This article takes a closer look at Fidelity Advisor Multi-Asset Income (FMSDX/FAYZX), Fidelity Strategic Real Return (FSRRX), and Fidelity Advisor Strategic Income (FADMX/FSIAX) which I have identified in previous articles as funds with high risk-adjusted-performance. They are managed by Adam Kramer, Ford O’Neil, and a strong team of co-managers.

This article continues the theme from the long-term trends identified in Retrospection Is a Hard Metric to Match. Recently Lance Roberts wrote Deficit Deniers & 40-Years of Economic Erosion covering the same 40 year period but emphasizes the detrimental impact of high federal budget deficits. The Catastrophe Portfolio, which contains FMSDX and FADMX, describes how to build a “buy and hold” portfolio for an investment environment starting with high valuations, high deficits, and low interest rates.

This article is divided into four sections so that readers can skip to the sections of interest: 1) Fund Managers, 2) Fund Strategy, 3) Composition, and 4) Performance. Key Points are provided for each section so that readers with limited time may gloss over sections. FMSDX is available to individuals at Fidelity while FAYZX is an older institutional share class. Likewise, FADMX is available to individuals while FSIAX is an institutional share class.

As an overview, Table #1 contains some of my favorite metrics and ratings from Mutual Fund Observer for a select few funds managed by Mr. Kramer and Mr. O’Neil. The funds are Conservative (MFO Risk = 2) to Aggressive (MFO Risk = 4) and the Lipper Preservation Ratings are Average (3) to Above Average (4). The MFO Rating shows that the funds have Average (3) to Best (5) risk-adjusted performance for their categories. The Ferguson Mega Rating has the funds from Average (3) to Best (5). The Fidelity Advisor Strategic Income (FSIAX/FADMX) and the Fidelity Convertible Securities (FCVSX) have an average Lipper Rating for Five Year Tax Efficiency and the rest are less tax efficient.

Table #1: Five Year Ratings and Metrics

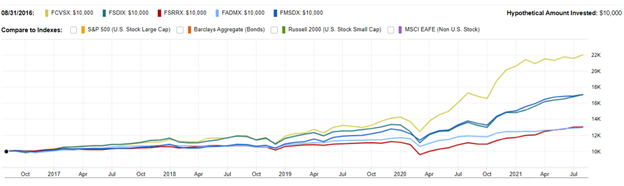

The Growth of $10,000 in these five funds for the past five years can be seen in Figure #1. Note that the performance of some of these funds has improved since the 2020 correction as can be seen in the YTD performance in Table #1 above or Figure #1 below. This is due to FMSDX being able to take advantage of volatility to find value among asset classes, and FSRRX protecting against inflation. FADMX had relatively stable performance, and by assets under management is the most popular fund. FCVSX and FSDIX have done well, but are not covered in this article, because of higher risk ratings.

Figure #1: Growth of $10,000

1. Fund Managers

Key Point: This section is a brief summary of the management teams of FMSDX, FSRRX and FADMX.

Morningstar gives FMSDX a Five Star Rating and a Quantitative Rating of Silver, in part for its strong management team who have a sizeable personal investment in the fund. They give FMSDX a High People Pillar rating. They only give FSRRX a Two-Star Rating but a Quantitative Rating of Silver for its strong management team. FADMX gets a Four-Star Rating and Quantitative Ratings of Neutral to Gold depending upon its share class. Morningstar describes the management team as “Experienced leadership, thoughtful succession planning, and a well-equipped team of researchers, analysts, and traders.”

Adam Kramer (Lead Manager FMDSX, Co-manager Primary FSRRX & FADMX)

Adam Kramer is a portfolio manager in the Fixed Income division, who manages Convertible Securities Funds, Multi-Asset Income Funds, Strategic Funds including Dividend & Income Funds, Real Return Funds, and Income Funds. Mr. Kramer began working at Fidelity in 2000 as a research analyst and has since covered a variety of industries. Prior to joining Fidelity, Mr. Kramer worked for RSM Richter in Montreal as a chartered accountant and auditor. He has been in the financial industry since 1994. Mr. Kramer is a Chartered Professional Accountant (CPA) who earned his bachelor of commerce degree in accounting and a graduate diploma in public accountancy from McGill University, and his master of business administration degree from Cornell University.

Ford O’Neil (Co-manager Primary FSRRX & FADMX, Co-Manager FMDSX)

Ford O’Neil joined Fidelity in 1990 and has over 36 years of industry experience. Mr. O’Neil manages various retail and institutional taxable bond funds and portfolios, and five funds across three sectors in the U.S. for Fidelity. He was a Co-Manager of FADMX since 2012 but became the Primary Manager in 2017 when he was joined by Adam Kramer. Before joining Fidelity in 1990, Mr. O’Neil was an associate in the Investment Banking department at Advest. He received his Bachelor of Arts degree in government from Harvard University in 1985 and an MBA from the University of Pennsylvania – The Wharton School in 1990.

Ramona Persaud (Co-Manager FMDSX)

Ramona Persaud was born in South America and grew up in Latin American and the Caribbean. She received a Bachelor of Science degree from the Polytechnic University in 1997, and a M.B.A. University of Pennsylvania (Wharton) in 2003. Ms. Persaud joined Fidelity Investments in 2003 and has worked as a research analyst and portfolio manager.

Bill Maclay (Co-Manager of FSRRX)

BA, University of Washington, 1999

MSF, Boston College, 2005

Brandon C Bettencourt (Co-Manager of FSRRX)

MS, Worcester Polytechnic Institute, 2008

BS, Boston University, 2005

Richard Munclinger (Co-Manager of FSRRX)

PhD, George Washington University, 2009

Mark J Notkin (Co-Manager of FADMX)

MBA, Boston University, 1988

BS, University of Massachusetts, Amherst, 1986

Franco Castagliuolo (Co-Manager of FADMX)

BS, Bryant University, 1997

Sean Corcoran (Co-Manager of FADMX)

MBA, Northeastern University, 2002

BS, Colorado School of Mines, 1995

Timothy J Gill (Co-Manager of FADMX)

BS, University of Vermont, 2000

Ario Emami Nejad (Co-Manager of FADMX)

PhD, Imperial College London, UK, 2010

Brian S Chang (Co-Manager of FADMX)

BA, Northwestern University, 2002

MBA, Columbia University – Columbia Business School, 2007

Rick Patel (Co-Manager of FADMX)

Mathematical Sciences, University of Oxford, 2000

Abingdon School, 1997

Nader Nazmi (Co-Manager of FADMX)

BS, Iowa State University, 1981

BSE, University of Illinois at Urbana-Champaign, 1983

PhD, University of Illinois at Urbana-Champaign, 1985

2. Investment Strategies

Key Point: These funds apply an active, tactical approach and are not a substitute for safer bond funds, but lie between stock and bonds on the risk spectrum.

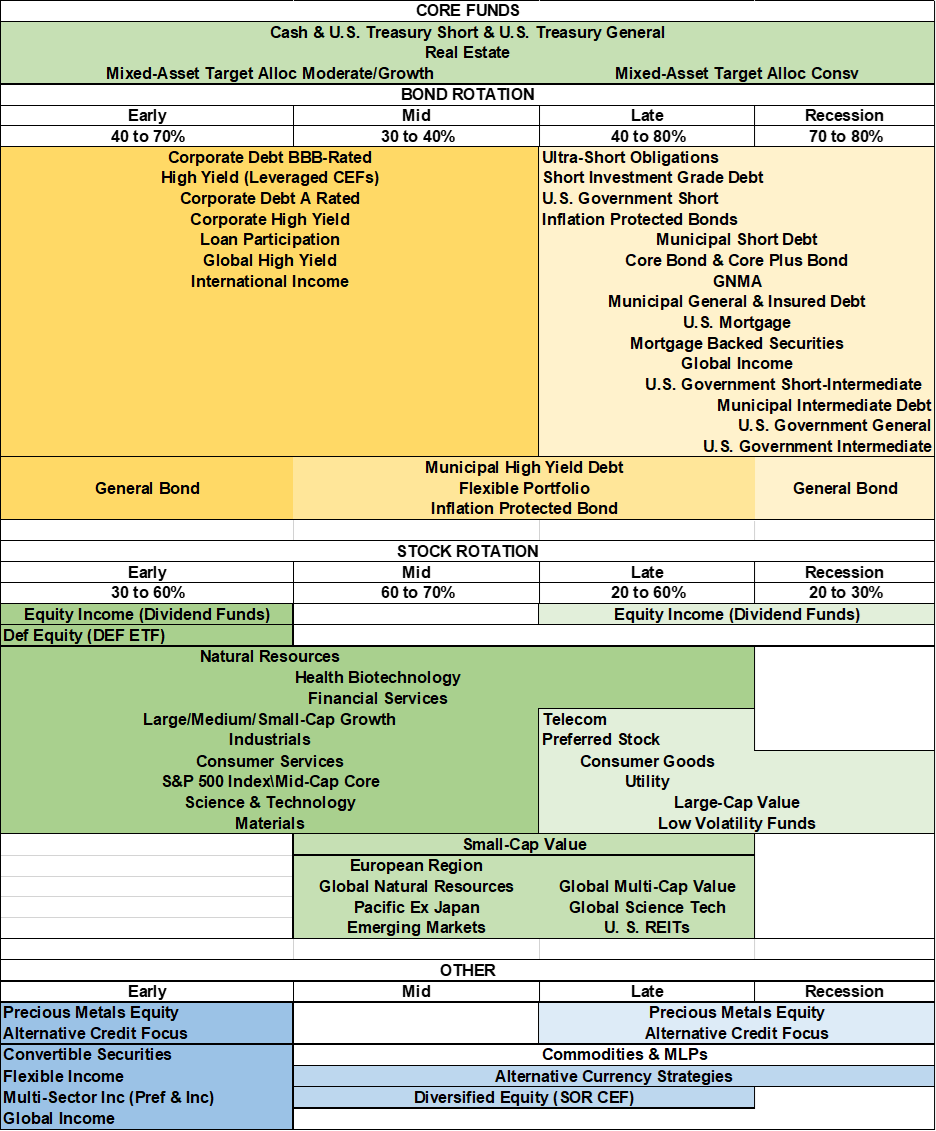

I like Fidelity’s approach to investing according to longer-term secular cycles and shorter-term business cycles.

Fidelity’s Business Cycle Board – composed of portfolio managers and other analysts within our Global Asset Allocation division – believes the U.S. has moved into the midcycle phase of expansion, marked by wide-scale reopening across states, with activity and inflation rates likely reaching a peak. Global economic expansion has likewise broadened, with variance across regions due in part to different vaccination and virus trends. Easy financial conditions are providing companies access to capital, but above-average valuations across many asset classes and potential volatility due to the anticipated tapering of monetary support remain risk factors.

– Abigail P. Johnson, Chairman’s Message, June 30, 2021

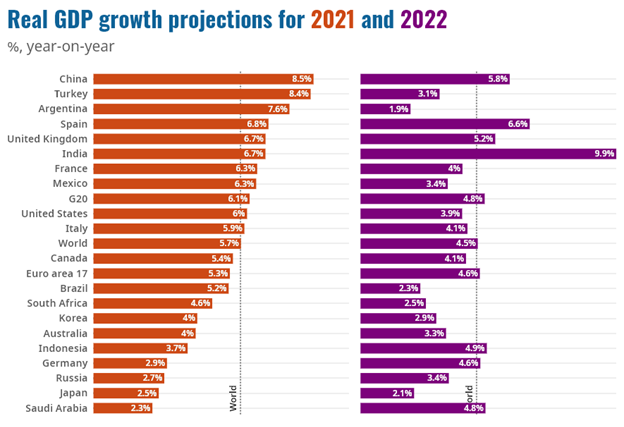

The Organisation for Economic Co-operation and Development (OECD) has released its Interim Economic Outlook as shown in Figure #2. As Fidelity points out, we are in a mid-cycle phase of the expansion, and the OECD expects growth to moderate, but sill grow at a healthy rate.

Figure #2: OECD World Growth Projections 2021 & 2022

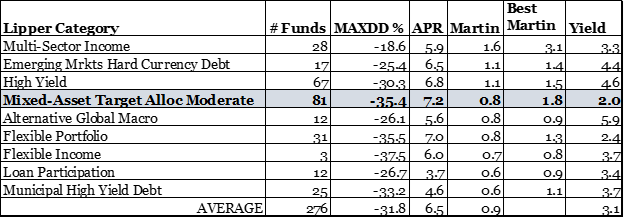

Table #2 shows the average performance over the past fifteen years of all of the funds with the exception of those rated in the lowest fund family in these Lipper Categories. Martin Ratio is the risk adjusted performance and “Best Martin” is the highest Martin Ratio for all funds within that Lipper Category. Over the past fifteen years, the Multi-Sector Income Category had the highest risk adjusted returns. The traditional Moderate Allocation Mixed Asset Fund category has done well.

Table #2: Fifteen Year Risk and Reward of Income Oriented Funds

Table #3 is from Tactical Sleeve for the Conservative Minded where I used MFO to categorize the best performing funds by stage of the business cycle. The flexible and multi-sector categories are broad, but appeal to me for the potential to offer higher risk adjusted returns by changing allocations based on market conditions.

Table #3: Best Performing Funds by Business Cycle Stage

The team approach of Fidelity includes a macroeconomic research group and fixed income specialists.

In the wake of the global financial crisis, the firm’s fixed-income group improved communication and accountability across its various teams while also investing heavily in operations, developing a bevy of tools for portfolio managers to slice and dice a portfolio’s risks and identify opportunities in individual credits and mortgage pools.

– Mike Mulach, “A thoughtful multi-sector offering,” Morningstar.com, Aug 24, 2021

Fidelity Multi-Asset Income (FMSDX)

Fidelity Multi-Asset Income Fund invests tactically across domestic and global equities, investment-grade debt securities, high-yield bonds, preferred stock, floating-rate securities, bank loans, emerging-markets debt, and real estate investment trusts in order to take advantage of short and long term market opportunities. The key take-aways from Adam Kramer, “Income and inflation: What you should know” (Fidelity Viewpoints, July 13, 2021) are:

-

- Multi-asset income strategies may help investors meet their needs for income in the second half of 2021 despite interest rate uncertainty and the high prices of many stocks.

- In exchange for higher income, some assets that these strategies invest in may experience more volatility than traditional income investments. In an inflationary environment, however, strategies that can invest in a variety of income-oriented assets may offer both higher income and better capital preservation tools than traditional fixed-income investments.

- High-yield bonds, floating-rate loans, dividend-paying U.S. and international value stocks including energy and gold producers, master limited partnerships (MLPs), and real estate investment trusts (REITs), are among the investments that may offer income opportunities in the second half of 2021.

- Professional investment managers may find opportunities when markets misprice these assets due to excessive pessimism about the future.

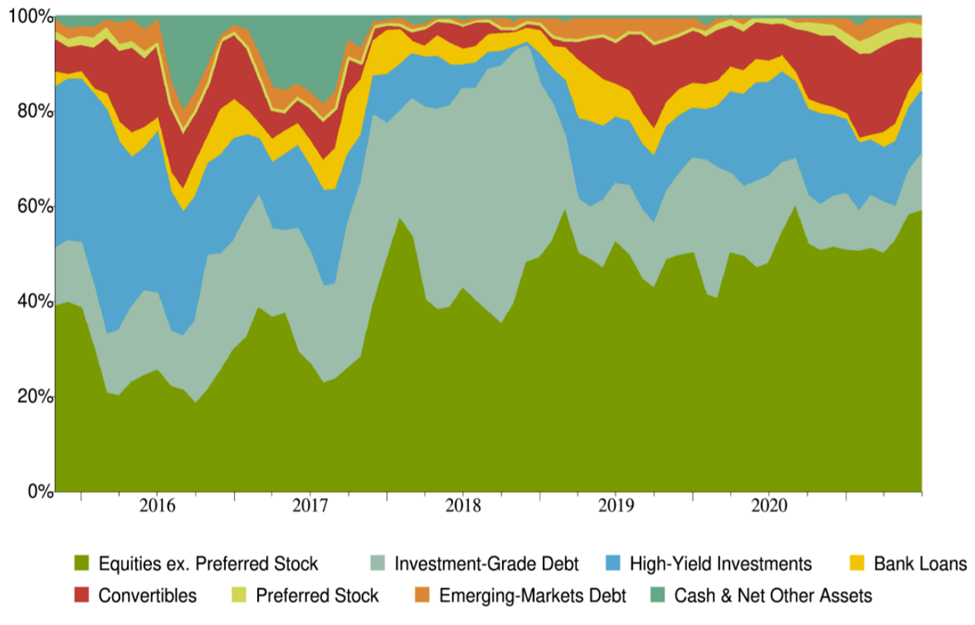

Figure #3 from Fidelity’s Quarterly Fund Review, shows how this tactical approach has changed allocations over time.

Figure #3: Rotation in FMDSX Allocations

Fidelity Strategic Real Return Fund (FSRRX)

Fidelity Strategic Real Return Fund uses a multi-asset-class strategy that seeks inflation-adjusted return consistent with reasonable investment risk by investing in domestic and foreign issuers including U.S. TIPS, floating-rate high-yield bank loans, commodities, and related investments, and real-estate-related securities including REITs. Subportfolio managers are responsible for security selection in their respective areas of expertise, while the lead portfolio managers have the flexibility to make tactical allocation shifts. The managers use fundamental analysis of factors such as financial condition and industry position, and market and economic conditions to select investments.

When looking at the composition of FSRRX it can be confusing that there can be so much invested in “Other” categories. These are actually Fidelity’s central funds (specialized investment vehicles used by Fidelity funds to invest in particular security types or investment disciplines). Pairing allocations to categories along with holdings from MFO, I equate the following:

Fidelity Cent Invt Portfolios = Fidelity Floating Rate Central Fund

Fidelity Garrison Str Tr = Fidelity Commodity Strategy Central Fund

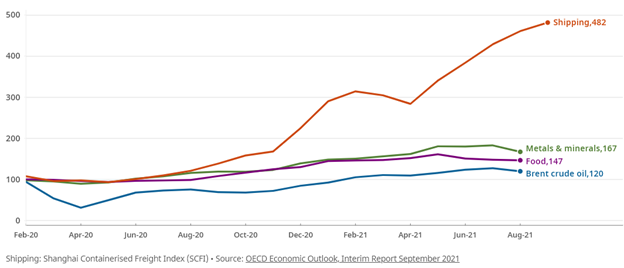

Inflation has many components and some are rising as shown in Figure #4 by the OECD. Inflation is affected by technology, supply chain, globalization, and geopolitics. Some aspects of inflation may be transitionary, but others may be less so.

Figure #4: Rising Inflation Components

Fidelity Strategic Income Fund (FADMX)

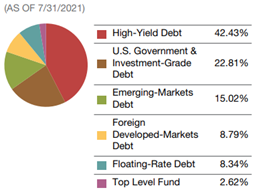

FADMX seeks a high level of current income, but may also seek capital appreciation. The managers of FADMX invest primarily in debt securities by allocating assets among four general investment categories: high yield securities, U.S. Government and investment-grade securities, emerging market securities, and foreign developed market securities. The fund uses a neutral mix of approximately 45% high yield, 25% U.S. Government and investment-grade, 15% emerging markets, and 15% foreign developed markets. Forward foreign currency exchange contracts are used to hedge currency exposure. The Fund uses swaps, options, and futures contracts, and forward-settling securities, to manage risk. The fund also uses Fidelity’s central funds as described above.

The managers use a disciplined investment process incorporating economic and market signals to allocate across the range of the portfolio’s asset classes while the sub-portfolio managers seek to focus on security selection. The fund’s investment approach is to offer a diversified strategy with the potential to provide income regardless of the interest-rate environment. The managers use a bottoms-up approach to find attractive valuations.

3. Fund Composition

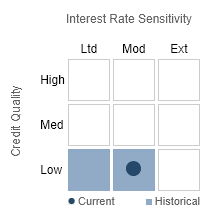

Key Point: The Funds have different strategies but there is some overlap in assets that investors should be aware of when managing their portfolios. The fixed income portions of these three funds are lower quality on average with interest rate sensitivity ranging from low for FSRRX to moderate for FADMX and extensive for FMSDX.

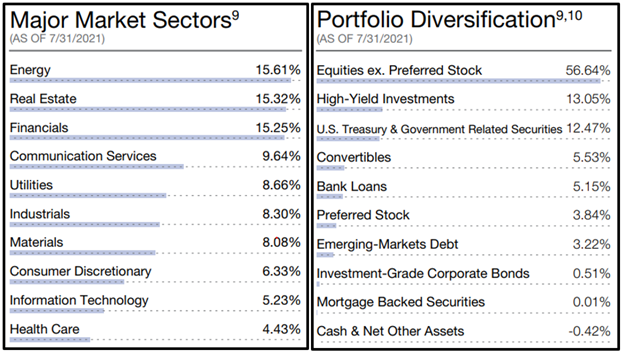

Fidelity Multi-Asset Income (FMSDX)

We are likely past the peak in year-on-year GDP growth rates, but growth and inflation are likely to stay elevated, thanks to consumer spending, retailer restocking, and monetary and fiscal stimulus measures. This should drive ongoing robust earnings growth: We are looking for 42% growth in global corporate earnings this year and 9% in 2022. We think this is a good environment for equities overall, and in particular for the energy and financials sectors…

FMSDX may be of interest to an investor who wants income (2.9% yield) with high risk-adjusted returns through an actively managed diversified portfolio. FMSDX has had a maximum drawdown of 11% over the past five years, and an average annual return of 11% during this time period. I like the value approach as shown by the higher allocation to energy, real estate, and financials and lower allocation to technology. I also like the portfolio diversification.

Table 4: FMSDX Composition

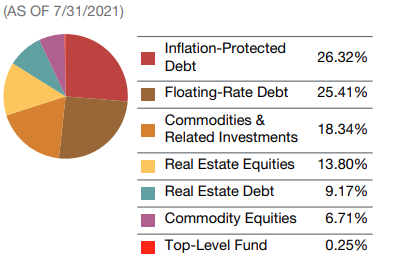

Fidelity Strategic Real Return Fund (FSRRX)

Investors holding cash or traditional bonds but looking for additional income now should consider alternative means of yield generation, across private credit, senior loans, active fixed income, direct real estate, and FX, or by employing leverage or volatility-linked strategies.

FSRRX may be a fund of interest to those who believe that inflation is a concern or that rates may rise. It has had a maximum drawdown of nearly 15% over the past five years with an average annual return of over 5%. The yield is about 2 percent.

Table 5: FSRRX Composition

Fidelity Strategic Income Fund (FADMX)

FADMX may be a fund of interest to those who are seeking yield (3.1%), and are willing to accept a moderate amount of risk. FADMX has had a maximum drawdown of 9% over the past five years with an average annual return of over 5%.

Table 6: FADMX Composition

Source: Fidelity FADMX Fund Fact Sheet

Table 7: FAMDX Rate Sensitivity

Source: Fidelity FADMX Composition

4. Fund Performance

Key Point: Future performance will differ because valuations, which are an excellent predictor of long-term returns, are now high, parts of inflation may or may not be transitionary, and rates are low. Use your judgment, and consider the risks…

The Fidelity Asset Manager 50% (FASMX) is shown as a baseline fund. All funds have compared well against their peers for the past five years. Fidelity Advisor Multi-Asset Manager (FAYZX/FMSDX) has performed better than FASMX with a lower drawdown and higher yield. Fidelity Strategic Dividend and Income (FSDIX) has also outperformed FASMX, but with a higher drawdown and higher yield. Over the past fifteen years. Fidelity Advisor Strategic Income (FSIAX/FADMX) has performed relatively well compared to FASMX but with a higher yield. FSRRX has not performed well over the past fifteen years, because inflation has been low, but the yield is decent.

Table 8: Fund Performance (Metrics for Five Years)

Closing

Nearing retirement, I have consolidated accounts, talked with an advisor, and loosely come up with a strategy to have a managed tax-efficient after-tax account, and a managed Roth IRA for riskier investments, self-managed Traditional IRAs for more conservative investments, and a conversion from a Traditional IRA to a Roth IRA. I reviewed the basis of this strategy in Best Tax Efficient Funds. Taxes should be considered in building your portfolio, but not be the main driver of investment choices.

There is an excellent article on converting to a Roth in the September 2021 issue of the AAII Journal (Roger Young, “Can a Roth IRA Conversion Save You Money?”). It may make sense for those who have saved diligently mostly in traditional IRAs, have taxable accounts, and may have pensions. “It is especially attractive if their taxable income is low in their early retirement years”. By deferring social security until age 70, I will keep “income low in my early retirement years”, which “will reduce unwanted RMDs” and lower taxes in later years.

For the more conservative, self-managed accounts, FMSDX is one of my largest holdings. I bought FSRRX as a lower-risk hedge against inflation. Over time, I plan to add FADMX. FMSDX is best suited for a Roth IRA or 401k because of its higher returns and lower tax efficiency. FADMX is best suited for a taxable account, traditional IRA, or 401k because of its lower relative returns and moderate tax efficiency. FSRRX is best suited for a Traditional IRA because of its lower returns and low tax efficiency. If higher inflation develops then FSRRX would be suited for a Roth IRA or 401k. Investors with a longer time horizon may want to consider FSDIX.

As for the managed accounts? I once read that one of the primary roles of an investment advisor is to protect us from ourselves. This may mean from being too aggressive, too conservative, or from trading too often. I want a fund manager to do the heavy lifting for me. As Harry Callahan, played by Clint Eastwood, said in Magnum Force, “A man’s gotta know his limitations”.

As for the managed accounts? I once read that one of the primary roles of an investment advisor is to protect us from ourselves. This may mean from being too aggressive, too conservative, or from trading too often. I want a fund manager to do the heavy lifting for me. As Harry Callahan, played by Clint Eastwood, said in Magnum Force, “A man’s gotta know his limitations”.

Best Wishes and Stay Safe!