By David Snowball

The Securities and Exchange Commission, by law, gets between 60 and 75 days to review proposed new funds before they can be offered for sale to the public. Each month, Funds in Registration gives you a peek into the new product pipeline. Most funds currently in registration will become available by late October.

Our list contains 37 new funds and active ETFs, with another 15 (unlisted) high minimum institutional funds and passive ETFs. Funds worth putting on your radar include FPA Balanced, a 60/40 fund with A-tier managers; three new funds from Fidelity, their largest single-month rollout in years; an emerging Chinese blue chips fund from T. Rowe Price; and PIMCO’s Climate Bond Fund and Enhanced Short Maturity Active ESG ETF, which are among a half dozen new sustainable-fund options.

AdvisorShares Pure US Cannabis ETF

AdvisorShares Pure US Cannabis ETF (MJUS), an actively-managed ETF, seeks long-term capital appreciation. The plan is to use “a variety of methods” to select a stock portfolio representing companies that “derive at least 50% of their net revenue from the marijuana and hemp business in the United States.” The fund will be managed by Dan Ahrens and Robert Parker of AdvisorShares. Its opening expense ratio will be under 1% but otherwise has not been disclosed.

Aegon Global Sustainable Equity Fund

Aegon Global Sustainable Equity Fund will seek to maximize total return, consisting of income and capital appreciation. The process starts by excluding firms engaged in a wide variety of activities (from adult entertainment to fossil fuel extraction), then to identify “industry leaders” among the remaining firms and finally to conduct a stock-by-stock financial and competitive analysis. The fund will be managed by a team from Kames Capital, plc, the Scottish sub-adviser. Its opening expense ratio is 1.05%, and the minimum initial investment will be $2,000 for Investor shares. There’s an unusually long discussion of legal proceedings against the adviser that it would be prudent to review. Similarly, the disclosure of Kames’ performance with related investments, which seems limited and unimpressive, should be a reasonable part of your due diligence.

Cambria Private Equity Strategy ETF

Cambria Private Equity Strategy ETF (LBO), an actively-managed ETF, seeks long-term capital appreciation. The plan is to buy publicly traded equities using “a proprietary algorithm designed to generate returns that mimic the returns of U.S. private equity funds.” To be clear, no actual private equity positions are included in the fund. The fund will be managed by Mebane T. Faber. Its opening expense ratio has not been disclosed .

Cambria Venture Capital Strategy ETF

Cambria Venture Capital Strategy ETF, an actively-managed ETF, seeks long-term capital appreciation. The plan is to invest in publicly-traded securities, chosen by “a proprietary algorithm designed to generate returns that mimic the returns of U.S. venture capital funds.” As with its sibling Private Equity fund, this ETF does not invest in its namesakes: it does not hold stakes in VC funds or in VC-funded companies. The fund will be managed by Meb Faber. Its opening expense ratio has not been disclosed.

Catenary V-Alternative Fund

Catenary V-Alternative Fund will seek total return. The plan is to buy and sell put options on the S&P 500 index, and to invest the remainder of the portfolio in muni bonds. The fund will be managed by Jim Besaw and Eli Cohen, who managed the hedge fund which is being converted to this mutual fund. The hedge fund launched in April 2017, has averaged 1.1% annualized returns and lost 5.6% in 2018, about in-line with the average options-based mutual fund. Its opening expense ratio has not yet been disclosed, nor has the minimum initial investment.

Coho Relative Value ESG Fund

Coho Relative Value ESG Fund will seek total return. Their investable universe is about 200 mid- to large-cap stocks that meet both their ESG and quality screens. The plan is to invest in the 25-35 which are most attractively valued. Their separate account composite, which is to say private accounts managed with this same strategy, has outperformed the S&P 500 Vale index since inception (2011), as well as for the past one- and five-year periods. Over the longer periods, they have about a 150 bps advantage over the index. The fund will be managed by a team from Coho Partners. Its opening expense ratio has not been disclosed, nor has the minimum initial investment.

Core Alternative ETF

Core Alternative ETF (CCOR), an actively-managed ETF, seeks capital appreciation and capital preservation with a low correlation to the broader U.S. equity market. The plan is to invest in high-quality domestic, dividend-paying companies but also to buy and sell options in an attempt to generate additional income and hedge downside exposure. The fund started life as Cambria Core Equity ETF. This new version loses one of the original managers (Meb Faber) and gains a new guy (Danny Mack) while David Pursell remains from the original. In raw performance terms, CCOR has substantially trailed both of its self-declared benchmarks (the S&P 500 and a 60/40 blend) since inception. Curiously, for a volatility-managed product, CCOR’s fact sheet says nothing about the fund’s volatility or risk-return metrics. Its opening expense ratio has not been disclosed.

Cushing Small Cap Growth Fund

Cushing Small Cap Growth Fund will seek capital appreciation. It will be a small cap portfolio driven by fundamental, bottom-up research which will also utilize stop loss orders to manage downside risk. Given its growth orientation, they anticipate substantial exposure to consumer, healthcare and tech stocks. That’s significant because Cushing is a specialist investor in the energy sector, and this will be their first broad fund. The fund will be managed Jerry Swank, Alan Norton and Thomas Norton. Its opening expense ratio has not been disclosed; the minimum initial investment on “A” shares is $2,000.

Day Hagan/Ned Davis Research Smart Sector ETF

Day Hagan/Ned Davis Research Smart Sector ETF, an actively-managed ETF, will seek long-term capital appreciation and preservation of capital. This will be an ETF-of-ETFs whose plan is to make money by selecting overweighting or underweighting sectors based on investment models co-created by Day Hagan and Ned Davis Research. They also may move to 50% cash in hostile markets. The fund will be managed by Donald Hagan. Its opening expense ratio is 0.78%.

DFA Global Social Core Equity Portfolio

DFA Global Social Core Equity Portfolio will seek long-term capital appreciation. The plan is to built a fund-of-DFA-funds. The underlying funds are the firm’s existing US Social Core (30-60% of the portfolio), International Social Core (20-55%) and Emerging Markets Social Core (5-25%). The base allocation is at least 40% U.S. The fund will be managed by a DFA team. Its opening expense ratio is 0.36%, and the minimum initial investment will be set by your adviser. DFA funds are only available through DFA-trained advisers; they’re sort of the original “smart beta” funds, well-respected and hard to access.

Fidelity [Horizon] Fund

Fidelity [Horizon] Fund will seek capital appreciation. And no, I have no idea of why the word [Horizon] appears in brackets, but it does so throughout the prospectus. The plan is to build an unconstrained global equity fund. The prospectus offers no clue about what distinction it might hold in comparison to Fidelity’s four other global equity funds. The fund will be managed by an eight person team. Its opening expense ratio is has not been disclosed. There is no minimum initial investment requirement but will be available only through Fidelity. Available on October 23rd.

Fidelity Stocks for Inflation ETF

Fidelity Stocks for Inflation ETF will track the Fidelity Stocks for Inflation Index. We don’t report on registration filings for passive ETFs, which generally strike us as an over-hyped asset class and dangerous to investors not prepared for what happens to them in a market downturn. That said, it’s so rare for Fido to even contemplate a passive ETF that we thought we’d better note the inception of this one. The underlying index includes “large and mid-capitalization U.S. companies with attractive valuations, high quality profiles and positive momentum signals, emphasizing industries that tend to outperform in inflationary environments.” Its opening expense ratio has not been disclosed.

Fidelity U.S. Low Volatility Equity Fund

Fidelity U.S. Low Volatility Equity Fund will seek long-term growth of capital. The plan is to “combine fundamental stock selection and quantitative risk management techniques focused on reducing absolute portfolio risk in an effort to produce returns in excess of the Russell 3000 Index over a full market cycle but with lower absolute volatility.” The fund will be managed by Zack Dewhirst, a quant who has been with Fidelity since 2007. Its opening expense ratio has not been disclosed, and the minimum initial investment will be zero. Available on October 23rd.

First Trust Active Factor Large Cap ETF

First Trust Active Factor Large Cap ETF, an actively-managed ETF, seeks capital appreciation. The plan is to build a portfolio of large cap stocks, but to selectively overweight stocks based on which investment factors – (i) value; (ii) momentum; (iii) quality; and (iv) low volatility – are most attractive. The fund will be managed by a six person team from First Trust. Its opening expense ratio has not been disclosed. Sibling ETFs for mid cap and small cap stocks will launch at the same time using an identical framework.

FPA Balanced Fund

FPA Balanced Fund will seek to generate both income and capital appreciation over the long term while avoiding permanent impairments of capital. The plan is to combine a global equity portfolio (typically 55-65%) with a relatively unconstrained bond portfolio. In general, FPA is willing to be bold when the market is priced to reward boldness, and determined to preserve capital otherwise. The fund will be managed by pretty much everybody at FPA. Its opening expense ratio has not been disclosed (okay, it’s been “disclosed” as X.XX%), and the minimum initial investment will be $1,500 for Investor shares.

Franklin Liberty Systematic Style Premia ETF

Franklin Liberty Systematic Style Premia ETF, an actively-managed ETF, seeks absolute return. The plan is to combine a top-down risk premium sleeve of the portfolio with a bottom-up long/short sleeve. If you’re wondering what on earth that means, you’re not alone and might be best served to stepping carefully away. The fund will be managed by Chandra Seethamraju, Sundaram Chettiappan, and Vaneet Chadha, all from Franklin Advisers. Upside: the lead manager has a PhD, presumably is brilliant and is the head quant at Franklin. Downside: he’s never actually managed other people’s money before. Its opening expense ratio has not been disclosed.

Frost Global Bond Fund

Frost Global Bond Fund will seek to maximize total return, consisting of income and capital appreciation. The plan is to build a … well, global bond portfolio using five factors (e.g., projected shape of the yield curve) but using those factors “to varying degrees depending on its views” of three other factors. The fund will be managed by Jeffery Elswick, Tim Tucker, and Markie Atkission. The folks help manage Frost’s other fixed-income funds which range from “solid” to “outstanding.” Its opening expense ratio is 1.0%, and the minimum initial investment will be $1 million for the fund’s Institutional shares which are the only ones immediately on offer.

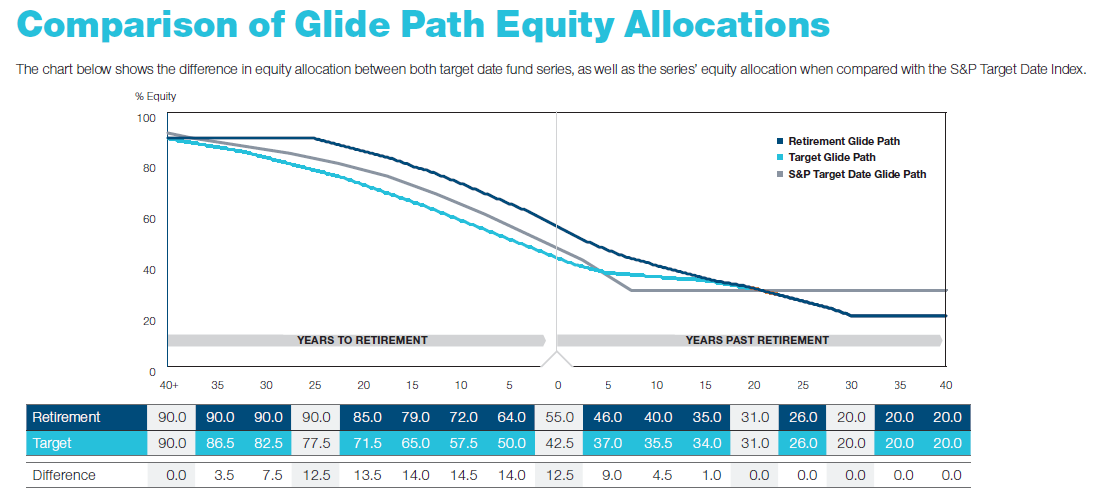

Harbor Target Retirement 2060 Fund

Harbor Target Retirement 2060 Fund will seek capital appreciation and current income consistent. It’s a fund-of-Harbor-funds whose initial allocation is 93% equities. The fund will be managed by a Harbor team. In general, the Harbor funds are fairly lackluster but not awful. Its opening expense ratio is 0.79%, and the minimum initial investment will be $1,000.

Integrity Short Term Government Fund

Integrity Short Term Government Fund will seek a high and stable rate of total return. This is a rechristened version of the four-star M.D. Sass Short Term US Government Agency Income Fund. The plan is to use a quant strategy to buy mortgage-backed securities, with an average duration of 1-3 years. The fund will be managed by M.D. Sass Investor Services. Its opening expense ratio has not been disclosed, and the minimum initial investment will be $1,000.

Levin Easterly Value Opportunities Fund

Levin Easterly Value Opportunities Fund will seek long-term capital appreciation. The plan is to invest in 35-40 large cap stocks. In general, you might think of it as a “blue chip value” portfolio. The fund will be managed by Jack Murphy and Christopher Susanin of Levin Easterly Partners. The firm’s Large Cap Value Long Only Taxable Strategy Composite pretty much tracks the returns of the Russell 2000 Value Total Return Index and substantially trails the S&P 500 Total Return Index, its two benchmarks. Its opening expense ratio is 1.70%, and the minimum initial investment will be $250 for Investor shares.

Pacific Global Focused High Yield ETF

Pacific Global Focused High Yield ETF, an actively-managed ETF, seeks income and long-term growth of capital. The plan is to invest in 60 to 90 liquid high yield debt securities. Their benchmark is Bloomberg Barclays US High Yield Very Liquid Index; despite that “US” there, the fund can invest globally in dollar-denominated corporate bonds. The fund will be managed by Bob Boyd and Brian Robertson of Pacific Asset Management. Its opening expense ratio is sketched-in as [0.39]%, for what that’s worth.

Pacific Global International Equity Income ETF

Pacific Global International Equity Income ETF, an actively-managed ETF, seeks income and long-term growth of capital. The plan is to hold 200-450 mid- to large-cap stocks of dividend-paying firms located in developed markets outside the US. The fund will be managed by Paul Dokas and Robert Ginsberg of Cadence Capital Management. Its opening expense ratio is 0.39%.

Pacific Global Senior Loan ETF

Pacific Global Senior Loan ETF, an actively-managed ETF, seeks a high level of current income. The plan is to buy income-producing senior floating rate loans but they also expect to invest primarily in non-investment grade securities. The notion, I suppose, is that loans pay rather a lot and the “senior” status offers some buffer against credit or default risk since these are first in line to get paid if things do go south. The fund will be managed by Bob Boyd and Michael Marzouk of Pacific Asset Management. There’s odd text in the incomplete prospectus that identifies this as the reorganized version of an unnamed predecessor fund. I presume that’s the three-star Pacific Funds High Income (PLHIX). Its opening expense ratio is 0.68%.

PIMCO Climate Bond Fund

PIMCO Climate Bond Fund will seek, you’ll like this, “optimal risk adjusted returns, consistent with prudent investment management, while giving consideration to long term climate related risks and opportunities.” The plan is to buy “a broad spectrum of climate focused instruments and debt from issuers demonstrating leadership with respect to addressing climate related factors.” Because climate threats are long-term, PIMCO imagines that its investment strategies will emphasize long-term rather than tactical moves. The fund will be managed by a party yet-unnamed. Its opening expense ratio has not been disclosed, and the minimum initial investment will vary from $1,000 – $1 million, depending on share class.

PIMCO Enhanced Short Maturity Active ESG ETF

PIMCO Enhanced Short Maturity Active ESG ETF, an actively-managed ETF whose name is correctly rendered all in capital letters, seeks maximum current income, consistent with preservation of capital and daily liquidity, while incorporating PIMCO’s ESG investment strategy. The plan is to build an ESG-screened portfolio of investment grade, global bonds with an average portfolio duration under one year. The fund will be managed by a team from PIMCO. Its opening expense ratio has not been disclosed but the hints are that they’re shooting for ultra-low. We’ll see.

Red Cedar Short Term Bond Fund

Red Cedar Short Term Bond Fund will seek preservation of capital and to maximize current income. The plan is to buy dollar-denominated bonds, potentially both US and foreign issues, that are investment grade and that create a portfolio with a 1-3 year maturity. The fund will be managed by Jason M. Schwartz of Red Cedar Investment Management. Its opening expense ratio has not been disclosed, and the minimum initial investment will be $5,000.

RPAR Risk Parity ETF

RPAR Risk Parity ETF (RPAR), an actively-managed ETF, seeks to generate positive returns during periods of economic growth, preserve capital during periods of economic contraction, and preserve real rates of return during periods of heightened inflation. The plan is to invest in a mix of TIPs, equities, commodities and Treasury bonds. The mix is calibrated to achieve “risk parity,” the state where each sleeve of the portfolio generates no more volatility than any other sleeve does. That’s an awfully admirable objective, though the other risk parity funds already on the market tend to post losses in about 50% of their calendar years. The fund will be managed by Michael Venuto of Toroso Investments and Charles Ragauss of CSat Investment Advisory. Its opening expense ratio has not been disclosed.

Standpoint Multi-Asset Fund

Standpoint Multi-Asset Fund will seek positive absolute returns. The plan is to combine a global equities strategy with a global futures strategy that encompasses seven asset classes. “Managed futures” is such an appealing strategy with excellent historical credentials, it’s just been the death of a lot of funds that tried actually making money with it. Perhaps these guys, with their equities sleeve, will pull it off. The fund will be managed by Eric Crittenden and Shawn Serikov. Its opening expense ratio is 1.51%, and the minimum initial investment will be $2,500.

T. Rowe Price China Evolution Equity Fund

T. Rowe Price China Evolution Equity Fund will seek long-term growth of capital. The plan is to invest in emerging blue chips in and around China. The fund will be managed by Wenli Zheng. It appears that Zheng is also an analysis for T. Rowe Price International Discovery. Its opening expense ratio is 1.40%, and the minimum initial investment will be $2,500.

Thrivent Core Emerging Markets Equity Fund

Thrivent Core Emerging Markets Equity Fund will seek long-term growth of capital. The plan is to invest in emerging markets stocks, conceivably through ETFs for part of the portfolio, using “a disciplined approach that involves computer-aided, quantitative analysis.” The fund will be managed by Noah J. Monsen and Brian W. Bomgren. They’re also members of the management teams of several other decent-to-excellent Thrivent funds. Its opening expense ratio is 0.20%, and there is no minimum initial investment requirement.

Uncommon Conservative Fund

Uncommon Conservative Fund will seek current income with some capital appreciation. The plan is to put 80% of the portfolio in fixed-income ETFs and 20% in equity ETFs. The equity sleeve focuses on quality firms and offers both value and growth exposure. That said, nothing really cries out “uncommon” about the strategy. The fund will be managed by Wes Strode and Paul Knipping of Portfolio Design Advisors. Its opening expense ratio has not been disclosed, and the minimum initial investment will be $2,000. The same prospectus covers its siblings, Uncommon Moderate (60/40) and Uncommon Capital Appreciation (80/20).

WCM Focused Small Cap Fund

WCM Focused Small Cap Fund will seek long-term capital appreciation. The plan is to buy undervalued dynamic, industry-leading US small caps that have above-average growth prospects. Nothing in the prospectus explicitly addresses the question of why it’s “focused.” The fund will be managed by John Rackers and Chad Hoffman. Its opening expense ratio has not been disclosed, and the minimum initial investment will be $1,000.

WCM Small Cap Growth Fund

WCM Small Cap Growth Fund will seek long-term capital appreciation. The plan is to buy dynamic, industry-leading US small caps that have above-average growth prospects. The fund will be managed by John Rackers and Chad Hoffman. Its opening expense ratio has not been disclosed, and the minimum initial investment will be $1,000.

Andrew Ross Sorkin wrote an interesting piece in the Business Section of The New York Times for Monday, July 29, 2019. It was about a retired corporate attorney, Jamie Gamble, who concluded in retirement that corporate executives, including the ones who used to hire him and his firm, “are legally obligated to act like sociopaths.” Mr. Gamble’s argument centers around a corporation’s obligation to focus on itself (preservation) and defining increased profitability as the prime directive; that is, the maximization of shareholder value. I encourage you to read the article,

Andrew Ross Sorkin wrote an interesting piece in the Business Section of The New York Times for Monday, July 29, 2019. It was about a retired corporate attorney, Jamie Gamble, who concluded in retirement that corporate executives, including the ones who used to hire him and his firm, “are legally obligated to act like sociopaths.” Mr. Gamble’s argument centers around a corporation’s obligation to focus on itself (preservation) and defining increased profitability as the prime directive; that is, the maximization of shareholder value. I encourage you to read the article,  them to your attention. First, the short, five-episode series on HBO,

them to your attention. First, the short, five-episode series on HBO,  the grandmother, ostensibly under the guise of a family wedding. The grandmother is not being told that she has cancer and only a short time (so say the doctors) to live. The granddaughter learns things about her grandmother she did not know, such as that she was in the army and shot. These things she learns from two retired People’s Liberation Army generals who come to the wedding to see her grandmother. The movie is in Chinese with subtitles, but the contrast between our culture and that of China is quite stunning and compelling. If you want a short lesson in what the real differences are between the U.S. and China, this is a great way to get it in two hours.

the grandmother, ostensibly under the guise of a family wedding. The grandmother is not being told that she has cancer and only a short time (so say the doctors) to live. The granddaughter learns things about her grandmother she did not know, such as that she was in the army and shot. These things she learns from two retired People’s Liberation Army generals who come to the wedding to see her grandmother. The movie is in Chinese with subtitles, but the contrast between our culture and that of China is quite stunning and compelling. If you want a short lesson in what the real differences are between the U.S. and China, this is a great way to get it in two hours.

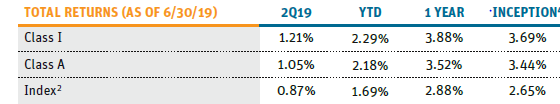

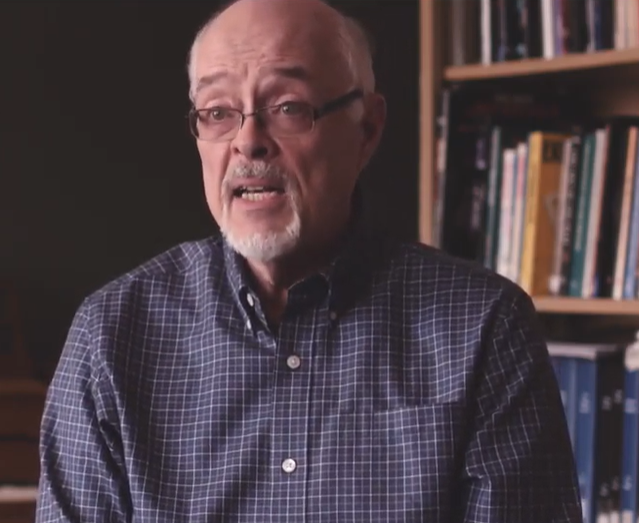

Clayton Triick manages Angel Oak UltraShort Income which launched in April 2018. He joined Angel Oak Capital Advisors in 2011 as an expert inthe residential mortgage-backed securities markets, which is a subset of the larger asset-backed securities market. Prior to joining Angel Oak, he was a portfolio manager for YieldQuest, a now defunct advisor whose internal dynamics were, he allows, “a bit challenging.” Since joining Angel Oak, he has been co-manager on Angel Oak Financials Income (ANFLX, $225 million AUM, five stars from Morningstar) and lead manager on Angel Oak UltraShort Income.

Clayton Triick manages Angel Oak UltraShort Income which launched in April 2018. He joined Angel Oak Capital Advisors in 2011 as an expert inthe residential mortgage-backed securities markets, which is a subset of the larger asset-backed securities market. Prior to joining Angel Oak, he was a portfolio manager for YieldQuest, a now defunct advisor whose internal dynamics were, he allows, “a bit challenging.” Since joining Angel Oak, he has been co-manager on Angel Oak Financials Income (ANFLX, $225 million AUM, five stars from Morningstar) and lead manager on Angel Oak UltraShort Income.