“But I don’t want to go among mad people,” Alice remarked.

“Oh, you can’t help that,” said the Cat: “we’re all mad here. I’m mad. You’re mad.”

“How do you know I’m mad?” said Alice.

“You must be,” said the Cat, “or you wouldn’t have come here.”

– Alice in Wonderland, Lewis Carroll

At the time of this writing, the S&P 500 has fallen 7.8% year to date. Some respectful sources point to retail (small) investors panicking. Alice, the Mad Hatter, and I are not so sure. There are those who believe they can time the markets and are trying to jump ahead of the falling market before the rest of the crowd. Then some investors have the financial acumen to make quick, intelligent decisions. Should you sit back and ignore the volatility, buy the dip or sell the news? The Talking Heads know and will sell you the news or service. For many of us, panic is a realistic option. How do we fight this natural tendency which honed the survival skills of our ancient ancestors?

This article covers the following sections, and readers may skip to the sections of interest.

-

- Analysis Paralysis

- Talking Heads

- Investment Environment

- Storyline

- Investment Strategy

- Model Portfolios

1. Analysis Paralysis

-

- Analysis paralysis occurs when over-analysis or overthinking of alternatives prevents an individual or a group from making a decision.

- In investing, analysis paralysis can lead to missed opportunities.

- Psychologists say the root cause of analysis paralysis is anxiety. We fear choosing the wrong option.

- Decision-making, both trivial and life-changing, can be improved by resisting analysis paralysis.

- One tactic: “Stair-step” your decisions, taking a series of small steps towards a big decision.

– Analysis Paralysis, Investopedia

Most of us succumb to analysis paralysis at some point while investing. Small investors are generally poor market timers, and Vanguard’s philosophy is that many investors should use low-cost index funds and stick to set allocation, which decreases as we age. I lean more toward Fidelity’s philosophy of investing according to the business cycle. Traveling through empty airports after COVID struck, without standing in lines, and with most shops closed was surreal, and I had some analysis paralysis. Some of my family got COVID while I was out of the country, and I was unable to travel to see them.

The way that I reduce my analysis paralysis is to have a financial plan, follow the bucket approach with three years of living expenses in safe short-term investments, have an investment strategy, simplify investments, and study the markets. I also like the final point in the quote above to make changes in small steps. My view of the investment environment does not change much month to month, and neither should my investments.

2. Talking Heads

As I’m now in my fourth decade of memo writing, I’m sometimes tempted to conclude I should quit, because I’ve covered all the relevant topics. Then a new idea for a memo pops up, delivering a pleasant surprise.

– Latest Memo From Howard Marks: Selling Out, Oakmark Capital

I used the term “Talking Heads” figuratively to represent all financial news sources that tend to be more focused on selling the news than educating the investor. I have learned so much from credible books such as Mastering the Market Cycle by Howard Marks. I am leery of sources that have explanations of daily movements in the stock markets or proclaim future directions with extreme confidence. Unreliable sources can lead to analysis paralysis and anxiety. As I near retirement and have focused on simplifying my investment strategy, I trimmed down the number of news sources that I review to the more reliable.

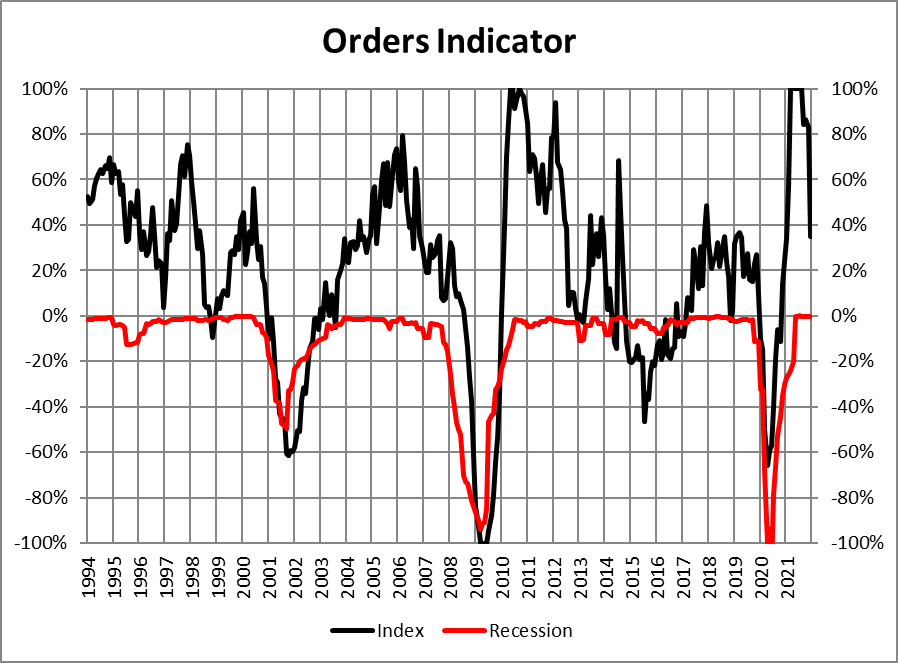

One of the reasons that I developed the Investment Model was to view the data myself because many of the relationships between indicators and markets are exaggerated by the Talking Heads. Below I show my Orders Indicator, which is a composite of durable goods orders (DGORDER, ADXDNO) and non-defensive capital goods orders (NEWORDER, ANDENO). Orders precede purchases and are a leading indicator of the economy. Orders show the economy is growing but at a slower pace. They are currently suggesting a major slowing of the economy.

Figure #1: Leading Indicator – New Orders

3. Investment Environment

I wrote a primer on Business Cycle Portfolio Strategy in the December 2019 Mutual Fund Observer newsletter. I am no Benjamin Graham, and while I like his guideline of never investing less than 25% in stock nor more than 75%, as I near retirement, I adjusted the parameters in the Investment Model to a minimum allocation to stocks of 35% and a maximum of 65%.

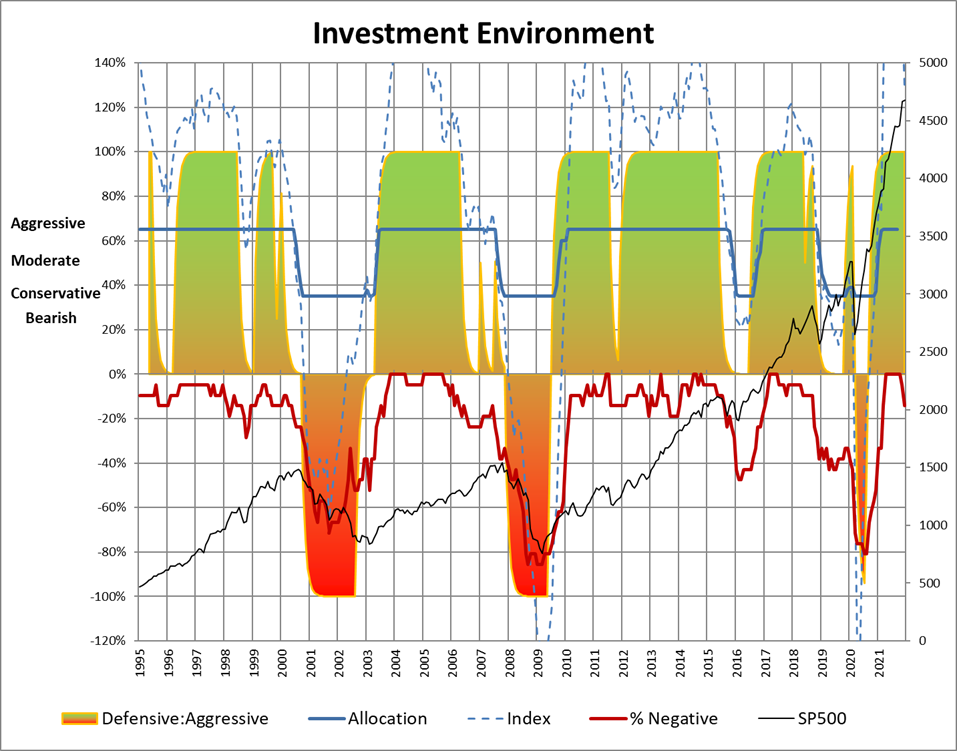

I discovered the St. Louis Federal Reserve FRED database around 2010 and began building investment models such as the current model shown in Figure #2. The model is based on 32 composite indicators of which the two most negative are inflation and valuations but also productivity, investment, and housing. The S&P 500 has delivered 11% returns for the past 27 years with three major bear markets. Investing according to the Investment Model would have delivered 9.3% annualized returns with lower risk (drawdowns) than the S&P500. Much of the gains in the S&P500 are due to quantitative easing artificially increasing asset prices.

In Figure #2, the dashed blue line is the Investment Environment (IE) which is the basis of the Allocation Index before a 35% and 65% cap is applied. The Allocation Index (blue) is now at 65% stocks, recommending being at the more aggressive end of my allocation range. The red line is the percent of negative indicators and shows the breadth of the slowdown. It is clear that the IE index is falling rapidly, indicating a deterioration of the investment environment. For this reason, I believe that it is prudent to continue (gradually) to reduce risk in portfolios as we near the late stage of the business cycle.

Figure #2: Investment Model

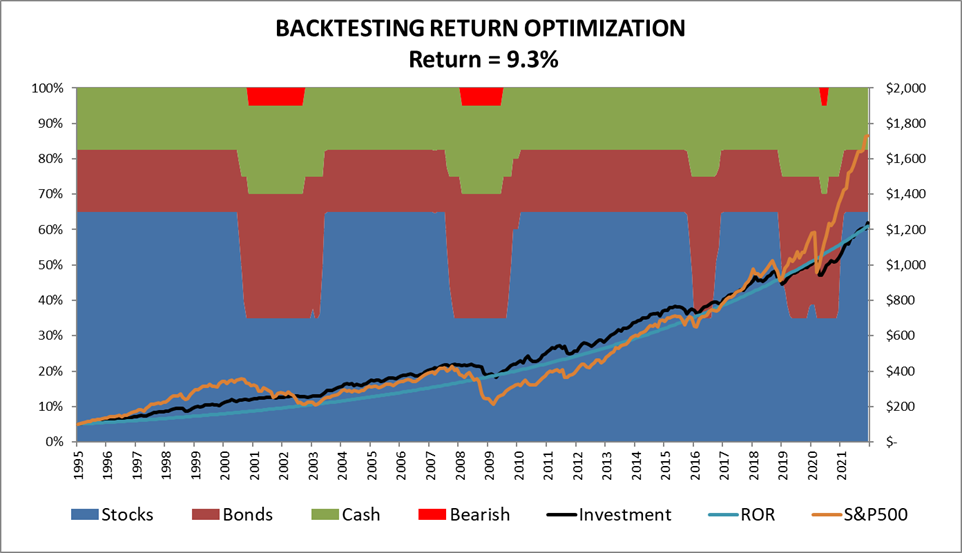

Figure #3 shows the changes in allocation in the Investment Model.

Figure #3: Investment Model Allocations

Excellent books on investment models and business cycles are Nowcasting the Business Cycle by James Picerno, Conquering the Divide by Cornehlsen and Carr, Investing with the Trend by Gregory L. Morris, Ahead of the Curve by Joseph H. Ellis, Probable Outcomes by Ed Easterling, The Era of Uncertainty by Francois Trahan and Katerine Krantz, The Research Driven Investor by Timothy Hayes, and Beating the Market 3 Months at a Time by Gerald Appel and Marvin Appel.

4. Storyline

Fisher is correct that rates may not impact the financial markets in the short term. However, most of the gains got forfeited in every instance as interest rates slowed economic growth, reduced earnings, or created some crisis… Most importantly, a much higher degree of reversion occurs when the Fed tightens monetary policy during elevated valuations.

– Don’t Fight The Fed, Lance Roberts

I started building the Investment Model when I discovered the St. Louis Federal Reserve Database (FRED). The Investment Model is intended to have a six-month forward look at general market conditions. It does not understand COVID, nor the tensions with Russia over Ukraine, nor the crackdown in China. However, it does show established relationships between data and the Investment Environment. My ranking system for funds is developed using data from the Mutual Observer Premium Service Multi-Screen. It has more granularity than the Investment Model and is good for confirming trends. I extract data on two hundred quality funds and rank them based on total return trends and fund flows.

One factor that I include in my storyline is the high price of the dollar relative to other currencies, as well as high domestic valuations relative to international markets. As the Dollar Currency Index from CNBC shows, the dollar is at some of the highest levels in the past forty years. The 1980s saw the breaking of inflation, and the late 1990s experienced the technology bubble. I expect the dollar to weaken at some point in the next few years. High debt and deficits are another concern. International funds tend to outperform when the dollar weakens.

Figure 4: Dollar Currency Index

Based on the Investment Model, Ranking System, and my investment sources, I develop a storyline to guide investments. This storyline is reviewed monthly. My storyline for 2022 is:

-

- Fear of Fed Tapering will increase volatility. I include defensive but not bearish funds. I exchanged the Fidelity Select Med Technology & Devices (FSMEX) fund because of its high volatility in the Fidelity Model Portfolio for the Fidelity Multi-Asset Income Fund (FMSDX).

- Inflation will compress high valuations. The economy will continue to grow at a slower rate in 2022. I have included commodity and real return funds and tilt toward value.

- Inflation will moderate the economy when rates start to rise, further increasing volatility. I own consumer staples and utility funds which tend to do well during the late stage of the business cycle.

- Concentrated market capitalization in a handful of technology stocks increases risk. I have tilted portfolios away from technology.

- High valuations relative to international and monetary policy favor international stocks. I tilt toward global developed economies.

- Interest rates will rise, but the impact will be muted initially because it is coming off a low base.

- Emerging markets funds may suffer as rates rise. Smaller caps may outperform. I exchanged a modest amount of American New World (NWFFX).

- I expect the current dip/correction to be short-lived, and the market will recover. I will use market fluctuations to adjust portfolios but not try to time the markets.

5. Investment Strategy

The long, long bull market since 2009 has finally matured into a fully-fledged epic bubble. Featuring extreme overvaluation, explosive price increases, frenzied issuance, and hysterically speculative investor behavior, I believe this event will be recorded as one of the great bubbles of financial history, right along with the South Sea bubble, 1929, and 2000…

But this bubble will burst in due time, no matter how hard the Fed tries to support it, with consequent damaging effects on the economy and on portfolios. Make no mistake – for the majority of investors today, this could very well be the most important event of your investing lives.

– Waiting For The Last Dance, Jeremy Grantham

There are some experienced and successful investors, such as Jeremy Grantham, quoted above, that provide an important perspective to individual investors. While the economy may continue to grow, valuations will compress, and returns will be lower over then few years or decades.

My neutral allocation is 50% to stocks tilted to 65% during the recovery stage of the business cycle and to 35% in the Late Stage as a recession seems more probable. We are in the middle stage of the business cycle, and I have shifted investments to those that do well in the late stage of the business cycle. Most of the funds that I hold are core funds where allocations may tilt slightly, but I reserve approximately 20% to be in a tactical sleeve to adjust according to the business cycle.

6. Model Portfolios

I have built two model portfolios using the Morningstar Portfolio Tool, including dividends, based on my latest articles in Mutual Fund Observer. The two models are intended to be moderately conservative portfolios in Traditional IRAs. The funds and allocations are shown along with one-month, three-month, and year-to-date returns. I like to look at the performance of funds during dips to gain a glimmer of how they might perform during a major correction. The S&P500 (SPY) is shown as a baseline fund. While the S&P 500 fell 7.79% at the time of this writing, the Vanguard model fell only 1.2%. I am especially pleased with the Vanguard Global versions of the Wellington and Wellesley Funds. The domestic Wellington fund may be the riskiest fund in the portfolio. The Commodity Fund did great, but performance is likely to fall as supply chains reopen.

Table #1: Vanguard Model Portfolio for Traditional IRAs

There are two ways that I may tilt the Vanguard Model Portfolio to be more conservative: 1) exchange funds in the tactical sleeve (VDC, VPU, VCMDX) for cash or bonds, and 2) exchange the more aggressive VGWAX for the more conservative VWIAX. COTZX changes allocations based on cyclically adjusted price-to-earnings ratios and plays a large part in automatically adjusting allocations to the business cycle. I see no reason to change the portfolio at this time. Commodities are a hedge against inflation, and COTZX is a hedge against a major market correction.

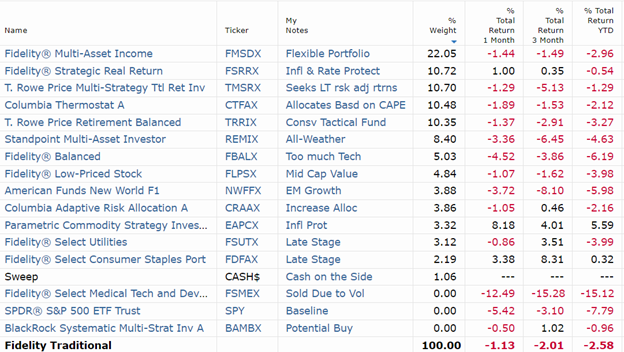

The Fidelity Model Portfolio is also intended to be a moderately conservative portfolio suitable for a traditional IRA. It lost 2.58% year to date compared to 7.79% for the S&P 500 or 33% of the S&P 500 decline. I sold FSMEX early in the market decline because of the high volatility. I also decreased allocations to the emerging market fund, NWFFX, by a small amount.

I selected the funds in the Fidelity Model Portfolio for several reasons, including low correlation to the S&P500, long-term risk-adjusted returns, tactical approach, and stage of the business cycle. I will be monitoring them over the rest of the year. Some will bob while others are weaving.

FBALX is a potential candidate to reduce because of its high allocation to technology. Funds that I may increase allocations to are Consumer Staples (FDFAX) and Columbia Adaptive Risk (CRAAX). The Blackrock Systematic Multi-Strategy Fund (BAMBX) is not part of the portfolio but one that I am considering adding. Its short-term performance has been good.

Table #2: Fidelity Model Portfolio for Traditional IRAs

I plan on creating more model portfolios as I retire later this year.

Closing

Far more money has been lost by investors preparing for corrections, or trying to anticipate corrections, than has been lost in corrections themselves.

– Peter Lynch

I don’t disagree with Mr. Lynch, but as I said at the start of this article, there are those that try to time the markets and others such as Benjamin Graham and Howard Marks that successfully adjust risk according to the business cycle and/or valuations. Capital preservation should be an important part of investment strategies as we move toward the normalization of quantitative easing and rates, a maturing business cycle, and extreme valuations.

Writing this article helps me analyze how I invest and where I need to adjust going forward. Each month, I look forward to the “dropping” of the Lipper global data through MFO screens and adjusting my rating system to evaluate the changing trends.