An entire generation of investors has come of age without needing to learn how to protect portfolios and their wealth from Inflation. The mantra, three or four years ago, was “inflation is dead.” When inflation finally appeared last year, the Federal Reserve Chair declared it to be merely “transitory.” Sticky and low inflation for years has permitted the Fed to keep interest rates at historically low levels – a development which some fear has underwritten federal deficits, emboldened stock speculators, and punished savers. Increasingly, it appears that inflation might be neither dead nor transitory. Which assets could be helpful to an investor who considers the possibility of continued and high inflation a risk?

In the next few pages, I’m going to talk about:

- The role of Asset Allocation and major Asset Classes as it pertains to inflation.

- The unique place held by Treasury Inflation Protected Securities (TIPS)

- Potential risks and rewards in TIPS

- Funds that help investors get exposure to TIPS

- Series I Bonds

Using asset allocation to address inflation

The late David Swensen, manager of the Yale Endowment Fund, wrote his thoughts on investments for the personal investor in the 2005 book, Unconventional Success: A Fundamental Approach to Personal Investment (2005). Asset allocation (rather than stock picking or market timing) is the foundation for successful investing. Each chosen asset in our portfolio must have a policy objective. Assets must either:

- Participate in economic growth and profits

- Protect against financial catastrophe

- Protect against domestic inflation

Here, we are focused on the third policy objective, inflation. To protect investors from domestic inflation, three major asset classes can do the job in varying degrees:

- Domestic Equities (Stocks)

- Domestic Equity Real Estate Investment Trusts (Equity REITS)

- US Government TIPS (TIPS)

Domestic Corporate Equities/US Stocks:

- During periods of actual inflation, corporations attempt to raise prices and revenues. They can accomplish this, but not always immediately, and not always as much as inflation is rising. The linkage of earnings (and stock prices) to inflation exists but is weak. Domestic US Stocks provide a better hedge against domestic inflation over the long term rather than the short-term.

- For example, the 1970s experienced high inflation. From 1974 to 1981, CPI averaged 9.3% annually. In that window, the S&P 500 Index had a price return of only 2.89% per year. However, starting in 1982, stocks took off and more than caught up with inflation.

- If there is real and persistent inflation, domestic stocks might initially struggle. With enough time and patience, Stocks will eventually

Domestic Equity REITs:

- Equity REITs own real estate and lease it to tenants. During periods of inflation, REITs can benefit in 2-3 ways:

- The replacement cost of property rises with the cost of construction and labor.

- Many leases have automatic rent adjustments tied to the CPI.

- REITs may often get a higher long-term rent than otherwise during or just after a period of high inflation.

- Equity REITs have a more direct link to inflation than stocks. In a 2017 University of Pennsylvania paper titled Inflation and Real Estate Investments, the authors write:

The period 1974-1981 was the most inflationary eight years in the history of the Consumer Price Index at 9.3% per year, but equity REIT returns easily preserved purchasing power, with income and total returns averaging 10.2% and 16.3% per year.

- Equity REITs are better known and more owned since the 1970s. With popularity comes more volatility. For example, when Covid-19 hit the markets, the Vanguard Equity REITs fund declined by 42% in one month and took one year to get back to its pre-Covid price. Equity REITs will likely be ok if there is real inflation, but one must be prepared for volatility.

Treasury Inflation Protected US Government Securities – TIPS

- TIPS are bonds issued by the US Treasury. They are the only financial instrument directly linked to changes in the Urban Consumer Price Index (CPI-U). The principal of a TIPS Bond formulaically appreciates with inflation. There is also a fixed coupon paid, but it is close to zero these days. TIPS extend out to 30 years and are issued in the 5-, 10-, and 30-year maturity.

- These are some TIPS prices from the WSJ as of Jan 21, 2022:

| MATURITY | ~ Years to Maturity | COUPON | BID | ASKED | YIELD* |

| 2027 Jan 15 | 5 | 0.375 | 107.2 | 107.24 | -1.13 |

| 2031 Jul 15 | 9.5 | 0.125 | 107.27 | 108 | -0.69 |

| 2051 Feb 15 | 29 | 0.125 | 106.12 | 106.27 | -0.11 |

-

- The current prices of the TIPS are such that the real yield of each of the TIPS bonds is negative.

- A negative yield means that investors are paying the US Government an interest rather than receiving one. Why do investors buy bonds with a negative yield?

- Investors must want direct exposure to increasing CPI, and TIPS is the only major asset class with that direct link. Generally, TIPS thrives in unexpectedly high inflation, while Fixed coupon US Government bonds decline.

- The iShares 20+ Year Treasury Bond ETF (TLT), which holds fixed coupon bonds, had a total return of -4.6% for the year 2021.

- On the other hand, the iShares TIPS Bond ETF (TIP), which holds inflation-linked bonds, had a total return of +5.6% for the year. Despite buying bonds with a negative yield, investors who held TIPS still came out ahead because of the 7% CPI observed last year. For bonds, that’s a good return.

What are the potential rewards and risks for investing in TIPS going forth?

Just like in 2021, future gains in TIPS are likely to come from high levels of CPI, which will increase the Principal value of the bond.

What might future inflation look like?

The bond market’s best expectation, and the one the Federal Reserve loves to watch, is a metric called the 5-Year, 5-Year Forward inflation expectation, which currently stands at 2.12% inflation per year. That’s a lot lower than the 7% CPI of last year and lower than where many think inflation is headed. Let us look at some historical windows:

| Period | 2000-2020 | 1983-2000 | 1972-1983 |

| Average Annual CPI | 2.17% | 3.27% | 8.22% |

| Scenario | “Mild” | “Warm” | “Hot” |

Many think that inflation will come in “under Hot” for 2022 and then simmer down to “Warm” after that. Because inflation is a complex economic phenomenon, and few current market participants have lived through the high inflation of the 1970s, predictions don’t mean much.

The reason to have a core asset allocation to TIPS is to protect against unexpected future inflation. Even if the CPI settles down in the Warm zone, it’s likely an investor will come out ahead in TIPS.

What are the risks involved in investing in TIPS?

- If future inflation strangely dips and comes in “Mild,” given the negative yields in TIPS, the investment might scratch or make 1% per year. In that case, 2021 might look like a one-off event.

- The Federal Reserve has signaled an end to its bond-buying program (called “quantitative easing”) and hiking interest rates, with the direct goal to beat inflation. Traditionally, when the Fed hikes rates, real yields on TIPS rise. The magnitude of the bond selloff depends on their Duration. Usually, the 30-year TIPS real yields go up somewhere between .60 and .75 percent during the cycle. The PIMCO Long Dated TIPS (LTPZ) fell 23% in 2013 during the first Taper, fell 16% in 2016 during the interest rate hikes, and another 15% in 2018 as the rate hikes continued. However, short-dated TIPS, for example, iShares 0-5 Year TIPS Bond ETF (STIP), with less bond duration, hold up better during tightening cycles.

- One of the biggest buyers of TIPS has been the Federal Reserve itself, owning 28% of all outstanding TIPS bonds because of conducting QE. As QE turns to QT, they will buy less and might even reduce their balance sheet, bringing selling pressure on TIPS. The market’s interest in an Asset class wanes when the price returns decline. There could be additional investor outflow from TIPS as an asset class.

With potential negative flows and Fed tightening, TIPS could go through a price selloff. They have already started 2022 on a negative note. However, if inflation continues to come in Warm or Hot, it will be hard to hold TIPS down. The sweet spot might be to be positioned in lower duration TIPS where the flows and the Fed will hurt less while still accruing the benefit if inflation continues to come in Hot.

Gaining TIPS exposure through funds and ETFs

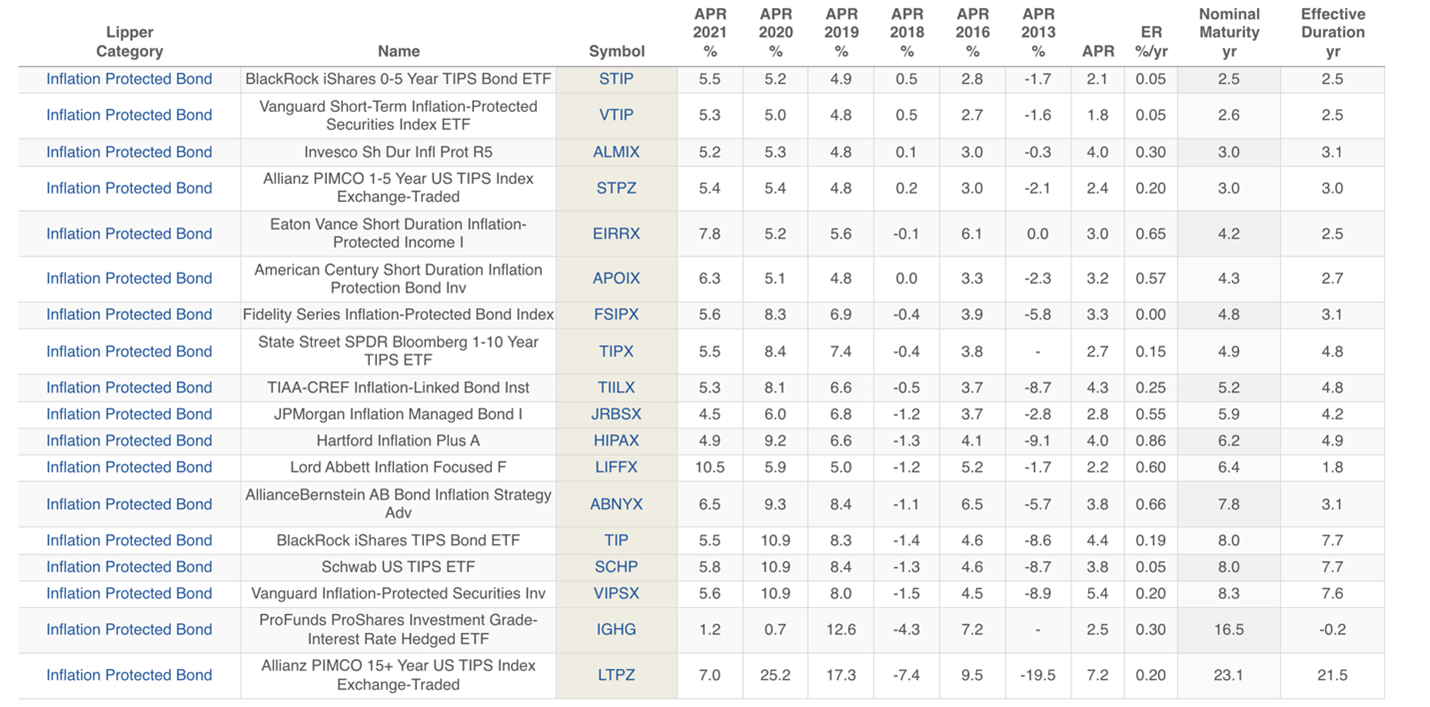

Using the MFO Premium Search engine, I searched for funds with the following parameters:

Objective: Inflation Protected Bond

AUM: Minimum $500mm

Bond Duration: 5 years or less

To compare, I also kept in some benchmark TIPS ETFs and mutual funds:

iShares TIPS Bond ETF (TIP)

Schwab US TIPS ETF (SCHP)

Vanguard Inflation-Protected Securities (VIPSX)

PIMCO 15+ Year US TIPS Index ETF (LTPZ)

STIP, VTIP, ALMIX, STPZ show us as funds with a low nominal maturity and low effective duration. In years the longer-dated TIPS were hurt, these shorter-dated funds were slightly down to even mildly up. The shorter-dated TIPS feels like a safer sleeve that might still meet the policy objective of inflation protection.

One should note that when the principal of the TIPS increases with CPI, this increase is taxable in the current year, even though we do not receive the CPI-adjusted principal back until maturity. TIPS may be inflation-friendly, but they are not tax-friendly. Therefore, Tax-Deferred Accounts might be a better place to house TIPS for most investors.

Wouldn’t we earn more income in some managed bond fund that takes credit risk, high yield bond risk, bank loans, etc? Why bother with TIPS at all? In response, I remind myself that part of an asset’s job is to help protect the portfolio during a financial catastrophe. In every distressed selloff, most of these said credit bond funds suffered a substantial drawdown. Credit funds tend to behave like a mini version of equities. By contrast, US Government Bonds are the only bonds that will retain their buying power. This flexibility allows us to rebalance and buy risky assets (stocks).

Series I Bonds: The small investor’s friend

We share enthusiasm for Mr. Zweig’s favorite secret investment

The best friend of the US Saver has been the Series I Savings Bonds. These can only be bought by US resident investors in sizes of up to $10,000 per year through Treasury Direct (and an additional $5,000 when funded through tax refunds). Series I have gone from relative obscurity to the bond investment du jour with billions invested in the last few months. This interest in Series I has been due to a tactical and a strategic reason. Tactically, the interest received on Series I is backward-looking. The large CPI number will guarantee an almost 7% six-month coupon of that amount from April to October of 2022. Strategically, these bonds have no duration risk. Their price can never go down, and one can choose to pay no taxes until maturity. On the other hand, they must be held for at least a full year, and liquidating before five years incurs a three-month interest penalty. Series I seem like excellent to hold for 2022. $10,000 of investment is a sweet deal, but those with a larger investment capital pool must dig deeper and wider than the Series I Bond.

Learning more …

Those truly interested in understanding the detailed mechanics of inflation and TIPS may watch the following videos I prepared in late 2020 for a YouTube channel I run: Devesh Shah’s Understanding Personal Investments.

- Inflation and the Difference between Nominal and Real Returns: Video 31

- US Government Inflation Linked Bonds An Overview: Video 37

- US Government TIPS Technical Details: Video 38

- US Government Savings Bonds An Exceptional Deal for the Small Saver: Video 39