By David Snowball

We warned last month that we were “at the beginning of the annual insanity.” This month, it’s at flood tide.

The Securities and Exchange Commission, by law, gets between 60 and 75 days to review proposed new funds before they can be offered for sale to the public. Fund companies anxious to have a new fund up and running by December 31st need to have it in the hopper by the third week in October at the latest. And, my goodness, a lot of folks did find time to file.

The fund industry is given to fads and herding behavior. The success of one “tactical multi-asset income” fund triggers a rush of poseurs and wannabees, embracing the same language or strategy. The wave that has yet to crest is “socially responsible investing,” an entirely excellent idea now being embraced by folks with no prior commitment to the discipline and, in many cases, no demonstrated competence at it.

This season’s hot list: (1) socially responsible and (2) “hedged with put options.” A half dozen of the funds below implement sustainability screens, and ten are pledging to protect you with options—only a couple of others any evidence of demonstrated competence.

Before you even think about investing in any of these funds, some of which are sure to be splendid, check for evidence that the fund manager(s) can execute the strategy through good markets and bad. Everyone spends time figuring out how to do their jobs, but that’s not an argument for why you should be the one paying for the manager’s on-the-job training or for their “I’m sure I can make magic” moments.

How? Two spots: the “portfolio managers” section (there’s a one-sentence one just before the purchase requirements section; skip that one and search for the longer bio under “portfolio managers”) and a section called “related performance,” which will detail the record of separate accounts or private funds that they’ve run using the same strategy. If the manager has no public record of success, run away!

Likewise, if they plan on charging you something near or above two percent, run even faster! That’s a crazy hurdle that almost none of them will surmount with any consistency.

The Great Gabelli offers the month’s longest list of new launches, nine, with the majority being ETF versions of existing mutual funds. (And, occasionally, ETF versions of pretty regrettable existing mutual funds.) His roster, all covered in the same prospectus, includes:

- Gabelli Growth Innovators ETF (GGRW)

- Gabelli Financial Services ETF (GABF)

- Gabelli Global Small Cap ETF (GABS)

- Gabelli Small & Mid Cap ETF (GSMD)

- Gabelli Micro Cap ETF (GMRO)

- Gabelli Love Our Planet & People ETF (LOPP)

- Gabelli Asset ETF (GAST)

- Gabelli Equity Income ETF (GABE)

- Gabelli Green Energy ETF (GGRE)

Love our Planet and People? I think this is someone’s attempt to “talk in a language that young people will hear!” Remember, this is the firm with the Pet Parents ETF too. In any case, it’s a pretty run-of-the-green-mill ESG equity fund. All of the Gabelli ETFs charge the same: 0.90%.

Close behind Gabelli in the race for the most filings is James Alpha, which seems to have concluded that liquid alternatives are the wave of the future.

On the whole, we identified more than 50 new mutual funds and active ETFs in the pipeline. Almost all will launch on the last day of December. We saw the same sort of surge in filings last November, and we’ve tracked the performance of those funds in this month’s Rookie Roster essay. You might enjoy it.

Adaptive Growth Opportunities ETF

Adaptive Growth Opportunities ETF, an actively-managed ETF, seeks capital appreciation. The plan is to invest in ETFs, equities, and fixed income securities in sectors that the managers predict will outperform the market. The manager will allocate a significant percentage to cash and cash equivalents, when appropriate, to position the portfolio defensively. Brian Shevland will manage the fund. Its opening expense ratio is 1.55%.

Advisors Capital Small/Mid Cap Fund

Advisors Capital Small/Mid Cap Fund will seek long-term capital appreciation. The plan is to invest in 30-45 small- to mid-cap stocks issued by firms that are attractively valued, conservatively-structured, competitively-advantaged, dynamic companies with growing free cash flow and honest, competent leadership. The fund will be managed by a three-person team from AC Funds. Its opening expense ratio is 1.99%, and the minimum initial investment will be $2,500.

Advisors Capital Tactical Fixed Income Fund

Advisors Capital Tactical Fixed Income Fund will seek total return with capital preservation as a secondary objective. The plan is to use an “opportunistic and unconstrained investment strategy” to choose some combination of bonds, ETFs, preferred stocks, and so on. The fund will be managed by Kevin Kelly and Kevin Strauss. Its opening expense ratio is 2.29%, and the minimum initial investment will be $2,500.

Advisors Capital US Dividend Fund

Advisors Capital US Dividend Fund will seek long-term capital appreciation. The plan is to invest in 30-50 dividend-paying stocks issued by firms that are attractively valued, conservatively-structured, competitively-advantaged, dynamic companies with growing free cash flow and honest, competent leadership. The fund will be managed by a four-person team from AC Funds. Its opening expense ratio is 1.99%, and the minimum initial investment will be $2,500.

AdvisorShares Alpha DNA Equity Sentiment ETF

AdvisorShares Alpha DNA Equity Sentiment ETF, an actively-managed ETF, seeks long-term capital appreciation. The plan is to (jargon alert!) “deploy a systematic quantitative research platform that combines companies’ alternate digital performance data (data about the online interactions between customers and the digital properties of a company) with financial fundamentals (such as revenue and earnings per share) to algorithmically identify companies that it determines are likely to surprise the market with breakout performance in upcoming quarters.” The resulting portfolio will contain small-cap, mid-cap, and large-cap US stocks and will typically be hedged with put options. The fund will be managed by Wayne Ferbert of Alpha DNA Investment Management. Its opening expense ratio has not been disclosed.

ALPS Active REIT ETF

ALPS Active REIT ETF, an actively-managed, non-transparent ETF, seeks total return through dividends and capital appreciation. The plan is to invest in publicly traded common equity securities of US REITs and US real estate operating companies (not structured as REITs), publicly-traded preferred equity of US REITs and real estate operating companies, cash, and cash equivalents. The fund will be managed by Nicholas Tannura and Julie Pence of GSI Capital. Its opening expense ratio has not been set.

AXS Merger Fund

AXS Merger Fund will seek to achieve positive risk-adjusted returns with less volatility than in the equity markets. The plan is to use a research-driven process to identify investment opportunities with favorable risk/reward trade-offs and pursue “merger arbitrage” techniques. The fund will be managed by George Kellner and Christopher Pultz of Kellner Management, LP. Its investor class opening expense ratio is 2.51%, with a minimum initial investment of $2,500 and a ticker symbol of GAKAX. The institutional share class (GAKIX) has an initial minimum investment of $5,000, with no minimum on subsequent investments and an opening expense ratio of 2.26%.

BBH Partner Fund – High Quality Reserves

BBH Partner Fund – High Quality Reserves will seek income balanced with low price volatility. The plan is to buy very high-quality asset-backed securities, both domestic and foreign. The fund will be managed by Andrew Hofer and Neil Hohmann of Brown Brothers Harriman & Co. Its opening expense ratio has not been established. The minimum initial investment will be $5,000, with no minimum on subsequent purchases.

Boston Common ESG Impact Emerging Markets Fund

Boston Common ESG Impact Emerging Markets Fund will seek long-term capital appreciation. The plan is to create a portfolio of firms that are high quality (lower debt/total capital, earnings stability and stable cash flow), sustainable and undervalued. They’re risk-conscious, rely on bottom-up, fundamental research, and are activist investors who try to influence corporate practices. Their other two “impact” funds – US and International – have been only … uhh, modestly successful. The fund will be managed by Matt Zalosh, Praveen Abichandani, and Liz Su. Its opening expense ratio is 0.99%, and the minimum initial investment will be $10,000.

Cabot Equity Growth ETF

Cabot Equity Growth ETF, an actively-managed ETF, seeks capital appreciation. The plan is to invest in equity securities of companies that will experience above-average secular growth in expanding market segments. The adviser uses the research of the Cabot Wealth Network (CWN). While the fund intends to remain fully invested, it may invest in cash or cash equivalents when CWN’s proprietary Market Timing Indicators predict or identify a bear market. Joe Hegener will manage the fund. Its opening expense ratio has not yet been established.

Catalyst Dynamic Portfolio Fund

Catalyst Dynamic Portfolio Fund will seek long-term capital appreciation. The plan is to use a proprietary quantitative, fundamental top-down investment strategy to allocate its assets to equity, fixed income, and commodity ETFs representing diverse market sectors. The fund will be managed by Richard Oberuc and Philip Nehro of First National Corp. Its opening expense ratio is 1.71%, and the minimum initial investment will be $2,500 for regular and IRA accounts and $100 for automatic investment accounts. The minimum subsequent investment is $50.

Certeza Convex Core Fund

Certeza Convex Core Fund seeks total return. The plan is to buy long and short put and call options on the S&P and on the VIX to provide “a structured return and risk profile that provides upside exposure to the US large-cap equity market and downside risk mitigation.” The fund will be managed by Brett, Jim Macfarlane, and Patrick Sharp. Its opening expense ratio has not been disclosed, and the minimum investment for “A” shares is $2,500.

Corbett Road Tactical Opportunity ETF

Corbett Road Tactical Opportunity ETF, an actively-managed ETF, seeks to provide long-term total return. The plan is to employ its proprietary MACROCAST™ scoring system to allocate investments between equity securities and cash, cash equivalents, and fixed income ETFs. The fund will be managed by Rush Zarrabian, Andrew Serowik, and Travis Trampe. Its opening expense ratio is not yet set. The ticker symbol is OPPX.

Eaton Vance Taxable Municipal Bond Fund

Eaton Vance Taxable Municipal Bond Fund will seek total return with an emphasis on income. The plan is to buy taxable, intermediate-term munis. Those might be bonds issued by an airport authority, a state university, or a port authority. The fund will be managed by Cynthia Clemson and Craig Brandon. Its opening expense ratio is 0.80%, and the minimum initial investment will be $1,000 for Class A shares.

Esoterica-Lucerne European Sustainability ETF

Esoterica-Lucerne European Sustainability ETF, an actively-managed ETF, seeks capital appreciation. The plan is to invest primarily in small and midcap European companies with favorable ESG qualities. The fund managers have not yet been named. Its opening expense ratio has not been established. The ticker symbol is SUST.

Euclid Capital Growth ETF

Euclid Capital Growth ETF, an actively-managed ETF, seeks capital appreciation. The plan is to invest through “Underlying ETFs” in various US and non-U.S. equity sectors during bull markets and fixed income securities, cash, or cash equivalents in a higher-risk environment. ETFs to be included must be listed on a major U.S. Exchange and meet certain liquidity, trading volume, and expense ratio criteria. The fund will be managed by Michael Venuto, Charles Ragauss, William Hoover, Frederic Smoak, John Creekmur, and Karl Ashley. Its opening expense ratio is not yet set.

Franklin Exponential Data ETF

Franklin Exponential Data ETF, an actively-managed ETF, seeks capital appreciation. The plan is to invest in the common stock of companies that are relevant to the theme of exponential data – those that benefit from the use of large data sets and the growth of data or related to data creation, amplification, collection, cleaning, recording, analysis, processing, transmission, delivery, storage, encryption, and security. The fund will be managed by Matthew Moberg and Joyce Lin. Its opening expense ratio has not been set.

Horizon Kinetics Inflation Beneficiaries ETF

Horizon Kinetics Inflation Beneficiaries ETF (INFL), an actively-managed ETF, seeks long-term growth of capital in real (inflation-adjusted) terms. The plan is to invest in the stocks of domestic and foreign companies that are expected to benefit from rising prices of real assets (such as commodities, precious metals, natural resources, real estate, basic materials, equipment, utilities, and infrastructure). They’ll hold 20-60 names. The fund will be managed by Steven Bregman and James Davolos. Its opening expense ratio has not been disclosed.

James Alpha Global Real Estate Investments Fund

James Alpha Global Real Estate Investments Fund will seek total return through a combination of current income and capital appreciation. The plan is to use quantitative screens to find the top 100 real estate securities then rely on fundamental/qualitative research to whittle that down to the top 40. The fund will be managed by Andrew Duffy of Ranger Global Real Estate Advisors, LLC. Mr. Duffy’s previous posts include Eagle Asset Management, TIAA-CREF and a hedge fund. Its opening expense ratio and minimum initial investment have not yet been established.

James Alpha Hedged High Income Fund

James Alpha Hedged High Income Fund will seek high current income. The plan is to combine a combination of long-short, long-only, short-only, and hedging strategies with a fixed-income portfolio. The fund will be managed by Kevin Greene, James Vitalie, Michael Montague, Akos Beleznay, Glenn Koach, Tom Krasner, Jon Duensing, Sal Naro, Vincent Mistretta, and Michael Cannon. Its opening expense ratio and minimum initial investment have not yet been established.

James Alpha Macro Fund

James Alpha Macro Fund will seek attractive long-term risk-adjusted returns relative to traditional financial market indices. The plan is to construct a multi-asset portfolio using a lot of complicated and expensive hedge fund-like strategies. The record for such funds is … not universally affirming. I’d look pretty carefully at the track record of the management team. The fund will be managed by Kevin Greene, James Vitalie, Michael Montague, and Akos Beleznay. Its opening expense ratio and minimum initial investment have not yet been established.

James Alpha Managed Risk Domestic Equity Fund

James Alpha Managed Risk Domestic Equity Fund will seek capital appreciation. The plan is to pair investments in the S&P 500 with an options hedging strategy. The fund will be managed by Kevin Greene, James Vitalie, Michael Montague, Akos Beleznay, Edward Boll, and William Visconto. Its opening expense ratio and minimum initial investment have not yet been established.

James Alpha Managed Risk Emerging Markets Equity Fund

James Alpha Managed Risk Emerging Markets Equity Fund will seek capital appreciation. The plan is to pair investments in the MSCI EM Index with an options hedging strategy. The fund will be managed by Kevin Greene, James Vitalie, Michael Montague, Akos Beleznay, Edward Boll, William Visconto, and James Ryan. Its opening expense ratio and minimum initial investment have not yet been established.

James Alpha Multi Strategy Alternative Income Fund

James Alpha Multi Strategy Alternative Income Fund will seek long-term capital appreciation. The plan is to combine a bunch of hedge fund-like income-oriented strategies, from long/short equity to merger arbitrage and risk-adjusted long/short debt. The fund will be managed by Kevin Greene, James Vitalie, Michael Montague, Akos Beleznay, Andrew Duffy, William Bales, Jakob Holm, George Kellner, Christopher Pultz, Sal Naro, Vincent Mistretta, and Michael Cannon. Its opening expense ratio and minimum initial investment have not yet been established.

Loomis Sayles International Growth Fund

Loomis Sayles International Growth Fund will seek long-term growth of capital. The plan is to invest in growth stocks, targeting companies with sustainable competitive advantages, good management, strong cash flows, and long-term value. The fund will be managed by Aziz Hamzaogullari. Its opening expense ratio has not been established. The minimum initial investment will be $2,500, with a $50 minimum subsequent purchase.

Main Thematic Innovation Rotation ETF

Main Thematic Innovation Rotation ETF, an actively-managed ETF, seeks to outperform the MSCI ACWI Index® in rising markets while limiting losses during periods of decline. The plan is to use a “fund of funds” structure to invest in theme-based equity ETFs in “dynamic thematic rotation.” The fund will be managed by Kim Arthur, James Concidine, and J. Richard Fredericks. Its opening expense ratio has not been set.

MFS Emerging Markets Equity Research Fund

MFS Emerging Markets Equity Research Fund will seek capital appreciation. The plan is to build an all-cap EM portfolio. No particular suggestion about what the “Research” in the fund’s name signals unless it’s the generic “hey, we do our research before buying.” The fund will be managed by Sanjay Natarajan and Deividas Seferis. Its opening expense ratio is not yet set. The minimum initial investment will be $1,000 (reduced to $0 for automatic investment plans) with no minimum subsequent investment.

Mirova U.S. Sustainable Equity Fund

Mirova U.S. Sustainable Equity Fund will seek long-term capital appreciation. The plan is to select stocks by considering important “major transitions” (e.g., climate change, cloud computing, aging populations) that the world is undergoing and selecting companies that it believes are well managed, are expected to benefit from strong, sustainable competitive advantages, and have demonstrated a solid financial structure while avoiding irresponsible risks. The fund will be managed by Amber Fairbanks, Jens Peers, and Hua Cheng. Mirova’s global and international versions of the strategy have been quite successful; that’s a hopeful sign. Its opening expense ratio has not been disclosed, and the minimum initial investment will be $2,500.

Nationwide Large Cap Equity Fund

Nationwide Large Cap Equity Fund will seek long-term capital appreciation. The plan is to buy large-cap stocks with all of the usual virtues: higher quality, reasonably priced, strong business model … The fund managers have not yet been identified. Its opening expense ratio is not established, and the minimum initial investment will be $2,000.

Overlay Shares Hedged Large Cap Equity ETF

Overlay Shares Hedged Large Cap Equity ETF, an actively-managed ETF, seeks total return. The plan is to get equity exposure through other ETFs and use put options to hedge the portfolio. The fund will be managed by Bradley Ball, Adam Stewart, CFA, Shawn Gibson and Justin Boller of Liquid Strategies LLC. Its opening expense ratio has not been disclosed.

Overlay Shares Short Term Bond ETF

Overlay Shares Short Term Bond ETF, an actively-managed ETF, seeks total return. The plan is to invest in short-term, investment-grade domestic bonds through other ETFs and to use listed short-term put options to generate income. The fund will be managed by Bradley Ball, Adam Stewart, Shawn Gibson, and Justin Boller of Liquid Strategies LLC. Its opening expense ratio has not been disclosed.

Parvin Hedged Equity Solari World Fund

Parvin Hedged Equity Solari World Fund (PHSWX) seeks capital preservation, current income, and growth. The plan is to create a global equity portfolio (45-55% US, 30-40% developed international, 10-25% emerging) of ESG-screened, seasoned, well-capitalized businesses. The managers then hedge the portfolio with put options. The fund will be managed by J. Steven Smith of Parvin Fund Management. Mr Smith’s 40+ year career has included stints at Nuveen, Morgan Stanley, and Lehman Brothers. Its opening expense ratio has not been disclosed, and its minimum initial investment will be $1,000. The same prospectus covers the launch of Parvin Select Equity Solari World Fund, the unhedged version of the strategy.

Performance Trust Credit Fund

Performance Trust Credit Fund will seek long-term investment returns by investing in income-producing securities with the potential for capital appreciation. The plan is to use a value-oriented strategy on a top-down basis to determine allocations among sectors in the fixed-income universe and on a bottom-up basis to select specific investments within each sector. The fund will be managed by Anthony Harris, G. Michael Plaiss, Jason Appleson, and Lars Anderson. Its opening expense ratio is 0.99%. The minimum initial investment will be $2,500, with a subsequent investment minimum of $500.

Rayliant Quantamental China Equity ETF

Rayliant Quantamental China Equity ETF, an actively-managed ETF, seeks long-term capital appreciation. The plan is to invest in China using “a combination of quantitative and fundamental investment approaches, known as ‘quantamental’ investing, whereby large amounts of data and algorithms are paired with human insights about economic and financial features (i.e., fundamentals) to make investment decisions.” In addition to being an ugly word, quantamental has rather a lot of marketing buzz surrounding it. If you search the phrase “quantamental investing,” you find some number of folks describing a magic wand. The fund will be managed by Jason Hsu, PhD, Vivek Viswanathan, PhD, and Phillip Wool, PhD. Messrs Hsu and Viswanathan held senior positions at Research Affiliates for around a decade, Dr Wool has been on faculty at SUNY-Buffalo. Its opening expense ratio has not been disclosed.

RBC Small Cap Growth Fund

RBC Small Cap Growth Fund will seek long-term capital appreciation. The plan is to invest in 60-80 small-cap stocks. The ideal portfolio companies have a unique market niche, long-term revenue and earnings growth, consistent financial results, high sales and earnings growth rates, returns on equity and profit margins, “high-quality earnings,” and reasonable valuation. The fund will be managed by Kenneth Tyszko and Richard Drage. Mr. Tyszko runs a SMID-cap fund for US investors and a mid-cap fund for Canadians, both of which are pretty middle-of-the-road. Its opening expense ratio is 1.14%, and the minimum initial investment will be $1,000.

Sirios Focus Fund

Sirios Focus Fund will seek long-term capital appreciation. The plan is to invest primarily in mid- and large-cap stocks of “companies with long-term earnings potential by focusing on earnings growth drivers such as new products, capital spending programs, acquisitions, volume and pricing trends, cost reduction and restructuring programs, and product mix changes.” The fund will be managed by the adviser’s co-founder John F. Brennan. Mr. Brennan also manages an okay long/short fund. Its opening expense ratio has not been disclosed, and the minimum initial investment will be $2,500.

Sound Fixed Income ETF

Sound Fixed Income ETF, an actively-managed ETF, seeks current income. The plan is to invest in US corporate bonds, preferred securities, and ETFs that invest in bonds, sovereign debt, and private placement debt securities. The statement of the discipline comes down to, “we’ll try to choose wisely.” The fund will be managed by a team from Sound Income Strategies, LLC. Its opening expense ratio has not been disclosed. The same portfolio announces four other active ETFs managed by the same team: Enhanced Fixed Income, Sound Equity Income, Sound Enhanced Equity Income, and Sound Total Return.

Swan Hedged Equity US Large Cap ETF

Swan Hedged Equity US Large Cap ETF, an actively-managed ETF, seeks long-term capital appreciation while mitigating overall market risk. The plan is to invest in domestic large-cap stocks then hedge the portfolio with index put options. There’s a whole series of Swan Defined Risk funds concerning which Morningstar’s frets about “a small team, higher fees, and a process that lacks an edge.” The fund will be managed by Randy Swan, Robert Swan, Micah Wakefield, and Chris Hausman. Its opening expense ratio has not been disclosed.

Virtus Newfleet ABS/MBS ETF

Virtus Newfleet ABS/MBS ETF, an actively-managed ETF, seeks income. The plan is to invest in “the securitized credit sectors of the fixed income market by utilizing a relative value, sector rotation approach, which seeks to target ABS and MBS that provide competitive yield and current income.” The fund will be managed by David Albrycht, Andrew Szabo, Nick Rinaldi, and Zachary Szyndlar. Its opening expense ratio has not yet been set.

Ziegler FAMCO Hedged Equity Fund

Ziegler FAMCO Hedged Equity Fund will seek growth of capital and income. The plan is to buy large-cap domestic stocks and use options to hedge the portfolio. Technically, a “covered call” strategy. The fund will be managed by Wiley Angell of Zeigler and Davis Rushing and Kelly Rushing from USCA Asset Management, LLC. The team runs about $90 million in assets in a separate account version of this strategy. From inception (November 2916) through December 2019, the separate account composite returned 4.4%, and its benchmark index returned 7.4%. Its opening expense ratio has not yet been established. The minimum initial investment will be $1,000 for investor class shares, with a $100 minimum subsequent investment.

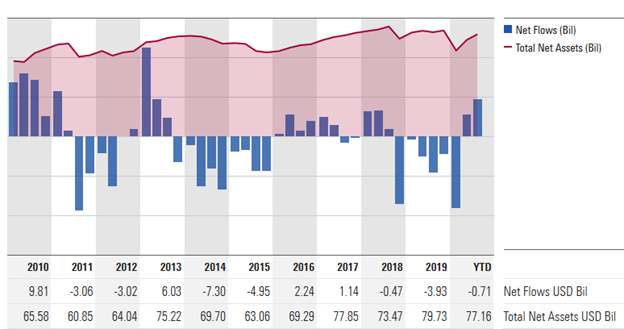

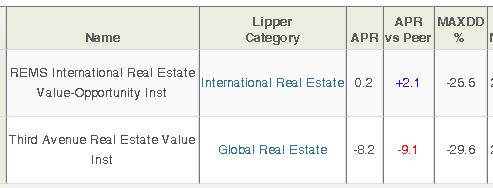

The investment industry is desperate for your money. Mainline firms like Invesco have announced 200 layoffs, Wells Fargo 700 so far, Eaton Vance is likely to see a purge under its new ownership. Compensation consultant Johnson Associates projects that the industry will cut 10% of its entire workforce between late 2020 and 2021. People are panicked, and panicked people do worrisome things. In particular, the industry is desperately slapping a “green” label on every failing fund in hopes of drawing assets and rolling out every variant of new green / socially-responsible / sustainable strategies that they can imagine.

The investment industry is desperate for your money. Mainline firms like Invesco have announced 200 layoffs, Wells Fargo 700 so far, Eaton Vance is likely to see a purge under its new ownership. Compensation consultant Johnson Associates projects that the industry will cut 10% of its entire workforce between late 2020 and 2021. People are panicked, and panicked people do worrisome things. In particular, the industry is desperately slapping a “green” label on every failing fund in hopes of drawing assets and rolling out every variant of new green / socially-responsible / sustainable strategies that they can imagine.

Segall Bryant & Hamill Small Cap Core Fund (SBHCX) is another converted hedge fund, Lower Wacker Small Cap Investment Fund, LLC, (Ummm … Lower Wacker Drive in Chicago is a subterranean stretch that could easily double for the set of a post-apocalyptic zombie flick.) It is crushing its small-cap peers, but that still translates to returns of under 1% YTD. $37 million has found its way to the fund. Morningstar likes it (Bronze Q) though only one of the two managers has invested in it.

Segall Bryant & Hamill Small Cap Core Fund (SBHCX) is another converted hedge fund, Lower Wacker Small Cap Investment Fund, LLC, (Ummm … Lower Wacker Drive in Chicago is a subterranean stretch that could easily double for the set of a post-apocalyptic zombie flick.) It is crushing its small-cap peers, but that still translates to returns of under 1% YTD. $37 million has found its way to the fund. Morningstar likes it (Bronze Q) though only one of the two managers has invested in it.

This month, not so much. Here’s the text:

This month, not so much. Here’s the text:

“Later in the year,” according to the filing, the Holland Balanced Fund (HOLBX) will be liquidated. It’s a perfectly nice fund, run since 1995 by Michael Holland, albeit one with a tiny asset base and an egregious expense ratio (2.0%). Now in his mid-70s, Mr. Holland has had a long and storied career with stints at The Blackstone Group, Salomon Group, Oppenheimer Funds, JPMorgan and a while working with the endowment at his alma mater, Harvard University. We wish him well in this next chapter of his life.

“Later in the year,” according to the filing, the Holland Balanced Fund (HOLBX) will be liquidated. It’s a perfectly nice fund, run since 1995 by Michael Holland, albeit one with a tiny asset base and an egregious expense ratio (2.0%). Now in his mid-70s, Mr. Holland has had a long and storied career with stints at The Blackstone Group, Salomon Group, Oppenheimer Funds, JPMorgan and a while working with the endowment at his alma mater, Harvard University. We wish him well in this next chapter of his life.