Dear friends,

When I say, “I hope you’re well,” it’s far more than an opening formality.

Did you blink?

If so, you missed it. The Great Bull Market of 2020. In perhaps the shortest-lived bull market in history, the DJIA rebounded by over 21.4% in three days after The (First) Bear Market of 2020. The latter growled from 19 February – 23 March, while the latter charged from 23 – 26 March after which we had a sharp down, a sharp up, a wimpy down and a sharp down.

If so, you missed it. The Great Bull Market of 2020. In perhaps the shortest-lived bull market in history, the DJIA rebounded by over 21.4% in three days after The (First) Bear Market of 2020. The latter growled from 19 February – 23 March, while the latter charged from 23 – 26 March after which we had a sharp down, a sharp up, a wimpy down and a sharp down.

What’s next?

Three magic words: No. one. knows.

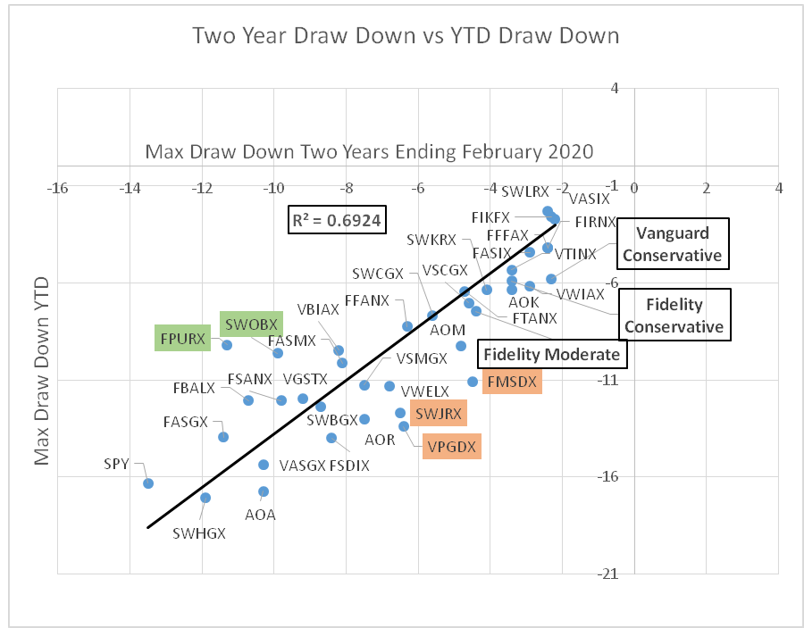

We do know some things. First, small investors have been pretty resolute so far. Professional traders have run in circles, howling, as their trading algorithms materially worsened with each price swing. If you’ve made intelligent asset allocation choices, there’s virtually no action more sensible than ignoring the Howling Class and getting on with life.

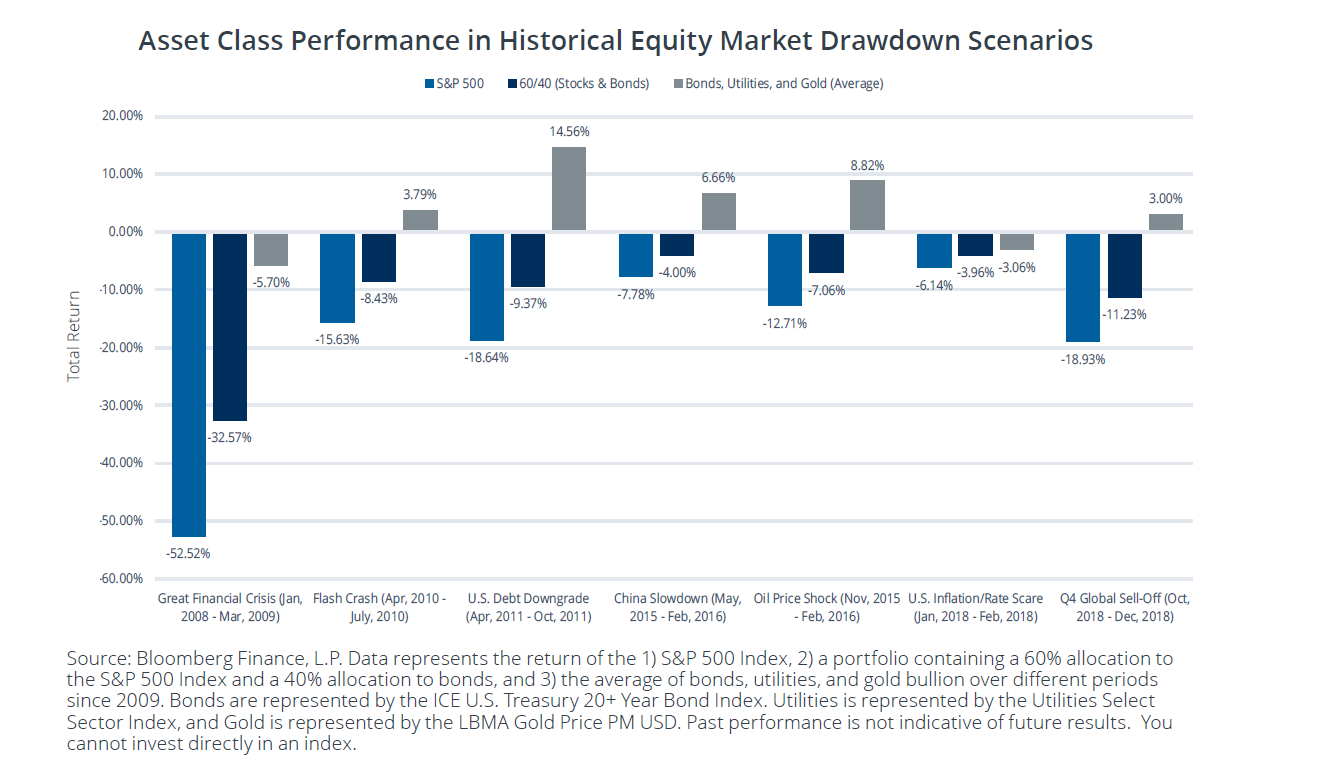

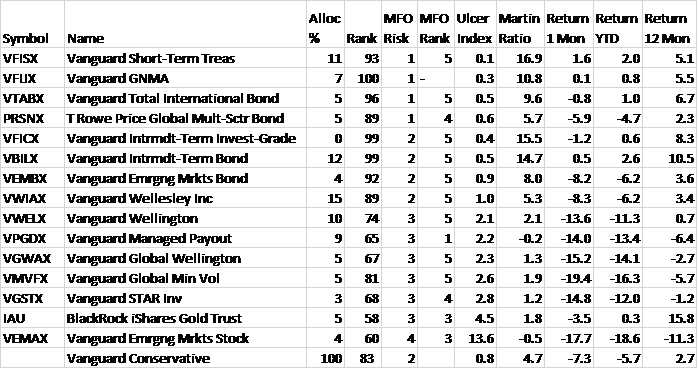

Second, markets are down across all sorts of asset classes. The only things consistently up are the Treasuries purchased by panicked people looking for the safest of safe havens. I noted on March 25th that

Vanguard Short-Term Treasury (VFISX) yields 0.8%, costs 0.2% and has risen 1.47% in four weeks. That’s equivalent to 10 months of its normal (5-year) annual returns. Currently, the yield on one-year Treasuries is 0.25%; deduct the 0.2% and you’re yielding 0.05% a year.

Intermediate and Long-Term Treasuries have both returned more in four weeks than they normally would in an entire year.

If you look at the Vanguard bond index returns, the longer the term on Treasuries, the higher the four-week return. If you look at the Vanguard corporate bond indexes, all are substantially negative and the longer the term, the greater the loss.

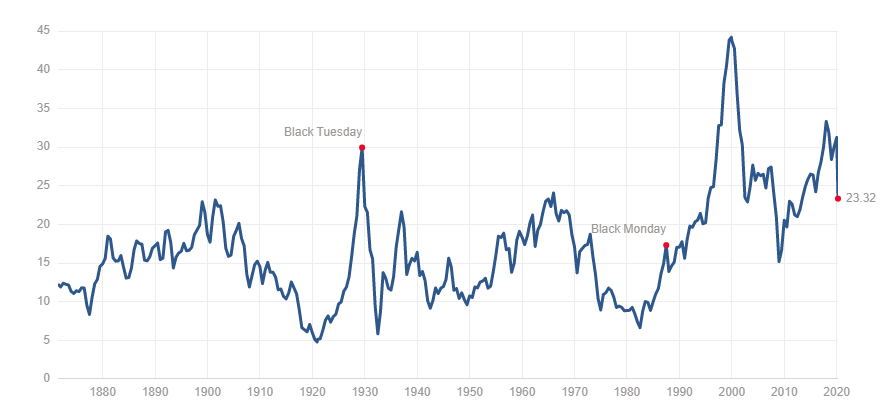

Third, the markets still aren’t cheap. One sensible metric, which tries to factor out some of the short-term noise in both the economy and the market, is the Shiller 10-Year CAPE. The cyclically-adjusted price/10-year earnings ratio is a terrible tool for timing market purchases, but a pretty good one for measuring the broad cost of the market. At mid-day on April 1, it stood at 23.41, still about 40% higher than the average price over the market’s long history.

The mean CAPE ratio over the past 140 years is 16.7 and the median is 15.8. Stocks were their absolute cheapest in December 1920 (4.8 p/e) and their most expensive in December 1999 (44.2). (source: https://www.multpl.com/shiller-pe)

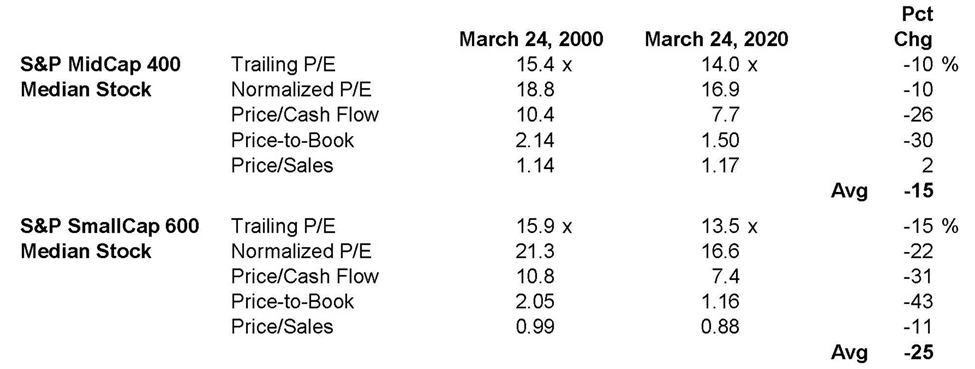

“The market” is a lot lower than its 1999 peak but that’s a bit deceptive. “The market” averages, regardless of which market, are driven by a handful of its large stocks. An alternate way of looking is to focus on the median stock in the index. That is, the stock that’s exactly in the middle of the pack. By that standard, valuations remain painfully close to their highest point in history.

source: Research.LeutholdGroup.com, 3/30/2020

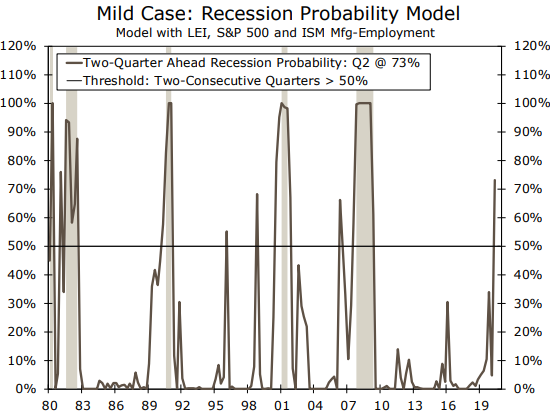

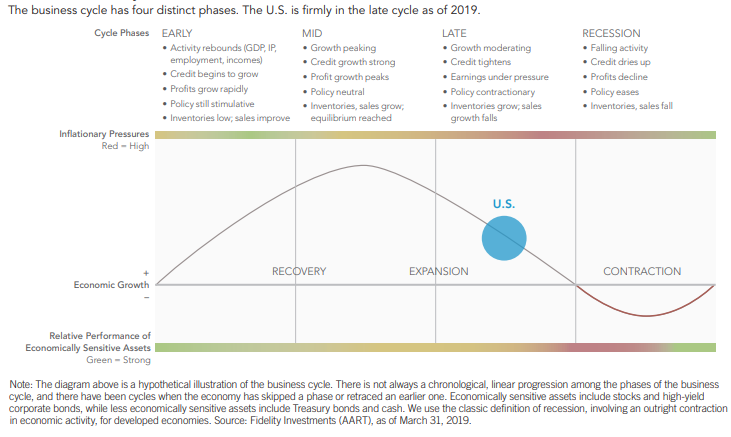

Fourth, we may be “bottoming” but there’s no reason to believe we’ve seen “the bottom.” It’s not uncommon for a bear market bottom to sort of evolve over two or three months. The market registers the majority of its eventual declines, then stumbles for weeks with some sharp upswings and some sharp downswings but no clear direction. We are, with luck, sort of beginning that process.

Our work suggests that a cyclical bear market remains underway, and we believe it is too early to move to an overweight position in equities despite the vastly improved valuations from just two months ago. We have reduced some of the hedges in our tactical funds in recent weeks, and net equity exposure across those strategies is now in the 43-44% range. The massive rebound in the last five trading days looks much more like the handiwork of a mischievous bear rather than that of a newborn bull. (Research.LeutholdGroup.com, 3/30/2020)

Four things you should consider doing

-

Don’t be a hero. A number of value investors skipped Christmas in 2008 because they saw a once-in-a-lifetime opportunity developing. Those who flung money at the market in early 2009 were richly rewarded. Very few sensible people seem to be seeing an opportunity of that magnitude just yet.

“Stay the course” probably the sounder advice. Tweedy Browne’s newly-issued letter on markets and pandemics speaks sensibly. The firm reminds readers that it’s more than a century old, so they have the experience to see occasional crashing-and-burning as part of the price of admission. They point out that the last 25 years have seen a long series of catastrophes – two currency meltdowns in the EMs, the Russian debt default, LTCM debacle, 9/11, the ’07-09 GFC – and a market that’s returned nearly 500%, cumulatively.

I rather liked their conclusion:

… at times like this, we actually begin to feel better about our prospects for future returns. That said, our and your ability to have a successful investment experience depends in large part on the willingness to “stay on the bus.” The ride can be bumpy, but you ultimately have to stay on board to have any chance of reaching your destination. As Margaret Thatcher famously said to George Bush Sr. just before the start of the Kuwait War in 1990, “Remember George, this is no time to go wobbly.”

-

Deploy extra cash slowly and strategically. Mohammed el-Erian argues that the market hasn’t finished its descent. For those who disagree, el-Erian recommends dividing your available cash into five pieces then invest just 20% of your cash in each of the next five months.

I automatically invest in five funds at the beginning of each month. In agreeing with Dr. el-Erian, I bought additional shares of five funds in mid-March, with Brown Advisory Sustainable Growth Fund (BIAWX) receiving the bulk of the investment. The total at mid-month was not much greater than my automatic start-of-month investments. I anticipate repeating that move in each of the next four months.

-

Start assembling your shopping list. Really first-rate funds, many of which we list in “Briefly Noted” this month, are reopening to new investors. They anticipate tremendous opportunities in the months ahead and are looking to raise cash in order to act when the moment comes. That “moment” may well come first in the emerging markets, where many investors fear to tread. GMO asset allocation team member, James Montier (whose profile pic has him wearing a freakish Hawaiian shirt):

Emerging markets are trading on a Shiller P/E of 13x. This is the level of valuation that generally gets me excited. We have not experienced permanent impairment of capital from this level outside of markets that have shut down due to war. This doesn’t guarantee short-term returns or that we have reached a bottom: cheap stocks can always get cheaper. But it does provide a compellingly attractive entry point for those with a long horizon.

Even better are the value stocks within emerging markets, which trade on single-digit Shiller P/Es. So, embrace career risk, dare to be different, and recall the motto of the Special Air Service: Who Dares Wins.

One strategy for the moment is to begin investigating EM and, perhaps especially, EM value funds. Perhaps global small caps for the venturesome. Perhaps first-tier equity income funds for folks tired of the excitement. There is no opportunity that you’re going to miss if you spend the next month or six weeks reviewing your opportunities and reflecting on how you’d like to move.

-

Make a difference. As in, in your community.

It’s time to make a difference.

Small businesses and local non-profits are the organizations that are taking the greatest hit from our necessary adjustments to slow the spread of the COVID-19 virus. Businesses with fewer than 50 employees shed 90,000 jobs in March (Axios.com, 4/1/20). A CNN analysis of nonprofits suggests that “less than half of nonprofits have one month of operating reserves” (CNN.com, 3/20/20), making this “an extinction-level event” for many. The local newspapers whose websites we’re all flocking to, reveling in their decision to make COVID-related stories free for all, are hemorrhaging revenue as advertising disappears. The industry is described as being “in near collapse” (Axios.com, 3/21/20). The business conditions indicators from the Dallas and New York Fed reached their lowest levels ever and since 2009, respectively.

You can’t save the world. But you might be able to save the coffee shop down the street. Chip and I have resolved to try by taking one conscious local support action each day. In the past 10 days we’ve:

Bought a très cool t-shirt from the good folks at Cool Beanz Coffee in Rock Island. You can, too. We also participated in their program to provide coffee for hospital and public safety personnel; for a contribution of $10, they deliver a pound of fresh coffee to a local hospital, fire, or police station.

Bought a très cool t-shirt from the good folks at Cool Beanz Coffee in Rock Island. You can, too. We also participated in their program to provide coffee for hospital and public safety personnel; for a contribution of $10, they deliver a pound of fresh coffee to a local hospital, fire, or police station.- Contributed to the RiverBend Food Bank which provides something like 21 million meals a year in western Illinois and eastern Iowa, but whose shelves are running bare.

- Posted Google reviews, positive and detailed, for five local businesses that we’d visited this month.

- Signed Chip up for a bookmaking class at Crafted QC. (Canceled. We’ll rebook.) I bought a gift certificate from them instead.

- Ordered take-out from Café de Marie and Azteca in Davenport and the Village Corner Deli in the Village of East Davenport. Excellent food, quiche, really good arroz con pollo, great turkey reuben, only so-so shrimp tostadas. Our batting average was pretty good!

- Bought a Roland keyboard from Grigg’s Music for Will’s (now online) piano class.

- Bought a gift certificate from Half Nelson, a nice downtown restaurant in Davenport that we’d rather visit when times are good than use for takeout when they’re not.

- As part of our “Even when we can’t be close, we can be together,” we assembled Easter-ish packages for family and friends with chocolates from Chocolate Manor and Lagomarcino’s. (Those go out this week. Don’t spoil the surprise.)

- Systematically, intentionally and joyfully over-tipped whenever we could. Iowa’s minimum wage for folks in foodservice is $4.35/hour. Yikes.

- Answered two challenge grant opportunities: Bill and Melinda Gates promised to match 1:1 our contribution to Donors Choose “Keep Kids Learning” project and Jeff and Reggie Goldstein did the same for contributions to the Quad Cities Disaster Recovery Fund.

- And when the Magic Money from the feds appears, sometime in the next three weeks, it will join the flow. I know that particular move isn’t appropriate for everyone; for a lot of families, that $1200, or whatever, might lift spirits and put food on the table. If so, there’s no better use for it. For those of us who aren’t financially insecure, the best thing we can do – for our economy, for our community, for our hearts – is to get it as quickly as possible to the place it will make the greatest difference.

None of which is big. All of which are things that we would have, eventually, or should have done anyway. Much of it came in the form of $30-40 payments. Will it save a slice of my adopted hometown? Don’t know. But I’ll be ding-danged if I’m going to sit here obsessing about toilet paper and not trying, over and over, to help.

Perhaps you’re doing likewise? Perhaps you might yet?

Thanks!

For being here. For reading and, at least occasionally, writing back to me. For your good humor and your good leads on funds and stories.

Thanks to Dan a/k/a OJ, who also got lost in the shuffle, and to Kirk, Sunil, Jason, Henry, Trev, W. E., and Donald. Thanks, as ever, to the good folks who’ve expressed their confidence by being “subscribers” to MFO; that is, who’ve set up modest monthly contributions through our PayPal link. They are David, Doug, Brian, Matthew, Gregory, James, William, and William.

I would, at this point, often enough encourage you to support MFO. But really, for now, I’d much rather you support those struggling in your local community.

Dark days are coming. Better days are coming. We’ll be there through them both, and thinking of you.

I have been told several times over the last year by active managers I know that the crop of analysts they presently have are the best analysts they have ever had. Unfortunately, to go back to my analogy, most of them have not been shot at before, that is, they have never been in a bear market. So as the days go by, they find themselves staring at the vast swaths of red on their Bloomberg terminals, frozen in place, with anything they recommend in equities or fixed income, working at best for a few days.

I have been told several times over the last year by active managers I know that the crop of analysts they presently have are the best analysts they have ever had. Unfortunately, to go back to my analogy, most of them have not been shot at before, that is, they have never been in a bear market. So as the days go by, they find themselves staring at the vast swaths of red on their Bloomberg terminals, frozen in place, with anything they recommend in equities or fixed income, working at best for a few days. In closing, I am going to leave you with another historical analogy. In terms of thinking about where we are, with massive running of the currency printing presses around the world, and governments buying every kind of bond in sight to keep the capital markets from freezing up, you need to think about the post-World War One period. Specifically, look at those people who had wealth and investments going into the Weimar Republic in Germany. Then look at those people who still had wealth and investments coming out of the Weimar Republic. And draw your conclusions accordingly.

In closing, I am going to leave you with another historical analogy. In terms of thinking about where we are, with massive running of the currency printing presses around the world, and governments buying every kind of bond in sight to keep the capital markets from freezing up, you need to think about the post-World War One period. Specifically, look at those people who had wealth and investments going into the Weimar Republic in Germany. Then look at those people who still had wealth and investments coming out of the Weimar Republic. And draw your conclusions accordingly.

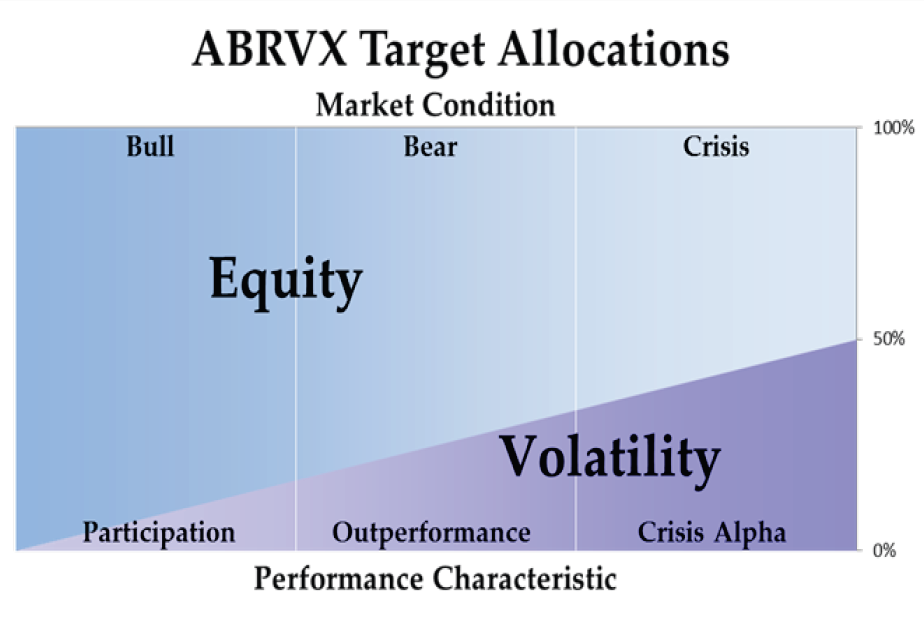

Prospective investors should imagine the core of the portfolio as focused, long-only, technology-centered. In reality the portfolio will likely be more nuanced and complex, but that’s the heart of it.

Prospective investors should imagine the core of the portfolio as focused, long-only, technology-centered. In reality the portfolio will likely be more nuanced and complex, but that’s the heart of it.