Objective and strategy

Crawford Small Cap Dividend pursues attractive long-term total return with below-market risk. They pursue that goal by investing in a portfolio of small-cap US companies that demonstrate a consistent pattern of earnings and dividend growth. Their discipline is bottom-up, value-oriented and focused on company fundamentals. There are currently 72 stocks in the portfolio.

Adviser

Crawford Investment Counsel. Crawford is an investment management boutique headquartered in Atlanta, Georgia. The firm was found in 1980 and is owned by the Crawford family. John H. Crawford III, the firm’s founder, is their CEO and CIO. John H. Crawford IV joined him in 1990 and serves as director of equity investments. David Crawford joined the firm in 1992 and serves as its president.

They manage about $6.3 billion in assets (as of 30 June 2019) for institutions, private clients and their advisors. The firm is particularly proud of the high level of investor loyalty which, they believe, is driven by a combination of strong performance, good risk management and a high level of client service. They advise the three Crawford funds, including Crawford Dividend Growth and Crawford Multi-Asset Income.

Manager

John H. Crawford, IV and Boris Kuzmin. Mr. Crawford is Director of Equity Investments and one of the firm’s co-owners. He’s been with Crawford since 1990. Before that, John worked at Merrill Lynch Capital Markets. John received his BBA in Finance from The University of Georgia and his MS in Finance from Georgia State. He has earned the Chartered Financial Analyst designation, which is pretty major. I celebrate the fact that he’s Chair on the Board of Trustees for the University of Georgia Foundation; even in a thriving state like Georgia, higher education needs the help of all of the smart people it can muster.

Mr. Kuzmin is a Senior Research Analyst and Director of Small Cap Strategy. He’s been with the firm since 2004. Before that, he was an Equity Research Analyst at Emory Investment Management which is responsible for the endowments of Emory University, the Carter Center and Emory Healthcare. He earned his BS in Economics with Honors from the Russian Academy of Economics and his MBA from Emory. Like Mr. Crawford, he has earned the Chartered Financial Analyst designation.

They are supported by a team of six investment analysts.

Strategy capacity and closure

The strategy, including this fund and separate accounts managed using the same strategy, will continually evaluate capacity and may institute a soft close at $2.0 billion and around $2.5 billion, the managers would seriously consider a hard close. The fund has $220 million in assets and the separate accounts add about $30, which puts current assets in the strategy at around $250 million.

Management’s stake in the fund

Mr. Crawford has invested between $500,000 and $1 million in the fund. Mr. Kuzmin has invested between $10,000 – 50,000. As of December 30, 2018, none of the fund’s trustees had chosen to invest in it.

Active share

96.22. “Active share” measures the degree to which a fund’s portfolio differs from the holdings of its benchmark portfolio. High active share indicates management which is providing a portfolio that is substantially different from, and independent of, the index. An active share of zero indicates perfect overlap with the index, 100 indicates perfect independence. The “active share” research done by Martijn Cremers and Antti Petajisto finds that only 30% of U.S. fund assets are in funds that are reasonably independent of their benchmarks (80 or above) and only a tenth of assets go to highly active managers (90 or above).

CDOFX has an active share of 96, which reflects a very high degree of independence from its benchmark Russell 2000 Index.

Opening date

September 26, 2012

Minimum investment

$2,500 (as of July 2023)

Expense ratio

0.99% after waivers on assets of about $285.8 million (as of July 4, 2023).

Comments

Some funds simply demand attention. We run extensive data analyses each month, both for individual fund profiles and broader articles. I noticed that a surprising number of screens had Crawford Small Cap Dividend pop up. By way of example, Crawford popped up in a screen for our article on picking your first ESG / sustainable investing fund (Finding ESG Fund One, April 2019), in a list of high-performing funds with excellent sustainability scores despite not having a formal ESG mandate.

Likewise, as we were preparing our “Small Wins for Investors” (August 2019) feature, Crawford popped up for an expense ratio reduction and our quick capsule of the fund reminded us of their appeal:

Crawford Small Cap Dividend (CDOFX) is a five-star small-cap fund with below-average expense ratio. On September 1, the cap on their expenses fell another 6 points to 99 bps for the no-load shares. As with Cove Street, there’s a lot to like here: high sustainability score, very high active share, much higher-than-average quality portfolio for a small-cap fund, and admirably low-risk scores.

By Morningstar’s scoring, they are a five-star small-cap blend fund. By MFO’s, they are an equity-income Great Owl; that is, an equity-oriented fund that generates substantial income and that has risk-adjusted returns in the top 20% of its peer group for every period longer than 12 months. It’s particularly striking that Crawford excels in both its small-cap Morningstar category and its all-cap Lipper category.

That led us to promise, in September, a profile of the fund for October.

The managers of the Crawford Small Cap Dividend Fund build their portfolio around three principles:

- Find small-cap, blue-chip companies

- Buy them at an attractive price

- Hold them, generally for three or more years.

That first step represents the fund’s greatest distinction. When we think of small-cap companies, we tend to imagine relatively young, relatively untested businesses. While that’s a good general rule (manager John Crawford notes that a third of the companies in his benchmark index, the Russell 2000, are losing money), Crawford is looking for the exceptions to the rule. By way of illustration we can look at the history of the fund’s top three holdings:

- Top holding Simulations-Plus was founded in 1996 and employs about 100 people but

- #2 holding Mueller Water Products was founded in the 1850s; it makes the guts of things like fire hydrants and gas lines and employs 4,200 people.

- #3 Avnet was founded on New York’s Radio Row in the 1920s; it’s an electronics and engineering firm that employs 15,000 people in 125 offices and has been repeatedly recognized as “a World’s Most Ethical Company by Ethisphere Institute.”

For them, small-cap, blue chips are firms that:

Have been paying, and preferably growing, dividends for at least three years;

Have stable earnings and strong free cash flow, which means they’re not dependent on external funding nor hostage to interest rate changes;

Have a history of allocating capital well; and,

Have market caps between $100 million and $5 billion; the portfolio has an average market cap of $3.1 billion

The firm believes that “quality and dividends are inexorably linked, and we look to a company’s dividend history as an initial indicator of quality.” Growing dividends, among other things, signal a firm’s ability to grow cash flows over time.

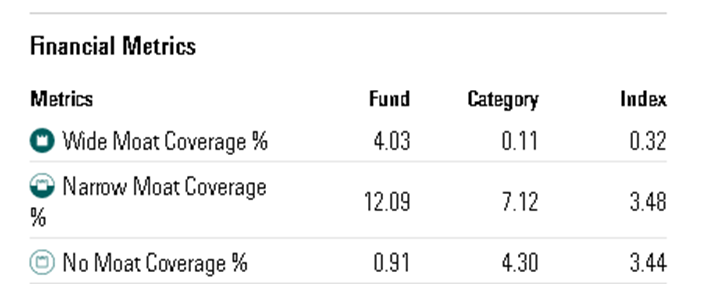

That’s translated to a portfolio that is strikingly higher quality than its peers. Morningstar calculates that 16% of Crawford’s firms have an economic moat; that is, a sustainable business advantage. That is well more than double their peers’ commitment to high-quality stocks and four times higher than their benchmark index’s.

source: Morningstar.com

The combination of a high-quality, risk-conscious portfolio with the tendency of underfollowed small caps to become misunderstood and mispriced has then translated into strikingly stronger results than its peers have managed.

Comparison of 5-Year Performance (Since 201409)

| APR | Max DD | Recvry mo |

Std dev | DS dev | Ulcer Index | Bear mkt dev | Sharpe Ratio |

Sortino Ratio |

Martin Ratio | Capture ratio | |

| Crawford Small Cap Dividend | 8.6% | -16.0 | 12+ | 13.7 | 8.9 | 4.5 | 7.7 | 0.56 | 0.87 | 1.71 | 0.95 |

| Small-cap core average | 5.2 | -21.5 | 13 | 15.8 | 10.9 | 6.9 | 9.3 | 0.27 | 0.40 | 0.67 | 0.74 |

| Equity Income Average | 6.6 | -12.8 | 13 | 11.4 | 7.5 | 4.2 | 6.8 | 0.51 | 0.78 | 1.59 | 0.87 |

Here’s how to read that table: CDOFX has outperformed its small-cap core peer group by every measure of return (APR), risk (maximum drawdown, time to recover from the max drawdown, standard deviation, downside – or “bad” – deviation, bear market deviation and Ulcer index which factors together the depth and length of drawdowns), and risk-adjusted returns (Sharpe ratio, the more conservative Sortino, the much more conservative Martin and the capture ratio, which measures both the upside and downside capture of the S&P 500’s movement) over the past five years. It has substantially outperformed its Lipper peer group – remember: those are 145 mostly safe, conservative, large-cap dividend-payers – in raw return while only modestly greater volatility, which means that its risk-adjusted performance exceeds that of its peers.

Bottom Line

Lipper views equity-income funds as such distinctively conservative creatures that they classify them separately from categories such as large-cap value, where most equity income funds reside. It is rare to find the upside potential of a small-cap portfolio with so many of the characteristics of a conservative large-cap one. Cautious, long-term investors who sense opportunity in the reversal of the long domination of large caps over small caps might put CDOFX high on their due diligence list.