Updates

In October 2016, Dennis Baran profiled City National Rochdale Emerging Markets (RIMIX/CNRYX). His bottom line on the fund,

CNRYX offers an investor exposure to emerging markets by its concentrated strategy in Asia. Since inception, the fund has adhered to its six-country Asian allocation and not included other EM Asian countries or EM countries outside of that region in any meaningful way. The manager believes that the long-term positives of the region discussed here can become a virtuous cycle that could last for decades and lead to fund outperformance. The results thus far support that thesis: the fund has earned a five-star designation from Morningstar, is ranked highest by Lipper in total return, consistent return, tax efficiency, expense, and is a MFO Great Owl.

Since that publication, CNRYX has continued to outperform its Morningstar peer group, has maintained its five-star and Great Owl designations (though Morningstar’s “machine learning” analyst program is officially “neutral” on the fund) and now has $1.7 billion in assets under management.

Reader Dan Quisenberry wrote in April with a question about one statement in the profile.

In the October 2016 issue of MFO you wrote about CNRYX, City National Rochdale EM Fund. I have owned RIMIX for a few years and I remember this sentence specifically…

Currently, all assets are being moved into CNRYX, which now has $853M, and RIMIX $143M. The remaining assets of RIMIX will be moved in the next six months. All shareholders will then have a class without a 12b-1 fee and a lower expense ratio.

Was this cancelled? I still own RIMIX and it hasn’t been converted into CNRYX. RIMIX is available at third party brokerage houses.

Dennis reached out repeatedly to the adviser for confirmation over an 11 day period. Just when he was about to abandon the effort, he received a 10 word reply from CNR’s chief compliance officer, “I can confirm that the assets were indeed moved over.” Dennis eventually concluded, “It was not a conversion of RIMIX shares into CNRYX, and that is why both funds remain available.”

We do try to follow up when you have questions about funds or about things we’ve written, and you should do likewise. Most advisors, admittedly not all, are surprisingly forthcoming and informative. If you act respectfully but are not treated with respect in turn, take your money, go elsewhere then share a short explanation of your decision with your former fund company (see “contact us” on any website). You’re helping neither yourself nor the advisor by empowering poor behavior.

Briefly Noted . . .

Causeway Global Absolute Return Fund (CGAVX) is relying a bit more on machines now. Traditionally, the fund’s long portfolio has been generated through fundamental analysis and the short portfolio has been quantitatively driven:

The Investment Adviser uses its fundamental global value equity strategy to manage the Fund’s long exposures (the “long portfolio” of the Fund). The Investment Adviser uses its quantitative investment strategy designed to identify short exposures that it expects to underperform the World Index to manage the Fund’s short exposures (the “short portfolio” of the Fund).

New language signals a change to just the long portfolio strategy: “The Investment Adviser integrates fundamental and quantitative investment research to manage the Fund’s long exposures.” The new prospectus substantially rewrites and expands their discussion on the nature and creation of the fund’s long portfolio.

Morningstar’s “machine learning” process, designed to assign medalist ratings to funds not actively covered by human analysts, is positive about everything except the fund’s expenses (1.77%) and assigns it a Silver medal. That might well be justified, but investors interested in a market neutral fund might find Causeway (the blue line) a bit more than they’d bargained for.

Leuthold’s Grizzly Short Fund (GRZZX) underwent a 4:1 reverse split on May 18, 2018 because … well, being short is grizzly just now. The net effect is that investors received one “new” share for every four “old” shares, with the new shares worth precisely four times as much as the old ones.

If you’re invested in one of the Oppenheimer muni bond funds, you’re going to see much leaner management teams. Effective June 29, 2018, each fund will transition from having a management team to have a single specialized portfolio manager.

SMALL WINS FOR INVESTORS

As of May 21, 2018, American Century Equity Income (TWEIX) was reopened to all investors.

Delaware Value Fund (DDVAX) reopened to new investors on May 14, 2018. The fund had been closed since October 10, 2016.

Driehaus International Small Cap Growth Fund (DRIOX) will experience a substantial drop in its management fee, from 1.50% down to 1.00% as of July 1, 2018.

Marsico Focus Fund (MFOCX), Marsico Growth Fund (MGRIX), and Marsico 21st Century Fund (MXXIX) reduced their 12(b)1 fees “to a rate of 0% per annum,” effective on June 1, 2018.

CLOSINGS (and related inconveniences)

Effective July 1, 2018, through at least January 31, 2019, shares of Conestoga Small Cap Fund (CCASX) will no longer be available to new accounts through financial intermediaries without existing client relationships with the Fund or the Adviser. In addition, shareholders of the Conestoga SMid Cap Fund (CCSMX) will no longer be able to exchange their SMid Cap Fund shares for shares of the fund.

Effective as of the close of business on May 31, 2018, CrossingBridge Long/Short Credit Fund (CLCAX/CLCIX) closed the Class A shares of the Fund to all new purchases. David Sherman described the retail accounts as few in number and expensive to maintain, in part because of the cost of having a “share class” active.

With a few exceptions, Meridian Small Cap Growth Fund (MISGX) will close to new retail investors – those investing under $100,000 – on June 30, 2018.

On May 29, 2015, MFS International Value (MGIAX) was closed to new investors subject to certain exceptions. A not particularly clear SEC filing suggests that the fund remains closed but that, as of mid-June, the closure adds some wiggle room.

Vanguard Dividend Growth Fund is closed to all new investors (with the exception of (1) investors who are added and invest in the Fund only through technology-driven model portfolios and (2) participants who invest in the Fund only through defined contribution plans that offer the Fund as an existing option).

OLD WINE, NEW BOTTLES

Alger International Growth Fund (ALGAX) is undergoing two changes, one unremarkable and one entirely admirable. The unremarkable change is that, on August 30, 2018, it is changing its name to Alger International Focus Fund. The entirely admirable change is that it’s eliminating babble from the explanation of its investment strategy. The current text begins:

Fred Alger Management, Inc. believes companies undergoing Positive Dynamic Change offer the best investment opportunities. Positive Dynamic Change refers to companies realizing High Unit Volume Growth or companies undergoing Positive Lifecycle Change. High Unit Volume Growth companies are

Two problems stand out. (1) Fred Alger Management, Inc., is not a living thing and, hence, has no beliefs. (2) Capitalized Big Concepts are usually substitutes for clear thought since Capitalized Big Concepts aren’t questioned, they’re marketed. The Alger text has three CBCs in a single sentence.

I’m hopeful that the management team which took over the fund in March 2018 is responsible for the reassertion of clear English in the prospectus:

The Fund invests in Companies which it believes are attractively valued, high quality growth companies with definable strategic advantages/moat and competitive positioning that offer strong earnings visibility and sustainability. The team focuses on analyzing growth trajectories and identifying catalysts for future growth for companies that are in a positive earnings revision cycle. The Fund is an all-cap, all-country, opportunistic focus fund which generally holds less than 50 holdings.

Not flawless (it doesn’t exclude the U.S., the “/moat” is ugly and adds nothing; in general, use “less than” for things that cannot be counted but “fewer than” for things that can), but it’s a lot cleaner.

Similarly, Alger Global Growth Fund (CHUSX) becomes Alger Global Focus Fund, with an identical principal strategy.

American Customer Satisfaction Core Alpha ETF (ACSI) is now American Customer Satisfaction ETF. Not clear whether it was the “core” or the “alpha” part that spooked them.

On or about July 3, 2018, Catalyst Insider Income Fund (IIXAX) will become Catalyst Enhanced Income Strategy Fund. The fund will then seek “current income,” though a proposed fee increase by the advisor suggests that they’ll be the first to see increased income from the change. Former insiders David Miller and Charles Ashley will be replaced as the portfolio managers by Leland Abrams and Brandon Jundt of Wynkoop, LLC.

Sometime in the third quarter of 2018, Epiphany FFV Strategic Income Fund (EPIAX), will be reorganized into the Eventide Limited-Term Bond Fund. The Epiphany fund relies on “Trinity’s FFV Scorecard® screening based on the principles of Biblically Responsible Investing,” the new fund will use Eventide’s ethical values screens. The management team will remain intact.

Effective May 31, 2018, Fidelity Series Emerging Markets Fund (FEMSX) has been renamed Fidelity Series Emerging Markets Opportunities Fund. At the same time, Fidelity Series 1000 Value Index Fund (FIOOX) was renamed Fidelity Series Large Cap Value Index Fund.

Geneva Advisors All Cap Growth Fund has become AT All Cap Growth Fund (AWGIX) while Geneva Advisors Equity Income Fund was reorganized into AT Equity Income Fund (AWYIX). The change took place on February 12, 2018 but the SEC filing noting the change was May 29.

Goodwood no more. On May 18, 2018, Goodwood SMID Long/Short Fund was adopted by Crow Point Partners. That adoption occasioned four changes: the investment strategy shifted from small- and mid-cap long/short to long-only small growth, the management team changed, the fund name changed to Crow Point Growth Fund, and the expense ratio was reduced to 1.35%. Our June 2018 Elevator Talk with the new managers offers more detail. Check it out!

The Guggenheim BulletShares have been rechristened as the PowerShares BulletShares. (Perhaps an eventual line of leveraged funds will earn the PowerShares BulletShares PowerBullets designation?)

| Former Fund | Current Fund |

| Guggenheim BulletShares 2025 High Yield Corporate Bond ETF | PowerShares BulletShares 2025 High Yield Corporate Bond Portfolio |

| Guggenheim BRIC ETF | PowerShares BRIC Portfolio |

| Guggenheim Raymond James SB-1 Equity ETF | PowerShares Raymond James SB-1 Equity Portfolio |

| Wilshire US REIT ETF | PowerShares Wilshire US REIT Portfolio |

| Guggenheim Canadian Energy Income ETF | PowerShares Canadian Energy Income Portfolio |

| Guggenheim China Small Cap ETF | PowerShares China Small Cap Portfolio |

| Guggenheim China Technology ETF | PowerShares China Technology Portfolio |

| Guggenheim S&P High Income Infrastructure ETF | PowerShares S&P High Income Infrastructure Portfolio |

| Guggenheim Solar ETF | PowerShares Solar Portfolio |

With the departure of Mackenzie Financial (a/k/a “Cundill”) as sub-adviser and the arrival of Pzena, Ivy Cundill Global Value Fund (ICDAX) has been rechristened Ivy Pzena International Value Fund. Principal investment strategies were appropriately revised.

Effective July 31, 2018 JPMorgan Intrepid European Fund (VEUAX) becomes JPMorgan Europe Dynamic Fund and JPMorgan Intrepid International Fund (VFTAX) gets renamed JPMorgan International Advantage Fund.

PIMCO appears to be broadening the investment mandates for many of their funds. Those changes are reflected in a series of name changes that go into effect on July 30, 2018

| Current name | Impending name |

| PIMCO GNMA Fund | PIMCO GNMA and Government Securities Fund |

| PIMCO Investment Grade Corporate Bond Fund | PIMCO Investment Grade Credit Bond Fund |

| PIMCO Mortgage Opportunities Fund | PIMCO Mortgage Opportunities and Bond Fund |

| PIMCO Unconstrained Bond Fund | PIMCO Dynamic Bond Fund |

| PIMCO Long-Term Credit Fund | PIMCO Long-Term Credit Bond Fund |

| PIMCO Credit Absolute Return Fund | PIMCO Credit Opportunities Bond Fund |

| PIMCO RAE Fundamental PLUS EMG Fund | PIMCO RAE PLUS EMG Fund |

| PIMCO RAE Fundamental PLUS Fund | PIMCO RAE PLUS Fund |

| PIMCO RAE Fundamental PLUS International Fund | PIMCO RAE PLUS International Fund |

| PIMCO RAE Fundamental PLUS Small Fund | PIMCO RAE PLUS Small Fund |

| PIMCO Foreign Bond Fund (U.S. Dollar-Hedged) | PIMCO International Bond Fund (U.S. Dollar-Hedged) |

| PIMCO Foreign Bond Fund (Unhedged) | PIMCO International Bond Fund (Unhedged) |

| PIMCO Emerging Markets Currency Fund | PIMCO Emerging Markets Currency and Short-Term Investments Fund |

| PIMCO Global Bond Fund (U.S. Dollar-Hedged) | PIMCO Global Bond Opportunities Fund (U.S. Dollar-Hedged) |

| PIMCO Global Bond Fund (Unhedged) | PIMCO Global Bond Opportunities Fund (Unhedged) |

| PIMCO Real Return Asset Fund | PIMCO Long-Term Real Return Fund |

| PIMCO Unconstrained Tax Managed Bond Fund | PIMCO Strategic Bond Fund |

On June 28, 2018, Snow Capital Opportunity Fund (SNOAX) becomes Snow Capital Long/Short Opportunity Fund. About 11% of the current portfolio is in short positions, and the adviser will change the fund’s investment strategy “to increase the percentage of short sales within the Fund to enhance the hedging strategy.” At the same time, Snow Capital Dividend Plus Fund (SDPAX) will be rechristened Snow Capital Equity Income Fund. The $3.6 million fund invests in dividend-paying value stocks which, they’re convinced, is better reflected by the phrase “equity income” than by “dividend plus.” By Morningstar’s calculation, the funds have one- and two-star ratings.

Effective July 31, 2018 SPDR Bloomberg Barclays Issuer Scored Corporate Bond ETF (CBND) will change its name (to Bloomberg Barclays Corporate Bond ETF), management fee, benchmark index and principal investment strategy. Thankfully, they respected the fund’s ticker symbol and left it alone.

Effective on or about July 20, 2018, Touchstone Total Return Bond Fund (TCPAX) will be renamed the Touchstone Impact Bond Fund. The fund’s investment strategies will be revised to reflect an ESG focus:

EARNEST also believes that entities that are cognizant of ESG issues tend to be more successful over time. As a result, EARNEST prefers to invest in government programs and companies that have sustainable operating models and seek to achieve positive aggregate societal impact. This inclusive approach views positive impact characteristics as additive to an investment’s risk/return profile. When assessing an issue’s impact profile, EARNEST considers a wide range of factors, including but not limited to support for economic development, home ownership, and job creation.

Vanguard Telecommunication Services Index Fund (VOX) has changed its name to Vanguard Communication Services Index Fund.

OFF TO THE DUSTBIN OF HISTORY

The Board of Directors has approved a plan of liquidation for the AC Alternatives Long Short Fund (ALEVX). Under the plan, the liquidation date of the fund will be July 30, 2018. The fund closes to new investments on July 25, 2018, which leads you to wonder who’d be dumb enough to put money into a by-then overpriced money market fund for a period of five days.

Active Alts Contrarian ETF (SQZZ) liquidated on May 30, 2018.

Around July 13, 2018, Carillon Eagle Smaller Company Fund (EGEAX) will be absorbed by Carillon Scout Small Cap Fund (UMBHX) while Carillon Eagle Mid Cap Stock Fund (HMCAX) gets taken in by the four-star Carillon Eagle Mid Cap Growth Fund HAGAX).

Campbell Multi-Asset Carry Fund (CCRYX) will be closed and liquidated effective on or about the close of business on June 22, 2018.

Catalyst Time Value Trading Fund (TVTAX) will liquidate on June 25, 2018.

Pending shareholder approval, Centre Active U.S. Tax Exempt Fund (DHBRX) is merging with Centre Global Infrastructure Fund (DHINX), sometime in the third quarter of 2018. Usually the announcement of such mergers makes some vague attempt to explain what the merged funds have in common: same investment objectives, similar investment strategies, same managers and so on. The decision to merge a $20 million muni bond fund into a $2 million global equity fund is apt to be the occasion for a burst of rhetorical gymnastics.

Clearbridge Global Health Care Innovations Fund will liquidate around July, 2018.

Crawford Dividend Yield Fund (CDYLX) will, “in the best interests of the shareholders,” liquidate on June 27, 2018.

Credit Suisse Commodity ACCESS Strategy Fund (CRCAX) was scheduled to liquidate on May 31, 2018. The execution has been pushed back by a week, to June 6, 2018, in order to give the managers time to finishing liquidating the portfolio.

Day Hagan Hedged Strategy Fund (DHJAX) plans to cease operations on June 25, 2018.

Effective May 21, 2018, Eaton Vance Global Small-Cap Fund was reorganized into the $25 million Eaton Vance Global Small-Cap Equity Fund (ESVAX).

Equinox BH-DG Strategy Fund (EBHIX) will liquidate on June 29, 2018.

Keeley All Cap Value Fund (KACVX) will be reorganized into Keeley Small-Mid Cap Value Fund (KSMVX) on or about July 27, 2018. Both funds currently sport two stars in Morningstar’s ratings system.

First Investors Real Estate Fund (FIRDX) will be FIRED on June 22, 2018.

The liquidations of Nuveen Symphony International Equity Fund, Nuveen Symphony Mid-Cap Core Fund and Nuveen Symphony Small Cap Core Fund are complete.

Marsico Flexible Capital Fund (MFCFX) will merge into Marsico Global Fund (MGLBX) on or about August 3, 2018. This seems just a part of the larger unwinding of Mr. Marsico’s empire whose AUM has fallen from $5.4 billion ten years ago to $1.4 billion now. The fund had a splendid five-year run (through mid-2012) under Doug Rao, then six not-embarrassing years under his two successors, ending up with a four-star rating from Morningstar. Mr. Marsico took over the fund personally in March 2018 and is merging it into a tiny, five-star fund that Mr. Marsico has managed (or co-managed) since its inception of 2007.

PIMCO Real Return Limited Duration Fund (PPIRX) will be liquidated on or about July 30, 2018. In the meantime, it’s closed to all investors. The fund has a $1 million minimum and $10 million in assets after 2+ years of operation.

T. Rowe Price Institutional Credit Opportunities Fund (TRXPX) originally slated to liquidate in the first quarter of 2018 is now scheduled to merge into T. Rowe Price Credit Opportunities Fund (TCRRX) on June 25, 2018, with TRXPX shareholders received institutional-class shares in exchange.

The $15 million Touchstone International Growth Fund (TIAPX) is closed and will be liquidated on or about July 30, 2018 after about two years of mediocre performance.

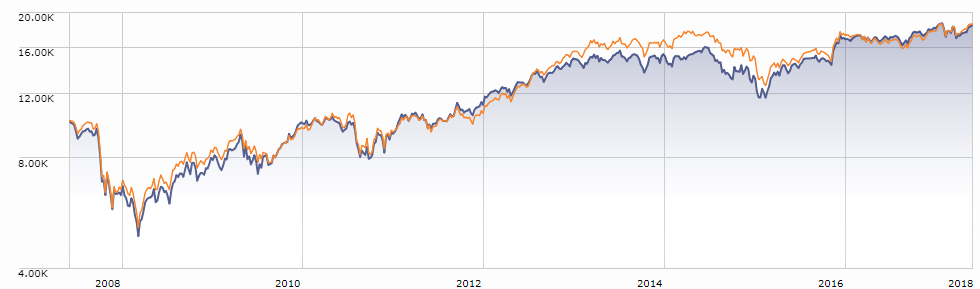

Touchstone Small Cap Growth Fund (MCSAX) is disappearing into the Touchstone Small Company Fund (SAGWX) on September 21, 2018. In an interesting side note, Touchstone reports removing the current Fiera management team and bringing into specialists from Russell Implementation Services to begin morphing the Small Cap Growth portfolio. At the same time Touchstone Small Cap Value Opportunities Fund (TSOAX) will merge into Touchstone Small Cap Value Fund (TVOAX). Ahead of the merger, the TVOAX management team will take over TSOAX. The 10 year record of the two funds gives you a sense of the significance of the change. The surviving fund is the blue line.

On May 30, 2018, USAA shareholders approved the merger of the First Start Growth Fund (USFGX) into the Cornerstone Moderately Aggressive Fund (USCRX). Effective June 2, 2018, the First Start Growth Fund is closed to new investors.

FYI, on April 28, 2018, Virtus Duff & Phelps International Equity Fund, Virtus Horizon International Wealth Masters Fund, Virtus Rampart Global Equity Trend Fund and Virtus Rampart Low Volatility Equity Fund were liquidated.

The Really X-Trackers: On May 16, 2018, the Board of Trustees of DBX ETF Trust unanimously voted to close and liquidate Xtrackers MSCI EAFE Small Cap Hedged Equity ETF, Xtrackers MSCI Brazil Hedged Equity ETF and Xtrackers MSCI Mexico Hedged Equity ETF. The dirty deed will be done in early June.

Wasatch-1st Source Income Fund (FMEQX) is slated to be liquidated “as soon as practicable,” which they translate to July 13, 2018. This might be read as part of a move by Wasatch to reclaim their core business; they’ve merged the long/short fund into a global equity one, liquidated the short term income fund, and they’ve allowed founder Samuel Stewart to leave with their Strategic Income and World Innovators funds. That leaves only the Wasatch-Hoisington Treasury Fund as an anomaly, but with the senior Mr. Hoisington finishing his 44th year as an investor, it might simply be a matter of time before that marriage dissolves as well.