I am now in my fourth week of retirement. This article is the third of a three-part series describing my experiences as I retire. It builds upon “Certainty of Death and Taxes,” where I describe how taxes, social security, and Medicare may impact retirement financial plans. The topics covered in this article are:

- Investment Environment: A recession is becoming more likely in 2023

- Sequence of Return Risk: How a recession early in retirement can damage retirement plans

- Tax Efficiency: Optimizing lifetime after-tax retirement income

- Withdrawal Strategy: Using a basket of accounts to reduce taxes

- Investment Strategy: The extended Bucket Strategy

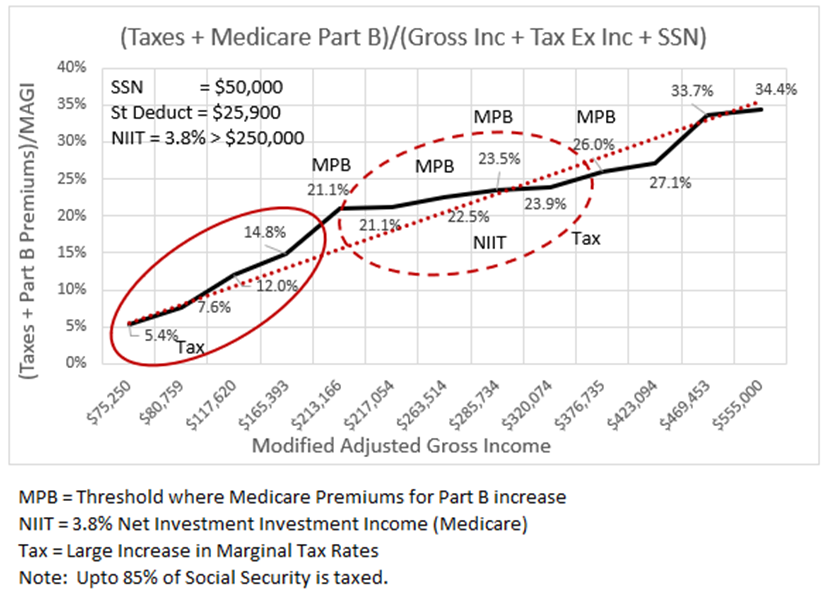

I used the tax and Medicare thresholds and rates from “Certainty of Death and Taxes” to build Figure #1, which is the percent of Modified Adjusted Gross Income (MAGI) that a married couple filing jointly will pay for Federal Taxes and income-adjusted Medicare premiums assuming that they receive $50,000 in Social Security benefits annually and all income is taxed at the ordinary income rate. Optimizing after-tax retirement benefits means shifting income along the curve by deferring or accelerating income or using sources of income that are not included in MAGI, such as withdrawals from Roth IRAs. Income from tax-efficient after-tax accounts has lower tax rates than capital gains and may shift the curve downward.

Figure #1: Federal Tax and Medicare Part B Income Adjusted Premiums

Figure #1 represents a worst-case scenario for a retiree who is faced with a range of options, all involving ordinary income, including social security, pensions, some annuities, RMDs, and Roth Conversions. The ideal range to be in is the income range covered by the solid red ellipsoid, which is highly efficient with an effective tax (Federal taxes combined with Medicare Premiums) rate of 5 to 15% for up to $165,393 in MAGI. Although less tax-efficient, the red ellipsoid with a dashed line where the MAGI in the income range from about $215,000 up to $320,000 has an effective tax/premium rate of 21% to 24%. Both ranges defined by the two ellipses may be valid for an investor looking at short- and long-term goals which may be impacted by Roth Conversions and deferring Social Security. Roth Conversions may temporarily shift a retiree into the higher MAGI range but reduce RMDs in the longer term to shifting the retiree into the lower MAGI range.

The following quote from Fidelity highlights the importance of this article.

Some investors spend untold hours researching stocks, bonds, and mutual funds with good return prospects. They read articles, watch investment shows, and ask friends for help and advice. But many of these investors could be overlooking another way to potentially add to their returns: tax efficiency. (“How To Invest Tax-Efficiently”, Fidelity Viewpoints, 01/13/2022)

Christine Benz from Morningstar lays out a good foundation for this article in “An Investing Road Map for Retirees.” Another good starting point is “14 Reasons You Might Go Broke in Retirement” by Bob Niedt at Kiplinger. The articles are worth reading for anyone at any age who wants to be prepared for retirement.

First Month of Retirement

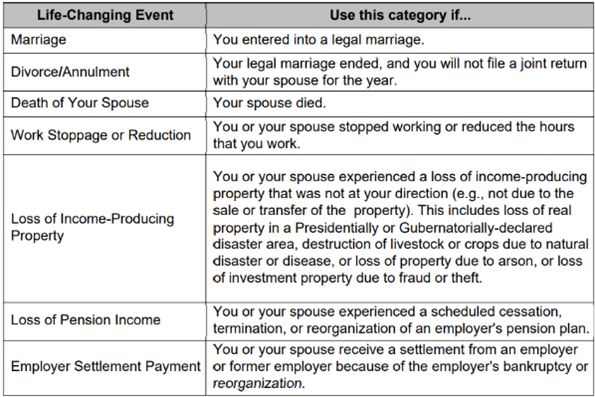

As described in my article, “Certainty of Death and Taxes”, in the July MFO newsletter, Medicare costs go up for high-income earners, which is based on their income from two years prior. This impacts most people who have just retired, and their income is much lower now than two years ago. A trip to the Social Security Office was beneficial, and I was told to fill out form SSA – 44, which adjusts premiums for life-changing events like retirement. The form is available online at www.ssa.gov and explains life-changing events as:

Table #1: Life-Changing Events that may lower Medicare Part B Premiums When Retiring

To fill out the form, I compiled or estimated my Modified Adjusted Gross Income (MAGI) for 2020 through 2023 to show my income levels when working, during the year of retirement with some work income and pensions, and at full retirement with pensions and no employment income. I also used this information to look at how these changes impact taxes and Medicare Premiums along the curve in Figure #1. It is useful in developing a strategy to determine how much of a Traditional IRA can be converted to a Roth IRA.

Investment Environment – Short and Long Term

The US real GDP just came in with a 0.9% decline for the second quarter, which is close to the 1.2% decline estimated by the Atlanta Fed’s GDPNow. Kudos to the Atlanta Fed. However, Real GDP grew by +1.6% year over year, which is slow but not alarming. Growth is peaking. Simon Kennedy wrote “Threat of US Recession Mounts,” in which he says Bloomberg Economics estimates that there is a 38% chance of a recession during the next year based partly on corporate profit outlook, consumer sentiment, financial conditions, and rising rates. In Vanguard’s “Economic and Market Outlook”, they place the probability of recession in the United States at 25% in the next twelve months and 65% over the next two years.

Fidelity Institutional, in their “Third Quarter Market Update,” places the US economy in the late stage of the business cycle with a “rising but moderate near-term recession risk.” Another point of view that resonates with me is the Fidelity Institutional Insights which describes the long-term capital markets over the next twenty years, in which I added the explanations in brackets.

Given slower economic growth [due to demographic trends], high asset valuations [particularly in the U.S.], and low starting bond yields [which are rising], we expect asset returns over the next 20 years to be significantly lower than long-term averages. (“Capital Market Assumptions: A Comprehensive Global Approach for the Next 20 Years”, Fidelity, 09/07/2021)

Inflation, as measured by one of the Fed’s favorite metrics, personal consumption expenditures, just rose to 6.8%. Employment costs are rising but not keeping up with inflation. Supply chain disruptions, the Russian Invasion of Ukraine, and years of underinvestment in commodities contributed to high commodity prices. The Federal Reserve aggressively raising interest rates and the dollar as a “safe haven” contributed to a stronger dollar lowering the cost of imports. Heather Burke describes it well in her article on Bloomberg, “Five Things You Need to Know to Start Your Day”:

The dollar capped off its vertiginous rise over this past year by rallying 1% last week. This creates problems for the rest of the world as most global trade is denominated in dollars. The flip side of a strong dollar is weaker currencies in other countries. That, combined with the strength of the US consumer after the pandemic and global supply shortages, means the US is exporting inflation to the rest of the world…

…a stronger dollar tends to cause the rest of the world pain by tightening global financial conditions and hitting global trade (imports into the US get cheaper, yes, but the drag from a stronger dollar on global financial conditions tends to outweigh any benefit other countries get from exports). (Heather Burke, “Five Things You Need to Know to Start Your Day”, Bloomberg, 07/18/2022)

Each Saturday morning, I read Doug Noland’s Weekly Commentary on Seeking Alpha which this week is titled “Nowhere To Hide.” Mr. Noland highlights the rising global risks, but I found this viewpoint supportive of my own:

And while commodity prices have retreated over recent weeks, we believe the new cycle will be an era of hard asset outperformance versus financial assets. …

And let me summarize some key aspects of the new cycle that will profoundly impact the markets. Consumer prices will have a stronger and sustained inflationary bias. Central banks will be forced back to a traditional inflation focus rather than the experimental market-centric approach of the past cycle. Policy rates will be higher, and QE will be relegated to a crisis-fighting tool. Financial conditions will be significantly tighter on a more sustained basis. (Doug Noland, “Weekly Commentary: Nowhere To Hide”, Seeking Alpha, 07/23/2022)

Sequence of Return Risk

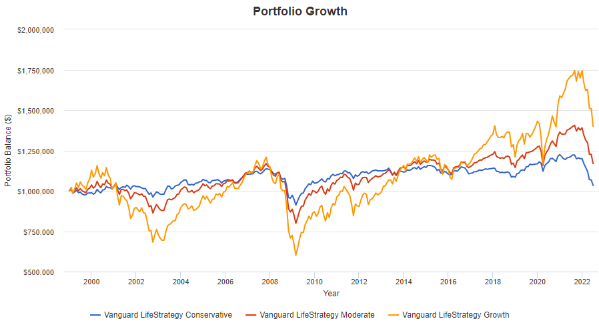

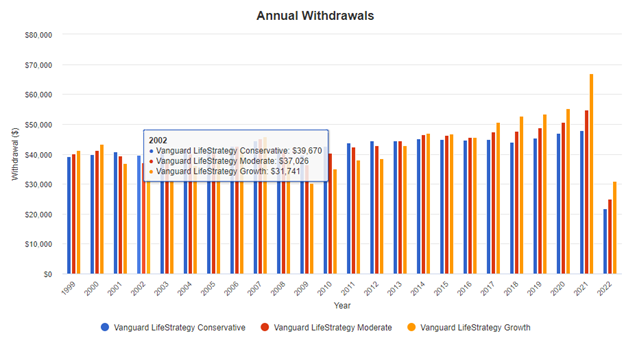

Major bear markets have a larger impact on someone entering retirement than if the recession occurs later during retirement in what is known as the “Sequence of Return Risk.” To illustrate this, I use Portfolio Visualizer Backtest Portfolio Asset Allocation assuming a four percent withdrawal rate for three Vanguard funds for two nineteen-year periods, with one starting prior to the bursting of the Tech Bubble in 1999 and the other starting after the bursting in 2003. The Vanguard LifeStrategy Conservative fund was impacted less for both ending balance and lifetime income. There was a much more dramatic impact on the Vanguard LifeStrategy Growth fund, where lifetime income fell from $805,727 to $480,996 for the person who retired before the recession compared to afterwards. I am attempting to balance higher income in more conservative portfolios and higher balance in more aggressive portfolios.

Table #2: Sequence of Risk Return Example

| Nineteen Year Period | 1999 – 2017 | 2003 – 2021 | ||

| Fund | Balance | Income | Balance | Income |

| Vanguard LifeStrategy Conservative | $1,140,110 | $762,891 | $1,214,396 | $720,348 |

| Vanguard LifeStrategy Moderate | $1,226,979 | $686,397 | $1,548,884 | $775,513 |

| Vanguard LifeStrategy Growth | $1,351,234 | $480,996 | $2,403,061 | $805,727 |

Source: Created by the Author Using Portfolio Visualizer Asset Allocation

Figure #2 shows the impact of drawdowns on remaining balances, and Figure #3 shows the impact on income at the bottom of the bear market. Note that income for the Growth fund in the worst year is 20% lower than the Conservative fund.

Figure #2A: Sequence of Return Risk Impact of Drawdowns on Remaining Balances

Source: Created by the Author Using Portfolio Visualizer Asset Allocation

Figure #2B: Sequence of Return Risk Impact of Drawdowns on Income

Source: Created by the Author Using Portfolio Visualizer Asset Allocation

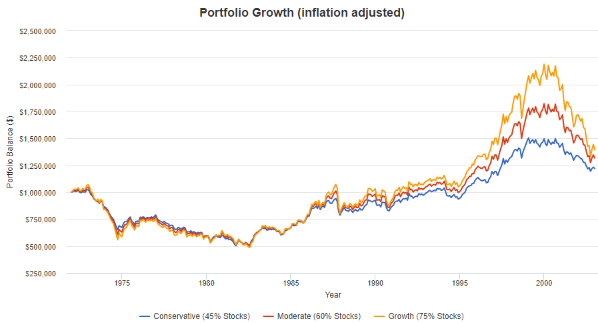

To illustrate the differences in inflationary time periods, I again use Portfolio Visualizer but with Backtest Portfolio Asset Class Allocation in order to show the impact of starting retirement prior to a bear market during the stagflationary 1970s with slower growth and higher inflation. The inflation-adjusted balances fell in half over the next two decades regardless of the investment style. “Stagflation” is a period of high inflation and relatively high unemployment. Currently, we are not in a traditional stagflationary period, because of the tight labor market.

Figure #2C: Sequence of Return Risk Impact During the 1970s’ Stagflation Period

Source: Created by the Author Using Backtest Portfolio Asset Class Allocation

Christine Benz from Morningstar wrote “Does the 4% Guideline Rest on a Flawed Assumption?” which describes that many retirees tend to spend more during their early years of retirement and less in the latter years. Ms. Benz points out, as well as Fidelity did earlier in this article, that returns over the few decades are probably going to be lower than historical averages:

The reasoning is straightforward. The Morningstar Investment Management team expects stock and especially bond returns to be fairly modest over the next 30 years–a typical planning horizon for retirement–and they think the next 10 could be particularly weak. Given those low return inputs, our research concluded that new retirees would do well to start conservatively on the spending front. (Christine Benz, “Does the 4% Guideline Rest on a Flawed Assumption?”, Morningstar, 12/10/2021)

Ms. Benz adds that spending needs are variable based upon life events, capital expenditures, and health care costs, among others. The founder of the 4% Guideline, Bill Bengen, said that the “sequence of inflation” risk is similar to the “sequence of return risk”.

If inflation hits early in retirement, he [Bill Bengen] argues, that inflates all subsequent withdrawals. If a retiree is embarking on retirement in what appears to be a period of elevated inflation, that argues for taking a conservative tack on starting withdrawals.

Tax Efficiency

The base case was presented in Figure #1. There are a variety of ways to improve upon the base case, such as:

- Deferring Social Security Benefits until age 70 reduces income in the short-term

- Using capital gains from an after-tax account at a lower tax rate

- Converting Traditional IRAs to a Roth to reduce RMDs in the future

- Rolling a pension into an IRA as a lump sum to reduce income until age 72.

- Withdrawing after-tax contributions from a Roth to avoid higher marginal tax rates.

- Making charitable donations to avoid a higher marginal tax rate.

- Reducing withdrawals from Traditional IRAs to the minimum RMD.

- Using a deferred annuity to reduce income until needed.

The American Association of Individual Investors (AAII) has a comprehensive “Guide to Personal Tax Planning” if you are a member. They point out when a taxpayer may be subject to the Alternative Minimum Tax (AMT), which for married couples filing joint returns in 2021 was 26% of the first $199,900 of alternative minimum taxable income in excess of the exemption amount, plus 28% of any additional alternative minimum taxable income. Reasons that people may fall under the AMT include:

- You have large itemized deductions for state and local taxes, including property and state income tax, or from state sales tax;

- You have exercised incentive stock options;

- You have significant deductions for accelerated depreciation;

- You have large miscellaneous itemized deductions or a large deduction for unreimbursed employee business expenses;

- You have a large capital gain.

(AAII Staff, The Individual Investor’s Guide to Personal Tax Planning 2021, AAII, December 2021)

Many taxable bonds are tax-inefficient because distributions are taxed as ordinary income, and money not needed in the near term is well suited for tax-deferred accounts such as Traditional IRAs. Stocks that are more volatile and have higher returns over the long term are well suited in Roth IRAs where taxes have already been paid.

Taxable accounts have benefits for meeting multiple goals. Christine Benz from Morningstar provides six reasons for having a taxable account in addition to tax-advantaged accounts, which I summarize:

- Flexibility to have access to your money without having to pay taxes on the principle. This adds the flexibility of changing the mix of withdrawals in the future when tax rates change.

- Tax efficient index funds to benefit from capital gains and tax-free municipal bonds and funds.

- Tax loss harvesting to offset capital gains and possibly ordinary income.

- Withdrawals of principal with no and capital gains with low taxes.

- More control over taxes in retirement. There are no RMDs.

- Favorable tax treatment for heirs where capital gains taxes are based on the price when they inherited the assets from you.

(Christine Benz, “6 Reasons a Taxable Account Should Be Part of Your Retirement Portfolio”, Morningstar, 01/28/2022)

Withdrawal Strategy

Maryalene LaPonsie describes, in a U.S. News & World Report, “9 Retirement Distribution Strategies That Will Make Your Money Last”. The ones that I am employing are 1) taking a total return approach by varying the sources of distributions, 2) Creating a floor of guaranteed income to meet basic spending needs, 3) Bucket Strategy based on life timeline events, 4) Minimizing mandatory distributions from Traditional IRAs by converting a portion to Roth IRAs, and 5) Account Sequencing to optimize after-tax income over retirement.

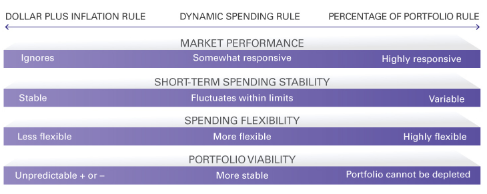

Kevin I. Khang, Ph.D., and Andrew S. Clarke, CFA at Vanguard, suggest a dynamic spending approach in “Safeguarding Retirement In a Bear Market” (June 2020), where spending is varied between 2% and 5% based on portfolio returns. This can reduce the downside risk of running out of money during retirement without much change in overall income. Vanguard Perspectives (May 2021) builds upon this concept of dynamic spending by comparing three different spending strategies 1) Dollar value plus inflation, 2) Dynamic Spending, and 3) Percentage of Portfolio. The pros and cons of these strategies are described below.

Figure #3: Comparing Three Spending Strategies

(Kevin I. Khang, Ph.D. and Andrew S. Clarke, CFA “Safeguarding Retirement in a Bear Market”, Vanguard, June 2020)

Having large amounts in Traditional IRAs is not conducive to the Dynamic Spending Rule. Excess (elective) RMDs above spending needs can be placed in an after-tax account which can then be used during peak spending years or passed along to heirs.

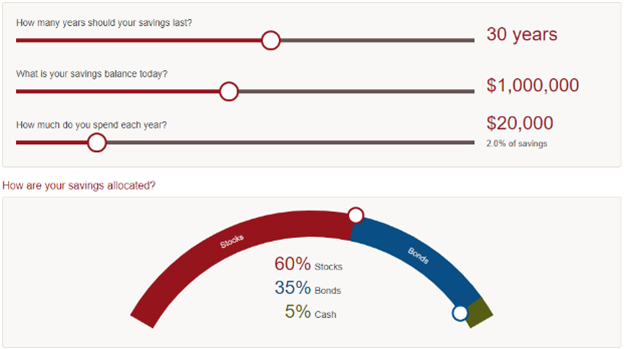

Here is a useful Retirement Nest Egg Calculator by Vanguard. If you select that you have a life expectancy of 30 years, have one million dollars in savings, invest with a 60/40 stock to bond ratio, and need $40,000 (4% withdrawal rate) above other income sources to meet spending needs, then the result is that there is a 91% probability of your savings lasting your expected lifetime using historical performance. If you want close to a hundred percent probability of not running out of money, then you may need to drop your spending below $28,000 per year, or less than a 3% withdrawal rate. This is a great tool but does not take into account whether your sources of income are taxable.

Figure #4: Vanguard’s Retirement Nest Egg Calculator

(“Retirement Nest Egg Calculator”, Vanguard)

Roger Young, CFP at T. Rowe Price, gives some excellent examples of withdrawal strategies in “How to Make Your Retirement Account Withdrawals Work Best for You.” Mr. Young concludes that retirees may benefit from one or more of the following strategies:

- Drawing from tax-deferred accounts to take advantage of a low (or even zero) marginal tax rate, especially before RMDs

- Selling taxable investments when income is below the taxation threshold for long-term capital gains (often supplementing with Roth distributions to meet spending needs)

- Considering heirs’ tax rates when deciding between tax-deferred and Roth distributions (if you’re confident there will be an estate)

- Evaluating whether to hold taxable assets until death to take advantage of the step-up in basis (again, only if the assets won’t be needed for spending in your lifetime) (Roger Young, CFP, “How to Make Your Retirement Account Withdrawals Work Best for You”, Rowe Price)

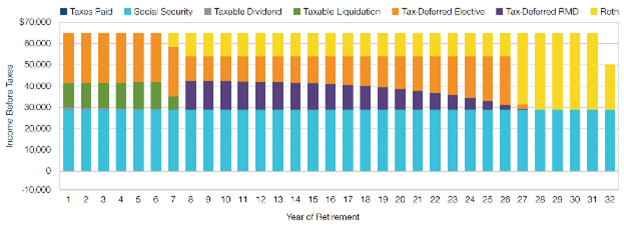

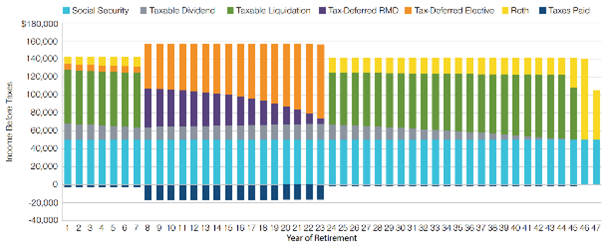

Figure #5 represents how retirees with relatively modest income might optimize their withdrawal strategy with little to no taxes. Notice the withdrawals of tax-deferred RMDs (purple) and the elective withdrawals (orange).

Figure #5: Tax Optimization Example Under Bracket Filling Method

(Roger Young, CFP, “How to Make Your Retirement Account Withdrawals Work Best for You”,T. Rowe Price)

Figure #6 is an example of how people with higher incomes who might want to leave an estate may choose to optimize their strategy. The elective withdrawals may be rolled over into a taxable account which has benefits for passing along to heirs. In my case, I expect a combination of Roth Conversion and accelerated Traditional IRA withdrawals when I finalize my strategy because I am overweighted in Traditional IRAs.

Figure #6: Tax Optimization Example Prioritizing Tax-Deferred Distributions

(Roger Young, CFP, “How to Make Your Retirement Account Withdrawals Work Best for You”, T. Rowe Price)

Investment Strategy

This article points out higher level risks to people entering retirement in the near future due to: 1) Sequence of return risk from recessions, 2) Inflation, and 3) Lower stock market returns over the next twenty years than historical averages. Conservatism and active retirement planning are prudent in the current environment.

Two of the changes as retirement became a reality were to sell our former residence and my decision to take some of my company pensions as a lump sum which will be rolled over into a Traditional IRA. These greatly increase flexibility during retirement planning. I have created buckets based on lifetime income needs. These include spending needs for several years before Social Security Benefits begin, a defensive Traditional IRA for emergency needs, a tax-managed account, balanced Traditional IRAs, and a growth-oriented Roth IRA. I manage the more conservative buckets and use Fidelity Wealth Management services for several buckets that are oriented for the longer time horizon.

Writing “Certainty of Death and Taxes” and this article has refined my investing strategy in retirement and provided me confidence in what I am doing. I will meet with a CPA in October and finalize the strategy.

As for my own short-term investment strategy, I try to reduce risk by balancing between funds that do well in inflation and funds that do well during recessions. I have increased cash. My neutral allocation is 50% to stocks (and commodities) with a minimum of 35% and a maximum of 65%, depending upon the business cycle. I am currently at 45% stocks. A recession is not imminent, and I believe that we are experiencing a bear market rally. I have periodically bought CD ladders to benefit from rising rates. As rate hikes appear to peak, I will move back into bond funds for protection in a recession.