Fund advisers are required to file prospectuses for proposed funds with the SEC; the SEC has 75 days to review the filing. If the SEC doesn’t object, then the adviser is free to launch – or to not launch, which is more common than you think – the proposed fund. Funds placed in registration in December will “go live” in February or March 2018. This month’s filings include three actively-managed ETFs, two conversions of existing funds and one Continue reading →

Author Archives: David Snowball

Briefly Noted

Updates

In December’s story, “There’s no idea so dumb that it won’t attract a dozen ETFs,” I derided the notion of blockchain ETFs. That’s because they have so few meaningful investments; there just aren’t many publicly traded blockchain-focused firms to build a portfolio around. I described their investment universe as “a small, motley collection of firms that recently changed their names to blockchainify them (360 Capital Financial suddenly became 360 Blockchain), over-the-counter stocks, foreign small caps and recent IPOs.”

Shortly thereafter, Long Island Iced Tea Corporation – literally, guys who make Continue reading →

December 1, 2017

Dear friends,

Welcome to Winter. It’s my favorite time of the year. My students, with their hummingbird-like metabolisms, are loath to surrender their shorts and sandals even now.

The midwinter holidays ahead – not just Christmas but a dozen other celebrations rooted in other cultures and other traditions – are, at base, expressions of gratitude. They occur in the darkest, coldest, most threatening time of year. They occur at the moment when we most need others, and they most need us. No one thrives when they’re alone and each day brings 14 to 18 hours of darkness. And so we’ve chosen, from time immemorial, to open our Continue reading →

The Terrific Twos

We thought we’d start catching up with the 130 U.S. equity funds which have passed their second anniversary but have not yet reached their third, which is when conventional trackers such as Morningstar and Lipper pick them up. As Charles has repeatedly demonstrated, the screener at MFO Premium allows you to answer odd and interesting questions. As I, and other users of the site, have asked him, “would it be possible to …?” Charles has almost always responded with a cheerful “let me see what I can do. I’ll get back to you.”

Two days later, the screener has Continue reading →

Launch Alert: The Touchstone adoptees

On October 30, 2017, Touchstone Investments finalized the adoption of a suite of Sentinel funds. The Sentinel funds were somewhere between “solid” and “outstanding,” depending on the fund in question, but they were not at all well known. Given the maturity of the mutual fund marketplace, Sentinel saw little prospect for growth and little reason to continue serving as adviser to the funds. Like a number of other firms, including UMB which recently sold the Scout Funds, Sentinel looked to sell the funds after (80) years in the business. Touchstone Investments stepped up.

Nine Sentinel funds were involved in Continue reading →

There’s no idea so dumb that it won’t attract a dozen ETFs

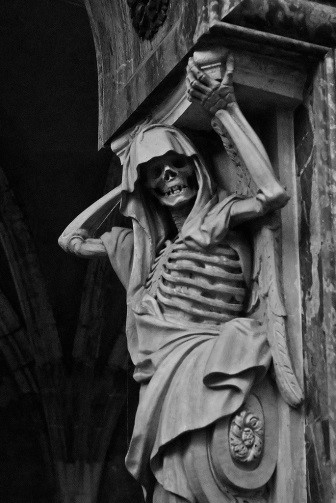

I’m not sure that Bitcoins actually exist. I’ve never seen one, and I’ve never interacted with one. I can’t quite explain what they are, beyond invoking the term “cryptocurrency” (which leads me to wonder if its ghoulish story will eventually be popularized under the title, “Tales from the Crypto …”?). Our colleague Sam Lee is intrigued by the potential for the underlying software, though skeptical of Bitcoin per se.

I’m not sure that Bitcoins actually exist. I’ve never seen one, and I’ve never interacted with one. I can’t quite explain what they are, beyond invoking the term “cryptocurrency” (which leads me to wonder if its ghoulish story will eventually be popularized under the title, “Tales from the Crypto …”?). Our colleague Sam Lee is intrigued by the potential for the underlying software, though skeptical of Bitcoin per se.

Not quite as skeptical as Hamilton Nolan seems to be. Mr. Nolan, whose writing style occasionally makes Continue reading →

Funds in Registration

Relatively few funds enter registration in November or December. Advisers really want to go live by December 30th, so that they will be able to show full-year results for 2018. As a result, lots of funds go into registration in October so that they can emerge from the SEC’s “quiet period” by the end of December. As a result, this month’s filings are limited to a handful of institutional funds that might offer retail shares, and a pack of high-visibility active ETFs from Vanguard. Continue reading →

Briefly Noted

Updates

It’s been a good first year for Laura Geritz, the folks at the Rondure funds and her partners at Grandeur Peak. Rondure New World (RNWOX) has drawn $90 million in assets since its May 1, 2017 launch. Rondure Overseas (ROSOX) has drawn just $15 million so far, despite having stronger absolute and relative returns than its sibling. New World is an unconstrained all-cap  fund investing in firms that are either in or are substantially tied to, the emerging markets. Overseas has a much lower market cap reflecting, in part, New World’s investments in huge multinational corporations that have substantial interests in the emerging world. Both funds have about 8% cash and portfolios that are reassuringly out-of-step with their peers; that is, both Continue reading →

fund investing in firms that are either in or are substantially tied to, the emerging markets. Overseas has a much lower market cap reflecting, in part, New World’s investments in huge multinational corporations that have substantial interests in the emerging world. Both funds have about 8% cash and portfolios that are reassuringly out-of-step with their peers; that is, both Continue reading →

November 1, 2017

Dear friends,

Augustana, my longtime academic home for those of you who don’t know, seems to grow some odd things. Continue reading →

Launch Alert: Northern Funds U.S. Quality ESG Fund (NUESX)

On October 02, 2017, Northern Trust Asset Management launched Northern U.S. Quality ESG Fund. It strikes me as a particularly interesting fund which combines two separately valuable commitments in a single low-cost platform.

The case for investing in high quality companies is almost definitional. No sensible person buys low quality anything when, for about the same price, they can get a high quality alternative. The key is having a viable definition of “quality” and a clear sense of how much of a premium a quality company might charge. Northern has done a Continue reading →

Elevator Talk: Sean Stannard-Stockton, Ensemble Fund (ENSBX)

Since the number of funds we can cover in-depth is smaller than the number of funds worthy of in-depth coverage, we’ve decided to offer one or two managers each month the opportunity to make a 200 word pitch to you. That’s about the number of words a slightly-manic elevator companion could share in a minute and a half. In each case, I’ve promised to offer a quick capsule of the fund and a link back to the fund’s site. Other than that, they’ve got 200 words and precisely as much of your time and attention as you’re willing to share. These aren’t endorsements; they’re opportunities to learn more.

The conventional wisdom is that passive investing, particularly Continue reading →

Fuller & Thaler Behavioral Small-Cap Equity (FTHNX), November 2017

Objective and strategy

FTHNX pursues long-term capital appreciation. The managers invest in a diversified US small cap equity portfolio. The managers seek out stocks where other investors are likely to make behavioral mistakes. If they conclude that an investor mistake is likely and the company has solid fundamentals, the portfolio managers generally buy the stock. They sell when the misbehavior has run its course, which tends to lead to a high turnover portfolio. That said, they do not automatically buy or sell based on a single security’s characteristics; they impose a risk management overlay that helps control exposures to sectors, size, and other characteristics. The fund currently holds Continue reading →

Funds in Registration

A great month, especially if you’re rich. AQR has two new bonds funds tagged for $1,000,000 and $5,000,000 minimums. DFA has registered to launch Emerging Markets Sustainability Core 1 Portfolio and Global Core Plus Fixed Income Portfolio, kept so far from the hoi polloi that they don’t even list investment minimums. Rather, we suppose, like the restaurants that don’t list prices on the menu. Likewise, the Martin Currie Emerging Markets SMA Shares Fund will only be available to Legg Mason’s SMA customers. Joel Greenblatt has filed his latest fund, Gotham 500 Plus Fund, with a quarter million dollar minimum. It’ll invest long in large caps and long/short in small- to mid-caps. 17 of his 19 other funds have peer-beating returns since inception. RMB International Small Cap Fund has a $100,000 minimum for now, though an Investor class might come along one day. The advisor has no other international funds; remember, these used to be the Burnham Funds. The RQSI GAA Systematic Global Macro Fund will set you back 2.48% and $5,000,000. Continue reading →

Briefly Noted …

The $12 million Global Strategic Income Fund (VEEEX) has a couple upgrades planned for the next month. “These changes included the appointment of a new adviser and sub-adviser to the Fund; revisions to the Fund’s investment objective; revisions to the Fund’s investment strategy; a change to the name of the Fund; changes to certain service provider agreements; and the addition of new share classes as well as the conversion of Class C Shares into Class A Shares.” Nominally the current version of the fund had a global, all-asset strategy; practically, it was a global equity fund with a 30-day SEC yield of 0.00%. The new fund will be Continue reading →

October 1, 2017

Dear friends,

It’s finally fall, my favorite season of the year. The heat abates, the garden quiets, the apples ripen. Chip and I will soon venture north to Wisconsin for leaf peeking and visits to orchards. You’d be amazed at the variety of flavors found in apples; there are about 200 varieties grown in the US, with the average grocery store stocking just a half dozen (including that flavorless favorite, Red Delicious). You’ve still got time to do better. In the Midwest, anyway, October is the month for Haralson and King David, Golden Russet and Creston, Enterprise and Voyager. Heck, you might find a few Lura Red or Wolf Rivers left, if you’re Continue reading →

The Story without a title

In journalism, the headlines you read are generally an afterthought, crafted by a headline writer – not the story’s author – to fit the available space and grab attention. For us, story titles function differently: they’re “framing devices,” which we write early and which help us figure out how to explain the entire story.

This is “the story without a title,” because I’ve got Continue reading →

The wise reader’s two most important words. “Uh, no.”

Having concluded that we’re not willing to pay for the services of professional journalists and editors, we’re increasingly getting what we paid for: stories written by robots, amateurs, dilettantes and self-interested parties posing as journalists. Here’s my monthly roundup of stories that made my head hurt, plus one opening note on Continue reading →

Elevator Talk: Ryan Caldwell, Chiron Capital Allocation Fund (CCAPX)

Since the number of funds we can cover in-depth is smaller than the number of funds worthy of in-depth coverage, we’ve decided to offer one or two managers each month the opportunity to make a 200 word pitch to you. That’s about the number of words a slightly manic elevator companion could share in a minute and a half. In each case, I’ve promised to offer a quick capsule of the fund and a link back to the fund’s site. Other than that, they’ve got 200 words and precisely as much of your time and attention as you’re willing to share. These aren’t endorsements; they’re opportunities to learn more.

The good news is that, as a concept, “world allocation funds” makes Continue reading →

Launch Alert: Artisan Global Discovery Fund (APFDX)

On August 21, 2017, Artisan Partners launched a near-clone of their very successful Artisan Global Opportunities Fund (ARTRX). Artisan organizes their managers into eight autonomous teams, with each team supported by an analyst corps and responsible for one or more funds. Global Discovery will be managed by the Growth team, which is also responsible for Global Opportunities, Mid Cap (ARTMX) and Continue reading →

Funds in registration

It’s been a quiet month in the land of new fund registrations. There are ten new (mostly) no-load retail funds in the pipeline, as well as a half dozen loaded funds (which I’m mostly ignoring) and a slew of ETFs. The most intriguing development is the question, who’s offering the most pointless ETF? Candidates are the ProShares Decline of Bricks and Mortar Retail ETF which will surely compete with the ProShares Long Clicks/Short Bricks Retail ETF while the USCF Contango-Killer Natural Gas Fund (No K-1) takes on Continue reading →