Yep, January’s been good. Scary-good. There are several dozen funds that clocked double-digit gains, including several scary-bad ones (Birmiwal Oasis? Legg Mason Capital Management Opportunity C?) but no great funds. So if your portfolio is up six or seven or eight percent so far in 2013, smile and then listen to Han Solo’s call: “Great, kid. Don’t get cocky.” If, like mine, yours is up just two or three percent so far in 2013, smile anyway and say, “you know, Bill, Dan, Jeremy and I were discussing that very issue over coffee last week. I mentioned your portfolio and two of the three just turned pale. The other one snickered and texted something to his trading desk.”

American Funds: The Past Ten Years

In October we launched “The Last Ten,” a monthly series, running between then and February, looking at the strategies and funds launched by the Big Five fund companies (Fido, Vanguard, T Rowe, American and PIMCO) in the last decade.

Here are our findings so far:

Fidelity, once fabled for the predictable success of its new fund launches, has created no compelling new investment option in a decade.

T. Rowe Price continues to deliver on its promises. Investing with Price is the equivalent of putting a strong singles-hitter on a baseball team; it’s a bet that you’ll win with consistency and effort, rather than the occasional spectacular play.

PIMCO has utterly crushed the competition, both in the thoughtfulness of their portfolios and in their performance.

Vanguard’s launches in the past decade are mostly undistinguished, in the sense that they incorporate neither unusual combinations of assets (no “emerging markets balanced” or “global infrastructure” here) nor innovative responses to changing market conditions (as with “real return” or “inflation-tuned” ones). Nonetheless, nearly two-thirds of Vanguard’s new funds earned four or five star ratings from Morningstar, reflecting the compounding advantage of Vanguard’s commitment to low costs and low turnover.

We’ve saved the most curious, and most disappointing, for last. American Funds has always been a sort of benevolent behemoth. They’re old (1931) and massive. They manage more than $900 billion in investments and over 50 million shareholder accounts, with $300 billion in non-U.S. assets.

We’ve saved the most curious, and most disappointing, for last. American Funds has always been a sort of benevolent behemoth. They’re old (1931) and massive. They manage more than $900 billion in investments and over 50 million shareholder accounts, with $300 billion in non-U.S. assets.

It’s hard to know quite what to make of American. On the one hand, they’re an asset-sucking machine. They have 34 funds over $1 billion in assets, 19 funds with over $10 billion each in assets, and two over $100 billion. In order to maximize their take, each fund is sold in 16 – 18 separate packages.

By way of example, American Funds American Balanced is sold in 18 packages and has 18 ticker symbols: six flavors of 529-plan funds, six flavors of retirement plan accounts, the F-1 and F-2 accounts, the garden-variety A, B and C and a load-waived possibility. Which plan you qualify for makes a huge difference. The five-year record for American Balanced R5 places it in the top 10% of its peer group but American Balanced 529B only makes it into the top 40%.

On the other hand, they’re very conservative and generally quite successful. Every American fund is also a fund-of-funds; it has multiple managers … uhh, “portfolio counselors,” each of whom manages just one sleeve of the total portfolio. In general, costs are below average to low, risk scores are below average to low and their Morningstar ratings are way above average.

|

|

Expected Value

|

Observed value

|

|

American Funds, Five Star Funds, overall

|

43

|

38

|

|

American Funds, Four and Five Star Funds, overall

|

139

|

246

|

|

Five Star funds, launched since 9/2002

|

1

|

0

|

|

Four and Five Star funds, launched since 9/2002

|

4

|

1

|

In the past decade, the firm has launched almost no new funds and has made no evident innovations in strategy or product.

It’s The Firm that Time Forgot

Over those 10 years, American Funds launched 31 funds. Sort of. In reality, they repackaged existing American Funds into 10 new target-date funds. Then they repackaged existing American Funds into 16 new funds for college savings plans. After that, they repackaged existing American Funds into new tax-advantaged bond funds. In the final analysis, their new fund launches are three niche bond funds: two muni and one short-term.

|

The Repackaged College Funds

|

|

Balanced Port 529

|

—

|

Moderate Allocation

|

513

|

|

College 2015 529

|

—

|

Conservative Allocation

|

77

|

|

College 2018 529

|

—

|

Conservative Allocation

|

86

|

|

College 2021 529

|

—

|

Moderate Allocation

|

78

|

|

College 2024 529

|

—

|

Moderate Allocation

|

62

|

|

College 2027 529

|

—

|

Aggressive Allocation

|

44

|

|

College 2030 529

|

—

|

Aggressive Allocation

|

33

|

|

College Enrollment 529

|

—

|

Intermediate-Term Bond

|

29

|

|

Global Balanced 529

|

—

|

World Allocation

|

3,508

|

|

Global Growth Port 529

|

—

|

World Stock

|

139

|

|

Growth & Income 529

|

—

|

Aggressive Allocation

|

613

|

|

Growth Portfolio 529

|

—

|

World Stock

|

254

|

|

Income Portfolio 529

|

—

|

Conservative Allocation

|

596

|

|

International Growth & Income 529

|

★★★★ |

Foreign Large Blend

|

5,542

|

|

Mortgage 529

|

—

|

Intermediate-Term Bond

|

730

|

|

The Repackaged Target-Date Funds

|

|

Target Date Ret 2010

|

★ |

Target Date

|

1,028

|

|

Target Date Ret 2015

|

★★ |

Target Date

|

1,629

|

|

Target Date Ret 2020

|

★★ |

Target Date

|

2,376

|

|

Target Date Ret 2025

|

★★ |

Target Date

|

2,071

|

|

Target Date Ret 2030

|

★★★ |

Target Date

|

2,065

|

|

Target Date Ret 2035

|

★★ |

Target Date

|

1,416

|

|

Target Date Ret 2040

|

★★★ |

Target Date

|

1,264

|

|

Target Date Ret 2045

|

★★ |

Target Date

|

679

|

|

Target Date Ret 2050

|

★★★ |

Target Date

|

622

|

|

Target Date Ret 2055

|

—

|

Target-Date

|

119

|

|

The Repackaged Funds-of-Bond-Funds

|

|

Preservation Portfolio

|

—

|

Intermediate-Term Bond

|

368

|

|

Tax-Advantaged Income Portfolio

|

—

|

Conservative Allocation

|

113

|

|

Tax-Exempt Preservation Portfolio

|

—

|

National Muni Bond

|

164

|

|

The Actual New Funds

|

|

Short-Term Tax-Exempt

|

★ ★ |

National Muni Bond

|

719

|

|

Short Term Bond Fund of America

|

★ |

Short-Term Bond

|

4,513

|

|

Tax-Exempt Fund

|

—

|

New York Muni Bond

|

134

|

|

|

|

|

|

A huge firm. Ten tumultuous years. And they manage to image three pedestrian bond funds, none of which they execute with any particular panache.

Not to sound dire, but phrases like “rearranging the deck chairs” and “The Titanic was huge and famous, too” come unbidden to mind.

Morningstar, Part One: Rating the Rater

Morningstar’s “analyst ratings” have come in for a fair amount of criticism lately. Chuck Jaffe notes that, like the stock analysts of yore, Morningstar seems never to have met a fund that it doesn’t like. “The problem,” Jaffe writes, “is the firm’s analysts like nearly two-thirds of the funds they review, while just 5% of the rated funds get negative marks. That’s less fund watchdog, and more fund lap dog” (“The Fund Industry’s Worst Offenders of 2012,” 12/17/12). Morningstar, he observes, “howls at that criticism.”

The gist of Morningstar’s response is this: “we only rate the funds that matter, and thousands of these flea specks will receive neither our attention nor the average investor’s.” Laura Lallos, a senior mutual-fund analyst for Morningstar, puts it rather more eloquently. “We focus on large funds and interesting funds. That is, we cover large funds whether they are ‘interesting’ or not, because there is a wide audience of investors who want to know about them. We also cover smaller funds that we find interesting and well-managed, because we believe they are worth bringing to our subscribers’ attention.”

More recently Javier Espinoza of The Wall Street Journal noted that the different firms’ rating methods create dramatically different thresholds for being recognized as excellent (“The Ratings Game,” 01/04/13). Like Mr. Jaffe, he notes the relative lack of negative judgments by Morningstar: only 235 of 4299 ratings – about 5.5% – are negative.

Since the Observer’s universe centers on funds too small or too new to be worthy of Morningstar’s attention, we were pleased at Morningstar’s avowed intent to cover “smaller funds that we find interesting and well-managed.” A quick check of Morningstar’s database shows:

2390 funds with under $100 million in assets.

41 funds that qualify as “worthy of our subscribers’ attention.” It could be read as good news that Morningstar thinks 1.7% of small funds are worth looking at. One small problem. Of the 41 funds they rate, 34 are target-date or retirement income funds and many of those target-date offerings are actually funds-of-funds. Which leaves …

7 actual funds that qualify for attention. That would be one-quarter of one percent of small funds. One quarter of one percent. Uh-huh.

But that also means that the funds which survive Morningstar’s intense scrutiny and institutional skepticism of small funds must be SPLENDID! And so, here they are:

Ariel Discovery Investor (ARDFX), rated Bronze. This is a small cap value fund that we considered profiling shortly after launch, but where we couldn’t discern any compelling argument for it. On whole, Morningstar rather likes the Ariel funds despite the fact that they don’t perform very well. Five of the six Ariel funds have trailed their peers since inception and the sixth, the flagship Ariel Fund (ARGFX) has trailed the pack in six of the past 10 years. That said, they have an otherwise-attractive long-term, low-turnover value orientation.

Matthews China Dividend Investor (MCDFX), rated Bronze. Also five stars, top 1% performer, low risk, low turnover, with four of five “positive” pillars and the sponsorship of the industry’s leading Asia specialist. I guess I’d think of this as rather more than Bronze-y but Matthews is one of the fund companies toward which I have a strong bias.

TCW International Small Cap (TGICX), rated Bronze also only one of the five “pillars” of the rating is actually positive. The endorsement is based on the manager’s record at Oppenheimer International Small Company (OSMAX). Curiously, TGICX turns its portfolio at three times the rate of OSMAX and has far lagged it since launch.

The Collar (COLLX), rated Bronze, uses derivatives to offset the stock market’s volatility. In three years it has twice made 3% and once lost 3%. The underlying strategy, executed in separate accounts, made a bit over 4% between 2005-2010. Low-risk, low-return and different from – if not demonstrably better than – other options-based funds.

Quaker Akros Absolute Return (AAARFX) rated Neutral. Well … this fund does have exceedingly low risk, about one-third of the beta of the average long/short fund. On the other hand, over the eight years between inception and today, it managed to turn a $10,000 investment into a $10,250 portfolio. Right. Invest $10,000 and make a cool $30/year. Your account would have peaked in September 2009 (at $11,500) and have drifted down since then.

Quaker Event Arbitrage A (QEAAX), rated Neutral. Give or take the sales load, this is a really nice little fund that the Observer profiled back when it was the no-load Pennsylvania Avenue Event Driven Fund (PAEDX). Same manager, same discipline, with a sales force attached now.

Van Eck Multi-Manager Alternatives A (VMAAX), which strikes me as the most baffling pick of the bunch. It has a 5.75% load, 2.84% expense ratio, 250% turnover (stop me when I get to the part that would attract you), and 31 managers representing 14 different sub-advisers. Because Van Eck cans managers pretty regularly, there are also 20 former managers of the fund. Morningstar rates the fund as “Neutral” with the sole positive pillar being “people.” It’s not clear whether Morningstar was endorsing the fund on the dozens already fired, the dozens recently hired or the underlying principle of regularly firing people (see: Romney, Mitt, “I like firing people”).

I’m afraid that on a Splendid-o-meter, this turns out to be one Splendid (Matthews), one Splendid-ish (Quaker Event Driven), four Meh and one utterly baffling (Van Ick).

Of 57 small, five-star funds, only one (Matthews) warrants attention? Softies that we are, the Observer has chosen to profile seven of those 57 and a bunch of non-starred funds. We’re actually pretty sure that they do warrant rather more attention – Morningstar’s and investors’ – than they’ve received. Those seven are:

Huber Small Cap Value (HUSIX)

Marathon Value (MVPFX)

Pinnacle Value (PVFIX)

Stewart Capital Mid Cap (SCMFX)

The Cook and Bynum Fund (COBYX)

Tilson Dividend (TILDX)

Tributary Balanced (FOBAX)

Introducing: The Elevator Talk

Being the manager of a small fund can be incredibly frustrating. You’re likely very bright. You have a long record at other funds or in other vehicles. You might well have performed brilliantly for a long time: top 1% for the trailing year, three years and five years, for example. (There are about 10 tiny funds with that distinction.) And you still can’t get anybody to notice you.

Dang.

The Observer helps, both because we’ve got 11,000 or so regular readers and an interest in small and new funds. Sadly, there’s a limit to how many funds we can profile; likely somewhere around 20 a year. I’m frequently approached by managers, asking if we’d consider profiling their funds. When we say “no,” it’s as often because of our resource limits as of their records.

The Observer helps, both because we’ve got 11,000 or so regular readers and an interest in small and new funds. Sadly, there’s a limit to how many funds we can profile; likely somewhere around 20 a year. I’m frequently approached by managers, asking if we’d consider profiling their funds. When we say “no,” it’s as often because of our resource limits as of their records.

Frustration gave rise to an experimental new feature: The Elevator Talk. We’ve decided to offer one or two managers each month the opportunity to make a 200 word pitch to you. That’s about the number of words a slightly-manic elevator companion could share in a minute and a half. In each case, I’ve promised to offer a quick capsule of the fund and a link back to the fund’s site. Other than that, they’ve got 200 words and precisely as much of your time and attention as you’re willing to share. These aren’t endorsements; they’re opportunities to learn more.

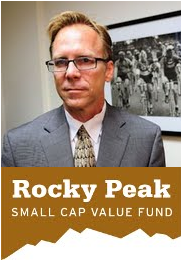

Elevator Talk #1: Tom Kerr, Rocky Peak Small Cap Value (RPCSX)

Mr. Kerr manages the Rocky Peak Small Cap Value Fund (RPCSX), which launched on April 2, 2012. He co-managed RCB’s Small Cap Value strategy and the CNI Charter RCB Small Cap Value Fund (formerly RCBAX, now CSCSX) fund. Tom offers these 200 words on why folks should check in:

Mr. Kerr manages the Rocky Peak Small Cap Value Fund (RPCSX), which launched on April 2, 2012. He co-managed RCB’s Small Cap Value strategy and the CNI Charter RCB Small Cap Value Fund (formerly RCBAX, now CSCSX) fund. Tom offers these 200 words on why folks should check in:

Although this is a new Fund, I have a 14-years solid track record managing small cap value strategies at a prior firm and fund. One of the themes of this new Fund is improving on the investment processes I helped develop. I believe we can improve performance by correcting mistakes that my former colleagues and I made such as not making general or tactical stock market calls, or not holding overvalued stocks just because they are perceived to be great quality companies.

The Fund’s valuation process of picking undervalued stocks is not dogmatic with a single approach, but encompasses multivariate valuation tools including discounted cash flows, LBO models, M&A valuations and traditional relative valuation metrics. Taken together those don’t give up a single “right number” but range of plausible valuations, for which our shorthand is “the Circle of Value.”

As a small operation with one PM, two intern analysts and one administrative assistant, I can maintain patience and diligence in the investment process and not be influenced by corporate politics, investment committee bureaucracy and water cooler distractions.

The Fund’s goal is to be competitive in up markets but significantly outperform in down markets, not by holding high levels of cash (i.e. making a market call), but by carefully buying stocks selling at a discount to intrinsic value and employing a reasonable margin of safety.

The fund’s minimum initial investment is $10,000, reduced to $1,000 for IRAs and accounts set up with AIPs. The fund’s website is Rocky Peak Funds . Tom’s most-recent discussion of the fund appears in his September 2012 Semi-Annual Report. If you meet him, you might ask about the story behind the “rocky peak” name.

Morningstar, Part Two: “Speaking of Old Softies”

There are, in addition, 123 beached whales: funds with more than a billion in assets that have trailed their peer groups for the past three, five and ten years. Of those, 29 earn ratings in the Bronze to Gold range, 31 are Neutral and just six warrant Negative ratings. So, being large and consistently bad makes you five times more likely to earn a positive rating than a negative one.

There are, in addition, 123 beached whales: funds with more than a billion in assets that have trailed their peer groups for the past three, five and ten years. Of those, 29 earn ratings in the Bronze to Gold range, 31 are Neutral and just six warrant Negative ratings. So, being large and consistently bad makes you five times more likely to earn a positive rating than a negative one.

Hmmm … what about being very large and consistently wretched? There are 25 funds with more than two billion in assets that have trailed at least two-thirds of their peers for the past three, five and ten years. Of those, seven earn Bronze or Silver ratings while just three are branded with the Negative. So, large and wretched still makes you twice as likely to earn Morningstar’s approval as their disapproval.

What are huge and stinkin’ like Limburger cheese left to ripen in the August sun? Say $5 billion and trailing 75% of your peers? There are five such funds, and not a Negative in sight.

Morningstar’s Good Work

Picking on Morningstar is both fun and easy, especially if you don’t have the obligation to come up with anything better on your own. It’s sad that much of the criticism, as when pundits claim that Morningstar’s system has no predictive validity (check our “Best of the Web” discussion: Morningstar has better research to substantiate their claims than any other publicly accessible system), is uninformed blather. I’d like to highlight two particularly useful pieces that Morningstar released this month.

Their annual “Buy the Unloved” recommendations were released on January 24. This is an old and alluring system that depends on the predictable stupidity of the masses in order to make money. At base, their recommendation is to buy in 2013 funds in the three categories that saw the greatest investor flight in 2012. Conversely, avoiding the sector that others have rushed to, is wise. Katie Rushkewicz Reichart reports that

From 1993 through 2012, the “unloved” strategy gained 8.4% annualized to the “loved” strategy’s 5.1% annualized. The unloved strategy has also beaten the MSCI World Index’s 6.9% annualized gain and has slightly beat the Morningstar US Market Index’s 8.3% return.

So, where should you be buying? Large cap U.S. stocks of all flavors. “The most unloved equity categories are also the most unpopular overall: large growth (outflows of $39.5 billion), large value (outflows of $16 billion), and large blend (outflows of $14.4 billion).”

A second thought-provoking feature offered a comparison that I’ve never before encountered. Within each broad fund category, Morningstar tracked the average performance of mutual funds in comparison to ETFs and closed-end funds. In terms of raw performance, CEFs were generally superior to both mutual funds and ETFs. That makes some sense, at least in rising markets, because CEFs make far greater use of leverage than do other products. The interesting part was that CEFs maintained their dominance even when the timeframe included part of the 2007-09 meltdown (when leverage was deadly) and even when risk-adjusted, rather than raw, returns are used.

There’s a lot of data in their report, entitled There’s More to Fund Investing Than Mutual Funds (01/29/13), and I’ll try to sort through more of it in the month ahead.

Matthews Asia Strategic Income Conference Call

We spent an hour on Tuesday, January 22, talking with Teresa Kong of Matthews Asia Strategic Income. The fund is about 14 months old, has about $40 million in assets, returned 13.6% in 2012 and 11.95% since launch (through Dec. 31, 2012).

We spent an hour on Tuesday, January 22, talking with Teresa Kong of Matthews Asia Strategic Income. The fund is about 14 months old, has about $40 million in assets, returned 13.6% in 2012 and 11.95% since launch (through Dec. 31, 2012).

For folks interested but unable to join us, here’s the complete audio of the hour-long conversation.

|

The MAINX conference call

|

|

When you click on the link, the file will load in your browser and will begin playing after it’s partially loaded. If the file downloads, instead, you may have to double-click to play it.

|

Quick highlights:

- this is designed to offer the highest risk-adjusted returns of any of the Matthews funds. In this case “risk-adjusted” is measured by the fund’s Sharpe ratio. Since launch, its Sharpe ratio has been around 2.0 which would be hard for any fixed-income fund to maintain indefinitely. They’ve pretty comfortable that they can maintain a Sharpe of 1.0 or so.

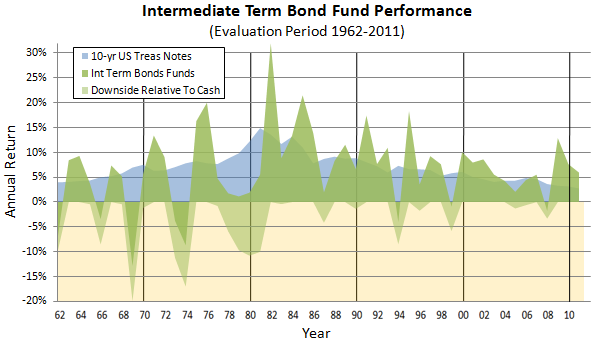

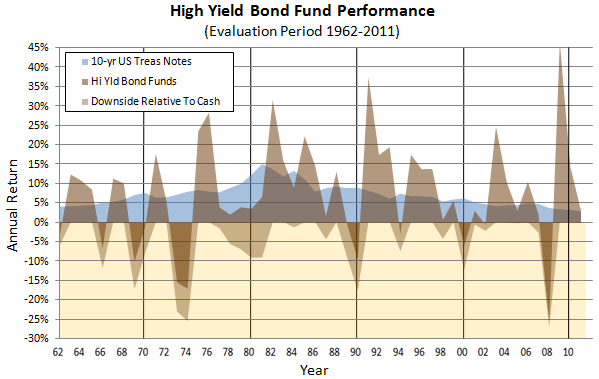

- the manager describes the US bond market, and most especially Treasuries, as offering “asymmetric risk” over the intermediate term. Translation: more downside risk than upside opportunity. She does not embrace the term “bubble” because that implies an explosive risk (i.e., “popping”) where she imagines more like the slow leak of air out of a balloon. (Thanks for Joe N for raising the issue.)

- given some value in having a fixed income component of one’s portfolio, Asian fixed-income offers two unique advantages in uncertain times. First, the fundamentals of the Asian fixed-income market – measures of underlying economic growth, market evolution, ability to pay and so on – are very strong. Second, Asian markets have a low beta relative to US intermediate-term Treasuries. If, for example, the 5-year Treasury declines 1% in value, U.S. investment grade debt will decline 0.7%, the global aggregate index 0.5% and Asia fixed-income around 0.25%.

- MAINX is one of the few funds to have positions in both dollar-denominated and local currency Asian debt (and, of course, equities as well). She argues that the dollar-denominated debt offers downside protection in the case of a market disruption since the panicked “flight to quality” tends to benefit Treasuries and linked instruments while local currency debt might have more upside in “normal” markets. (Jeff Wang’s question, I believe.)

- in equities, Matthews looks for stocks with “bond-like characteristics.” They target markets where the dividend yield in the stock market exceeds the yield on local 10-year bonds. Taiwan is an example. Within such markets, they look for high yielding, low beta stocks and tend to initiate stock positions about one-third the size of their initial bond positions. A new bond might come in at 200 basis points while a new stock might be 75. (Thanks to Dean for raising the equities question and Charles for noticing the lack of countries such as Taiwan in the portfolio.)

- most competitors don’t have the depth of expertise necessary to maximize their returns in Asia. Returns are driven by three factors: currency, credit and interest rates. Each country has separate financial regimes. There is, as a result, a daunting lot to learn. That will lead most firms to simply focus on the largest markets and issuers. Matthews has a depth of expertise that allows them to do a better job of dissecting markets and of allocating resources to the most profitable part of the capital structure (for example, they’re open to buying Taiwanese equity but find its debt market to be fundamentally unattractive). There was an interesting moment when Teresa, former head of BlackRock’s emerging markets fixed-income operations, mused, “even a BlackRock, big as we were, I often felt we were a mile wide and [pause] … not as deep as I would have preferred.” The classic end of the phrase, of course, is “and an inch deep.” That’s significant since BlackRock has over 10,000 professionals and about $1.4 trillion in assets under management.

AndyJ, one of the members of the Observer’s discussion board and a participant in the call, adds a seventh highlight:

- TK said explicitly that they have no neutral position or target bands of allocation for anything, i.e., currency exposure, sovereign vs. corporate, or geography. They try to get the biggest bang for the level of risk across the portfolio as a whole, with as much “price stability” (she said that a couple of times) as they can muster.

Matthews Asia Strategic Income, Take Two

One of the neat things about writing for you folks is the opportunity to meet all sorts of astonishing people. One of them is Charles Boccadoro, an active member of the Observer’s discussion community. Charles is renowned for the care he takes in pulling together data, often quite powerful data, about funds and their competitors. After he wrote an analysis of MAINX’s competitors, Rick Brooks, another member of the board, encouraged me to share Charles’s work with a broader audience. And so I shall.

By way of background, Charles describes himself as

Strictly amateur investor. Recently retired aerospace engineer. Graduated MIT in 1981. Investing actively in mutual funds since 2002. Was heavy FAIRX when market headed south in 2008, but fortunately held tight through to recovery. Started reading FundAlarm in 2007 and have followed MFO since inception in May 2011. Tries to hold fewest funds in portfolio, but many good recommendations by MFO community make in nearly impossible (e.g., bought MAINX after recent teleconference). Live in Central Coast California.

Geez, the dude’s an actual rocket scientist.

After carefully considering eight funds which focus on Asian fixed-income, Charles concludes there are …

Few Alternatives to MAINX

Matthews Asia Strategic Income Fund (MAINX) is a unique offering for US investors. While Morningstar identifies many emerging market and world bond funds in the fixed income category, only a handful truly focus on Asia. From its prospectus:

Under normal market conditions, the Strategic Income Fund seeks to achieve its investment objective by investing at least 80% of its total net assets…in the Asia region. ASIA: Consists of all countries and markets in Asia, including developed, emerging, and frontier countries and markets in the Asian region.

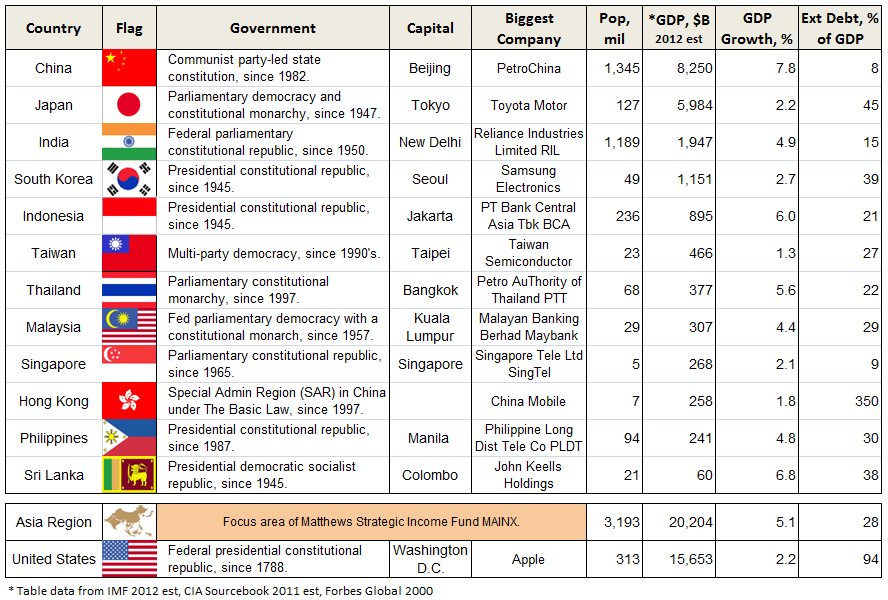

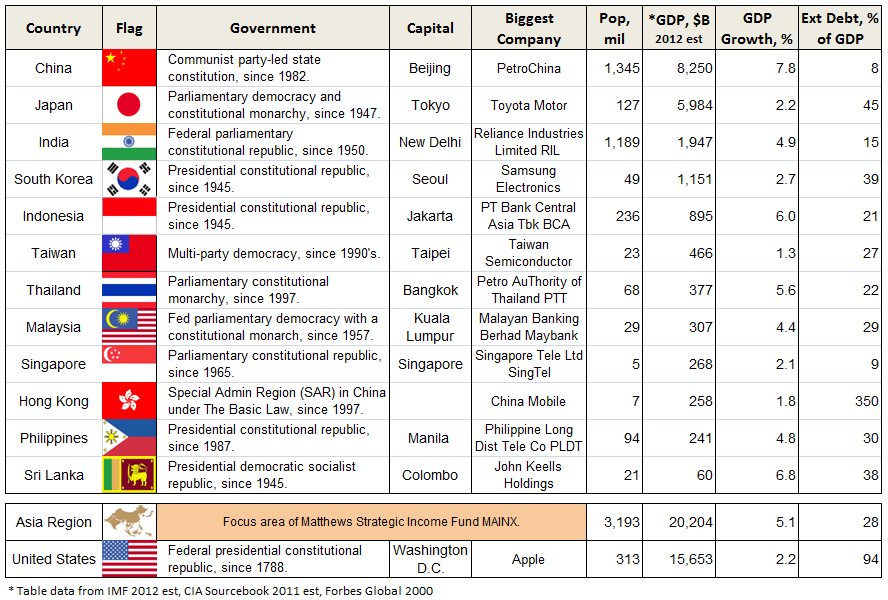

Fund manager Teresa Kong references two benchmarks: HSBC Asian Local Bond Index (ALBI) and J.P. Morgan Asia Credit Index (JACI), which cover ten Asian countries, including South Korea, Hong Kong, India, Singapore, Taiwan, Malaysia, Thailand, Philippines, Indonesia and China. Together with Japan, these eleven countries typically constitute the Asia region. Recent portfolio holdings include Sri Lanki and Australia, but the latter is actually defined as Asia Pacific and falls into the 20% portfolio allocation allowed to be outside Asia proper.

As shown in following table, the twelve Asian countries represented in the MAINX portfolio are mostly republics established since WWII and they have produced some of the world’s great companies, like Samsung and Toyota. Combined, they have ten times the population of the United States, greater overall GDP, 5.1% GDP annual growth (6.3% ex-Japan) or more than twice US growth, and less than one-third the external debt. (Hong Kong is an exception here, but presumably much of its external debt is attributable to its role as the region’s global financial center.)

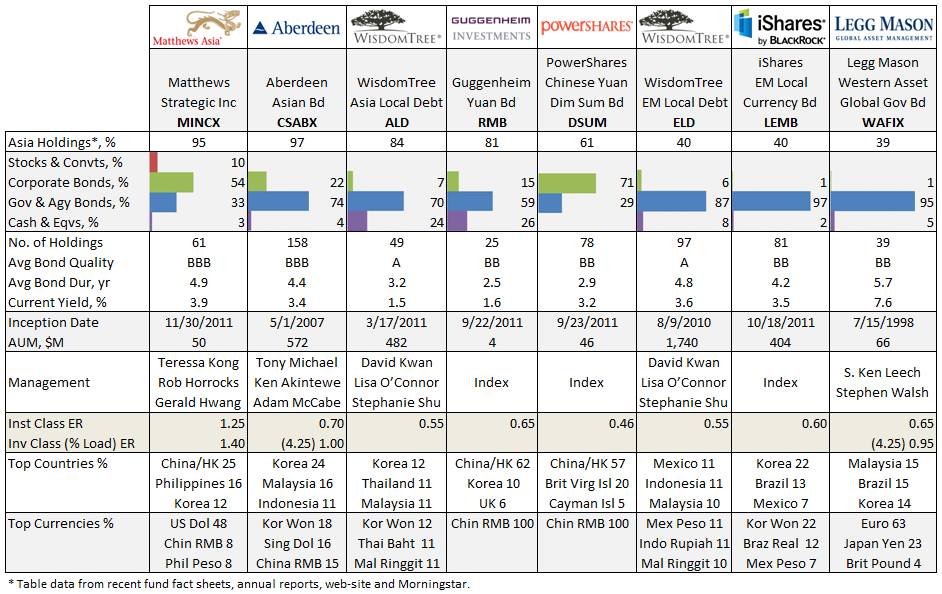

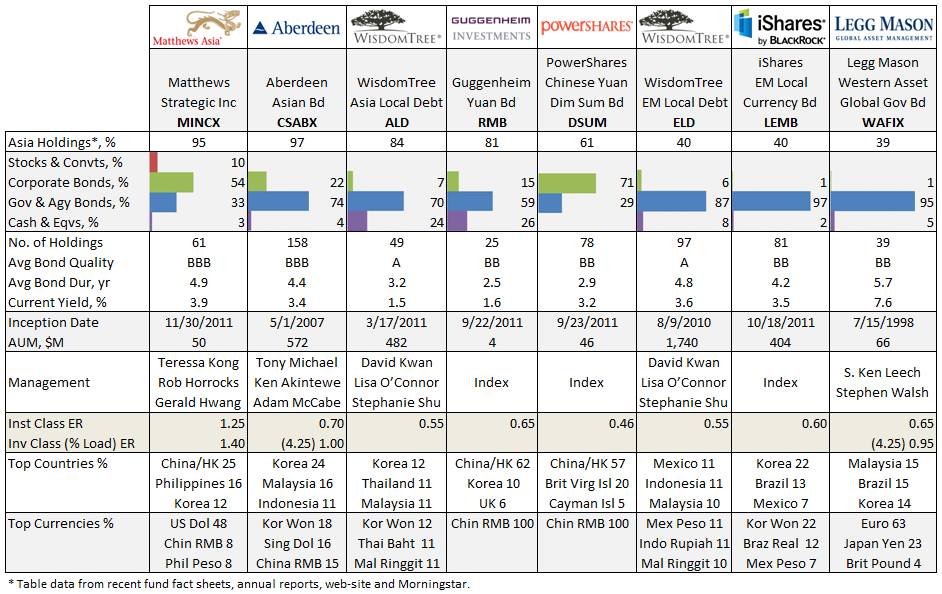

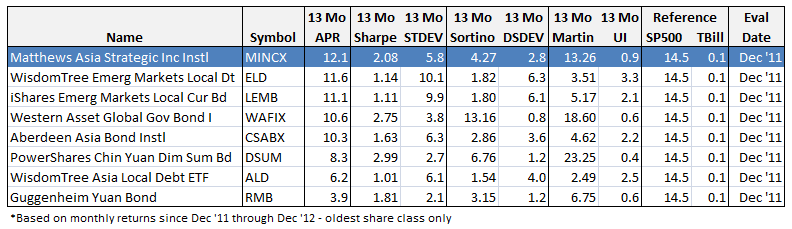

Very few fixed income fund portfolios match Matthews MAINX (or MINCX, its institutional equivalent), as summarized below. None of these alternatives hold stocks.

Aberdeen Asian Bond Fund CSBAX and WisdomTree ETF Asian Local Debt ALD cover the most similar geographic region with debt held in local currency, but both hold more government than corporate debt. CSBAX recently dropped “Institutional” from its name and stood-up investor class offerings early last year. ALD maintains a two-tier allocation across a dozen Asian countries, ex Japan, monitoring exposure and rebalancing periodically. Both CSBAX and ALD have about $500M in assets. ALD trades at fairly healthy volumes with tight bid/ask spreads. WisdomTree offers a similar ETF in Emerging Market Local Debt ELD, which comprises additional countries, like Russia and Mexico. It has been quite successful garnering $1.7B in assets since inception in 2010. Powershares Chinese Yuan Dim Sum Bond ETF DSUM (cute) and similar Guggenheim Yuan Bond ETF RMB (short for Renminbi, the legal tender in mainland China, ex Hong Kong) give US investors access to the Yuan-denominated bond market. The fledgling RMB, however, trades at terribly low volumes, often yielding 1-2% premiums/discounts.

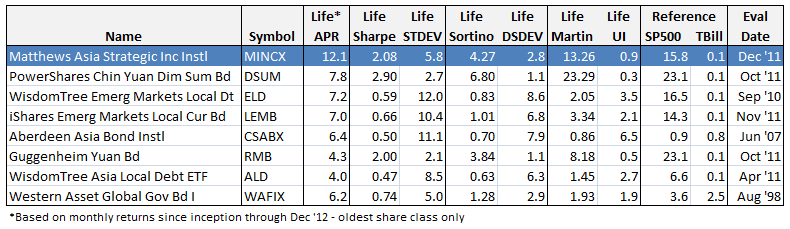

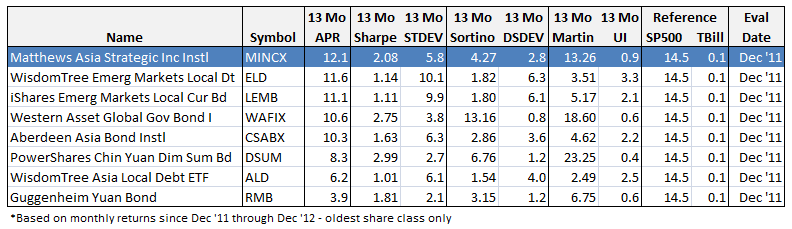

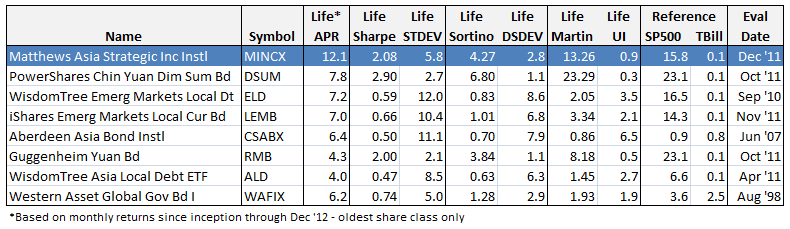

A look at life-time fund performance, ranked by highest APR relative to 3-month TBill:

Matthews Strategic Income tops the list, though of course it is a young fund. Still, it maintains low down side volatility DSDEV and draw down (measured by Ulcer Index UI). Most of the offerings here are young. Legg Mason Western Asset Global Government Bond (WAFIX) is the oldest; however, last year it too changed its name, from Western Asset Non-U.S. Opportunity Bond Fund, with a change in investment strategy and benchmark.

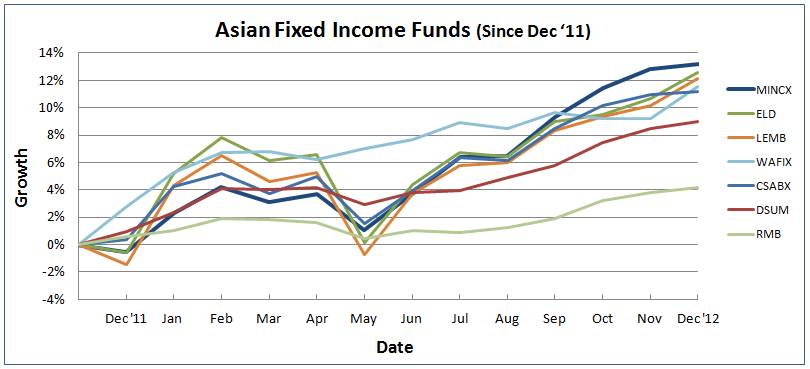

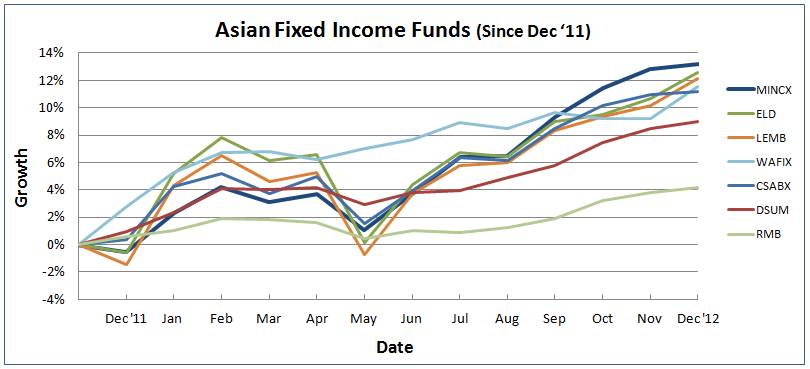

Here’s look at relative time frame, since MAINX inception, for all funds listed:

Charles, 25 January 2013

February’s Conference Call: Seafarer Overseas Growth & Income

As promised, we’re continuing our moderated conference calls through the winter. You should consider joining in. Here’s the story:

As promised, we’re continuing our moderated conference calls through the winter. You should consider joining in. Here’s the story:

- Each call lasts about an hour

- About one third of the call is devoted to the manager’s explanation of their fund’s genesis and strategy, about one third is a Q&A that I lead, and about one third is Q&A between our callers and the manager.

- The call is, for you, free. Your line is muted during the first two parts of the call (so you can feel free to shout at the danged cat or whatever) and you get to join the question queue during the last third by pressing the star key.

Our next conference call features Andrew Foster, manager of Seafarer Overseas Growth and Income (SFGIX). It’s Tuesday, February 19, 7:00 – 8:00 p.m., EST.

Why you might want to join the call?

Put bluntly: you can’t afford another lost decade. GMO is predicting average annual real returns for U.S. large cap stocks of 0.1% for the next 5-7 years. The strength of the January 2013 rally is likely to push GMO’s projections into the red. Real return on US bonds is projected to be negative, about -1.1%. Overseas looks better and the emerging markets – source of the majority of the global economy’s growth over the next decade – look best of all.

The problem is that these markets have been so volatile that few investors have actually profited as richly as they might by investing in them. The average e.m. fund dropped 55% in 2008, rose 75% in 2009, then alternated between gaining and losing 18% per year before 2010 – 2012. That sort of volatility induces self-destructive behavior on most folk’s part; over the past five years (through 12/30/12), Vanguard’s Emerging Market Stock Index fund lost 1% per year but the average investor in that fund lost 6% per year. Why? Panicked selling in the midst of crashes, panicked buying at the height of upbursts.

In emerging markets investing especially, you benefit from having an experienced manager who is as aware of risks as of opportunities. For my money (and he has some small pile of my money), no one is better at it than Andrew Foster of Seafarer. Andrew had a splendid record as manager of Matthews Asian Growth and Income (MACSX), which for most of his watch was the least risky, most profitable way to invest in Asian equities. Andrew now runs Seafarer, where he runs an Asia-centered portfolio which has the opportunity to diversify into other regions of the world. He’ll join us immediately after the conclusion of Seafarer’s splendid first year of operation to talk about the fund and emerging markets as an opportunity set, and he’ll be glad to take your questions as well.

How can you join in?

Click on the “register” button and you’ll be taken to Chorus Call’s site, where you’ll get a toll free number and a PIN number to join us. On the day of the call, I’ll send a reminder to everyone who has registered.

Click on the “register” button and you’ll be taken to Chorus Call’s site, where you’ll get a toll free number and a PIN number to join us. On the day of the call, I’ll send a reminder to everyone who has registered.

Would an additional heads up help?

About a hundred readers have signed up for a conference call mailing list. About a week ahead of each call, I write to everyone on the list to remind them of what might make the call special and how to register. If you’d like to be added to the conference call list, just drop me a line.

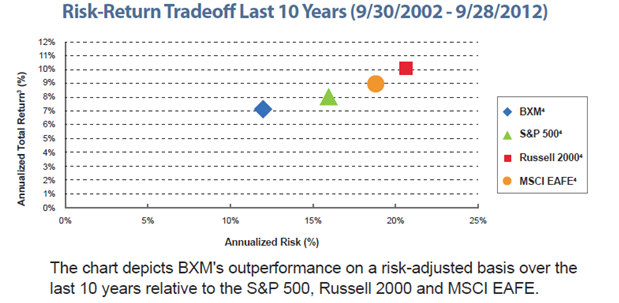

Bonus Time! RiverNorth Explains Dynamic Buy-Write

A couple months ago we profiled RiverNorth Dynamic Buy-Write Fund (RNBWX), which uses an options strategy to pursue returns in excess of the stock market’s with only a third of the market’s volatility. RiverNorth is offering a webcast about the fund and its strategy for interested parties. It will be hosted by Eric Metz, RNBWX’s manager and a guy with a distinguished record in options investing. He’s entitled the webcast “Harnessing Volatility.” The webcast will be Wednesday, February 20th, 2013 3:15pm CST – 4:15pm CST.

A couple months ago we profiled RiverNorth Dynamic Buy-Write Fund (RNBWX), which uses an options strategy to pursue returns in excess of the stock market’s with only a third of the market’s volatility. RiverNorth is offering a webcast about the fund and its strategy for interested parties. It will be hosted by Eric Metz, RNBWX’s manager and a guy with a distinguished record in options investing. He’s entitled the webcast “Harnessing Volatility.” The webcast will be Wednesday, February 20th, 2013 3:15pm CST – 4:15pm CST.

The call will feature:

- Overview of volatility

- Growth of options and the use of options strategies in a portfolio

- How volatility and options strategies pertain to the RiverNorth Dynamic Buy-Write Fund (RNBWX)

- Advantages of viewing the world with volatility in mind

To register, navigate over to www.rivernorthfunds.com and click on the “Events” link.

Cook & Bynum On-Deck

Our March conference call will occur unusually early in the month, so I wanted to give you advance word of it now. On Tuesday, March 5, from 7:00 – 8:00 CST, we’ll have a chance to talk with Richard Cook and Dow Bynum, of The Cook and Bynum Fund (COBYX). The guys run an ultra-concentrated portfolio which, over the past three years, has produced returns modestly higher than the stock market’s with less than half of the volatility.

Our March conference call will occur unusually early in the month, so I wanted to give you advance word of it now. On Tuesday, March 5, from 7:00 – 8:00 CST, we’ll have a chance to talk with Richard Cook and Dow Bynum, of The Cook and Bynum Fund (COBYX). The guys run an ultra-concentrated portfolio which, over the past three years, has produced returns modestly higher than the stock market’s with less than half of the volatility.

You’d imagine that a portfolio with just seven stocks would be wildly erratic. It isn’t. Our bottom line on our profile of the fund: “It’s working. Cook and Bynum might well be among the best. They’re young. The fund is small and nimble. Their discipline makes great sense. It’s not magic, but it has been very, very good and offers an intriguing alternative for investors concerned by lockstep correlations and watered-down portfolios.”

How can you join in?

If you’d like to join in, just click on register and you’ll be taken to the Chorus Call site. In exchange for your name and email, you’ll receive a toll-free number, a PIN and instructions on joining the call.

If you’d like to join in, just click on register and you’ll be taken to the Chorus Call site. In exchange for your name and email, you’ll receive a toll-free number, a PIN and instructions on joining the call.

Remember: registering for one call does not automatically register you for another. You need to click each separately. Likewise, registering for the conference call mailing list doesn’t register you for a call; it just lets you know when an opportunity comes up.

Observer Fund Profiles

Each month the Observer provides in-depth profiles of between two and four funds. Our “Most Intriguing New Funds” are funds launched within the past couple years that most frequently feature experienced managers leading innovative newer funds. “Stars in the Shadows” are older funds that have attracted far less attention than they deserve. This month’s lineup features:

Artisan Global Equity (ARTHX): after the January 11 departure of lead manager Barry Dargan, the argument for ARTHX is different but remains compelling.

Matthews Asia Strategic Income (MAINX): the events of 2012 and early 2013 make an already-intriguing fund much more interesting.

PIMCO Short Asset Investment, “D” shares (PAIUX): Bill Gross trusts this manager and this strategy to management tens of billions in cash for his funds. Do you suppose he might be good enough to warrant your attention to?

Whitebox Long Short Equity, Investor shares (WBLSX): yes, I know I promised a profile of Whitebox for this month. This converted hedge fund has two fundamentally attractive attributes (crushing its competition and enormous amounts of insider ownership), but I’m still working on the answer to two questions. Once I get those, I’ll share a profile. But not yet.

Funds in Registration

New mutual funds must be registered with the Securities and Exchange Commission before they can be offered for sale to the public. The SEC has a 75-day window during which to call for revisions of a prospectus; fund companies sometimes use that same time to tweak a fund’s fee structure or operating details. Every day we scour new SEC filings to see what opportunities might be about to present themselves. Many of the proposed funds offer nothing new, distinctive or interesting. Some are downright horrors of Dilbertesque babble.

Funds in registration this month won’t be available for sale until, typically, the beginning of March 2013. We found a dozen funds in the pipeline, notably:

Artisan Global Small Cap Fund (ARTWX) will be Artisan’s fourth overly-global fund and also the fourth for Mark Yockey and his team. They’re looking pursue maximum long-term capital growth by investing in a global portfolio of small-cap growth companies. . The plan is to apply the same investing discipline here as they do with Artisan International Small Cap (ARTJX) and their other funds. The investment minimum is $1000 and expenses are capped at 1.5%.

Driehaus Event Driven Fund seeks to provide positive returns over full-market cycles. Generally these funds seek arbitrage gains from events such as bankruptcies, mergers, acquisitions, refinancings, earnings surprises and regulatory rulings. They intend to have a proscribed volatility target for the fund, but have not yet released it. They anticipate a concentrated portfolio and turnover of 100-200%. K.C. Nelson, Portfolio Manager for Driehaus Active Income (LCMAX) and Driehaus Select Credit (DRSLX), will manage the fund. The minimum initial investment is $10,000, reduced to $2000 for IRAs. Expenses not yet set.

Details on these funds and the list of all of the funds in registration are available at the Observer’s Funds in Registration page or by clicking “Funds” on the menu atop each page.

On a related note, we also tracked down 20 fund manager changes, including a couple high profile departures.

Launch Alert: Eaton Vance Bond

On January 31, Eaton Vance launched Eaton Vance Bond Fund (EVBAX), a multi-sector bond fund that can invest in U.S. investment grade and high yield bonds, floating-rate bank loans, non-U.S. sovereign and corporate debt, convertible securities and preferred stocks. Why should you care? Its lead manager is Kathleen Gaffney, once the investing partner of and heir apparent to Dan Fuss. Fuss and Gaffney managed Loomis Sayles Bond (LSBRX), a multisector fund strikingly similar to the new fund, to an annualized return of 10.6% over their last decade together. That beat 94% of their peers, as well as beating the long-term record of the stock market. “A” class shares carry a 4.75% front load, expenses after waivers of 0.95% and a minimum initial investment of $1000.

Launch Alert: Longleaf Global Opens

On Jan. 2, Southeastern Asset Management rolled out its first U.S. open-end fund since 1998 and its first global mutual fund ever available in the United States. The new fund is Longleaf Global (LLGLX), a concentrated fund that invests at least 40% of its assets outside the U.S. A version of the strategy already is available in Europe.

Mason Hawkins and Staley Cates, who received Morningstar’s Domestic-Stock Fund Manager of the Year award in 2006, manage the fund. Like other Longleaf funds, the portfolio targets holding between 15 and 25 companies. The fund will have an unconstrained portfolio that invests in companies of all market capitalizations and geographies. Its expense ratio is capped at 1.65%.

Sibling funds Longleaf Partners (LLPFX) and Longleaf Partners Small-Cap (LLSCX) receive Morningstar Analyst Ratings of Gold while Longleaf Partners International (LLINX) is rated Bronze.

Launch Just-A-Second-There: Longleaf Global Closes

After just 18 trading days, Longleaf Global closed to new investors. The fund drew in a manageable $28 million and then couldn’t manage it. On January 28, the fund closed without warning and without explanation. The fund’s phone reps said they had “no idea of why” and the fund’s website contained a single line noting the closure.

A subsequent mailing to the fund’s investors explained that there simply was nowhere immediately worth investing. The $16 trillion U.S. stock market didn’t contain $30 million in investible good ideas. With the portfolio 50% in cash, their judgment was that the market offered no more than about $15 million in worthwhile opportunities.

Here’s the official text:

We are temporarily closing Longleaf Partners Global Fund to new investors. Although the Fund was only launched on December 31, 2012, our Governing Principles guide our decision to close until we can invest the large cash position currently in the Fund. Since October when we began planning to open the Global Fund, stock prices have risen rapidly, leaving few good businesses that meet our 60% of appraisal discount. Limited qualifying investments, combined with relatively quick inflows from shareholders, have left us with more cash than we can invest. Remaining open would dilute existing investors by further raising our cash level.

Our Governing Principle, “We will consider closing to new investors if closing would benefit existing clients,” has caused us to close the three other Longleaf Funds at various times over the past 20 years. When investment opportunities enable us to put the Fund’s cash to work, and additional inflows will benefit our partners, we will re-open the Global Fund to new investors.

Artisan Gets Active

One of my favorite fund advisers are the Artisan Partners. I’ve had modest investments with the Artisan Funds since 1996 when I owned Artisan Small Cap (ARTSX) and Artisan International (ARTIX). I sold my Small Cap stake when Small Cap Value (ARTVX) became available and International when International Value (ARTKX) opened, but I’ve stayed with Artisan throughout. The Observer has profiles of five Artisan funds.

Why? Three reasons. (1) They do consistently good work. (2) Their funds build upon their teams’ expertise. And (3) their policies – from low minimums to the willingness to close funds – are shareholder friendly.

And they’ve had a busy month.

Two of Artisan’s management teams were finalists for Morningstar’s international fund manager of the year honors: David Samra and Daniel O’Keefe of Artisan International Value (ARTKX) and Artisan Global Value (ARTGX) and the team headed by Mark Yockey of Artisan International (ARTIX) and Artisan International Small Cap (ARTJX).

In a rarity, one of the managers left Artisan. Barry Dargan, formerly of MFS International and lead manager of Artisan Global Equity (ARTHX), left the firm following a year-end conversation with Yockey and others. ARTHX was managed by a team led by Mr. Dargan and it employed a consistent, well-articulated discipline. The fund will continue being managed by the same team with the same discipline, though Mr. Yockey will now take the lead.

Artisan has filed to launch Artisan Global Small Cap Fund (ARTWX), which will be managed by Mark Yockey, Charles-Henri Hamker and David Geisler. Yockey and Hamker co-manage other funds together and Mr. Geisler has been promoted to co-manager in recognition of his excellent work as a senior analyst on the team. Artisan argues that their teams have managed such smooth transitions from primarily domestic or primary international charges into global funds because all of their investing has a global focus. The international managers need to know the U.S. market inside and out since, for example, they can’t decide whether Fiat is a “buy” without knowing whether Ford is a better buy. We’ll offer more details on the fund when it comes to market.

Briefly Noted …

FPA has announced the addition of a new analyst, Victor Liu, for FPA International Value (FPIVX). The fund started with two managers, Eric Bokota and Pierre Py. Mr. Bokota left suddenly for personal reasons and FPA has been moving carefully to find a successor for him. Mr. Py expects Victor Liu to become that successor. Prior to joining FPA, Mr. Liu was a Vice President and Research Analyst for a highly-respected firm, Causeway Capital Management LLC, from 2005 until 2013. The fund posted top 2% results in 2012 and investors have reason to be optimistic about the year ahead.

Rivers seem to be all the rage in the mutual fund world. In addition to River Road Asset Management which sub-advises several ASTON funds, there’s River Oak Discovery (RIVSX) and the Riverbridge, RiverFront (note the trendy mid-word capitalization), RiverNorth, RiverPark and RiverSource fund families. Equally-common bits of geography seem far less popular. Hills (Beech, Cavanal, Diamond), lakes (Great and Partners), mounts (Lucas), and peaks (Aquila, Grandeur, Rocky) are uncommon while ponds, streams, creeks, gorges and plateaus are invisible. (Swamps and morasses are regrettably common, though seldom advertised.)

Small Wins for Investors

Calamos Growth & Income (CVTRX) reopened to new investors in January. Despite a lackluster return in 2012, the fund has a strong long-term record, beating 99% of its peers during the trailing 15-year period through December 2012. In August 2012, Calamos announced that lead manager and firm co-CIO Nick Calamos would be leaving the firm. Gary Black, former Janus CIO, joined the management team as his replacement.

The folks at FPA have lowered the expense ratio for FPA International Value (FPIVX). FPA has also extended the existing fee waiver and reduced the Fund’s fees effective February 1, 2013. FPA has contractually capped the Fund’s fees at 1.32% through June 30, 2015, several basis points below the current rate.

Scout Unconstrained Bond (SUBYX and SUBFX) is now available in a new, lower-cost retail package. On December 31, 2012, the old retail SUBFX became the institutional share class with a $100,000 minimum. At the same time Scout launched new “Y” shares that are no-load with the same minimum investment as the old shares, but also with a substantial expense reduction. When we profiled the fund in November, the after-waiver e.r. was 99 basis points while the “Y” shares are at 80 bps. Scout also reduces the minimum initial investment to $100 for accounts set up with an automatic investing plan.

Scout has also released “Unconstrained Fixed-Income Investing: A Timely Alternative in a Perilous Environment.” They argue that unconstrained investing:

- Has the potential to make portfolios less vulnerable to higher interest rates and enduring economic uncertainty;

- May better position assets to grow long term purchasing power;

- Is worth consideration as investors may need to consider more opportunistic strategies to complement or replace the core strategies that have worked well so far.

They also explain the counter-cyclical investment approach which they have successfully employed for more than three decades. Mark Egan and team were also finalists for 2012 Fixed Income Manager of the Year honors.

Vanguard has cut expense ratios on four more funds, by 1 -3 basis points. Those are Equity Income, PRIMECAP Core, Strategic Equity and Strategic Small Cap Equity. It raised the e.r. on Growth Equity by 2 basis points.

Closings

ASTON/River Road Independent Value (ARVIX) closed to new investors on January 18 after being reopened just four months. I warned you.

Fairholme Fund (FAIRX) is closing on February 28, 2013. Here’s the perfect illustration of the risks and rewards of high-conviction investing: top 1% in 2010, bottom 1% in 2011, top 1% in 2012, closed in 2013. The smaller Fairholme Allocation (FAAFX), which has actually outperformed Fairholme since launch, and Fairholme Focused Income (FOCIX) funds are closing at the same time.

Fidelity Small Cap Discovery (FSCRX) closed to new investors on January 31. The fund has been a rarity for Fidelity: a really good small cap fund. Most of its success has come under manager Chuck Myers. Fans of his work might still check out Fidelity Small Cap Value (FCPVX). It’s nearly as big as Discovery ($3.1 versus $3.9 billion) but hasn’t had to deal with huge inflows.

JPMorgan Mid Cap Value (JAMCX) will close to new investors at the end of February.

MainStay Large Cap Growth Fund closed to new investors on January 17. They ascribe the decision to “a significant increase in the net assets” and a desire “to moderate cash flows.”

Virtus announced it will close Virtus Emerging Markets Opportunities (HEMZX) to new investors on Feb. 1. The fund had strong inflows in recent years, ending 2012 with more than $6.8 billion in assets. Rajiv Jain was named Morningstar International-Stock Fund Manager of the Year for 2012. In three of the past five calendar years the fund has outpaced more than 95% of its peers (it landed in the bottom decile of its category for 2009, despite a 48% return for the year, and placed in the top half of the category in 2011).

Old Wine in New Bottles

DWS is changing the names of its three Dreman Value Management-run funds, including the Neutral-rated DWS Dreman Small Cap Value (KDSAX), to drop the subadvisor’s name. Dreman’s assets under management have shrunk dramatically to just $4.1 billion today from $20 billion in 2007. The firm previously subadvised a large-cap value fund for DWS but was dropped after that fund (now called DWS Equity Dividend (KDHAX)) lost 46% in 2008, leading to massive outflows. The three funds Dreman subadvises for DWS now account for roughly half of the firm’s total assets under management.

We noted earlier in fall that several of the Legg Mason affiliates are shrinking from the Legg name. The most recent manifestations: Legg Mason Global Currents International All Cap Opportunity and Legg Mason Global Currents International Small Cap Opportunity changed their names to ClearBridge International All Cap Opportunity (SBIEX) and ClearBridge International Small Cap Opportunity (LCOAX) on Dec. 5, 2012.

Off to the Dustbin of History

ASTON Dynamic Allocation (ASENX) has been closed to new investment and will be shut down on January 30. The fund’s performance has been weak and 2012 was its worst year yet. The fact that it drew only $22 million in investments and carried a one-star rating from Morningstar likely contributed to the decision. The fund, subadvised by Smart Portfolios, was launched early 2008. This will be ASTON’s third closure of late, following the shutdown of ASTON/Cardinal Mid Cap Value and ASTON/Neptune International in mid-autumn.

Fidelity plans to merge the Fidelity 130/30 Large Cap (FOTTX) and Fidelity Advisor Strategic Growth (FTQAX) into Fidelity Stock Selector All Cap (FDSSX) in June in June. Neither of the deadsters had distinguished records and neither drew much in assets, at least by Fidelity’s standards.

Invesco Powershares will liquidate thirteen more ETFs on February 26. Those are

- Dynamic Insurance Portfolio (PIC)

- Morningstar StockInvestor Core Portfolio (PYH)

- Dynamic Banking Portfolio (PJB)

- Global Steel Portfolio (PSTL)

- Active Low Duration Portfolio (PLK)

- Global Wind Energy Portfolio (PWND)

- Active Mega-Cap Portfolio (PMA)

- Global Coal Portfolio (PKOL)

- Global Nuclear Energy Portfolio (PKN)

- Ibbotson Alternative Completion Portfolio (PTO)

- RiverFront Tactical Balanced Growth Portfolio (PAO)

- RiverFront Tactical Growth & Income Portfolio (PCA)

- Convertible Securities Portfolio (CVRT)

Just when you thought the industry was all dull and normal, along comes Janus. Janus’s Board approved the merger of Janus Global Research into Janus Worldwide (JAWWX) on March 15, 2013. Now in a dull and normal world, that would mean the disappearance of the Global Research fund. Not with Janus! Global Research will merge into Worldwide, resulting in “the Combined Fund.” The Combined Fund will then be named “Janus Global Research,” will adopt Global Research’s management team and will use Global Research’s performance record. Investors get rewarded with a four basis point decrease in their expense ratio.

The RS Capital Appreciation Fund will be merged with RS Growth Fund in March. In the interim, RS removed Cap App’s entire management team and replaced them with Growth’s: Stephen Bishop, Melissa Chadwick-Dunn, and D. Scott Tracy.

RiverPark Small Cap Growth (RPSFX) liquidated on Jan. 25, 2013. I like and respect Mr. Rubin and the RiverPark folks as a whole, but this fund never struck me as particularly compelling. With only $4.5 million in assets, it seems the others agreed. On the upside, this leaves the managers free to focus on their noticeably-promised RiverPark Long/Short Opportunity (RLSFX) fund.

Scout Stock (UMBSX) will liquidate in March. Scout has always been a very risk averse fund for which Morningstar and the Observer both had considerable enthusiasm. The problem is that the combination of low risk with below average returns was not compelling in the marketplace and assets have dropped by well over half in the past decade.

In a move fraught with covert drama, Sentinel Asset Management is merging the $51 million Sentinel Mid Cap II (SYVAX) into Sentinel Mid Cap (SNTNX). The drama started when Sentinel fired Mid Cap II’s management team in 2011. The fund’s shareholders then refused to ratify a new management team. Sentinel responded by converting Mid Cap II into a clone of Mid Cap with the same management team. Then in August 2012, that management team resigned to join a competitor. Sentinel rotated in the team that manages Sentinel Common Stock (SENCX) to manage both and, soon, to manage just the survivor.

Torray Institutional (TORRX) liquidated at the end of December. Like many institutional funds, it was hostage to one or two large accounts. When a major investor pulled out, the fund was left with too few assets to be profitable. Torray Fund (TORYX), on which it was based, has had a long stretch of wretched performance (in the bottom quartile of its large cap peer group for six of the past 10 years) but retains over $300 million in assets.

In Closing . . .

We received a huge and humbling stack of mail in January, very little of which I’ve yet responded to. Some folks, including some professional practices, shared contributions (including one in the … hmm, “mid three digit” range) for which we’re really grateful. Other folks shared holiday greetings (Zak, Hoyt and River Road Asset Management won, hands down, for the cutest and classiest card of the season), offers, reflections and requests. Augustana settles into Spring Break in early February and I’m resolved to settle in for an afternoon and catch up with you folks. Preliminary notes include:

- Major congratulations, Maryrose! Great news.

- Pretty much any afternoon during Spring Break, Peter

- Thanks for sharing the Fund Investor’s Classroom, Richard. I’ll sort through it as soon as I’m out of my own classroom.

- Rick, Mohan, it’s always good to hear from old friends

- Fraud Catcher, fascinating book and a fascinating life. Thanks for sharing it, Tom.

- And, to you all, it’s always good to hear from new friends.

Thanks, as always, for your support and encouragement. It makes a world of difference. Do consider joining us for the Seafarer conference call in a couple weeks. Otherwise, I’ll see you all in March.

We’ve saved the most curious, and most disappointing, for last. American Funds has always been a sort of benevolent behemoth. They’re old (1931) and massive. They manage more than $900 billion in investments and over 50 million shareholder accounts, with $300 billion in non-U.S. assets.

We’ve saved the most curious, and most disappointing, for last. American Funds has always been a sort of benevolent behemoth. They’re old (1931) and massive. They manage more than $900 billion in investments and over 50 million shareholder accounts, with $300 billion in non-U.S. assets.

Mr. Kerr manages the Rocky Peak Small Cap Value Fund (RPCSX), which launched on April 2, 2012. He co-managed RCB’s Small Cap Value strategy and the CNI Charter RCB Small Cap Value Fund (formerly RCBAX, now CSCSX) fund. Tom offers these 200 words on why folks should check in:

Mr. Kerr manages the Rocky Peak Small Cap Value Fund (RPCSX), which launched on April 2, 2012. He co-managed RCB’s Small Cap Value strategy and the CNI Charter RCB Small Cap Value Fund (formerly RCBAX, now CSCSX) fund. Tom offers these 200 words on why folks should check in: There are, in addition, 123 beached whales: funds with more than a billion in assets that have trailed their peer groups for the past three, five and ten years. Of those, 29 earn ratings in the Bronze to Gold range, 31 are Neutral and just six warrant Negative ratings. So, being large and consistently bad makes you five times more likely to earn a positive rating than a negative one.

There are, in addition, 123 beached whales: funds with more than a billion in assets that have trailed their peer groups for the past three, five and ten years. Of those, 29 earn ratings in the Bronze to Gold range, 31 are Neutral and just six warrant Negative ratings. So, being large and consistently bad makes you five times more likely to earn a positive rating than a negative one.  We spent an hour on Tuesday, January 22, talking with Teresa Kong of Matthews Asia Strategic Income. The fund is about 14 months old, has about $40 million in assets, returned 13.6% in 2012 and 11.95% since launch (through Dec. 31, 2012).

We spent an hour on Tuesday, January 22, talking with Teresa Kong of Matthews Asia Strategic Income. The fund is about 14 months old, has about $40 million in assets, returned 13.6% in 2012 and 11.95% since launch (through Dec. 31, 2012).

As promised, we’re continuing our moderated conference calls through the winter. You should consider joining in. Here’s the story:

As promised, we’re continuing our moderated conference calls through the winter. You should consider joining in. Here’s the story:

A couple months ago we profiled

A couple months ago we profiled  Our March conference call will occur unusually early in the month, so I wanted to give you advance word of it now. On

Our March conference call will occur unusually early in the month, so I wanted to give you advance word of it now. On

Three out of 30 funds managed by Royce outperformed their benchmarks for the 1-year period; 4 out of 24 for the 3-year period; 12 out of 19 for the 5-year period; and all 11 outperformed for the 10-year period.

Three out of 30 funds managed by Royce outperformed their benchmarks for the 1-year period; 4 out of 24 for the 3-year period; 12 out of 19 for the 5-year period; and all 11 outperformed for the 10-year period. On October 12, 2012, RiverNorth launched their fourth fund, RiverNorth Dynamic Buy-Write Fund. “Buy-write” describes a sort of “covered call” strategy in which an investor might own a security and then sell to another investor the option to buy the security at a preset price in a preset time frame. It is, in general, a defensive strategy which generates a bit of income and some downside protection for the investor who owns the security and writes the option.

On October 12, 2012, RiverNorth launched their fourth fund, RiverNorth Dynamic Buy-Write Fund. “Buy-write” describes a sort of “covered call” strategy in which an investor might own a security and then sell to another investor the option to buy the security at a preset price in a preset time frame. It is, in general, a defensive strategy which generates a bit of income and some downside protection for the investor who owns the security and writes the option.

Based on the success of our September conference call with David Sherman of Cohanzick Asset Management and RiverPark’s president, Morty Schaja, we have decided to try to provide our readers with one new opportunity each month to speak with an “A” tier fund manager.

Based on the success of our September conference call with David Sherman of Cohanzick Asset Management and RiverPark’s president, Morty Schaja, we have decided to try to provide our readers with one new opportunity each month to speak with an “A” tier fund manager.