassuring key is that our fellow citizens are not slaves of their social media feeds; they’re folks who think, and act, in pursuit of what they understand to be the common good.

For that, we should all be grateful.

-

The market is cratering. Then not. Then it is and/or might be.

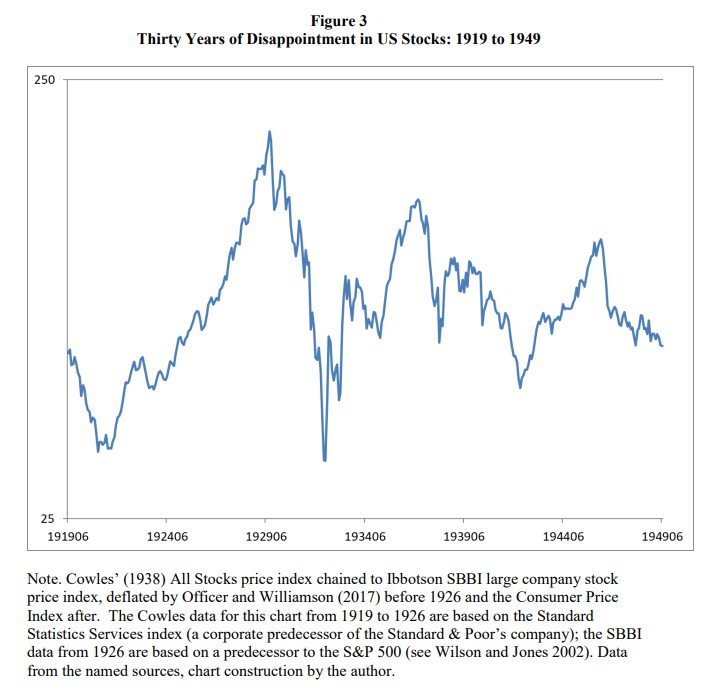

As we’ve been reminding you for a couple years, the valuations in the stock market are detached from any reasonable grounding. Against all reason, markets have kept rising, leading investors to thoughtlessly pour money into market cap weighted stock index funds (at their core, momentum plays) and indebtedness weighted bond index funds (which automatically allocate to the most indebted issuer in a universe, not to the most creditable ones).

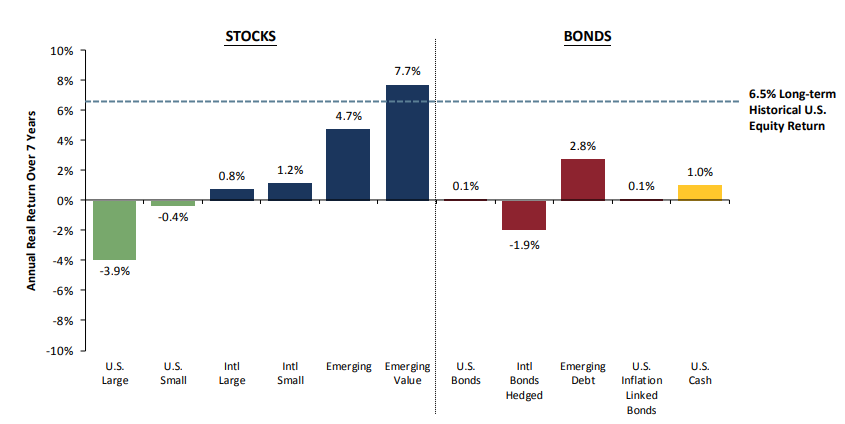

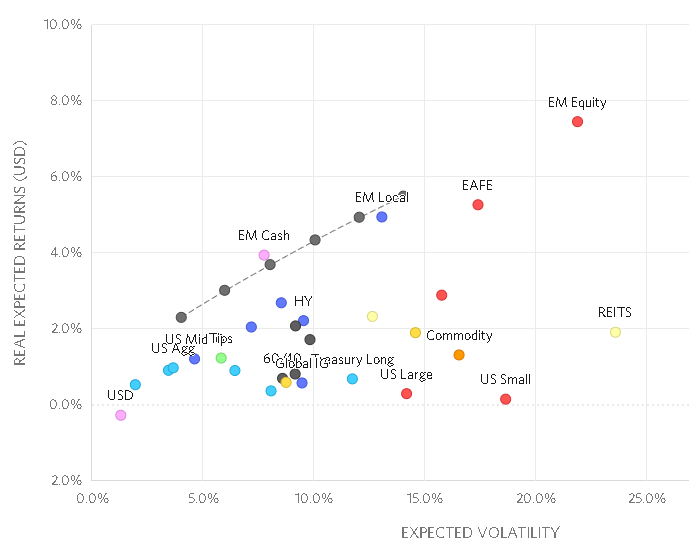

The inevitable price of ridiculously high starting valuations is years, and perhaps a decade or more, of negligible returns. As recently as last month, GMO’s forecast was for negative real returns across most asset classes for the next five to seven years.

Turbulence provides opportunities, both for individual investors to spend some time at year end thinking a bit about how they want to build and balance their portfolios, but also for professional investors to finally profit from some reasonably priced investments.

It is possible that this is the prelude to a financial apocalypse fed by political obstinacy, policy misjudgments and bad luck (see Barbara Tuchman’s The March of Folly: From Troy to Vietnam (1985), a chronicle of governmental “woodenheadedness” for details) but it feels like an entirely necessary slap upside the head. We will work with you to get through it.

-

It’s easy to get smarter. It’s also easier to get dumber, but that’s a matter of choice.

PEARLS BEFORE SWINE © Stephan Pastis. Reprinted by permission of ANDREWS MCMEEL SYNDICATION. All rights reserved.

I’m endlessly amazed by the quality of work done by NPR and American Public Media, both on-air and through easily accessible podcasts. I listen to both daily, usually podcasts that I download to my phone and listen to as I walk. I would commend, especially, the Marketplace franchise to folks. Here’s how they describe themselves:

“Marketplace is on a mission to raise the economic intelligence of the country. Its core programs — Marketplace, Marketplace Morning Report and Marketplace Tech — are broadcast on more than 800 public radio stations nationwide and heard by 14.6 million listeners every week. Marketplace podcasts including Make Me Smart with Kai and Molly, The Uncertain Hour and Corner Office can be found at marketplace.org or on your favorite podcast app.”

Make Me Smart is a particular delight. The hosts have one central issue each week (“the curse of bigness” recently) surrounded by the sort of amiable give-and-take that you’d associate with really smart people who very much enjoy one another’s company. It’s definitely not an “eat your broccoli” (much less “eat your danged Brussels Sprouts”) sort of experience.

-

The FAANGs have lost a trillion dollars. In what, six weeks?

I rather worry that we’ve allowed a few corporations to accumulate unprecedented power over us. Admittedly, John D. Rockefeller had a net worth (in 2018 dollars) of a quarter trillion (untaxed) dollars and his Standard Oil Company controlled roughly 90% of the US energy market. The difference between him and the new monopolists is that they control our personal information as well as our wallets. (See, e.g., the easy What Does Google Know About You? Infographic for a peek.)

Mark Zuckerberg and Facebook are ham-handed in their manipulations, with the multi-billionaire Zuckerberg thinking he’s “all that and a bag of chips.” He brooks neither self-doubt nor opposition. It calls to mind a long ago science fiction novel, Kornbluth and Pohl’s The Space Merchants (1953). It’s about a vastly overcrowded world in which huge corporations have supplanted governments and nations exist only to help support those corporations. Two snippets have stuck with me over many years. One might be Mr. Zuckerberg’s mantra:

“Mitch, you’re a youngster, only star class a short time. But you’ve got power. Five words from you, and in a matter of weeks or months half a million consumers will find their lives compleatly changed. That’s power, Mitch, absolute power. And you know the old saying. Power ennobles. Absolute power ennobles absolutely.”

And the other might speak to his future:

“He spoke of the trouble with the Senator from Du Pont Chemicals with his forty-five votes, and of an easy triumph over the Senator from Nash-Kelvinator with his six.”

Where is Nash-Kelvinator, you might ask? Largely chewed up, along with virtually all of the original Dow stocks and all of the grand monopolies of a century ago. While capitalism will, eventually, eat Amazon and Facebook both, they have the potential for great mischief ere that happens. Tim Wu lays out the case for government intervention against modern monopolies, much as it intervened to break up Standard Oil, in his new book The Curse of Bigness (2018).

I am, on whole, glad that the FAANGs have been a bit defanged and that questions about the legitimacy and consequences of their power are at least getting more of an airing than before.

-

We had George Herbert Walker Bush. Mr. Bush was the last American president who neither loathed his opponents, nor was loathed by them.

Mr. Bush came from a patrician strain of Republicanism that believed America thrived on respect and service to others, not on self-aggrandizement and self-service. As with my dad and millions of others, his first act of public service was as a soldier in World War Two (dad was a submariner, Mr. Bush an airman) and, like dad, he devoted a portion of the rest of his life to public service: congressman, UN ambassador, head of the RNC, quasi-ambassador to China, director of central intelligence, director of the Council on Foreign Relations, vice-president, president, philanthropist.

He frequently liked his political opponents because he realized that, disagreements aside, he and they were devoting their lives to the same end. I’ve always been struck by a statement he made in one of the 1988 presidential debates against Massachusetts governor Michael Dukakis. The two men disagreed on the era’s most incendiary question, abortion. Here’s how Mr. Bush framed his beliefs and their disagreement:

“I think human life is very, very precious. And, look, this hasn’t been an easy decision for me to make. I know others disagree with it. But when I was in that little church across the river from Washington and saw our grandchild christened in our faith, I was very pleased indeed that the mother had not aborted that child, and put the child up for adoption (his son, Marvin Bush, and his wife, Margaret Conway, adopted two children). And so I just feel this is where I’m coming from. And it is personal. And I don’t assail him on that issue, or others on that issue. But that’s the way I, George Bush, feel about it.”

None of that serves to gloss over the fact that Mr. Bush did a bunch of dumb things, that he may have opened the door to a divisive role for religion in politics or that his behavior toward women was sometimes reprehensible.

He was a deeply flawed human being who never doubted his homeland and never wavered in his commitment to make it “a kinder, gentler nation.”

-

I’ve got friends. Admittedly, rather more in low places than high, but that’s okay.

David Brooks, a perennially anguished conservative-with-a-conscience, wrote a thoughtful piece in the New York Times entitled, “It’s Not the Economy, Stupid” (11/29/2018). Mr. Brooks asked a reasonable question, if we’re enjoying “one of the best economies of our lifetime,” why are Americans so glum? He allows that the usual suspects (student loan debt, unstable employment and Donald Trump) might account for some of the angst but, he argues, the greater part is

“the crisis of connection. People, especially in the middle- and working-class slices of society, are less likely to volunteer in their community, less likely to go to church, less likely to know their neighbors, less likely to be married than they were at any time over the past several decades.”

Driven by the effects of drug abuse and suicides, life expectancy in the US has fallen for a third consecutive year; the last time that happened, 1915-18, a world war and global flu pandemic killed 800,000 Americans. It is, he concluded, “a straight-up social catastrophe” that neither liberals nor conservatives grasp or address.

Scholars have been raging about this problem for more than a generation, mostly famously in Robert Putnam’s Bowling Alone (2000, with the book just expanding his 1995 essay). And yet it is a curiously self-inflicted malady.

Against that trend, I find myself with an embarrassment of riches. That is, in many ways, the result of a choice and of investments we’ve made. Chip and I each work with amazing people, but we also work hard to attract and support amazing people. We shared a joyful evening with some of my international students at Halloween and will open our house to one of hers for a couple weeks in February.

Isolation is, for many of us, a choice. We choose screen time, we choose “me time,” we find reasons not to reach out.

I pray you choose otherwise. I have. It’s an enormous, life-sustaining pain in the butt.

Among those friends are the many people who make MFO possible. While Charles, Chip and Ed are the most visible and central players. Less visible, but no less meaningful are the contributions of the estimable Bob Cochran, Dennis Baran, and The (crepuscular) Shadow.

We have also linked this part of our lives with tens of thousands of you. It was your letters, long ago, that convinced us to launch MFO as FundAlarm reached its last chapter. It’s your notes, in email and sometimes on Twitter, that monthly help allay self-doubt and answer the question, “is this still worth doing? Are we making a difference?”

A new adventure!

The folks at Fund Intelligence reached out in November to ask if I’d serve as a judge in their annual fund industry awards. Combining, as I do, amiability and cluelessness, I said “yes.”

I signed, and will certainly respect, a confidentiality / non-disclosure agreement concerning the individual submissions. Nonetheless, it seems like an interesting opportunity and a potentially rich learning experience. I’ll share what I can, as I can.

The Twitter thing

As those of you on Twitter might have noticed, I am not a master of social media. I sat with Daisy Maxey of The Wall Street Journal once, listening to Jack Bogle speak. Daisy’s Twitter output in 45 minutes modestly exceeded my lifetime total on MFO’s behalf.

Nonetheless, we recognize that social media has a potentially useful role to play in connecting with underserved populations. Young folks, who have the irreproducible advantage of a time horizon measured in multiple decades, tend to be uncertain and poorly connected to traditional sources of advice. They also tend to use social media rather more than their elders.

In hopes of better serving such groups, we’ve added a little “Tweet this” button to the end of each story. If you’re engaged on social media and it strikes you that some particular story might have merit for the folks who follow you, please consider pushing the button. It can’t hurt and might, we hope, help someone who would otherwise remain adrift. Thanks!

In hopes of better serving such groups, we’ve added a little “Tweet this” button to the end of each story. If you’re engaged on social media and it strikes you that some particular story might have merit for the folks who follow you, please consider pushing the button. It can’t hurt and might, we hope, help someone who would otherwise remain adrift. Thanks!

Matching grant / challenge grant offer.

The only two sources of support for MFO were Amazon, under a partnership they subsequently terminated, and reader contributions. Last December, in response to Amazon’s decision, three readers collectively offered up a matching grant: for every dollar donated in December 2017, they would match contributions on a 1:1 basis up to a total of $2,000. Within 48 hours, you folks responded with $7,000 in contributions, which was sort of stunning.

We were offered a similar, though modestly smaller matching grant this year: two members have offered, between them, to match dollar-for-dollar the first $1000 we receive in December 2018.

If it’s in your budget and in your best interest, we’d encourage you to make a tax-deductible year-end contribution to MFO. Contributions of $100 or more get you a year’s access to MFO Premium, home of the unique fund screener that we’ve built for folks who want information – sophisticated risk measures, rolling returns, correlations between funds – that are normally unavailable to regular folks. Whether you choose to give $1 or $10,000, we’re grateful and we’ll keep digging on your behalf.

Some folks have chosen to use our PayPal link to create regular monthly contributions, which we find almost freakishly cool. Thanks, as ever, to Deb and Greg, whose continued monthly support makes us smile. We’re so pleased that Brian, George, David, William and Doug have chosen to follow Deb and Greg’s lead in setting up recurring monthly contributions to MFO. Thanks, too, to Katrina, Doug, and Anne for your kind contributions in November.

Our challenges are great. We can face them better together. We are glad that you’re here. We hope you like the issue and hope, even more, to see you again in the New Year.

Her professional career saw two pinnacles: she was one of the more powerful women in the middle 1990s and one of its most powerful a decade later. And in between those two, she walked away. At age 43, Brenda resigned from her post at Pepsi, then she and husband Randy packed up the family, sold the Connecticut estate and moved back to her home state, Illinois. Brenda was loath to let life be entirely consumed, as it was in the 1990s, by an endless series of 14-hour workdays. Her argument was simple: “It’s not that my children needed me. It’s that I needed them. If I didn’t spend more time now, I would not have that opportunity.” Two years into her sabbatical, she reported “I’ve had no boredom. Not a minute. Not a nanosecond.”

Her professional career saw two pinnacles: she was one of the more powerful women in the middle 1990s and one of its most powerful a decade later. And in between those two, she walked away. At age 43, Brenda resigned from her post at Pepsi, then she and husband Randy packed up the family, sold the Connecticut estate and moved back to her home state, Illinois. Brenda was loath to let life be entirely consumed, as it was in the 1990s, by an endless series of 14-hour workdays. Her argument was simple: “It’s not that my children needed me. It’s that I needed them. If I didn’t spend more time now, I would not have that opportunity.” Two years into her sabbatical, she reported “I’ve had no boredom. Not a minute. Not a nanosecond.”

Effective November 19, 2018, Seafarer Overseas Growth & Income Fund’s Institutional Class (SIGIX) is available for purchase by all investors. That reflects their desire “to restore the balance between subscription and redemption activity.” The Investor share class remains pretty much closed to new investors, though it remains open to existing investors. Mr. Foster notes that some distributors are misreporting the change by claiming that the Investor Class is open. It is not.

Effective November 19, 2018, Seafarer Overseas Growth & Income Fund’s Institutional Class (SIGIX) is available for purchase by all investors. That reflects their desire “to restore the balance between subscription and redemption activity.” The Investor share class remains pretty much closed to new investors, though it remains open to existing investors. Mr. Foster notes that some distributors are misreporting the change by claiming that the Investor Class is open. It is not.