No one knows quite when the April Fool’s (or All Fool’s) tradition arose. The internet is rife with simple, self-assured explanations that are flawed only by the fact that they’re wrong. “Attestations,” that is, contemporary historical recordings referring to the event, are scarce and most of the explanations (“it’s all about the Gregorian calendar in France!”) fail to account for all of the observed behavior.

My preferred speculation: spring, it felt like a good time to do silly things.

Huge swaths of the investing world have reached the same conclusion and have done things so odd that I keep thinking: “you’re joking, right? April Fool’s? Please!” Axios reports that “money has been flooding into US equities” as “investor psychology shifts to risk in a big way” (3/22/21). Apparently, stocks at astronomical valuations (Tesla sells for a p/e of 163, making Apple seem like a deep-value stock with a p/e of 28. Roku, which has never had earnings, trades at $330/share) aren’t enough to satisfy risk appetites, so our compatriots have gone elsewhere, too.

The S.S. Portfolio

Collectively, we’ve decided that trading cards, bitcoin, and .jpg files are worth billions to trillions. Erin Griffith, writing for The New York Times (3/13/21) begins the story:

This past week, a trading card featuring the quarterback Tom Brady sold for a record $1.3 million. The total value of the cryptocurrency Bitcoin hit $1 trillion. And Christie’s sold a digital artwork by an artist known as Beeple for $69.3 million after bids started at just $100 … the frenzy has spilled over into the riskiest — and in some cases, wackiest — assets, including digital ephemera and media, cryptocurrencies, collectibles like trading cards and even sneakers.

Perhaps $60 billion of our stimulus checks is being “invested” in bitcoin. By coincidence, Morningstar published a nice analysis of the effect of adding even modest allocations of bitcoin to a portfolio. Amy Arnott looks at 10-year performance and concludes that even a tiny slice of bitcoin drives up volatility so much that the Sharpe ratio (i.e., risk-adjusted returns) for a buy-and-hold portfolio decreases with every addition of bitcoin.

Perhaps $60 billion of our stimulus checks is being “invested” in bitcoin. By coincidence, Morningstar published a nice analysis of the effect of adding even modest allocations of bitcoin to a portfolio. Amy Arnott looks at 10-year performance and concludes that even a tiny slice of bitcoin drives up volatility so much that the Sharpe ratio (i.e., risk-adjusted returns) for a buy-and-hold portfolio decreases with every addition of bitcoin.

Much of bitcoin’s eye-popping 10-year record owes to an off-the-charts runup from 2011 through 2013, when the CMBI Bitcoin TR index posted annualized returns of more than 1,000% per year … These gains may not be repeatable, partly because trading volumes in bitcoin have increased nearly 3,000-fold since 2014. … It’s also worth noting that as bitcoin moves to the mainstream, it’s becoming less valuable as a portfolio diversifier. (2/1/21)

And now Fortune magazine is relying on someone named La La Anthony as an authority on cryptocurrency.

(Okay, I Googled “La La Anthony.” It was not reassuring.)

And yet, the billions pour in, and even Fidelity is preparing to launch a bitcoin fund. Which, I guess, is justified by the confident conclusion that buy-and-hold investing is dead (again).

Fracking companies have decided to become part-time bitcoin miners. The gas that they’ve traditionally flared off during their mining operations is being converted to electricity and used to power bitcoin miners.

SPACs, or “blank-check companies,” have turned investors into stalkers. The New York Times (3/19/21) reports that many SPACs collect money first and find something to invest in second, which has led to intense pressure to find investable uses for their stash. The CFO at one private firm reports being “relentlessly hounded since last year” by SPACs.

Under the heading of “humility? Who needs humility?” Cathie Woods – the infallible investing wizard of ARK whose flagship ARK Innovation fund has returned 46% a year over the past five years – has filed with the SEC to remove unnecessary burdens from her funds. Up until now, no more than 30% of a fund’s portfolio could be held in a single stock. Gone! Up until now, a single fund could own no more than 20% of the total stock in a company. Gone! In their place? SPACs and space travel.

Kudos to Morningstar analyst Robby Greengold for startling clarity on the ARK mania:

ARK Innovation ETF has been in tune with market’s unfolding narrative in recent years, but its lone portfolio manager, inexperienced team, and lax risk controls make it ill-prepared to grapple with a major plot twist…

[Manager Cathie Wood] honed her thematic process at AllianceBernstein from 2001 to 2013, where the thematic strategies she ran had high volatility and underwhelming risk-adjusted results on her watch…

Exacerbating that key-person risk is the firm’s inability to develop and retain talent: Many of its analysts have come and gone, and most of the nine remaining lack deep industry experience.

Wood’s reliance on her instincts to construct the portfolio is a liability. …The firm favors companies that are often unprofitable, highly volatile, and could plummet in tandem. … As its asset base has swelled to $23 billion, the fund has become less liquid and more vulnerable to severe losses. (3/31/21)

Please do read his analysis if you’ve been tempted to hop aboard the rocket.

Jason Zweig has been positively aflame lately with stories that pretty much cry out, “watch out! The inmates are running the asylum! The preschoolers are flying the jet!” On March 26, 2021, he reported:

Bragging rights used to go to those investors who worked the hardest at learning the most. Now the glory often goes to those who know the least and don’t even care. That has turned the traditional investing hierarchy upside down, although it probably won’t last.

“I don’t know what the f— I’m doing,” a young man said in a TikTok video in January. “I just know I’m making money.”

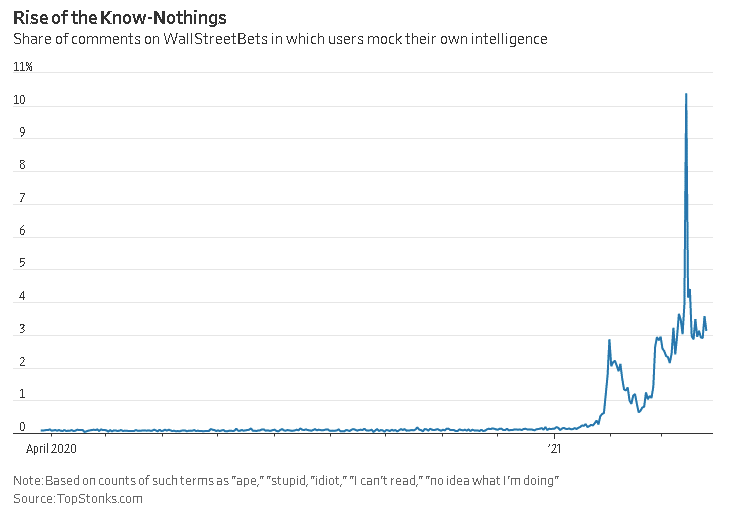

The accompanying live graphic captures the moment when “investors” concluded that having even the slightest clue about what you’re doing is overrated:

He raised similar alarms about “a bitcoin savings account” (3/5/21) and the InfinityQ magical money machine (2/26/2021).

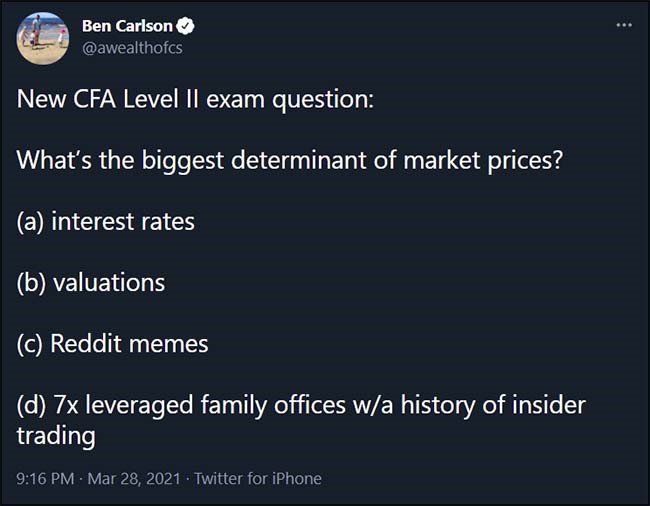

Blaine Rollins’ March 29th weekly briefing shares a Tweet from Ben Carlson, proprietor of A Wealth of Common Sense, that sort of encapsulates the moment.

My portfolio lives, now as ever, in boring (which is to say, “soothing”) balance: 50% equities, 50% stability. The Total Stock Market Index is up 62% in the past 12 months. 291 funds (and uncounted ETFs) have 12-month returns in excess of 100%, led by Victory Global Natural Resource’s 274% gain. The 200 Club – funds returning over 200% in 12 months – is a diverse bunch, including some funds whose long-term records are execrable.

- Victory Global Natural Resources

- Morgan Stanley Institutional Inception

- Jacob Internet

- Morgan Stanley Global Endurance

- Direxion Monthly Small Cap Bull

- Rydex Russell 2000 2x Strategy

- Upright Growth

- ProFunds UltraSmall Cap

- Jacob Discovery Baron Partners

- ProFunds UltraMid Cap

My best recommendation: this is no time to be a hero. If you’re curious about whether it’s ever time to be a hero, you might check this month’s “Do stocks pay even in the long-term” essay.

Thanks!

To David (Hi, David, and welcome! We’ve profiled Eventide Healthcare & Life Sciences but didn’t have a really satisfying interaction with the adviser. Good China-lite EM funds often have a smaller cap tilt: Virtus KAR EM Small Cap is 8% China, Harbor EM Equity is 10%, Harbor EM Small Cap is 11%, Seafarer is 16% while the average fund weighs in a 34%), Wilson, and the good folks at S&F Investments. To PayPal contributors Steven from San Francisco and Thomas from Williamsburg, both lovely towns. To our faithful subscribers, Greg, Matthew, William, William, Brian, David, and Doug.

And, as ever, to the indefatigable, joyful, curious, querulous folks on our discussion board: The Shadow (who sees all), Dave Moran, Ira Artman, OJ, and you all. Thanks!

On the end of a pandemic

It’s not here.

It’s not here.

Yet.

My brilliant, whimsical dean and I were talking. We’ve decided that if this were a baseball game we would be in the 8th inning.

Not all innings are created equal. The first brings hopefulness and a bunch of runs scored. The sixth, another peak for the hitters. The 7th has its stretch and musical interlude, the ghost of Harry Caray, and a sense of turning toward home. The 9th is all the excitement in the feeling of closure and the knowledge that “we’ll get them tomorrow.”

But the eighth inning? It’s kind of a slump in the game, I think. It’s typically a low-scoring inning. Not quite time to leave but not quite enough time to start building anything new. Mostly it’s the inning where the vendors cry out “last call for beer.” (Except, of course, at Fenway Park which has an 8th inning stretch instead of a 7th inning one. My guess is that that’s done, as most things in Boston are, to annoy the Yankees and their fans.)

And yet, with the prospect that 8/9s of the pandemic is behind us, that’s where we are. A bit weary, a bit hopeful, and still in our seats.

I’m using the time to think about the game so far. A lot of others are, too. I’m impressed by the ability of so many people to transcend our shared exhaustion and occasional numbness and to look with fresh eyes on a year that packed 12 years’ worth of events into it. (Did I say “and 12 years’ worth of grey hair”? No, I did not but, damn…)

On this sunny, hyacinth-riddled, robin-spattered spring day, I wanted to pass along a handful of the ones that I’ve read and liked most.

Therapist Esther Perel’s reflection: “Even when we can’t change our circumstances, we can change our mindset. Turning the unknown into something we look forward to exploring is the antidote to fear.” One interesting note that I’ve heard from several people, that a lot of us who had no real use for classroom technology and apps have been a bit surprised to learn that there might be cool uses for Kahoots or You Can Book Me in a purely normal classroom.

Pete Buttigieg, who has been working with his husband to relearn the basic negotiations of marriage, now wonders at “how little we communicate with words.”

Sandra Boynton, whose Hippos Go Berserk is classic, concluded that “birthday cakes are essential.” My impulse is, “I’m going to eat the icing first, just in case someone tries to snatch the damned cake away.”

Sandra Boynton, whose Hippos Go Berserk is classic, concluded that “birthday cakes are essential.” My impulse is, “I’m going to eat the icing first, just in case someone tries to snatch the damned cake away.”

Tom Hanks’ takeaway is, “never play solitaire again.” During the worst of the pandemic, it was “a salve for the mind in the hands, the safety valve that meant having something to do.” Then it occurred to him actually, “there was already plenty to do! Damn! A sink to clean out, a dishwasher to empty, laundry to sort, rice to put in a cooker, letters I could have written and the typewriter and the stationery to do it.”

In a sort of “duh” moment, Neil deGrasse Tyson discovered “science needs better marketing.” (You mean I shouldn’t swallow a UV light?)

As you might imagine, I really liked the fact that Katie Roiphe, a reporter and conservative provocateur who also teaches at NYU was seized by “the joy of in-person teaching.” After a year online, she returned to the classroom to discover that “something mysterious happens. It is physical. It is an energy you can fake or aspire to but not actually have in a Zoom class,” the exceptional and unnatural effort of which “exhausts you, depresses you and diminishes you in tiny but cumulative ways.” Sharing space and time with her students is, quite literally, embodied connection.

A student who moved here from somewhere warm doesn’t yet have a proper winter coat, another student talks about her job in a grocery store. Another tells me about something a professor said in another class. There is something important in the hanging around, the idle, casual, totally random snippets of conversation… I send a friend a giddy text about how happy I am, ‘It’s like a drug.’

Yep. The one who’s too quiet to speak up on Zoom but who lingers after class until the others have gone. The chance to share a compliment that not everyone needs to hear. The awesome intensity, the stunning bravery, of a student who has journeyed 8,000 miles for this moment. I worry, sometimes, that I’ve focused too much on the extraordinary challenges to embrace the ordinary joys and rewards. I’ll try to do better.

Me? I think I’ve discovered I’m a vampire. (Don’t tell Chip. It’ll just make her worry.) I’ve always thought of myself as a solitary creature whose early life experiences left him reluctant to let other people get too close, uncomfortable in social gatherings, a bit awkward around strangers. Growing up, my best friends were all books. There is, I correctly but incompletely reported, “a difference between being ‘alone’ and being ‘lonely.’”

Me? I think I’ve discovered I’m a vampire. (Don’t tell Chip. It’ll just make her worry.) I’ve always thought of myself as a solitary creature whose early life experiences left him reluctant to let other people get too close, uncomfortable in social gatherings, a bit awkward around strangers. Growing up, my best friends were all books. There is, I correctly but incompletely reported, “a difference between being ‘alone’ and being ‘lonely.’”

What I’ve recently discovered is that I’m a vampire, of a sort. I draw energy from those around me. The banter around a conference table before we got down to business. The five-minute meetings held in a colleague’s doorway. The long walks around campus, side by side. The sound of a friend on the other side of my thin office wall. The chance to sit with my students on benches in the Old Main hall, talking about the dreams of people forty years my junior.

I’ve discovered that I need their energy. I fade, bit by bit, without it. New projects seem too much to handle. Routine tasks get delayed, then completed … sort of. I need them, more than I knew. (But don’t tell them or their heads will get all swolled up!)

And you? Tell me.

We’re here, side by side and shoulder to shoulder. In the bottom of the 8th. Ahead by one run, haunted by the bone-headed errors we made early in the game. Cheered by a handful of crucial plays. Weary, as the players on the field are, and hopeful. Knowing that the game has given us a lot, for good and ill, but that it is near its end. We will see it to its end. Summer. We’re that close.

Celebrate these last innings. Give yourself the break you deserve. Plunge your hands into the still-cool garden soil and actually see the richness of the world that sustains your life. Renew the habit of walking in the warming spring sun. Rise to the challenge of planning post-pandemic mischief. Threaten a haiku tattoo.

Because we’re that close and you’re that good.