Dear friends,

Welcome to February. It’s a month frequently associated with the color red – as in Valentine’s Day hearts, chocolate boxes, and scandalous lingerie – but investors have started the year seeing a different kind of red.

Here’s a compendium of every Vanguard index mutual fund (one share class for each) but appearances by a handful of special guests. In one month, investors had YTD returns of …

| Vanguard Index unless otherwise specified | January 2022 | |

| Grayscale Stellar Lumens Trust | Wacky crypto | -60.9% |

| Grayscale Ethereum Trust | Ether | -44.3% |

| De-SPAC ETF | SPAC | -33.0% |

| Breakwave Dry Bulk Shipping | Commodity | -30.5% |

| ARKK Innovation | “Disruptive” stocks | -29.8% |

| Grayscale Bitcoin Trust | Bitcoin | -29.6% |

| Small Cap Growth | Small Growth | -18.42% |

| Extended Market | Mid-Cap Growth | -15.43% |

| Growth | Large Growth | -15.24% |

| Real Estate | Real Estate | -12.28% |

| Mid Cap | Mid-Cap Blend | -12.07% |

| Small Cap | Small Blend | -12.06% |

| FTSE Social Index | Large Blend | -11.45% |

| Total Stock Market | Large Blend | -10.24% |

| Global X Gold Explorers | Precious metals | -9.7% |

| 500 Index | Large Blend | -9.17% |

| FTSE All-World ex-US Small | Foreign Small/Mid Blend | -8.55% |

| Pacific Stock | Diversified Pacific/Asia | -7.44% |

| Small Cap Value | Small Value | -7.39% |

| Developed Markets | Foreign Large Blend | -6.08% |

| European Stock | Europe Stock | -5.63% |

| Total Intl Stock | Foreign Large Blend | -5.13% |

| Long-Term Corporate | Long-Term Bond | -4.97% |

| Long-Term Bond | Long-Term Bond | -4.21% |

| Extended Duration | Long Government | -3.99% |

| Value | Large Value | -3.08% |

| Emerging Markets Gov’t Bond | Emerging Markets Bond | -3.04% |

| Interm-Term Corporate Bond | Corporate Bond | -2.71% |

| Emerging Markets Stock | Diversified EM Stock | -2.43% |

| Intermediate Bond | Intermediate Core | -2.32% |

| Total Bond Market | Intermediate Core | -2.20% |

| Short-Term Corporate Bond | Short Term Bd | -1.26% |

| Short Term Bond | Short Term Bond | -1.07% |

| Total International Bond | World Bond – USD Hedged | -0.94% |

All returns are YTD through 27 January, 2020, per Morningstar.com

That’s not the scariest of the January returns. For those, you need to look at funds and ETFs that have employed leverage: “ultra-bear” and “ultra-bull” funds, some of which have one-month losses of 80-95%. But since you surely didn’t get within a mile of those, we’ll look elsewhere.

What to make of it all? Hmmm …

- You cannot buy past returns, and it’s toxic to try.

The main reason anyone would be interested in those first half dozen funds is that they’ve made crazy money in the past. Breakwave Dry Bulk Shipping made 282% last year, while the Ethereum Trust booked 109%. The Bitcoin Trust returned over 1000% in 2017 and over 100% in two of the past three years. ARKK gained 159% just two short years ago … but the panting crowds who rushed in one year ago are sitting on losses of 43%.

- If you care about how stocks have done in January, you really should not be invested in stocks.

Losing money is not an aberration. It’s a design feature. The only way to earn returns greater than those offered by a risk-free asset is to take risks. In investing, the risk is that the thing you bought with the expectation that it would go up, went down. When we looked at the record of Vanguard’s ten largest equity index funds, we found that they have had a worst-case period in which investors were underwater, on average, for 78 months before their portfolios recovered. Depending on the fund, they fell for between 16 and 30 months before hitting bottom and beginning their rebound. As Devesh points out in his January 21 YouTube video on risk and asset allocation, “If you’re going to be invested, every once in a while you’re going to lose money. That is just part of the investment landscape. The only way to not lose money is never be invested.”

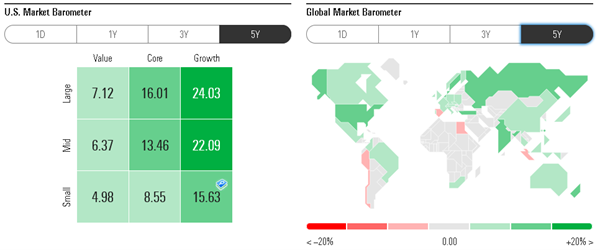

- You need to balance your concern about the past five weeks with the insane gains you’ve been granted over the past five years.

And those returns factor in the losses in January. Even after a wretched month, long-term growth investors have pocketed crazy-good returns, far above the 10% that’s viewed as the US stock market’s long-term average.

And those returns factor in the losses in January. Even after a wretched month, long-term growth investors have pocketed crazy-good returns, far above the 10% that’s viewed as the US stock market’s long-term average.

- Asset allocation matters.

Fidelity’s series of Asset Manager funds are functionally identical, except for the amount of exposure to the stock market that they offer you. In each case, the number in the fund’s name signals the percentage of the portfolio invested in stocks.Let’s look at stock exposure (column 1), short-term and medium-term returns (columns 2, 3, and 4), and medium-term volatility (measured by the five-year record from 2017-2021).

Fidelity Asset Manager YTD return 3-year return 5-year return Max drawdown Standard deviation Bear market deviation 20% -3.0% 6.0% 4.8% -6.2 4.4 2.8 30% -3.9% 7.8% 6.2% -8.3 5.9 3.7 40% -4.8% 9.3% 7.3% -10.2 7.3 4.7 50% -5.6% 10.6% 8.3% -12.2 8.8 5.6 60% -6.4% 11.9% 9.2% -14.2 10.3 6.6 70% -7.2% 13.1% 10.2% -16.2 11.7 7.5 85% -8.4% 14.9% 11.7% -19 13.9 8.9 What do you see? Any equity exposure – even as little as 20% – means that you’re going to see red, at least some red, at least some of the time. As equity exposure rises, so do longer-term returns … and the prospects for striking short-term losses and ongoing volatility.

What should you do about it?

Investing is, by its nature, a long-term activity. So …

Step One: you should review your long-term plans. How much risk are you taking? Is it appropriate to your long-term needs and tolerance? Have you chosen appropriate funds or ETFs to implement the plan? Are you investing steadily? If not, change for the better. If so, proceed to Step Two.

Step Two: get on with life. Disconnect from the noise. Read a book. Apple: A Global History (2011) points out that for most of human history, apples were not eaten, they were consumed as cider, and until the 19th century, all cider was “hard cider.” Buy your beloved some chocolates (sugar-free or not, depending). If you screw that up, you need to sing them a love song. (Just a warning.) Jot down the three things that you’re most grateful for today. (Chip, mostly, but also the fact that we get to bring you three new voices this issue, and the spring semester starts this week, and nearly half of the kids in my Advertising and Consumer Culture course are international students, which should make for really cool discussions). Make a difference in your hometown. (One of my former students is running for Congress. Bless you, Angie, and may god have mercy on your sanity.) Go shovel (or sweep) a neighbor’s walk. Say something nice to the next person you meet. Make a rich soup.

Speaking of new voices!

As part of the plan, other folks have begun stepping up as Snowball was stepping back.

Devesh Shah

Hi, I’m Devesh Shah, and I’m pleased to meet you. As a professional, I was a co-inventor of the CBOE VIX Volatility Index, an equities and derivatives trader, and a Partner at Goldman Sachs.

My passions now mostly involve writing, teaching about investments, practicing yoga, playing the piano, and volunteering with a non-profit, Sponsors for Educational Opportunities (SEO), that opens up career and college pathways for underprivileged students of color. I am an alum of SEO. My hope for the months ahead is to share a few things I have learnt about investing.

Mark Freeland

Hi, I’m Mark Freeland, and if you read the MFO Discussion Board (as you should), you’ll know me as msf. I, too, am a personal investor who learned about investing over time, following the adage that if you want something done right, do it yourself. At least if one can. Mathematical, scientific, software background, so analytics come pretty naturally to me. I fell into a CFO role at a four-person startup a few years ago; I think because I was the only one who could open a spreadsheet. Prior to that, I’d been on employee committees (again in small companies) recommending 401k investment options.

Bill Moore

The Shadow here! Like Mark, I’m a long-time member of the MFO community. I’ve started over 2300 discussion threads, most focusing on developments in the fund industry. I am a personal investor who was introduced to mutual funds when I was young to fund my college education. As I have grown older, I have expanded my mutual fund holdings to a point where I probably have too many; however, this year, they all did extremely well due to the overall performance of the market. I work in the financial industry regulating the consumer finance industry in my state. My hope for the months ahead is that I might share word of developments in the finance industry – the comings and goings, launches and liquidations, the fun and the follies – with you.

Lynn Bolin

As most MFO readers now, I’m Lynn. I’m not really a “new voice” at MFO since I’ve been writing MFO essays that link economic conditions and our changing life needs with portfolio construction since September 2019. I spent several years developing an investment model, and in 2016 sent an article to Seeking Alpha out of curiosity to see if they would be interested in publishing one. A reader later recommended that I should check out MFO, started incorporating MFO Premium data in my articles, and soon became a contributor at MFO. I really enjoy the format of MFO and learn so much on the discussion board. My hope for the months ahead is to retire and spend more time with family. My wife, Anna, has major landscaping plans for me, which I greatly enjoy, along with an occasional barbeque. High on my bucket list is to visit Yellowstone National Park and explore my new retirement home in Colorado. I have been an inactive member of AAII for decades, but greatly enjoyed their investing conferences. I look forward to greater opportunities to expand my investing knowledge. Retiring will give me more time to explore the great tools available at MFO and to participate in the discussion board more actively.

Contributing, though a bit different, is YogiBearBull, who, like Lynn and MFO Premium’s Charles Boccadoro, was an engineer. Yogi has a broad interest in personal finance, maintains his own personal finance site, and frequently publishes cool and thoughtful summaries (most recently of Barron’s Mutual Fund Quarterly) on the discussion board. We’ll share highlights and links each month.

If you like what they wrote this month, write them and say so! If you didn’t quite agree with them, write them and say so! And if you’d like to join your voice to theirs, write Snowball and let him know.

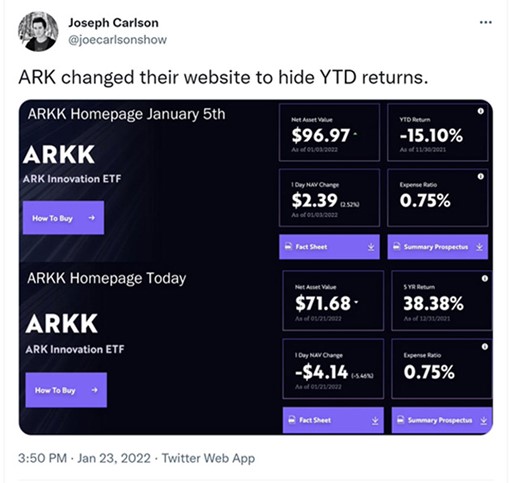

Congratulations to Citywire for some excellent ARKK Snark

CityWire picked up on a tweet by Joseph Carlson, proprietor of the Joe Carlson Show on YouTube, which has 40,000 subscribers. I don’t know Mr. Carlson, but apparently, he argues for investing in high-quality, dividend-paying stocks, which seems entirely sensible. In any case, he spotted a quiet change on the ARKK Innovation homepage. Alex Steger, writing for CityWire, reports:

Yesterday (27 January 2022), Citywire reported that ARK Invest had quietly changed a prominent box at the top of its online fact sheet for its flagship ARK Innovation ETF (ARKK) from showing not-ideal recent returns to highlighting some more flattering five-year numbers.

The change was first highlighted on Sunday by eagle-eyed Twitter user Joseph Carlson.

We checked this out using the good old Wayback Machine, and it stood up.

As of January 18, the page ran YTD numbers to the end of the most recent full month, so showed 2021’s 23.38% loss. But on January 19 (by which point the 2022 YTD figure was -21.90%), the box changed to show the annualized five-year number, which to the end of 2021 was a handy 38.38%. Hmm.

But no sooner had our report landed in our readers’ inboxes than… ARK changed it back again!

Justifiable snarking followed.

Thanks, as ever.

Thanks to our faithful contributors this month: Kathy, the folks at S&F Investment Advisors (serious about the fund profile offer, really), Wilson, Sheila from Edgewood, David, Wayne from Starkville, Sunil from Goleta, and John from Pensacola. And, most especially, to our subscribers: Gregory, William, Brian, David, William, Doug.

If you would like MFO to thrive in the year ahead, please support it … either financially or by reaching out to Devesh, Mark, Lynn, and Bill to let them know that you appreciate their dedication and are interested in their insights. You’d be surprised at how far a little encouragement goes!

On behalf of the folks at MFO,