Updates

We pause a moment to commemorate the lives and mourn the passing of two fund managers this month.

Dowe Bynum (1978-2020), half of the team of Cook & Bynum, passed away on Friday, July 17, 2020, at peace and surrounded by loved ones. Dowe, who eschewed his given first name “Jasper,” cofounded Cook & Bynum in 2001 with long-time partner Rickard Cook. They believed that they could best execute their disciplined value strategy far from the maddening distractions of the East Coast, and so founded their firm in Birmingham, Alabama. He was diagnosed with brain cancer about three years ago. Richard Cook has been largely responsible for the day-to-day management of the portfolio since that time. Dowe’s illness deeply affected his family, his friend and partner, and their firm.

(1978-2020), half of the team of Cook & Bynum, passed away on Friday, July 17, 2020, at peace and surrounded by loved ones. Dowe, who eschewed his given first name “Jasper,” cofounded Cook & Bynum in 2001 with long-time partner Rickard Cook. They believed that they could best execute their disciplined value strategy far from the maddening distractions of the East Coast, and so founded their firm in Birmingham, Alabama. He was diagnosed with brain cancer about three years ago. Richard Cook has been largely responsible for the day-to-day management of the portfolio since that time. Dowe’s illness deeply affected his family, his friend and partner, and their firm.

Monte Avery (1957-2020), one of the senior managers of the Viking Funds for the past 27 years, passed away on July 13, 2020. He’d been managing diabetes and heart disease for years. He helped manage the Integrity Energized Dividend Fund and a suite of muni bond funds that targeted the upper Midwest (and Maine?). They were, even by the standards of such funds, exceptionally risk-conscious though that came at the expense of strong returns. I had a funny conversation with the Viking folks once on the vicissitudes of a firm headquartered in North Dakota and serving the needs of elderly Scandinavians.

Monte Avery (1957-2020), one of the senior managers of the Viking Funds for the past 27 years, passed away on July 13, 2020. He’d been managing diabetes and heart disease for years. He helped manage the Integrity Energized Dividend Fund and a suite of muni bond funds that targeted the upper Midwest (and Maine?). They were, even by the standards of such funds, exceptionally risk-conscious though that came at the expense of strong returns. I had a funny conversation with the Viking folks once on the vicissitudes of a firm headquartered in North Dakota and serving the needs of elderly Scandinavians.

I wish their families, and most especially Dowe’s wife and their three youngsters, peace.

Briefly Noted . . .

The Master Catalog of Bad Investing Decisions starts with “any fund that’s forced into a reverse share split.” After the close of the markets on August 27, 2020, Direxion will author six new entries in the catalog:

| Fund Name | Reverse Split Ratio | Approximate decrease in the total number of outstanding shares |

| Direxion Daily S&P Biotech Bear 3X Shares | 1 for 20 | 95% |

| Direxion Daily Semiconductor Bear 3X Shares | 1 for 12 | 92% |

| Direxion Daily Communication Services Index Bear 3X Shares | 1 for 10 | 90% |

| Direxion Daily Consumer Discretionary Bear 3X Shares | 1 for 10 | 90% |

| Direxion Daily Dow Jones Internet Bear 3X Shares | 1 for 10 | 90% |

| Direxion Daily S&P Oil & Gas Exp. & Prod. Bear 2X Shares | 1 for 10 | 90% |

As a result of these reverse splits, every twenty, twelve, or ten shares of a Fund will be exchanged for one share. Illustrating the principle that these are not buy-and-hold investments, $10,000 invested in Biotech Bear 3X (LABD) at inception would now be worth $78. If you’d bought the fund on March 4, 2020, and held it for two weeks, you would have more than doubled your original investment. If you held it for two months, you would have halved your original investment.

On July 14, 2020, the Board of Trustees changed the investment objective for Virtus WMC International Dividend ETF (VWID) from seeking capital appreciation with a secondary objective of seeking income, to just seeking income.

SMALL WINS FOR INVESTORS

Each of the Gotham Absolute Return Fund (GARIX), the Gotham Enhanced Return Fund (GENIX), and the Gotham Neutral Fund (GONIX) have reduced their investment advisory fee from 2.00% to 1.50% and their expense limitation from 2.15% to 1.50%. Even at 1.5%, Morningstar categorizes their expenses as “high” for institutional funds; more so because their performance has been no better than middling.

All Wasatch Funds, except Core Growth Fund, International Opportunities Fund, and Small Cap Growth Fund, are now open to investors.

CLOSINGS (and related inconveniences)

On August 1, 2020, FPA New Income (FPNIX) closed to new investors. That decision was driven by “a combination of the current investment opportunity set, the overall size of the strategy, and modest but consistent asset growth.” The fund has posted gains in each of the past 35 years. Its managers are also responsible for the slightly more venturesome FPA Flexible Fixed Income Fund (FPFIX) which has a $100,000 minimum.

OLD WINE, NEW BOTTLES

Anfield Tactical Fixed Income ETF (AFTI) is now the Anfield Dynamic Fixed Income ETF (ADFI).

Gadsden Dynamic Multi-Asset ETF (GDMA) is being adopted by the Alpha Architect, but there should be no visible changes to the fund’s name or operations.

On December 20, 2013, the Holmes Growth Fund changed its name to the Holmes Macro Trends Fund. The Holmes Macro Trends Fund changed its name to the Global Luxury Goods Fund (USLUX) effective July 1, 2020.

Going a bit greener: Somewhere between September and December, iShares iBoxx $ High Yield ex Oil & Gas Corporate Bond ETF (HYXE) will become the iShares ESG Advanced High Yield Corporate Bond ETF (HYXF). They currently track a high-yield bond index that excludes the oil and gas industry; after the change, the mandates broadens to ESG issues and avoiding “involvement in controversial activities.” The expense ratio then drops from 0.5% to 0.35%.

Masters no more. Effective July 31, 2020, the Litman Gregory name was replaced with PartnerSelect in the name of each of their funds. Nothing else changes.

| Current Name | New Name (effective July 31, 2020) |

| Litman Gregory Masters Equity | PartnerSelect Equity |

| Litman Gregory Masters International | PartnerSelect International |

| Litman Gregory Masters Smaller Companies | PartnerSelect Smaller Companies |

| Litman Gregory Masters Alternative Strategies | PartnerSelect Alternative Strategies |

| Litman Gregory Masters High Income Alternatives | PartnerSelect High Income Alternatives |

Effective September 8, 2020, the Securian AM Managed Volatility Equity Fund (VVMIX) will be renamed the Securian AM Equity Stabilization Fund. The investment objective then shifts from outperforming a custom benchmark of low vol stocks and bonds to getting as much money as they can while capping volatility at 10%.

Segall Bryant & Hamill Global Large Cap Fund (WTMVX) will be renamed the Segall Bryant & Hamill Global All Cap Fund on September 22, 2020.

OFF TO THE DUSTBIN OF HISTORY

Morningstar reports that 225 funds were liquidated or merged away in the first six months of 2020. In describing “flowmaggedon,” a term that we really could have lived without, Russel Kinnel reports being “struck by just how many small funds there are.” Nearly two-thirds of active funds have under $500 million in assets.

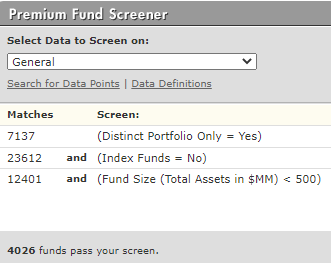

For more than 10 years Mutual Fund Observer has been covering “the funds that are off Morningstar’s radar.” Still, I admit being surprised by Mr. Kinnel’s surprise. The fund screener at Morningstar has gotten pretty glitchy but still, it’s not that hard to find this stuff out:

I wonder if he knows that over 300 of them are five-star funds, of which only 11 have analyst coverage? (Another dozen are parts of a target-date series where the whole series – BlackRock LifePath, TIAA-CREF Lifecycle Index, and so on, gets covered.)

Hot lead for Morningstar’s Fund Spies: 45 of those funds have a five-star rating for the past 3, 5, and 10 year periods as well as an overall five-star rating. You might want to cover them before they perish for lack of … well, coverage.

AlphaCentric Energy Income Fund (AEIAX), after eight months of operation and a 23% YTD loss, was liquidated on July 31, 2020.

On August 1, 2020, the Applied Finance Dividend Fund AFADX) was merged into the Applied Finance Core Fund (AFALX). Morningstar’s quantitative medalist system gives the Core Fund a Gold rating … a rating that it shares with, oh, Yacktman, Dodge & Cox, and LSV Value.

Arabesque Systematic USA Fund will be liquidated on or about September 18, 2020. That’s a pity. It was a really solid ESG balanced fund, though with an investment minimum ($50,000) that was a bit too high to warrant much attention from MFO.

Somewhere between December 2020 and the beginning of 2021, the AB (AllianceBernstein) International Portfolio (AIZAX) and Tax-Managed International Portfolio (ABXAX) will transfer all of their assets and stated liabilities to the AB International Strategic Equities Portfolio (STEZX).

BMO Small-Cap Core Fund (BBCAX), the BMO Alternative Strategies Fund (BMASX), and the BMO High Yield Bond Fund (BMHAX) will be liquidated on August 28, 2020.

Brand Value ETF (BVAL) was liquidated on July 30, 2020.

Bread & Butter Fund (BABFX) closed up shop on July 30, 2020. We may have been a tiny bit dismissive of the fund at its launch, almost 15 years ago since the qualifications of the manager struck us as thin. Of the past 12 years (our longest available measurement period), the fund has trailed all but one of its 150 Lipper multi-cap value peers.

The Ultimate Loser? Ken Heebner’s CGM Focus Fund (CGMFX) still has a quarter billion in assets despite losing an average of 7% annually for 12 years. In 2008, TheStreet.com declared him “the best manager alive” after 10 fat years … and immediately before 12 lean ones.

Columbia Funds continues paring its lineup

| Target Fund | Acquiring Fund | Reorganization Date |

| Columbia Global Energy and Natural Resources Fund (UMESX) | Columbia Global Equity Value Fund IEVAX | August 7, 2020 |

| Columbia Global Infrastructure Fund | Columbia Global Equity Value Fund | July 10, 2020 |

| Columbia Select International Equity Fund (NIEQX) | Columbia Acorn International Select LAIAX | August 7, 2020 |

The acquiring funds are particularly good, but they have the virtue of being large enough to be sustainable which is important when you’ve seen 10 consecutive years of asset outflows.

In one of those announcements sensible only to lawyers, Glenmede Alternative Risk Premia Portfolio (GLARX) was liquidated on July 23, 2020 and, a day later, the adviser notified people that “therefore, effectively immediately, the [fund] is closed to investments.” Dudes: the fund can be neither open nor closed if it no longer exists.

Harbor High-Yield Opportunities Fund (HHYVX) joins the heavenly chorus on August 31, 2020.

Highland Opportunistic Credit Fund (HNRAX) will eventually liquidate. The authorized liquidation date was June 16, 2020, but the managers worry that market volatility has been too high to allow them to manage an orderly liquidation in which they receive a fair price for their portfolio holdings. So the new date is “ASAP.”

Hodges Capital is liquidating the Institutional share class (HDPIX) of Hodges Fund (HDPMX) because it’s “not economically viable.” Over the past eight years, Hodges has finished in the top 1% of its peer group twice (2013, 2016) but also trailing 96-100% of its peers five times (2015 and 2017-2020).

On or about September 26, 2020, Manning & Napier is going to merge its target-date series of funds into its Pro-Blend series (Conservative, Moderate, Extended Term, and Maximum Term). Current shareholders in Target Income and Target 2015 move into Conservative; 2020 and 2025 into Moderate; 2030, 2035, and 2040 into Extended; and longer-dated funds into Maximum Term. Some of the Target funds are quite good but all of them have tiny-to-modest asset bases, presumably pushing the merger to maintain economies of scale.

Meritage Growth Equity Fund (MPGEX), Meritage Value Equity Fund (MVEBX), and Meritage Yield-Focus Equity Fund (MPYEX) have all closed to new investments and will all be liquidated on August 27, 2020.

Neuberger Berman Unconstrained Bond Fund (NUBAX), launched in 2014 when “unconstrained” was the marketing term du jour, will become a former fund on or about August 17, 2020. Neuberger Berman Short Duration High Income Fund (NHSAX) departs the same day.

Newfound Multi-Asset Income Fund (NFMAX) has closed and will be liquidated on August 24, 2020.

Sometime in the third quarter of 2020, Pioneer Corporate High Yield Fund (HYCYX) will eat the Pioneer Dynamic Credit Fund (RCRAX). Pioneer coyly refers to the resulting entity as “the Combined Fund,” which is a fair description in the way that the encounter between a wolf and a rabbit result in “the Combined Animal.”

Segall Bryant & Hamill Mid Cap Value Dividend Fund (WIMCX) will liquidate on or about September 17, 2020. Segall Bryant & Hamill Small Cap Value Dividend Fund (WISVX) merges into the larger and stronger Segall Bryant & Hamill Small Cap Value Fund (SBRVX) on or about September 25, 2020.

As of July 24, 2020, the merger of Vanguard Capital Value Fund into Vanguard Windsor (VWINX) is complete.

Vanguard U.S. Value Fund (VUVLX) will be merged into Vanguard Value Index Fund (VIVAX) in early 2021. VUVLX is a low-cost quant fund that decided, in 2016, to update its models. In retrospect, that seems to have been a bad idea and fund transitioned from consistent outperformer (every year 2010-2016) to consistent underperformer (every year from 2017-present). Vanguard says that merger offers “a comparable fund with better historical long-term investment performance, deliver a large expense ratio reduction for U.S. Value Fund shareholders, and create a larger combined fund which we anticipate would achieve greater economies of scale.”