Updates

AMG River Road Long-Short is no more. At an as-yet-unspecified date following the inevitable shareholder approval, the $20 million / four-star AMG River Road Long-Short Fund will be wiped away, with its regulatory paperwork giving rise to AMG River Road International Value Equity Fund. Its portfolio (which has only 5% international equity exposure) will be liquidated and replaced with a new all-cap, absolute value portfolio. The new managers will be Wenjun (William) Yang and Jeffrey Hoskins, the latter being an ESG specialist. On the upside, several fees – including the management fee – are dropping, which might translate to a less expensive fund.

David Hobbs has resigned as Principal, Vice President, Treasurer, and Principal Financial Officer at Cook & Bynum Capital Management. His resignation is effective on September 30, 2021. David’s corporate bio now reads, “Mr. Hobbs currently serves as Chief Financial Officer and Chief Investment Officer for EBSCO Industries.” Folks familiar with doing online academic research would be familiar with the EBSCO research databases, a huge searchable corpus covering 375 full-time databases and 600,000+ ebooks. Like Cook & Bynum, it’s a private, Alabama-based firm with a strong record of community engagement.

David Hobbs has resigned as Principal, Vice President, Treasurer, and Principal Financial Officer at Cook & Bynum Capital Management. His resignation is effective on September 30, 2021. David’s corporate bio now reads, “Mr. Hobbs currently serves as Chief Financial Officer and Chief Investment Officer for EBSCO Industries.” Folks familiar with doing online academic research would be familiar with the EBSCO research databases, a huge searchable corpus covering 375 full-time databases and 600,000+ ebooks. Like Cook & Bynum, it’s a private, Alabama-based firm with a strong record of community engagement.

Hsiao sighting: On August 24, 2020, Matthews Asia announced the departure of manager Tiffany Hsiao. Ms. Hsiao managed Matthews China Small Companies (MCSMX, since 2015) and, with long-time lead manager Michael Oh, Matthews Asia Innovators (MATFX, since 2018). CityWire ranks her as a “AAA” manager and describes her as “a star.” By their rating system, she was the second-ranked female portfolio manager in the US. She’s piloted China Small Companies to a five-star record and considerable acclaim. She’s been described as “brilliant and driven.” Over the past five years, roughly the period in which she’s managed the fund, China Small Companies has the highest returns (21.5% annualized) and highest Sharpe ratio (0.99) of any China region fund in the Lipper database.

Hsiao sighting: On August 24, 2020, Matthews Asia announced the departure of manager Tiffany Hsiao. Ms. Hsiao managed Matthews China Small Companies (MCSMX, since 2015) and, with long-time lead manager Michael Oh, Matthews Asia Innovators (MATFX, since 2018). CityWire ranks her as a “AAA” manager and describes her as “a star.” By their rating system, she was the second-ranked female portfolio manager in the US. She’s piloted China Small Companies to a five-star record and considerable acclaim. She’s been described as “brilliant and driven.” Over the past five years, roughly the period in which she’s managed the fund, China Small Companies has the highest returns (21.5% annualized) and highest Sharpe ratio (0.99) of any China region fund in the Lipper database.

She joined Artisan Partners immediately upon departing Matthews.

On July 1, 2021, Artisan Partners announced that she had been given responsibility for their new Artisan China Post-Venture Strategy. Her investment passion is in finding innovators and disruptors, and her new strategy will invest in 20-40 high-growth, small- to mid-caps firms. It also has the ability to invest up to 15% in private assets.

The fund is not available to the general public.

Mairs & Power Small Cap Fund has added SPACs to its investible universe. There is no defined limit on the fund’s ability to invest in SPACs, but Mairs & Power is an awfully prudent bunch.

Osterweis Capital Management announced on July 1, 2021, that the Osterweis Strategic Investment Fund is being renamed the Osterweis Growth & Income Fund. At the same time, it reduced the management fee to 0.75% for both Osterweis Fund (OSTFX) and Osterweis Growth & Income Fund (OSTVX). We’ll update our profile of Osterweis Strategic Investment (“It is easy to dismiss OSTVX because it refuses to play by other people’s rules; it rejects the formulaic 60/40 split, it refuses to maintain a blind commitment to investment-grade bonds, its stock sector-, size- and country-weightings are all uncommon”) to reflect the changes.

Briefly Noted . . .

Moving to active: On August 28, 2021, Steward Large Cap Enhanced Index Fund will be renamed Steward Large Cap Core Fund, and Steward Small-Mid Cap Enhanced Index Fund will be renamed Steward Small Cap Growth Fund. Both become active, values-oriented funds whose managers “may also consider a company’s environmental, social and governance (ESG) characteristics.” The funds will actively avoid firms involved in alcohol, tobacco, gambling, the provisions of abortion-related services, adult entertainment, and recreational cannabis.

Moving to passive: On August 3, 2021, Aberdeen Standard Bloomberg All Commodity Strategy K-1 Free ETF and Aberdeen Standard Bloomberg All Commodity Longer Dated Strategy K-1 Free ETF will no longer operate as actively managed funds.

Moving to ETFville: Sometime in the second quarter of 2021, Cannabis Growth Fund becomes the Cannabis Growth ETF. The growth since inception has been negative: Morningstar calculates that an initial investment of $10,000 would have dwindled to $7863 (as of 6/25/2021) because of a disastrous first year.

Adding to the ETFville traffic: DFA has converted four open-end funds with around $30 billion in assets into active, transparent ETFs. They are

- Dimensional U.S. Equity ETF (DFUS, formerly Tax-Managed U.S. Equity Portfolio DTMEX)

- Dimensional U.S. Small Cap ETF (DFAS, formerly Tax-Managed U.S. Small Cap Portfolio DFTSX)

- Dimensional U.S. Targeted Value ETF (DFAT, formerly Tax-Managed U.S. Targeted Value Portfolio DTMVX)

- Dimensional U.S. Core Equity 2 ETF (DFAC, formerly T.A. U.S. Core Equity 2 Portfolio DFQTX)

The ETFs have lower expenses than their predecessors, on average 27% lower, with expense ratios of 11 – 34 bps. Two more conversions are anticipated in the fall.

Moving to space: Procure Space ETF just added a first-of-its-kind risk disclosure. UFOs.

Unidentified Aerial Phenomena (“UAP”) Risk

A UAP, formerly known as an “unidentified flying object” or “UFO,” is a flying object that looks or moves unlike any known aircraft used by the US or any foreign country. Recently, the US military has acknowledged the existence of UAPs and confirmed the authenticity of certain videos and images purporting to show UAPs. Given that currently there is no identification of these observed phenomena, it is possible that UAPs could create unintentional or deliberate operational, data security, “cyber,” and other interference with the operation of satellites and other objects in space. Such activities could result in a significant adverse impact on the Fund’s securities, thereby causing the Fund’s investment in such portfolio securities to lose value and adversely affecting the Fund’s ability to fulfill its investment objectives.

A UAP, formerly known as an “unidentified flying object” or “UFO,” is a flying object that looks or moves unlike any known aircraft used by the US or any foreign country. Recently, the US military has acknowledged the existence of UAPs and confirmed the authenticity of certain videos and images purporting to show UAPs. Given that currently there is no identification of these observed phenomena, it is possible that UAPs could create unintentional or deliberate operational, data security, “cyber,” and other interference with the operation of satellites and other objects in space. Such activities could result in a significant adverse impact on the Fund’s securities, thereby causing the Fund’s investment in such portfolio securities to lose value and adversely affecting the Fund’s ability to fulfill its investment objectives.

SMALL WINS FOR INVESTORS

DF Dent Premier Growth Fund, DF Dent Midcap Growth Fund, and DF Dent Small Cap Growth Fund, which are three- and four-star funds, have eliminated their 2% redemption fees.

Effective July 1, 2021, Class I Shares of Gabelli Small Cap Growth Fund, Equity Income Fund, and Global Financial Services Funds are available to investors with a minimum initial investment amount of $10,000. Previously, the minimum was $500,000.

Effective July 1, 2021, Zeo Short Duration Income is reducing its e.r. by a little (4 bps), and Zeo Sustainable Credit is dropping it by a lot (33 bps, to 0.99%). Both funds are adding a much-needed assistant PM to add analytic support.

CLOSINGS (and related inconveniences)

As of the close of business on August 16, 2021, the American Century Small Cap Value Fund will be generally closed to new investors other than those who (i) invest directly with American Century (where American Century is listed as the dealer of record); (ii) invest through certain financial intermediaries selected by American Century; or (iii) otherwise qualify for an exemption under American Century’s closed fund policy.

Effective after the close of business on June 20, 2021, the Artisan International Value Fund will be closed to most new investors.

OLD WINE, NEW BOTTLES

AMG Managers Fairpointe Mid Cap Fund has become AMG River Road Mid Cap Value Fund.

On August 9, 2021, AMG GW&K Small Cap Value Fund II (formerly AMG Managers Silvercrest Small Cap Fund) will be merged into AMG GW&K Small Cap Value Fund.

On or about August 31, 2021, Blackrock Basic Value Fund becomes BlackRock Large Cap Focus Value Fund. The new portfolio will hold 30 – 50 funds.

Effective August 31, 2021, “all references to BlackRock Mid Cap Dividend Fund are changed to BlackRock Mid‑Cap Value Fund to reflect the Fund’s new name.” Curiously, there’s no new strategy to be reflected. That’s curious because changing a fund’s name without changing its strategy is usually a marketing ploy, but this fund has managed to pair a mediocre YTD performance with really large YTD fund inflows.

Effective October 1, 2021, the BlackRock CoreAlpha Bond Fund will change its name to the BlackRock Advantage CoreAlpha Bond Fund.

On or about September 23, 2021, the BlackRock Emerging Markets Flexible Dynamic Bond Portfolio will change its name to the BlackRock Sustainable Emerging Markets Flexible Bond Fund. Less dynamic, more sustainable, still flexible … it’s like marketing buzz bingo.

Effective July 1, 2021, the BlackRock Systematic ESG Bond Fund becomes the BlackRock Sustainable Advantage CoreAlpha Bond Fund. The change is accompanied by a reduction in the fund’s investment advisory fee.

On June 25, 2021, the Blueprint Growth Fund became the Blueprint Adaptive Growth Allocation Fund.

On November 5, 2021, BNY Mellon Structured Midcap Fund will be folded into BNY Mellon Small/Mid Cap Growth Fund.

On July 1, the name of the ClearBridge Focus Value ETF changed to ClearBridge and ClearBridge All Cap Growth ETF to ClearBridge All Cap Growth ESG ETF.

Effective June 1, 2021, the name of the Hennessy BP Energy Fund has been changed to the Hennessy BP Energy Transition Fund.

On or about July 8, 2021, JPMorgan Emerging Markets Equity Core ETF becomes JPMorgan ActiveBuilders Emerging Markets Equity ETF.

On or about June 24, 2021, the Board approved the reorganization of the Schroder Funds into the Hartford Schroders Sustainable Core Bond Fund.

Effective August 1, 2021, KraneShares CCBS China Corporate High Yield Bond USD Index ETF becomes KraneShares Asia Pacific High Yield Bond ETF. The new fund will track the performance of an unspecified “specific fixed income securities index.”

Effective June 11, 2021, Trend Aggregation Dividend Stock ETF became The Active Dividend Stock ETF.

Effective on or about July 16, 2021, USA Mutuals Navigator Fund changes its name to USA Mutuals All Seasons Fund.

Effective June 23, 2021, VanEck Vectors Real Asset Allocation ETF became VanEck Inflation Allocation ETF. Same fund, different marketing.

On or about June 30, 2021, the name and principal investment strategies of the WCM Focused ESG Emerging Markets Fund, and WCM Focused ESG International Fund will be changed:

- The name of the WCM Focused ESG Emerging Markets Fund will be changed to WCM Sustainable Developing World Fund.

- The name of the WCM Focused ESG International Fund will be changed to WCM Sustainable International Fund.

OFF TO THE DUSTBIN OF HISTORY

Early in the fourth quarter of 2021, AB FlexFeeTM Large Cap Growth Portfolio will be merged into AB Large Cap Growth Fund.

Aegon Emerging Markets Debt Fund was liquidated on June 25, 2021.

Amplify CrowdBureau Online Lending, and Digital Banking ETF will be liquidated by June 28, 2021. It tracked a peer-to-peer lending index, earned a Morningstar Q analyst rating of Silver … and managed to turn $10,000 at inception into $6868.

BMO Global Low Volatility Equity Fund will be liquidated on July 30, 2021. The liquidation was approved back in February, then suspended while BMO reconsidered, and is now on track again.

BNY Mellon Large Cap Stock will be liquidated on July 28, 2021.

Dupont Capital Emerging Markets Fund will experience “final liquidation” on or about July 28, 2021.

On August 23, 2021, iShares Russell 1000 Pure U.S. Revenue ETF (AMCA), iShares Currency Hedged MSCI Mexico ETF (HEWW) iShares Adaptive Currency Hedged MSCI EAFE ETF (DEFA), iShares Factors U.S. Blend Style ETF (STLC), iShares Factors US Mid Blend Style ETF (STMB), iShares Factors U.S. Small Blend Style ETF (STSB), and iShares International Preferred Stock ETF (IPFF) will be liquidated.

On or about July 16, 2021, JOHCM International Small Cap Equity Fund will be liquidated. JOHCM has been trying to arrange a series of fund mergers but hasn’t been able to secure shareholder quorums, so they appear to be moving to Plan B.

Pacer Military Times Best Employers ETF will be closed and liquidated immediately after the close of business on July 29, 2021.

On June 25, 2021, the Board of Trustees approved the termination and winding down of Pacific Global Focused High Yield ETF with the liquidation payment to shareholders expected to take place on or about August 5, 2021.

At some point in the fourth quarter of 2021, Schroder Core Bond Fund will merge into Hartford Schroders Sustainable Core Bond Fund.

The TIFF Short-Term Fund was liquidated on June 15, 2021.

Tortoise MLP & Energy Infrastructure Fund has been merged into the Tortoise MLP & Energy Income Fund.

The TIFF Short-Term Fund was liquidated on June 15, 2021.

PGIM QMA Global Tactical Allocation Fund is expected to be liquidated on August 23, 2021.

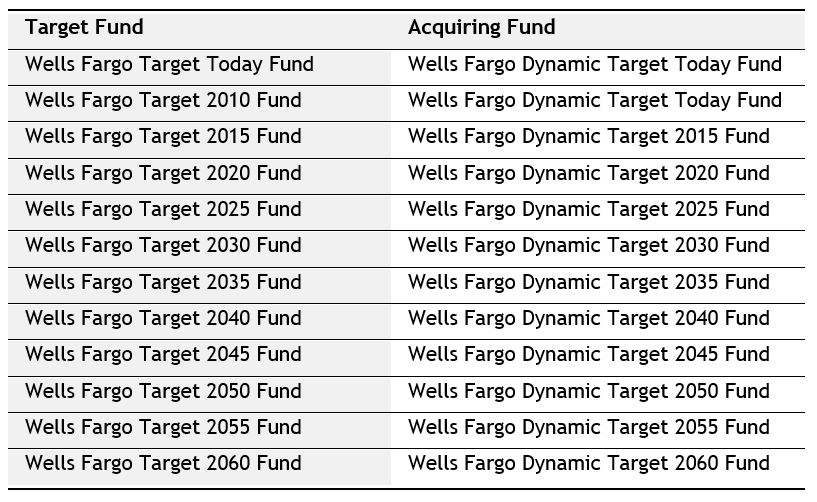

In October 2021, Wells Fargo will simplify its target-date fund lineup by … well, merging half of its funds out of existence.

Wilmington Short-Term Bond Fund will be liquidated on July 22, 2021. That is, indeed, short-term. Wilmington Intermediate-Term Fund will be merged into the Broad Market Bond Fund, but the date has not been disclosed.